Noticias del mercado

-

15:45

U.S.: Chicago Purchasing Managers' Index , December 42.9 (forecast 49.8)

-

14:50

Option expiries for today's 10:00 ET NY cut

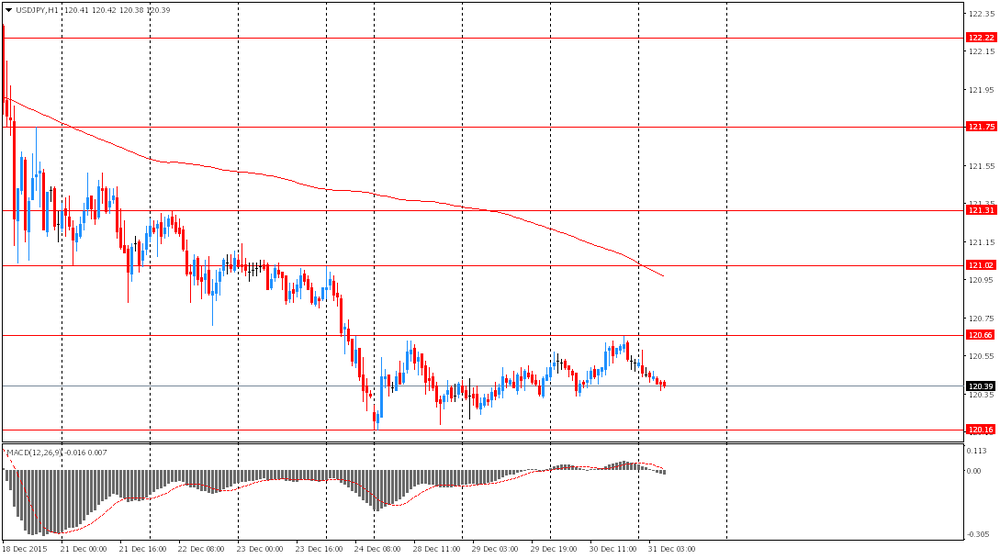

USDJPY 120.00 (USD 213m)

EURUSD 1.0900 (EUR 306m) 1.0975 (151m) 1.1000 (107m)

USDCAD 1.3875 (USD 100m)

AUDUSD 0.7300 (AUD 180m) 0.7250 (201m)

EURGBP 0.7400 (297m)

-

14:30

U.S.: Initial Jobless Claims, December 287 (forecast 270)

-

14:30

U.S.: Continuing Jobless Claims, December 2198 (forecast 2201)

-

12:16

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 213m)

EUR/USD 1.0900 (EUR 306m) 1.0975 (151m) 1.1000 (107m)

USD/CAD 1.3875 (USD 100m)

AUD/USD 0.7300 (AUD 180m) 0.7250 (201m)

EUR/GBP 0.7400 (297m)

-

08:10

Foreign exchange market. Asian session: the yen advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Private Sector Credit, m/m November 0.7% Revised From 1.1% 0.6% 0.4%

The yen climbed against the U.S. dollar as declines in oil prices spurred demand for this safe-haven asset. Nevertheless market participants doubt that this tendency will be sustained. Experts believe that the yen will decline against the greenback amid diversion in monetary policies of central banks of Japan and the U.S. According to Bloomberg the yen may lose 4% of its value in 2016. Today is the last trading session of the year and trading volumes are low.

The U.S. Department of Labor will release its initial jobless claims data at 13:30 GMT today. The number of claims is expected to have declined to 270,000 from 267,000 in the previous week.

The closely-watched Chicago Purchasing Managers' Index will be released at 14:45 GMT. This index is published ahead of the PMI from the Institute for Supply Management and may provide clues on the nationwide index. Analysts expect the index to have risen to 49.7 points in December from 48.7 points in November. A reading below 50 suggests contraction.

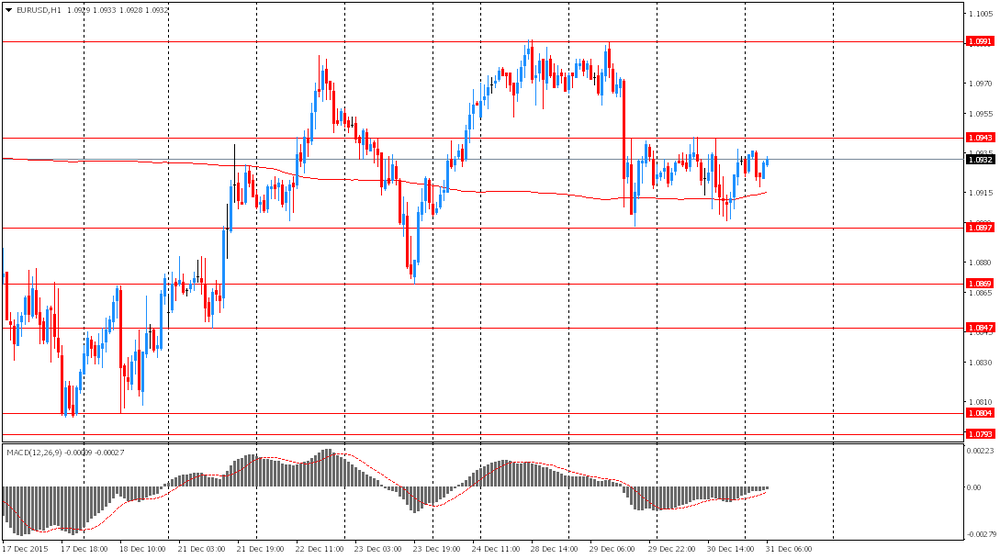

EUR/USD: the pair fluctuated within $1.0915-35 in Asian trade

USD/JPY: the pair fell to Y120.35

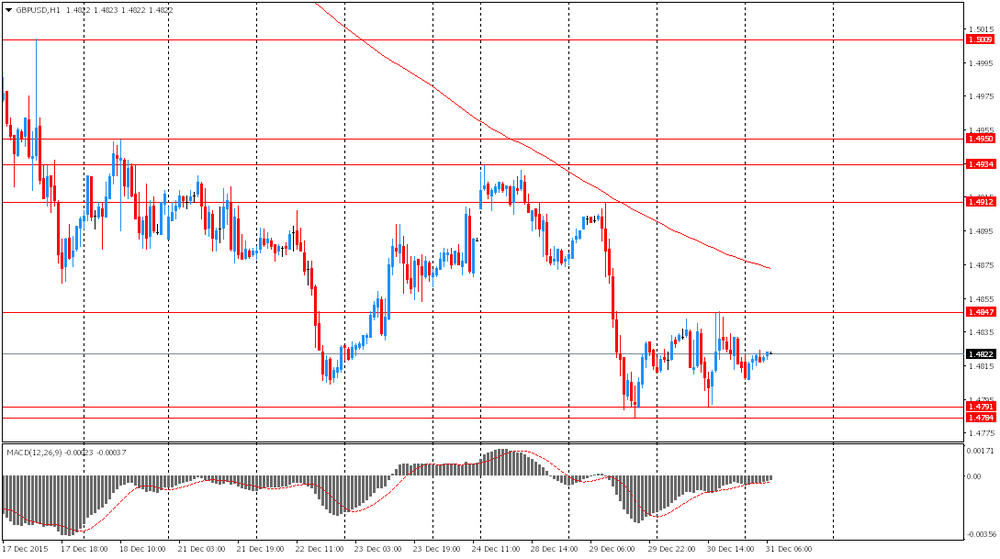

GBP/USD: the pair rose to $1.4825

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

13:30 U.S. Continuing Jobless Claims December 2195 2201

13:30 U.S. Initial Jobless Claims December 267 270

14:45 U.S. Chicago Purchasing Managers' Index December 48.7 49.8

-

07:19

Options levels on thursday, December 31, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1039 (4724)

$1.0988 (5588)

$1.0962 (2627)

Price at time of writing this review: $1.0926

Support levels (open interest**, contracts):

$1.0884 (1952)

$1.0856 (3712)

$1.0822 (2825)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 56087 contracts, with the maximum number of contracts with strike price $1,1100 (7389);

- Overall open interest on the PUT options with the expiration date January, 8 is 73105 contracts, with the maximum number of contracts with strike price $1,0450 (8004);

- The ratio of PUT/CALL was 1.30 versus 1.31 from the previous trading day according to data from December, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.5101 (2880)

$1.5002 (464)

$1.4904 (298)

Price at time of writing this review: $1.4827

Support levels (open interest**, contracts):

$1.4794 (1913)

$1.4697 (1131)

$1.4599 (776)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 20055 contracts, with the maximum number of contracts with strike price $1,5100 (2880);

- Overall open interest on the PUT options with the expiration date January, 8 is 19492 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 0.97 versus 0.99 from the previous trading day according to data from December, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:30

Currencies. Daily history for Dec 30’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0931 +0,11%

GBP/USD $1,4814 -0,01%

USD/CHF Chf0,9885 -0,45%

USD/JPY Y120,51 +0,05%

EUR/JPY Y131,73 +0,14%

GBP/JPY Y178,54 +0,03%

AUD/USD $0,7284 -0,14%

NZD/USD $0,6839 -0,41%

USD/CAD C$1,3877 +0,26%

-

02:58

Schedule for today, Thursday, 31’2015:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

00:30 Australia Private Sector Credit, m/m November 0.7% Revised From 1.1% 0.6% 0.4%

06:00 Germany Bank Holiday

13:30 U.S. Continuing Jobless Claims December 2195 2201

13:30 U.S. Initial Jobless Claims December 267 270

14:45 U.S. Chicago Purchasing Managers' Index December 48.7 49.8

-

01:31

Australia: Private Sector Credit, m/m, November 0.0 (forecast 0.6%)

-