Noticias del mercado

-

18:02

European stocks closed: FTSE 100 6,274.05 -40.52 -0.64% CAC 40 4,677.14 -24.22 -0.52% DAX 10,743.01 -117.13 -1.08%

-

16:30

U.S.: Crude Oil Inventories, December 2.629 (forecast -2.5)

-

16:00

U.S.: Pending Home Sales (MoM) , November -0.9% (forecast 0.5%)

-

14:50

Option expiries for today's 10:00 ET NY cut

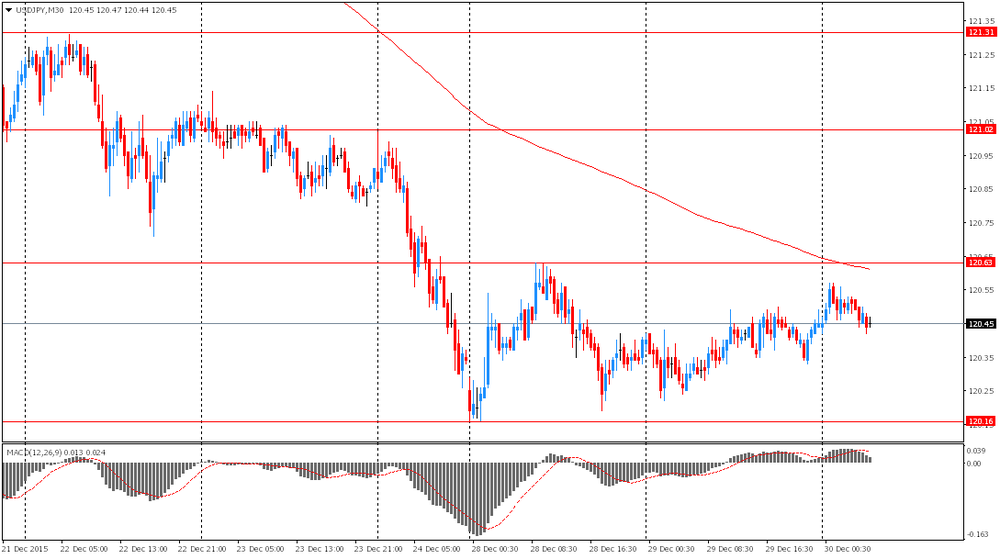

USD/JPY 120.00 (USD 284m) 121.00 (120m) 122.00 (926m)

EUR/USD 1.0875 (EUR200m) 1.0880 (383m) 1.1000 ( 597m)

GBP/USD 1.4700 (GBP 492m) 1.4725 (169m) 1.4940-50 (GBP 129m)

AUD/USD 0.7225 (AUD 210m) 0.7290 (AUD 375m) 0.7300 (142m) 0.7315 (131m) 0.7350 (306m)

NZD/USD 0.6750 (148m)

USD/CNY 6.5000 (USD 400m)

USD/SGD 1.4050 (USD 600m) 1.4100 (397m)

-

11:19

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 284m) 121.00 (120m) 122.00 (926m)

EUR/USD 1.0875 (EUR200m) 1.0880 (383m) 1.1000 ( 597m)

GBP/USD 1.4700 (GBP 492m) 1.4725 (169m) 1.4940-50 (GBP 129m)

AUD/USD 0.7225 (AUD 210m) 0.7290 (AUD 375m) 0.7300 (142m) 0.7315 (131m) 0.7350 (306m)

NZD/USD 0.6750 (148m)

USD/CNY 6.5000 (USD 400m)

USD/SGD 1.4050 (USD 600m) 1.4100 (397m)

-

10:16

Eurozone: Private Loans, Y/Y, November 1.4% (forecast 1.3%)

-

10:00

Eurozone: M3 money supply, adjusted y/y, November 5.1% (forecast 5.4%)

-

08:24

Options levels on wednesday, December 30, 2015:

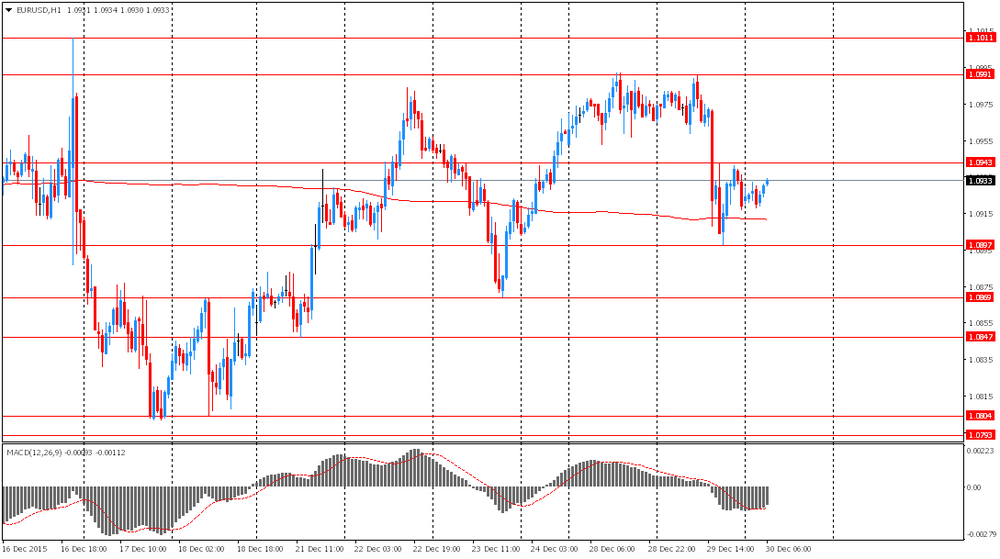

EUR / USD

Resistance levels (open interest**, contracts)

$1.1050 (4750)

$1.1003 (5522)

$1.0978 (2627)

Price at time of writing this review: $1.0931

Support levels (open interest**, contracts):

$1.0888 (1906)

$1.0858 (3670)

$1.0823 (2766)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 55813 contracts, with the maximum number of contracts with strike price $1,1100 (7418);

- Overall open interest on the PUT options with the expiration date January, 8 is 73007 contracts, with the maximum number of contracts with strike price $1,0450 (8000);

- The ratio of PUT/CALL was 1.31 versus 1.30 from the previous trading day according to data from December, 29

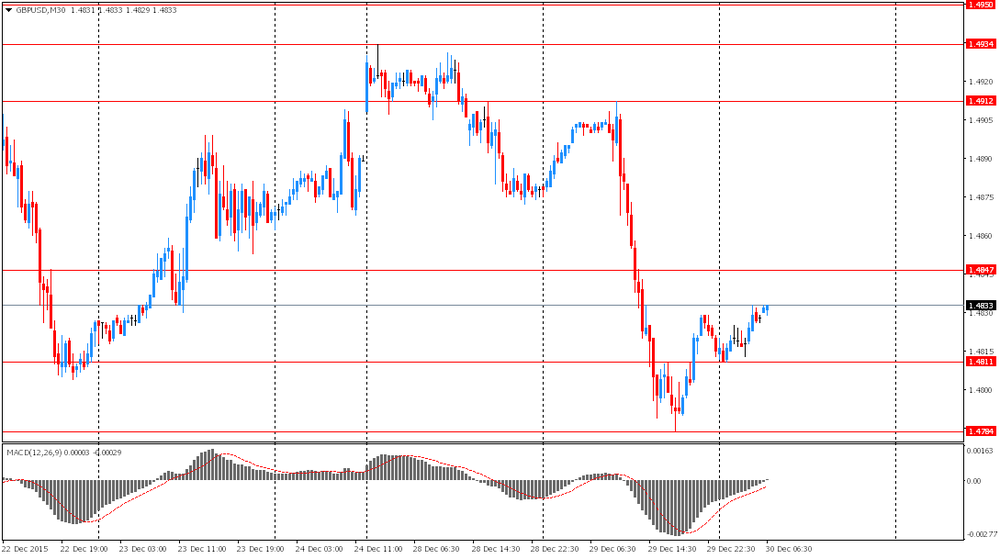

GBP/USD

Resistance levels (open interest**, contracts)

$1.5101 (2726)

$1.5002 (506)

$1.4905 (222)

Price at time of writing this review: $1.4823

Support levels (open interest**, contracts):

$1.4794 (1776)

$1.4697 (1130)

$1.4599 (804)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 19712 contracts, with the maximum number of contracts with strike price $1,5100 (2726);

- Overall open interest on the PUT options with the expiration date January, 8 is 19449 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 0.99 versus 0.99 from the previous trading day according to data from December, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

United Kingdom: Nationwide house price index, y/y, December 4.5% (forecast 3.8%)

-

08:01

United Kingdom: Nationwide house price index , December 0.8% (forecast 0.5%)

-

08:00

Switzerland: UBS Consumption Indicator, November 1.66

-

07:53

Foreign exchange market. Asian session: the Australian dollar edged down

The pound climbed after yesterday's decline to an eight-month low against the U.S. dollar. Investors shifted expectations of a BOE rate hike to the second half of 2016. Market participants are also cautious ahead of a probable referendum on UK's EU membership. An exit from the European Union could harm investment, which supports the pound.

The Australian dollar edged down amid ongoing declines in oil prices. An industry group the American Petroleum Institute said yesterday that U.S. oil inventories likely rose by 2.9 million barrels last week.

EUR/USD: the pair fluctuated within $1.0915-35 in Asian trade

USD/JPY: the pair fell to Y120.35

GBP/USD: the pair rose to $1.4840

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 United Kingdom Nationwide house price index, y/y December 3.7% 3.8%

07:00 United Kingdom Nationwide house price index December 0.1% 0.5%

07:00 Switzerland UBS Consumption Indicator November 1.6

09:00 Eurozone Private Loans, Y/Y November 1.2% 1.3%

09:00 Eurozone M3 money supply, adjusted y/y November 5.3% 5.4%

12:00 U.S. MBA Mortgage Applications December 7.3%

15:00 U.S. Pending Home Sales (MoM) November 0.2% 0.5%

15:30 U.S. Crude Oil Inventories

-

01:03

Currencies. Daily history for Dec 29’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0919 -0,43%

GBP/USD $1,4815 -0,43%

USD/CHF Chf0,9929 +0,44%

USD/JPY Y120,45 +0,05%

EUR/JPY Y131,55 -0,37%

GBP/JPY Y178,48 -0,36%

AUD/USD $0,7294 +0,63%

NZD/USD $0,6867 +0,32%

USD/CAD C$1,3841 -0,46%

-

00:00

Schedule for today, Wednesday, 30’2015:

(time / country / index / period / previous value / forecast)

07:00 United Kingdom Nationwide house price index, y/y December 3.7% 3.8%

07:00 United Kingdom Nationwide house price index December 0.1% 0.5%

07:00 Switzerland UBS Consumption Indicator November 1.6

09:00 Eurozone Private Loans, Y/Y November 1.2% 1.3%

09:00 Eurozone M3 money supply, adjusted y/y November 5.3% 5.4%

12:00 U.S. MBA Mortgage Applications December 7.3%

15:00 U.S. Pending Home Sales (MoM) November 0.2% 0.5%

15:30 U.S. Crude Oil Inventories December -5.877 -2.5

-