Noticias del mercado

-

20:21

American focus: the Canadian dollar fell after the announcement of the Bank of Canada

The Canadian dollar traded in a narrow range of roughly immediately after the publication of statements of the Bank of Canada's monetary policy on Wednesday, and then declined slightly. The Bank of Canada left its key interest rate a day at 0.75%, and noted that his predictions about the prospects for the Canadian economy coincide with the forecasts in the latest report, published in April.

"While the weakness in the US in Q1 increased concern about the basic forces of the economy, is expected to return to sustainable growth in the 2nd quarter," noted the Bank of Canada. "The Canadian dollar has strengthened in recent weeks amid rising oil prices and a weakening US dollar", - the central bank. "If these factors persist, their effects need to be studied, as in the following months will be published more data."

Statement by the central bank, mainly coincided with market expectations, so almost no impact, despite uneven trading immediately after its publication. According to analysts, after the publication of statements of the Bank of Canada, the US dollar is likely to continue its quite sharp recovery observed in the past few sessions. In a statement, the Bank of Canada said that, if the power of the Canadian dollar continues, the total effect on the financial conditions may lead to the fact that the central bank will revise the amount of stimulus necessary economy.

The yen continued to fall in price against the dollar, reaching a minimum in this July 9, 2007, due to the publication of the report, the representative of the Cabinet. It was reported that the Government of Japan for the first time in 10 months increased its estimate of consumer spending, but the overall outlook for the economy remained unchanged. In addition, the government lowered the estimate of exports and production. The report also said that growth in consumer spending is gaining momentum, which is a more upbeat assessment from the previous statement that the overall pace of growth is assured. Growth stocks and wages, as well as cheaper oil had a positive effect on consumer sentiment, which in turn has supported consumer spending. Also, the Cabinet of Ministers said that the economy continues to recover at a moderate pace.

Meanwhile, experts note that comments Chief Cabinet Secretary of Japan Sugi eased investors' concerns about the possibility of verbal intervention by the US government and Japan. Suga earlier on Wednesday again said that he did not consider the current rapid currency fluctuations. However, some point out that began on Tuesday a stronger dollar against the yen is not accompanied by an increase in the yield of US Treasury bonds, which is difficult to explain.

Euro regained lost ground after Greece and creditors have begun the technical negotiations aimed at reaching an agreement, as reported by Bloomberg and Reuters, citing a source in the Greek government. According to him, the proposed agreement includes the reform of VAT, but avoids the "recessionary measures." The agreement will be referred to reduction in target levels of primary surplus, long-term solutions for a long time and change, but not cutting, the pension system in Greece. The source said the remaining differences between the IMF and the EU. "If it was not required to reach an agreement with the IMF, the question would have been resolved."

Previously, support for the euro has statistics on Germany. According to figures released today by the research group GfK, consumer sentiment in Germany in June are expected to grow again. At the same time, GfK warned that geopolitical risks may put pressure on future consumer spending. Leading consumer confidence index GfK in June should rise to 10.2 from 10.1 in May. "The report on consumer confidence in Germany was better than expected, which should positively impact on domestic consumption in the coming months.

-

17:07

Greek Prime Minister Alexis Tsipras: Athens is "close" to a deal with its creditors

Greek Prime Minister Alexis Tsipras said on Wednesday that Athens was "close" to a deal with its creditors.

"We have made many steps. We are on the final stretch towards a positive deal," Tsipras noted.

Greek prime minister added that the government will pay wages and pensions at the end of the week.

Earlier, news reported that Greece and its creditors were starting to draft an agreement.

-

16:57

U.S. Treasury Secretary Jack Lew urged Greece and its creditors to sign a new debt agreement

U.S. Treasury Secretary Jack Lew urged Greece and its creditors to sign a new debt agreement until the next debt payment deadline. He added that he feared the Greek exit from the Eurozone.

"No one should have a false sense of confidence that they know what the risk of a crisis in Greece would be," Lew noted.

-

16:28

Bank of Canada kept its interest rate unchanged at 0.75%, the current monetary policy remains appropriate

The Bank of Canada (BoC) announced its interest rate decision on Wednesday. The BoC kept its interest rate unchanged at 0.75%. This decision was expected by analysts.

The central bank noted that there is still persistent slack in the Canadian economy and that the U.S. economic growth was weak in the first quarter. But the BoC expects the Canadian economy to bounce back in the second quarter.

Canada's central bank said that the consumer price inflation is near the bottom of the central bank's 1.0% - 3.0% range due to falling energy prices, while the core consumer price inflation is above 2% due to a depreciation of Canadian dollar.

The BoC said that consumption in Canada performed relatively well due to lower oil prices.

The central bank also said that risks to the outlook for inflation have not changed and risks to financial stability are evolving as expected.

According to the central bank, financial conditions for Canadian households and firms remain highly stimulative.

The BoC decided that the current monetary policy remains appropriate.

-

16:00

Canada: Bank of Canada Rate, 0.75% (forecast 0.75%)

-

15:54

Bank of Japan Deputy Governor Kikuo Iwata: the timing for achieving the central bank's 2% inflation target has been "somewhat delayed"

Bank of Japan Deputy Governor Kikuo Iwata said on Wednesday that the timing for achieving the central bank's 2% inflation target has been "somewhat delayed". He added that the inflation in Japan is likely to reach 2% target around the first half of next fiscal year as the underlying inflation was improving and as wages were increasing.

"Going forward, inflation is likely to accelerate. That will bring about a rise in inflation expectations, and such expectations are expected to remain firm," Iwata noted.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E839mn), $1.0840-50(E423mn), $1.0900(E543mn), $1.0940-55(E1.5bn), $1.1000(E1.0bn)

USD/JPY: Y121.00($710mn), Y121.80($300mn), Y123.00($440mn), Y124.00($350mn)

GBP/USD: $1.5320(Gbp270mn)

AUD/USD: $0.7525(A$2.0bn), $0.7750(A$302mn), $0.7800(A$644mn), $0.7810-20(A$500mn)

-

15:31

NBB business climate rises to -4.9 in May

The National Bank of Belgium (NBB) released its business survey on Wednesday. The business climate rose to -4.9 in May from -6.2 in April, beating forecasts for an increase to -6.0. It was the fourth consecutive monthly rise.

The gain was driven by increases in in all branches of activity.

The business climate index for the trade sector climbed to -1.8 in May from -8.2 in April.

The business climate index for the manufacturing sector rose to -6.4 in May from -7.3 in April due to more favourable assessments of total order books.

The business climate index for the services sector was up to 9.4 in May from 9 in April due to more optimistic outlook about future developments and due to general market demand.

The business climate index for the building sector increased to -13.9 in May from -15.6 in April due to more optimistic outlook about demand prospects and due to wider use of equipment.

-

15:00

Belgium: Business Climate, May -4.9 (forecast -6)

-

14:42

European Central Bank has not increased the ceiling for Emergency Liquidity Assistance

According to a person familiar with the matter, the European Central Bank (ECB) has not increased the ceiling for Emergency Liquidity Assistance (ELA) to Greek banks. The Bank of Greece has not requested to raise the ceiling. A Greek bank official noted that there is an unused liquidity buffer of €3 billion.

Under the ELA programme, the Greek central bank provides money to its country's financial institutions. The Bank of Greece has lent around €80.2 billion to Greek lenders.

-

14:25

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:10 U.S. FOMC Member Laсker Speaks

00:30 Australia Leading Index April -0.3% 0.1%

01:30 Australia Construction Work Done Quarter I -0.6% Revised From -0.2% -1.5% -2.4%

06:00 Germany Gfk Consumer Confidence Survey June 10.1 10 10.2

06:00 Switzerland UBS Consumption Indicator April 1.34 Revised From 1.35 1.25

06:45 France Consumer confidence May 94 95 93

11:00 U.S. MBA Mortgage Applications May -1.5% -1.6%

The U.S. dollar higher against the most major currencies on speculation the Fed to start to hike its interest rate this year.

There will be released no major economic report in the U.S. today.

The euro traded lower against the U.S. dollar after the mixed economic data from the Eurozone. German Gfk consumer confidence index climbed to 10.2 in June from 10.1 in May, beating expectations for a decline to 10.0. It was the highest level since October 2001.

The increase was driven by a strong domestic demand and low inflation.

"Private spending is a key driver for economic growth this year," Gfk noted. But Gfk warned that the debt talks between Greece and its creditors, the Ukraine crisis and IS terrorism may weigh on consumption in Germany.

French consumer confidence index fell to 93 in May from 94 in April, missing expectation for a rise to 95. It was the first fall in seven months.

The decline was driven by a pessimistic outlook regarding consumers' future saving capacity. The index of the outlook on consumers' saving capacity plunged to -5 in May from 4 April.

The Greek debt crisis continue to weigh on the euro.

The British pound traded lower against the U.S. dollar in the absence of any major reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the Bank of Canada's interest rate decision. Analysts expect the central bank to keep its monetary policy unchanged.

The Swiss franc traded lower against the U.S. dollar after the release of the UBS consumption index in Switzerland. The UBS consumption index decreased to 1.25 in April from 1.34 in March. March's figure was revised down from 1.35.

The increase was driven by a drop in new car registrations.

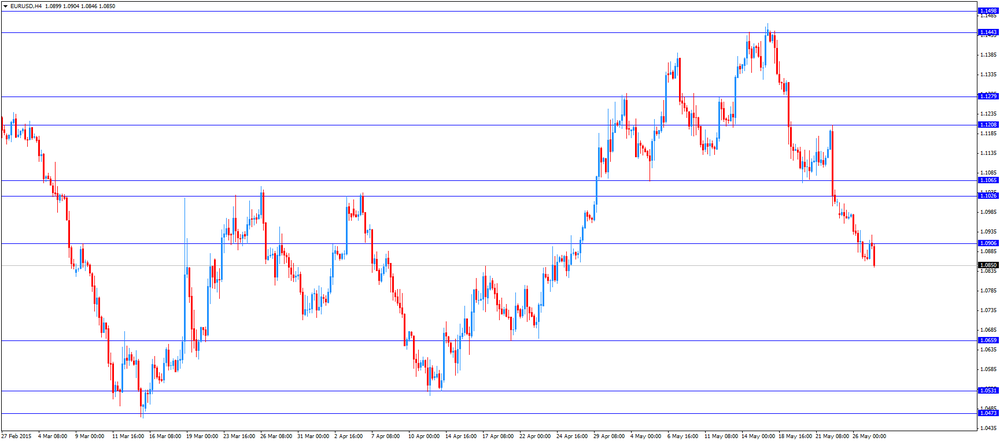

EUR/USD: the currency pair declined to $1.0846

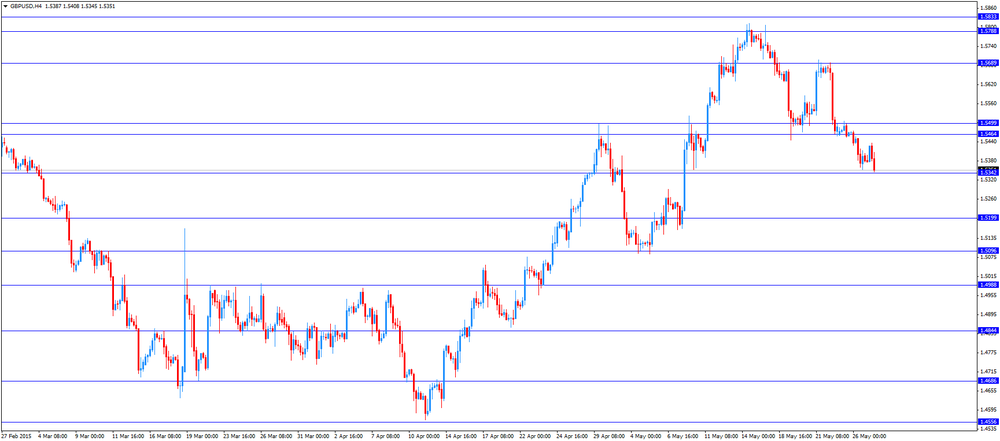

GBP/USD: the currency pair fell to $1.5345

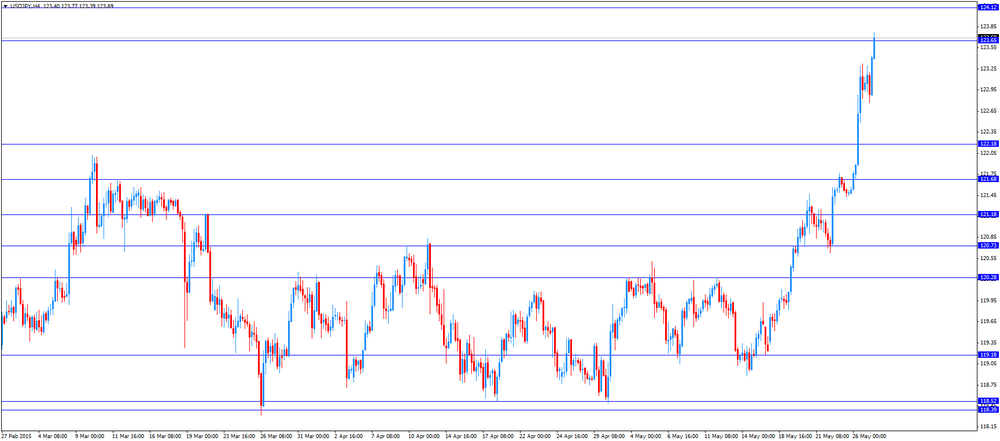

USD/JPY: the currency pair rose to Y123.77

The most important news that are expected (GMT0):

13:00 Belgium Business Climate May -6.2 -6

14:00 Canada Bank of Canada Rate 0.75% 0.75%

14:00 Canada BOC Rate Statement

23:50 Japan Retail sales, y/y April -9.7% 5.4%

-

14:00

Orders

EUR/USD

Offers 1.0930 1.0960 1.0980 1.1000 1.1020 1.1050

Bids 1.0880 1.0865 1.0850 1.0825-30 1.0800 1.0785

GBP/USD

Offers 1.5435 1.5450 1.5470 1.5485 1.5500 1.5525

Bids 1.5375 1.5350 1.5335 1.5320 1.5300 1.5285 1.5265 1.5250

EUR/GBP

Offers 0.7100 0.7115 0.7130 0.7165 0.7185 0.7200

Bids 0.7060-65 0.7050 0.7030 0.7015 0.7000

EUR/JPY

Offers 134.40 134.80 135.00 135.40

Bids 133.80 133.40 133.25 133.00 132.80 132.50

USD/JPY

Offers 123.30 123.50 123.80 124.00 124.25

Bids 122.75-80 122.50 122.35 122.20 122.00 121.80 121.60

AUD/USD

Offers 0.7775 0.7800 0.7820 0.7835 0.7865 0.7880 0.7900

Bids 0.7725-30 0.7700 0.7680 0.7650

-

13:00

U.S.: MBA Mortgage Applications, May -1.6%

-

11:43

UBS consumption index declines to 1.25 in April

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index decreased to 1.25 in April from 1.34 in March.

March's figure was revised down from 1.35.

The increase was driven by a drop in new car registrations. New car registrations fell 5.0% in April.

The retailer sentiment index remained unchanged at -13 in April.

-

11:31

French consumer confidence index declines to 93 in May

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index fell to 93 in May from 94 in April, missing expectation for a rise to 95. It was the first fall in seven months.

The decline was driven by a pessimistic outlook regarding consumers' future saving capacity. The index of the outlook on consumers' saving capacity plunged to -5 in May from 4 April.

-

11:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E839mn), $1.0840-50(E423mn), $1.0900(E543mn), $1.0940-55(E1.5bn), $1.1000(E1.0bn)

USD/JPY: Y121.00($710mn), Y121.80($300mn), Y123.00($440mn), Y124.00($350mn)

GBP/USD: $1.5320(Gbp270mn)

AUD/USD: $0.7525(A$2.0bn), $0.7750(A$302mn), $0.7800(A$644mn), $0.7810-20(A$500mn)

-

11:18

German Gfk consumer confidence index rises to the highest level since October 2001

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 10.2 in June from 10.1 in May, beating expectations for a decline to 10.0. It was the highest level since October 2001.

The increase was driven by a strong domestic demand and low inflation.

"Private spending is a key driver for economic growth this year," Gfk noted. But Gfk warned that the debt talks between Greece and its creditors, the Ukraine crisis and IS terrorism may weigh on consumption in Germany.

-

11:02

Bank of Japan’s April monetary policy meeting minutes: the underlying inflation was improving

The Bank of Japan (BoJ) released its April monetary policy meeting minutes. According to minutes, the underlying inflation was improving. But many board members said that there were downside risks to consumer prices due to uncertainty about long-term inflation expectations, consumer spending and the output gap.

Some board members said that the country's consumer price inflation wouldn't reach the 2% target in fiscal 2017.

Most board members expect that the growth in fiscal 2017 could slow due to a planned sales tax hike.

Minutes showed that the central bank wants to continue its monetary policy until the 2% inflation target will be reached, and it will adjust its monetary policy if needed.

The BoJ decided to keep unchanged its monetary policy at its April meeting.

-

10:44

Real GDP in the OECD area climbs 0.3% in the first quarter

The Organization for Economic Cooperation and Development (OECD) released its real gross domestic product (GDP) growth figures on Tuesday. Real GDP of 34 OECD member countries rose 0.3% in the first quarter, after a 0.5% gain in the fourth quarter.

Real GDP of the United States was down to 0.1% from 0.5%, real GDP of Germany declined to 0.3% from 0.7%, while Britain's economy slowed to 0.3% from 0.6%.

GDP of France climbed to 0.6% from 0.0%, Italy's economy increased 0.3%, while Japan's GDP was up to 0.6% from 0.3%.

Eurozone's economy expanded at 0.4% in the first quarter, after a 0.3% rise in the fourth quarter. On a yearly basis,

GDP of 34 OECD member countries was up to 1.9% in the first quarter from 1.8% in the previous quarter.

-

10:28

European Central Bank Governing Council Member Ignazio Visco: the central bank should continue its quantitative easing until inflation in the Eurozone does not reach the central bank’s 2% target

European Central Bank (ECB) Governing Council Member Ignazio Visco said that the central bank should continue its quantitative easing until inflation in the Eurozone does not reach the central bank's 2% target.

He ruled out that the central bank's asset buying programme encourage risk taking on financial markets.

"There are no signs to date that low interest rates are provoking generalised imbalances," Visco noted.

-

10:15

Industrial profits in China rise 2.6% in April

China's National Bureau of Statistics released its industrial profits data on Wednesday. Industrial profits in China increased at an annual pace of 2.6% in April, after a 0.4% decline in March. It was the first annual rise since September 2014.

During the first four months of 2015, industrial profits were down 1.3% as compared to the same period last year.

Profit of the mining industry dropped at an annual pace of 60.7% in the January to April period, while profits in the manufacturing sector rose 6.2%.

-

09:01

France: Consumer confidence , May 93 (forecast 95)

-

08:23

Options levels on wednesday, May 27, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1056 (4535)

$1.1024 (1959)

$1.0972 (2168)

Price at time of writing this review: $1.0910

Support levels (open interest**, contracts):

$1.0858 (4314)

$1.0843 (6936)

$1.0818 (7974)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 108711 contracts, with the maximum number of contracts with strike price $1,1200 (5109);

- Overall open interest on the PUT options with the expiration date June, 5 is 131111 contracts, with the maximum number of contracts with strike price $1,0800 (8901);

- The ratio of PUT/CALL was 1.21 versus 1.22 from the previous trading day according to data from May, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.5701 (2629)

$1.5603 (2404)

$1.5505 (1350)

Price at time of writing this review: $1.5427

Support levels (open interest**, contracts):

$1.5389 (3065)

$1.5294 (2296)

$1.5196 (2137)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 34901 contracts, with the maximum number of contracts with strike price $1,5700 (2629);

- Overall open interest on the PUT options with the expiration date June, 5 is 52940 contracts, with the maximum number of contracts with strike price $1,5000 (3289);

- The ratio of PUT/CALL was 1.52 versus 1.49 from the previous trading day according to data from May, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:10 U.S. FOMC Member Laсker Speaks

00:30 Australia Leading Index April -0.3% 0.1%

01:30 Australia Construction Work Done Quarter I -0.6% Revised From -0.2% -1.5% -2.4%

The dollar climbed after strong American data bolstered the case for higher interest rates. Better-than-expected readings on U.S. capital-equipment orders, new home sales and regional manufacturing Tuesday burnished the outlook for tighter monetary policy, with the Federal Reserve emphasizing that any rate increases will be driven by data. Talks between Greece and its creditors are said to be stalling ahead of next month's payment deadline.

Fed Vice Chairman Stanley Fischer said Tuesday at Tel Aviv University that U.S. policy makers will consider global growth as they start to raise key rates, adding that borrowing costs could be boosted more gradually should the world economy falter. Chair Janet Yellen said last week that borrowing costs will be boosted this year.

EUR / USD: during the Asian session, the pair was trading in the $ 1.0860-90

GBP / USD: during the Asian session, the pair was trading in the $ 1.5375-95

USD / JPY: during the Asian session the pair rose to Y123.30

-

08:16

Germany: Gfk Consumer Confidence Survey, June 10.2 (forecast 10)

-

08:16

Switzerland: UBS Consumption Indicator, April 1.25

-

03:30

Australia: Construction Work Done, Quarter I -2.4% (forecast -1.5%)

-

02:30

Australia: Leading Index, April 0.1%

-

00:29

Currencies. Daily history for May 26’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0872 -0,98%

GBP/USD $1,5380 -0,58%

USD/CHF Chf0,9532 +0,84%

USD/JPY Y123,05 +1,24%

EUR/JPY Y133,79 +0,27%

GBP/JPY Y189,25 +0,66%

AUD/USD $0,7734 -1,14%

NZD/USD $0,7230 -1,07%

USD/CAD C$1,2431 +0,97%

-

00:00

Schedule for today, Wednesday, May 27’2015:

(time / country / index / period / previous value / forecast)

00:10 U.S. FOMC Member Laсker Speaks

00:30 Australia Leading Index April -0.3%

01:30 Australia Construction Work Done Quarter I -0.2% -1.5%

06:00 Germany Gfk Consumer Confidence Survey June 10.1 10

06:00 Switzerland UBS Consumption Indicator April 1.35

06:45 France Consumer confidence May 94 95

11:00 U.S. MBA Mortgage Applications May -1.5%

13:00 Belgium Business Climate May -6.2

14:00 Canada Bank of Canada Rate 0.75% 0.75%

14:00 Canada BOC Rate Statement

20:30 U.S. API Crude Oil Inventories May -5.2

23:50 Japan Retail sales, y/y April -9.7% 5.4%

-