Noticias del mercado

-

22:14

U.S. stocks closed

U.S. stocks slipped, with benchmark indexes near records, before data Friday that may show the economy contracted in the first quarter while investors watch for progress on Greek debt talks.

Greece's international creditors have since lined up to say that the two sides are still far apart on a debt-relief deal before a payment deadline next week. While Greece isn't on the G-7's official agenda, the topic may dominate discussions on the sidelines, as ministers from the world's biggest economies urged a resolution of the crisis to stop it from spilling beyond Europe's borders.

Meanwhile, investors continue to assess economic reports for clues on the timing of a Federal Reserve interest-rate increase. Data today showed jobless claims increased by 7,000, but remained below 300,000 for the 12th straight week. In a separate report, a measure of pending home resales climbed more than forecast to the highest level in nine years.

A report due Friday may also show the U.S. economy contracted in the first quarter, according to economists' estimates, compared with a prior reading showing growth. Fed policy makers are preparing to raise rates that they've held near zero since December 2008, with economists expecting a first increase in September, according to a survey.

Fed Bank of San Francisco President John Williams said Thursday the U.S. will likely raise rates later this year as the world's biggest economy recovers from a weak first quarter. His comments echo those of Fed Chair Janet Yellen, who said last week she still expects to raise borrowing costs this year if the economy meets her forecasts, with a gradual pace of tightening to follow.

Global markets retreated Thursday after Chinese stocks plunged the most in four months, as brokerages tightened lending restrictions and the central bank drained cash from the financial system.

-

21:00

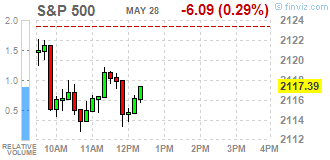

S&P 500 2,120.21 -3.27 -0.15 %, NASDAQ 5,096.96 -9.63 -0.19 %, Dow 18,119.18 -43.81 -0.24 %

-

19:17

WSE: Session Results

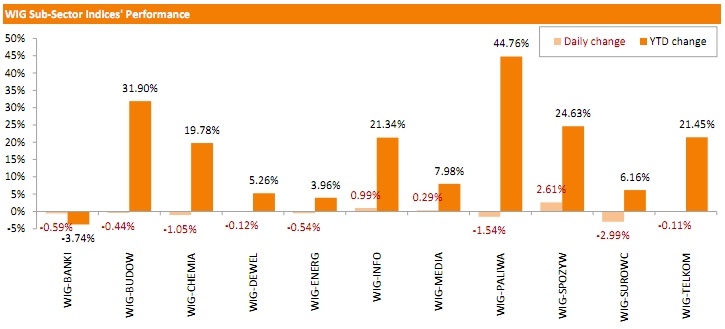

Polish equity market retreated on Thursday. The broad market benchmark - the WIG index dropped by 0.55%, while the large liquid companies measure - the WIG30 index fell by 0.82%.

Of the WIG30 index components, only 5 names managed to generate positive results. KERNEL (WSE: KER) topped the list of the best performers, posting a 3.13% growth as the market cheered the company's good quarterly results. It was followed by ASSECO POLAND (WSE: ACP), ING BSK (WSE: ING) CYFROWY POLSAT (WSE: CPS) and EUROCASH (WSE: EUR), gaining 1.63%, 1.29%, 0.69% and 0.68% respectively. On the contrary, JSW (WSE: JSW), PGNIG (WSE: PGN), KGHM (WSE: KGH), LOTOS (WSE: LTS) and GTC (WSE: GTC) lagged following their gains in the previous session, posting losses in the range 1.98%-6.04%.

Only 3 out of 11 WIG sub-sector indices closed higher: the food companies benchmark - the WIG-SPOZYW index added 2.61%, the IT-companies' measure - the WIG-INFO index gained 0.99% and the madia names indicator - the WIG-MEDIA index inched up 0.29%. At the same time, the basic material producers - the WIG-SUROWC index (-2.99%) produced the biggest losses, followed by benchmarks tracking the performance of the oil&gas industry and the chemicals sector - the WIG-PALIWA index (-1.54%) and the WIG-CHEMIA (-1.05%).

-

18:27

Wall Street. Major U.S. stock-indexes fell

Major U.S. stocks fell on Thursday amid concerns about a Greek default, a tumble in Chinese shares and an unexpected rise in weekly jobless claims. European officials downplayed talk that Greece and its lenders were drafting an agreement that would provide Athens much-needed debt relief. World markets were also under pressure after investors in China said several major brokerages had tightened requirements on margin financing, triggering fears of further steps to reduce leverage in the red-hot market.

Initial claims for state unemployment benefits rose to a seasonally adjusted 282,000 for the week ended May 23, the Labor Department said on Thursday. Economists on average had expected claims falling to 270,000.

Almost all of Dow stocks in negative area (22 of 30). Top looser - Caterpillar Inc. (CAT, -2.21%). Top gainer - Intel Corporation (INTC, +0.90%).

All of S&P index sectors also in negative area. Top looser - Basic Materials (-1.2%).

At the moment:

Dow 18076.00 -65.00 -0.36%

S&P 500 2113.50 -7.50 -0.35%

Nasdaq 100 4530.25 -12.00 -0.26%

10-year yield 2.14% +0.00

Oil 57.05 -0.46 -0.80%

Gold 1187.80 +1.30 +0.11%

-

18:01

European stocks closed: FTSE 100 7,040.92 +7.59 +0.11 %, CAC 40 5,137.83 -44.70 -0.86 %, DAX 11,677.57 -93.56 -0.79 %

-

18:00

European stocks close: most stocks closed lower on concerns over the Greek debt problem

Most stock indices closed lower on concerns over the Greek debt problem. Prime Minister Alexis Tsipras said on Wednesday that Athens was "close" to a deal with its creditors. But some top European officials and International Monetary Fund Managing Director Christine Lagarde denied that there is a progress in debt talks between Greece and its creditors.

"I would not say that we already have reached substantial results," Lagarde said in an interview.

The European Central Bank (ECB) released its Financial Stability Review on Thursday. The central bank said that if debt talks between Greece and its creditors last for a long time, it could raise the yields on debt of other countries from the Eurozone.

European Central Bank (ECB) Vice President Vitor Constancio pointed out on Thursday that a default of the Greek government and the solvency of Greek banks are not connected automatically. He noted that Greece will not leave the Eurozone if it does not repay its loans.

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index remained unchanged at 103.8 in May, beating expectations for a decline to 103.5.

April's figure was revised up from 103.7.

The consumer confidence index dropped to -5.5 in May from -4.6 in April due to faltering optimism about the level of future unemployment, the future general economic situation and the future savings.

The industrial confidence index increased to -3.0 in May from -3.2 the previous month, in line with expectations, due to optimistic production expectations.

The services sentiment index climbed to 7.8 in May from 7.0 in April due to optimistic demand expectations and the better assessment of the past business situation.

The construction confidence index rose to -25.0 in May from -25.5 in April due to the better assessment of the level of order books.

The business climate index was down to 0.28 in May, missing forecasts of a rise to 0.35.

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Thursday. The revised U.K. GDP expanded at 0.3% in the first quarter, missing expectations for a 0.4 gain, after a 0.5% rise in the fourth quarter. It was the slowest pace since the fourth quarter of 2012.

On a yearly basis, the revised U.K. GDP rose 2.4% in the first quarter, missing forecasts of a 2.5% increase, after a 3.0% gain in the fourth quarter.

The service sector climbed 0.5% in the first quarter, the construction sector dropped 1.6%, and the production sector was down 0.1%, while agriculture sector decreased 0.2%.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,040.92 +7.59 +0.11 %

DAX 11,677.57 -93.56 -0.79 %

CAC 40 5,137.83 -44.70 -0.86 %

-

17:03

European Central Bank Vice President Vitor Constancio: a default of the Greek government and the solvency of Greek banks are not connected automatically

European Central Bank (ECB) Vice President Vitor Constancio pointed out on Thursday that a default of the Greek government and the solvency of Greek banks are not connected automatically. He noted that Greece will not leave the Eurozone if it does not repay its loans.

Constancio noted that there improvements in financial stability in the Eurozone.

"The financial stability situation in Europe has improved. One can say that our policies are working," the ECB vice president said.

-

16:47

European Central Bank’s Financial Stability Review: if debt talks between Greece and its creditors last for a long time, it could raise the yields on debt of other countries from the Eurozone

The European Central Bank (ECB) released its Financial Stability Review on Thursday. The central bank said that if debt talks between Greece and its creditors last for a long time, it could raise the yields on debt of other countries from the Eurozone.

"Financial market reactions to the developments in Greece have been muted to date, but in the absence of a quick agreement on structural implementation needs, the risk of an upward adjustment of the risk premia demanded on vulnerable euro area sovereigns could materialize," the ECB said.

-

16:34

European Central Bank Governing Council Member Ewald Nowotny: the central bank will not provide any short-term financing for Greece

European Central Bank (ECB) Governing Council Member Ewald Nowotny said in an interview to CNBC on Thursday that the central bank will not provide any short-term financing for Greece.

"We do not have flexibility to do, let's say, some financing outside our rules," he noted.

The ECB denied on Wednesday that it has increased the ceiling for Emergency Liquidity Assistance (ELA) to Greek banks.

-

16:23

U.S. pending home sales climbs 3.4% in April

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Thursday. Pending home sales in the U.S. rose 3.4% in April, exceeding expectations for a 0.9% increase, after a 1.2% gain in March. March's figure was revised up from a 1.1% rise.

Pending home sales increased in all four regions of the country.

"Realtors are saying foot traffic remains elevated this spring despite limited-and in some cases severe-inventory shortages in many metro areas," the NAR's chief economist Lawrence Yun said.

He added that home prices accelerated in many markets.

"The housing market can handle interest rates well above 4 percent as long as inventory improves to slow price growth and underwriting standards ease to normal levels so that qualified buyers - especially first-time buyers - are able to obtain a mortgage," Yun pointed out.

-

15:53

Swiss trade surplus rises to CHF2.85 billion in April

The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus climbed to CHF2.85 billion in April from CHF2.49 billion in the previous month. March's figure was revised down from a surplus of CHF2.52 billion.

Analysts had expected the surplus to increase to CHF2.77 billion.

Exports decreased seasonally adjusted 1.1% in April, while imports were down 3.5%.

On a yearly basis, exports fell 5.1% in April, while imports dropped 8.1%.

-

15:28

Before the bell: S&P futures -0.22%, NASDAQ futures -0.25%

U.S. stock-index futures fell as concerns reignited about a Greek debt deal while data showed signs that the labor market remains firm.

Global markets:

Nikkei 20,551.46 +78.88 +0.39%

Hang Seng 27,454.31 -626.90 -2.23%

Shanghai Composite 4,620.27 -321.45 -6.50%

FTSE 7,030.2 -3.13 -0.04%

CAC 5,148.24 -34.29 -0.66%

DAX 11,719.86 -51.27 -0.44%

Crude oil $57.35 (-0.25%)

Gold $1186.40 (+0.07%)

-

15:27

Canadian current account deficit widens to C$17.5 billion in the first quarter

Statistics Canada released current account data on Thursday. Canadian current account deficit widened to C$17.5 billion in the first quarter from a deficit of C$13.1 billion in the fourth quarter. The fourth quarter figure was revised up from a deficit of C$13.9 billion.

Analysts had expected a deficit of C$18.5 billion.

The decline was driven by wider gap in the trade in goods. The trade in goods deficit rose to a record C$7.25 billion in the first quarter.

-

15:15

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Procter & Gamble Co

PG

79.40

+0.01%

1.6K

Twitter, Inc., NYSE

TWTR

36.47

+0.16%

15.1K

Barrick Gold Corporation, NYSE

ABX

11.73

+0.26%

75.3K

General Motors Company, NYSE

GM

35.91

+0.28%

77.3K

Boeing Co

BA

143.00

0.00%

0.9K

Starbucks Corporation, NASDAQ

SBUX

51.59

0.00%

2.1K

Pfizer Inc

PFE

34.29

-0.03%

19.6K

Hewlett-Packard Co.

HPQ

33.75

-0.09%

0.9K

Home Depot Inc

HD

112.05

-0.10%

0.4K

JPMorgan Chase and Co

JPM

66.40

-0.11%

13.0K

Johnson & Johnson

JNJ

101.00

-0.13%

3.8K

McDonald's Corp

MCD

97.67

-0.14%

0.7K

Verizon Communications Inc

VZ

49.50

-0.14%

1.8K

The Coca-Cola Co

KO

41.05

-0.17%

2.4K

Tesla Motors, Inc., NASDAQ

TSLA

247.00

-0.17%

5.3K

Merck & Co Inc

MRK

59.35

-0.18%

0.2K

Cisco Systems Inc

CSCO

29.25

-0.20%

2.9K

Google Inc.

GOOG

538.73

-0.20%

3.6K

General Electric Co

GE

27.46

-0.22%

4.6K

AT&T Inc

T

34.87

-0.23%

14.1K

Intel Corp

INTC

33.63

-0.24%

28.7K

Ford Motor Co.

F

15.28

-0.26%

4.2K

Amazon.com Inc., NASDAQ

AMZN

430.20

-0.28%

2.2K

Goldman Sachs

GS

207.80

-0.29%

9.0K

International Business Machines Co...

IBM

171.50

-0.29%

0.3K

Facebook, Inc.

FB

80.31

-0.30%

29.3K

Citigroup Inc., NYSE

C

54.70

-0.31%

16.2K

Microsoft Corp

MSFT

47.46

-0.32%

5.1K

Wal-Mart Stores Inc

WMT

74.95

-0.32%

1.4K

Walt Disney Co

DIS

110.01

-0.33%

1.7K

Visa

V

69.25

-0.35%

1.2K

Chevron Corp

CVX

102.75

-0.35%

0.3K

American Express Co

AXP

79.80

-0.39%

0.7K

Exxon Mobil Corp

XOM

84.76

-0.41%

10.0K

Deere & Company, NYSE

DE

93.97

-0.41%

0.5K

Apple Inc.

AAPL

131.47

-0.44%

311.8K

Nike

NKE

102.00

-0.55%

1.0K

ALCOA INC.

AA

12.72

-0.55%

32.8K

Caterpillar Inc

CAT

87.30

-0.71%

4.7K

Yahoo! Inc., NASDAQ

YHOO

43.00

-0.87%

7.7K

Yandex N.V., NASDAQ

YNDX

17.72

-1.17%

1.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.89

-1.29%

13.4K

-

15:14

Initial jobless claims rise by 7,000 to 282,000 in the week ending May 23

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending May 23 in the U.S. climbed by 7,000 to 282,000 from 275,000 in the previous week, missing expectations for a decline by 5,000.

The previous week's reading was revised down from 274,000.

Jobless claims remained below 300,000. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 10,000 to 2,222,000 in the week ended May 16.

-

15:08

Upgrades and downgrades before the market open

Upgrades:

General Motors (GM) upgraded from Underweight to Equal-Weight at Morgan Stanley

Downgrades:

Other:

-

14:47

Canadian industrial product and raw materials price indexes are mixed in April

Statistics Canada released its industrial product and raw materials price indexes on Thursday. The Industrial Product Price Index (IPPI) fell 0.9% in April, missing expectations for a 0.1% decline, after a 0.2% increase in March. March's figure was revised up from a 0.3% gain.

The decrease was driven by lower prices for energy and petroleum products. Energy and petroleum products were down 3.2% in April.

17 of the 21 commodity groups declined, 2 increased and 2 were unchanged.

The Raw Materials Price Index (RMPI) climbed 3.8% in April, after a 1.5% drop in March. March's figure was revised down from a 0.9% decrease.

The increase was driven by higher prices for crude energy products. Crude energy products soared 9.9% in April.

2 of the 6 commodity groups rose, 3 decreased and 1 were unchanged.

-

14:04

Japan’s retail sales rise 5.0% in April

Japan's Ministry of Economy, Trade and Industry released its retail sales figures for Japan on late Wednesday. Retail sales in Japan rose 5.0% in April, missing expectations for a 5.4% gain, after a 9.7% drop in March.

The increase was driven by higher cars and electronics sales.

Commercial sales climbed at an annual pace of 2.7% in April, while wholesale sales increased 1.8%.

Sales from large retailers rose at an annual pace of 8.6% in April.

-

12:00

European stock markets mid session: most stocks traded lower as concerns over the Greek debt continued to weigh on markets

Most stock indices traded lower as concerns over the Greek debt continued to weigh on markets. Prime Minister Alexis Tsipras said on Wednesday that Athens was "close" to a deal with its creditors. But some top European officials and International Monetary Fund Managing Director Christine Lagarde denied that there is a progress in debt talks between Greece and its creditors.

"I would not say that we already have reached substantial results," Lagarde said in an interview.

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index remained unchanged at 103.8 in May, beating expectations for a decline to 103.5.

April's figure was revised up from 103.7.

The consumer confidence index dropped to -5.5 in May from -4.6 in April due to faltering optimism about the level of future unemployment, the future general economic situation and the future savings.

The industrial confidence index increased to -3.0 in May from -3.2 the previous month, in line with expectations, due to optimistic production expectations.

The services sentiment index climbed to 7.8 in May from 7.0 in April due to optimistic demand expectations and the better assessment of the past business situation.

The construction confidence index rose to -25.0 in May from -25.5 in April due to the better assessment of the level of order books.

The business climate index was down to 0.28 in May, missing forecasts of a rise to 0.35.

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Thursday. The revised U.K. GDP expanded at 0.3% in the first quarter, missing expectations for a 0.4 gain, after a 0.5% rise in the fourth quarter. It was the slowest pace since the fourth quarter of 2012.

On a yearly basis, the revised U.K. GDP rose 2.4% in the first quarter, missing forecasts of a 2.5% increase, after a 3.0% gain in the fourth quarter.

The service sector climbed 0.5% in the first quarter, the construction sector dropped 1.6%, and the production sector was down 0.1%, while agriculture sector decreased 0.2%.

Current figures:

Name Price Change Change %

FTSE 100 7,047.08 +13.75 +0.20 %

DAX 11,734.21 -36.92 -0.31 %

CAC 40 5,153.66 -28.87 -0.56 %

-

11:41

Eurozone’s economic sentiment index remains unchanged at 103.8 in May

The European Commission released its economic sentiment index for the Eurozone on Thursday. The index remained unchanged at 103.8 in May, beating expectations for a decline to 103.5.

April's figure was revised up from 103.7.

The consumer confidence index dropped to -5.5 in May from -4.6 in April due to faltering optimism about the level of future unemployment, the future general economic situation and the future savings.

The industrial confidence index increased to -3.0 in May from -3.2 the previous month, in line with expectations, due to optimistic production expectations.

The services sentiment index climbed to 7.8 in May from 7.0 in April due to optimistic demand expectations and the better assessment of the past business situation.

The construction confidence index rose to -25.0 in May from -25.5 in April due to the better assessment of the level of order books.

The business climate index was down to 0.28 in May, missing forecasts of a rise to 0.35.

-

11:24

Revised U.K. GDP grows at 0.3% in the first quarter, the slowest pace since the fourth quarter of 2012

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Thursday. The revised U.K. GDP expanded at 0.3% in the first quarter, missing expectations for a 0.4 gain, after a 0.5% rise in the fourth quarter. It was the slowest pace since the fourth quarter of 2012.

On a yearly basis, the revised U.K. GDP rose 2.4% in the first quarter, missing forecasts of a 2.5% increase, after a 3.0% gain in the fourth quarter.

The service sector climbed 0.5% in the first quarter, the construction sector dropped 1.6%, and the production sector was down 0.1%, while agriculture sector decreased 0.2%.

-

11:05

Private capital expenditure in Australia plunges 4.4% in the first quarter

The Australian Bureau of Statistics released its private capital expenditure data on Thursday. Private capital expenditure in Australia dropped 4.4% in the first quarter, missing expectations for a 2.4% decline, after a 1.7% fall in the fourth quarter.

The fourth quarter's figure was revised up from a 2.2% decrease.

Capex for buildings and structures plunged 6.5% in the first quarter, while capital spending for equipment, plants and machinery fell 0.5%.

On a yearly basis, private capital expenditure in Australia declined 5.3%.

-

10:50

Bank of England starts a trial of new interest rate decision system today

The Bank of England (BoE) announced last year that it will change the way it carries out and announces interest rate decisions. The central bank plans to announce its interest rate decision and to release its meeting minutes at the same day.

The first meeting held under the new rules should be held in August.

The BoE will test the new system over the next two months, starting today.

The Monetary Policy Committee (MPC) may move to meeting eight times a year rather than 12.

-

10:34

El Pais: Spanish Prime Minister's office has written a letter to European institutions

The Spanish daily newspaper El Pais wrote on Wednesday that Spanish Prime Minister's office has written a letter to European institutions. Spanish Prime Minister's office has asked for greater mobility of labour between EU member countries, increased fiscal union with a common budget and the issuance of common debt in the form of Eurobonds.

Madrid also asked the European Central Bank (ECB) to adopt a U.S. Federal Reserve-style mix of policy.

The Prime Minister's office and the ECB declined to comment.

-

10:17

Queen Elizabeth II announced Britain’s government to hold a referendum on whether the U.K. should leave the EU

Queen Elizabeth II announced on Wednesday that Britain's government will hold a referendum on whether the U.K. should leave the EU.

"My government will renegotiate the United Kingdom's relationship with the European Union and pursue reform of the European Union for the benefit of all member states," she said.

The referendum should be held before the end of 2017, Queen Elizabeth II noted.

-

04:03

Nikkei 225 20,609.28 +136.70 +0.67 %, Hang Seng 27,798.85 -282.36 -1.01 %, Shanghai Composite 4,975.77 +34.06 +0.69 %

-

00:32

Stocks. Daily history for Apr May 27’2015:

(index / closing price / change items /% change)

Nikkei 225 20,472.58 +35.10 +0.17 %

Hang Seng 28,081.21 -168.65 -0.60 %

S&P/ASX 200 5,725.3 -48.13 -0.83 %

Shanghai Composite 4,941.71 +30.82 +0.63 %

FTSE 100 7,033.33 +84.34 +1.21 %

CAC 40 5,182.53 +98.99 +1.95 %

Xetra DAX 11,771.1 +146.00 +1.26 %

S&P 500 2,123.48 +19.28 +0.92 %

NASDAQ Composite 5,106.59 +73.84 +1.47 %

Dow Jones 18,162.99 +121.45 +0.67 %

-