Noticias del mercado

-

21:00

Dow -0.38% 16,269.00 -61.47 Nasdaq -0.18% 4,747.98 -8.74 S&P -0.27% 1,937.41 -5.33

-

18:36

WSE: Session Results

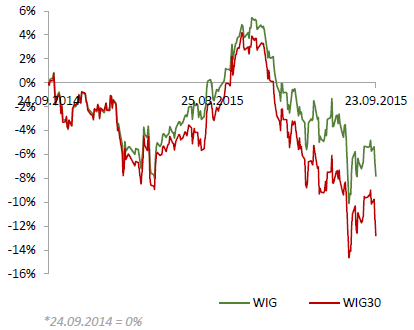

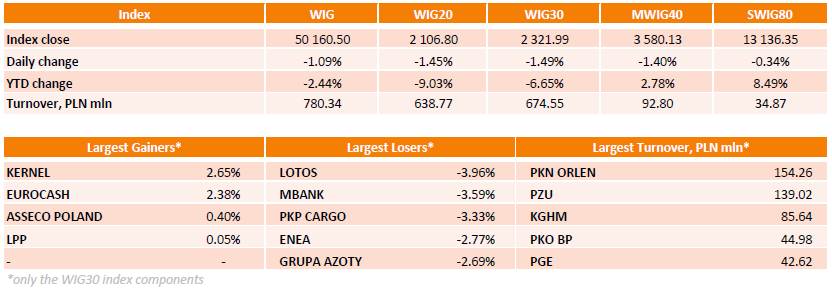

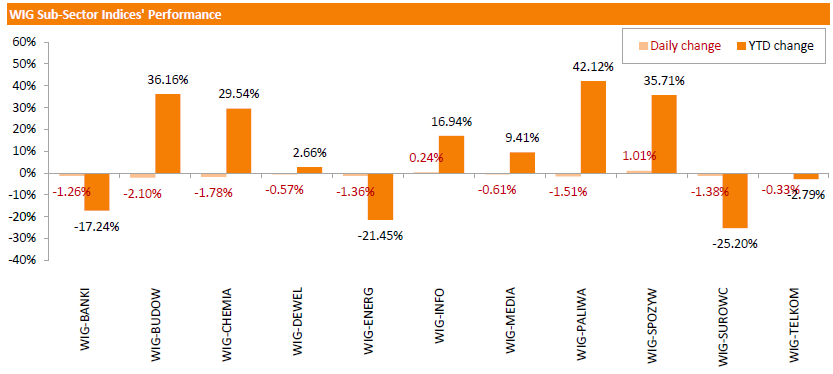

Polish equities declined on Wednesday. The broad market benchmark, the WIG Index, lost 1.09%. Most sectors fell, with construction stocks (-2.10%) posting the sharpest drop.

The large-cap stocks plunged by 1.49%, as measured by the WIG30 Index. Within the index components, LOTOS (WSE: LTS) suffered the steepest decline, dropping 3.96% on the back of the news that the company sought financing to launch production from its Baltic oil platform as one of the banks, which were engaged in the project, announced intention to withdraw from the consortium. Other major laggards were MBANK (WSE: MBK), PKP CARGO (WSE: PKP), ENEA (WSE: ENA), GRUPA AZOTY (WSE: ATT) and PGNIG (WSE: PGN), losing 2.39-3.59%. On the other side of the ledger, KERNEL (WSE: KER) led a handful of gainers with a 2.65% advance, followed by EUROCASH (WSE: EUR), climbing 2.38%.

-

18:35

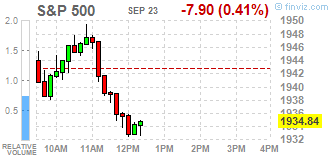

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell in volatile trading on Wednesday as weak Chinese and U.S. factory data hit material and industrial stocks. Data showed U.S. manufacturing growth stayed at a two-year low in September, while Chinese factory activity shrank to a 6-1/2 year low in the month. The volatility in the U.S. stock market has increased recently as investors fret over a China-led global economic slowdown, a concern the Federal Reserve alluded to last week when it left interest rates unchanged.

Almost all of Dow stocks in negative area (24 of 30). Top looser - United Technologies Corporation (UTX, -2.43%). Top gainer - Pfizer Inc. (PFE, +0.88).

All of S&P index sectors also in negative area. Top looser Basic Materials (-1.5%).

At the moment:

Dow 16119.00 -110.00 -0.68%

S&P 500 1922.75 -9.25 -0.48%

Nasdaq 100 4247.75 -19.50 -0.46%

10 Year yield 2,15% +0,02

Oil 45.11 -1.25 -2.70%

Gold 1130.50 +5.70 +0.51%

-

18:00

European stocks close: stocks closed higher on the PMI data from the Eurozone

Stock indices closed higher on the PMI data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's preliminary manufacturing PMI fell to 52.0 in September from 52.3 in August, in line with expectations.

Eurozone's preliminary services PMI declined to 54.0 in September from 54.4 in August. Analysts had expected the index to decrease to 54.2.

Markit's Chief Economist Chris Williamson said that Eurozone's economy expanded further, "but there remains a worrying failure of growth to accelerate to a pace sufficient to generate either higher inflation or strong job creation".

"The survey data indicate that the Eurozone economy expanded 0.4% in the third quarter, in line with the second quarter. This is, however, below what's generally regarded as its long-term potential growth rate and puts the economy on course to grow by just 1.6% this year," he added.

Germany's preliminary manufacturing PMI declined to 52.5 in September from 53.3 in August, missing forecasts of a decrease to 52.8.

Germany's preliminary services PMI was down to 54.3 in September from 54.9 in August. Analysts had expected index to decline to 54.6.

Markit's economist Oliver Kolodseike noted that the German economy was partly driven by higher output.

France's preliminary manufacturing PMI rose to 50.4 in September from 48.3 in August, beating forecasts of a rise to 48.5.

France's preliminary services PMI increased to 51.2 in September from 50.6 in August. Analysts had expected the index to climb to 51.0.

The French statistical office Insee released its final gross domestic product data for France on Wednesday. The French final GDP was stable in the second quarter, in line with the preliminary estimate, after a 0.7% increase in the first quarter. The first quarter's figure was revised up from a 0.6% growth.

On a yearly basis, French final GDP climbed 1.1% in the second quarter, up from the preliminary estimate of 1.0% growth, after a 0.8% rise in the first quarter.

European Central Bank (ECB) President Mario Draghi said before the Committee on Economic and Monetary Affairs of the European Parliament in Brussels on Wednesday that the central bank is ready to expand its asset-buying programme to boost the inflation in the Eurozone. He added that the downside risk to the inflation increased slower growth in emerging-market economies, a stronger euro and a decline in oil and commodity prices.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,032.24 +96.40 +1.62 %

DAX 9,612.62 +41.96 +0.44 %

CAC 40 4,432.83 +4.32 +0.10 %

-

16:12

European Central Bank (ECB) President Mario Draghi: the central bank is ready to expand its asset-buying programme to boost the inflation in the Eurozone

European Central Bank (ECB) President Mario Draghi said before the Committee on Economic and Monetary Affairs of the European Parliament in Brussels on Wednesday that the central bank is ready to expand its asset-buying programme to boost the inflation in the Eurozone. He added that the downside risk to the inflation increased slower growth in emerging-market economies, a stronger euro and a decline in oil and commodity prices.

But Draghi pointed out that it is too early to say whether the recent turbulence in emerging markets and a fall in oil and commodity prices will lead to a lower inflation.

"More time is needed to determine in particular whether the loss of growth momentum in emerging markets is of a temporary or permanent nature and to assess the driving forces behind the drop in the international price of commodities and behind the recent episodes of severe financial turbulence," he said.

-

16:00

U.S. preliminary manufacturing purchasing managers' index remains unchanged at 53.0 in September

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Wednesday. The U.S. preliminary manufacturing purchasing managers' index (PMI) remained unchanged at 53 in September, in line with expectations. It is the lowest level since October 2013.

A reading above 50 indicates expansion in economic activity.

Higher expansion in output was offset by slower pace of expansion in new orders and employment.

"Manufacturing remained stuck in crawler gear in September, fighting an uphill battle against the stronger dollar, slumping demand in many export markets and reduced capital spending, especially by the energy sector," Markit Chief Economist Chris Williamson.

"The sluggish growth, weaker forward-looking indicators and downturn in price pressures all point to the Fed holding off with rate hikes until next year," he added.

-

15:36

U.S. Stocks open: Dow +0.10%, Nasdaq +0.15%, S&P +0.10%

-

15:31

Greek Prime Minister Alexis Tsipras forms the new government

Greek Prime Minister Alexis Tsipras formed the new government. The new government was sworn into office on Wednesday. The cabinet is mostly unchanged. Euclid Tsakalotos was appointed as finance minister, while George Chouliarakis was appointed as deputy finance minister.

Yiannis Mouzalas was appointed as minister for migration.

-

15:28

Before the bell: S&P futures +0.18%, NASDAQ futures +0.29%

U.S. index futures rose slightly.

Hang Seng 21,302.91 -493.67 -2.26%

Shanghai Composite 3,116.71 -68.91 -2.16%

FTSE 6,066.93 +131.09 +2.21%

CAC 4,477.41 +48.90 +1.10%

DAX 9,688.27 +117.61 +1.23%

Japan Stock Market was closed.

Crude oil $46.67 (+0.65%)

Gold $1128.50 (+0.33%)

-

15:17

European Central Bank Governing Council member Bostjan Jazbec: the central bank was not discussing the extension of the asset-buying programme

European Central Bank Governing Council member Bostjan Jazbec said on Wednesday that the central bank was not discussing the extension of the asset-buying programme, adding that the monetary policy works with a delay.

"Monetary policy always works with a delay. At the moment there are no discussions on any other policies than QE. It seems that QE is bearing results, so now it's too early to talk about any new policies," he said.

-

15:11

European Central Bank Governing Council member Ewald Nowotny is wary of adding further stimulus measures

European Central Bank Governing Council member Ewald Nowotny said in an interview with Bloomberg Television on Wednesday that he was wary of adding further stimulus measures.

"Monetary policy should be a steady-hand policy. We shouldn't act in a too-active way," he said.

Nowotny pointed out that the economy in the Eurozone is recovering, but slower than expected.

-

15:02

Canadian retail sales gain 0.5% in July

Statistics Canada released retail sales data on Friday. Canadian retail sales rose by 0.5% in July, in line with expectations, after a 0.4% increase in June. June's figure was revised down from a 0.6% gain.

The rise was driven by higher sales at motor vehicle and parts dealers and clothing and clothing accessories stores. Motor vehicle and parts sales rose 2.0% in July, while sales at clothing and clothing accessories stores climbed 2.5%.

Sales at gasoline stations declined 0.2% in July, while sales at electronics and appliance stores dropped 1.7%.

Sales at food and beverage stores were down 0.5% in July.

Sales rose in 6 of 11 subsectors.

Canadian retail sales excluding automobiles were flat in July, missing expectations for a 0.4% rise, after a 0.5% gain in June. June's figure was revised down from a 0.8% rise.

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Yandex N.V., NASDAQ

YNDX

11.76

1.64%

10.8K

Intel Corp

INTC

29.05

1.33%

63.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.72

1.23%

3.9K

Barrick Gold Corporation, NYSE

ABX

6.18

1.15%

25.8K

ALCOA INC.

AA

9.58

0.84%

2.9K

Cisco Systems Inc

CSCO

25.34

0.80%

1.2K

Boeing Co

BA

134.98

0.74%

6.2K

Twitter, Inc., NYSE

TWTR

27.01

0.67%

37.0K

Apple Inc.

AAPL

114.12

0.63%

171.9K

Yahoo! Inc., NASDAQ

YHOO

30.59

0.63%

1.1K

Exxon Mobil Corp

XOM

73.19

0.62%

3.1K

Facebook, Inc.

FB

93.54

0.62%

66.7K

General Motors Company, NYSE

GM

30.21

0.60%

0.2K

Microsoft Corp

MSFT

44.10

0.46%

2.5K

E. I. du Pont de Nemours and Co

DD

48.79

0.45%

0.4K

International Business Machines Co...

IBM

145.07

0.44%

0.1K

Citigroup Inc., NYSE

C

50.60

0.44%

6.5K

Amazon.com Inc., NASDAQ

AMZN

540.10

0.32%

5.0K

Google Inc.

GOOG

624.68

0.32%

1.7K

JPMorgan Chase and Co

JPM

61.09

0.30%

3.3K

Goldman Sachs

GS

180.25

0.29%

0.4K

Caterpillar Inc

CAT

71.87

0.27%

1.3K

Chevron Corp

CVX

77.46

0.27%

0.6K

AT&T Inc

T

32.35

0.25%

7.4K

Wal-Mart Stores Inc

WMT

63.75

0.25%

0.4K

Ford Motor Co.

F

13.95

0.22%

8.8K

Tesla Motors, Inc., NASDAQ

TSLA

261.50

0.21%

6.3K

Walt Disney Co

DIS

102.70

0.20%

5.3K

Home Depot Inc

HD

115.99

0.16%

4.6K

ALTRIA GROUP INC.

MO

54.28

0.15%

13.1K

Visa

V

70.34

0.13%

4.3K

American Express Co

AXP

75.75

0.05%

0.5K

Starbucks Corporation, NASDAQ

SBUX

57.15

0.05%

0.8K

Procter & Gamble Co

PG

70.21

0.03%

0.8K

HONEYWELL INTERNATIONAL INC.

HON

96.07

0.03%

0.1K

Pfizer Inc

PFE

32.26

0.00%

0.7K

The Coca-Cola Co

KO

38.79

0.00%

15.1K

Johnson & Johnson

JNJ

93.10

-0.15%

0.4K

General Electric Co

GE

25.02

-0.36%

18.5K

Hewlett-Packard Co.

HPQ

25.54

-0.43%

33.6K

UnitedHealth Group Inc

UNH

122.00

-0.76%

2.2K

Nike

NKE

114.00

-1.70%

2.0K

-

14:54

Upgrades and downgrades before the market open

Upgrades:

Intel (INTC) upgraded to Mkt Perform from Underperform at Bernstein

Downgrades:

Other:

-

12:04

European stock markets mid session: stocks traded higher after the PMI data from the Eurozone

Stock indices traded higher after the release of the PMI data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's preliminary manufacturing PMI fell to 52.0 in September from 52.3 in August, in line with expectations.

Eurozone's preliminary services PMI declined to 54.0 in September from 54.4 in August. Analysts had expected the index to decrease to 54.2.

Markit's Chief Economist Chris Williamson said that Eurozone's economy expanded further, "but there remains a worrying failure of growth to accelerate to a pace sufficient to generate either higher inflation or strong job creation".

"The survey data indicate that the Eurozone economy expanded 0.4% in the third quarter, in line with the second quarter. This is, however, below what's generally regarded as its long-term potential growth rate and puts the economy on course to grow by just 1.6% this year," he added.

Germany's preliminary manufacturing PMI declined to 52.5 in September from 53.3 in August, missing forecasts of a decrease to 52.8.

Germany's preliminary services PMI was down to 54.3 in September from 54.9 in August. Analysts had expected index to decline to 54.6.

Markit's economist Oliver Kolodseike noted that the German economy was partly driven by higher output.

France's preliminary manufacturing PMI rose to 50.4 in September from 48.3 in August, beating forecasts of a rise to 48.5.

France's preliminary services PMI increased to 51.2 in September from 50.6 in August. Analysts had expected the index to climb to 51.0.

The French statistical office Insee released its final gross domestic product data for France on Wednesday. The French final GDP was stable in the second quarter, in line with the preliminary estimate, after a 0.7% increase in the first quarter. The first quarter's figure was revised up from a 0.6% growth.

On a yearly basis, French final GDP climbed 1.1% in the second quarter, up from the preliminary estimate of 1.0% growth, after a 0.8% rise in the first quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,010.02 +74.18 +1.25 %

DAX 9,660.52 +89.86 +0.94 %

CAC 40 4,467.93 +39.42 +0.89 %

-

11:47

French final GDP is flat in the second quarter

The French statistical office Insee released its final gross domestic product data for France on Wednesday. The French final GDP was stable in the second quarter, in line with the preliminary estimate, after a 0.7% increase in the first quarter. The first quarter's figure was revised up from a 0.6% growth.

Household spending was flat in the second quarter, after a 0.9% increase in the first quarter, while government spending rose 0.4%, after a 0.9% gain in the first quarter.

Exports climbed 2.0% in the second quarter, while imports rose 0.5%.

On a yearly basis, French final GDP climbed 1.1% in the second quarter, up from the preliminary estimate of 1.0% growth, after a 0.8% rise in the first quarter.

-

11:15

France's preliminary manufacturing and services PMIs rise in September

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Wednesday. France's preliminary manufacturing PMI rose to 50.4 in September from 48.3 in August, beating forecasts of a rise to 48.5.

France's preliminary services PMI increased to 51.2 in September from 50.6 in August. Analysts had expected the index to climb to 51.0.

"The French private sector eked out another month of modest growth in September, with manufacturing making a meaningful contribution to expansion for the first time in well over a year. However, there was less positive news on the employment front, with jobs being shed at the sharpest rate since November 2014. A marked drop in service providers' business confidence further suggests that the general sluggishness in the economy is set to persist in the foreseeable future," the Senior Economist at Markit Jack Kennedy said.

-

11:07

Germany's preliminary manufacturing and services PMIs fall in September

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Wednesday. Germany's preliminary manufacturing PMI declined to 52.5 in September from 53.3 in August, missing forecasts of a decrease to 52.8.

Germany's preliminary services PMI was down to 54.3 in September from 54.9 in August. Analysts had expected index to decline to 54.6.

Markit's economist Oliver Kolodseike noted that the German economy was partly driven by higher output.

"Digging a bit deeper into the data suggests that the German economy is set to grow further in the coming months. New orders rose at the strongest rate in almost two years, with companies benefitting from a positive economic environment and improved demand from both domestic and foreign clients," he noted.

-

10:57

Eurozone's preliminary manufacturing and services PMIs decline in September

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's preliminary manufacturing PMI fell to 52.0 in September from 52.3 in August, in line with expectations.

Eurozone's preliminary services PMI declined to 54.0 in September from 54.4 in August. Analysts had expected the index to decrease to 54.2.

Markit's Chief Economist Chris Williamson said that Eurozone's economy expanded further, "but there remains a worrying failure of growth to accelerate to a pace sufficient to generate either higher inflation or strong job creation".

"The survey data indicate that the Eurozone economy expanded 0.4% in the third quarter, in line with the second quarter. This is, however, below what's generally regarded as its long-term potential growth rate and puts the economy on course to grow by just 1.6% this year," he added.

-

10:43

Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index falls to 47.0 in September

The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) decreased to 47.0 in September from 47.3 in August, missing expectations for a rise to 47.5, and hitting a 78-month low.

A reading below 50 indicates contraction of activity.

The output index fell to 45.7 in September from 46.4 in August, reaching a 78-month low. New orders, new export orders, employment, output prices and input prices also declined.

Dr. He Fan, Chief Economist at Caixin Insight Group, said that the index indicates that China's manufacturing industry "has reached a crucial stage in the structural transformation process".

"Overall, the fundamentals are good. The principle reason for the weakening of manufacturing is tied to previous changes in factors related to external demand and prices. Fiscal expenditures surged in August, pointing to stronger government efforts on the fiscal policy front. Patience may be needed for policies designed to promote stabilization to demonstrate their effectiveness," he added.

-

10:31

Chinese Academy of Social Science: the Chinese economy is expected to expand 6.9% in 2015

According to the government think-tank Chinese Academy of Social Science, the Chinese economy is expected to expand 6.9% in 2015, down from the previous estimate of a 7.0% growth.

The think-tank noted that the slowdown was driven by a decline in investment by firms and individuals and growing debt pressures faced by local governments.

-

10:21

International Monetary Fund Managing Director Christine Lagarde: downside risks to global growth increased

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Tuesday that downside risks to global growth increased due to lower commodity prices, a realignment of monetary policy and slower growth in China.

"The slowdown of Chinese growth was predictable, predicted, but has consequences and probably more spillover effects in the region in particular than was anticipated," she said.

-

10:13

Australia’s leading economic index rises 0.3% in July

The Conference Board released its leading economic index for Australia on Wednesday. The index rose 0.3% in July, after a 0.3% fall in June. June's figure was revised down from a 0.2% decline. It was the first increase in for months.

The coincident index increased 0.2% in July, after a 0.1% gain in June. June's figure was revised down from a 0.2% rise.

The index indicates the economy should continue to grow.

-

08:01

Global Stocks: U.S. indices fell

U.S. stock indices fell on Tuesday amid a slump in commodity prices and persistent uncertainty regarding Federal Reserve's rate hike.

The Dow Jones Industrial Average plunged 179.72 points, or 1.1%, to 16,330.47 after an initial decline of 288 points. The S&P 500 fell 24.23 points, or 1.2%, to 1,942.74. The Nasdaq Composite Index lost 72.23 point, or 1.5% to 4,756.72.

Data showed on Tuesday that the Richmond Fed Manufacturing Index fell to -5 in September from 0 in August; economists had expected it to advance to +4. "Order backlogs and new orders decreased, while shipments declined. Average wages continued to increase at a moderate pace this month, however manufacturing employment grew mildly. Prices of raw materials and prices of finished goods rose, although at a slightly slower pace compared to last month. Manufacturers anticipated improved business conditions during the next six months. Producers expected faster growth in shipments and in the volume of new orders," Fed overview said.

This morning in Asia Hong Kong Hang Seng dropped 2.98%, or 650.27 points, to 21,146.31. China Shanghai Composite Index fell 2.16%, or 68.72 point, to 3,116.90. Japanese markets are on holiday.

Asian stock indices fell after a preliminary report from Markit Economics and Caixin Media showed that China's manufacturing sector had fallen to a six-and-a-half-year low of 47.0 in September. Economists had expected a 47.5 reading after 47.3 reported previously.

-

04:06

Hang Seng 21,322.96 -473.62 -2.17 %, Shanghai Composite 3,145.6 -40.02 -1.26 %

-

00:36

Stocks. Daily history for Sep 22’2015:

(index / closing price / change items /% change)

Hang Seng 21,796.58 +39.65 +0.18 %

S&P/ASX 200 5,103.55 +37.31 +0.74 %

Shanghai Composite 3,186.32 +29.78 +0.94 %

FTSE 100 5,935.84 -172.87 -2.83 %

CAC 40 4,428.51 -156.99 -3.42 %

Xetra DAX 9,570.66 -377.85 -3.80 %

S&P 500 1,942.74 -24.23 -1.23 %

NASDAQ Composite 4,756.72 -72.23 -1.50 %

Dow Jones 16,330.47 -179.72 -1.09 %

-