Noticias del mercado

-

17:32

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the mostly weak-than-expected U.S. economic data

The U.S. dollar traded mixed against the most major currencies after the mostly weak-than-expected U.S. economic data. The U.S. preliminary gross domestic product increased at an annual rate of 2.6% in the fourth quarter, missing expectations for a 3.3% gain, after a 5.0% rise in the third quarter.

Consumers spending strengthened in the fourth quarter, but businesses investment, trade and government spending weakened.

For 2014 as a whole, GDP expanded 2.4% compared to 2.2% in 2013.

The personal consumption expenditures (PCE) price index declined at an annual rate of 0.5% in the fourth quarter. That was the weakest reading since the first quarter of 2009.

The personal consumption expenditures (PCE) price index excluding food and energy increased 1.1%.

The Chicago purchasing managers' index increased from 59.4 in January to 58.8 in December, exceeding expectations for a fall to 58.1. December's figure was revised up from 58.3.

The final University of Michigan's consumer sentiment index was 98.1 in January, in line with expectations, down from the preliminary estimate of 98.2.

The euro traded lower against the U.S. dollar. The inflation declined to an annual rate of -0.6% in January from -0.2% in December. Analysts had expected a 0.5% drop.

Eurozone's unemployment rate fell to 11.4% in December from 11.5% in November. Analysts had expected the unemployment rate to remain unchanged at 11.5%.

German adjusted retail sales climbed 0.2% in December, after a 0.9% gain in November. November's figure was revised down from a 1.0% increase.

The British pound fell against the U.S. dollar. Net lending to individuals in the U.K. increased by £2.2 billion in December, after a £3.3 billion gain in November.

The number of mortgages approvals in the U.K. increased by 60,280 in December, after a gain by 58,960 in November.

The Canadian dollar traded lower against the U.S. dollar after the weak Canadian gross domestic product (GDP). Canada's GDP decreased 0.2% in November, after a 0.3% fall in October.

The decline was driven by lower oil prices and unexpected weakness in manufacturing and mining.

The Swiss franc traded higher against the U.S. dollar. The KOF leading indicator decreased to 97.0 in January from 98.8 in December, missing expectations for a decrease to 97.8. December's figure was revised up from 98.7.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie traded mixed against the greenback after the weak economic data from Australia. Australia's producer price index (PPI) rose 0.1% in the fourth quarter, after a 0.2% increase in the third quarter.

On a yearly basis, Australia's PPI increased 1.1% in the fourth quarter, after a 1.2% gain in the third quarter.

Private sector credit in Australia climbed 0.5% in December, after a 0.5% increase in October.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen increased against the greenback after the mixed economic data from Japan. Japan's national consumer price index (CPI) rose 2.4% in December, after a 2.4 increase in November.

Japan's national CPI excluding fresh food increased 2.5% in December, missing expectations for a a 2.6% gain, after a 2.7% rise in November.

Tokyo's CPI climbed 2.13 in January, after a 2.1% rise in December.

Tokyo's CPI excluding fresh food gained 2.2% in January, in line with expectations, after a 2.3% increase in December.

Household spending in Japan dropped at annual rate of 3.4% in December, missing forecasts of a 2.5% decrease, after a 2.5% fall in November.

Japan's unemployment rate decreased to 3.4% in December from 3.5% in November. Analysts had expected the unemployment rate to remain unchanged.

Preliminary industrial production in Japan climbed 1.0% in December, missing expectations for a 1.3% increase, after a 0.6% decline in November.

-

16:01

U.S.: Reuters/Michigan Consumer Sentiment Index, January 98.1 (forecast 98.1)

-

15:57

U.S. economy grew 2.6% in the fourth quarter

The U.S. Commerce Department released gross domestic product data on Friday. The U.S. preliminary gross domestic product increased at an annual rate of 2.6% in the fourth quarter, missing expectations for a 3.3% gain, after a 5.0% rise in the third quarter.

Consumers spending strengthened in the fourth quarter, but businesses investment, trade and government spending weakened.

Business investment rose 1.9% in the fourth quarter, exports were up 2.8%, while government spending decreased 2.2%.

Consumer spending grew 4.3% in the fourth quarter, the fastest since early 2006. Consumer spending benefited from a job growth and falling oil prices.

For 2014 as a whole, GDP expanded 2.4% compared to 2.2% in 2013.

The personal consumption expenditures (PCE) price index declined at an annual rate of 0.5% in the fourth quarter. That was the weakest reading since the first quarter of 2009.

The personal consumption expenditures (PCE) price index excluding food and energy increased 1.1%.

The personal consumption expenditures (PCE) price index is the Fed's preferred measure for inflation.

-

15:45

U.S.: Chicago Purchasing Managers' Index , January 59.4 (forecast 58.1)

-

15:18

Canada's GDP 0.2% in November

Statistics Canada released GDP (gross domestic product) data on Friday. Canada's GDP decreased 0.2% in November, after a 0.3% fall in October.

The decline was driven by lower oil prices and unexpected weakness in manufacturing and mining.

Manufacturing output fell by 1.9% in November, the deepest fall since January 2009, mining declined by 2.5%, while oil and gas extraction was down by 0.7%.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E291mn), $1.1300(E427mn), $1.1400(E565mn), $1.1450-60(E662mn)

USD/JPY: Y115.50($1.17bn), Y117.75($680mn), Y118.00($698mn), Y118.50($513mn), Y119.00($1.6bn)

EUR/JPY: Y134.50(E252mn), Y138.00(E460mn)

GBP/USD: $1.5350(stg340mn)

AUD/USD: $0.7750 (A$619mn), $0.7850(A$527mn), $0.7900(A$303mn)

NZD/USD: $0.7200(NZ$634mn), $0.7300(NZ$624mn), $0.7400(NZ$289mn)

USD/CAD: C$1.2500($280mn)

-

14:33

U.S.: Employment Cost Index, Quarter IV +0.6%

-

14:31

U.S.: PCE price index ex food, energy, q/q, Quarter IV +1.1%

-

14:31

U.S.: PCE price index, q/q, Quarter IV 0.0%

-

14:30

Canada: GDP (m/m) , November -0.2%

-

14:30

U.S.: GDP, q/q, Quarter IV +2.6% (forecast +3.3%)

-

14:07

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the mixed economic data from Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 United Kingdom Gfk Consumer Confidence January -4 -2 +1

00:30 Australia Producer price index, q / q Quarter IV +0.2% +0.1%

00:30 Australia Producer price index, y/y Quarter IV +1.2% +1.1%

00:30 Australia Private Sector Credit, m/m December +0.5% +0.5%

00:30 Australia Private Sector Credit, y/y December +5.9% +5.9%

05:00 Japan Housing Starts, y/y December -14.3% -14.7%

07:00 Germany Retail sales, real adjusted December +0.9% +0.2%

07:00 Germany Retail sales, real unadjusted, y/y December -0.8% +4.0%

07:45 France Consumer spending December +0.4% +1.5%

07:45 France Consumer spending, y/y December -1.1% +0.5%

08:00 Switzerland KOF Leading Indicator January 98.8 Revised From 98.7 97.8 97.0

09:30 United Kingdom Net Lending to Individuals, bln December 3.3 2.2

09:30 United Kingdom Mortgage Approvals December 59 60

10:00 Eurozone Unemployment Rate December 11.5% 11.5% 11.4%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January -0.2% -0.5% -0.6%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. economic data. The U.S. preliminary gross domestic product is expected to rise at an annual rate of 3.3% in the fourth quarter, after a 5.0% gain in the third quarter.

The Chicago purchasing managers' index is expected to decline to 58.1 in January from 58.3 in December.

The final Reuters/Michigan Consumer Sentiment Index is expected to decline to 98.1 in January.

The euro traded lower against the U.S. dollar after the mixed economic data from Eurozone. The inflation declined to an annual rate of -0.6% in January from -0.2% in December. Analysts had expected a 0.5% drop.

Eurozone's unemployment rate fell to 11.4% in December from 11.5% in November. Analysts had expected the unemployment rate to remain unchanged at 11.5%.

German adjusted retail sales climbed 0.2% in December, after a 0.9% gain in November. November's figure was revised down from a 1.0% increase.

The British pound traded lower against the U.S. dollar after the economic data from the U.K. Net lending to individuals in the U.K. increased by £2.2 billion in December, after a £3.3 billion gain in November.

The number of mortgages approvals in the U.K. increased by 60,280 in December, after a gain by 58,960 in November.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian gross domestic product (GDP). Canada's GDP rose 0.3% in November.

The Swiss franc traded mixed against the U.S. dollar after the weaker-than-expected KOF leading indicator. The KOF leading indicator decreased to 97.0 in January from 98.8 in December, missing expectations for a decrease to 97.8. December's figure was revised up from 98.7.

EUR/USD: the currency pair fell to $1.1291

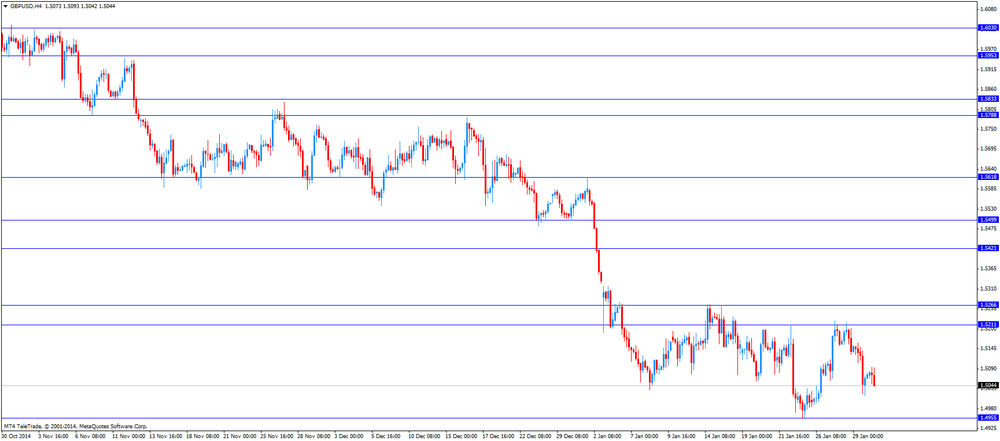

GBP/USD: the currency pair declined to $1.5042

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada GDP (m/m) November +0.3%

13:30 U.S. Employment Cost Index Quarter IV +0.7%

13:30 U.S. PCE price index, q/q Quarter IV +3.2%

13:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.4%

13:30 U.S. GDP, q/q (Preliminary) Quarter IV +5.0% +3.3%

14:45 U.S. Chicago Purchasing Managers' Index January 58.3 58.1

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) January 98.2 98.1

-

14:00

Orders

EUR/USD

Offers $1.1500, $1.1450/60, $1.1400, $1.1380/85, $1.1370

Bids $1.1305/295, $1.1250, $1.1220

GBP/USD

Offers $1.5145/50, $1.5120/25, $1.5100

Bids $1.5000

AUD/USD

Offers $0.7900, $0.7850, $0.7800, $0.7775/80

Bids $0.7700, $0.7650, $0.7600

EUR/JPY

Offers Y135.00, Y134.45/50, Y133.80/00

Bids Y132.55/50, Y132.10/00

USD/JPY

Offers Y119.00, Y118.50, Y118.00

Bids Y117.50, Y117.10/00, Y116.95/85, Y116.50

EUR/GBP

Offers stg0.7600

Bids

-

11:30

Eurozone: CPI matches historic low - Unemployment Rate slightly declined

Eurozone's Unemployment rate for December declined with a reading of 11.4%. Economists forecasted a reading of 11.5% in line with previous month's data.

The Eurozone's Harmonized Consumer Price Index for January extended its slide by -0.6%, matching the biggest decline in the history of the Eurozone, compared to a reading of -0.2% in the previous month. A reading below forecasts of -0.5%. The data shows the importance of the challenges the ECB is facing I order to avoid deflation and bring back the Eurozone to the targeted inflation rate of 2%.

-

11:19

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E291mn), $1.1300(E427mn), $1.1400(E565mn), $1.1450-60(E662mn)

USD/JPY: Y115.50($1.17bn), Y117.75($680mn), Y118.00($698mn), Y118.50($513mn), Y119.00($1.6bn)

EUR/JPY: Y134.50(E252mn), Y138.00(E460mn)

GBP/USD: $1.5350(stg340mn)

AUD/USD: $0.7750 (A$619mn), $0.7850(A$527mn), $0.7900(A$303mn)

NZD/USD: $0.7200(NZ$634mn), $0.7300(NZ$624mn), $0.7400(NZ$289mn)

USD/CAD: C$1.2500($280mn)

-

11:00

Eurozone: Unemployment Rate , December 11.4% (forecast 11.5%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, January -0.6% (forecast -0.5%)

-

10:30

United Kingdom: Net Lending to Individuals, bln, December 2.2

-

10:30

United Kingdom: Mortgage Approvals, December 60

-

10:20

Press Review: BOJ set to watch and wait as Abe team urges caution on fresh easing

BLOOMBERG

VIX Calls Most Shunned Since 2012 as Volatility Ignored

(Bloomberg) -- Even with stock swings nearly doubling since 2014 and U.S. equities poised for their worst month in a year, traders aren't signaling too much concern.

Investors own about 2.4 million options betting on a rise in the Chicago Board Options Exchange Volatility Index, compared to about 1.6 million contracts wagering on a drop. That's around the lowest ratio of calls to puts in more than two years, data compiled by Bloomberg show, indicating traders don't anticipate an increase in market turbulence anytime soon.

Traders have abandoned options betting on jumps in the VIX since November, even as the gauge spiked at least 18 percent three times this month. Stocks' tendency to power past declines at the end of 2014 encouraged traders to shed hedges and speculative bets in VIX options they weren't profiting from, according to Todd Salamone of Schaeffer's Investment Research Inc.

REUTERS

BOJ set to watch and wait as Abe team urges caution on fresh easing(Reuters) - The Bank of Japan has put monetary policy on hold and found backing for its wait-and-see stance from advisors to Prime Minister Shinzo Abe, who worry more easing could send the yen to damagingly low levels, according to officials in the administration and central bank.

This newfound caution from some of the same Abe advisors who urged the BOJ to launch its massive stimulus in 2013, meansJapan is set to be an outlier at a time when central banks from Canada to the euro zone to Singapore have shocked markets by easing policy in recent days.

Concerns about the yen, along with a belief among central bank officials - including Governor Haruhiko Kuroda - that coming wage increases will support higher prices, suggest the BOJ could hold policy steady until October, months after many economists expect it to be eased.

Source: http://www.reuters.com/article/2015/01/30/us-japan-economy-boj-idUSKBN0L30AA20150130

REUTERS

Lower gas prices seen fueling U.S. consumer spending in fourth quarter(Reuters) - The U.S. economy likely grew at a brisk clip in the fourth quarter as lower gasoline prices buoyed consumer spending, in a show of resilience despite a darkening global outlook.

Gross domestic product probably expanded at a 3 percent annual pace, according to a Reuters survey of economists. While that would be a step down from the third quarter's breakneck 5 percent rate, it would be the fifth quarter out of the last six that the economy has grown at or above a 3 percent pace.

"The consumer did the heavy lifting and I don't think there is any reason to expect that to change in the first half of this year because of the enormous tailwind from lower gasoline prices," said Ryan Sweet, a senior economist at Moody's Analytics in West Chester, Pennsylvania.

Source: http://www.reuters.com/article/2015/01/30/us-usa-economy-idUSKBN0L30BC20150130

-

09:00

Switzerland: KOF Leading Indicator, January 97.0 (forecast 97.8)

-

08:45

France: Consumer spending , December +1.5%

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly weaker against its major peers losing slightly

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:05 United Kingdom Gfk Consumer Confidence January -4 -2 +1

00:30 Australia Producer price index, q / q Quarter IV +0.2% +0.1%

00:30 Australia Producer price index, y/y Quarter IV +1.2% +1.1%

00:30 Australia Private Sector Credit, m/m December +0.5% +0.5%

00:30 Australia Private Sector Credit, y/y December +5.9% +5.9%

05:00 Japan Housing Starts, y/y December -14.3% -14.7%

07:00 Germany Retail sales, real adjusted December +1.0% +0.2%

07:00 Germany Retail sales, real unadjusted, y/y December -0.8% +4.0%

The U.S. dollar broadly lower against its major peers slightly trimming Thursday's gains after the mixed U.S. economic data yesterday. The number of initial jobless claims in the week ending January 24 in the U.S. fell by 43,000 to 265,000 from 308,000 in the previous week. Pending home sales in the U.S. declined 3.7% in December, missing expectations for a 0.6% increase, after a 0.6% gain in November. November's figure was revised down from a 0.8% rise. That was the biggest monthly decrease since December 2013. Today market participants await a set of U.S. data including the GDP for the fourth quarter, the Chicago Purchasing Manager's Index and the Reuters/Michigan Consumer Sentiment.

The Australian dollar traded recovered slightly from yesterday's 2% slump, as market participants expect that the central bank is likely to cut rates on February 3rd. The aussie recently was under pressure as falling energy and commodity prices weighed. Australia's Producer Price Index for the fourth grew less compared to the previous quarter with a reading of +0.1%. On a yearly basis the index rose +1.1% compared to +1.2% in the previous quarter. Private Sector Credit was unchanged at monthly +0.5% and +5.9% on a yearly basis. All eyes are on the next RBA meeting.

New Zealand's dollar traded stronger against the greenback. Yesterday data on Building Permits showed a decline by -2.1% compared to revised +10.5% in the previous month. The Reserve Bank of New Zealand surprised investors on Thursday with a possible rate cut.

The Japanese yen traded higher against the greenback on Friday after a mixed set of data that was mostly in line with forecasts. The Japanese Unemployment Rate declined for the month of December to 3.4%. The Tokyo Consumer Price Index rose to +2.3% with a previous reading of +2.1%. Household Spending decreased by -3.4%, analysts expected a decline by -2.5%. The National CPI was unchanged at +2.4%, ex fresh food CPI rose by 2.5%, less than the expected 2.6%. Industrial Production for December rose by +1.0% in December compared to -0.6% in November, not meeting forecasts of +1.3%. Housing starts shrank by -14.7% for a 10th straight year-on-year decline.

EUR/USD: the euro traded slightly stronger against the greenback

USD/JPY: the U.S. dollar lost against the yen

GPB/USD: Sterling traded slightly weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Consumer spending December +0.4%

07:45 France Consumer spending, y/y December -1.1%

08:00 Switzerland KOF Leading Indicator January 98.7 97.8

09:30 United Kingdom Net Lending to Individuals, bln December 3.3

09:30 United Kingdom Mortgage Approvals December 59

10:00 Eurozone Unemployment Rate December 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January -0.2% -0.5%

13:30 Canada GDP (m/m) November +0.3%

13:30 U.S. Employment Cost Index Quarter IV +0.7%

13:30 U.S. PCE price index, q/q Quarter IV +3.2%

13:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.4%

13:30 U.S. GDP, q/q (Preliminary) Quarter IV +5.0% +3.3%

14:45 U.S. Chicago Purchasing Managers' Index January 58.3 58.1

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) January 98.2 98.1

-

08:00

Germany: Retail sales, real adjusted , December +0.2%

-

08:00

Germany: Retail sales, real unadjusted, y/y, December +4.0%

-

07:30

Options levels on friday, January 30, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1526 (3205)

$1.1453 (3160)

$1.1397 (1523)

Price at time of writing this review: $1.1341

Support levels (open interest**, contracts):

$1.1264 (4033)

$1.1220 (1949)

$1.1158 (4430)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 84071 contracts, with the maximum number of contracts with strike price $1,2100 (6530);

- Overall open interest on the PUT options with the expiration date February, 6 is 75387 contracts, with the maximum number of contracts with strike price $1,1700 (6682);

- The ratio of PUT/CALL was 0.90 versus 0.92 from the previous trading day according to data from January, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.5400 (542)

$1.5301 (654)

$1.5203 (1078)

Price at time of writing this review: $1.5081

Support levels (open interest**, contracts):

$1.4993 (1041)

$1.4897 (1726)

$1.4798 (1171)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 16867 contracts, with the maximum number of contracts with strike price $1,5150 (1129);

- Overall open interest on the PUT options with the expiration date February, 6 is 17240 contracts, with the maximum number of contracts with strike price $1,5100 (1836);

- The ratio of PUT/CALL was 1.02 versus 1.02 from the previous trading day according to data from January, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:02

Japan: Housing Starts, y/y, December -14.7%

-

01:32

Australia: Private Sector Credit, y/y, December +5.9%

-

01:30

Australia: Producer price index, q / q, Quarter IV +0.1%

-

01:30

Australia: Producer price index, y/y, Quarter IV +1.1%

-

01:30

Australia: Private Sector Credit, m/m, December +0.5%

-

01:05

United Kingdom: Gfk Consumer Confidence, January +1 (forecast -2)

-

01:00

Currencies. Daily history for Jan 29’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1319 +0,28%

GBP/USD $1,5065 -0,48%

USD/CHF Chf0,9234 +2,00%

USD/JPY Y118,25 +0,60%

EUR/JPY Y133,86 +0,89%

GBP/JPY Y178,17 +0,16%

AUD/USD $0,7760 -1,62%

NZD/USD $0,7263 -0,73%

USD/CAD C$1,2615 +0,64%

-

00:50

Japan: Industrial Production (MoM) , December +1.0% (forecast +1.3%)

-

00:32

Japan: Household spending Y/Y, December -3.4% (forecast -2.5%)

-

00:31

Japan: National CPI Ex-Fresh Food, y/y, December +2.5% (forecast +2.6%)

-

00:31

Japan: Tokyo Consumer Price Index, y/y, January +2.3%

-

00:30

Japan: Tokyo CPI ex Fresh Food, y/y, January +2.2% (forecast +2.2%)

-

00:30

Japan: National Consumer Price Index, y/y, December +2.4%

-

00:30

Japan: Unemployment Rate, December 3.4% (forecast 3.5%)

-

00:00

Schedule for today, Friday, Jan 30’2015:

(time / country / index / period / previous value / forecast)

01:30 Japan Unemployment Rate December 3.5% 3.5%

01:30 Japan Tokyo Consumer Price Index, y/y January +2.1%

01:30 Japan Tokyo CPI ex Fresh Food, y/y January +2.3% +2.2%

01:30 Japan Household spending Y/Y December -2.5% -2.5%

01:30 Japan National Consumer Price Index, y/y December +2.4%

01:30 Japan National CPI Ex-Fresh Food, y/y December +2.7% +2.6%

01:50 Japan Industrial Production (MoM) (Preliminary) December -0.6% +1.3%

01:50 Japan Industrial Production (YoY) (Preliminary) December -3.7%

02:05 United Kingdom Gfk Consumer Confidence January -4 -2

02:30 Australia Producer price index, q / q Quarter IV +0.2%

02:30 Australia Producer price index, y/y Quarter IV +1.2%

02:30 Australia Private Sector Credit, m/m December +0.5%

02:30 Australia Private Sector Credit, y/y December +5.9%

07:00 Japan Housing Starts, y/y December -14.3%

09:00 Germany Retail sales, real adjusted December +1.0%

09:00 Germany Retail sales, real unadjusted, y/y December -0.8%

09:45 France Consumer spending December +0.4%

09:45 France Consumer spending, y/y December -1.1%

10:00 Switzerland KOF Leading Indicator January 98.7 97.8

11:30 United Kingdom Net Lending to Individuals, bln December 3.3

11:30 United Kingdom Mortgage Approvals December 59

12:00 Eurozone Unemployment Rate December 11.5% 11.5%

12:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January -0.2% -0.5%

15:30 Canada GDP (m/m) November +0.3%

15:30 U.S. Employment Cost Index Quarter IV +0.7%

15:30 U.S. PCE price index, q/q Quarter IV +3.2%

15:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.4%

15:30 U.S. GDP, q/q (Preliminary) Quarter IV +5.0% +3.3%

16:45 U.S. Chicago Purchasing Managers' Index January 58.3 58.1

17:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) January 98.2 98.1

-