Noticias del mercado

-

15:45

U.S.: Chicago Purchasing Managers' Index , December 42.9 (forecast 49.8)

-

15:33

U.S. Stocks open: Dow -0.61%, Nasdaq -0.50%, S&P -0.56%

-

15:22

Before the bell: S&P futures -0.39%, NASDAQ futures -0.39%

U.S. stock-index futures declined.

Global Stocks:

Nikkei Closed

Hang Seng 21,914.4 +32.25 +0.15%

Shanghai Composite 3,539.6 -33.28 -0.93%

FTSE 6,242.32 -31.73 -0.51%

CAC Closed

DAX Closed

Crude oil $36.33 (-0.74%)

Gold $1060.60 (+0.08%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Tesla Motors, Inc., NASDAQ

TSLA

238.60

0.21%

1.5K

The Coca-Cola Co

KO

43.64

0.16%

0.1K

Ford Motor Co.

F

14.17

0.00%

2.6K

Microsoft Corp

MSFT

56.30

-0.02%

3.6K

Wal-Mart Stores Inc

WMT

61.66

-0.03%

0.2K

ALTRIA GROUP INC.

MO

58.76

-0.07%

0.5K

Visa

V

78.29

-0.08%

0.1K

Merck & Co Inc

MRK

53.20

-0.09%

0.6K

Apple Inc.

AAPL

107.21

-0.10%

24.1K

AMERICAN INTERNATIONAL GROUP

AIG

62.45

-0.10%

5.1K

United Technologies Corp

UTX

96.75

-0.15%

0.2K

Amazon.com Inc., NASDAQ

AMZN

687.89

-0.17%

1.5K

Cisco Systems Inc

CSCO

27.48

-0.18%

1K

Twitter, Inc., NYSE

TWTR

22.19

-0.18%

0.3K

ALCOA INC.

AA

9.94

-0.20%

61.7K

JPMorgan Chase and Co

JPM

66.45

-0.21%

1.2K

Citigroup Inc., NYSE

C

52.18

-0.23%

1.1K

Nike

NKE

63.10

-0.24%

0.6K

Verizon Communications Inc

VZ

46.65

-0.26%

1.0K

Caterpillar Inc

CAT

68.50

-0.28%

0.3K

Facebook, Inc.

FB

105.90

-0.30%

16.5K

AT&T Inc

T

34.62

-0.35%

11.9K

Boeing Co

BA

145.90

-0.35%

0.2K

McDonald's Corp

MCD

119.01

-0.35%

0.9K

General Electric Co

GE

30.93

-0.39%

49.0K

Exxon Mobil Corp

XOM

77.78

-0.42%

3.0K

Starbucks Corporation, NASDAQ

SBUX

60.51

-0.51%

0.1K

Pfizer Inc

PFE

32.55

-0.61%

0.2K

Chevron Corp

CVX

89.37

-0.80%

21.7K

Barrick Gold Corporation, NYSE

ABX

7.30

-0.95%

18.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.64

-1.92%

1.0K

-

14:50

Option expiries for today's 10:00 ET NY cut

USDJPY 120.00 (USD 213m)

EURUSD 1.0900 (EUR 306m) 1.0975 (151m) 1.1000 (107m)

USDCAD 1.3875 (USD 100m)

AUDUSD 0.7300 (AUD 180m) 0.7250 (201m)

EURGBP 0.7400 (297m)

-

14:30

U.S.: Initial Jobless Claims, December 287 (forecast 270)

-

14:30

U.S.: Continuing Jobless Claims, December 2198 (forecast 2201)

-

12:16

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 213m)

EUR/USD 1.0900 (EUR 306m) 1.0975 (151m) 1.1000 (107m)

USD/CAD 1.3875 (USD 100m)

AUD/USD 0.7300 (AUD 180m) 0.7250 (201m)

EUR/GBP 0.7400 (297m)

-

08:10

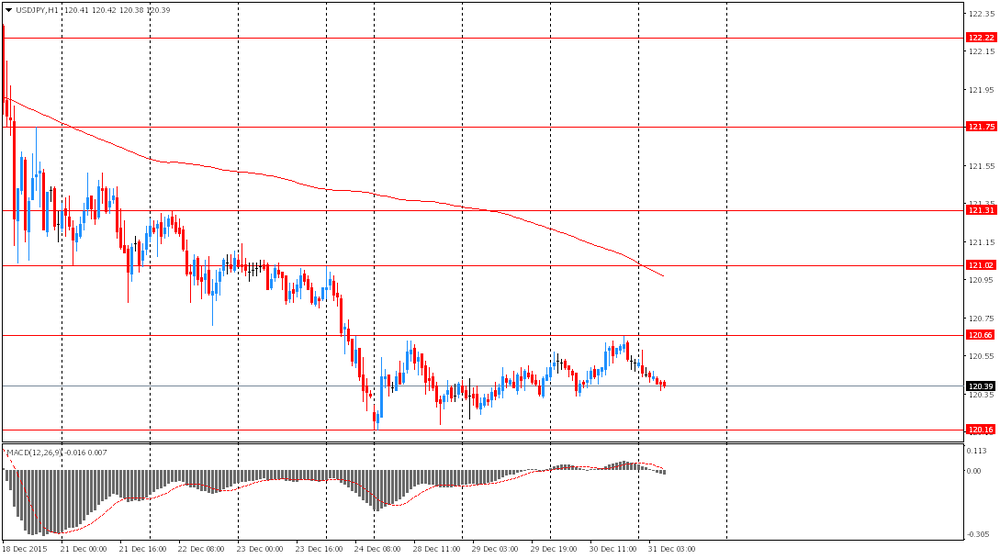

Foreign exchange market. Asian session: the yen advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Private Sector Credit, m/m November 0.7% Revised From 1.1% 0.6% 0.4%

The yen climbed against the U.S. dollar as declines in oil prices spurred demand for this safe-haven asset. Nevertheless market participants doubt that this tendency will be sustained. Experts believe that the yen will decline against the greenback amid diversion in monetary policies of central banks of Japan and the U.S. According to Bloomberg the yen may lose 4% of its value in 2016. Today is the last trading session of the year and trading volumes are low.

The U.S. Department of Labor will release its initial jobless claims data at 13:30 GMT today. The number of claims is expected to have declined to 270,000 from 267,000 in the previous week.

The closely-watched Chicago Purchasing Managers' Index will be released at 14:45 GMT. This index is published ahead of the PMI from the Institute for Supply Management and may provide clues on the nationwide index. Analysts expect the index to have risen to 49.7 points in December from 48.7 points in November. A reading below 50 suggests contraction.

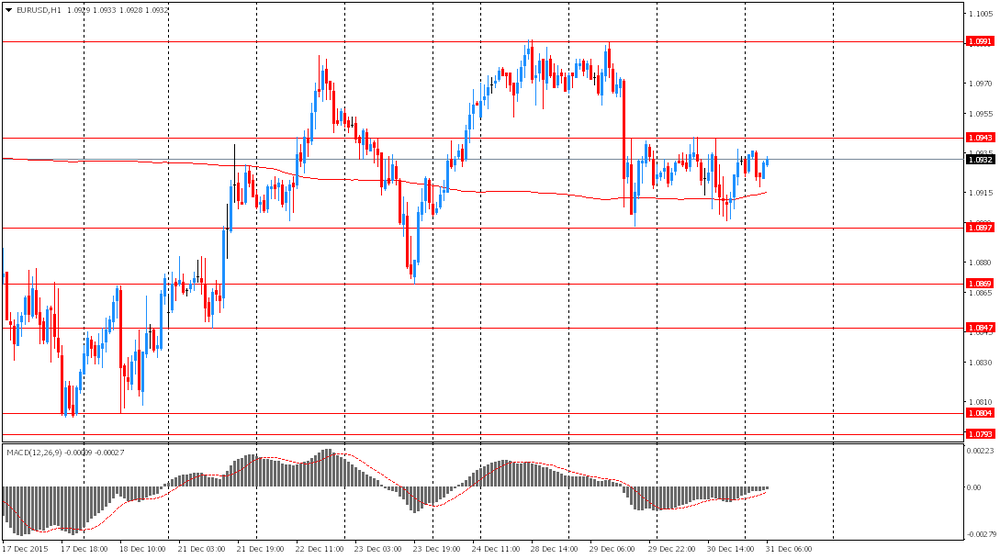

EUR/USD: the pair fluctuated within $1.0915-35 in Asian trade

USD/JPY: the pair fell to Y120.35

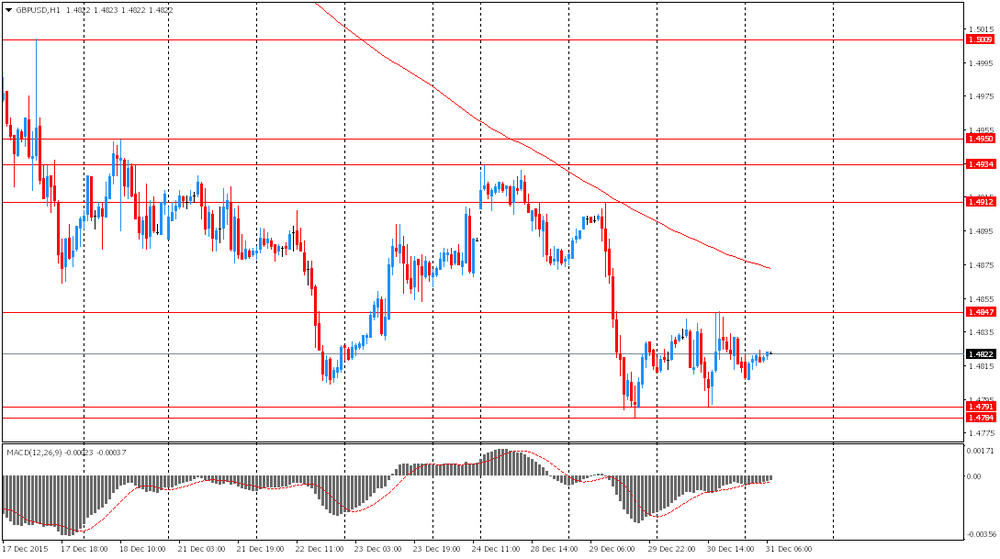

GBP/USD: the pair rose to $1.4825

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

13:30 U.S. Continuing Jobless Claims December 2195 2201

13:30 U.S. Initial Jobless Claims December 267 270

14:45 U.S. Chicago Purchasing Managers' Index December 48.7 49.8

-

07:45

Oil prices edged up after sharp declines

West Texas Intermediate futures for February delivery is currently at $36.66 (+0.16%), while Brent crude is at $36.64 (+0.49%) after suffering loss of more than 3% in the previous session. The Energy Information Administration reported an unexpected rise of 2.6 million barrels in U.S. crude oil inventories in the week ending December 25. WTI and Brent lost 31% and 36% of their value in 2015 respectively.

The supply glut will worry investors in 2016 too as OPEC's leader Saudi Arabia rejects calls for output target revisions and maintains high production levels in an attempt to defend its market share.

-

07:19

Options levels on thursday, December 31, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1039 (4724)

$1.0988 (5588)

$1.0962 (2627)

Price at time of writing this review: $1.0926

Support levels (open interest**, contracts):

$1.0884 (1952)

$1.0856 (3712)

$1.0822 (2825)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 56087 contracts, with the maximum number of contracts with strike price $1,1100 (7389);

- Overall open interest on the PUT options with the expiration date January, 8 is 73105 contracts, with the maximum number of contracts with strike price $1,0450 (8004);

- The ratio of PUT/CALL was 1.30 versus 1.31 from the previous trading day according to data from December, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.5101 (2880)

$1.5002 (464)

$1.4904 (298)

Price at time of writing this review: $1.4827

Support levels (open interest**, contracts):

$1.4794 (1913)

$1.4697 (1131)

$1.4599 (776)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 20055 contracts, with the maximum number of contracts with strike price $1,5100 (2880);

- Overall open interest on the PUT options with the expiration date January, 8 is 19492 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 0.97 versus 0.99 from the previous trading day according to data from December, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:13

Gold little changed

Gold is currently at $1,061.30 (+0.14%) on the last trading session of 2015. The precious metal is on track to post a nearly 10% decline this year amid a stronger dollar and expectations of higher interest rates in the U.S. Expectations of further rate hikes will put more pressure on bullion. Some analysts expect gold to trade lower and decline to $1,000 an ounce in 2016.

Low oil prices reduce inflation concerns and demand for gold, thus making bearish outlook for crude another factor to weigh on bullion.

-

06:57

Global Stocks: U.S. stock indices declined

U.S. stock indices closed lower on Wednesday amid declines in oil prices after the Energy Information Administration reported a gain in U.S. crude oil inventories.

The Dow Jones Industrial Average fell 117.11 points, or 0.7%, to 17,603.87. The S&P 500 lost 15.00 points, or 0.7%, to 2,063.36 (all of its 10 sectors fell, led by a 1.5% decline in the energy sector). The Nasdaq Composite declined 42.09 points, or 0.8%, to 5,065.85.

U.S. pending home sales fell by 0.9% in November, while economists had expected the index to gain 0.5%. The latest decline suggests that the housing market faced difficulties in winter after a rebound at the beginning of the year.

This morning in Asia Hong Kong Hang Seng added 0.15%, or 32.25, to 21,914.40. China Shanghai Composite Index fell 0.81%, or 29.12, to 3,543.76. Japanese markets are closed today.

Asian stock indices traded mixed in the last session of 2015. Stocks in mainland China declined amid concerns over the country's economic growth.

-

03:32

Commodities. Daily history for Dec 30’2015:

(raw materials / closing price /% change)

Oil 36.73 +0.36%

Gold 1,060.90 +0.10%

-

03:31

Stocks. Daily history for Sep Dec 30’2015:

(index / closing price / change items /% change)

S&P/ASX 200 5,319.94 +52.60 +1.00%

TOPIX 1,547.3 +3.91 +0.25%

SHANGHAI COMP 3,572.69 +8.96 +0.25%

HANG SENG 21,882.15 -117.47 -0.53%

FTSE 100 6,274.05 -40.52 -0.64 %

CAC 40 4,677.14 -24.22 -0.52 %

Xetra DAX 10,743.01 -117.13 -1.08 %

S&P 500 2,063.36 -15.00 -0.72 %

NASDAQ Composite 5,065.85 -42.09 -0.82 %

Dow Jones 17,603.87 -117.11 -0.66 %

-

03:30

Currencies. Daily history for Dec 30’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0931 +0,11%

GBP/USD $1,4814 -0,01%

USD/CHF Chf0,9885 -0,45%

USD/JPY Y120,51 +0,05%

EUR/JPY Y131,73 +0,14%

GBP/JPY Y178,54 +0,03%

AUD/USD $0,7284 -0,14%

NZD/USD $0,6839 -0,41%

USD/CAD C$1,3877 +0,26%

-

03:03

Hang Seng 21,953.09 +70.94 +0.32 %, Shanghai Composite 3,569.24 -3.64 -0.10 %

-

02:58

Schedule for today, Thursday, 31’2015:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

00:30 Australia Private Sector Credit, m/m November 0.7% Revised From 1.1% 0.6% 0.4%

06:00 Germany Bank Holiday

13:30 U.S. Continuing Jobless Claims December 2195 2201

13:30 U.S. Initial Jobless Claims December 267 270

14:45 U.S. Chicago Purchasing Managers' Index December 48.7 49.8

-

01:31

Australia: Private Sector Credit, m/m, November 0.0 (forecast 0.6%)

-