Noticias del mercado

-

21:08

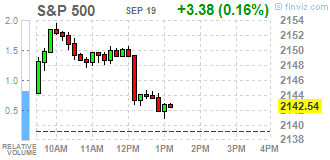

DJIA 18171.94 48.14 0.27%, NASDAQ 5248.89 4.32 0.08%, S&P 500 2145.27 6.11 0.29%

-

19:18

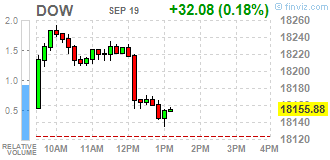

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Monday, a day before the Federal Reserve meets to discuss interest rates. The central bank is expected to leave rates unchanged at the two-day meeting, but investors will assess Fed Chair Janet Yellen's speech on Wednesday for clues on the timing of the next rate hike.

Most of Dow stocks in positive area (18 of 30). Top gainer - 3M Company (MMM, +1.02%). Top loser - Verizon Communications Inc. (VZ, -1.24%).

All S&P sectors in positive area. Top gainer - Utilities (+0.8%).

At the moment:

Oil 44.04 +0.42 +0.96%

Gold 1317.10 +6.90 +0.53%

Dow 18054.00 +1.00 +0.01%

S&P 500 2133.75 +1.25 +0.06%

Nasdaq 100 4797.75 -16.50 -0.34%

U.S. 10yr 1.69 -0.01

-

18:00

European stocks closed: FTSE 6813.55 103.27 1.54%, DAX 10373.87 97.70 0.95%, CAC 4394.19 61.74 1.43%

-

17:37

WSE: Session Results

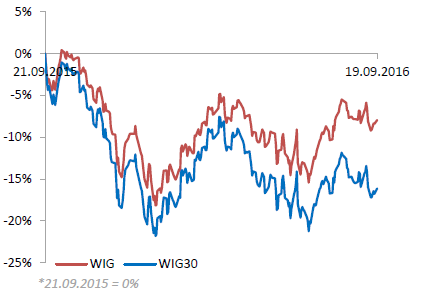

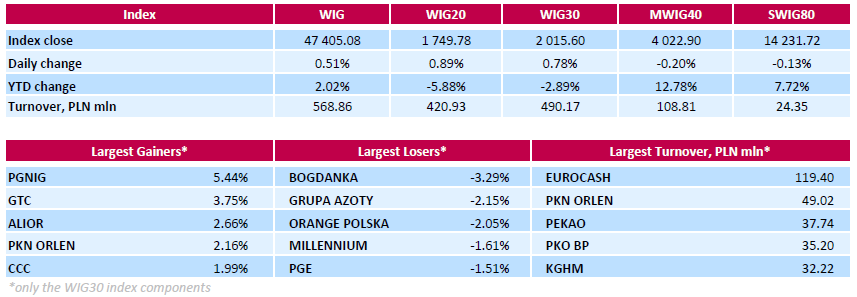

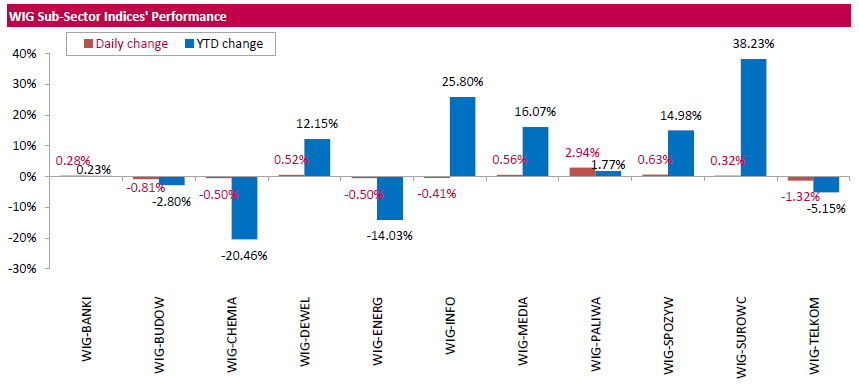

Polish equity market closed higher on Monday. The broad market measure, the WIG index, added 0.51%. Sector performance within the WIG Index was mixed. Oil and gas sector (+2.94%) was the strongest group, while telecoms (-1.32%) lagged behind.

The large-cap benchmark, the WIG30 Index, rose by 0.78%. Within the index components, oil and gas producer PGNIG (WSE: PGN) and property developer GTC (WSE: GTC) led the gainers, climbing by 5.44% and 3.75% respectively. Other major advancers were bank ALIOR (WSE: ALR), oil refiner PKN ORLEN (WSE: PKN), footwear retailer CCC (WSE: CCC), insurer PZU (WSE: PZU) and FMCG-wholesaler EUROCASH (WSE: EUR), gaining between 1.62% and 2.66%. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB), chemical producer GRUPA AZOTY (WSE: ATT) and telecommunication services provider ORANGE POLSKA (WSE: OPL) were among the weakest performers, dropping by 3.29%, 2.15% and 2.05% respectively.

-

15:51

WSE: After start on Wall Street

The afternoon data from the Polish economy surprised positively. After a weak July the rebound came and better-than-expected readings at both the retail and industrial production. Unfortunately we might see growing recession in the construction industry, construction output has been falling by 20.5%, which is the highest this year. It did not affect the quotations on the stock market. Today's trading is not so interesting because of the strongly reduced volatility, which has established itself on the market after the morning pulse.

The market in the United States opens with an increase of 0.34%, which can be considered rather modest achievement in relation to what is happening today on the European stock exchanges.

Our index of the largest companies in the hour before the close of trading was at the level of 1,752 points (+1,05%).

-

15:34

U.S. Stocks open: Dow +0.43%, Nasdaq +0.38%, S&P +0.38%

-

15:28

Before the bell: S&P futures +0.41%, NASDAQ futures +0.31%

U.S. stock-index futures rose, signaling equities will rebound from Friday's drop, amid gains in crude prices and speculations the Federal Reserve will hold interest rates steady this week.

Global Stocks:

Nikkei Closed

Hang Seng 23,550.45 +214.86 +0.92%

Shanghai 3,026.61 +23.77 +0.79%

FTSE 6,800.86 +90.58 +1.35%

CAC 4,390.87 +58.42 +1.35%

DAX 10,360.47 +84.30 +0.82%

Crude $43.62 (+1.37%)

Gold $1317.60 (+0.56%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.54

0.10(1.0593%)

57726

Amazon.com Inc., NASDAQ

AMZN

780.49

1.97(0.253%)

26318

Apple Inc.

AAPL

115.43

0.51(0.4438%)

665035

AT&T Inc

T

40.34

0.14(0.3483%)

174889

Barrick Gold Corporation, NYSE

ABX

17.5

0.16(0.9227%)

50513

Caterpillar Inc

CAT

82

-0.05(-0.0609%)

21473

Chevron Corp

CVX

98.5

0.66(0.6746%)

54276

Cisco Systems Inc

CSCO

30.95

0.11(0.3567%)

138840

Citigroup Inc., NYSE

C

46.51

0.10(0.2155%)

78474

E. I. du Pont de Nemours and Co

DD

68.4

1.15(1.71%)

27601

Exxon Mobil Corp

XOM

84.99

0.96(1.1424%)

115106

Facebook, Inc.

FB

129.96

0.89(0.6896%)

183447

Ford Motor Co.

F

12.2

0.09(0.7432%)

117492

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.16

0.22(2.2133%)

96572

General Electric Co

GE

29.82

0.14(0.4717%)

246748

General Motors Company, NYSE

GM

31.75

0.78(2.5186%)

82816

Goldman Sachs

GS

166.74

0.74(0.4458%)

11584

Google Inc.

GOOG

773

4.12(0.5358%)

8243

Home Depot Inc

HD

126.94

0.83(0.6582%)

34533

HONEYWELL INTERNATIONAL INC.

HON

114.4

0.14(0.1225%)

20559

Intel Corp

INTC

37.8

0.13(0.3451%)

162386

International Business Machines Co...

IBM

155

1.16(0.754%)

24423

McDonald's Corp

MCD

115.5

0.22(0.1908%)

23566

Merck & Co Inc

MRK

62.52

0.24(0.3854%)

75876

Microsoft Corp

MSFT

57.44

0.19(0.3319%)

210712

Nike

NKE

55.29

0.11(0.1993%)

41127

Pfizer Inc

PFE

34.02

0.08(0.2357%)

164835

Procter & Gamble Co

PG

88.24

0.19(0.2158%)

75439

Tesla Motors, Inc., NASDAQ

TSLA

206.4

1.00(0.4869%)

13615

The Coca-Cola Co

KO

42.35

0.21(0.4983%)

105359

Travelers Companies Inc

TRV

115.24

0.57(0.4971%)

8931

Twitter, Inc., NYSE

TWTR

19.38

0.27(1.4129%)

157845

United Technologies Corp

UTX

100.5

0.40(0.3996%)

21808

UnitedHealth Group Inc

UNH

139

0.53(0.3828%)

26535

Visa

V

82.75

0.68(0.8286%)

51979

Walt Disney Co

DIS

92.92

0.36(0.3889%)

40522

Yahoo! Inc., NASDAQ

YHOO

43.97

0.30(0.687%)

26225

-

14:53

Upgrades and downgrades before the market open

Upgrades:

General Motors (GM) upgraded to Overweight from Equal-Weight at Morgan Stanley; target raised to $37 from $29

Downgrades:

Other:

Intel (INTC) target raised to $42 from $38 at Mizuho

-

13:06

WSE: Mid session comment

The initial hours of trading brought overcome of the resistance in the region of 1,750 points, although it took place at not very impressive turnover. At the dawn of the forenoon phase of trading the main index was back to the level of 1,750 points and this movement was not supported by the similar behavior of the environment. Thus we might see the first problem on the demand side and the effects of low turnover.

The noon hours of trading brought the usual decline in activity and another round will start close to 14 hours (Warsaw time), when the US capital will enter the market.

The European Commission has opened on Monday a detailed investigation into the tax on retail sales in Poland, and ordered the suspension of its use until the end of analysis, the EC said in a statement. This is not particularly surprising, because for some time came the information that the Commission contests the new tax. This was the case in Hungary, which had to withdraw from such a tax.

In the middle of trading the WIG20 index was at the level of 1,753 points (+1,12%) and with the turnover of slightly above PLN 170 million.

-

13:00

Major European stock indices trading in the green zone

European stock indices show a moderate increase after last week recorded the highest weekly decline in three months. Shares of mining and energy companies rose in response to the positive dynamics of the oil market.

Oil prices rose more than 1 percent against the background of comments dfrom the President of Venezuela Nicolas Maduro whao said that the country's oil producers are close to an agreement to stabilize prices in the market. The deal could be announced later this month. Venezuela, whose economy is particularly hard hit by the collapse in oil prices, is one of the most active supporters of the agreement. It is known that the OPEC countries are planning to hold an informal meeting on the sidelines of the XV International Energy Forum in Algeria, which will be held from 26 to 28 September.

The composite index of the largest companies in the region Stoxx Europe 600 grew by 0.95 percent. If bids will end with the same result, it would be the biggest gain since Sept. 2.

Shares of Total SA and BP Plc more than 2 percent and BHP Billiton Ltd. (+3.2 Percent), HSBC Holdings Plc (+2,5 percent).

Capitalization of Weir Group Plc increased 3.6 percent after analysts at JPMorgan Chase & Co. recommended buying the stock, citing an improved outlook.

Price of Renault SA rose 2.4 percent after the automaker's shares on Friday fell to two-month low.

Sodexo SA rose 2.3 percent after the rating revison by experts of Raymond James Financial Inc.

Quotes of Deutsche Bank AG, which on Friday fell at the fastest pace since Brexit, fell another 1.4 percent.

Shares of Deutsche Wohnen AG fell 1.5 percent as Bank of America Corp. downgraded housing landlord securities to a "sell", pointing to the weakening of investors confidence in the industry.

At the moment:

FTSE 100 +87.90 6798.18 + 1.31%

DAX +71.42 10347.59 + 0.70%

CAC 40 +58.88 4391.33 + 1.36%

-

09:29

Major stock exchanges trading in the green zone: FTSE + 0.6%, DAX + 0.7%, CAC40 + 0.8%, FTMIB + 0.4%, IBEX + 1.0%

-

09:19

WSE: After opening

WIG20 index opened at 1740.57 points (+0.36%)*

WIG 47345.25 0.38%

WIG30 2010.04 0.50%

mWIG40 4034.65 0.09%

*/ - change to previous close

After lower closing on Friday, today we enter the new week on the spot market with an increase of 0.36% to 1,740 points. After first transactions bears make up Friday's fixing, and even attack the resistance level at around 1,750 points. We also may see a very good mood in an environment where the German DAX gaining approx. 0.7%. On the Warsaw market all the shares in the range of blue chips are on the green side, what indicates that after the settlement of the September series of futures market slightly recovers.

After fifteen minutes of trading the index WIG20 was on the level of 1,752 points (+1,08%).

-

08:34

Expected positive start of trading on the major stock exchanges in Europe: DAX futures + 0.8%, CAC40 + 0.8%, FTSE + 1.0%

-

08:25

WSE: Before opening

The morning mood at the beginning of the week is quite good. The US contracts slightly increase in value, same as Asian indexes. Everything happens without the participation of celebrating Japan. We do not see also any negative impact of the bombings in New York City and New Jersey, which will most likely not be associated with the activities of the so-called Islamic State.

The beginning week will be dominated by two major central banks. The most important will be than Wednesday, when on the morning will be given the BoJ decision and in the evening the message and the subsequent press conference after the FOMC meeting in the US.

The S&P agency raised the rating of Hungary due to the improvement in fiscal expectations, external balance and economic growth. This means that Hungary's rating from junk has become an investment.

In today's calendar will be announced our national macro readings about the rate of change in industrial production and retail sales. Investors are hoping that after weaker July this month will bring recovery, what is indicated by forecasts.

-

07:05

Global Stocks

European stocks wrapped up in negative territory Friday, with a selloff in Deutsche Bank AG pacing punishment among bank shares and helping to mark a second-straight losing week. The pummeling was set off by news late Thursday the U.S. Department of Justice asked Deutsche Bank to pay $14 billion to settle civil claims related to mortgage-backed securities.

U.S. stocks finished lower Friday as weak oil prices pressured energy shares, while anxiety ahead of next week's central-bank meetings weighed on sentiment. However, for the week, major stock-index gauges eked out small gains, in part, thanks to Apple Inc.'s stellar climb.

Asian stock markets rose Friday, helped by gains in Apple Inc.'s suppliers, while some uncertainty remained over the outcomes from central-bank policy meetings in Japan and the U.S. next week.

-

00:29

Stocks. Daily history for Sep 16’2016:

(index / closing price / change items /% change)

Nikkei 225 16,519.29 +114.28 +0.70%

Shanghai Composite 3,002.67 -20.84 -0.69%

S&P/ASX 200 5,296.70 +56.84 +1.08%

FTSE 100 6,710.28 -20.02 -0.30%

CAC 40 4,332.45 -40.77 -0.93%

Xetra DAX 10,276.17 -155.03 -1.49%

S&P 500 2,139.16 -8.10 -0.38%

Dow Jones Industrial Average 18,123.80 -88.68 -0.49%

S&P/TSX Composite 14,450.69 -52.98 -0.37%

-