Noticias del mercado

-

21:01

Dow -0.35% 17,658.35 -62.63 Nasdaq -0.50% 5,082.55 -25.39 S%P -0,40% 2070.05 -8.31

-

18:12

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Wednesday as crude oil slid back towards the 11-year low it hit last week. Crude oil gave up its gains from Tuesday after forecasts of a short winter in North America and Europe piled pressure on the oversupplied commodity. Trading volumes are expected to remain thin on the last trading days of the year.

Most of all of Dow stocks in negative area (19 of 30). Top looser - Chevron Corporation (CVX, -1,21%). Top gainer - Caterpillar Inc. (CAT, +0.43%).

All S&P sectors also in red area. Top looser - Conglomerates (-1.3%).

At the moment:

Oil 36.71 -1.16 -3.06%

Gold 1060.10 -7.90 -0.74%

Dow 17584.00 -54.00 -0.31%

S&P 500 2064.00 -8.75 -0.42%

Nasdaq 100 4665.50 -25.00 -0.53%

U.S. 10yr 2.31 +0.01

-

18:06

WSE: Session Results

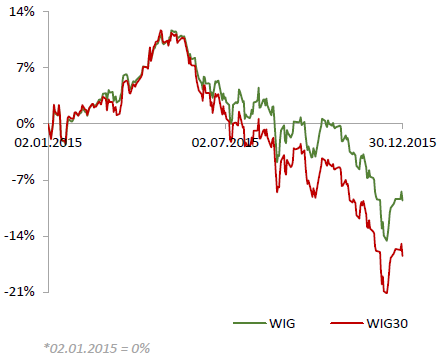

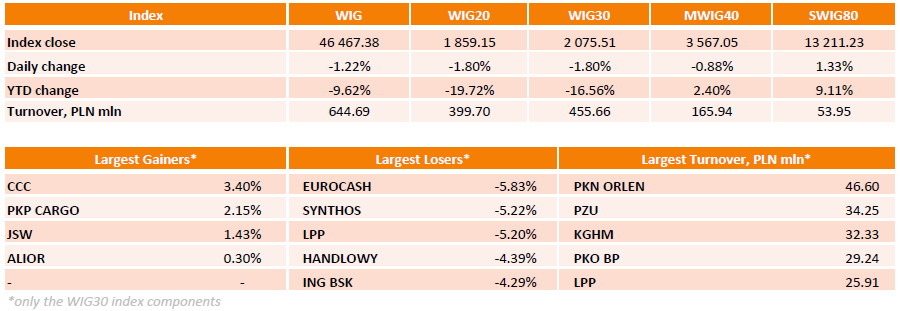

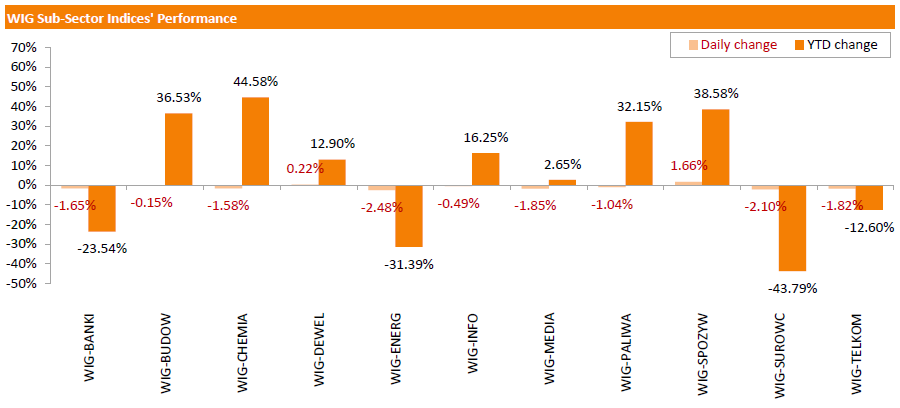

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, lost 1.22%. Except for food sector (+1.66%) and developers (+0.22%), every sector in the WIG Index declined, with utilities (-2.48%) lagging behind.

The large-cap stocks' benchmark, the WIG30 Index, fell by 1.8%. There were only four gainers among the index components. Footwear retailer CCC (WSE: CCC) posted the strongest advance, up 3.4%. Other outperformers were railway freight transport operator PKP CARGO (WSE: PKP), coking coal producer JSW (WSE: JSW) and bank ALIOR (WSE: ALR), gaining 2.15%, 1.43% and 0.3% respectively. On the other side of the ledger, FMCG wholesaler EUROCASH (WSE: EUR) topped the list of underperformers, tumbling by 5.83%. It was followed by chemical producer SYNTHOS (WSE: SNS) and clothing retailer LPP (WSE: LPP), slumping by 5.22% and 5.20% respectively.

For the year, the market lost 9.62%, suffering from weak performance of materials (-43.79%), utilities (-31.39%) and banking (-23.54%) sectors.

The market will be closed on Thursday and Friday.

-

15:33

U.S. Stocks open: Dow -0.16%, Nasdaq -0.16%, S&P -0.20%

-

15:23

Before the bell: S&P futures -0.27%, NASDAQ futures -0.18%

U.S. stock-index futures slipped.

Global Stocks:

Nikkei 19,033.71 +51.48 +0.27%

Hang Seng 21,882.15 -117.47 -0.53%

Shanghai Composite 3,572.69 +8.96 +0.25%

FTSE 6,275.88 -38.69 -0.61%

CAC 4,685.27 -16.09 -0.34%

DAX 10,743.01 -117.13 -1.08%

Crude oil $36.83 (-2.75%)

Gold $1060.90 (-0.66%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Hewlett-Packard Co.

HPQ

11.93

0.59%

13.0K

Merck & Co Inc

MRK

53.54

0.37%

0.1K

Intel Corp

INTC

35.45

0.03%

4.7K

Ford Motor Co.

F

14.23

0.00%

0.5K

Pfizer Inc

PFE

32.82

-0.03%

1.2K

International Business Machines Co...

IBM

139.70

-0.06%

0.4K

Wal-Mart Stores Inc

WMT

61.56

-0.08%

2.1K

UnitedHealth Group Inc

UNH

119.66

-0.13%

6.0K

Starbucks Corporation, NASDAQ

SBUX

61.05

-0.13%

2.1K

Visa

V

79.10

-0.14%

0.1K

Walt Disney Co

DIS

106.92

-0.15%

2.0K

ALTRIA GROUP INC.

MO

58.82

-0.17%

0.5K

Microsoft Corp

MSFT

56.45

-0.18%

1.1K

General Electric Co

GE

31.22

-0.19%

23.7K

Cisco Systems Inc

CSCO

27.70

-0.25%

0.6K

McDonald's Corp

MCD

119.73

-0.28%

0.4K

Apple Inc.

AAPL

108.42

-0.29%

39.4K

Boeing Co

BA

146.90

-0.31%

2.6K

Twitter, Inc., NYSE

TWTR

22.40

-0.31%

3.4K

Nike

NKE

64.05

-0.33%

0.6K

Citigroup Inc., NYSE

C

52.80

-0.34%

6.0K

Facebook, Inc.

FB

106.90

-0.34%

9.9K

Tesla Motors, Inc., NASDAQ

TSLA

236.30

-0.38%

4.7K

Yahoo! Inc., NASDAQ

YHOO

33.91

-0.38%

2.3K

Verizon Communications Inc

VZ

47.01

-0.42%

0.5K

FedEx Corporation, NYSE

FDX

148.57

-0.45%

2.2K

Amazon.com Inc., NASDAQ

AMZN

690.50

-0.50%

3.3K

Caterpillar Inc

CAT

68.69

-0.72%

0.8K

Chevron Corp

CVX

90.15

-1.21%

2.5K

Exxon Mobil Corp

XOM

78.20

-1.21%

10.4K

ALCOA INC.

AA

10.00

-1.28%

51.6K

Barrick Gold Corporation, NYSE

ABX

7.46

-1.71%

1.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.77

-2.87%

60.3K

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Intel (INTC) target raised to $38 from $37 at Needham

FedEx (FDX) target set at $182 at Goldman Sachs

-

07:05

Global Stocks: U.S. stock indices climbed

U.S. stock indices advanced on Tuesday amid gains in oil prices.

The Dow Jones Industrial Average rose 192.71 points, or 1.1%, to 17,720.98. The S&P 500 rose 21.86 points, or 1.1%, to 2,078.36 (all of its 10 sectors climbed). The Nasdaq Composite gained 66.95 points, or 1.3%, to 5,107.94.

A report from S&P/Case-Shiller showed that U.S. home prices rose at a faster pace in October; however recent data suggest that home sales lost momentum. The home price index rose by 5.2% in the twelve months through October compared to a 4.9% increase in September.

Meanwhile the Conference Board reported that the consumer confidence index improved to 96.5 (1985=100) in December from 92.6 in November. The current assessment index rose to 115.3 from 110.9; the expectations index advanced to 83.9 from 80.4.

This morning in Asia Hong Kong Hang Seng declined 0.54%, or 118.77, to 21,880.85. China Shanghai Composite Index fell 0.70%, or 24.93, to 3,538.81. The Nikkei gained 0.31%, or 58.39, to 19,040.62.

Asian stock indices traded mixed. Japanese stocks rose on higher crude oil prices and a weaker yen, which is favorable for exporters. Nevertheless trading was sluggish ahead of a holiday.

-

03:03

Nikkei 225 19,088.8 +106.57 +0.56 %, Hang Seng 22,024.89 +25.27 +0.11 %, Shanghai Composite 3,568.6 +4.86 +0.14 %

-

01:03

Stocks. Daily history for Sep Dec 29’2015:

(index / closing price / change items /% change)

Nikkei 225 18,982.23 +108.88 +0.58 %

Hang Seng 21,999.62 +80.00 +0.36 %

Shanghai Composite 3,563.91 +30.13 +0.85 %

FTSE 100 6,314.57 +59.93 +0.96 %

CAC 40 4,701.36 +83.41 +1.81 %

Xetra DAX 10,860.14 +206.23 +1.94 %

S&P 500 2,078.36 +21.86 +1.06 %

NASDAQ Composite 5,107.94 +66.95 +1.33 %

Dow Jones 17,720.98 +192.71 +1.10 %

-