Noticias del mercado

-

20:59

Dow +0.52% 16,285.87 +84.55 Nasdaq -1.07% 4,683.70 -50.78 S&P -2.13% 1,929.48 -41.92

-

18:21

WSE: Session Results

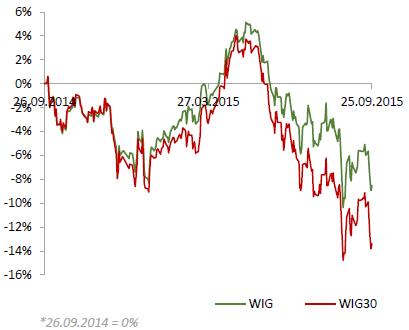

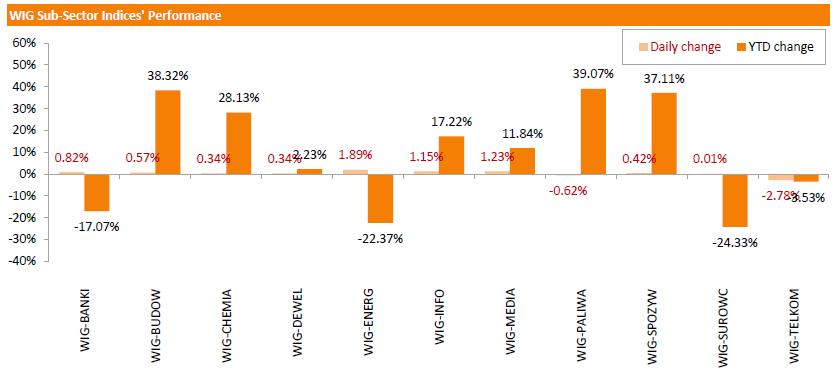

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, surged by 0.47%. Except for telecommunications (-2.78%) and oil and gas sector (-0.62%), every sector in the WIG Index gained.

The large-cap stocks' measure, the WIG30 Index, advanced by 0.48%. In the index basket, ENEA (WSE: ENA) climbed by 4.77%, partially paring losses after five consecutive days of declines. CCC (WSE: CCC) recovered by 3.73%. Other top performers were PGE (WSE: PGE), ASSECO POLAND (WSE: ACP) and TAURON PE (WSE: TPE), which added 1.54%-1.94%. On the other side of the ledger, ORANGE POLSKA (WSE: OPL) fared the worst, plunging by 3.69%. It was followed by LPP (WSE: LPP), falling by 1.36%.

-

18:00

European stocks close: stocks closed higher on yesterday's comments by the Fed Chairwoman Janet Yellen

Stock indices closed higher on yesterday's comments by the Fed Chairwoman Janet Yellen. She said in a speech at the University of Massachusetts on Thursday that she expects that the Fed will start raising its interest rates by the end of the year, followed by a gradual pace of interest rate hikes.

"Most of my colleagues and I anticipate that it will likely be appropriate to raise the target range for the federal funds rate sometime later this year," she said.

Yellen noted that the inflation will rise toward the Fed's 2% target as low oil prices are temporary.

The Fed chairwoman also said that the slowdown in the global economy is not significant not to raise interest rates this year.

Meanwhile, the economic data from the Eurozone was mixed. The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.8% in August from last year, missing expectations for a 5.3% gain, after a 5.3 % increase in July.

Loans to the private sector in the Eurozone climbed 1.0% in August from the last year, missing expectations for a 1.1% rise, after a 0.9% gain in July.

French statistical office INSEE released its consumer confidence index for France on Friday. French consumer confidence index climbed to 97 in September from 94 in August. It was the highest level since October 2007.

August's figure was revised up from 93.

Analysts had expected the index to remain unchanged at 94.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,109.01 +147.52 +2.47 %

DAX 9,688.53 +260.89 +2.77 %

CAC 40 4,480.66 +133.42 +3.07 %

-

18:00

European stocks closed: FTSE 100 6,109.01 +147.52 +2.47% CAC 40 4,480.66 +133.42 +3.07% DAX 9,688.53 +260.89 +2.77%

-

17:49

Oil prices trade mixed

Oil prices traded mixed. WTI crude oil was supported by U.S. GDP data. The U.S. Commerce Department released gross domestic product (GDP) figures on Wednesday. The U.S. final GDP soared 3.9% in the second quarter, up from the revised estimate of a 3.7% growth, after a 0.2% decline in the first quarter.

The upward revision was partly driven by an upward revision to consumer spending and business investment.

Data by Genscape Inc. also supported oil prices. The company said on Thursday that crude stocks at the Cushing, Oklahoma, declined by more than 500,000 barrels in the week ending September 22.

The weak consumer price inflation data from Japan weighed on oil prices. Japan's national consumer price index (CPI) remained unchanged at an annual rate of 0.2% in August.

Japan's national CPI excluding fresh food declined to an annual rate of -0.1% in August from 0.0% in July, in line with expectations.

WTI crude oil for November delivery increased to $45.32 a barrel on the New York Mercantile Exchange.

Brent crude oil for October declined to $48.38 a barrel on ICE Futures Europe.

-

17:22

Gold price declines on yesterday's comments by the Fed Chairwoman Janet Yellen

Gold price fell on yesterday's comments by the Fed Chairwoman Janet Yellen. She said in a speech at the University of Massachusetts on Thursday that she expects that the Fed will start raising its interest rates by the end of the year, followed by a gradual pace of interest rate hikes.

"Most of my colleagues and I anticipate that it will likely be appropriate to raise the target range for the federal funds rate sometime later this year," she said.

Yellen noted that the inflation will rise toward the Fed's 2% target as low oil prices are temporary.

The Fed chairwoman also said that the slowdown in the global economy is not significant not to raise interest rates this year.

The U.S. GDP data also weighed on gold price. The U.S. Commerce Department released gross domestic product (GDP) figures on Wednesday. The U.S. final GDP soared 3.9% in the second quarter, up from the revised estimate of a 3.7% growth, after a 0.2% decline in the first quarter.

The upward revision was partly driven by an upward revision to consumer spending and business investment.

October futures for gold on the COMEX today decline to 1143.90 dollars per ounce.

-

17:04

Federal Reserve Bank of St. Louis President James Bullard reiterates that the Fed should start raising its interest rates

Federal Reserve Bank of St. Louis President James Bullard said in a speech on Friday that the Fed should start raising its interest rates.

"A prudent monetary policy based on traditional central banking principles would begin normalizing the committee's policy settings gradually, since the goals of policy have essentially been met," he said.

He added that even the Fed starts raising its interest rates, the monetary policy will remain accommodative.

"For those who still think more accommodation is needed--do not worry! Policy will remain exceptionally accommodative through the medium term no matter how the committee proceeds," he said.

Bullard is not a voting member of the Federal Open Market Committee this year.

-

16:53

Thomson Reuters/University of Michigan final consumer sentiment index decreases to 87.2 in September

The Thomson Reuters/University of Michigan final consumer sentiment index decreased to 87.2 in September from 91.9 in August, up from the preliminary estimate of 85.7 and beating expectations a decrease to 86.7. It was the lowest reading since October 2014.

"Consumers now believe that that global economic trends can directly influence their own job and wage prospects," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

The current economic conditions index declined to 101.2 in September from 105.1 in August, up from a preliminary reading of 100.3.

The index of consumer expectations fell to 78.2 in September from 83.4 in August, up from a preliminary reading of 76.4.

The inflation expectations for the next year remained unchanged at 2.8% in September.

-

16:39

Wall Street. Major U.S. stock-indexes rose

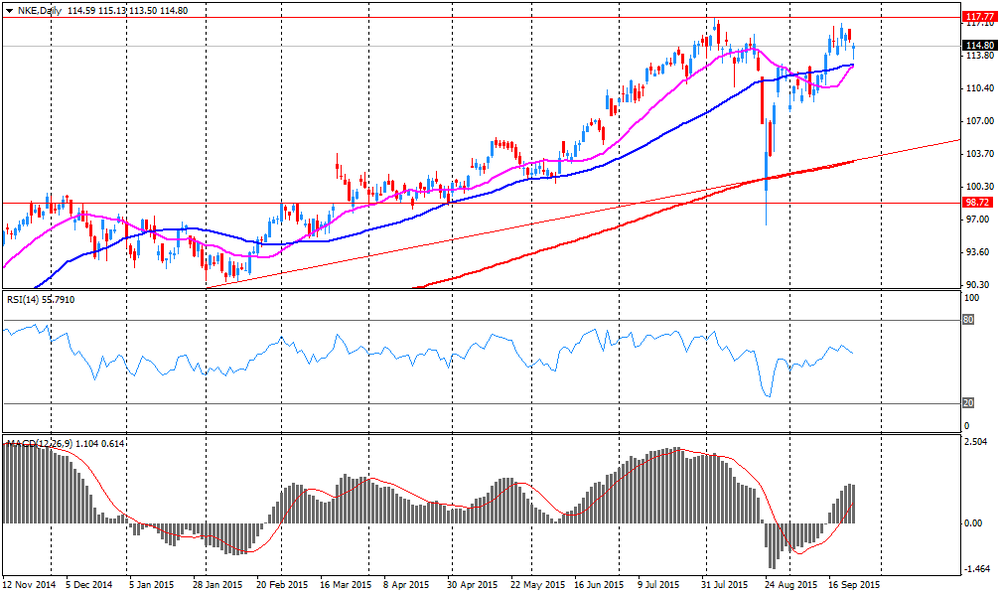

Major U.S. stock-indexes trading higher on Friday, a day after Federal Reserve Chair Janet Yellen said she expects interest rates to be raised this year, easing concerns about slowing global growth. Nike's surprisingly strong results in China and data showing that the U.S. economy expanded more than previously estimated in the second quarter added to the positive tone.

Almost all of Dow stocks in positive area (25 of 30). Top looser - Caterpillar Inc. (CAT, -0.93%). Top gainer - NIKE, Inc. (NKE, +8.73).

Almost all of S&P index sectors also in positive area. Top looser - Conglomerates (-0.0%). Top gainer - Consumer Goods (+1,3%).

At the moment:

Dow 16256.00 +157.00 +0.98%

S&P 500 1933.00 +14.25 +0.74%

Nasdaq 100 4271.75 +25.75 +0.61%

10 Year yield 2,17% +0,05

Oil 45.88 +0.97 +2.16%

Gold 1144.10 -9.70 -0.84%

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, September 87.2 (forecast 86.7)

-

15:57

U.S. preliminary services purchasing managers' index declines to 55.6 in September

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary services purchasing managers' index (PMI) declined to 55.6 in September from 56.1 in August, in line with expectations.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a slowdown in new business growth and a drop in input price inflation.

"The survey data point to sustained steady expansion of the US economy at the end of the third quarter, but various warning lights are now flashing brighter, meaning growth may continue to weaken in coming months. Although the surveys suggest the economy expanded at a 2.2% annualised rate in the third quarter, growth slowed in September and could weaken further in coming months," Markit Chief Economist Chris Williamson.

-

15:49

Bank of England’s Financial Policy Committee: risks to U.K. financial stability increased due to a slowdown in the Chinese and emerging market economies

The Bank of England's (BoE) Financial Policy Committee (FPC) said on Friday that risks to U.K. financial stability increased due to a slowdown in the Chinese and emerging market economies, but risks in relation to Greece and the Eurozone declined.

"Overall, the FPC judges that the outlook remains challenging. While the resilience of the financial system has continued to improve, downside risks have risen," the FPC said in its statement.

-

15:45

U.S.: Services PMI, September 55.6 (forecast 55.6)

-

15:37

Sheng Songcheng, head of the survey and statistics department at the People’s Bank of China (PBoC): the yuan devaluation and recent capital outflows will be short-term

Sheng Songcheng, head of the survey and statistics department at the People's Bank of China (PBoC), said on Friday that the yuan devaluation and recent capital outflows will be short-term.

He added that China's exchange rate reform was implemented at a good time.

-

15:35

U.S. Stocks open: Dow +1.15%, Nasdaq +0.95%, S&P +0.82%

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E1.2bn), $1.1200(E700mn), $1.1250($832mn), $1.1300($317mn)

USD/JPY: Y119.00($250mn),Y120.00($430mn), Y120.20($230mn)

USD/CAD: Cad1.3070($350mn), Cad1.3295/00($550mn), Cad1.3455($250mn)

AUD/USD: $0.6780(A$619mn), $0.7100(A$461mn), $0.7135(A$316mn), $0.7200(A$330mn)

NZD/USD: $0.6325(NZ$300mn)

AUD/JPY: Y83.00(A$1.0bn)

-

15:28

Before the bell: S&P futures +1.19%, NASDAQ futures +1.20%

U.S. stock-index futures advanced as Federal Reserve Chair Janet Yellen reassured investors that U.S. economic growth is sturdy enough to withstand turmoil in emerging markets.

Nikkei 17,880.51 +308.68 +1.76%

Hang Seng 21,186.32 +90.34 +0.43%

Shanghai Composite 3,091.81 -50.88 -1.62%

FTSE 6,111.27 +149.78 +2.51%

CAC 4,500.79 +153.55 +3.53%

DAX 9,715.18 +287.54 +3.05%

Crude oil $45.25 (+0.78%)

Gold $1141.10 (-1.18%)

-

15:12

Bank of Japan Governor Haruhiko Kuroda: the decline in the consumer price inflation was driven by a recent drop in energy costs

Bank of Japan (BoJ) Governor Haruhiko Kuroda said after a meeting with Prime Minister Shinzo Abe on Friday that the decline in the consumer price inflation was driven by a recent drop in energy costs, noting that "the price trend is on a solid footing".

Kuroda pointed out that consumer prices excluding energy prices rose about 1.1% in August. This figure was released with other official government data today.

Bank of Japan governor said that he and Abe did not discuss the consumer price data.

-

15:01

Ali Kardor, the chief of investment for the National Iranian Oil Company: Iran plans to rise its oil exports by 500,000 barrels a day by late November or early December

Ali Kardor, the chief of investment for the National Iranian Oil Company, said on Thursday that Iran plans to rise its oil exports by 500,000 barrels a day by late November or early December. He noted that the country expects its exports to exceed today's figure by 1 million barrels a day.

Kardor also said that oil price could decline by $3 to $4 when Iran boosts its oil exports.

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Nike

NKE

124.38

8.35%

149.4K

Citigroup Inc., NYSE

C

50.15

2.08%

96.8K

ALCOA INC.

AA

9.36

1.96%

15.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.18

1.90%

91.3K

E. I. du Pont de Nemours and Co

DD

48.94

1.89%

0.1K

Yandex N.V., NASDAQ

YNDX

11.05

1.84%

4.7K

JPMorgan Chase and Co

JPM

61.30

1.79%

12.5K

AMERICAN INTERNATIONAL GROUP

AIG

57.89

1.74%

1.0K

Goldman Sachs

GS

179.80

1.63%

1K

Amazon.com Inc., NASDAQ

AMZN

542.00

1.55%

12.5K

Intel Corp

INTC

28.92

1.54%

8.2K

International Business Machines Co...

IBM

146.48

1.43%

1.9K

3M Co

MMM

139.50

1.40%

0.1K

Visa

V

71.22

1.40%

0.5K

General Motors Company, NYSE

GM

29.85

1.39%

3.0K

Walt Disney Co

DIS

101.99

1.36%

0.6K

Tesla Motors, Inc., NASDAQ

TSLA

266.64

1.34%

6.8K

Ford Motor Co.

F

13.83

1.32%

10.5K

Cisco Systems Inc

CSCO

25.74

1.30%

7.2K

Johnson & Johnson

JNJ

93.65

1.27%

0.5K

Home Depot Inc

HD

117.80

1.25%

3.1K

Boeing Co

BA

131.34

1.23%

1.1K

Pfizer Inc

PFE

33.10

1.22%

3.8K

Facebook, Inc.

FB

95.52

1.18%

171.4K

Starbucks Corporation, NASDAQ

SBUX

59.05

1.16%

8.5K

The Coca-Cola Co

KO

39.60

1.15%

1.7K

Apple Inc.

AAPL

116.24

1.08%

341.1K

Yahoo! Inc., NASDAQ

YHOO

29.65

1.06%

2.5K

ALTRIA GROUP INC.

MO

55.18

1.04%

6.5K

Exxon Mobil Corp

XOM

73.48

1.03%

7.2K

Procter & Gamble Co

PG

72.09

1.02%

3.0K

Merck & Co Inc

MRK

51.10

1.01%

2.2K

Hewlett-Packard Co.

HPQ

25.50

0.95%

0.5K

Microsoft Corp

MSFT

44.32

0.93%

4.5K

Wal-Mart Stores Inc

WMT

64.42

0.92%

19.0K

Twitter, Inc., NYSE

TWTR

26.83

0.86%

12.8K

HONEYWELL INTERNATIONAL INC.

HON

94.42

0.85%

0.1K

General Electric Co

GE

25.11

0.80%

13.0K

Chevron Corp

CVX

77.50

0.79%

1K

Deere & Company, NYSE

DE

76.25

0.65%

0.1K

American Express Co

AXP

75.17

0.64%

0.4K

McDonald's Corp

MCD

97.89

0.62%

8.4K

Verizon Communications Inc

VZ

44.35

0.59%

4.2K

AT&T Inc

T

32.28

0.53%

44.0K

Google Inc.

GOOG

628.95

0.50%

16.7K

Caterpillar Inc

CAT

65.40

-0.61%

7.0K

Barrick Gold Corporation, NYSE

ABX

6.36

-3.05%

16.3K

-

14:50

Upgrades and downgrades before the market open

Upgrades:

NIKE (NKE) upgraded to Buy from Neutral at Sterne Agee CRT

3M (MMM) upgraded to Outperform from Neutral at Credit Suisse

Intel (INTC) upgraded to Mkt Perform from Mkt Underperform at JMP Securities

Downgrades:

Caterpillar (CAT) downgraded to Market Perform at William Blair

Other:

Caterpillar (CAT) target lowered to $70 from $84 at RBC Capital Mkts

Caterpillar (CAT) initiated with an Equal Weight at Barclays

Deer & Company (DE) initiated with an Underweight at Barclays

NIKE (NKE) target raised to $120 from $109 at FBR Capital

Coca-Cola (KO) reinstated with a Buy at Deutsche Bank

Freeport-McMoRan (FCX) target lowered to $14 from $16 at RBC Capital Mkts

-

14:47

U.S. final GDP jumps 3.9% in the second quarter

The U.S. Commerce Department released gross domestic product (GDP) figures on Wednesday. The U.S. final GDP soared 3.9% in the second quarter, up from the revised estimate of a 3.7% growth, after a 0.2% decline in the first quarter.

The upward revision was partly driven by an upward revision to consumer spending and business investment.

Consumer spending rose by 3.6% in the second quarter, up from the previous estimate of a 3.1% increase.

Business investment jumped by 6.2% in the second quarter, up from the previous estimate of a 3.1% gain.

-

14:30

U.S.: GDP, q/q, Quarter II 3.9% (forecast 3.7%)

-

14:25

Contractual wages and salaries in Italy are flat in August

The Italian statistical office ISTAT released its consumer confidence index for Italy on Friday. Contractual wages and salaries in Italy were flat in August, after a 0.1% rise in July.

On a yearly basis, contractual wages and salaries increased 1.2% in August, after a 1.2% gain in July.

Contractual wages and salaries in the private sector jumped 1.7% in August, while wages in the public sector remained flat.

-

14:13

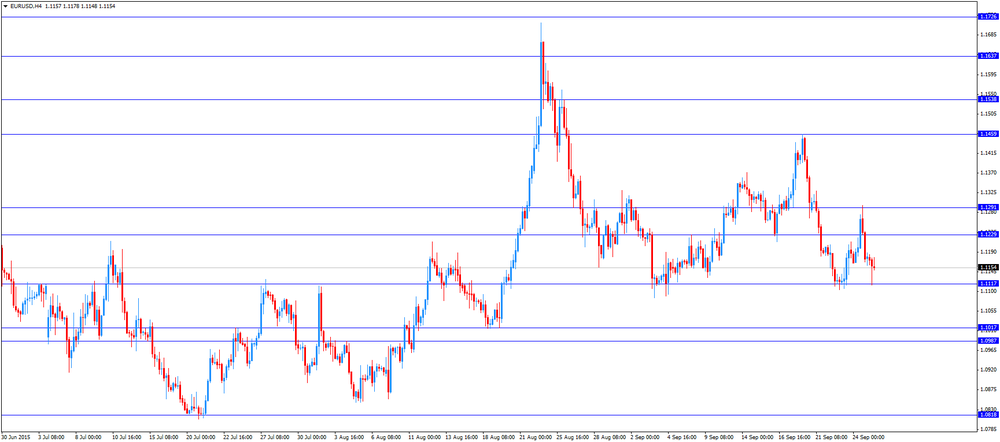

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:45 France Consumer confidence September 94 Revised From 93 94 97

07:00 Eurozone ECB's Jens Weidmann Speaks

08:00 Eurozone Private Loans, Y/Y August 0.9% 1.1% 1.0%

08:00 Eurozone M3 money supply, adjusted y/y August 5.3% 5.3% 4.8%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The final U.S. GDP is expected to rise 3.7% in the second quarter, after a 0.2% decline in the first quarter.

The preliminary U.S. services purchasing managers' index (PMI) is expected to decline to 55.6 in September from 56.1 in August.

The final Reuters/Michigan Consumer Sentiment Index is expected to drop to 86.7 in September from 91.9 in August.

The greenback was supported by yesterday's comments by the Fed Chairwoman Janet Yellen. She said in a speech at the University of Massachusetts on Thursday that she expects that the Fed will start raising its interest rates by the end of the year, followed by a gradual pace of interest rate hikes.

"Most of my colleagues and I anticipate that it will likely be appropriate to raise the target range for the federal funds rate sometime later this year," she said.

Yellen noted that the inflation will rise toward the Fed's 2% target as low oil prices are temporary.

The Fed chairwoman also said that the slowdown in the global economy is not significant not to raise interest rates this year.

The euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone. The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.8% in August from last year, missing expectations for a 5.3% gain, after a 5.3 % increase in July.

Loans to the private sector in the Eurozone climbed 1.0% in August from the last year, missing expectations for a 1.1% rise, after a 0.9% gain in July.

French statistical office INSEE released its consumer confidence index for France on Friday. French consumer confidence index climbed to 97 in September from 94 in August. It was the highest level since October 2007.

August's figure was revised up from 93.

Analysts had expected the index to remain unchanged at 94.

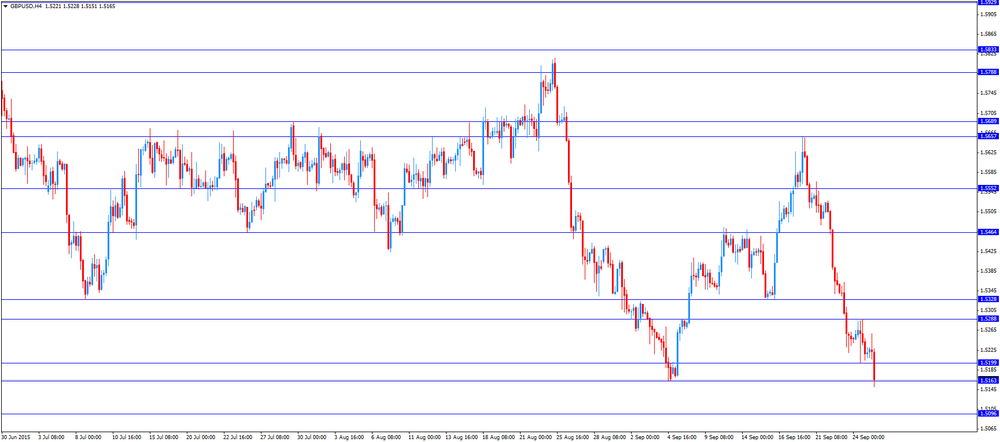

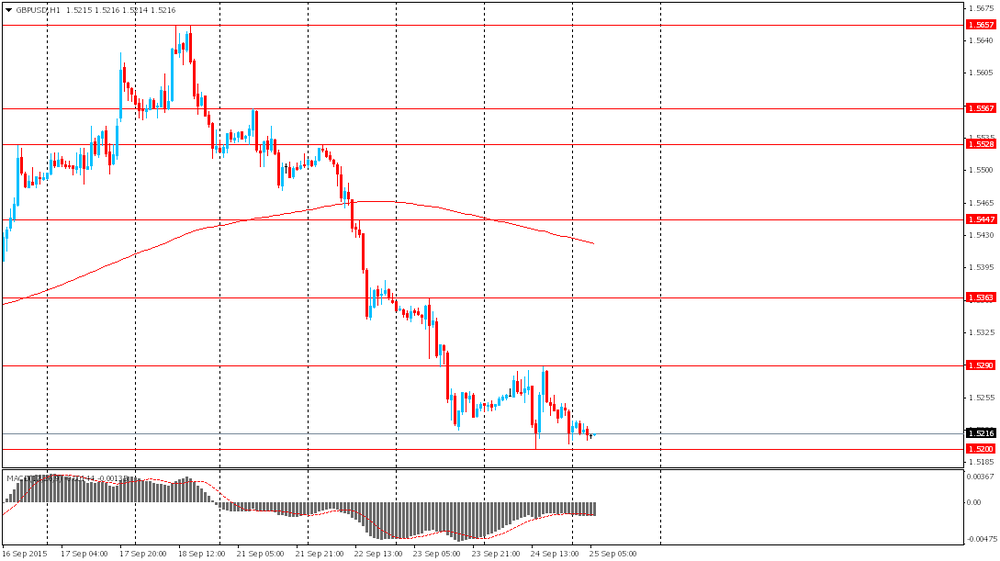

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5151

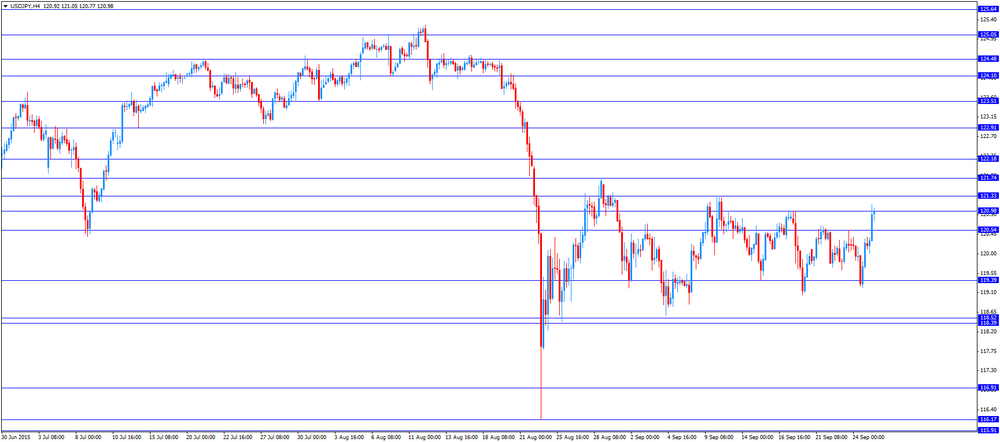

USD/JPY: the currency pair rose to Y121.13

The most important news that are expected (GMT0):

12:30 U.S. GDP, q/q (Finally) Quarter II 0.6% 3.7%

13:45 U.S. Services PMI (Preliminary) September 56.1 55.6

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 91.9 86.7

16:30 Eurozone ECB's Jens Weidmann Speaks

-

12:00

European stock markets mid session: stocks traded higher on yesterday’s comments by the Fed Chairwoman Janet Yellen

Stock indices traded higher on yesterday's comments by the Fed Chairwoman Janet Yellen. She said in a speech at the University of Massachusetts on Thursday that she expects that the Fed will start raising its interest rates by the end of the year, followed by a gradual pace of interest rate hikes.

"Most of my colleagues and I anticipate that it will likely be appropriate to raise the target range for the federal funds rate sometime later this year," she said.

Yellen noted that the inflation will rise toward the Fed's 2% target as low oil prices are temporary.

The Fed chairwoman also said that the slowdown in the global economy is not significant not to raise interest rates this year.

Meanwhile, the economic data from the Eurozone was mixed. The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.8% in August from last year, missing expectations for a 5.3% gain, after a 5.3 % increase in July.

Loans to the private sector in the Eurozone climbed 1.0% in August from the last year, missing expectations for a 1.1% rise, after a 0.9% gain in July.

French statistical office INSEE released its consumer confidence index for France on Friday. French consumer confidence index climbed to 97 in September from 94 in August. It was the highest level since October 2007.

August's figure was revised up from 93.

Analysts had expected the index to remain unchanged at 94.

Current figures:

Name Price Change Change %

FTSE 100 6,106.74 +145.25 +2.44 %

DAX 9,708.25 +280.61 +2.98 %

CAC 40 4,498.58 +151.34 +3.48 %

-

11:45

Japan’s Cabinet Office downgrades its growth outlook

Japan's Cabinet Office downgraded its growth outlook on Friday. It said that the country's economy continued to recover moderately, but added "slowness can be seen in some areas". These areas are private consumption and exports.

"The economy's undercurrent continues to recover moderately and factors to strengthen the move are being put into place," Economic and Fiscal Policy Minister Akira Amari said.

The government said that there are downside risks to the outlook such as the slowdown in emerging Asian economies and the process of normalizing monetary policy in the U.S.

The government pointed out that it will closely monitor fluctuations in the financial and capital markets.

It was the first downward revision since October 2014.

-

11:28

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E1.2bn), $1.1200(E700mn), $1.1250($832mn), $1.1300($317mn)

USD/JPY: Y119.00($250mn),Y120.00($430mn), Y120.20($230mn)

USD/CAD: Cad1.3070($350mn), Cad1.3295/00($550mn), Cad1.3455($250mn)

AUD/USD: $0.6780(A$619mn), $0.7100(A$461mn), $0.7135(A$316mn), $0.7200(A$330mn)

NZD/USD: $0.6325(NZ$300mn)

AUD/JPY: Y83.00(A$1.0bn)

-

11:25

Spanish producer prices decline 1.7% in August

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Friday. The Spanish producer prices dropped 1.7% in August, after a 0.1% decrease in July. It was the first decline in seven months.

On a yearly basis, producer price inflation in Spain fell 2.2% in August, after a 1.3% decline in July. Producer prices have been declining since July 2014.

Producer prices excluding energy climbed 0.6% year-on-year in August, after a 0.6% rise in July.

Energy prices dropped 9.8% year-on-year in August.

-

11:19

French consumer confidence index climbs to 97 in September, the highest level since October 2007

French statistical office INSEE released its consumer confidence index for France on Friday. French consumer confidence index climbed to 97 in September from 94 in August. It was the highest level since October 2007.

August's figure was revised up from 93.

Analysts had expected the index to remain unchanged at 94.

The index of the outlook on consumers' saving capacity rose to -2 in September from -11 in August.

The index of households' assessment of their financial situation in the past twelve months was up to -26 in September from -28 in August.

The index of the outlook on consumers' financial situation increased to -8 in September from -11 in August.

The index of the outlook on unemployment rising in coming months fell to 45 in September from 51 in the previous month.

The index for future inflation expectations dropped to -41 in September from -37 in August.

-

10:55

M3 money supply in the Eurozone rises 4.8% in August from last year

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 4.8% in August from last year, missing expectations for a 5.3% gain, after a 5.3 % increase in July.

Loans to the private sector in the Eurozone climbed 1.0% in August from the last year, missing expectations for a 1.1% rise, after a 0.9% gain in July.

-

10:44

Japan's national CPI excluding fresh food drops to an annual rate of -0.1% in August

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Thursday evening. Japan's national consumer price index (CPI) remained unchanged at an annual rate of 0.2% in August.

Japan's national CPI excluding fresh food declined to an annual rate of -0.1% in August from 0.0% in July, in line with expectations.

The decline was driven by fuel prices and communication prices. Fuel prices dropped 5.9% year-on-year in August, while communication prices declined 2.7%.

-

10:33

Fed Chairwoman Janet Yellen expects that the Fed will start raising its interest rates by the end of the year

The Fed Chairwoman Janet Yellen said in a speech at the University of Massachusetts on Thursday that she expects that the Fed will start raising its interest rates by the end of the year, followed by a gradual pace of interest rate hikes.

"Most of my colleagues and I anticipate that it will likely be appropriate to raise the target range for the federal funds rate sometime later this year," she said.

Yellen noted that the inflation will rise toward the Fed's 2% target as low oil prices are temporary.

The Fed chairwoman also said that the slowdown in the global economy is not significant not to raise interest rates this year.

Yellen pointed out that the decision to raise interest rates will depend on further progress toward achieving full employment and a rise in the inflation toward the 2% target.

-

10:23

The number of registered job seekers without any employment activity in France rises 0.6% in August

The French labour ministry said on Thursday that the number of registered job seekers without any employment activity rose 0.6% in August, after a 0.1% decline in July.

The total number of partial or fully unemployed was 3.57 million people.

The total number of the long-term unemployed increased by 0.8% to 2.4 million people in August.

The unemployment in France remains at high levels since French President Francois Hollande took office in 2012. The French government is struggling to bring down unemployment.

-

10:16

Eurozone: Private Loans, Y/Y, August 1.0% (forecast 1.1%)

-

10:14

Average weekly earnings of Canadian non-farm payroll employees increases 1.6% in July

Statistics Canada released its average weekly earnings data of Canadian non-farm payroll employees on Thursday. Average weekly earnings of Canadian non-farm payroll employees increased 1.6% in July year-on-year.

Weekly earnings rose C$957 in July from C$954 a year earlier.

The increase was driven by wage growth, changes in the composition of employment by industry, occupation, level of job experience and average hours worked per week.

Employees in Canada worked an average 33.0 hours per week in July, unchanged from both the previous month and from the same month a year earlier.

Total non-farm employment climbed by 38,200 month-on-month in July.

-

10:00

Eurozone: M3 money supply, adjusted y/y, August 4.8% (forecast 5.3%)

-

09:03

Oil prices climbed

West Texas Intermediate futures for November delivery advanced to $45.30 (+0.87%), while Brent crude rose to $48.50 (+0.69%) despite weak inflation data from Japan. The core consumer price index fell by 0.1% in August compared to the same period last year. The index has fallen for the first time since 2013. However officials said that GDP growth trend was intact and the core CPI fell because of low energy costs. Excluding energy the index rose by 1.1%.

Meanwhile the global glut persisted and traders are concerned about Iran pumping additional crude into the market in the coming months. An Iranian official said on Thursday he expects his country to raise its oil exports by 500,000 barrels a day by late November or early December, mostly with sales to Asia.

-

08:45

France: Consumer confidence , September 97 (forecast 94)

-

08:35

Gold slipped from a one-month high

Gold declined to $1,146.80 (-0.61%) from a one-month high after Fed Chair Yellen said a rate hike before the end of 2015 is likely. Investors also took profits after yesterday's 2% jump.

SPDR Gold Trust holdings rose 3.87 tonnes to 680.27 tonnes on Thursday.

According to International Monetary Fund data, Russia and Kazakhstan raised their gold holdings for the sixth month in a row in August.

-

08:32

Global Stocks: U.S. indices continued declining

U.S. stock indices declined on Thursday ahead of Fed Chair Janet Yellen's speech. Stocks managed to rebound partly from their declines, but general lack of confidence prevented investors from buying crashed stocks.

The Dow Jones Industrial Average fell 78.57 points, or 0.5%, to 16201.32. The S&P 500 declined 6.52, or 0.3%, to 1932.24. The Nasdaq Composite Index lost 18.27, or 0.4%, to 4734.48.

Caterpillar shares (a Dow component) fell $4.40, or 6.3%, to $65.80 after the company said it would cut 10,000 jobs by the end of 2018.

This morning in Asia Hong Kong Hang Seng fell 0.47%, or 98.77 points, to 20,997.21. China Shanghai Composite Index dropped 1.76%, or 55.36 point, to 3,087.32. The Nikkei gained 0.82%, or 143.33, to 17,715.16.

Asian stocks outside Japan fell amid declines in U.S. equities and uncertainty over prospects of Federal Reserve's rates. Yellen said on Thursday that a rate hike by the end of 2015 is likely, although low inflation justifies low rates for now.

Japanese stocks rose after Bank of Japan Governor Haruhiko Kuroda said he discussed domestic and global economy with Prime Minister Shinzo Abe.

-

08:28

Foreign exchange market. Asian session: the euro remained under pressure

The euro remained under pressure after Fed Chair Yellen's speech boosted the U.S. dollar. Janet Yellen said yesterday that the central bank would raise rates by the end of the year and noted that inflationary pressures are likely to grow in the coming years. Nevertheless she said that the decision had not been made yet and it depends on the labor market and price stability.

The yen had a mixed session. On one hand it was weighed by inflation data. The core consumer price index fell by 0.1% in August compared to the same period last year. The index has fallen for the first time since 2013. On the other hand the yen was supported by speeches of Japan economy minister and Bank of Japan Governor. Both officials said that GDP growth trend was intact and that the core CPI fell because of low energy costs. Excluding energy the index rose by 1.1%.

EUR/USD: the pair slid to $1.1165 in Asian trade

USD/JPY: the pair is currently at Y120.34

GBP/USD: the pair is currently at $1.5225

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Consumer confidence September 93 94

07:00 Eurozone ECB's Jens Weidmann Speaks

08:00 Eurozone Private Loans, Y/Y August 0.9% 1.1%

08:00 Eurozone M3 money supply, adjusted y/y August 5.3% 5.3%

12:30 U.S. GDP, q/q (Finally) Quarter II 0.6% 3.7%

13:45 U.S. Services PMI (Preliminary) September 56.1 55.6

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 91.9 86.7

16:30 Eurozone ECB's Jens Weidmann Speaks

-

08:19

Options levels on friday, September 25, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1339 (1561)

$1.1295 (1192)

$1.1246 (780)

Price at time of writing this review: $1.1164

Support levels (open interest**, contracts):

$1.1119 (5362)

$1.1089 (2144)

$1.1055 (3974)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 54327 contracts, with the maximum number of contracts with strike price $1,1500 (4925);

- Overall open interest on the PUT options with the expiration date October, 9 is 69993 contracts, with the maximum number of contracts with strike price $1,1000 (7146);

- The ratio of PUT/CALL was 1.29 versus 1.26 from the previous trading day according to data from September, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.5502 (1654)

$1.5404 (541)

$1.5307 (574)

Price at time of writing this review: $1.5225

Support levels (open interest**, contracts):

$1.5191 (2801)

$1.5095 (1694)

$1.4997 (1971)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 22319 contracts, with the maximum number of contracts with strike price $1,5500 (1654);

- Overall open interest on the PUT options with the expiration date October, 9 is 22474 contracts, with the maximum number of contracts with strike price $1,5200 (2801);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from September, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:49

-

04:08

Nikkei 225 17,571.8 -0.03 0.00%, Hang Seng 21,152.16 +56.18 +0.27 %, Shanghai Composite 3,128.53-14.16 -0.45 %

-

01:33

Japan: National Consumer Price Index, y/y, August 0.2%

-

01:33

Japan: National CPI Ex-Fresh Food, y/y, August -0.1% (forecast -0.1%)

-

01:32

Japan: Tokyo Consumer Price Index, y/y, September -0.1%

-

01:32

Japan: Tokyo CPI ex Fresh Food, y/y, September -0.2% (forecast -0.2%)

-

00:59

Commodities. Daily history for Sep 24’2015:

(raw materials / closing price /% change)

Oil 45.10 +0.42%

Gold 1,153.30 -0.04%

-

00:58

Stocks. Daily history for Sep 24’2015:

(index / closing price / change items /% change)

Nikkei 225 17,571.83 -498.38 -2.76 %

Hang Seng 21,095.98 -206.93 -0.97 %

S&P/ASX 200 5,071.67+73. 53 +1.47 %

Shanghai Composite 3,143.58 +27.69 +0.89 %

FTSE 100 5,961.49 -70.75 -1.17 %

CAC 40 4,347.24 -85.59 -1.93 %

Xetra DAX 9,427.64 -184.98 -1.92 %

S&P 500 1,932.24 -6.52 -0.34 %

NASDAQ Composite 4,734.48 -18.26 -0.38 %

Dow Jones 16,201.32 -78.57 -0.48 %

-

00:57

Currencies. Daily history for Sep 24’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1174 -0,12%

GBP/USD $1,5217 -0,20%

USD/CHF Chf0,9781 -0,08%

USD/JPY Y120,25 +0,04%

EUR/JPY Y134,37 -0,07%

GBP/JPY Y182,96 -0,17%

AUD/USD $0,6981 -0,32%

NZD/USD $0,6319 +0,79%

USD/CAD C$1,3336 +0,08%

-

00:06

Schedule for today, Friday, Sep 25’2015:

(time / country / index / period / previous value / forecast)

06:45 France Consumer confidence September 93 94

07:00 Eurozone ECB's Jens Weidmann Speaks

08:00 Eurozone Private Loans, Y/Y August 0.9% 1.1%

08:00 Eurozone M3 money supply, adjusted y/y August 5.3% 5.3%

12:30 U.S. GDP, q/q (Finally) Quarter II 0.6% 3.7%

13:45 U.S. Services PMI (Preliminary) September 56.1 55.6

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 91.9 86.7

16:30 Eurozone ECB's Jens Weidmann Speaks

-