Noticias del mercado

-

17:38

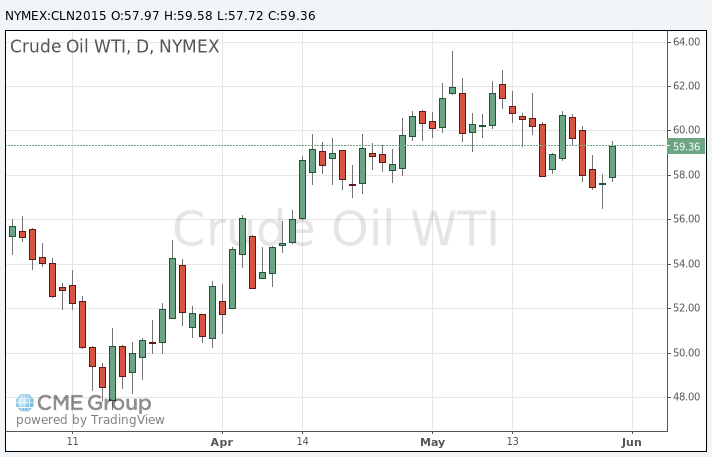

Oil prices traded higher, driven by a drop in U.S. crude oil inventories

Oil prices traded higher, driven by a drop in U.S. crude oil inventories. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Thursday. U.S. crude inventories declined by 2.8 million barrels to 479.4 million in the week to May 22. It was the fourth consecutive weekly decline. Analysts had expected a decline of 2 million barrels.

Investors are awaiting the release of the number of the U.S. oil rigs later in the day. The number of U.S. oil rigs declined by 1 last week.

Investors fear that oil producer could to add rigs and increase oil production.

WTI crude oil for July delivery rose to $59.58 a barrel on the New York Mercantile Exchange.

Brent crude oil for July rose to $63.33 a barrel on ICE Futures Europe.

-

17:25

Gold price traded higher on the Greek debt problem

Gold price traded higher on the Greek debt problem. The International Monetary Fund (IMF) offered Athens three more weeks to repay IMF loans. But International Monetary Fund Director Christine Lagarde said in an interview to a German newspaper that a Greek exit from the Eurozone is possible.

The weaker-than-expected revised U.S. GDP also supported gold price. The revised U.S. GDP declined 0.7% in the first quarter, missing expectations for a 0.1% fall, down from the previous estimate of a 0.2% rise. The downward revision was partly driven by an upward revision to imports.

June futures for gold on the COMEX today rose to 1193.30 dollars per ounce.

-

10:17

U.S. crude inventories decline by 2.8 million barrels to 479.4 million in the week to May 22

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Thursday. U.S. crude inventories declined by 2.8 million barrels to 479.4 million in the week to May 22. It was the fourth consecutive weekly decline.

Analysts had expected a decline of 2 million barrels.

Gasoline inventories were down by 3.3 million barrels last week, according to the EIA. U.S. oil production climbed by 304,000 barrels a day to 9.57 million barrels a day.

Crude stocks at the Cushing, Oklahoma, decreased by 433,000 barrels to 60 million barrels.

U.S. crude oil imports decreased by 503,000 barrels per day to 6.7 million barrels per day.

Refineries in the U.S. were running at 93.6% of capacity.

-

00:34

Commodities. Daily history for May 28’2015:

(raw materials / closing price /% change)

Oil 57. 68 +0.30%

Gold 1,188.10 +0.21%

-