Noticias del mercado

-

20:20

American focus: the dollar fell

The dollar weakened against most major currencies after data on the US labor market. The number of Americans who first applied for unemployment benefits rose last week but remained near the values indicating a stable situation on the labor market. This was reported in the Labor Department report. The number of initial applications for unemployment benefits rose by 7,000 to a seasonally adjusted, reaching 282,000 in the week ended May 23. Economists had expected 270,000 new claims. We also add the figure for the previous week was revised up to 275 000 from 274 000. The Labor Department said that no special factors did not affect the latest data. Meanwhile, it became known that the moving average for 4 weeks, which smooths the volatile weekly data, rose by 5000 - to 271 500 (the lowest value since April 2000). Meanwhile, the number of people who continue to receive unemployment benefits rose by 11,000 to 2.2 million. For the week ended May 16. Recall data on re-treatment come with a week delay.

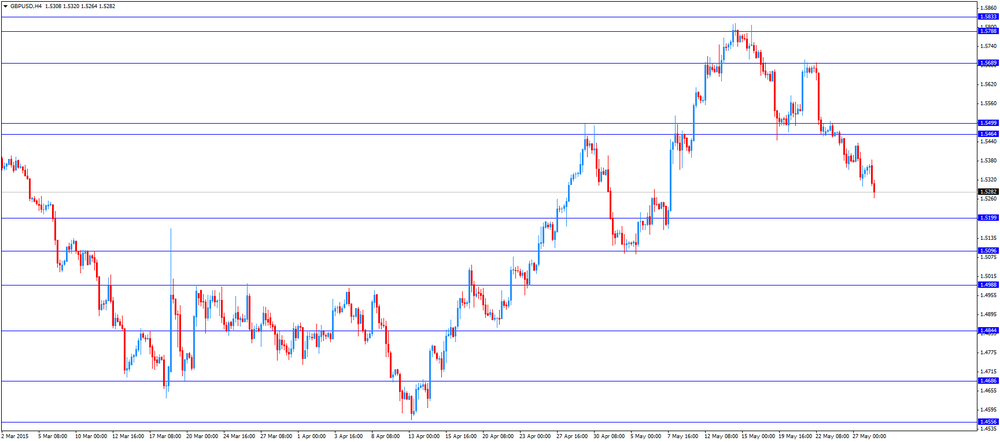

The pound fell sharply against the US dollar, falling below $ 1.5300 and headed for the minimum values since May 8, as data on British GDP were worse than expected. The revised data provided by the Office for National Statistics showed: in-kind British GDP increased by 0.3% between the fourth quarter of 2014 and the first quarter of 2015. It is worth emphasizing, unedited figure was compared with the previous estimate of GDP, published April 28. Analysts expect that the economy will expand by 0.4% against growth of 0.6% in the fourth quarter. Compared with the first quarter of 2014 UK GDP (in real terms) increased by 2.4%, also in line with the preliminary data published earlier. However, experts predicted expansion of 2.5% against growth of 3.0% in the fourth quarter. Office for National Statistics said that GDP in current prices increased by 0.9% between the 4th quarter 2014 and 1st quarter of 2015. Meanwhile, over the same period per capita GDP increased by 0.1%. The ONS said that business investment grew by 1.7 percent during the first three months of the year (up from the second quarter of 2014) against the forecast of 1.0 percent and economists decline of 0.9 percent at the end of 2014. But trade was the main "brake" of the economy, subtracting 0.9 percentage points from quarterly GDP growth. Meanwhile, household spending rose 0.5 percent, slightly slowing the pace compared to the end of 2014.

-

17:03

European Central Bank Vice President Vitor Constancio: a default of the Greek government and the solvency of Greek banks are not connected automatically

European Central Bank (ECB) Vice President Vitor Constancio pointed out on Thursday that a default of the Greek government and the solvency of Greek banks are not connected automatically. He noted that Greece will not leave the Eurozone if it does not repay its loans.

Constancio noted that there improvements in financial stability in the Eurozone.

"The financial stability situation in Europe has improved. One can say that our policies are working," the ECB vice president said.

-

17:00

U.S.: Crude Oil Inventories, May -2.802 (forecast -2.0)

-

16:47

European Central Bank’s Financial Stability Review: if debt talks between Greece and its creditors last for a long time, it could raise the yields on debt of other countries from the Eurozone

The European Central Bank (ECB) released its Financial Stability Review on Thursday. The central bank said that if debt talks between Greece and its creditors last for a long time, it could raise the yields on debt of other countries from the Eurozone.

"Financial market reactions to the developments in Greece have been muted to date, but in the absence of a quick agreement on structural implementation needs, the risk of an upward adjustment of the risk premia demanded on vulnerable euro area sovereigns could materialize," the ECB said.

-

16:34

European Central Bank Governing Council Member Ewald Nowotny: the central bank will not provide any short-term financing for Greece

European Central Bank (ECB) Governing Council Member Ewald Nowotny said in an interview to CNBC on Thursday that the central bank will not provide any short-term financing for Greece.

"We do not have flexibility to do, let's say, some financing outside our rules," he noted.

The ECB denied on Wednesday that it has increased the ceiling for Emergency Liquidity Assistance (ELA) to Greek banks.

-

16:23

U.S. pending home sales climbs 3.4% in April

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Thursday. Pending home sales in the U.S. rose 3.4% in April, exceeding expectations for a 0.9% increase, after a 1.2% gain in March. March's figure was revised up from a 1.1% rise.

Pending home sales increased in all four regions of the country.

"Realtors are saying foot traffic remains elevated this spring despite limited-and in some cases severe-inventory shortages in many metro areas," the NAR's chief economist Lawrence Yun said.

He added that home prices accelerated in many markets.

"The housing market can handle interest rates well above 4 percent as long as inventory improves to slow price growth and underwriting standards ease to normal levels so that qualified buyers - especially first-time buyers - are able to obtain a mortgage," Yun pointed out.

-

16:00

U.S.: Pending Home Sales (MoM) , April 3.4% (forecast 0.9%)

-

15:53

Swiss trade surplus rises to CHF2.85 billion in April

The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus climbed to CHF2.85 billion in April from CHF2.49 billion in the previous month. March's figure was revised down from a surplus of CHF2.52 billion.

Analysts had expected the surplus to increase to CHF2.77 billion.

Exports decreased seasonally adjusted 1.1% in April, while imports were down 3.5%.

On a yearly basis, exports fell 5.1% in April, while imports dropped 8.1%.

-

15:49

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E538mn), $1.0940(E446mn), $1.1000(E998mn), $1.1150(E1.8bn)

USD/JPY: Y123.00($859mn), Y124.20($300mn), Y124.50($725mn), Y124.80($400mn)

GBP/USD: $1.5100(Gbp1.1bn)

NZD/USD: $0.7200(NZ$234mn)

-

15:27

Canadian current account deficit widens to C$17.5 billion in the first quarter

Statistics Canada released current account data on Thursday. Canadian current account deficit widened to C$17.5 billion in the first quarter from a deficit of C$13.1 billion in the fourth quarter. The fourth quarter figure was revised up from a deficit of C$13.9 billion.

Analysts had expected a deficit of C$18.5 billion.

The decline was driven by wider gap in the trade in goods. The trade in goods deficit rose to a record C$7.25 billion in the first quarter.

-

15:14

Initial jobless claims rise by 7,000 to 282,000 in the week ending May 23

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending May 23 in the U.S. climbed by 7,000 to 282,000 from 275,000 in the previous week, missing expectations for a decline by 5,000.

The previous week's reading was revised down from 274,000.

Jobless claims remained below 300,000. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 10,000 to 2,222,000 in the week ended May 16.

-

14:47

Canadian industrial product and raw materials price indexes are mixed in April

Statistics Canada released its industrial product and raw materials price indexes on Thursday. The Industrial Product Price Index (IPPI) fell 0.9% in April, missing expectations for a 0.1% decline, after a 0.2% increase in March. March's figure was revised up from a 0.3% gain.

The decrease was driven by lower prices for energy and petroleum products. Energy and petroleum products were down 3.2% in April.

17 of the 21 commodity groups declined, 2 increased and 2 were unchanged.

The Raw Materials Price Index (RMPI) climbed 3.8% in April, after a 1.5% drop in March. March's figure was revised down from a 0.9% decrease.

The increase was driven by higher prices for crude energy products. Crude energy products soared 9.9% in April.

2 of the 6 commodity groups rose, 3 decreased and 1 were unchanged.

-

14:30

Canada: Current Account, bln, Quarter I -17.5 (forecast -18.5)

-

14:30

Canada: Industrial Product Price Index, m/m, April -0.9% (forecast -0.1%)

-

14:30

U.S.: Initial Jobless Claims, May 282 (forecast 270)

-

14:30

U.S.: Continuing Jobless Claims, 2222 (forecast 2208)

-

14:30

Canada: Industrial Product Price Index, y/y, April -2.4%

-

14:22

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the weaker-than-expected GDP data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Private Capital Expenditure Quarter I -1.7% Revised From -2.2% -2.4% -4.4%

06:00 United Kingdom Nationwide house price index, y/y May 5.2% 4.7%

06:00 United Kingdom Nationwide house price index May 1.0% 0.3%

06:00 Switzerland Trade Balance April 2.49 Revised From 2.52 2.77 2.85

06:20 U.S. FOMC Member Williams Speaks

08:30 United Kingdom BBA Mortgage Approvals April 39.2 Revised From 38.8 39.2 42.11

08:30 United Kingdom GDP, q/q (Revised) Quarter I 0.6% 0.4% 0.3%

08:30 United Kingdom GDP, y/y (Revised) Quarter I 3.0% 2.5% 2.4%

09:00 G7 G7 Meetings

09:00 Eurozone Consumer Confidence (Finally) May -4.6 -5.5 -5.5

09:00 Eurozone Economic sentiment index May 103.8 Revised From 103.7 103.5 103.8

09:00 Eurozone Business climate indicator May 0.32 0.35 0.28

09:00 Eurozone Industrial confidence May -3.2 -3.0 -3.0

The U.S. dollar higher against the most major currencies ahead of U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 4,000 to 270,000.

Pending home sales in the U.S. are expected to climb 0.9% in April, after a 1.1% increase in March.

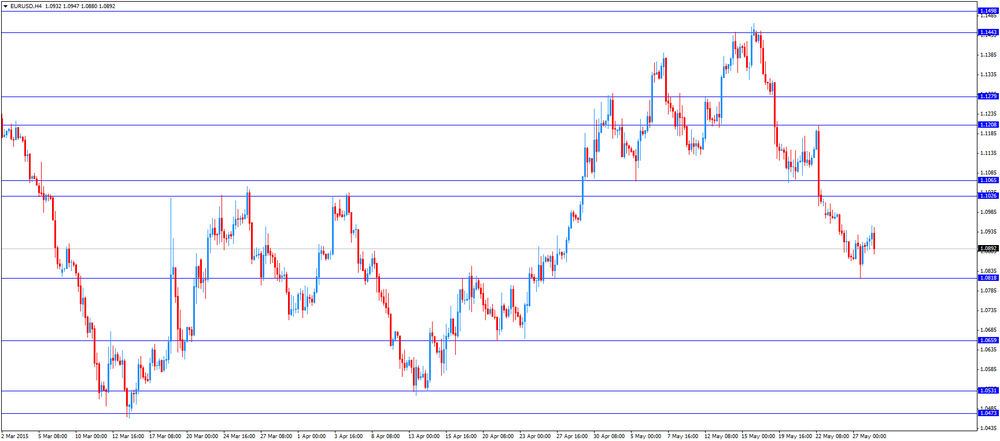

The euro declined against the U.S. dollar as concerns over the Greek debt continued to weigh on the euro. Prime Minister Alexis Tsipras said on Wednesday that Athens was "close" to a deal with its creditors. But some top European officials and International Monetary Fund Managing Director Christine Lagarde denied that there is a progress in debt talks between Greece and its creditors.

"I would not say that we already have reached substantial results," Lagarde said in an interview.

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index remained unchanged at 103.8 in May, beating expectations for a decline to 103.5.

April's figure was revised up from 103.7.

The consumer confidence index dropped to -5.5 in May from -4.6 in April due to faltering optimism about the level of future unemployment, the future general economic situation and the future savings.

The industrial confidence index increased to -3.0 in May from -3.2 the previous month, in line with expectations, due to optimistic production expectations.

The services sentiment index climbed to 7.8 in May from 7.0 in April due to optimistic demand expectations and the better assessment of the past business situation.

The construction confidence index rose to -25.0 in May from -25.5 in April due to the better assessment of the level of order books.

The business climate index was down to 0.28 in May, missing forecasts of a rise to 0.35.

The British pound traded lower against the U.S. dollar after the weaker-than-expected GDP data from the U.K. The revised U.K. GDP expanded at 0.3% in the first quarter, missing expectations for a 0.4 gain, after a 0.5% rise in the fourth quarter. It was the slowest pace since the fourth quarter of 2012.

On a yearly basis, the revised U.K. GDP rose 2.4% in the first quarter, missing forecasts of a 2.5% increase, after a 3.0% gain in the fourth quarter.

The service sector climbed 0.5% in the first quarter, the construction sector dropped 1.6%, and the production sector was down 0.1%, while agriculture sector decreased 0.2%.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian economic data. Canadian current account deficit is expected to widen to C$18.5 billion in the first quarter from a deficit of C$13.92 billion in the fourth quarter.

The Swiss franc traded lower against the U.S. dollar despite the better-than-expected Swiss trade data. The Swiss trade surplus climbed to CHF2.85 billion in April from CHF2.49 billion in the previous month. March's figure was revised down from a surplus of CHF2.52 billion. Analysts had expected the surplus to increase to CHF2.77 billion.

Exports decreased 1.1% in April, while imports were down 3.5%.

EUR/USD: the currency pair declined to $1.0880

GBP/USD: the currency pair fell to $1.5264

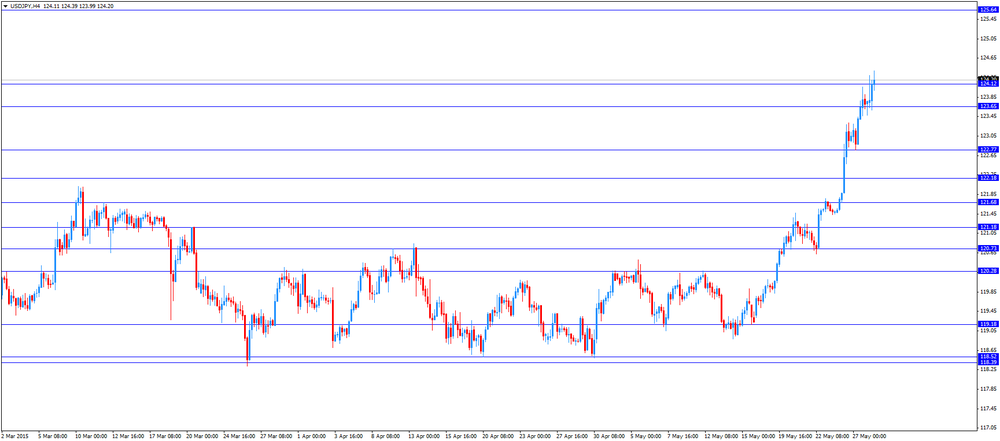

USD/JPY: the currency pair rose to Y124.39

The most important news that are expected (GMT0):

12:30 Canada Raw Material Price Index April -0.9%

12:30 U.S. Initial Jobless Claims May 274 270

14:00 U.S. Pending Home Sales (MoM) April 1.1% 0.9%

23:30 Japan Household spending Y/Y April -10.6% 3.1%

23:30 Japan Tokyo Consumer Price Index, y/y May 0.7%

23:30 Japan Tokyo CPI ex Fresh Food, y/y May 0.4% 0.1%

23:30 Japan Unemployment Rate April 3.4% 3.4%

23:30 Japan National Consumer Price Index, y/y April 2.3%

23:30 Japan National CPI Ex-Fresh Food, y/y April 2.2% 0.2%

23:50 Japan Industrial Production (MoM) (Preliminary) April -0.8% 0.8%

23:50 Japan Industrial Production (YoY) (Preliminary) April -1.7%

-

14:04

Japan’s retail sales rise 5.0% in April

Japan's Ministry of Economy, Trade and Industry released its retail sales figures for Japan on late Wednesday. Retail sales in Japan rose 5.0% in April, missing expectations for a 5.4% gain, after a 9.7% drop in March.

The increase was driven by higher cars and electronics sales.

Commercial sales climbed at an annual pace of 2.7% in April, while wholesale sales increased 1.8%.

Sales from large retailers rose at an annual pace of 8.6% in April.

-

14:00

Orders

EUR/USD

Offers 1.0950-60 1.0980 1.1000 1.1020 1.1050 1.1080 1.1100

Bids 1.0900 1.0880-85 1.0865 1.0850 1.0825-30 1.0800 1.0785 1.0750

GBP/USD

Offers 1.5385 1.5400 1.5420 1.5435 1.5450 1.5470 1.5485 1.5500 1.5525

Bids 1.5340 1.5320 1.5300 1.5285 1.5265 1.5250 1.5230 1.5200

EUR/GBP

Offers 0.7125-30 0.7165 0.7185 0.7200

Bids 0.7090-95 0.7080 0.7065 0.7050 0.7030 0.7015 0.7000

EUR/JPY

Offers 135.50 135.75 136.00 136.30 136.50

Bids 135.00 134.80 134.40 134.00 133.80 133.40 133.25 133.00

USD/JPY

Offers 124.00 124.25 124.50 124.80 125.00

Bids 123.50 123.30 123.00 122.75-80 122.50 122.35 122.20 122.00

AUD/USD

Offers 0.7720 0.7760 0.7780 0.7800 0.7820 0.7835

Bids 0.7670 0.7650 0.7625-30 0.7600 0.7585 0.7565 0.7550

-

11:41

Eurozone’s economic sentiment index remains unchanged at 103.8 in May

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index remained unchanged at 103.8 in May, beating expectations for a decline to 103.5.

April's figure was revised up from 103.7.

The consumer confidence index dropped to -5.5 in May from -4.6 in April due to faltering optimism about the level of future unemployment, the future general economic situation and the future savings.

The industrial confidence index increased to -3.0 in May from -3.2 the previous month, in line with expectations, due to optimistic production expectations.

The services sentiment index climbed to 7.8 in May from 7.0 in April due to optimistic demand expectations and the better assessment of the past business situation.

The construction confidence index rose to -25.0 in May from -25.5 in April due to the better assessment of the level of order books.

The business climate index was down to 0.28 in May, missing forecasts of a rise to 0.35.

-

11:24

Revised U.K. GDP grows at 0.3% in the first quarter, the slowest pace since the fourth quarter of 2012

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Thursday. The revised U.K. GDP expanded at 0.3% in the first quarter, missing expectations for a 0.4 gain, after a 0.5% rise in the fourth quarter. It was the slowest pace since the fourth quarter of 2012.

On a yearly basis, the revised U.K. GDP rose 2.4% in the first quarter, missing forecasts of a 2.5% increase, after a 3.0% gain in the fourth quarter.

The service sector climbed 0.5% in the first quarter, the construction sector dropped 1.6%, and the production sector was down 0.1%, while agriculture sector decreased 0.2%.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E538mn), $1.0940(E446mn), $1.1000(E998mn), $1.1150(E1.8bn)

USD/JPY: Y123.00($859mn), Y124.20($300mn), Y124.50($725mn), Y124.80($400mn)

GBP/USD: $1.5100(Gbp1.1bn)

NZD/USD: $0.7200(NZ$234mn)

-

11:05

Private capital expenditure in Australia plunges 4.4% in the first quarter

The Australian Bureau of Statistics released its private capital expenditure data on Thursday. Private capital expenditure in Australia dropped 4.4% in the first quarter, missing expectations for a 2.4% decline, after a 1.7% fall in the fourth quarter.

The fourth quarter's figure was revised up from a 2.2% decrease.

Capex for buildings and structures plunged 6.5% in the first quarter, while capital spending for equipment, plants and machinery fell 0.5%.

On a yearly basis, private capital expenditure in Australia declined 5.3%.

-

11:00

Eurozone: Economic sentiment index , May 103.8 (forecast 103.5)

-

11:00

Eurozone: Business climate indicator , May 0.28 (forecast 0.35)

-

11:00

Eurozone: Industrial confidence, May -3.0 (forecast -3.0)

-

11:00

Eurozone: Consumer Confidence, May -5.5 (forecast -5.5)

-

10:50

Bank of England starts a trial of new interest rate decision system today

The Bank of England (BoE) announced last year that it will change the way it carries out and announces interest rate decisions. The central bank plans to announce its interest rate decision and to release its meeting minutes at the same day.

The first meeting held under the new rules should be held in August.

The BoE will test the new system over the next two months, starting today.

The Monetary Policy Committee (MPC) may move to meeting eight times a year rather than 12.

-

10:34

El Pais: Spanish Prime Minister's office has written a letter to European institutions

The Spanish daily newspaper El Pais wrote on Wednesday that Spanish Prime Minister's office has written a letter to European institutions. Spanish Prime Minister's office has asked for greater mobility of labour between EU member countries, increased fiscal union with a common budget and the issuance of common debt in the form of Eurobonds.

Madrid also asked the European Central Bank (ECB) to adopt a U.S. Federal Reserve-style mix of policy.

The Prime Minister's office and the ECB declined to comment.

-

10:31

United Kingdom: BBA Mortgage Approvals, April 42.11 (forecast 39.2)

-

10:30

United Kingdom: GDP, q/q, Quarter I 0.3% (forecast 0.4%)

-

10:30

United Kingdom: GDP, y/y, Quarter I 2.4% (forecast 2.5%)

-

10:17

Queen Elizabeth II announced Britain’s government to hold a referendum on whether the U.K. should leave the EU

Queen Elizabeth II announced on Wednesday that Britain's government will hold a referendum on whether the U.K. should leave the EU.

"My government will renegotiate the United Kingdom's relationship with the European Union and pursue reform of the European Union for the benefit of all member states," she said.

The referendum should be held before the end of 2017, Queen Elizabeth II noted.

-

08:10

Options levels on thursday, May 28, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1128 (4454)

$1.1054 (4964)

$1.0995 (3186)

Price at time of writing this review: $1.0912

Support levels (open interest**, contracts):

$1.0864 (6946)

$1.0838 (7378)

$1.0797 (3290)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 109295 contracts, with the maximum number of contracts with strike price $1,1100 (4964);

- Overall open interest on the PUT options with the expiration date June, 5 is 129123 contracts, with the maximum number of contracts with strike price $1,0800 (9212);

- The ratio of PUT/CALL was 1.18 versus 1.21 from the previous trading day according to data from May, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.5601 (2410)

$1.5503 (1359)

$1.5406 (1602)

Price at time of writing this review: $1.5356

Support levels (open interest**, contracts):

$1.5293 (2281)

$1.5196 (2096)

$1.5098 (1277)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 34992 contracts, with the maximum number of contracts with strike price $1,5700 (2604);

- Overall open interest on the PUT options with the expiration date June, 5 is 52514 contracts, with the maximum number of contracts with strike price $1,5000 (3221);

- The ratio of PUT/CALL was 1.50 versus 1.52 from the previous trading day according to data from May, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Switzerland: Trade Balance, April 2.85 (forecast 2.77)

-

03:30

Australia: Private Capital Expenditure, Quarter I -4.4% (forecast -2.4%)

-

01:52

Japan: Retail sales, y/y, April 5.0% (forecast 5.4%)

-

00:29

Currencies. Daily history for May 27’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0899 +0,25%

GBP/USD $1,5351 -0,19%

USD/CHF Chf0,95 -0,34%

USD/JPY Y123,70 +0,53%

EUR/JPY Y134,83 +0,77%

GBP/JPY Y189,89 +0,34%

AUD/USD $0,7731 -0,04%

NZD/USD $0,7265 +0,48%

USD/CAD C$1,2453 +0,18%

-

00:00

Schedule for today, Thursday, May 28’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Private Capital Expenditure Quarter I -2.2% -2.4%

06:00 United Kingdom Nationwide house price index, y/y May 5.2% 4.7%

06:00 United Kingdom Nationwide house price index May 1.0% 0.3%

06:00 Switzerland Trade Balance April 2.52 2.77

06:20 U.S. FOMC Member Williams Speaks

08:30 United Kingdom BBA Mortgage Approvals April 38.8 39.2

08:30 United Kingdom GDP, q/q (Revised) Quarter I 0.6% 0.3%

08:30 United Kingdom GDP, y/y (Revised) Quarter I 3.0% 2.4%

09:00 G7 G7 Meetings

09:00 Eurozone Consumer Confidence (Finally) May -4.6 -5.5

09:00 Eurozone Economic sentiment index May 103.7 103.5

09:00 Eurozone Business climate indicator May 0.32 0.35

09:00 Eurozone Industrial confidence May -3.2 -3.0

12:30 Canada Current Account, bln Quarter I -13.92 -18.5

12:30 Canada Industrial Product Price Index, m/m April 0.3% -0.1%

12:30 Canada Industrial Product Price Index, y/y April -1.8%

12:30 Canada Raw Material Price Index April -0.9%

12:30 U.S. Initial Jobless Claims May 274 270

12:30 U.S. Continuing Jobless Claims 2211 2208

14:00 U.S. Pending Home Sales (MoM) April 1.1% 0.9%

14:30 U.S. Crude Oil Inventories May -2.674

22:45 New Zealand Building Permits, m/m April 11%

23:05 United Kingdom Gfk Consumer Confidence May 4 4

23:30 Japan Household spending Y/Y April -10.6% 3.1%

23:30 Japan Tokyo Consumer Price Index, y/y May 0.7%

23:30 Japan Tokyo CPI ex Fresh Food, y/y May 0.4% 0.1%

23:30 Japan Unemployment Rate April 3.4% 3.4%

23:30 Japan National Consumer Price Index, y/y April 2.3%

23:30 Japan National CPI Ex-Fresh Food, y/y April 2.2% 0.2%

23:50 Japan Industrial Production (MoM) (Preliminary) April -0.8% 0.8%

23:50 Japan Industrial Production (YoY) (Preliminary) April -1.7%

-