Noticias del mercado

-

21:01

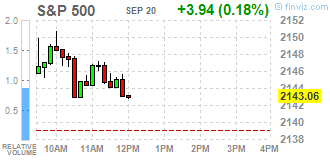

DJIA 18170.50 50.33 0.28%, NASDAQ 5250.88 15.86 0.30%, S&P 500 2144.68 5.56 0.26%

-

18:05

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Tuesday, helped by gains in healthcare stocks, even as investors awaited monetary policy decisions from the U.S. Federal Reserve and the Bank of Japan. Though the Fed is not expected to raise rates, Chair Janet Yellen's speech on Wednesday is keenly awaited for any clues about rate changes in the coming months.

Most of Dow stocks in positive area (23 of 30). Top gainer - Merck & Co., Inc. (MRK, +1.62%). Top loser - E. I. du Pont de Nemours and Company (DD, -0.33%).

Most of S&P sectors also in positive area. Top gainer - Healthcare (+0.8%). Top loser - Conglomerates (-0.1%).

At the moment:

Dow 18101.00 +49.00 +0.27%

S&P 500 2138.00 +5.00 +0.23%

Nasdaq 100 4805.75 +11.50 +0.24%

Oil 44.16 +0.30 +0.68%

Gold 1318.40 +0.60 +0.05%

U.S. 10yr 1.67 -0.03

-

18:01

European stocks closed: FTSE 6830.79 17.24 0.25%, DAX 10393.86 19.99 0.19%, CAC 4388.60 -5.59 -0.13%

-

17:39

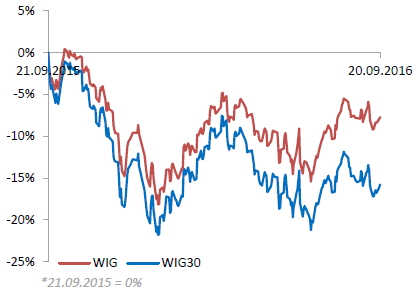

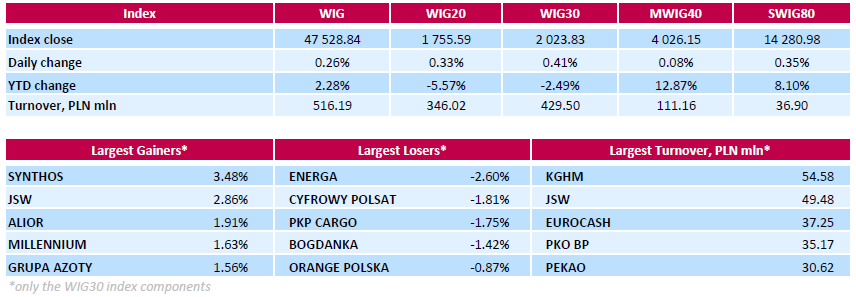

WSE: Session Results

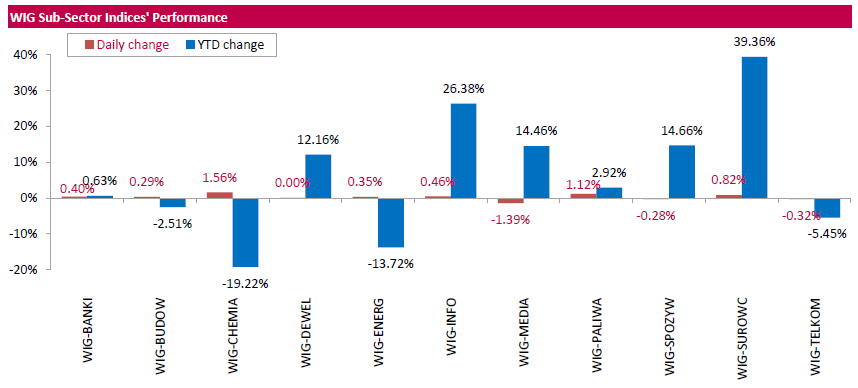

Polish equity market closed higher on Tuesday. The broad market benchmark, the WIG Index, surged by 0.26%. Most sectors rose, with chemicals (+1.56%) posting the biggest advance.

The large-cap stocks grew by 0.41%, as measured by the WIG30 Index. Within the index components, chemical producer SYNTHOS (WSE: SNS) led the gainers pack with a 3.48% advance, followed by coking coal producer JSW (WSE: JSW) and bank ALIOR (WSE: ALR), climbing by 2.86% and 1.91% respectively. On the other side of the ledger, genco ENERGA (WSE: ENG) recorded the biggest drop of 2.6%. Other major decliners were media group CYFROWY POLSAT (WSE: CPS), railway freight transport operator PKP CARGO (WSE: PKP) and thermal coal miner BOGDANKA (WSE: LWB), falling by 1.81%, 1.75% and 1.42% respectively.

-

16:10

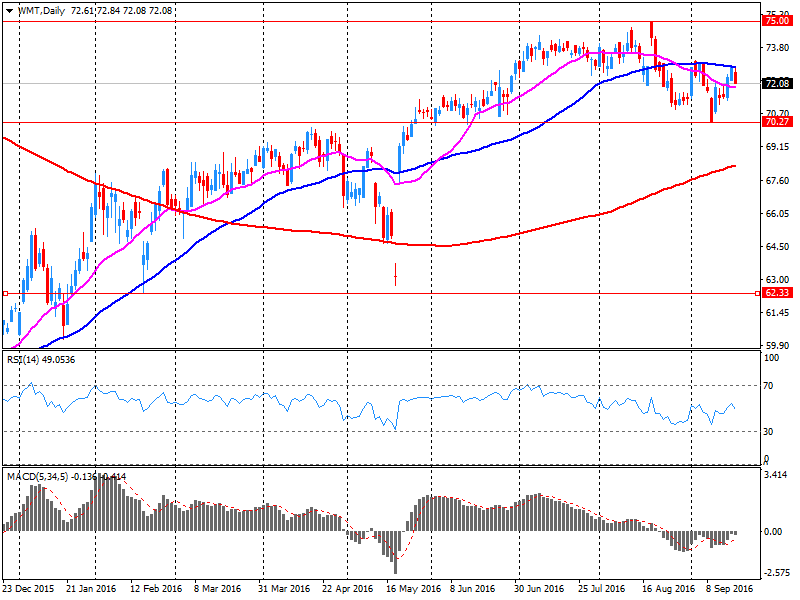

Company News: Wal-Mart (WMT) has completed the acquisition of Jet.com

The company Wal-Mart (WMT) has completed the acquisition of Jet.com worth $ 3.3 billion. In this regard, the company has updated the expectations of influence the transaction will have on financial results.

According to the report, Walmart estimates that the deal will have a "dilutive effect" on the earnings per share for 2017 of $ 0.05, because of operating losses and one-time transaction costs.

WMT shares rose in premarket trading to $ 72.25 (+ 0.22%).

-

15:54

WSE: After start on Wall Street

Opening of the market in the US was held in a positive mood, which is a response to a slightly better behavior of parquets in Europe. The S&P500 index after a weak session yesterday returned to the starting point before exactly 24 hours.

However, we may venture to say that until tomorrow's showdown on the table by the Fed, rather should not be pressure to rise above the level of 2,150 points, an area of the last days stabilization. Oil prices are going down, which will not be helpful for Wall Street.

An hour before the end of trading the WIG20 index reached the level of 1,747 points (-0,12%).

-

15:45

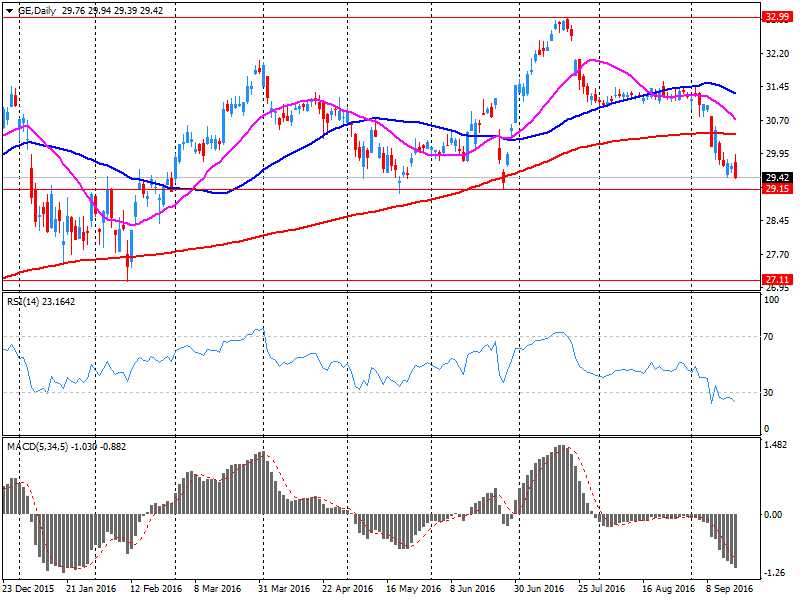

Company news: General Electric Co. (GE) plans to invest $ 10 billion in Argentina over the next decade

As Reuters reports, the US industrial conglomerate General Electric will invest $ 10 bn in Argentina until 2026. This was stated by Deputy Chairman John Rice on Monday. Thus, of GE becomes another foreign company that has announced new plans after the inauguration of President Mauricio Macri.

GE has invested $ 1.2 billion conjunction with local partners and customers over the past four months, informs the company in a statement, including $ 900 millio invested in the construction of thermal power plants, and another $ 280 million have been provided in the form of credit for Aerolineas Argentinas to finance the purchase of seven aircrafts.

GE say that the company's investment will help build seven power stations, which will add about 1 gigawatt of power to the electrical system of Argentina.

GE shares rose in premarket trading to $ 29.57 (+ 0.48%).

-

15:33

U.S. Stocks open: Dow +0.43%, Nasdaq +0.35%, S&P +0.40%

-

15:24

Before the bell: S&P futures +0.36%, NASDAQ futures +0.30%

U.S. stock-index futures rose, with volatility heading for an almost two-week low, as investors awaited Wednesday's Federal Reserve policy decision.

Global Stocks:

Nikkei 16,492.15 -27.14 -0.16%

Hang Seng 23,530.86 -19.59 -0.08%

Shanghai 3,023.30 -2.75 -0.09%

FTSE 6,865.09 +51.54 +0.76%

CAC 4,414.04 +19.85 +0.45%

DAX 10,453.46 +79.59 +0.77%

Crude $43.41 (-1.03%)

Gold $1317.10 (-0.05%)

-

15:03

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

778

2.90(0.3741%)

1984

Apple Inc.

AAPL

113.13

-0.45(-0.3962%)

203781

Barrick Gold Corporation, NYSE

ABX

17.26

0.07(0.4072%)

72993

Boeing Co

BA

126.36

-1.12(-0.8786%)

150

Caterpillar Inc

CAT

82.3

0.42(0.5129%)

805

Chevron Corp

CVX

98.33

0.29(0.2958%)

5084

Cisco Systems Inc

CSCO

31.11

0.09(0.2901%)

4470

Citigroup Inc., NYSE

C

46.8

0.21(0.4507%)

4876

Exxon Mobil Corp

XOM

83.94

0.11(0.1312%)

2349

Facebook, Inc.

FB

128.99

0.34(0.2643%)

27986

Ford Motor Co.

F

12.05

-0.06(-0.4955%)

271046

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10

-0.01(-0.0999%)

36268

General Electric Co

GE

29.54

0.11(0.3738%)

1694

General Motors Company, NYSE

GM

32.1

0.38(1.198%)

202

Home Depot Inc

HD

126.17

-0.12(-0.095%)

3927

Intel Corp

INTC

37.38

0.22(0.592%)

805

JPMorgan Chase and Co

JPM

66.42

0.23(0.3475%)

1100

Merck & Co Inc

MRK

61.75

0.42(0.6848%)

685

Microsoft Corp

MSFT

57.17

0.24(0.4216%)

3135

Pfizer Inc

PFE

33.74

0.09(0.2675%)

1185

Starbucks Corporation, NASDAQ

SBUX

53.24

0.23(0.4339%)

1140

Tesla Motors, Inc., NASDAQ

TSLA

206.6

0.26(0.126%)

5241

The Coca-Cola Co

KO

42.19

0.09(0.2138%)

1060

Twitter, Inc., NYSE

TWTR

18.3

-0.06(-0.3268%)

92693

Wal-Mart Stores Inc

WMT

72.25

0.16(0.2219%)

4975

Walt Disney Co

DIS

92.9

0.27(0.2915%)

1925

Yahoo! Inc., NASDAQ

YHOO

43.44

0.25(0.5788%)

350

Yandex N.V., NASDAQ

YNDX

20.6

-0.17(-0.8185%)

300

-

14:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Ford Motor (F) downgraded to Neutral from Buy at Buckingham Research

Other:

Intel (INTC) initiated with a Positive at Susquehanna

General Motors (GM) initiated with a Neutral at Nomura; target $33

Ford Motor (F) initiated with a Buy at Nomura; target $14

-

13:06

WSE: Mid session comment

The first half of today's trading on the Warsaw market stands under the sign of failure of the demand side. Most of all we may see the weak level of turnover.

The Warsaw market is also in opposition to the surroundings, where the DAX gaining 0.5% improves yesterday's highs, and together with other European indices seek to continue the reflection. Quotations on the Old Continent run very quietly, however, in striking contrast to the weakness of oil companies and banks.

At the halfway point of the session the WIG20 index was at the level of 1,744 points, with a turnover of only PLN 140 million.

-

12:59

Major European stock indices traded in the green zone

European stock indices show a slight increase, continuing yesterday's trend. The focus of investors is on the meetings of the Bank of Japan and the Federal Reserve, the results of which will be announced on Wednesday

"The market is on standby in anticipation of the Fed meeting, - said Alan Mehoen, an analyst at Danske Bank A / S. - business cycle is weak at the moment, so that the Fed is likely to raise rates later this year. We expect that the volatility of the stock market in the next six months will increase, but the rate of growth of stocks can greatly slow down. "

Certain influence on trading had data from Germany. Statistical Office Destatis reported that up to August, producer prices decreased by 1.6 percent year on year, which was slower than the drop of 2 per cent in July. Excluding energy, producer prices fell by 0.3 per cent and compared with the previous year remained unchanged. On a monthly basis, producer prices fell by 0.1 percent, registering the first fall in six months. Recall that in July, prices increased by 0.2 percent.

The composite index of the largest companies in the region Stoxx Europe 600 grew by 0.2 percent. Stock indices in Spain, Portugal and Italy show the largest decline among the Western European markets, due to the drop in prices of the region's creditors. Shares of Banca Popolare di Milano Scarl and CaixaBank SA fell at least 2.1 percent.

Energy stocks also fell markedly affected by the renewed decline in oil prices. Capitalization of Total SA and BP Plc fell 0.5 percent and 0.7 percent.

Regus Plc cost decreased by 5.7 percent, as the company's founder, Mark Dixon sold 37 million shares.

Quotes of IG Group Holdings Plc fell 3.5 percent after the company said that the first quarter has been challenging due to reduced activity in the financial markets in July and August, which limited trading opportunities.

Shares of Bayer AG shares rose 1.3 percent, helped by the increase in sales forecast for its new drugs.

GVC Holdings Plc increased by 3 percent, as the company reported that annual profit and revenue will be closer to the upper boundary of the forecast range.

At the moment:

FTSE 100 +36.38 6849.93 + 0.53%

DAX +58.59 10432.46 + 0.56%

CAC 40 +13.27 4407.46 + 0.30%

-

09:41

Major stock markets trading lower: FTSE -0.2%, DAX flat, CAC40 -0.3%, FTMIB flat, IBEX -0.2%

-

09:17

WSE: After opening

WIG20 index opened at 1748.71 points (-0.06%)*

WIG 47323.45 -0.17%

WIG30 2010.28 -0.26%

mWIG40 4023.35 0.01%

*/ - change to previous close

Trading on the spot market begin cosmetically below yesterday's volatility with a rather weak basis of all the components of the main index. The turnover remained very low and reach modest PLN 4 million. We should therefore be aware that the movements are to a large extent random and very easy to create. Such an opening may confirm the belief that demand is on the side and do not intend to get involved in saving the market at this level. The German DAX remains neutral, so the morning, according to our expectations, is calm.

The first 15 minutes clearly shows that at this level of activity there is no chance for any breakthrough. After the first quarter of trading the WIG20 index was at the level of 1,745 points (-0,25%).

-

08:46

Expected negative start of trading on the major stock exchanges in Europe: DAX futures -0.1%, CAC40 -0.2%, FTSE -0.1%

-

08:24

WSE: Before opening

Yesterday's session on Wall Street ended in neutral. Contracts in the US slightly gain and predict a calmer morning in anticipation of Wednesday, once in the morning we will know what is going the BoJ to do. After a long weekend, due to yesterday's holiday, a slight decline we may observe in the case of the Nikkei index. Generally, the dominant color in Asia remains red, but not very strong.

The beginning of the week brought an increase in oil prices. Increases in crude prices have strengthened in the second part of the session. With the market flow signals about a possible reduction of the supply of this raw material.

The morning market is going to be calm. Today there is not much pulses to trade, macro calendar is almost empty, and the comments in the morning clearly focused on the upcoming decisions of major central banks.

Yesterday's session on the Warsaw Stock Exchange was a disappointment, because there has been no decisive break of resistance level, which could be counted on after the relatively successful first hour of trading. Today's session and wait for the decisions of the central banks may promote consolidation in the Warsaw market.

-

06:33

Global Stocks

European stocks gained ground Monday, with commodity shares among the best performing, giving the benchmark its strongest advance in more than two weeks. "The main thrust of [Monday's] momentum likely arises from the low chances of a U.S. rate rise on Wednesday evening," said Spreadex financial analyst Connor Campbell in a note.

U.S. stocks on Monday closed essentially flat, after trading firmly higher, in a volatile session ahead of the start of a pair of closely watched central-bank policy meetings. Earlier in the session, gains in crude-oil futures and a report showing a surge in home-builder confidence appeared to help lift the equity benchmarks, but those advances evaporated late in the day.

Asian share-trading stayed tentative Tuesday as investors awaited policy decisions from the U.S. Federal Reserve and the Bank of Japan. Markets reflected the uncertain balance between risks and rewards heading into this week's central bank meetings, said Ric Spooner, chief market analyst at CMC Markets.

-

00:28

Stocks. Daily history for Sep 19’2016:

(index / closing price / change items /% change)

Nikkei 225 16,519.29 +114.28 +0.70%

Shanghai Composite 3,026.61 +23.77 +0.79%

S&P/ASX 200 5,296.70 0.00 0.00%

FTSE 100 6,813.55 +103.27 +1.54%

CAC 40 4,394.19 +61.74 +1.43%

Xetra DAX 10,373.87 +97.70 +0.95%

S&P 500 2,139.12 -0.04 0.00%

Dow Jones Industrial Average 18,120.17 -3.63 -0.02%

S&P/TSX Composite 14,496.23 +45.54 +0.32%

-