Noticias del mercado

-

19:58

American focus: the US dollar significantly strengthened against the euro

Dollar rose significantly against the euro, by updating the two-month high, aided by the statistics on the US and expectations of today's speech by Fed Janet Yellen. Previously published data showed that US GDP growth for the 1st quarter was revised upwards, which increases the likelihood of the Fed raising interest rates soon. Bureau of Economic Analysis reported that real GDP grew by 0.8 per cent per annum in the first quarter of 2016. In preliminary estimates, real GDP grew by 0.5 per cent. In the fourth quarter, real GDP increased by 1.4 percent. Real GDP growth in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE), residential investment in fixed assets, as well as the costs of state and local authorities, which were partially offset by a negative contribution from residential fixed capital investment, exports, private investment in inventories and federal government spending. Imports, which is deducted in the calculation of GDP, decreased.

Meanwhile, the final results of the studies submitted by Thomson-Reuters and Institute of Michigan, revealed in May US consumers felt more optimistic about the economy than in the previous month. According to the data, in May consumer sentiment index rose to 94.7 compared with a final reading of 89.0 in April and the preliminary value of 95.8 points in May. It is estimated that the index should make 95.4.

As for the performances Yellen, she noted that in case of further improvement in the economy and the labor market, it is advisable to gradually and gently raise rates. "Based on the data, economic growth accelerated. Probably, in the following months, the rate hike would be appropriate ", - said Yellen. "Almost all the indicators point to the fact that the labor market situation has really improved. We are close to reaching the level of unemployment, which, according to most economists, corresponds to full employment. However, productivity growth is very weak, and we do not see a significant acceleration of wage growth, suggesting the preservation of free resources on the labor market ", - added the head of the Fed. Today futures on interest rates Fed indicate that the probability of a rate hike in June is 34% against 28% before the speech Yellen. Meanwhile, the chances increase rates in July increased from 55% to 62%.

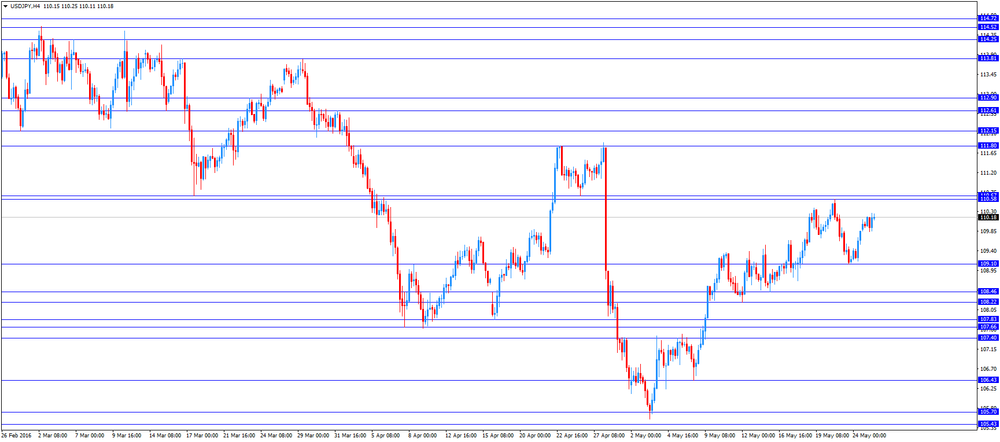

The yen fell against the dollar, returning to yesterday's low, which was caused by statements of Fed Yellen. Traders also remain cautious against the yen after the G7 leaders in a statement confirmed the commitment to avoid "competitive devaluation" of their currencies and cautioned against "disorderly" currency fluctuations. Group of Seven industrialized nations pledged to strive for sustainable global growth, leveling the differences in monetary policy and stimulate the economy. "Global growth - our top priority", - said G7 leaders. The Group also outlined the commitment to market exchange rates and the elimination of "competitive devaluation" of currencies, preventing sharp jerks exchange rates. It represents a compromise between Japan, which threatened to intervene to block the spike in the yen and the US who oppose market intervention.

On the trading dynamics have also influenced the news that Japanese Prime Minister Abe could once again defer the planned increase in sales tax in Japan. Today it is the first time he admitted this possibility, although according to his advisers, he considered it before. Earlier, Abe and others have provided the Government of Japan stated that the increase in sales tax next year will continue the planned scenario, if the global economy does not face a new world financial crisis.

-

16:29

Thomson Reuters/University of Michigan final consumer sentiment index rises to 94.7 in May

The Thomson Reuters/University of Michigan final consumer sentiment index climbed to 94.7 in May from 89.0 in April, down from the preliminary estimate of 95.8 and missing expectations a rise to 95.4.

"Sespite the meager GDP growth as well as a higher inflation rate, consumers became more optimistic about their financial prospects and anticipated a somewhat lower inflation rate in the years ahead," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

"The biggest uncertainty consumers see on the horizon is not whether the Fed will hike interest rates in the next few months, but the outlook for future government economic policies under a new president," he added.

The current economic conditions index increased to 109.9 in May from 106.7 in April, down from the preliminary reading of 108.6.

The index of consumer expectations rose to 84.9 in May from 77.6 in April, down from a preliminary reading of 87.5.

The one-year inflation expectations declined to 2.4% in May from 2.8% in April, down from the preliminary reading of 2.5%.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, May 94.7 (forecast 95.4)

-

15:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.00 (USD 200m) 110.75 (250m)

EUR/USD: 1.1100 (EUR 248m) 1.1150 (660m)

GBP/USD 1.4450 (GBP 526m) 1.4585 (493m)

EUR/GBP 0.7635 (EUR 730m) 0.7750 (875m) 0.7800 (420m)

AUD/USD 0.7210 (AUD 1.08bln) 0.7500 (340m)

USD/CAD 1.3000 (USD 560m) 1.3150 (360m)

-

15:32

Profits of industrial companies in China climb in April from a year earlier

China's National Bureau of Statistics (NBS) said on Friday that profits of industrial companies in China climbed 4.2% in April from a year earlier, after a 11.1% gain in March.

For the first months of 2016, industrial profits climbed 6.5% from a year earlier.

-

14:48

U.S. revised GDP rises 0.8% in the first quarter

The U.S. Commerce Department released gross domestic product (GDP) figures on Friday. The U.S. revised GDP climbed 0.8% in the first quarter, up from the preliminary estimate of a 0.5% rise, after a 1.4% in the fourth quarter. Analysts had expected the U.S. economy to expand 0.9% in the first quarter.

The upward revision was partly driven by a downward revision of the trade deficit.

Consumer spending rose by 1.9% in the first quarter, in line with the previous estimate.

Exports fell 2.0% in the first quarter, up from the preliminary estimate of a 2.6% fall, while imports were down 0.2%, down from the preliminary estimate of a 0.2% rise.

The PCE price index increased 0.3% in the first quarter, in line with the preliminary estimate, after a 0.3% rise in the fourth quarter.

The PCE price index excluding food and energy costs increased 2.1% in the first quarter, in line with the preliminary estimate, after a 1.3% rise in the fourth quarter.

The PCE price index is the Fed's preferred gauge for inflation.

-

14:31

U.S.: PCE price index ex food, energy, q/q, Quarter I 2.1% (forecast 2.1%)

-

14:30

U.S.: GDP, q/q, Quarter I 0.8% (forecast 0.9%)

-

14:30

U.S.: PCE price index, q/q, Quarter I 0.3% (forecast 0.3%)

-

14:16

Foreign exchange market. European session: the U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data. The revised personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 2.1% in the first quarter.

The revised U.S. GDP is expected to rise 0.9% in the first quarter, after a 1.4% growth in the fourth quarter.

The Fed Chairwoman Janet Yellen will speak at 17:15 GMT. Market participants hope for hints for further interest rate hikes.

The euro traded lower against the U.S. dollar in the absence of any major economic data from the Eurozone.

The British pound traded lower against the U.S. dollar in the absence of any major economic data from the U.K.

fk released its consumer confidence index for the U.K. on late Thursday evening. GfK's U.K. consumer confidence index rose to -1 in May from -3 in April. 4 of 5 measures rose in May.

"Despite the tiny uptick this month, our confidence in economic matters, whether we look back or ahead 12 months, remains way below last year," Joe Staton, Head of Market Dynamics at GfK, said.

"Is it because the Brexit gremlins are hard at work? Almost certainly yes," he added.

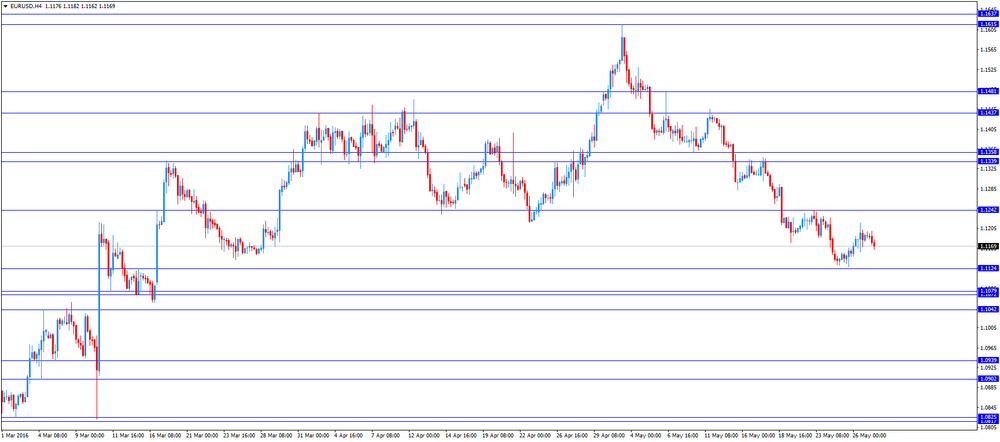

EUR/USD: the currency pair declined to $1.1162

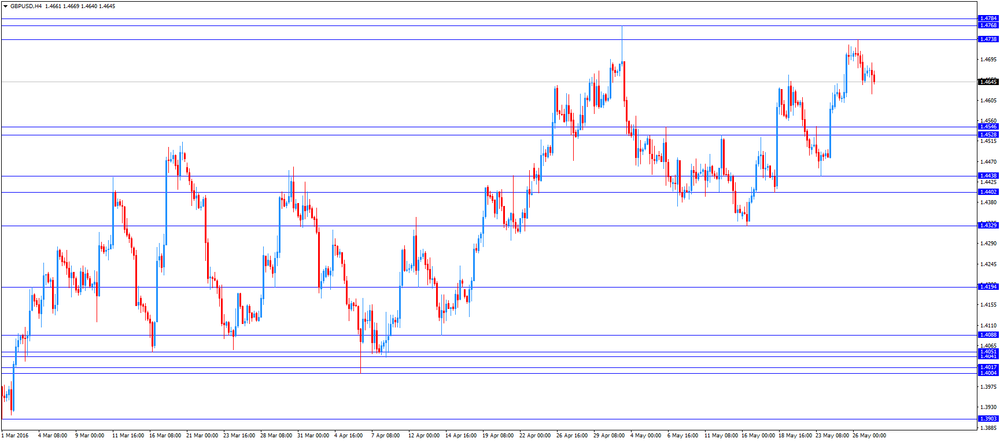

GBP/USD: the currency pair fell to $1.4619

USD/JPY: the currency pair was down to Y109.55

The most important news that are expected (GMT0):

12:30 U.S. PCE price index, q/q (Revised) Quarter I 0.3% 0.3%

12:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter I 2.1% 2.1%

12:30 U.S. GDP, q/q (Revised) Quarter I 1.4% 0.9%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) May 89 95.4

17:15 U.S. Fed Chairman Janet Yellen Speaks

-

11:44

Italian consumer confidence index decreases to 112.7 in May

The Italian statistical office Istat released its consumer confidence index for Italy on Wednesday. The Italian consumer confidence index decreased to 112.7 in May from 114.1 in April. April's figure was revised down from 114.2.

The decrease was driven by declines in economic, current and future components.

The business confidence index fell to 102.1 in May from 102.7 in April.

The decline was driven by a less favourable assessment on order books.

-

11:37

GfK’s U.K. consumer confidence index rises to -1 in May

Gfk released its consumer confidence index for the U.K. on late Thursday evening. GfK's U.K. consumer confidence index rose to -1 in May from -3 in April.

4 of 5 measures rose in May.

"Despite the tiny uptick this month, our confidence in economic matters, whether we look back or ahead 12 months, remains way below last year," Joe Staton, Head of Market Dynamics at GfK, said.

"Is it because the Brexit gremlins are hard at work? Almost certainly yes," he added.

-

11:32

Retail sales in Spain rise at a seasonally adjusted rate of 0.6% in April

The Spanish statistical office INE released its retail sales data on Friday. Retail sales in Spain rose at a seasonally adjusted rate of 0.6% in April, after a 0.5% gain in March.

Food sales were up 1.4% in April, while non-food sales increased by 0.8%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 4.1% in April, after a 4.4% rise in March.

Sales of non-food products jumped 5.8% in April from a year ago, while food sales rose 1.1%.

-

11:28

French consumer confidence index climbed to 98 in May

French statistical office INSEE released its consumer confidence index for France on Friday. French consumer confidence index climbed to 95 in May from 94 in April. It was the highest level since October 2007.

The index of the outlook on consumers' saving capacity rose to -2 in May from -5 in April.

The index of households' assessment of their financial situation in the past twelve months remained unchanged at -25 in May.

The index of the outlook on consumers' financial situation for next twelve months increased to -9 in May from -14 in April.

The index of the outlook on unemployment rising in coming months dropped to 21 in May from 49 in April.

The index for future inflation expectations remained fell to -39 in May from -36 in April.

-

11:06

Fed Governor Jerome Powell: the Fed could raise its interest rate soon

Fed Governor Jerome Powell said in a speech on Thursday that the Fed could raise its interest rate soon.

"Depending on the incoming data and the evolving risks, another rate increase may be appropriate fairly soon," he said.

"Several factors suggest that the pace of rate increases should be gradual," Powell added.

Fed governor noted that the referendum on Britain's membership in the European Union could weigh on the Fed's interest rate decision in June.

Powell is a voting member of the Federal Open Market Committee (FOMC).

-

10:56

St. Louis Fed President James Bullard: financial markets have an appropriate view on the Fed’s monetary policy in June after the release of the Fed’s April minutes

St. Louis Fed President James Bullard said on Thursday that financial markets had an appropriate view on the Fed's monetary policy in June after the release of the Fed's April monetary policy meeting minutes.

"I think they read the minutes correctly," he said.

Bullard noted that the Fed's interest rate decision in June would depend on the incoming economic data.

-

10:43

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy decline to 42.0 in in the week ended May 22

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy declined to 42.0 in in the week ended May 22 from 42.6 the prior week.

The decrease was driven by drops in 2 of 3 sub-indexes. The measure of views of the economy was down to 31.7 from 32.4, the buying climate index remained unchanged at 38.9, while the personal finances index fell to 55.3 from 56.5.

-

10:23

Japan's national CPI declines to an annual rate of -0.3% in April

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Thursday evening. Japan's national consumer price index (CPI) declined to an annual rate of -0.3% in April from -0.1% in March, in line with expectations.

Inflation was mainly driven by declines in fuel and communication prices. Fuel prices slid 9.1% year-on-year in April, while communication prices declined 2.5%.

Japan's national CPI excluding fresh food remained unchanged at an annual rate of -0.3% in April, beating expectations for a drop to -0.4%.

The Bank of Japan's inflation target is 2%.

-

10:12

U.S. pending home sales increases 5.1% in April

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Thursday. Pending home sales in the U.S. increased 5.1% in April, exceeding expectations for a 0.6% gain, after a 1.6% rise in March. March's figure was revised up from a 1.4% gain.

The increase was led by rises in almost all regions. Only pending home sales in the Midwest region declined in April

"The building momentum from the over 14 million jobs created since 2010 and the prospect of facing higher rents and mortgage rates down the road appear to be bringing more interested buyers into the market," the NAR's chief economist Lawrence Yun said.

"Even if rates rise soon, sales have legs for further expansion this summer if housing supply increases enough to give buyers an adequate number of affordable choices during their search," he added.

-

10:08

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.00 (USD 200m) 110.75 (250m)

EUR/USD: 1.1100 (EUR 248m) 1.1150 (660m)

GBP/USD 1.4450 (GBP 526m) 1.4585 (493m)

EUR/GBP 0.7635 (EUR 730m) 0.7750 (875m) 0.7800 (420m)

AUD/USD 0.7210 (AUD 1.08bln) 0.7500 (340m)

USD/CAD 1.3000 (USD 560m) 1.3150 (360m)

-

08:34

Options levels on friday, May 27, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1406 (5101)

$1.1319 (3670)

$1.1254 (3695)

Price at time of writing this review: $1.1192

Support levels (open interest**, contracts):

$1.1112 (5530)

$1.1077 (5191)

$1.1036 (3311)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 71409 contracts, with the maximum number of contracts with strike price $1,1400 (5101);

- Overall open interest on the PUT options with the expiration date June, 3 is 87843 contracts, with the maximum number of contracts with strike price $1,1200 (7968);

- The ratio of PUT/CALL was 1.23 versus 1.24 from the previous trading day according to data from May, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.4901 (2024)

$1.4803 (1717)

$1.4707 (2056)

Price at time of writing this review: $1.4660

Support levels (open interest**, contracts):

$1.4594 (964)

$1.4497 (1238)

$1.4399 (1906)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 32846 contracts, with the maximum number of contracts with strike price $1,4600 (2470);

- Overall open interest on the PUT options with the expiration date June, 3 is 34981 contracts, with the maximum number of contracts with strike price $1,4200 (3023);

- The ratio of PUT/CALL was 1.07 versus 1.05 from the previous trading day according to data from May, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:25

Asian session: The dollar stayed

The dollar stayed in consolidation mode on Friday after its rally to two-month highs ran out of steam with bulls looking for fresh guidance from the head of the U.S. central bank. It is still up nearly 2.3 percent this month, among the top performing currencies, after a string of Federal Reserve officials bolstered expectations for a hike in interest rates as early as next month. Traders are now keen to hear from Fed Chair Janet Yellen, who is due to speak at an event hosted by the Harvard University Radcliffe Institute for Advanced Study at 1715 GMT. Also closely watched is the second estimate of the March quarter U.S. gross domestic product. Analysts polled by Reuters expect to see an upgrade of the earlier reading, which showed the economy grew at its slowest pace in two years.

There was little reaction to the outcome of a two-day Group of Seven summit. The G7 industrial powers pledged on Friday to seek strong global growth, while papering over differences on currencies and stimulus policies.

The yen showed limited reaction to media reports that Japanese Prime Minister Shinzo Abe is considering delaying a sales tax hike, originally planned in April 2017, by around two years. If Japan were to delay the planned sales tax hike, some market participants say the initial reaction may be for Tokyo shares to rise, which could weigh on the safe haven yen. Still, a possible postponement of the sales tax hike has probably been mostly factored in, said a trader for a Japanese bank in Singapore, so any market impact may be limited even in the event of an official announcement to that effect.

EUR/USD: during the Asian session the pair traded in the range of $1.1185-00

GBP/USD: during the Asian session the pair traded in the range of $1.4655-80

USD/JPY: during the Asian session the pair climbed to Y110.00

Based on Reuters materials

-

01:31

Japan: National Consumer Price Index, y/y, April -0.5% (forecast -0.3%)

-

01:31

Japan: Tokyo CPI ex Fresh Food, y/y, May 0.5% (forecast -0.4%)

-

01:31

Japan: National CPI Ex-Fresh Food, y/y, April -0.5% (forecast -0.4%)

-

01:30

Japan: Tokyo Consumer Price Index, y/y, May -0.5% (forecast -0.4%)

-

00:29

Currencies. Daily history for May 26’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1192 +0,34%

GBP/USD $1,4664 -0,26%

USD/CHF Chf0,989 -0,22%

USD/JPY Y109,75 -0,38%

EUR/JPY Y122,83 -0,05%

GBP/JPY Y160,91 -0,66%

AUD/USD $0,7223 +0,48%

NZD/USD $0,6740 +0,34%

USD/CAD C$1,2974 -0,35%

-

00:01

Schedule for today, Friday, May 27’2016:

(time / country / index / period / previous value / forecast)

12:30 U.S. PCE price index, q/q Quarter I 0.3% 0.3%

12:30 U.S. PCE price index ex food, energy, q/q Quarter I 2.1% 2.1%

12:30 U.S. GDP, q/q Quarter I 1.4% 0.9%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index May 89 95.4

17:15 U.S. Fed Chairman Janet Yellen Speaks

-