Noticias del mercado

-

23:59

Schedule for today, Tuesday, 29’2015:

(time / country / index / period / previous value / forecast)

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y October 5.5% 5.4%

15:00 U.S. Consumer confidence December 90.4 92.9

-

18:01

European stocks closed: CAC 40 4,617.95 -45.23 -0.97% DAX 10,653.91 -73.73 -0.69%

-

14:50

Option expiries for today's 10:00 ET NY cut

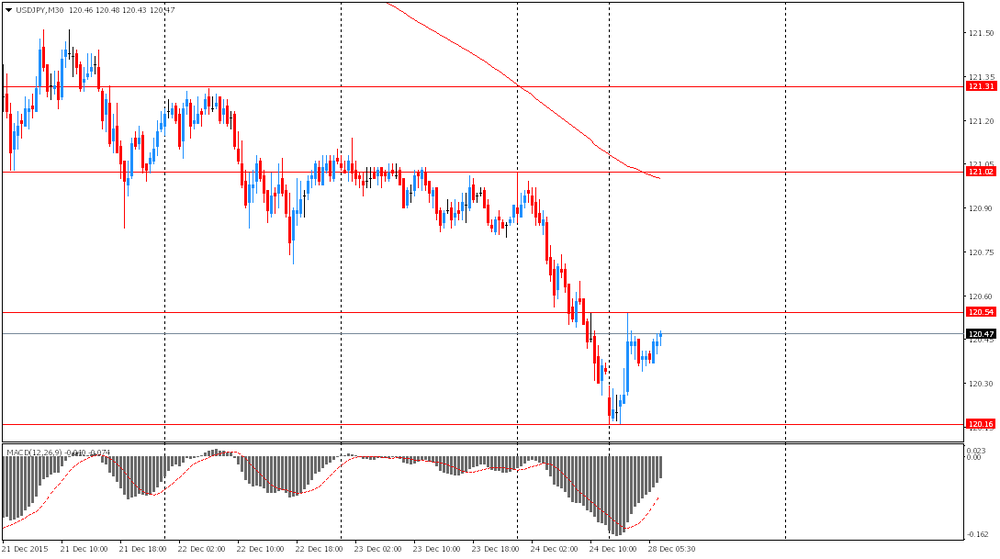

USD/JPY 120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD 1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

GBP/USD 1.4875 (GBP 150m)

AUD/USD 0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY 131.65 (EUR 465m)

-

11:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD 1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

GBP/USD 1.4875 (GBP 150m)

AUD/USD 0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY 131.65 (EUR 465m)

-

07:37

Foreign exchange market. Asian session: the U.S. dollar retreated

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia HIA New Home Sales, m/m November -3.0%

05:00 Japan Leading Economic Index (Finally) October 101.6 102.9 104.2

05:00 Japan Coincident Index (Finally) October 112.3 114.3 113.8

The U.S. dollar declined against the euro and the pound after recent gains, which were generated by the Federal Reserve's rate hike. Expectations of higher rates and the 25 basis points hike supported the greenback earlier. Nevertheless investors have already taken advantage of this event and now market participants are focused on further increases in 2016. Most analysts don't expect the Federal Reserve to raise rates again before April 2016.

The yen fell against the greenback amid weaker-than-expected data. Japanese retail sales fell by 2.5% m/m in November. The index declined 1.0% on an annualized basis. Meanwhile industrial production declined 1.0% m/m in November, but gained 1.6% on a y/y basis. Industrial production declined because of weak demand from emerging markets.

Trading volumes are still low after catholic Christmas and ahead of New Year. Market participants close their orders and try not to open new ones ahead of the holiday. That's why liquidity declines and volatility rises.

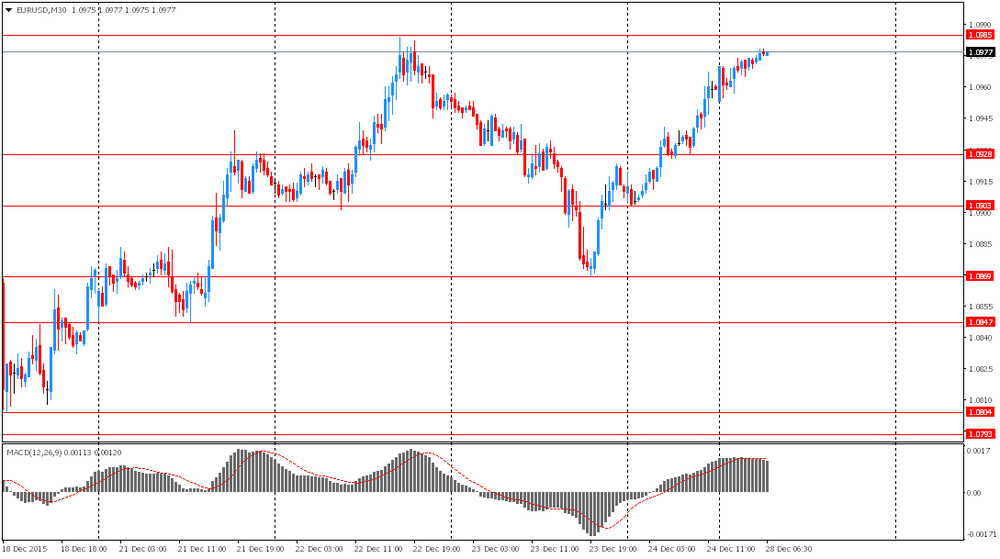

EUR/USD: the pair rose to $1.0975 in Asian trade

USD/JPY: the pair rose to Y120.55

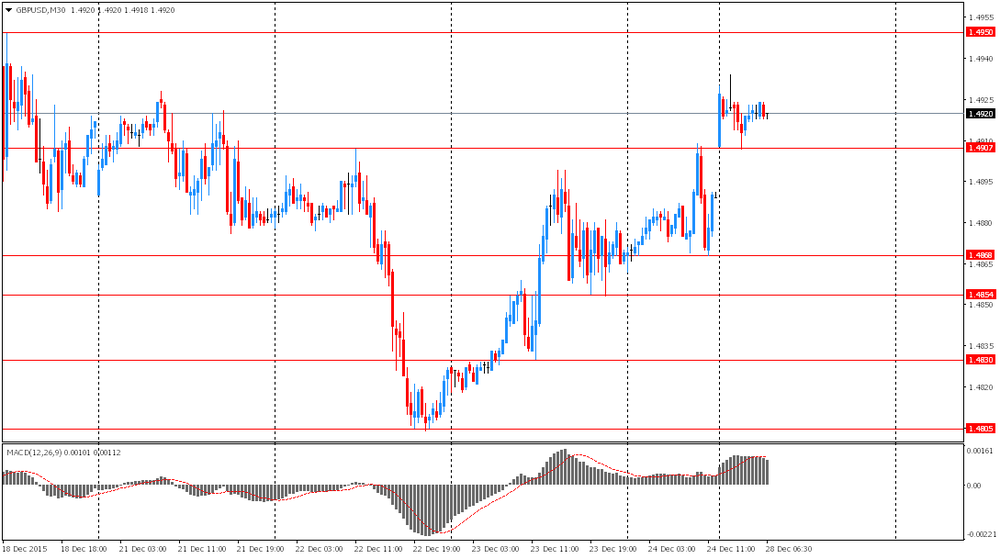

GBP/USD: the pair rose to $1.4935

-

07:06

Options levels on monday, December 28, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1130 (7538)

$1.1065 (4731)

$1.1021 (5506)

Price at time of writing this review: $1.0973

Support levels (open interest**, contracts):

$1.0855 (3112)

$1.0819 (2981)

$1.0779 (6103)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 56525 contracts, with the maximum number of contracts with strike price $1,1100 (7538);

- Overall open interest on the PUT options with the expiration date January, 8 is 72972 contracts, with the maximum number of contracts with strike price $1,0450 (7997);

- The ratio of PUT/CALL was 1.29 versus 1.29 from the previous trading day according to data from December, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1156)

$1.5103 (2592)

$1.5006 (432)

Price at time of writing this review: $1.4921

Support levels (open interest**, contracts):

$1.4796 (1722)

$1.4698 (1085)

$1.4599 (612)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 19022 contracts, with the maximum number of contracts with strike price $1,5100 (2592);

- Overall open interest on the PUT options with the expiration date January, 8 is 18985 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from December, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:16

Japan: Leading Economic Index , October 104.2 (forecast 102.9)

-

06:16

Japan: Coincident Index, October 113.8 (forecast 114.3)

-

01:01

Currencies. Daily history for Dec 24’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0959 +0,44%

GBP/USD $1,4889 +0,13%

USD/CHF Chf0,986 -0,47%

USD/JPY Y120,34 -0,47%

EUR/JPY Y131,87 -0,05%

GBP/JPY Y179,16 -0,35%

AUD/USD $0,7272 +0,54%

NZD/USD $0,6815 +0,34%

USD/CAD C$1,3852 +0,03%

-

00:56

Japan: Industrial Production (MoM) , November -1.0%

-

00:53

Japan: Industrial Production (YoY), November 1.6%

-

00:50

Japan: Retail sales, y/y, November -1.0%

-

00:00

Schedule for today, Monday, 28’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia HIA New Home Sales, m/m November -3.0%

05:00 Japan Leading Economic Index (Finally) October 101.6 102.9

05:00 Japan Coincident Index (Finally) October 112.3 114.3

06:00 United Kingdom Bank holiday

12:00 Canada Bank holiday

-