Noticias del mercado

-

21:00

S&P 500 2,109.81 -10.98 -0.52 %, NASDAQ 5,069.91 -28.06 -0.55 %, Dow 18,008.44 -117.68 -0.65 %

-

19:11

WSE: Session Results

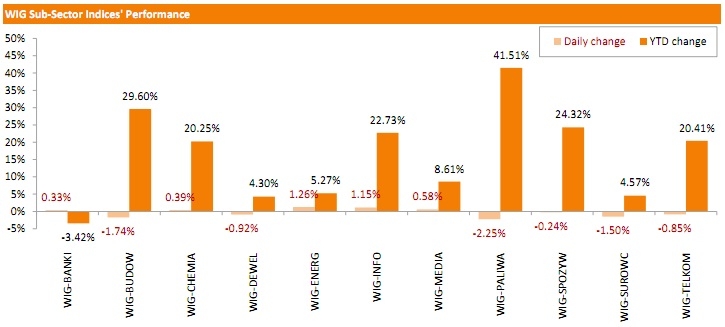

Polish equity market ended marginally lower on Friday. The broad market benchmark - the WIG index inched down 0.04%. Sector performance was mixed. Oil & gas and the constructions were weakest sectors, with the corresponding indicators - the WIG-PALIWA index and the WIG-BUDOW index declining 2.25% and 1.74% respectively. At the same time, utilities and technologies outperformed, with the respective measures - the WIG-ENERG index and the WIG-INFO index rising 1.26% and 1.15%.

The large liquid companies' measure - the WIG30 index slightly underperformed the WIG index, down 0.09%. JSW (WSE: JSW) and GTC (WSE: GTC) emerged as the biggest decliners within the WIG30 index components, losing a respective 4.31% and 3.71%. They were followed by oil&gas names PKN ORLEN (WSE: PKN) and PGNIG (WSE: PGN), decreasing by 2.82% and 2.01% respectively. KGHM (WSE: KGH) lost 1.75%, dragged down by lower cooper prices. On the other side of the ledger, CCC (WSE: CCC), PGE (WSE: PGE) and ALIOR (WSE: ALR) appeared to be among the biggest gainers, adding 2.62%, 1.93% and 1.6% respectively.

-

18:25

Wall Street. Major U.S. stock-indexes fell

Major U.S. stocks fell on Friday after weak GDP and consumer sentiment data added to investor concerns about the strength of the economy. The latest data showed the economy contracted at a 0.7 percent annual rate in the first quarter, a sharp turnaround from an earlier estimate of a 0.2 percent growth pace issued last month. Economists had expected GDP would be revised to show a contraction of 0.8 percent. Consumer sentiment fell in May, a survey by the University of Michigan showed, while the Institute for Supply Management-Chicago Business Barometer unexpectedly fell in May.

Almost all of Dow stocks in negative area (24 of 30). Top looser - The Boeing Company (BA, -1.12%). Top gainer - Intel Corporation (INTC, +1.35%).

All of S&P index sectors also in negative area. Top looser - Industrial goods (-0.8%).

At the moment:

Dow 18013.00 -121.00 -0.67%

S&P 500 2109.25 -12.50 -0.59%

Nasdaq 100 4520.50 -22.25 -0.49%

10-year yield 2.10% -0.03

Oil 59.59 +1.91 +3.31%

Gold 1189.80 +1.00 +0.08%

-

18:00

European stocks closed: FTSE 100 6,984.43 -56.49 -0.80 %, CAC 40 5,007.89 -129.94 -2.53 %, DAX 11,413.82 -263.75 -2.26 %

-

18:00

European stocks close: stocks closed lower as concerns over the Greek debt problem still weighed on markets

Stock indices closed lower as concerns over the Greek debt problem still weighed on markets. The International Monetary Fund (IMF) offered Athens three more weeks to repay IMF loans.

International Monetary Fund Director Christine Lagarde said in an interview to a German newspaper that a Greek exit from the Eurozone is possible.

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 5.3% in April from last year, exceeding expectations for a 4.9% gain, after a 4.6 % increase in March.

During three months to April, M3 money supply rose to 4.7% from 4.2% in the January to March period.

The lending for house purchase climbed 0.1% in three months to April, after a 0.2% rise a quarter ago.

Loans to the private sector in the Eurozone were flat in April from the last year, missing expectations for a 0.2% gain, after a 0.1% increase in March.

Destatis released its retail sales for Germany on Friday. German adjusted retail sales rose 1.7% in April, beating forecasts of a 0.8% rise, after a 1.4% decline in March. It was the first rise in three months. March's figure was revised up from a 2.3% decrease.

On a yearly basis, German retail sales climbed 1.0% in April, missing expectations for a 2.5% gain, after a 4.3% rise in March. March's figure was revised up from a 3.5% increase.

Sales of non-food products in Germany increased at an annual rate of 2.4% in April, while sales of food products declined by 2.1%.

French statistical office INSEE released its consumer spending data on Friday. French consumer spending increased 0.1% in April, after a 0.7% fall in March. March's figure was revised down from a 0.6% decrease.

Spending on food was up 0.4% in April, spending on automobiles rose 0.1%, spending on household durables fell 0.2%, while spending on energy declined 0.3%.

Spending on manufactured goods increased 0.3% in April.

On a yearly basis, consumer spending in France climbed 2% in April.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,984.43 -56.49 -0.80 %

DAX 11,413.82 -263.75 -2.26 %

CAC 40 5,007.89 -129.94 -2.53 %

-

16:47

Thomson Reuters/University of Michigan final consumer sentiment index drops to 90.7 in May

The Thomson Reuters/University of Michigan final consumer sentiment index dropped to 90.7 in May from 95.9 in April, beating expectations for a decline to 89.9, up from the preliminary estimate of 88.6.

"The decline was widespread among all age and income subgroups as well as across all regions of the country," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

The current economic conditions index declined to 100.8 in May from 107.0 in April.

The index of consumer expectations plunged to 84.2 from 88.8.

-

16:18

Chicago purchasing managers' index plunges to 46.3 in May

The Institute for Supply Management released its Chicago purchasing managers' index on Friday. The index plunged to 46.3 in May from 52.3 in April, missing expectations for an increase to 53.0.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The drop was driven by a decline in new orders. The new orders index fell to 47.5 in May from 55.1 in April.

The production and employment indexes also showed double-digit declined in percentage terms.

-

15:51

Greek final GDP declines 0.2% in the first quarter

The Hellenic Statistical Authority released its final gross domestic product (GDP) data for Greece on Friday. The Greek final GDP declined 0.2% in the first quarter, after a 0.4% drop in the fourth quarter. It was the second consecutive quarterly decline.

On a yearly basis, Greek final GDP rose 0.4% in the first quarter, after a 1.3% increase in the fourth quarter.

Consumer spending was up at an annual rate of 0.9%, investment jumped 23.1%.

Exports decreased at an annual rate of 0.9%, while imports climbed 10.6%.

-

15:39

U.S. Stocks open: Dow -0.30%, Nasdaq -0.10%, S&P -0.19%

-

15:34

U.S. revised GDP drops 0.7% in the first quarter

The U.S. Commerce Department released gross domestic product (GDP) figures on Friday. The U.S. revised GDP declined 0.7% in the first quarter, missing expectations for a 0.1% fall, down from the previous estimate of a 0.2% rise.

The decline in first quarter was driven by harsh weather and the strong U.S. dollar.

The downward revision was partly driven by an upward revision to imports.

Consumer spending rose by 1.8% in the first quarter, down from the previous estimate of a 1.9% increase.

Business investment declined 2.8% in first quarter, the biggest fall since late 2009.

Exports dropped 7.6% due to a stronger dollar, while imports climbed 5.6%.

The Personal consumer expenditures (PCE) price index declined 2% in the first quarter. The PCE price index excluding food and energy costs rose 0.8%.

The PCE price index is the Fed's preferred gauge for inflation.

-

15:27

Before the bell: S&P futures -0.26%, NASDAQ futures -0.32%

U.S. stock-index futures fluctuated after data showed the economy contracted in the first quarter.

Global markets:

Nikkei 20,563.15 +11.69 +0.06%

Hang Seng 27,424.19 -30.12 -0.11%

Shanghai Composite 4,613.19 -7.08 -0.15%

FTSE 7,041.61 +0.69 +0.01%

CAC 5,083.89 -53.94 -1.05%

DAX 11,553.94 -123.63 -1.06%

Crude oil $58.36 (+1.18%)

Gold $1189.10 (+0.08%)

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Wal-Mart Stores Inc

WMT

74.86

+0.03%

1.3K

Citigroup Inc., NYSE

C

54.57

+0.04%

30.9K

Chevron Corp

CVX

103.31

+0.07%

0.9K

Exxon Mobil Corp

XOM

85.17

+0.07%

1.2K

International Paper Company

IP

52.75

+0.08%

0.1K

Pfizer Inc

PFE

34.50

+0.17%

0.4K

Barrick Gold Corporation, NYSE

ABX

12.02

+0.17%

1.2K

Amazon.com Inc., NASDAQ

AMZN

427.64

+0.25%

0.2K

General Motors Company, NYSE

GM

36.48

+0.25%

0.3K

Intel Corp

INTC

34.14

+0.38%

47.7K

Twitter, Inc., NYSE

TWTR

36.98

+0.41%

31.1K

Yandex N.V., NASDAQ

YNDX

18.43

+0.55%

3.6K

McDonald's Corp

MCD

97.12

+0.66%

626.9K

Yahoo! Inc., NASDAQ

YHOO

43.51

+1.02%

42.2K

AT&T Inc

T

34.80

0.00%

0.2K

Home Depot Inc

HD

112.19

0.00%

0.5K

Johnson & Johnson

JNJ

101.15

0.00%

0.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.16

0.00%

12.0K

Google Inc.

GOOG

539.50

-0.05%

0.3K

The Coca-Cola Co

KO

41.11

-0.07%

5.5K

Ford Motor Co.

F

15.28

-0.07%

0.3K

Facebook, Inc.

FB

80.09

-0.07%

21.1K

Caterpillar Inc

CAT

85.94

-0.08%

1.8K

Procter & Gamble Co

PG

79.27

-0.08%

0.1K

Verizon Communications Inc

VZ

49.50

-0.08%

1.9K

ALCOA INC.

AA

12.67

-0.08%

17.6K

JPMorgan Chase and Co

JPM

66.13

-0.11%

1.1K

International Business Machines Co...

IBM

171.50

-0.12%

4.5K

Tesla Motors, Inc., NASDAQ

TSLA

251.00

-0.18%

13.8K

Cisco Systems Inc

CSCO

29.29

-0.20%

0.1K

Microsoft Corp

MSFT

47.35

-0.21%

2.2K

General Electric Co

GE

27.57

-0.22%

4.7K

Goldman Sachs

GS

208.00

-0.23%

16.0K

Walt Disney Co

DIS

110.27

-0.24%

1.1K

E. I. du Pont de Nemours and Co

DD

71.25

-0.27%

0.3K

Visa

V

69.36

-0.29%

3.2K

UnitedHealth Group Inc

UNH

119.25

-0.31%

0.3K

Apple Inc.

AAPL

131.37

-0.31%

162.1K

Starbucks Corporation, NASDAQ

SBUX

51.63

-0.35%

5.3K

-

15:04

Canada's GDP declines 0.1% in the first quarter, the first negative reading since the second quarter of 2011

Statistics Canada released GDP (gross domestic product) data on Friday. Canada's GDP decreased 0.1% in the first quarter, after a 0.6% gain in the fourth quarter.

It was the first negative reading since the second quarter of 2011.

The fall was driven by declines in many sectors, including mining, oil and gas extraction, construction, wholesale trade and manufacturing.

Household spending increased 0.1% in the first quarter, the slowest rise since the second quarter of 2012. Spending on durable goods dropped -1.4%, spending on semi-durable goods rose 0.3%, while spending on non-durable goods was up 0.7%.

Spending on services gained 0.1%.

Exports of goods and services decreased 0.3%, while Imports of goods and services declined 0.4%.

On a yearly basis, Canada's GDP dropped 0.6% in the first quarter, missing expectations for a 0.3% gain, after a 2.2% rise in the fourth quarter. The fourth quarter's figure was revised down from a 2.4% increase.

-

14:58

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Amazon (AMZN) target raised to $515 from $488 at Janney

-

14:43

Switzerland's GDP declines 0.2% in the first quarter

The State Secretariat for Economic Affairs (SECO) released its gross domestic product (GDP) data for Switzerland on Friday. Switzerland's GDP decreased 0.2% in the first quarter, missing expectations for a 0.1% fall, after a 0.5% gain in the fourth quarter. It was the fastest pace since the first quarter of 2009.

The fourth quarter's figure was revised down from a 0.6% gain.

The increase was driven by lower exports as the Swiss franc strengthen after the Swiss National Bank (SNB) removed its currency cap.

Exports of goods dropped 6.1% in the first quarter, driven by declines in all sectors.

Imports of goods rose 1.7% in the first quarter, driven by strong vehicle demand.

Household spending climbed to 0.5% in the first quarter, government spending was up 0.1%, equipment and software spending rose 0.5%, while construction spending increased 0.3%.

On a yearly basis, Switzerland's economy grew at 1.1% in the fourth quarter, missing expectations for a 1.5% rise, after a 1.9% increase in the fourth quarter.

-

14:24

KOF leading indicator for Switzerland climbs to 93.1 in May

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Friday. The KOF leading indicator climbed to 93.1 in May from 89.8 in April, exceeding expectations for a rise to 90.0. It was the highest level since January 2015.

April's figure was revised up from 89.5.

The rise was driven by a recovery of the indicators on Swiss manufacturing activity.

"Within the manufacturing sector, the outlook particularly improved in the metal and the machine building industry, followed by the electrical and the chemical industry," the KOF said.

The KOF added that "a swift recovery of the Swiss economy is thus not to be expected soon, but the likelihood of an upward trend reversal should have increased".

-

12:02

European stock markets mid session: stocks traded lower on concerns over the Greek debt problem

Stock indices traded lower on concerns over the Greek debt problem. The International Monetary Fund (IMF) offered Athens three more weeks to repay IMF loans.

International Monetary Fund Director Christine Lagarde said in an interview to a German newspaper that a Greek exit from the Eurozone is possible.

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 5.3% in April from last year, exceeding expectations for a 4.9% gain, after a 4.6 % increase in March.

During three months to April, M3 money supply rose to 4.7% from 4.2% in the January to March period.

The lending for house purchase climbed 0.1% in three months to April, after a 0.2% rise a quarter ago.

Loans to the private sector in the Eurozone were flat in April from the last year, missing expectations for a 0.2% gain, after a 0.1% increase in March.

Destatis released its retail sales for Germany on Friday. German adjusted retail sales rose 1.7% in April, beating forecasts of a 0.8% rise, after a 1.4% decline in March. It was the first rise in three months. March's figure was revised up from a 2.3% decrease.

On a yearly basis, German retail sales climbed 1.0% in April, missing expectations for a 2.5% gain, after a 4.3% rise in March. March's figure was revised up from a 3.5% increase.

Sales of non-food products in Germany increased at an annual rate of 2.4% in April, while sales of food products declined by 2.1%.

French statistical office INSEE released its consumer spending data on Friday. French consumer spending increased 0.1% in April, after a 0.7% fall in March. March's figure was revised down from a 0.6% decrease.

Spending on food was up 0.4% in April, spending on automobiles rose 0.1%, spending on household durables fell 0.2%, while spending on energy declined 0.3%.

Spending on manufactured goods increased 0.3% in April.

On a yearly basis, consumer spending in France climbed 2% in April.

Current figures:

Name Price Change Change %

FTSE 100 7,018.2 -22.72 -0.32 %

DAX 11,520.86 -156.71 -1.34 %

CAC 40 5,068.94 -68.89 -1.34 %

-

11:43

French consumer spending increases 0.1% in April

French statistical office INSEE released its consumer spending data on Friday. French consumer spending increased 0.1% in April, after a 0.7% fall in March. March's figure was revised down from a 0.6% decrease.

Spending on food was up 0.4% in April, spending on automobiles rose 0.1%, spending on household durables fell 0.2%, while spending on energy declined 0.3%.

Spending on manufactured goods increased 0.3% in April.

On a yearly basis, consumer spending climbed 2% in April.

-

11:29

German adjusted retail sales are up 1.7% in April

Destatis released its retail sales for Germany on Friday. German adjusted retail sales rose 1.7% in April, beating forecasts of a 0.8% rise, after a 1.4% decline in March. It was the first rise in three months.

March's figure was revised up from a 2.3% decrease.

On a yearly basis, German retail sales climbed 1.0% in April, missing expectations for a 2.5% gain, after a 4.3% rise in March. March's figure was revised up from a 3.5% increase.

Sales of non-food products increased at an annual rate of 2.4% in April, while sales of food products declined by 2.1%.

-

11:11

M3 money supply in the Eurozone rises 5.3% in April from last year

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 5.3% in April from last year, exceeding expectations for a 4.9% gain, after a 4.6 % increase in March.

During three months to April, M3 money supply rose to 4.7% from 4.2% in the January to March period.

The lending for house purchase climbed 0.1% in three months to April, after a 0.2% rise a quarter ago.

Loans to the private sector in the Eurozone were flat in April from the last year, missing expectations for a 0.2% gain, after a 0.1% increase in March.

-

10:50

Federal Reserve Bank of Minneapolis President Narayana Kocherlakota: the Fed should not start to raise its interest rate this year

Federal Reserve Bank of Minneapolis President Narayana Kocherlakota reiterated on Thursday that the Fed should not start to raise its interest rate this year.

"Under my current outlook, I continue to believe that it would be a mistake to raise the target range for the fed funds rate in 2015," he noted.

Kocherlakota noted that the job growth has not reached its pre-recession level.

"By some key metrics, the labor market improved more in 2014 than it had in almost 20 years. Yet, by these same metrics, we would need to see at least three more years like 2014 for labor market conditions to return to their 2006 levels," the Federal Reserve Bank of Minneapolis president said.

Kocherlakota is not a voting member of the Federal Open Market Committee this year.

-

10:37

Federal Reserve Bank of San Francisco President John Williams: the Fed will likely start to hike its interest rate later this year

Federal Reserve Bank of San Francisco President John Williams said in Singapore on Thursday that the Fed will likely start to hike its interest rate later this year as the U.S. economy improves. He added that the Fed might raise its interest rate gradually and move them to normal levels over the next few years.

Williams noted that the Fed could hike its interest rate at every monetary policy meeting.

The Federal Reserve Bank of San Francisco president expects the U.S. economy to expand at around to 2.0% this year. Williams also expects that the Fed will hike its interest rate in 2015, 2016 and 2017, and the interest rate will be between 3.5% and 4%.

"If you look at those forecasts back from March you'll see an adjustment over time from where we are now, gradually towards this 3.5 to 4 percent and normal level of Federal Funds rate," he said.

-

04:03

Nikkei 225 20,605.26 +53.80 +0.26 %, Hang Seng 27,485.15 +30.84 +0.11 %, Shanghai Composite 4,580.52 -39.74 -0.86 %

-

00:32

Stocks. Daily history for Apr May 28’2015:

(index / closing price / change items /% change)

Nikkei 225 20,551.46 +78.88 +0.39 %

Hang Seng 27,454.31 -626.90 -2.23 %

S&P/ASX 200 5,713.1 -12.17 -0.21 %

Shanghai Composite 4,620.27 -321.45 -6.50 %

FTSE 100 7,040.92 +7.59 +0.11 %

CAC 40 5,137.83 -44.70 -0.86 %

Xetra DAX 11,677.57 -93.56 -0.79 %

S&P 500 2,120.79 -2.69 -0.13 %

NASDAQ Composite 5,097.98 -8.62 -0.17 %

Dow Jones 18,126.12 -36.87 -0.20 %

-