Noticias del mercado

-

22:45

New Zealand: Trade Balance, mln, November -779 (forecast -809.5)

-

22:19

U.S. stocks closed

U.S. stocks rose for a second day as a rally in commodity shares ignited broader gains, while data showed consumer spending bolstered the economy amid slowing growth overseas.

The two most beaten-down industries this year, energy and raw-materials, led most of Tuesday's advance, keeping alive prospects for an anticipated year-end rally. Caterpillar Inc. surged 4.9 percent, while Wal-Mart Stores Inc. gained 1.7 percent as data showed consumers continued to spend. Chipotle Mexican Grill Inc. fell on an investigation into its links to a new spate of illnesses in three additional states.

The Standard & Poor's 500 Index climbed 0.9 percent to 2,039.07 at 4 p.m. in New York, as the gauge added to its rebound from a two-month low.

A report today showed the economy expanded at a revised 2 percent annualized rate in the third quarter, buoyed by consumer spending. Meanwhile, businesses struggled with weaker overseas growth and a strong dollar, which have weighed on net exports. Sustained growth in the U.S. combined with weakening in other parts of the globe, including in China, could widen the gap between exports and imports in the quarters ahead.

Investors have wavered between optimism on the U.S. economy and concern that slower growth overseas will spread. Federal Reserve policy makers last week signaled faith that the economy is performing well, while emphasizing they're in no hurry to further boost interest rates. Investors were initially soothed by that message, though oil's collapse below levels last seen during the 2008 global financial crisis has weighed on sentiment.

The S&P 500 historically rises in December, with the final two weeks delivering an average gain of 1.7 percent. The so-called Santa rally is under pressure this year, with the benchmark down 2 percent in December and in the midst of its worst final month since 2002. After rebounding as much as 13 percent from its summer low through early November, the S&P 500 has retreated 3.4 percent, putting it on track for its biggest annual drop since the 2008 financial crisis.

In addition to the GDP numbers, data this week on new-home sales, durable-goods orders and personal spending will offer further clues on the health of the economy, after the Fed's first rate increase in almost a decade. Officials at the central bank said any further rate hikes will be gradual and depend on the path of the recovery.

A separate report today showed sales of previously owned homes fell in November to the lowest level since April of last year as a change in industry rules lengthened the amount of time it took buyers to close on a deal.

-

21:00

DJIA 17409.86 158.24 0.92%, NASDAQ 4997.31 28.38 0.57%, S&P 500 2037.60 16.45 0.81%

-

20:20

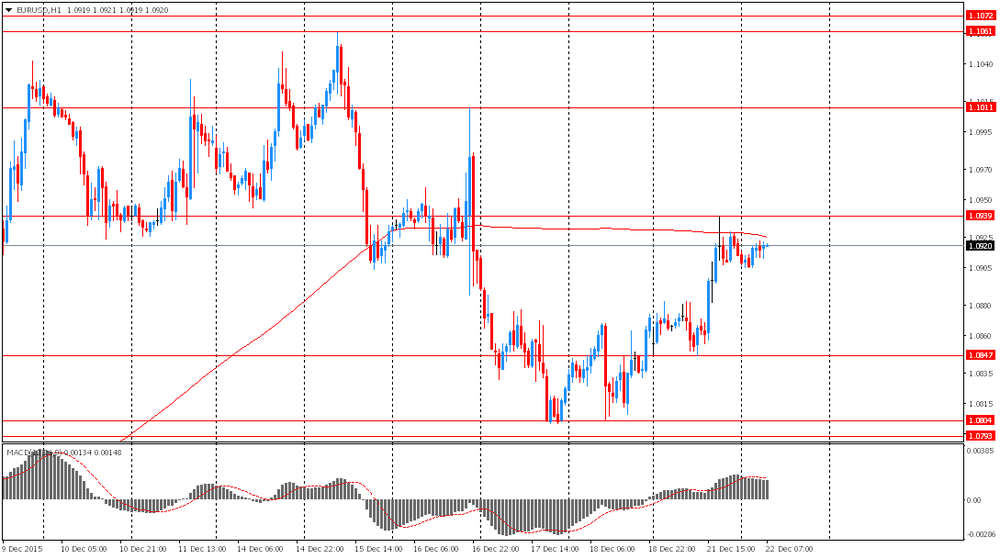

American focus: the euro rose

The euro rose against the dollar, as disappointing US data eased demand for the US currency, even though the losses are likely to be limited. Trading volumes are expected to remain low on the eve of the Christmas holidays. The dollar weakened after the National Association of Realtors said that sales in the secondary market fell last month by 10.5% to a 19-month low of 4.76 million units from 5.32 million in October. Analysts predicted a rise in November to 5.37 million units. The data came shortly after the US Commerce Department reported that gross domestic product grew at an annualized rate of 2.0% in the three months ended September 30, against the expected growth by 1.9%. Preliminary data originally showed an increase in the third quarter by 2.1%. In the second quarter, the US economy expanded by 3.9%. The euro kept as Spain faces a political crisis against the backdrop of controversial election results last weekend. On Monday, Spanish Prime Minister Mariano Rajoy said that his center-right People's Party (PP) intends to negotiate with competitors in an attempt to form a government, however, has reportedly left parties said they did not want to Rajoy remained in power.

The pound fell against the dollar, dropping to the lowest level since April 15. Little impact on the currency had data showing that the situation in the sector of public finances of Britain worsened in November. Natsstatistiki Office (ONS) reported that net borrowing state. sector grew to 13.56 billion. pounds in November, compared to 6.45 billion. pounds in October (revised from 7.47 billion. lbs). Economists had forecast that the volume of loans will amount to 11 billion. Lbs. At the end of November, the net debt of state. sector, excluding state banks. sector amounted to 1536.4 bln. pounds, which is equivalent to 80.5 percent of gross domestic product. The ONS said that in November last year the budget was paid 1.1 billion. Pounds in fines for violations in Forex trading, but this year there was no such income. In the first eight months of fiscal year 2015/16, net borrowing of the public sector was 8.9 per cent less per annum. Their volume amounted to 66.9 billion. Pounds, which is close to the target value for the 2015/16 financial year.

The Swiss franc rose against the dollar, despite the publication of weak data on the trade balance. The Federal Customs Administration reported that the surplus in the trade in goods decreased to 3.14 billion Swiss francs compared with 4.08 billion. Francs in October (revised from 4.16 billion. Francs). The volume of exports fell by 2.1 percent after rising 6.2 percent in October. At the same time, import growth slowed to 0.2 percent from 4 percent. On an annual basis, exports increased by 4.7 percent, offsetting a 1.5 percent decline recorded in October. Similarly, the volume of imports rose by 8.3 percent after falling by 5 per cent in the previous month. In the period from January to November 2015 trade surplus amounted to 34.16 billion Swiss. Francs.

-

18:00

European stocks closed: FTSE 6083.10 48.26 0.80%, DAX 10488.75 -9.02 -0.09%, CAC 40 4567.60 2.43 0.05%

-

17:56

WSE: Session Results

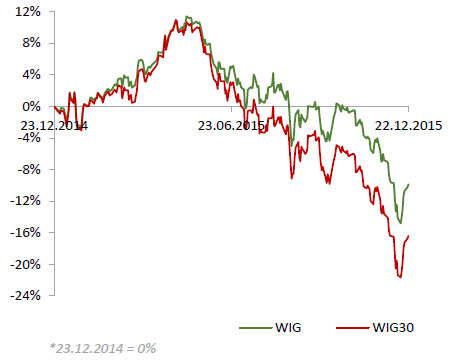

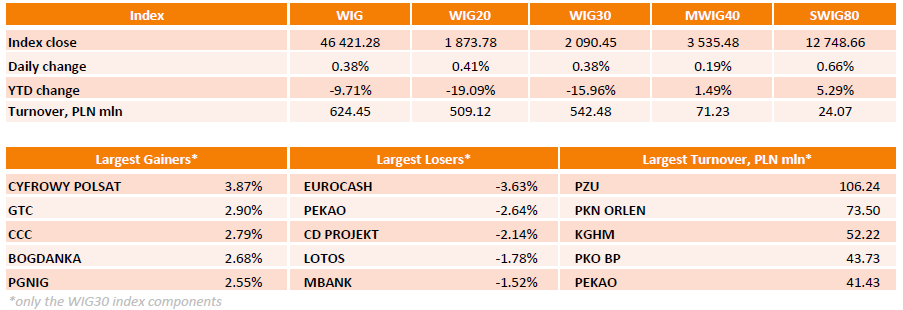

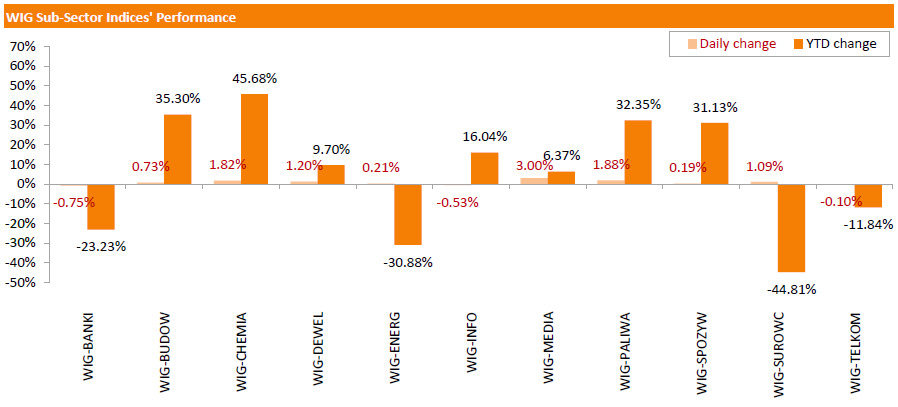

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, surged by 0.38%. Sector-wise, media stocks (+3%) fared the best, while banking names (-0.75%) lagged behind.

The large-cap stocks advanced by 0.38%, as measured by the WIG30 Index. In the index basket, media group CYFROWY POLSAT (WSE: CPS) led the outperformers, climbing by 3.87% on analyst upgrade. It was followed by property developer GTC (WSE: GTC), footwear retailer CCC (WSE: CCC) and thermal coal miner BOGDANKA (WSE: LWB), which gained 2.9%, 2.79% and 2.68% respectively. On the other side of the ledger, FMCG wholesaler EUROCASH (WSE: EUR) was the session's weakest name, tumbling by 3.63%. Other major laggards included bank PEKAO (WSE: PEO) and videogame developer CD PROJEKT (WSE: CDR), losing 2.64% and 2.14% respectively.

-

17:19

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Tuesday as GDP data for the third quarter showed stronger-than-expected growth and crude oil prices eased off multi-year lows. Trading volumes are expected to be relatively light this week, with U.S. stock markets operating a shortened session on Thursday and closing on Friday for Christmas.

Most of Dow stocks in positive area (18 of 30). Top looser - Apple Inc. (AAPL, -0,77%). Top gainer - Caterpillar Inc. (CAT, +3.49%).

Most of S&P index sectors in positive area. Top looser - Financial (-0.1%). Top gainer - Basic Materials (+1,5%).

At the moment:

Dow 17203.00 +25.00 +0.15%

S&P 500 2016.50 +1.50 +0.07%

Nasdaq 100 4561.25 -1.75 -0.04%

Oil 36.12 +0.31 +0.87%

Gold 1074.90 -5.70 -0.53%

U.S. 10yr 2.22 +0.02

-

16:01

U.S.: Richmond Fed Manufacturing Index, December 6 (forecast -1)

-

16:00

U.S.: Existing Home Sales , November 4.76 (forecast 5.37)

-

15:35

U.S. Stocks open: Dow +0.31%, Nasdaq +0.27%, S&P +0.33%

-

15:26

Before the bell: S&P futures +0.12%, NASDAQ futures +0.02%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 18,886.7 -29.32 -0.16%

Hang Seng 21,830.02 +38.34 +0.18%

Shanghai Composite 3,652.24 +9.77 +0.27%

FTSE 6,074.87 +40.03 +0.66%

CAC 4,558.91 -6.26 -0.14%

DAX 10,474.75 -23.02 -0.22%

Crude oil $35.96 (+0.42%)

Gold $1075.20 (-0.50%)

-

15:00

U.S.: Housing Price Index, m/m, October 0.5% (forecast 0.4%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.32

1.28%

24.8K

Ford Motor Co.

F

13.89

1.17%

50.4K

Caterpillar Inc

CAT

66

1.16%

17.2K

Nike

NKE

131

0.92%

3.1K

ALCOA INC.

AA

9.39

0.75%

2.0K

McDonald's Corp

MCD

118.49

0.68%

0.2K

General Motors Company, NYSE

GM

34.06

0.68%

1.0K

Tesla Motors, Inc., NASDAQ

TSLA

234

0.62%

2.9K

Hewlett-Packard Co.

HPQ

11.5

0.61%

0.6K

Starbucks Corporation, NASDAQ

SBUX

59.87

0.55%

1.7K

Visa

V

77.55

0.49%

0.9K

UnitedHealth Group Inc

UNH

117.98

0.49%

0.7K

Twitter, Inc., NYSE

TWTR

22.24

0.45%

25.5K

International Business Machines Co...

IBM

135.97

0.35%

0.5K

Google Inc.

GOOG

750.3

0.34%

0.3K

Goldman Sachs

GS

178.29

0.30%

1.7K

AT&T Inc

T

34.19

0.29%

2.0K

Chevron Corp

CVX

89.5

0.29%

1.2K

Intel Corp

INTC

34.34

0.29%

1.4K

Exxon Mobil Corp

XOM

77.48

0.28%

1.7K

Facebook, Inc.

FB

105.05

0.27%

47.8K

JPMorgan Chase and Co

JPM

65.71

0.26%

6.6K

Wal-Mart Stores Inc

WMT

59.7

0.25%

0.2K

Cisco Systems Inc

CSCO

26.7

0.24%

14.8K

Microsoft Corp

MSFT

54.95

0.22%

4.2K

Verizon Communications Inc

VZ

46

0.22%

0.2K

Walt Disney Co

DIS

106.75

0.15%

1.4K

Citigroup Inc., NYSE

C

51.87

0.15%

2.7K

Yahoo! Inc., NASDAQ

YHOO

33.01

0.14%

2.1K

Pfizer Inc

PFE

32.5

0.12%

3.0K

General Electric Co

GE

30.41

0.03%

9.6K

FedEx Corporation, NYSE

FDX

145.8

0.03%

0.6K

Amazon.com Inc., NASDAQ

AMZN

664.62

0.02%

3.4K

Apple Inc.

AAPL

106.95

-0.35%

96.0K

The Coca-Cola Co

KO

42.6

-0.42%

3.6K

Barrick Gold Corporation, NYSE

ABX

7.41

-0.80%

34.1K

-

14:59

Belgium: Business Climate, December -1.4 (forecast -4)

-

14:55

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target lowered to $130 from $135 at Cowen

American Express (AXP) initiated with a Market Perform at JMP Securities

-

14:45

Option expiries for today's 10:00 ET NY cut

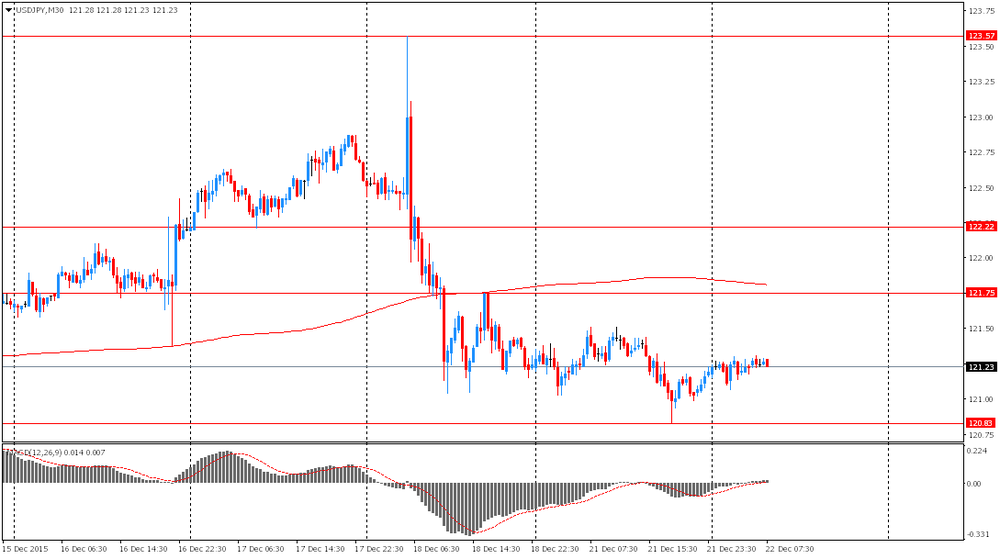

USDJPY 120.75 (USD 490m) 121.00 (USD 1.35bln) 123.00-05 (580m)

EURUSD 1.0700 (EUR 814m) 1.0800 (1.2bln) 1.0900 (3.1bln) 1.1000 (1.35bln)

AUDUSD 0.7100 (AUD 364m) 0.7125 (202m)

USDCHF 0.9860 (USD 200m) 0.9970 (200m)

-

14:30

U.S.: GDP, q/q, Quarter III 2.0% (forecast 1.9%)

-

14:30

U.S.: PCE price index ex food, energy, q/q, Quarter III 1.4% (forecast 1.3%)

-

14:02

Orders

EUR/USD

Offers 1.0930 1.0960 1.0985 1.1000 1.1025-30 1.1050 1.1080 1.1100

Bids 1.0900 1.0880-85 1.0850-55 1.0830 1.0800 1.0780-85 1.0750 1.0730 1.0700

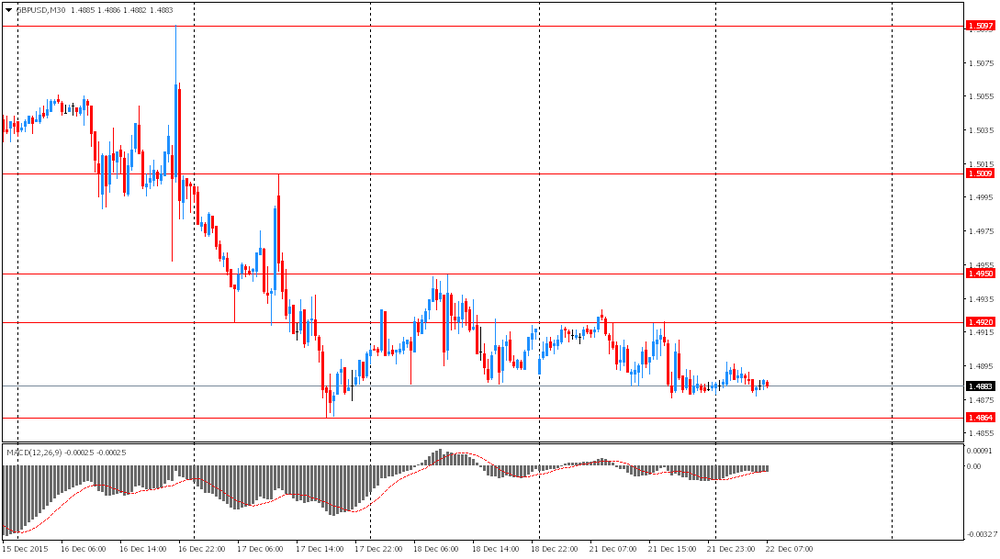

GBP/USD

Offers 1.4900 1.4925-30 1.4950-55 1.4980-85 1.5000 1.5030 1.5050

Bids 1.4865-70 1.4850 1.4830 1.4800 1.4785 1.4765 1.4750 1.4730 1.4700

EUR/GBP

Offers 0.7350 0.7375 0.7400 0.7420 0.7450

Bids 0.7320 0.7300 0.7275-80 0.7250 0.7225-30 0.7200

EUR/JPY

Offers 132.50 132.80 133.00 133.20 133.50 133.85 134.00

Bids 132.00 131.80 131.50 131.00 130.80 130.50 130.30 130.00

USD/JPY

Offers 121.25-30 121.50-55 121.80 122.00 122.20 122.50

Bids 121.00 120.85 120.60-65 120.50 120.30 120.00

AUD/USD

Offers 0.7250-55 0.7280 0.7300 0.7320-25 0.7345-50

Bids 0.7220 0.7200 0.7180 0.7150 0.7120-25 0.7100

-

10:30

United Kingdom: PSNB, bln, November -13.56 (forecast -11)

-

09:02

Option expiries for today's 10:00 ET NY cut

USD/JPY:121.00 (USD 1.35bln) 123.00-05 (580m)

EUR/USD:1.0700 (EUR 814m) 1.0800 (1.2bln) 1.0900 (2.6bln)

AUD/USD:0.7100 (AUD 364m) 0.7125 (202m

-

08:23

Options levels on tuesday, December 22, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1061 (4855)

$1.1012 (4828)

$1.0982 (2670)

Price at time of writing this review: $1.0905

Support levels (open interest**, contracts):

$1.0840 (3108)

$1.0770 (6030)

$1.0686 (5098)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 54708 contracts, with the maximum number of contracts with strike price $1,1100 (7419);

- Overall open interest on the PUT options with the expiration date January, 8 is 72904 contracts, with the maximum number of contracts with strike price $1,0450 (7928);

- The ratio of PUT/CALL was 1.33 versus 1.33 from the previous trading day according to data from December, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1155)

$1.5102 (2656)

$1.5005 (456)

Price at time of writing this review: $1.4892

Support levels (open interest**, contracts):

$1.4794 (1693)

$1.4697 (1054)

$1.4598 (529)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 18701 contracts, with the maximum number of contracts with strike price $1,5100 (2656);

- Overall open interest on the PUT options with the expiration date January, 8 is 18625 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from December, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:10

Foreign exchange market. Asian session: the dollar little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:05 United Kingdom Gfk Consumer Confidence December 1 1 2

07:00 Germany Gfk Consumer Confidence Survey January 9.3 9.3 9.4

07:00 Switzerland Trade Balance November 4.16 3.82 3.14

The U.S. dollar traded range-bound against major currencies ahead of Christmas at the end of the current working week. Trading is not expected to be dynamic this week. At the same time many traders have already closed their positions ahead of the end of the year, which increases market volatility. On Thursday, December 24, markets in Germany and Italy will be closed. On December 25 markets in other European countries as well as in Canada, the U.S., Australia and New Zealand will be on holiday.

The U.S. National Association of Realtors will publish existing home sales data at 15:00 GMT. According to a median forecast sales rose to 5.4 million in November compared to 5.36 million in October. Final U.S. Q3 GDP data will be published today at 13:30 GMT.

The Australian dollar rose on China leading economic indicator data from the Conference Board. The index rose by 0.6% in November after a 0.3% increase in October and a 1.6% rise in September. Electricity production, retail sales of consumer goods and value-added industrial production rose.

EUR/USD: the pair fluctuated within $1.0900-25 in Asian trade

USD/JPY: the pair traded within Y121.10-30

GBP/USD: the pair traded within $1.4875-95

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom PSNB, bln November -7.47 -11

13:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter III 1.9% 1.3%

13:30 U.S. GDP, q/q (Finally) Quarter III 3.9% 1.9%

14:00 Belgium Business Climate December -3.9 -4

14:00 U.S. Housing Price Index, m/m October 0.8% 0.4%

15:00 U.S. Richmond Fed Manufacturing Index December -3 -1

15:00 U.S. Existing Home Sales November 5.36 5.37

21:45 New Zealand Trade Balance, mln November -963 -809.5

-

08:00

Switzerland: Trade Balance, November 3.14 (forecast 3.82)

-

08:00

Germany: Gfk Consumer Confidence Survey, January 9.4 (forecast 9.3)

-

07:51

Oil prices rebounded

West Texas Intermediate futures for February delivery climbed to $36.15 (+0.95%), while Brent crude advanced to $36.64 (+0.80%) on speculation that cold weather will support prices as many countries entered the peak-demand heating season. However many regions see a relatively mild winter and ample supplies continue weighing on markets. According to BNP Paribas the number of heating days in the U.S. and Europe had been 30% and 39% below the 10-year average since December 7, respectively.

Fundamentals driven by the supply glut remain unfavorable. That's why many analysts say these gains will not be sustained.

-

07:15

Gold stabilized

Gold steadied at $1,077.40 (-0.30%) after two days of gains, which were generated by a relative weakness in the U.S. dollar. Nevertheless bullion's upward potential is limited due to concerns that higher interest rates in the U.S. will hit demand for the non-interest-paying precious metal. The Federal Reserve is likely to raise rates further in 2016.

Oil prices hit multi-year lows on Monday undermining gold's strength as the precious metal is often viewed as a hedge against oil-led inflation.

-

07:04

Global Stocks: U.S. stock indices gained

U.S. stock indices rose by the end of Monday session despite declines in European equities and persistent low oil prices. Trading volumes are likely to be relatively low this week.

The Dow Jones Industrial Average rose 122.87 points, or 0.7%, to 17,251.42. The S&P 500 gained 15.60 points, or 0.8%, to 2,021.15. The Nasdaq Composite gained 45.84 points, or 0.9% to 4,968.92.

Data showed that the Chicago Fed National Activity Index declined to -0.30 in November from -0.17 in October marking the fourth negative reading in a row. Analysts had expected the index to climb to +0.10. A reading below 0 suggests that the economy's growth pace was below average.

This morning in Asia Hong Kong Hang Seng edged down 0.04%, or 8.73, to 21,782.95. China Shanghai Composite Index fell by 0.35%, or 12.86, to 3.629.62. The Nikkei climbed 0.09%, or 16.25, to 18,932.27.

Asian indices traded mixed. Japanese stocks were supported by gains in U.S. stocks.

Chinese stocks traded range-bound after the country's government signaled it may stimulate the economy further.

-

03:03

Nikkei 225 18,867.88 -48.14 -0.25%, Hang Seng 21,781.49 -10.19 -0.05%, Shanghai Composite 3,646.09 +3.62 +0.10%

-

01:06

United Kingdom: Gfk Consumer Confidence, December 2 (forecast 1)

-

00:33

Commodities. Daily history for Dec 21’2015:

(raw materials / closing price /% change)

Oil 36,14 -1,34%

Gold 1,078.50 -0.19%

-

00:30

Stocks. Daily history for Sep Dec 21’2015:

(index / closing price / change items /% change)

S&P/ASX 200 5,109.05 +2.39 +0.05%

TOPIX 1,531.28 -5.82 -0.38%

SHANGHAI COMP 3,642.63 +63.67 +1.78%

HANG SENG 21,791.68 +36.12 +0.17%

FTSE 100 6,034.84 -17.58 -0.29%

CAC 40 4,565.17 -60.09 -1.30%

Xetra DAX 10,497.77 -110.42 -1.04%

S&P 500 2,021.15 +15.60 +0.78%

NASDAQ Composite 4,968.92 +45.84 +0.93%

Dow Jones 17,251.62 +123.07 +0.72%

-

00:29

Currencies. Daily history for Dec 21’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0913 +0,38%

GBP/USD $1,4883 -0,23%

USD/CHF Chf0,9921 +0,07%

USD/JPY Y121,18 -0,05%

EUR/JPY Y132,27 +0,34%

GBP/JPY Y180,36 -0,27%

AUD/USD $0,7187 +0,11%

NZD/USD $0,6760 +0,36%

USD/CAD C$1,3957 +0,11%

-

00:01

Schedule for today, Tuesday, 22’2015:

(time / country / index / period / previous value / forecast)

00:05 United Kingdom Gfk Consumer Confidence December 1 1

07:00 Germany Gfk Consumer Confidence Survey January 9.3 9.3

07:00 Switzerland Trade Balance November 4.16 3.82

09:30 United Kingdom PSNB, bln November -7.47 -11

13:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter III 1.9% 1.3%

13:30 U.S. GDP, q/ (Finally) Quarter III 3.9% 1.9%

14:00 Belgium Business Climate December -3.9 -4

14:00 U.S. Housing Price Index, m/m October 0.8% 0.4%

15:00 U.S. Richmond Fed Manufacturing Index December -3 -1

15:00 U.S. Existing Home Sales November 5.36 5.37

21:45 New Zealand Trade Balance, mln November -963 -809.5

-