Noticias del mercado

-

21:00

Dow +1.16% 17,732.14 +203.87 Nasdaq +1.43% 5,112.93 +71.94 S&P +1.12% 2,079.50 +23,09

-

18:53

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Tuesday as crude prices edged up, recovering some of their Monday losses.

Almost all of Dow stocks in positive area (29 of 30). Top looser - The Walt Disney Company (DIS, -0,52%). Top gainer - The Boeing Company (BA, +1.72%).

Almost all S&P sectors also in green area. Top looser - Conglomerates (-0.3%). Top gainer - Healthcare (+1,0%).

At the moment:

Dow 17609.00 +171.00 +0.98%

S&P 500 2067.50 +18.75 +0.92%

Nasdaq 100 4679.50 +65.75 +1.43%

Oil 37.76 +0.95 +2.58%

Gold 1068.00 -0.30 -0.03%

U.S. 10yr 2.27 +0.04

-

18:35

WSE: Session Results

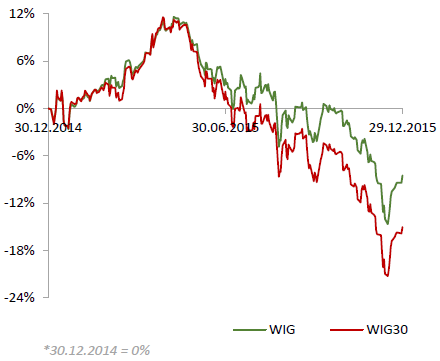

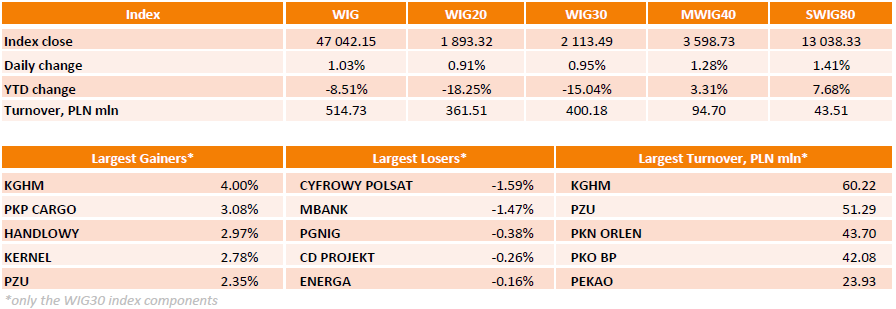

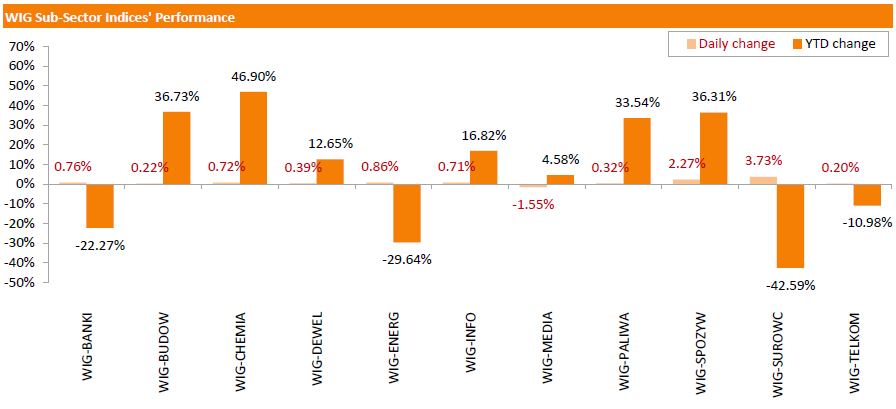

Polish equity market surged on Tuesday. The broad market measure, the WIG Index, added 1.03%. Media sector (-1.55%) was sole decliner within the WIG Index, while materials (+3.73) outpaced.

The large-cap companies' measure, the WIG30 Index, grew by 0.95%. In the index basket, the gainers were led by copper producer KGHM (WSE: KGH), railway freight transport operator PKP CARGO (WSE: PKP), bank HANDLOWY (WSE: BHW) and agricultural producer KERNEL (WSE: KER), rising 2.78%-4%. On the other side of the ledger, media group CYFROWY POLSAT (WSE: CPS) and bank MBANK (WSE: MBK) topped the decliners' list, slumping by 1.59% and 1.47% respectively.

-

18:00

European stocks closed: FTSE 100 6,314.57 +59.93 +0.96% CAC 40 4,701.36 +83.41 +1.81% DAX 10,860.14 +206.23 +1.94%

-

16:00

U.S.: Consumer confidence , December 96.5 (forecast 93.6)

-

15:29

Before the bell: S&P futures +0.70%, NASDAQ futures +0.72%

U.S. stock-index futures rose as oil rebounded.

Global Stocks:

Nikkei 18,982.23 +108.88 +0.58%

Hang Seng 21,999.62 +80.00 +0.36%

Shanghai Composite 3,563.91 +30.13 +0.85%

FTSE 6,290.15 +35.51 +0.57%

CAC 4,696.03 +78.08 +1.69%

DAX 10,846.27 +192.36 +1.81%

Crude oil $37.30 (+1.33%)

Gold $1072.50 (+0.39%)

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, October 5.5% (forecast 5.4%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.06

3.07%

47.7K

Chevron Corp

CVX

91.46

1.22%

0.1K

Exxon Mobil Corp

XOM

79.70

1.22%

2.8K

Barrick Gold Corporation, NYSE

ABX

7.62

1.20%

9.5K

Caterpillar Inc

CAT

69.20

0.90%

0.4K

Tesla Motors, Inc., NASDAQ

TSLA

231.00

0.90%

2.2K

Yahoo! Inc., NASDAQ

YHOO

33.88

0.83%

1.0K

Nike

NKE

64.33

0.81%

1.4K

Microsoft Corp

MSFT

56.40

0.80%

10.3K

International Business Machines Co...

IBM

138.61

0.73%

0.4K

JPMorgan Chase and Co

JPM

66.85

0.71%

0.5K

ALCOA INC.

AA

10.05

0.70%

9.3K

Hewlett-Packard Co.

HPQ

11.71

0.69%

0.1K

Goldman Sachs

GS

182.83

0.67%

0.1K

Walt Disney Co

DIS

107.95

0.65%

8.8K

Google Inc.

GOOG

767.40

0.64%

2.9K

Yandex N.V., NASDAQ

YNDX

15.73

0.64%

2.5K

Visa

V

79.02

0.62%

0.8K

Citigroup Inc., NYSE

C

52.66

0.53%

22.6K

Ford Motor Co.

F

14.25

0.49%

1.2K

Cisco Systems Inc

CSCO

27.43

0.44%

10.0K

Intel Corp

INTC

35.08

0.43%

3.0K

United Technologies Corp

UTX

96.50

0.43%

5.1K

General Electric Co

GE

31.03

0.42%

14.4K

AT&T Inc

T

34.90

0.40%

22.7K

Facebook, Inc.

FB

106.35

0.40%

23.6K

FedEx Corporation, NYSE

FDX

149.00

0.40%

17.1K

HONEYWELL INTERNATIONAL INC.

HON

104.74

0.39%

0.2K

Amazon.com Inc., NASDAQ

AMZN

677.79

0.38%

13.9K

Procter & Gamble Co

PG

80.20

0.35%

0.5K

Wal-Mart Stores Inc

WMT

60.95

0.33%

6.5K

Verizon Communications Inc

VZ

46.90

0.32%

0.9K

Merck & Co Inc

MRK

53.00

0.30%

0.5K

McDonald's Corp

MCD

119.10

0.29%

0.5K

Apple Inc.

AAPL

107.10

0.26%

127.7K

The Coca-Cola Co

KO

43.60

0.25%

1K

E. I. du Pont de Nemours and Co

DD

66.59

0.18%

0.2K

Home Depot Inc

HD

132.91

0.17%

5.8K

American Express Co

AXP

69.73

-0.04%

0.2K

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 230m) 121.00 (260m)

-

14:36

U.S.: International Trade, bln, November -60.5 (forecast -60.9)

-

08:16

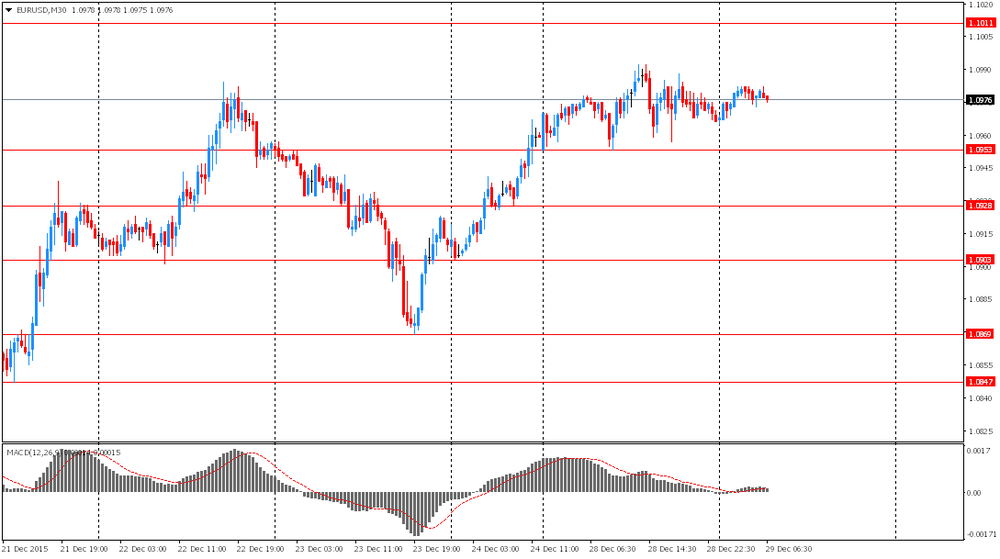

Options levels on tuesday, December 29, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1132 (7489)

$1.1070 (4681)

$1.1031 (5533)

Price at time of writing this review: $1.0964

Support levels (open interest**, contracts):

$1.0901 (1962)

$1.0868 (3561)

$1.0829 (6104)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 56247 contracts, with the maximum number of contracts with strike price $1,1100 (7489);

- Overall open interest on the PUT options with the expiration date January, 8 is 73122 contracts, with the maximum number of contracts with strike price $1,0450 (7997);

- The ratio of PUT/CALL was 1.30 versus 1.29 from the previous trading day according to data from December, 28

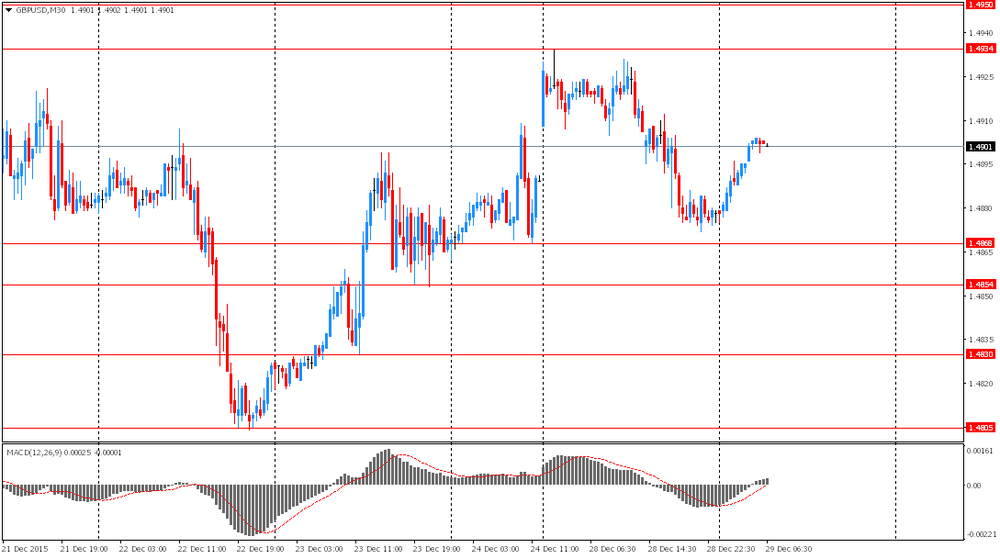

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1156)

$1.5102 (2659)

$1.5004 (470)

Price at time of writing this review: $1.4905

Support levels (open interest**, contracts):

$1.4795 (1850)

$1.4698 (1109)

$1.4599 (630)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 19275 contracts, with the maximum number of contracts with strike price $1,5100 (2659);

- Overall open interest on the PUT options with the expiration date January, 8 is 19168 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 0.99 versus 1.00 from the previous trading day according to data from December, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:58

Foreign exchange market. Asian session: the gained slightly against the dollar

The euro climbed against the U.S. dollar on ECB's Yves Mersch comments. The policymaker noted that the ECB may expand the quantitative easing program. Investors welcomed his words. In December investors were partly disappointed by the ECB's decision to simply extend the €60 billion program till March 2017 as they expected more aggressive steps to stimulate the economy.

The Australian dollar is range-bound. The currency is supported by recent gains in commodity prices. Market participants are waiting for data on manufacturing and services PMIs in the country's major trading partner China. The report will be released on January 1.

S&P/Case-Shiller will release its U.S. house price index data at 14:00 GMT. The index is expected to post a 5.4% gain in October after a 5.5% rise in September.

EUR/USD: the pair rose to $1.0980 in Asian trade

USD/JPY: the pair traded within Y120.20-40

GBP/USD: the pair rose to $1.4905

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y October 5.5% 5.4%

15:00 U.S. Consumer confidence December 90.4 93.6

-

07:35

Oil prices declined amid demand concerns

West Texas Intermediate futures for February delivery is currently at $36.88 (+0.19%), while Brent crude is at $36.67 (+0.14%) after suffering heavy losses in the previous session amid renewed concerns over demand growth in the oversupplied market.

Oil analysts JBC Energy estimated that oil demand growth in Europe posted a loss of 170,000 barrels per day on an annualized basis turning negative for the first time in 10 months. Analysts also said that China, world's second-biggest oil consumer, recorded slower diesel and gasoline demand growth.

Meanwhile Iran oil minister Bijan Namdar Zangeneh said that a return to pre-sanctions output volume is the country's target.

-

07:15

Gold under pressure

Gold climbed to $1,072.50 (+0.39%), but remained under pressure amid falling oil prices. The precious metal is often seen as a hedge from oil-led inflation, that's why low oil prices ease inflation concerns and reduce demand for bullion. This week trading is likely to remain thin. Gold is expected to be range-bound for the rest of the year.

Some analysts expect gold to trade lower and decline to $1,000 an ounce in 2016 amid prospects of further rate hikes by the Federal Reserve. Assets of SPDR Gold Trust, the biggest gold-backed exchange-traded fund in the world, fell by 0.18% to 643.56 tonnes on Monday.

-

07:04

Global Stocks: U.S. stock indices edged down

U.S. stock indices edged down on Monday amid declines in oil prices.

The Dow Jones Industrial Average lost 23.90 points, or 0.1%, to 17,528.27 after an initial decline of 115 points. The S&P 500 declined 4.48 points, or 0.22%, to 2,056.50 (its energy sector fell 1.79%). The Nasdaq Composite fell by 7.51 points, or 0.2%, to 5,040.99.

Meanwhile data from the Federal Reserve showed that business activity of producers in Texas rose in December marking the third straight month of growth. The corresponding index rose to 13.4 from 5.2 in November. A reading above 0 points to growth. However the new orders sub-index declined at a faster pace in December falling to -8.9 points.

This morning in Asia Hong Kong Hang Seng climbed 0.30%, or 66.12, to 21,985.74. China Shanghai Composite Index lost 0.28%, or 9.79, to 3,523.99. The Nikkei gained 0.47%, or 88.55, to 18,961.90.

Asian stock indices outside mainland China advanced after suffering losses at the beginning of the session. Japanese exporters gained.

-

03:02

Nikkei 225 18,867.26 -6.09 -0.03 %, Hang Seng 21,933.46 +13.84 +0.06 %, Shanghai Composite 3,535.35 +1.58 +0.04 %

-

01:03

Commodities. Daily history for Dec 28’2015:

(raw materials / closing price /% change)

Oil 36.69 -0.33%

Gold 1,068.50 +0.02%

-

01:02

Stocks. Daily history for Sep Dec 28’2015:

(index / closing price / change items /% change)

Nikkei 225 18,873.35 +104.29 +0.56 %

Hang Seng 21,919.62 -218.51 -0.99 %

Shanghai Composite 3,534.76 -93.16 -2.57 %

CAC 40 4,617.95 45.23 -0.97 %

S&P 500 2,056.5 -4.49 -0.22 %

NASDAQ Composite 5,040.99 -7.51 -0.15 %

Dow Jones 17,528.27 -23.90 -0.14 %

-

01:01

Currencies. Daily history for Dec 28’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0966 +0,06%

GBP/USD $1,4878 -0,07%

USD/CHF Chf0,9885 +0,25%

USD/JPY Y120,39 +0,04%

EUR/JPY Y132,04 +0,13%

GBP/JPY Y179,12 -0,02%

AUD/USD $0,7248 -0,33%

NZD/USD $0,6845 +0,44%

USD/CAD C$1,3904 +0,37%

-