Noticias del mercado

-

17:42

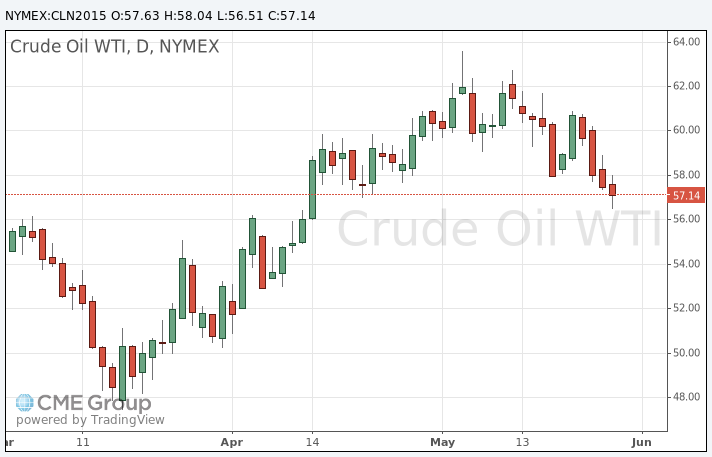

Oil prices traded lower, but recovered a part of losses after the release of U.S. crude oil inventories data

Oil prices traded lower, but recovered a part of losses after the release of U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Thursday. U.S. crude inventories declined by 2.8 million barrels to 479.4 million in the week to May 22. It was the fourth consecutive weekly decline.

Analysts had expected a decline of 2 million barrels.

Gasoline inventories were down by 3.3 million barrels last week, according to the EIA.

U.S. oil production climbed by 304,000 barrels a day to 9.57 million barrels a day.

Crude stocks at the Cushing, Oklahoma, decreased by 433,000 barrels to 60 million barrels.

U.S. crude oil imports decreased by 503,000 barrels per day to 6.7 million barrels per day.

Refineries in the U.S. were running at 93.6% of capacity.

WTI crude oil for July delivery decreased to $56.51 a barrel on the New York Mercantile Exchange.

Brent crude oil for July fell to $61.73 a barrel on ICE Futures Europe.

-

17:23

Gold price traded higher on the weaker-than-expected initial jobless claims from the U.S.

Gold price traded higher on the weaker-than-expected initial jobless claims from the U.S. The number of initial jobless claims in the week ending May 23 in the U.S. climbed by 7,000 to 282,000 from 275,000 in the previous week, missing expectations for a decline by 5,000. The previous week's reading was revised down from 274,000.

Jobless claims remained below 300,000. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 10,000 to 2,222,000 in the week ended May 16.

Gold price declined yesterday on the stronger U.S. dollar as the greenback was supported by speculation that Fed will start to hike its interest rate this year.

June futures for gold on the COMEX today rose to 1192.00 dollars per ounce.

-

00:33

Commodities. Daily history for May 27’2015:

(raw materials / closing price /% change)

Oil 59.00 -1.21%

Gold 1,187.50 -1.37%

-