Noticias del mercado

-

18:00

European stocks closed: FTSE 100 6,314.57 +59.93 +0.96% CAC 40 4,701.36 +83.41 +1.81% DAX 10,860.14 +206.23 +1.94%

-

16:00

U.S.: Consumer confidence , December 96.5 (forecast 93.6)

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, October 5.5% (forecast 5.4%)

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 230m) 121.00 (260m)

-

14:36

U.S.: International Trade, bln, November -60.5 (forecast -60.9)

-

08:16

Options levels on tuesday, December 29, 2015:

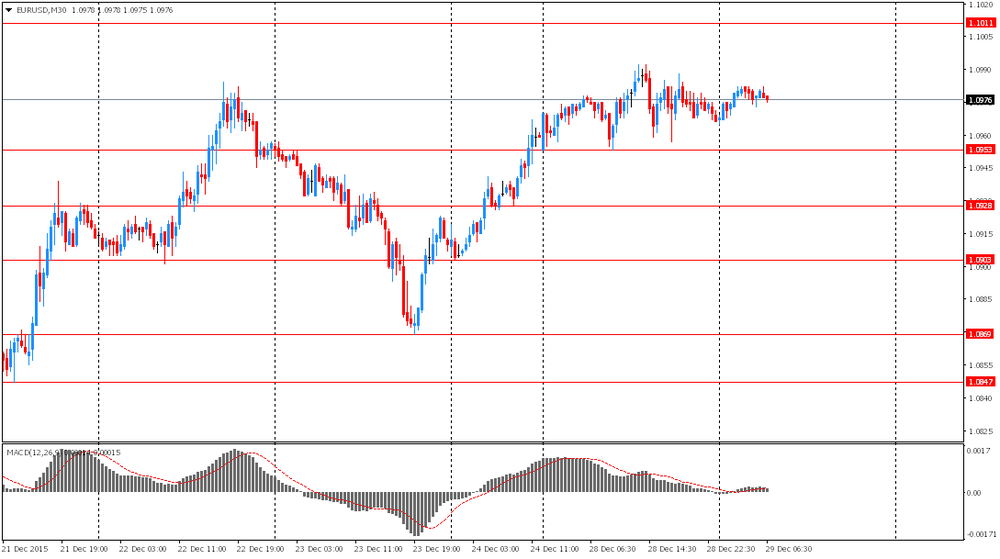

EUR / USD

Resistance levels (open interest**, contracts)

$1.1132 (7489)

$1.1070 (4681)

$1.1031 (5533)

Price at time of writing this review: $1.0964

Support levels (open interest**, contracts):

$1.0901 (1962)

$1.0868 (3561)

$1.0829 (6104)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 56247 contracts, with the maximum number of contracts with strike price $1,1100 (7489);

- Overall open interest on the PUT options with the expiration date January, 8 is 73122 contracts, with the maximum number of contracts with strike price $1,0450 (7997);

- The ratio of PUT/CALL was 1.30 versus 1.29 from the previous trading day according to data from December, 28

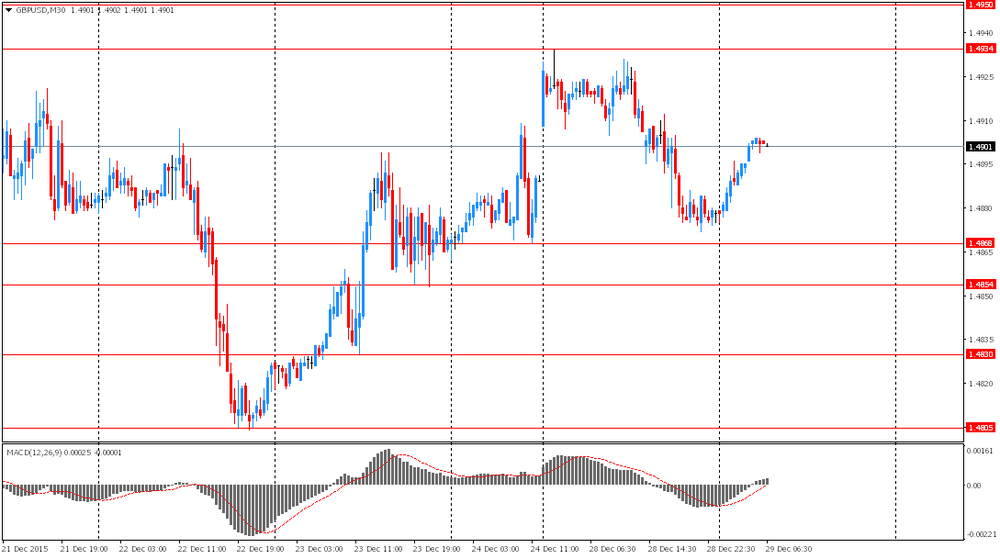

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1156)

$1.5102 (2659)

$1.5004 (470)

Price at time of writing this review: $1.4905

Support levels (open interest**, contracts):

$1.4795 (1850)

$1.4698 (1109)

$1.4599 (630)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 19275 contracts, with the maximum number of contracts with strike price $1,5100 (2659);

- Overall open interest on the PUT options with the expiration date January, 8 is 19168 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 0.99 versus 1.00 from the previous trading day according to data from December, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:58

Foreign exchange market. Asian session: the gained slightly against the dollar

The euro climbed against the U.S. dollar on ECB's Yves Mersch comments. The policymaker noted that the ECB may expand the quantitative easing program. Investors welcomed his words. In December investors were partly disappointed by the ECB's decision to simply extend the €60 billion program till March 2017 as they expected more aggressive steps to stimulate the economy.

The Australian dollar is range-bound. The currency is supported by recent gains in commodity prices. Market participants are waiting for data on manufacturing and services PMIs in the country's major trading partner China. The report will be released on January 1.

S&P/Case-Shiller will release its U.S. house price index data at 14:00 GMT. The index is expected to post a 5.4% gain in October after a 5.5% rise in September.

EUR/USD: the pair rose to $1.0980 in Asian trade

USD/JPY: the pair traded within Y120.20-40

GBP/USD: the pair rose to $1.4905

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y October 5.5% 5.4%

15:00 U.S. Consumer confidence December 90.4 93.6

-

01:01

Currencies. Daily history for Dec 28’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0966 +0,06%

GBP/USD $1,4878 -0,07%

USD/CHF Chf0,9885 +0,25%

USD/JPY Y120,39 +0,04%

EUR/JPY Y132,04 +0,13%

GBP/JPY Y179,12 -0,02%

AUD/USD $0,7248 -0,33%

NZD/USD $0,6845 +0,44%

USD/CAD C$1,3904 +0,37%

-