Noticias del mercado

-

23:59

Schedule for today, Tuesday, 29’2015:

(time / country / index / period / previous value / forecast)

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y October 5.5% 5.4%

15:00 U.S. Consumer confidence December 90.4 92.9

-

21:00

Dow -0.18% 17,520.77 -31.40 Nasdaq -0.32% 5,032.48 -16.01 S&P -0.31% 2054.69 -6.30

-

18:42

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes began the last trading week of the year in the red, dragged down by energy stocks, as oil prices resumed a slide brought on by a global oversupply. Trading volumes are expected be subdued through the week.

Global stocks ticked lower on Monday over fresh worries about Chinese growth after data showed profits at industrial companies in the world's second-largest economy fell in November for the sixth month in a row.

Most of Dow stocks 15 in negative area (22 of 30). Top looser - Chevron Corporation (CVX, -1,65%). Top gainer - The Walt Disney Company (DIS, +1.11%).

All S&P sectors also red. Top looser - Conglomerates (-1.9%).

At the moment:

Dow 17372.00 -77.00 -0.44%

S&P 500 2040.00 -11.25 -0.55%

Nasdaq 100 4586.25 -24.75 -0.54%

Oil 36.75 -1.35 -3.54%

Gold 1069.50 -6.40 -0.59%

U.S. 10yr 2.22 -0.02

-

18:11

WSE: Session Results

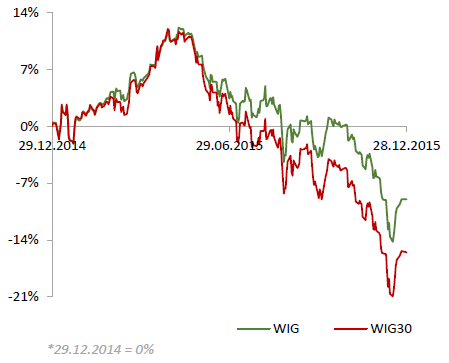

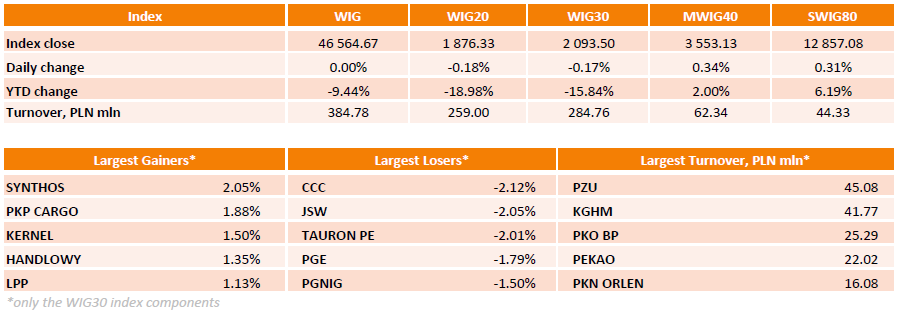

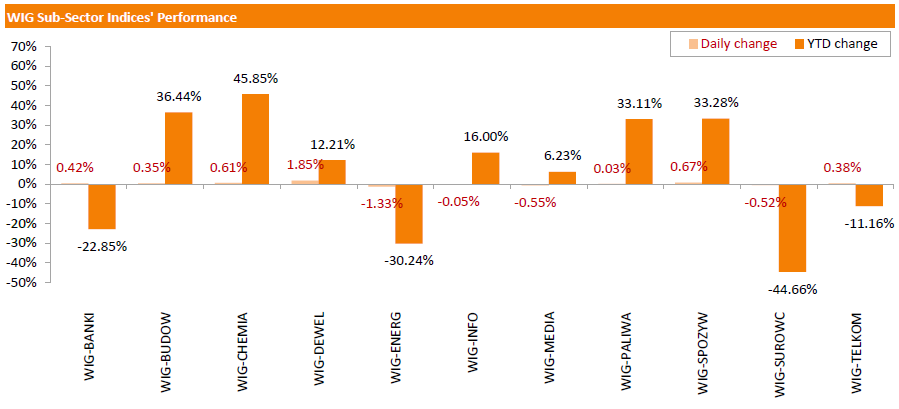

Polish equity market closed unchanged on Monday. Sector-wise, utilities stocks (-1.33%) fared the worst, while developing sector names (+1.85%) outperformed.

The large-cap stocks' measure, the WIG30 Index, fell by 0.17%. The decliners were led by footwear retailer CCC (WSE: CCC), which tumbled by 2.12%. Other biggest laggards included coking coal producer JSW (WSE: JSW) and two gencos TAURON PE (WSE: TPE) and PGE (WSE: PGE), which plunged by 2.05%, 2.01% and 1.79% respectively. On the other side of the ledger, chemical producer SYNTHOS (WSE: SNS) recorded the strongest daily result, climbing by 2.05% on analyst upgrade. It was followed by railway freight transport operator PKP CARGO (WSE: PKP) and agricultural producer KERNEL (WSE: KER), advancing 1.88% and 1.5% respectively.

-

18:01

European stocks closed: CAC 40 4,617.95 -45.23 -0.97% DAX 10,653.91 -73.73 -0.69%

-

15:33

U.S. Stocks open: Dow -0.45%, Nasdaq -0.37%, S&P -0.43%

-

15:22

Before the bell: S&P futures -0.33%, NASDAQ futures -0.19%

U.S. stock-index futures slipped.

Global Stocks:

Nikkei 18,873.35 +104.29 +0.56%

Hang Seng 21,919.62 -218.51 -0.99%

Shanghai Composite 3,534.76 -93.16 -2.57%

CAC 4,624.73 -38.45 -0.82%

DAX10,655.11 -72.53 -0.68%

Crude oil $37.13 (-2.60%)

Gold $1070.40 (-0.50%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Walt Disney Co

DIS

106.25

0.37%

1.2K

Amazon.com Inc., NASDAQ

AMZN

665.00

0.33%

4.1K

Google Inc.

GOOG

748.59

0.03%

1.9K

Hewlett-Packard Co.

HPQ

11.72

-0.09%

0.2K

Verizon Communications Inc

VZ

46.64

-0.15%

0.3K

McDonald's Corp

MCD

118.37

-0.17%

1.0K

Facebook, Inc.

FB

104.83

-0.18%

31.3K

Starbucks Corporation, NASDAQ

SBUX

60.19

-0.22%

0.1K

Tesla Motors, Inc., NASDAQ

TSLA

230.07

-0.22%

5.8K

Nike

NKE

63.03

-0.24%

13.5K

Microsoft Corp

MSFT

55.50

-0.31%

1.0K

AMERICAN INTERNATIONAL GROUP

AIG

61.51

-0.31%

0.5K

Apple Inc.

AAPL

107.68

-0.32%

32.2K

Visa

V

78.00

-0.33%

0.3K

Intel Corp

INTC

34.86

-0.34%

1.0K

Pfizer Inc

PFE

32.50

-0.37%

1.5K

Ford Motor Co.

F

14.25

-0.42%

1.0K

American Express Co

AXP

69.86

-0.43%

0.1K

JPMorgan Chase and Co

JPM

66.30

-0.45%

30.3K

AT&T Inc

T

34.50

-0.46%

5.4K

Cisco Systems Inc

CSCO

27.25

-0.47%

0.4K

General Electric Co

GE

30.67

-0.52%

6.6K

Twitter, Inc., NYSE

TWTR

22.85

-0.52%

13.4K

International Business Machines Co...

IBM

137.52

-0.53%

0.4K

Citigroup Inc., NYSE

C

52.42

-0.55%

2.5K

Wal-Mart Stores Inc

WMT

60.47

-0.59%

0.2K

E. I. du Pont de Nemours and Co

DD

66.00

-0.60%

0.3K

Caterpillar Inc

CAT

68.80

-0.84%

1.3K

Yahoo! Inc., NASDAQ

YHOO

33.81

-0.88%

11.5K

ALCOA INC.

AA

10.01

-1.09%

34.2K

FedEx Corporation, NYSE

FDX

147.66

-1.33%

0.7K

Exxon Mobil Corp

XOM

78.18

-1.45%

13.1K

Barrick Gold Corporation, NYSE

ABX

7.69

-1.66%

3.1K

Chevron Corp

CVX

90.50

-1.68%

10.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.36

-2.77%

92.0K

Yandex N.V., NASDAQ

YNDX

15.64

-2.86%

15.6K

-

14:50

Option expiries for today's 10:00 ET NY cut

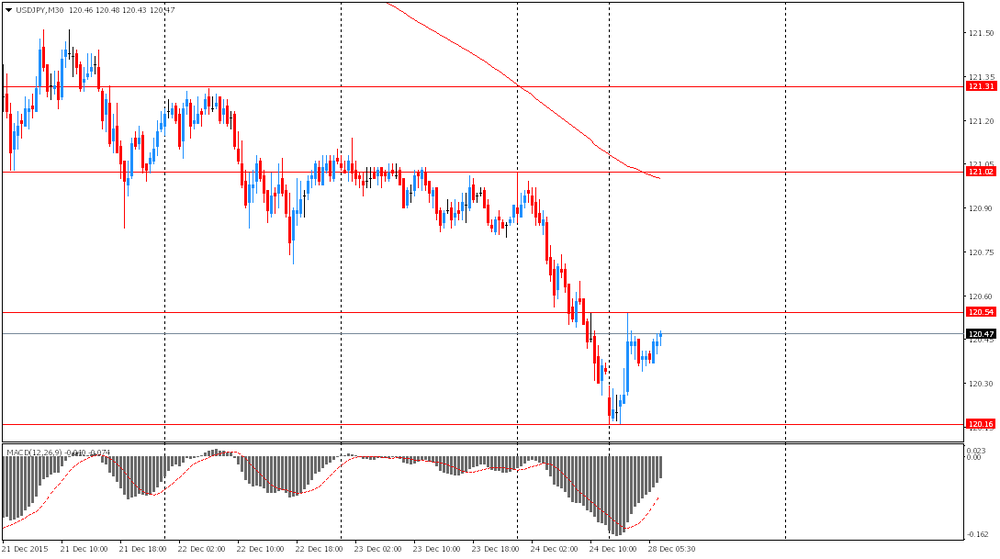

USD/JPY 120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD 1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

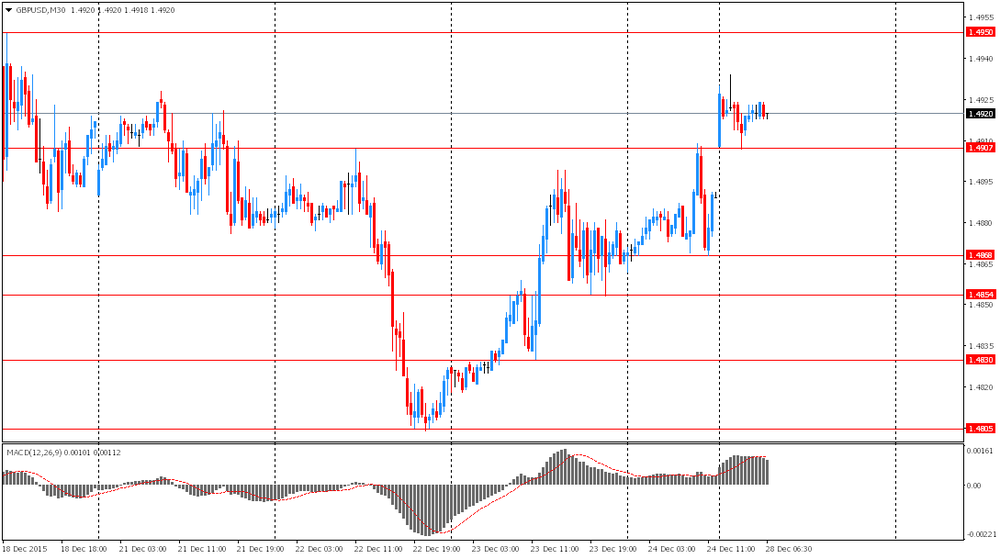

GBP/USD 1.4875 (GBP 150m)

AUD/USD 0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY 131.65 (EUR 465m)

-

14:45

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Intel (INTC) target raised to $38 from $37 at Deutsche Bank

NIKE (NKE) target raised to $77 from $75 at Argus

Amazon (AMZN) target raised to $797 from $727 at Axiom Capital

Alphabet A (GOOGL) target raised to $1000 from $900 at Axiom Capital

-

11:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.50-55 (USD 1.5bln) 121.45-50 (500m) 122.40 (689m)

EUR/USD 1.0900 (EUR 633m) 1.0920-25 (1.1bln) 1.1000 (2.5bln)

GBP/USD 1.4875 (GBP 150m)

AUD/USD 0.7190 (AUD 1.2bln) 0.7240 (330m) 0.7290-0.7300 (1bln)

EUR/JPY 131.65 (EUR 465m)

-

07:37

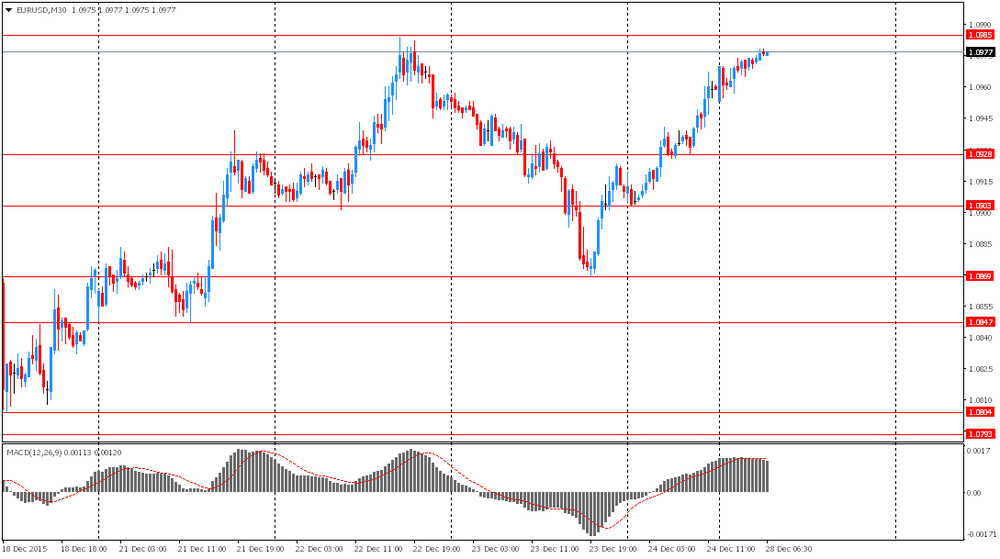

Foreign exchange market. Asian session: the U.S. dollar retreated

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia HIA New Home Sales, m/m November -3.0%

05:00 Japan Leading Economic Index (Finally) October 101.6 102.9 104.2

05:00 Japan Coincident Index (Finally) October 112.3 114.3 113.8

The U.S. dollar declined against the euro and the pound after recent gains, which were generated by the Federal Reserve's rate hike. Expectations of higher rates and the 25 basis points hike supported the greenback earlier. Nevertheless investors have already taken advantage of this event and now market participants are focused on further increases in 2016. Most analysts don't expect the Federal Reserve to raise rates again before April 2016.

The yen fell against the greenback amid weaker-than-expected data. Japanese retail sales fell by 2.5% m/m in November. The index declined 1.0% on an annualized basis. Meanwhile industrial production declined 1.0% m/m in November, but gained 1.6% on a y/y basis. Industrial production declined because of weak demand from emerging markets.

Trading volumes are still low after catholic Christmas and ahead of New Year. Market participants close their orders and try not to open new ones ahead of the holiday. That's why liquidity declines and volatility rises.

EUR/USD: the pair rose to $1.0975 in Asian trade

USD/JPY: the pair rose to Y120.55

GBP/USD: the pair rose to $1.4935

-

07:14

Oil prices declined

West Texas Intermediate futures for February delivery fell to $37.73 (-0.97%), while Brent crude declined to $37.74 (-0.40%). Analysts say that the WTI's newly gained premium over Brent is the most important factor in the market these days, when trading is thin due to holidays. This week is going to be shorter due to New Year too with markets in many countries still closed for Christmas. This week will not be data-rich, that's why the Energy Information Administration's inventories report due on Wednesday will attract more attention.

-

07:06

Options levels on monday, December 28, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1130 (7538)

$1.1065 (4731)

$1.1021 (5506)

Price at time of writing this review: $1.0973

Support levels (open interest**, contracts):

$1.0855 (3112)

$1.0819 (2981)

$1.0779 (6103)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 56525 contracts, with the maximum number of contracts with strike price $1,1100 (7538);

- Overall open interest on the PUT options with the expiration date January, 8 is 72972 contracts, with the maximum number of contracts with strike price $1,0450 (7997);

- The ratio of PUT/CALL was 1.29 versus 1.29 from the previous trading day according to data from December, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1156)

$1.5103 (2592)

$1.5006 (432)

Price at time of writing this review: $1.4921

Support levels (open interest**, contracts):

$1.4796 (1722)

$1.4698 (1085)

$1.4599 (612)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 19022 contracts, with the maximum number of contracts with strike price $1,5100 (2592);

- Overall open interest on the PUT options with the expiration date January, 8 is 18985 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from December, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:57

Gold edged down

Gold slid to $1,072.80 (-0.29%) despite a softer dollar as oil prices failed to sustain recent gains, which were triggered by the latest report on U.S. crude oil inventories. This week trading is likely to remain thin. Markets in many countries are still closed today and will be closed on Friday too due to New Year celebrations.

Some analysts expect gold to trade lower and decline to $1,000 an ounce at the beginning of 2016 amid prospects of further rate hikes by the Federal Reserve.

-

06:35

Global Stocks: U.S. stock indices little changed on Thursday

U.S. stock indices mostly edged down in a holiday-shortened session on Thursday. Markets were closed on Friday.

The Dow Jones Industrial Average lost 50.44 points, or 0.3%, to 17,552.17 (+2.5% over the week). The declined 3.32 points, or 0.2%, to 2,060.97 (+2.8% over the week). The Nasdaq Composite added 2 points, or less than 0.1% to 5,048.49 (+2.6% over the week).

This morning in Asia Hong Kong Hang Seng fell 0.38%, or 83.39, to 22,054.74. China Shanghai Composite Index lost 0.51%, or 18.52, to 3,609.39. The Nikkei gained 0.81%, or 151.97, to 18,921.03.

Asian stock indices outside Japan declined amid lack of hints for direction as markets in many countries were closed for Christmas on Friday. Japanese stocks were supported by recent gains in oil prices.

-

06:16

Japan: Leading Economic Index , October 104.2 (forecast 102.9)

-

06:16

Japan: Coincident Index, October 113.8 (forecast 114.3)

-

03:03

Nikkei 225 18,779.96 +10.90 +0.06 %, Hang Seng 22,060.21 -77.92 -0.35 %, Shanghai Composite 3,639.71 +11.80 +0.33 %

-

01:02

Commodities. Daily history for Dec 24’2015:

(raw materials / closing price /% change)

Oil 38.12 +0.05%

Gold 1,075.80 -0.01%

-

01:02

Stocks. Daily history for Sep Dec 24-25’2015:

(index / closing price / change items /% change)

Nikkei 225 18,769.06-20 .63 -0.11 %

Hang Seng 22,138.13 +97.54 +0.44 %

Shanghai Composite 3,628 +15.52 +0.43 %

FTSE 100 6,254.64 +13.66 +0.22 %

CAC 40 4,663.18 -11.35 -0.24 % 16.82m

Xetra DAX 10,727.64+238.89 +2.28 %

S&P 500 2,060.99-3.30 -0.16 %

NASDAQ Composite 5,048.49 +2.56 +0.05 %

Dow Jones 17,552.17 -50.44 -0.29 %

-

01:01

Currencies. Daily history for Dec 24’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0959 +0,44%

GBP/USD $1,4889 +0,13%

USD/CHF Chf0,986 -0,47%

USD/JPY Y120,34 -0,47%

EUR/JPY Y131,87 -0,05%

GBP/JPY Y179,16 -0,35%

AUD/USD $0,7272 +0,54%

NZD/USD $0,6815 +0,34%

USD/CAD C$1,3852 +0,03%

-

00:56

Japan: Industrial Production (MoM) , November -1.0%

-

00:53

Japan: Industrial Production (YoY), November 1.6%

-

00:50

Japan: Retail sales, y/y, November -1.0%

-

00:00

Schedule for today, Monday, 28’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia HIA New Home Sales, m/m November -3.0%

05:00 Japan Leading Economic Index (Finally) October 101.6 102.9

05:00 Japan Coincident Index (Finally) October 112.3 114.3

06:00 United Kingdom Bank holiday

12:00 Canada Bank holiday

-