Noticias del mercado

-

23:59

Schedule for today, Tuesday, Sep 20’2016

01:30 Australia House Price Index (QoQ) Quarter II -0.2% 2.5%

01:30 Australia RBA Meeting's Minutes

05:45 Switzerland SECO Economic Forecasts

06:00 Switzerland Trade Balance August 2.93

12:30 U.S. Housing Starts August 1211 1191

12:30 U.S. Building Permits August 1144 1170

16:50 Canada BOC Gov Stephen Poloz Speaks

22:45 New Zealand Visitor Arrivals August 14.4%

23:50 Japan Trade Balance Total, bln August 513.5 202.3

-

21:08

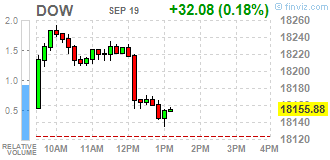

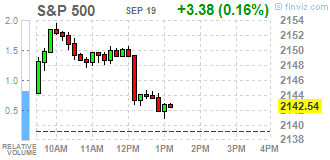

DJIA 18171.94 48.14 0.27%, NASDAQ 5248.89 4.32 0.08%, S&P 500 2145.27 6.11 0.29%

-

19:18

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Monday, a day before the Federal Reserve meets to discuss interest rates. The central bank is expected to leave rates unchanged at the two-day meeting, but investors will assess Fed Chair Janet Yellen's speech on Wednesday for clues on the timing of the next rate hike.

Most of Dow stocks in positive area (18 of 30). Top gainer - 3M Company (MMM, +1.02%). Top loser - Verizon Communications Inc. (VZ, -1.24%).

All S&P sectors in positive area. Top gainer - Utilities (+0.8%).

At the moment:

Oil 44.04 +0.42 +0.96%

Gold 1317.10 +6.90 +0.53%

Dow 18054.00 +1.00 +0.01%

S&P 500 2133.75 +1.25 +0.06%

Nasdaq 100 4797.75 -16.50 -0.34%

U.S. 10yr 1.69 -0.01

-

18:00

European stocks closed: FTSE 6813.55 103.27 1.54%, DAX 10373.87 97.70 0.95%, CAC 4394.19 61.74 1.43%

-

17:47

OIl prices rose today

Oil prices mark the rise after Sunday Venezuelan President Nicolas Maduro said that OPEC and its member exporters are "close" to reaching an agreement on the oil market stabilization and that it aims to ensure that the agreement may be announced as early as this month.

OPEC members will discuss potential limitation of production in the course of an informal meeting on the sidelines of the International Energy Conference in Algiers on September 26-28.

But many market participants doubt that the forthcoming meeting in late September will conclude with the adoption of any reduction of the global overproduction measures. Most of them believe that instead, oil producers will continue to monitor the market, postponing negotiations on freezing before the official meeting of OPEC in Vienna, scheduled for 30 November.

Earlier this year, an attempt to co-freeze level of production was not a success because of the refusal of Saudi Arabia to sign the agreement without the participation of Iran.

On Friday, Brent crude fell 82 cents, or 1.76% and for the week fell $ 4.67%, amid growing concerns about a possible increase in oil supplies from Libya and Nigeria.

Reports of the fighting in the Libyan oil ports provide additional support to the growth of prices. East Libyan forces announced the restoration of control over the two ports after the counter militants managed to capture one of the terminals for a while.

On Friday, WTI crude oil futures fell to a five-week low of $ 43.35, as signs of continued recovery of drilling activity in the US have increased concern about global oversaturation proposal.

Baker Hughes reported that the number of oil rigs in the US increased by 2 per week to 416, increasing the 11th week of the last 12.

The cost of the October futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 44.13 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of Brent crude rose to 46.85 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:40

Gold rose from important support area

Gold prices rose on a background of a weakening dollar, but gains were limited due to the upcoming meeting of the Fed and the growth of US government bonds.

The US Central Bank will hold a meeting on Tuesday and Wednesday. It is expected to keep the intrest rate at the same level, but can give a clear signal about the possibility of a hike in December.

Rates unchanged may weaken the US currency, potentially making gold more attractive to buyers. "The dollar weakened slightly as a whole is good for precious metals and gold in particular ... The economic data is not too good, so that they do not act now, - said Quantitative Commodity Research analyst Peter Fertig -. But there is a risk that Fed may surprise everyone and then precious metals will drop. "

Also, the gold market bulls are concerned about growth in real yields tied to the inflation rate of US bonds.

Nevertheless, the return of Chinese investors after the Mid-Autumn Festival, is expected to help to support gold, as well as strong technical support around the level of $ 1.305 per ounce, 100-day moving average.

The assets of the world's largest gold exchange-traded fund (ETF) SPDR Gold Shares rose on Friday by more than 1 percent to 942.61 tons.

The cost of the October futures for gold on COMEX rose to $ 1317.5 per ounce.

-

17:37

WSE: Session Results

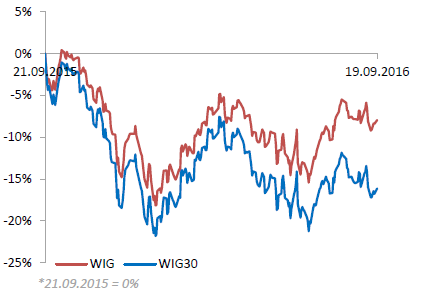

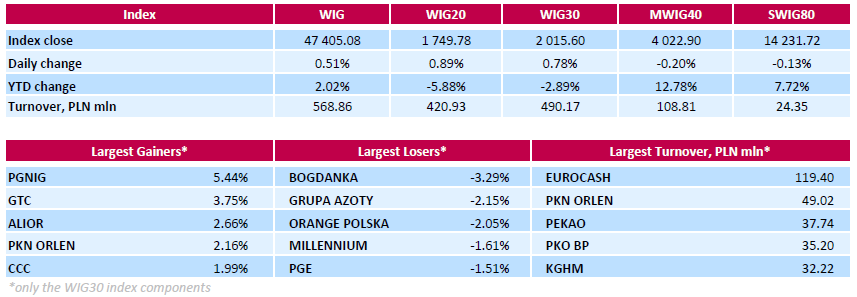

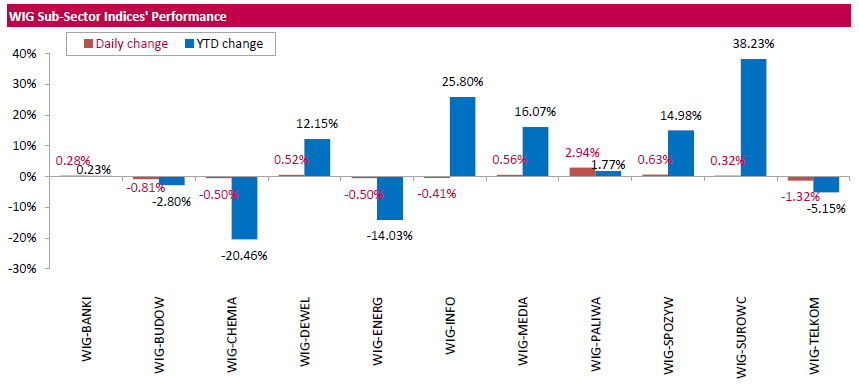

Polish equity market closed higher on Monday. The broad market measure, the WIG index, added 0.51%. Sector performance within the WIG Index was mixed. Oil and gas sector (+2.94%) was the strongest group, while telecoms (-1.32%) lagged behind.

The large-cap benchmark, the WIG30 Index, rose by 0.78%. Within the index components, oil and gas producer PGNIG (WSE: PGN) and property developer GTC (WSE: GTC) led the gainers, climbing by 5.44% and 3.75% respectively. Other major advancers were bank ALIOR (WSE: ALR), oil refiner PKN ORLEN (WSE: PKN), footwear retailer CCC (WSE: CCC), insurer PZU (WSE: PZU) and FMCG-wholesaler EUROCASH (WSE: EUR), gaining between 1.62% and 2.66%. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB), chemical producer GRUPA AZOTY (WSE: ATT) and telecommunication services provider ORANGE POLSKA (WSE: OPL) were among the weakest performers, dropping by 3.29%, 2.15% and 2.05% respectively.

-

17:10

CAD: Slipping Further Down US Trade List; USD/CAD En-Route To 1.37 - CIBC

"The value of trade between the US and China overtook that between the US and Canada as the world's largest last year. And when it comes to goods exports to the US, Canada appears to be falling further down the list. Low oil prices have uncovered a weaker underlying trade performance, seeing Canada's share of US imports fall. At the same time, Mexico has continued to pick up share. And a weaker loonie hasn't made competing against a low cost country such as Mexico any easier. Recent softness in the peso means that the Mexican currency has actually now fallen further against the US$ than the loonie has.

A continued uninspiring trade performance will weigh on the C$ against it American counterpart, seeing USDCAD rise to 1.37 by end-2017".

Copyright © 2016 CIBC, eFXnews™

-

17:05

US homebuilder confidence improves in September

The report said the NAHB/Wells Fargo Housing Market Index surged up to 65 in September from a downwardly revised 59 in August.

Economists had expected the index to come in unchanged compared to the 60 originally reported for the previous month.

With the substantial increase, the housing market index reached its highest level since hitting a matching reading in October of 2015.

"With the inventory of new and existing homes remaining tight, builders are confident that if they can build more homes they can sell them," said NAHB Chief Economist Robert Dietz.

He added, "Though solid job creation and low interest rates are also fueling demand, builders continue to be hampered by supply-side constraints that include shortages of labor and lots."

-

16:30

Australia: Conference Board Australia Leading Index, July 0.4%

-

16:00

U.S.: NAHB Housing Market Index, September 65 (forecast 60)

-

15:51

WSE: After start on Wall Street

The afternoon data from the Polish economy surprised positively. After a weak July the rebound came and better-than-expected readings at both the retail and industrial production. Unfortunately we might see growing recession in the construction industry, construction output has been falling by 20.5%, which is the highest this year. It did not affect the quotations on the stock market. Today's trading is not so interesting because of the strongly reduced volatility, which has established itself on the market after the morning pulse.

The market in the United States opens with an increase of 0.34%, which can be considered rather modest achievement in relation to what is happening today on the European stock exchanges.

Our index of the largest companies in the hour before the close of trading was at the level of 1,752 points (+1,05%).

-

15:45

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1000 (EUR 819m) 1.1170 (285m) 1.1200 (300m) 1.1265 (395m) 1.1300 (511m) 1.1310 (432m)

USDJPY: 102.10 (600m) 103.00 (306m) 103.50 (391m)

AUDUSD: 0.7400(AUD 345m) 0.7500 (834m) 0.7600 (400m)

USDCAD: 1.3200 (200m)

EURGBP 0.8500 (EUR 455m)

-

15:34

U.S. Stocks open: Dow +0.43%, Nasdaq +0.38%, S&P +0.38%

-

15:28

Before the bell: S&P futures +0.41%, NASDAQ futures +0.31%

U.S. stock-index futures rose, signaling equities will rebound from Friday's drop, amid gains in crude prices and speculations the Federal Reserve will hold interest rates steady this week.

Global Stocks:

Nikkei Closed

Hang Seng 23,550.45 +214.86 +0.92%

Shanghai 3,026.61 +23.77 +0.79%

FTSE 6,800.86 +90.58 +1.35%

CAC 4,390.87 +58.42 +1.35%

DAX 10,360.47 +84.30 +0.82%

Crude $43.62 (+1.37%)

Gold $1317.60 (+0.56%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.54

0.10(1.0593%)

57726

Amazon.com Inc., NASDAQ

AMZN

780.49

1.97(0.253%)

26318

Apple Inc.

AAPL

115.43

0.51(0.4438%)

665035

AT&T Inc

T

40.34

0.14(0.3483%)

174889

Barrick Gold Corporation, NYSE

ABX

17.5

0.16(0.9227%)

50513

Caterpillar Inc

CAT

82

-0.05(-0.0609%)

21473

Chevron Corp

CVX

98.5

0.66(0.6746%)

54276

Cisco Systems Inc

CSCO

30.95

0.11(0.3567%)

138840

Citigroup Inc., NYSE

C

46.51

0.10(0.2155%)

78474

E. I. du Pont de Nemours and Co

DD

68.4

1.15(1.71%)

27601

Exxon Mobil Corp

XOM

84.99

0.96(1.1424%)

115106

Facebook, Inc.

FB

129.96

0.89(0.6896%)

183447

Ford Motor Co.

F

12.2

0.09(0.7432%)

117492

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.16

0.22(2.2133%)

96572

General Electric Co

GE

29.82

0.14(0.4717%)

246748

General Motors Company, NYSE

GM

31.75

0.78(2.5186%)

82816

Goldman Sachs

GS

166.74

0.74(0.4458%)

11584

Google Inc.

GOOG

773

4.12(0.5358%)

8243

Home Depot Inc

HD

126.94

0.83(0.6582%)

34533

HONEYWELL INTERNATIONAL INC.

HON

114.4

0.14(0.1225%)

20559

Intel Corp

INTC

37.8

0.13(0.3451%)

162386

International Business Machines Co...

IBM

155

1.16(0.754%)

24423

McDonald's Corp

MCD

115.5

0.22(0.1908%)

23566

Merck & Co Inc

MRK

62.52

0.24(0.3854%)

75876

Microsoft Corp

MSFT

57.44

0.19(0.3319%)

210712

Nike

NKE

55.29

0.11(0.1993%)

41127

Pfizer Inc

PFE

34.02

0.08(0.2357%)

164835

Procter & Gamble Co

PG

88.24

0.19(0.2158%)

75439

Tesla Motors, Inc., NASDAQ

TSLA

206.4

1.00(0.4869%)

13615

The Coca-Cola Co

KO

42.35

0.21(0.4983%)

105359

Travelers Companies Inc

TRV

115.24

0.57(0.4971%)

8931

Twitter, Inc., NYSE

TWTR

19.38

0.27(1.4129%)

157845

United Technologies Corp

UTX

100.5

0.40(0.3996%)

21808

UnitedHealth Group Inc

UNH

139

0.53(0.3828%)

26535

Visa

V

82.75

0.68(0.8286%)

51979

Walt Disney Co

DIS

92.92

0.36(0.3889%)

40522

Yahoo! Inc., NASDAQ

YHOO

43.97

0.30(0.687%)

26225

-

14:53

Upgrades and downgrades before the market open

Upgrades:

General Motors (GM) upgraded to Overweight from Equal-Weight at Morgan Stanley; target raised to $37 from $29

Downgrades:

Other:

Intel (INTC) target raised to $42 from $38 at Mizuho

-

14:31

European session review: euro range trading

The following data was published:

(Time / country / index / period / previous value / forecast)

8:00 Eurozone balance of payments, without taking into account seasonal adjustments, in July 39.1 31.5 bn

10:00 Germany's Bundesbank Monthly Report

The yen strengthened against the US dollar, updating the Friday's high. Experts point out that the US currency remained under pressure in the run-up to the Fed meeting. Few people believe that the Fed will raise rates this week, but recent data reinforce the view that the policy tightening could occur before the end of the year, probably in December. In addition, market participants adjust their positions ahead of the Bank of Japan meeting. On Wednesday, the Bank of Japan completes the two-day meeting and will publish a report on the measures taken to combat deflation. Markets will focus on whether the Bank of Japan will lower its key interest rate or otherwise change policies.

The euro traded in a range against the US dollar, near Friday's low. Little influenced by the data for Germany and the euro zone. Statistical Office Destatis reported that the number of permits issued for housing construction in Germany, grew strongly in the first seven months, registering the largest increase in six years. According to the report, during the period from January to July, the number of permits issued for housing construction jumped by 26.1 percent year on year to 213.600 units. The last time such a large number of permits (for 7-month period) was in 2000 - when 216,000 permits were approved, the agency said. Of the total number of permits issued in January-July 179,600 were for new homes, which is 23.2 percent more compared to last year. Part of the last change was due to increase in the number of permits for the construction of shelters for refugees.

With regard to the data for the euro area, the ECB announced that the seasonally adjusted and corrected for the number of working days, the balance of payments surplus in July fell to 21.0 bln euro, compared to EUR 29.5 billion. In June. Analysts predicted that the surplus will decrease to 27.2 billion. Euro. The total current account in the last 12 months (to July) showed a surplus of 343.2 billion euros, equivalent to 3.0% of eurozone's GDP.

In addition, investors are preparing for the Fed meeting. It is unlikely that the Fed will raise rates, but investors will assess the tone of the official statement of the central bank, hoping to get hints. According to the futures market, the likelihood of tighter monetary policy is 12% in September and 55.0% in December.

EUR / USD: during the European session, the pair was trading in the $ 1.1150- $ 1.1173 range

GBP / USD: during the European session, the pair rose to $ 1.3073

USD / JPY: during the European session, the pair fell Y101.69

-

13:50

Orders

EUR/USD

Offers 1.1180 1.1200 1.1220-25 1.1250-55 1.1270 1.1285 1.1300

Bids 1.1145-50 1.1125 1.1100 1.1085 1.1050 1.1020 1.1000

GBP/USD

Offers 1.3080-85 1.3100 1.3125-30 1.3150 1.3185 1.3200 1.3220 1.3235 1.3250

Bids 1.3030 1.3000 1.2980 1.2940-50 1.2900 1.2880 1.2850

EUR/GBP

Offers 0.8560-65 0.8580 0.8600 0.8625-30 0.8650 0.8700

Bids 0.8525-30 0.8500 0.8480-85 0.8450 0.8420 0.8400

EUR/JPY

Offers 114.30 114.50 114.85 115.00 115.20-25 115.50 115.80 116.00

Bids 113.80-85 113.50 113.20 113.00 112.80 112.50 112.35 112.00

USD/JPY

Offers 102.20-25 102.50-55 102.75-80 103.00 103.35 103.50

Bids 102.00 101.75-80 101.60 101.50 101.20 101.00 100.80 100.50

AUD/USD

Offers 0.7550-55 0.7565 0.7580 0.7600 0.7630 0.7655-60

Bids 0.7500 0.7485 0.7465 0.7445-50 0.7420-25 0.7400

-

13:06

WSE: Mid session comment

The initial hours of trading brought overcome of the resistance in the region of 1,750 points, although it took place at not very impressive turnover. At the dawn of the forenoon phase of trading the main index was back to the level of 1,750 points and this movement was not supported by the similar behavior of the environment. Thus we might see the first problem on the demand side and the effects of low turnover.

The noon hours of trading brought the usual decline in activity and another round will start close to 14 hours (Warsaw time), when the US capital will enter the market.

The European Commission has opened on Monday a detailed investigation into the tax on retail sales in Poland, and ordered the suspension of its use until the end of analysis, the EC said in a statement. This is not particularly surprising, because for some time came the information that the Commission contests the new tax. This was the case in Hungary, which had to withdraw from such a tax.

In the middle of trading the WIG20 index was at the level of 1,753 points (+1,12%) and with the turnover of slightly above PLN 170 million.

-

13:00

Major European stock indices trading in the green zone

European stock indices show a moderate increase after last week recorded the highest weekly decline in three months. Shares of mining and energy companies rose in response to the positive dynamics of the oil market.

Oil prices rose more than 1 percent against the background of comments dfrom the President of Venezuela Nicolas Maduro whao said that the country's oil producers are close to an agreement to stabilize prices in the market. The deal could be announced later this month. Venezuela, whose economy is particularly hard hit by the collapse in oil prices, is one of the most active supporters of the agreement. It is known that the OPEC countries are planning to hold an informal meeting on the sidelines of the XV International Energy Forum in Algeria, which will be held from 26 to 28 September.

The composite index of the largest companies in the region Stoxx Europe 600 grew by 0.95 percent. If bids will end with the same result, it would be the biggest gain since Sept. 2.

Shares of Total SA and BP Plc more than 2 percent and BHP Billiton Ltd. (+3.2 Percent), HSBC Holdings Plc (+2,5 percent).

Capitalization of Weir Group Plc increased 3.6 percent after analysts at JPMorgan Chase & Co. recommended buying the stock, citing an improved outlook.

Price of Renault SA rose 2.4 percent after the automaker's shares on Friday fell to two-month low.

Sodexo SA rose 2.3 percent after the rating revison by experts of Raymond James Financial Inc.

Quotes of Deutsche Bank AG, which on Friday fell at the fastest pace since Brexit, fell another 1.4 percent.

Shares of Deutsche Wohnen AG fell 1.5 percent as Bank of America Corp. downgraded housing landlord securities to a "sell", pointing to the weakening of investors confidence in the industry.

At the moment:

FTSE 100 +87.90 6798.18 + 1.31%

DAX +71.42 10347.59 + 0.70%

CAC 40 +58.88 4391.33 + 1.36%

-

12:38

OPEC informal talks at IEF moved from 27 to 28 September

-

12:21

BIS warns of banking crisis risks in China over the next three years

"Excessive credit growth in China signals the growing threat of a banking crisis in the next three years", - reported in the statement of the Bank for International Settlements.

In its review of the international banking and financial markets, BIS said that the probability of a financial "heat" in China in rising - the gap between the increase in lending and GDP reached 30.1 in the first quarter. "The value above 10 signals that the crisis may cover the country in the next three years as China's LED is much higher than the second highest rate (12.1 for Canada) and is the highest of the countries evaluated.", - noted BIS experts.

Debt plays a key role in slowing China's economic growth after the global financial crisis. Debt reached 255 percent of GDP in 2015, which was largely due to a sharp increase in corporate borrowing. Recall two years ago, outstanding debt was 220 percent. Meanwhile, China's bank lending rose in August more than double compared to July, with most of the increase related to the high demand for mortgage loans.

The BIS also said that the debt service ratio - which measures the interest in relation to income - was 5.4, which is a "potential problem". This underlines the risk of default, as many borrowers are unable to repay the loans. Some analysts argue that the weakening of the capital strength of banks increases the likelihood that the government may have to "upload" more than $ 100 billion.

-

11:31

MNI sources: ECB likely to keep rates on hold until at least year-end

-

sources suggest ECB may turn out to have done enough already

-

QE unlikely to come to an abrupt end next March

-

may need to adjust parameters of QE programme

-

sources reject helicopter money or additional asset classes

-

no one interested in taking ECB depo rate lower

-

clear view still to fulfil ECB QE programme

*via forexlive

-

-

10:43

Oil is traded in the green zone

This morning New York WTI crude oil futures rose 1.4% to $ 44.23 and Brent crude oil futures rose 1.22% to $ 46.33 per barrel. Thus, the black gold is trading higher, after Venezuelan President Nicolas Maduro said yesterday that OPEC countries and other manufacturers are close to the conclusion of production level stabilization. In addition, the clashes in Libya have raised concern about the possible failure to restore the export of black gold out of the country. The clashes in the country prevented the shipment of the first batch of oil from the port of Ras Lanuf in nearly two years, as well as intensified fears of a new conflict over the oil resources of the country.

-

10:40

GBP: Risk Of Renewed Squeezes Intact; Long-Terms Shorts Key - Credit Agricole

"The GBP has been broadly range-bound of late, mainly on the back of stabilising central bank monetary policy expectations. Although the BoE left all options regarding lower rates as soon as this year open, improving data as for instance reflected in better than expected retail sales suggests that the central bank is in a position to wait and see for longer. This makes sense considering that conditions may turn more unstable as soon as Brexit negotiations actually start next year.

The GBP should remain broadly stable next week, especially as no top tier data is scheduled to be released.

When it comes to positioning it remains less elevated and close to levels of when the EU referendum was held. Nevertheless,should GBP lose further downside momentum it cannot be excluded that long-term shorts will be taken off.

Hence, scope of cannot be excluded".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 819m) 1.1170 (285m) 1.1200 (300m) 1.1265 (395m) 1.1300 (511m) 1.1310 (432m)

USD/JPY: 102.10 (600m) 103.00 (306m) 103.50 (391m)

AUD/USD: 0.7400(AUD 345m) 0.7500 (834m) 0.7600 (400m)

USD/CAD: 1.3200 (200m)

EUR/GBP 0.8500 (EUR 455m)

-

10:07

Euro area current account declines in July

In July 2016 the current account of the euro area recorded a surplus of €21.0 billion.

In the financial account, combined direct and portfolio investment recorded net acquisitions of assets of €58 billion and net disposals of liabilities of €14 billion.

The current account of the euro area recorded a surplus of €21.0 billion in July 2016. This reflected surpluses for goods (€26.4 billion), services (€4.9 billion) and primary income (€3.4 billion), which were partly offset by a deficit in secondary income (€13.7 billion).

The 12-month cumulated current account for the period ending in July 2016 recorded a surplus of €343.2 billion (3.2% of euro area GDP), compared with one of €309.7 billion (3.0% of euro area GDP) for the 12 months to July 2015. This development was mostly due to an increase in the surpluses for both goods (from €318.8 billion to €363.0 billion) and services (from €63.6 billion to €64.9 billion), as well as a decrease in the deficit for secondary income (from €134.5 billion to €126.0 billion). These were partly offset by decreases in the surplus for primary income (from €61.9 billion to €41.3 billion).

-

10:00

Eurozone: Current account, unadjusted, bln , July 31.5

-

09:29

Major stock exchanges trading in the green zone: FTSE + 0.6%, DAX + 0.7%, CAC40 + 0.8%, FTMIB + 0.4%, IBEX + 1.0%

-

09:19

WSE: After opening

WIG20 index opened at 1740.57 points (+0.36%)*

WIG 47345.25 0.38%

WIG30 2010.04 0.50%

mWIG40 4034.65 0.09%

*/ - change to previous close

After lower closing on Friday, today we enter the new week on the spot market with an increase of 0.36% to 1,740 points. After first transactions bears make up Friday's fixing, and even attack the resistance level at around 1,750 points. We also may see a very good mood in an environment where the German DAX gaining approx. 0.7%. On the Warsaw market all the shares in the range of blue chips are on the green side, what indicates that after the settlement of the September series of futures market slightly recovers.

After fifteen minutes of trading the index WIG20 was on the level of 1,752 points (+1,08%).

-

09:14

Bank of Japan and FOMC in the same day to set the price action medium term

-

09:11

Today’s events

At 10:00 GMT the Bundesbank Monthly Report

At 17:00 GMT the ECB Board member Yves Mersch will make a speech

-

08:34

Expected positive start of trading on the major stock exchanges in Europe: DAX futures + 0.8%, CAC40 + 0.8%, FTSE + 1.0%

-

08:25

WSE: Before opening

The morning mood at the beginning of the week is quite good. The US contracts slightly increase in value, same as Asian indexes. Everything happens without the participation of celebrating Japan. We do not see also any negative impact of the bombings in New York City and New Jersey, which will most likely not be associated with the activities of the so-called Islamic State.

The beginning week will be dominated by two major central banks. The most important will be than Wednesday, when on the morning will be given the BoJ decision and in the evening the message and the subsequent press conference after the FOMC meeting in the US.

The S&P agency raised the rating of Hungary due to the improvement in fiscal expectations, external balance and economic growth. This means that Hungary's rating from junk has become an investment.

In today's calendar will be announced our national macro readings about the rate of change in industrial production and retail sales. Investors are hoping that after weaker July this month will bring recovery, what is indicated by forecasts.

-

08:17

UK house prices rose 0.7% in September - Rightmove

According to rttnews. the average asking price for a house in the United Kingdom was up 0.7 percent on month in September, property tracking website Rightmove said on Monday - coming in at 306,499 pounds.

That follows the 1.2 percent contraction in August.

On a yearly basis, house prices advanced 4.0 percent - slowing marginally from the 4.1 percent growth in the previous month.

"The rising tide of prices is marooning more and more first-time buyers, out-stripping their ability to meet stricter lending criteria and afford the required deposits and monthly repayments," said Rightmove Director Miles Shipside.

-

08:15

Sep BoJ: 'We Are Not Optimistic'; Lowering USD/JPY Forecasts - Goldman Sachs

"This week's 'comprehensive assessment' from the BoJ could be one of two things.

On the one hand, it could be a fundamental reassessment of the policy stance, presumably with a view to adding stimulus. Given that the BoJ is missing its inflation forecast by a mile, this is certainly a reasonable expectation.

On the other hand, it could essentially be a PR exercise, selling the benefits of negative rates after the public backlash from the financial sector following the January IOER cut. This would see policy largely unchanged, with a view to building consensus around existing policies and setting the stage, perhaps, for further rate cuts down the road.

We outlines our expectations for the upcoming policy meeting. We are not optimistic. Similar to the ECB, focus at the BoJ has shifted toward making the existing policy stance sustainable, as opposed to adding stimulus to meet the inflation target. A particular risk - not our base case - is that the BoJ could take steps to bear steepen the yield curve, to help the financial sector following the dramatic curve flattening since January. In our view, such a step could further compound market confusion over BoJ objectives and exacerbate the damage done to longer-term inflation expectations year-to-date.

We are lowering our $/JPY forecast to 108, 110 and 115 in 3-, 6- and 12-months (from 115, 120 and 125 previously). Our 3-month target of 108 reflects our view that the BoJ will continue to ease at upcoming meetings, likely via further IOER cuts. The reduction in the 12-month forecast reflects our view that such easing is not enough to reverse the adverse dynamic that has taken hold since January. For that to be the case, more radical steps such as yield caps or price level targeting are needed, which we believe are not on the BoJ's radar screen at the present time".

Copyright © 2016 Goldman Sachs, eFXnews™

-

08:12

The consumer sentiment index from Westpac New Zealand increased in the third quarter

In the third quarter the index amounted to 108, which is higher than the previous value of 106. The study of consumer sentiment published by Westpac, is an indicator of consumer and company sentiment and in New Zealand. Typically, the indicator is based on the results of a study in which respondents give their assessment on various issues relating to the current and future economic conditions.

- Middle and high household income had a positive impact on consumer confidence

- lower income can lead to greater concerns about the economic outlook

- Rural areas are particularly concerned about the economic outlook in the coming years

-

07:07

Options levels on monday, September 19, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1304 (2614)

$1.1256 (1100)

$1.1216 (425)

Price at time of writing this review: $1.1167

Support levels (open interest**, contracts):

$1.1115 (3838)

$1.1087 (3471)

$1.1054 (6184)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 35562 contracts, with the maximum number of contracts with strike price $1,1400 (4640);

- Overall open interest on the PUT options with the expiration date October, 7 is 39474 contracts, with the maximum number of contracts with strike price $1,1100 (6184);

- The ratio of PUT/CALL was 1.11 versus 1.09 from the previous trading day according to data from September, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.3303 (1381)

$1.3205 (1196)

$1.3108 (995)

Price at time of writing this review: $1.3036

Support levels (open interest**, contracts):

$1.2893 (890)

$1.2796 (1695)

$1.2697 (1371)

Comments:

- Overall open interest on the CALL options with the expiration date October, 7 is 22466 contracts, with the maximum number of contracts with strike price $1,3450 (2781);

- Overall open interest on the PUT options with the expiration date October, 7 is 22473 contracts, with the maximum number of contracts with strike price $1,3000 (3766);

- The ratio of PUT/CALL was 1.00 versus 0.93 from the previous trading day according to data from September, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:05

Global Stocks

European stocks wrapped up in negative territory Friday, with a selloff in Deutsche Bank AG pacing punishment among bank shares and helping to mark a second-straight losing week. The pummeling was set off by news late Thursday the U.S. Department of Justice asked Deutsche Bank to pay $14 billion to settle civil claims related to mortgage-backed securities.

U.S. stocks finished lower Friday as weak oil prices pressured energy shares, while anxiety ahead of next week's central-bank meetings weighed on sentiment. However, for the week, major stock-index gauges eked out small gains, in part, thanks to Apple Inc.'s stellar climb.

Asian stock markets rose Friday, helped by gains in Apple Inc.'s suppliers, while some uncertainty remained over the outcomes from central-bank policy meetings in Japan and the U.S. next week.

-

01:02

New Zealand: Westpac Consumer Sentiment, Quarter III 108

-

00:30

Commodities. Daily history for Sep 16’2016:

(raw materials / closing price /% change)

Oil 43.19 +0.37%

Gold 1,313.20 +0.23%

-

00:29

Stocks. Daily history for Sep 16’2016:

(index / closing price / change items /% change)

Nikkei 225 16,519.29 +114.28 +0.70%

Shanghai Composite 3,002.67 -20.84 -0.69%

S&P/ASX 200 5,296.70 +56.84 +1.08%

FTSE 100 6,710.28 -20.02 -0.30%

CAC 40 4,332.45 -40.77 -0.93%

Xetra DAX 10,276.17 -155.03 -1.49%

S&P 500 2,139.16 -8.10 -0.38%

Dow Jones Industrial Average 18,123.80 -88.68 -0.49%

S&P/TSX Composite 14,450.69 -52.98 -0.37%

-

00:28

Currencies. Daily history for Sep 16’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1155 -0,78%

GBP/USD $1,3001 -1,85%

USD/CHF Chf0,9801 +0,86%

USD/JPY Y102,29 +0,24%

EUR/JPY Y114,09 -0,29%

GBP/JPY Y132,97 -1,62%

AUD/USD $0,7492 -0,32%

NZD/USD $0,7264 -0,81%

USD/CAD C$1,321 +0,45%

-