Noticias del mercado

-

21:00

Dow -129.27 17,287.58 -0.74% Nasdaq -19.23 4,664.18 -0.41% S&P -13.53 2,007.72 -0.67%

-

18:01

European stocks close: stocks closed lower as Eurozone’s inflation declines

Stock indices closed lower as Eurozone's inflation declines. The inflation fell to an annual rate of -0.6% in January from -0.2% in December. Analysts had expected a 0.5% drop.

Eurozone's unemployment rate fell to 11.4% in December from 11.5% in November. Analysts had expected the unemployment rate to remain unchanged at 11.5%.

German adjusted retail sales climbed 0.2% in December, after a 0.9% gain in November. November's figure was revised down from a 1.0% increase.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,749.4 -61.20 -0.90%

DAX 10,694.32 -43.55 -0.41%

CAC 40 4,604.25 -27.18 -0.59%

-

18:00

European stocks closed: FTSE 100 6,749.4 -61.20 -0.90% CAC 40 4,604.25 -27.18 -0.59% DAX 10,694.32 -43.55 -0.41%

-

15:36

U.S. Stocks open: Dow -0.34%, Nasdaq +0.15%, S&P +0.40%

Dow 17,357.76 -59.09 -0.34%

Nasdaq 4,690.37 +6.96 +0.15%

S&P 500 2,013.20 -8.05 -0.40%

10 Year Yield 1.67% -0.08 --

Gold $1,261.80 +7.20 +0.57%

Oil $44.52 -0.01 -0.02%

-

15:30

Before the bell: S&P futures -1.04%, Nasdaq futures -0.53%

U.S. stocks futures were down sharply, after the government data showed that the economy grew at a slower pace than anticipated in the fourth quarter.

Global markets:

Nikkei 17,674.39 +68.17 +0.39%

Hang Seng 24,507.05 -88.80 -0.36%

Shanghai Composite 3,211.67 -50.64 -1.55%

FTSE 6,777.6 -33.00 -0.48%

CAC 4,600.37 -31.06 -0.67%

DAX 10,673.72 -64.15 -0.60%

Crude oil $44.66 (+0.29%)

Gold $1264.00 (+0.75%)

-

15:13

Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.87

+0.24%

9.1K

Facebook, Inc.

FB

78.25

+0.32%

163.0K

Chevron Corp

CVX

103.50

+0.49%

3.0K

Google Inc.

GOOG

515.58

+0.96%

13.7K

Barrick Gold Corporation, NYSE

ABX

12.44

+1.22%

0.8K

Amazon.com Inc., NASDAQ

AMZN

352.20

+12.96%

439.3K

Visa

V

257.00

+3.63%

6.6K

American Express Co

AXP

81.99

-0.01%

5.7K

Exxon Mobil Corp

XOM

87.52

-0.07%

5.5K

Twitter, Inc., NYSE

TWTR

36.63

-0.14%

62.9K

Home Depot Inc

HD

107.34

-0.26%

0.1K

Apple Inc.

AAPL

118.55

-0.29%

568.9K

Tesla Motors, Inc., NASDAQ

TSLA

204.60

-0.29%

5.0K

Procter & Gamble Co

PG

85.37

-0.35%

5.8K

Johnson & Johnson

JNJ

102.00

-0.37%

0.4K

ALTRIA GROUP INC.

MO

54.19

-0.37%

0.1K

The Coca-Cola Co

KO

41.92

-0.43%

1.0K

Verizon Communications Inc

VZ

45.88

-0.50%

8.3K

Starbucks Corporation, NASDAQ

SBUX

88.58

-0.53%

21.6K

Yahoo! Inc., NASDAQ

YHOO

43.50

-0.53%

41.1K

General Electric Co

GE

23.95

-0.54%

24.7K

Goldman Sachs

GS

175.00

-0.56%

0.1K

JPMorgan Chase and Co

JPM

55.34

-0.59%

1K

Microsoft Corp

MSFT

41.76

-0.60%

32.1K

AT&T Inc

T

32.76

-0.61%

5.9K

McDonald's Corp

MCD

92.70

-0.61%

5.6K

Ford Motor Co.

F

14.76

-0.61%

64.7K

Caterpillar Inc

CAT

79.50

-0.63%

14.6K

Walt Disney Co

DIS

92.62

-0.64%

1.8K

International Business Machines Co...

IBM

154.45

-0.66%

0.6K

Citigroup Inc., NYSE

C

47.30

-0.67%

16.7K

ALCOA INC.

AA

15.86

-0.75%

5.0K

AMERICAN INTERNATIONAL GROUP

AIG

48.89

-0.75%

1.4K

FedEx Corporation, NYSE

FDX

171.59

-0.75%

0.1K

General Motors Company, NYSE

GM

32.90

-0.78%

3.9K

Boeing Co

BA

146.55

-0.83%

6.8K

Cisco Systems Inc

CSCO

26.96

-0.96%

3.0K

Intel Corp

INTC

33.87

-0.99%

2.7K

Deere & Company, NYSE

DE

84.55

-1.58%

1.0K

Yandex N.V., NASDAQ

YNDX

15.16

-1.81%

3.8K

-

15:08

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

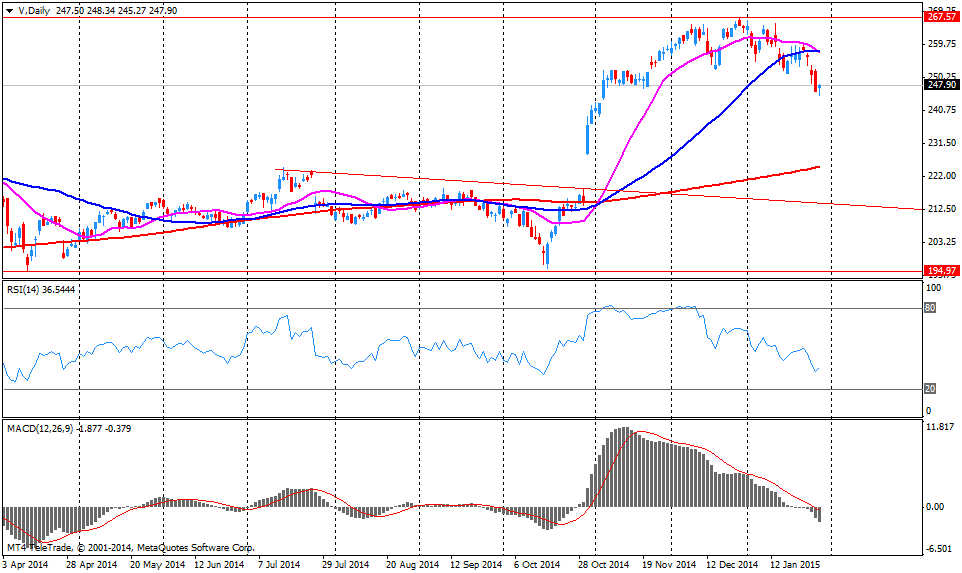

Visa (V) downgraded to Mkt Perform from Outperform at FBR Capital, target $260

Other:

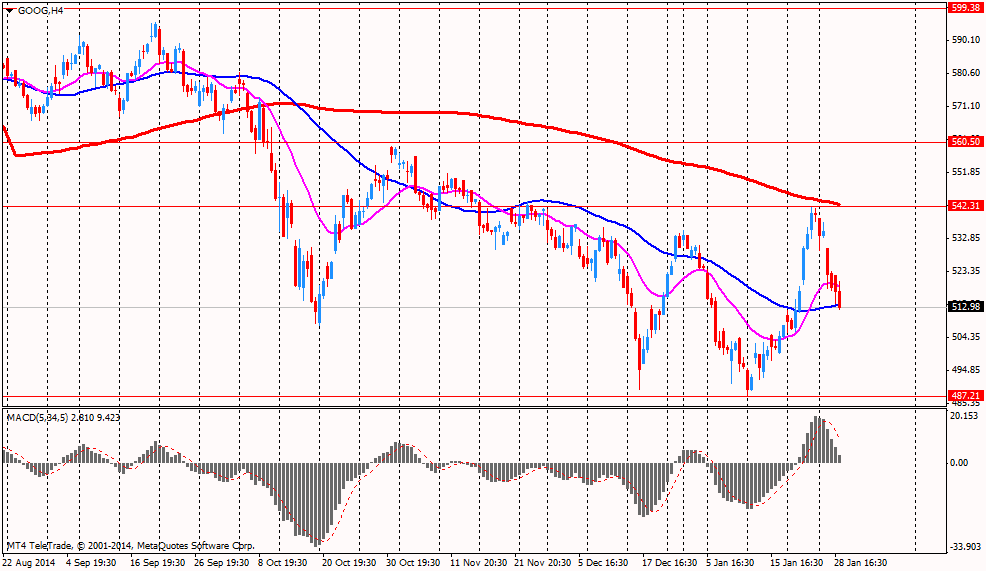

Google (GOOG) target lowered from $725 to $650 at RBC Capital Mkts and from $671 to $632 at FBR Capital

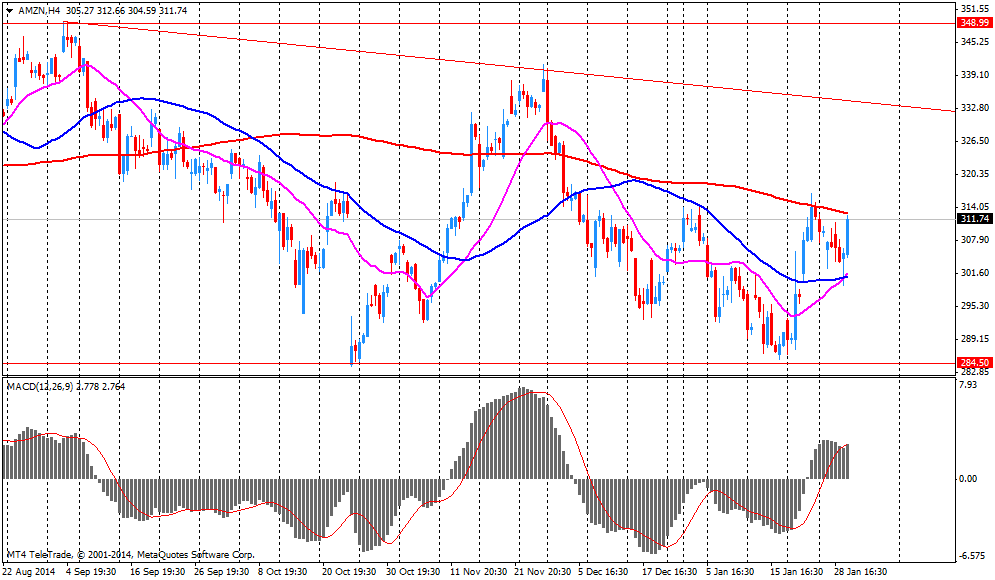

Amazon.com (AMZN) target raised from $400 to $420 at Piper Jaffray

-

15:01

Company News: Chevron (CVX) reported better than expected fourth quarter profits

Chevron (CVX) earned $1.85 per share in the fourth quarter, beating analysts' estimate of $1.65. Revenue in the fourth quarter decreased 17.9% year-over-year to $46.09 billion, but exceeding analysts' estimate of $44.89 billion.

The company has announced that it will cut its capital expenditure by 13% in 2015.

Chevron (CVX) shares increased to $103.50 (+0.49%) prior to the opening bell.

-

14:53

Company News: Visa (V) yesterday reported better than expected first fiscal quarter profits

Visa (V) earned $2.53 per share in the first fiscal quarter, beating analysts' estimate of $2.49. Revenue in the first fiscal quarter increased 7.2% year-over-year to $3.38 billion, exceeding analysts' estimate of $3.34 billion.

Visa (V) shares increased to $256.80 (+3.55%) prior to the opening bell.

-

14:49

Company News: Amazon.com (AMNZ) yesterday reported better than expected fourth quarter earnings, but revenue missed forecasts

Amazon.com (AMNZ) earned $0.45 per share in the fourth quarter, beating analysts' estimate of $0.16. Revenue in the fourth quarter increased 14.6% year-over-year to $29.33 billion, missing analysts' estimate of $29.63 billion.

The company released its forecasts for the first quarter 2015. Revenue is expected to be $20.9-$22.9 billion (analysts' estimate: $22.96 billion).

Amazon.com (AMNZ) shares increased to $327.50 (+5.04%) prior to the opening bell.

-

14:35

Company News: Google (GOOG) yesterday reported weaker than expected fourth quarter profits

Google (GOOG) earned $6.88 per share in the fourth quarter, missing analysts' estimate of $7.14. Revenue in the fourth quarter increased 15.2% year-over-year to $18.10 billion, missing analysts' estimate of $18.47 billion.

Google (GOOG) shares increased to $517.00 (+1.24%) prior to the opening bell.

-

13:00

European stock markets mid-session: Indices reverse positive start ahead of U.S. data

European indices reverse early gains ahead of U.S. data. Earlier today German Retail Sales for December rose less at a +0.2% pace compared to +1.0% in the previous month. Real unadjusted Retail Sales jumped +4.0%.

Consumer Spending in France rose by +1.5% in December compared to +0.4% in November.

Eurozone's Unemployment rate for December declined with a reading of 11.4%. Economists forecasted a reading of 11.5% in line with previous month's data.

The Eurozone's Harmonized Consumer Price Index for January extended its slide by -0.6%, matching the biggest decline in the history of the Eurozone, compared to a reading of -0.2% in the previous month. A reading below forecasts of -0.5%. The data shows the importance of the challenges the ECB is facing I order to avoid deflation and bring back the Eurozone to the targeted inflation rate of 2%.

Later in the day a set of U.S. data including the highly anticipated GDP for the fourth quarter, the Chicago Purchasing Manager's Index and the Reuters/Michigan Consumer Sentiment will be in the focus.

The commodity heavy FTSE 100 index is currently trading -0.35% quoted at 6,787.02 points. Germany's DAX 30 lost -0.01% trading at 10,736.39, almost flat reversing early gains, being quoted below its all-time high at 10,810.57 hit on Tuesday. France's CAC 40 is currently trading at 4,621.25 points, -0.22%.

-

10:00

European Stocks. First hour: Indices gain in early trading

European indices rise in early trading amid earnings reports still being supported by the ECB's stimulus program.

German Retail Sales for December rose less at a +0.2% pace compared to +1.0% in the previous month. Consumer Spending in France rose by +1.5% in December compared to +0.4% in November.

Markets await data on Eurozone's Unemployment Rate and Harmonized CPI due at 10:00 GMT. Later in the day a set of U.S. data including the GDP for the fourth quarter, the Chicago Purchasing Manager's Index and the Reuters/Michigan Consumer Sentiment will be in the focus.

The commodity heavy FTSE 100 index is currently trading +0.03% quoted at 6,812.95 points. Germany's DAX 30 rose by +0.21% trading at 10,760.56. France's CAC 40 added +0.20%, currently trading at 4,640.72 points.

-

09:00

Global Stocks: Wall Street and Nikkei gain, Chinese indices decline

U.S. markets closed higher on Thursday on mixed U.S. data, reversing early losses in the late afternoon on rising oil-prices and a rally in Apple and Boeing shares lend further support. Initial jobless claims in the week ending January 24 in the U.S. fell by 43,000 to 265,000 from 308,000 in the previous week. Pending home sales in the U.S. declined 3.7% in December, missing expectations for a 0.6% increase, after a 0.6% gain in November. November's figure was revised down from a 0.8% rise. That was the biggest monthly decrease since December 2013. Today market participants await a set of U.S. data including the GDP for the fourth quarter, the Chicago Purchasing Manager's Index and the Reuters/Michigan Consumer Sentiment.

The DOW JONES index added +1.31%, closing at 17,416.85 points. The S&P 500 rose by +0.95% with a final quote of 2,021.25 points

Chinese stock markets traded lower on Friday. Yesterday Chinese regulators launched inspections into brokerages that allow margin trading as concerns rise that markets are becoming over-leveraged. Hong Kong's Hang Seng is trading -0.48% at 24,478.94 points. China's Shanghai Composite closed at 3,211.67 points -1.55%.

Japan's Nikkei posted gains on Friday on strong corporate results that buoyed sentiment, closing +0.39% with a final quote of 17,674.39. SoftBank Corp, an index-heavyweight, limited gains. The bank is a major stakeholder in Alibaba that reported lower-than-expected revenues. For the week the index added +0.9%, ending the month with a gain of 1.3%. The Japanese Unemployment Rate declined for the month of December to 3.4%. The Tokyo Consumer Price Index rose to +2.3% with a previous reading of +2.1%. Household Spending decreased by -3.4%, analysts expected a decline by -2.5%. The National CPI was unchanged at +2.4%, ex fresh food CPI rose by 2.5%, less than the expected 2.6%. Industrial Production for December rose by +1.0% in December compared to -0.6% in November, not meeting forecasts of +1.3%. Housing starts shrank by -14.7% for a 10th straight year-on-year decline.

-

03:03

Nikkei 225 17,759.72 +153.50 +0.87%, Hang Seng 24,675.25 +79.40 +0.32%, Shanghai Composite 3,280.02 +17.72 +0.54%

-

01:01

Stocks. Daily history for Jan 29’2015:

(index / closing price / change items /% change)

TOPIX 1,413.58 -16.34 -1.14%

SHANGHAI COMP 3,263.73 -42.00 -1.27%

HANG SENG 24,574.87 -286.94 -1.15%

FTSE 100 6,810.6 -15.34 -0.22%

CAC 40 4,631.43 +20.49 +0.44%

Xetra DAX 10,737.87 +26.90 +0.25%

S&P 500 2,021.25 +19.09 +0.95%

NASDAQ Composite 4,683.41 +45.41 +0.98%

Dow Jones 17,416.85 +225.48 +1.31%

-