Noticias del mercado

-

17:41

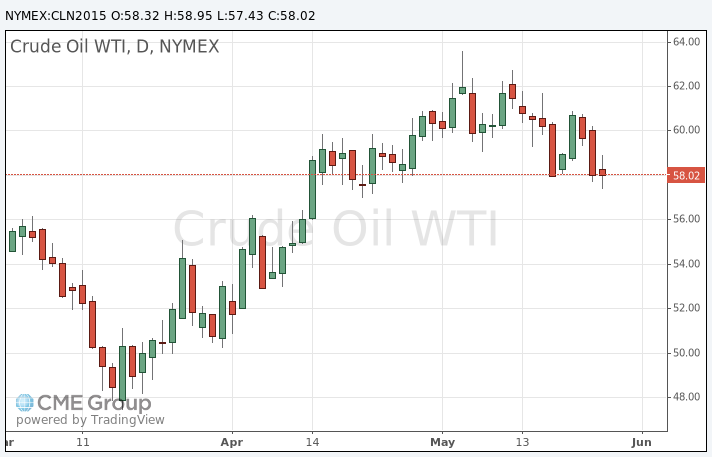

Oil prices traded lower as market participants monitored closely the direction of the U.S. dollar

Oil prices traded lower as market participants monitored closely the direction of the U.S. dollar. The greenback traded higher against the most major currencies on speculation the Fed to start to hike its interest rate this year. The U.S. currency declined as news reported that Greece and its creditors were starting to draft an agreement. Greek Prime Minister Alexis Tsipras said on Wednesday that Athens was "close" to a deal with its creditors.

Market participants are awaiting the release of U.S. crude oil inventories by the American Petroleum Institute (API) later in the day and by the U.S. Energy Information Administration (EIA) tomorrow.

The EIA's figures could show that U.S. crude oil inventories declined by 2.0 million barrels in the week ended May 22.

WTI crude oil for July delivery decreased to $57.43 a barrel on the New York Mercantile Exchange.

Brent crude oil for July fell to $63.19 a barrel on ICE Futures Europe.

-

17:24

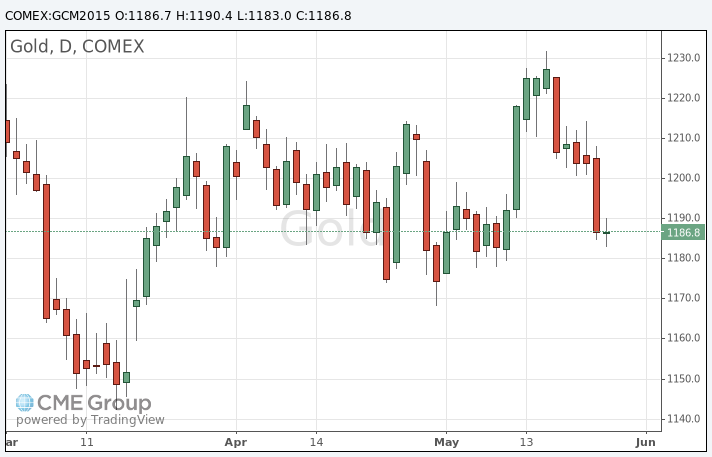

Gold price traded lower on the stronger U.S. dollar

Gold price traded lower on the stronger U.S. dollar. The greenback was supported by speculation that Fed will start to hike its interest rate this year.

The Fed noted that the interest rate hike will depend on the incoming U.S. economic data. The economic data in April was mixed. Analysts expect that the interest rate hike in September is more likely than the interest rate in June, despite the Fed Chair Janet Yellen has not ruled out the interest rate hike in June.

June futures for gold on the COMEX today decreased to 1183.00 dollars per ounce.

-

10:15

Industrial profits in China rise 2.6% in April

China's National Bureau of Statistics released its industrial profits data on Wednesday. Industrial profits in China increased at an annual pace of 2.6% in April, after a 0.4% decline in March. It was the first annual rise since September 2014.

During the first four months of 2015, industrial profits were down 1.3% as compared to the same period last year.

Profit of the mining industry dropped at an annual pace of 60.7% in the January to April period, while profits in the manufacturing sector rose 6.2%.

-

00:31

Commodities. Daily history for May 26’2015:

(raw materials / closing price /% change)

Oil 59.00 -1.21%

Gold 1,187.50 -1.37%

-