Noticias del mercado

-

21:00

S&P 500 2,122.16 +17.96 +0.85 %, NASDAQ 5,099.19 +66.43 +1.32 %, Dow 18,170.59 +129.05 +0.72 %

-

19:46

WSE: Session Results

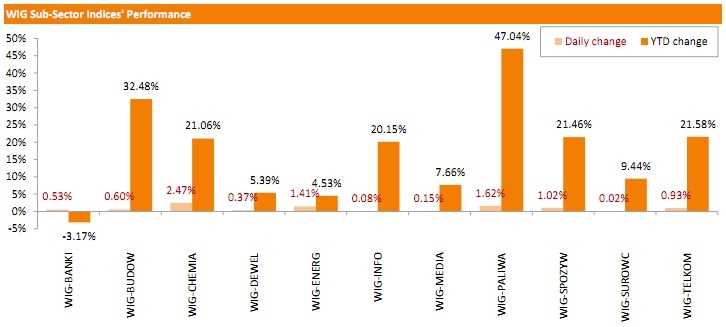

Polish equity market demonstrated growth on Wednesday, supported by positive dynamics on the major European bourses. The broad market benchmark - the WIG index gained 0.55%, while the large liquid companies measure - the WIG30 index added 0.73%.

In the large liquid stock universe, utilities name ENEA (WSE: ENA) added 4.77% and became the session's best performer, followed by ING BSK (WSE: ING), SYNTHOS (WSE: SNS) and CCC (WSE: CCC), which advanced in the range of 3.20% to 3.79%. At the same time, ALIOR (WSE: ALR) was the sharpest decliner, posting a 1.51% drop. It should be noted, the bank was a standout performer in the sector in the previous two sessions, when the majority of its peers recorded heavy post-election losses. The other two big losers were LPP (WSE: LPP) and PZU (WSE: PZU), dropping a respective 1.28% and 1.13%.

All sub-sector indices recorded growth, with yesterday's laggard - the WIG-CHEMIA index (+2.47%) outperforming.

-

18:12

Wall Street. Major U.S. stock-indexes rose

Major U.S. stocks rose on Wednesday, rebounding strongly from their steepest fall in three weeks on Tuesday, as the dollar's rally eased on reports that Greece would avoid a default. The dollar enjoyed its biggest rally in two years on Tuesday, spurred by buoyant U.S. economic data that fueled expectations of an interest rate hike coming sooner rather than later this year. The strong dollar, which means that U.S. companies earn less when sales abroad are brought back, and concerns about Greece had weighed heavily on Wall Street.

Almost all of Dow stocks in positive area (27 of 30). Top looser - American Express Company (AXP, -0.36%). Top gainer - Apple Inc. (AAPL, +1.75%).

All of S&P index sectors also in positive area. Top gainer - Healthcare (+1,2%).

At the moment:

Dow 18131.00 +78.00 +0.43%

S&P 500 2116.50 +11.50 +0.55%

Nasdaq 100 4523.75 +44.00 +0.98%

10-year yield 2.16% +0.02

Oil 57.99 -0.04 -0.07%

Gold 1186.20 -0.70 -0.06%

-

18:00

European stocks closed: FTSE 100 7,033.33 +84.34 +1.21 %, CAC 40 5,182.53 +98.99 +1.95 %, DAX 11,771.13 +146.00 +1.26 %

-

18:00

European stocks close: stocks closed higher as news reported that Greece and its creditors were starting to draft an agreement

Stock indices closed higher as news reported that Greece and its creditors were starting to draft an agreement. Greek Prime Minister Alexis Tsipras said on Wednesday that Athens was "close" to a deal with its creditors.

"We have made many steps. We are on the final stretch towards a positive deal," Tsipras noted.

Greek prime minister added that the government will pay wages and pensions at the end of the week.

The released economic from the Eurozone was mixed. German Gfk consumer confidence index climbed to 10.2 in June from 10.1 in May, beating expectations for a decline to 10.0. It was the highest level since October 2001.

The increase was driven by a strong domestic demand and low inflation.

"Private spending is a key driver for economic growth this year," Gfk noted. But Gfk warned that the debt talks between Greece and its creditors, the Ukraine crisis and IS terrorism may weigh on consumption in Germany.

French consumer confidence index fell to 93 in May from 94 in April, missing expectation for a rise to 95. It was the first fall in seven months.

The decline was driven by a pessimistic outlook regarding consumers' future saving capacity. The index of the outlook on consumers' saving capacity plunged to -5 in May from 4 April.

The National Bank of Belgium (NBB) released its business survey on Wednesday. The business climate rose to -4.9 in May from -6.2 in April, beating forecasts for an increase to -6.0. It was the fourth consecutive monthly rise.

The gain was driven by increases in in all branches of activity.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,033.33 +84.34 +1.21 %

DAX 11,771.13 +146.00 +1.26 %

CAC 40 5,182.53 +98.99 +1.95 %

-

17:07

Greek Prime Minister Alexis Tsipras: Athens is "close" to a deal with its creditors

Greek Prime Minister Alexis Tsipras said on Wednesday that Athens was "close" to a deal with its creditors.

"We have made many steps. We are on the final stretch towards a positive deal," Tsipras noted.

Greek prime minister added that the government will pay wages and pensions at the end of the week.

Earlier, news reported that Greece and its creditors were starting to draft an agreement.

-

16:57

U.S. Treasury Secretary Jack Lew urged Greece and its creditors to sign a new debt agreement

U.S. Treasury Secretary Jack Lew urged Greece and its creditors to sign a new debt agreement until the next debt payment deadline. He added that he feared the Greek exit from the Eurozone.

"No one should have a false sense of confidence that they know what the risk of a crisis in Greece would be," Lew noted.

-

16:28

Bank of Canada kept its interest rate unchanged at 0.75%, the current monetary policy remains appropriate

The Bank of Canada (BoC) announced its interest rate decision on Wednesday. The BoC kept its interest rate unchanged at 0.75%. This decision was expected by analysts.

The central bank noted that there is still persistent slack in the Canadian economy and that the U.S. economic growth was weak in the first quarter. But the BoC expects the Canadian economy to bounce back in the second quarter.

Canada's central bank said that the consumer price inflation is near the bottom of the central bank's 1.0% - 3.0% range due to falling energy prices, while the core consumer price inflation is above 2% due to a depreciation of Canadian dollar.

The BoC said that consumption in Canada performed relatively well due to lower oil prices.

The central bank also said that risks to the outlook for inflation have not changed and risks to financial stability are evolving as expected.

According to the central bank, financial conditions for Canadian households and firms remain highly stimulative.

The BoC decided that the current monetary policy remains appropriate.

-

15:54

Bank of Japan Deputy Governor Kikuo Iwata: the timing for achieving the central bank's 2% inflation target has been "somewhat delayed"

Bank of Japan Deputy Governor Kikuo Iwata said on Wednesday that the timing for achieving the central bank's 2% inflation target has been "somewhat delayed". He added that the inflation in Japan is likely to reach 2% target around the first half of next fiscal year as the underlying inflation was improving and as wages were increasing.

"Going forward, inflation is likely to accelerate. That will bring about a rise in inflation expectations, and such expectations are expected to remain firm," Iwata noted.

-

15:32

U.S. Stocks open: Dow +0.19%, Nasdaq +0.20%, S&P +0.17%

-

15:31

NBB business climate rises to -4.9 in May

The National Bank of Belgium (NBB) released its business survey on Wednesday. The business climate rose to -4.9 in May from -6.2 in April, beating forecasts for an increase to -6.0. It was the fourth consecutive monthly rise.

The gain was driven by increases in in all branches of activity.

The business climate index for the trade sector climbed to -1.8 in May from -8.2 in April.

The business climate index for the manufacturing sector rose to -6.4 in May from -7.3 in April due to more favourable assessments of total order books.

The business climate index for the services sector was up to 9.4 in May from 9 in April due to more optimistic outlook about future developments and due to general market demand.

The business climate index for the building sector increased to -13.9 in May from -15.6 in April due to more optimistic outlook about demand prospects and due to wider use of equipment.

-

15:28

Before the bell: S&P futures +0.07%, NASDAQ futures +0.12%

U.S. stock-index futures fluctuated amid mixed results from luxury retailers and an acquisition by Hormel Foods Corp.

Global markets:

Nikkei 20,472.58 +35.10 +0.17%

Hang Seng 28,081.21 -168.65 -0.60%

Shanghai Composite 4,941.71 +30.82 +0.63%

FTSE 6,990.97 +41.98 +0.60%

CAC 5,118.95 +35.41 +0.70%

DAX 11,639.66 +14.53 +0.12%

Crude oil $57.81 (-0.40%)

Gold $1184.00 (-0.19%)

-

15:15

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

General Motors Company, NYSE

GM

35.55

+0.08%

2.0K

Nike

NKE

103.51

+0.09%

0.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.10

+0.10%

1.2K

General Electric Co

GE

27.56

+0.15%

1.7K

The Coca-Cola Co

KO

41.05

+0.15%

0.7K

Verizon Communications Inc

VZ

49.50

+0.16%

5.4K

AT&T Inc

T

34.75

+0.23%

0.6K

Intel Corp

INTC

33.18

+0.23%

11.3K

McDonald's Corp

MCD

98.69

+0.23%

4.2K

ALTRIA GROUP INC.

MO

51.40

+0.23%

0.5K

American Express Co

AXP

80.38

+0.24%

0.3K

Johnson & Johnson

JNJ

101.07

+0.25%

0.2K

Barrick Gold Corporation, NYSE

ABX

11.69

+0.26%

44.5K

Google Inc.

GOOG

533.70

+0.26%

0.5K

International Business Machines Co...

IBM

170.60

+0.28%

1.9K

Microsoft Corp

MSFT

46.72

+0.28%

0.3K

Citigroup Inc., NYSE

C

54.40

+0.29%

2.9K

Goldman Sachs

GS

207.00

+0.30%

23.1K

Facebook, Inc.

FB

79.57

+0.30%

25.0K

ALCOA INC.

AA

12.80

+0.31%

3.4K

Apple Inc.

AAPL

130.05

+0.33%

217.0K

Ford Motor Co.

F

15.24

+0.33%

3.7K

Caterpillar Inc

CAT

88.14

+0.34%

1.7K

E. I. du Pont de Nemours and Co

DD

71.00

+0.35%

0.2K

Wal-Mart Stores Inc

WMT

75.16

+0.35%

6.6K

Twitter, Inc., NYSE

TWTR

36.65

+0.38%

22.6K

Cisco Systems Inc

CSCO

29.07

+0.41%

45.5K

Walt Disney Co

DIS

109.89

+0.41%

0.7K

Starbucks Corporation, NASDAQ

SBUX

51.05

+0.41%

0.2K

Procter & Gamble Co

PG

79.50

+0.45%

1.7K

Boeing Co

BA

143.50

+0.49%

2.2K

Amazon.com Inc., NASDAQ

AMZN

427.70

+0.52%

2.2K

Hewlett-Packard Co.

HPQ

33.58

+0.60%

0.4K

JPMorgan Chase and Co

JPM

66.14

+0.62%

0.8K

Tesla Motors, Inc., NASDAQ

TSLA

249.10

+0.66%

6.4K

Visa

V

69.00

+0.67%

2.8K

Exxon Mobil Corp

XOM

85.96

+0.71%

1.3K

Chevron Corp

CVX

103.23

-0.06%

18.9K

Yahoo! Inc., NASDAQ

YHOO

42.65

-0.46%

13.0K

Yandex N.V., NASDAQ

YNDX

18.00

-0.94%

0.3K

-

14:42

European Central Bank has not increased the ceiling for Emergency Liquidity Assistance

According to a person familiar with the matter, the European Central Bank (ECB) has not increased the ceiling for Emergency Liquidity Assistance (ELA) to Greek banks. The Bank of Greece has not requested to raise the ceiling. A Greek bank official noted that there is an unused liquidity buffer of €3 billion.

Under the ELA programme, the Greek central bank provides money to its country's financial institutions. The Bank of Greece has lent around €80.2 billion to Greek lenders.

-

12:00

European stock markets mid session: most stocks traded higher as concerns over the Greek debt crisis eased

Most stock indices traded higher as concerns over the Greek debt crisis eased.

The released economic from the Eurozone was mixed. German Gfk consumer confidence index climbed to 10.2 in June from 10.1 in May, beating expectations for a decline to 10.0. It was the highest level since October 2001.

The increase was driven by a strong domestic demand and low inflation.

"Private spending is a key driver for economic growth this year," Gfk noted. But Gfk warned that the debt talks between Greece and its creditors, the Ukraine crisis and IS terrorism may weigh on consumption in Germany.

French consumer confidence index fell to 93 in May from 94 in April, missing expectation for a rise to 95. It was the first fall in seven months.

The decline was driven by a pessimistic outlook regarding consumers' future saving capacity. The index of the outlook on consumers' saving capacity plunged to -5 in May from 4 April.

Current figures:

Name Price Change Change %

FTSE 100 6,993.62 +44.63 +0.64 %

DAX 11,667.32 +42.19 +0.36 %

CAC 40 5,118.3 +34.76 +0.68 %

-

11:43

UBS consumption index declines to 1.25 in April

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index decreased to 1.25 in April from 1.34 in March.

March's figure was revised down from 1.35.

The increase was driven by a drop in new car registrations. New car registrations fell 5.0% in April.

The retailer sentiment index remained unchanged at -13 in April.

-

11:31

French consumer confidence index declines to 93 in May

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index fell to 93 in May from 94 in April, missing expectation for a rise to 95. It was the first fall in seven months.

The decline was driven by a pessimistic outlook regarding consumers' future saving capacity. The index of the outlook on consumers' saving capacity plunged to -5 in May from 4 April.

-

11:18

German Gfk consumer confidence index rises to the highest level since October 2001

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 10.2 in June from 10.1 in May, beating expectations for a decline to 10.0. It was the highest level since October 2001.

The increase was driven by a strong domestic demand and low inflation.

"Private spending is a key driver for economic growth this year," Gfk noted. But Gfk warned that the debt talks between Greece and its creditors, the Ukraine crisis and IS terrorism may weigh on consumption in Germany.

-

11:02

Bank of Japan’s April monetary policy meeting minutes: the underlying inflation was improving

The Bank of Japan (BoJ) released its April monetary policy meeting minutes. According to minutes, the underlying inflation was improving. But many board members said that there were downside risks to consumer prices due to uncertainty about long-term inflation expectations, consumer spending and the output gap.

Some board members said that the country's consumer price inflation wouldn't reach the 2% target in fiscal 2017.

Most board members expect that the growth in fiscal 2017 could slow due to a planned sales tax hike.

Minutes showed that the central bank wants to continue its monetary policy until the 2% inflation target will be reached, and it will adjust its monetary policy if needed.

The BoJ decided to keep unchanged its monetary policy at its April meeting.

-

10:44

Real GDP in the OECD area climbs 0.3% in the first quarter

The Organization for Economic Cooperation and Development (OECD) released its real gross domestic product (GDP) growth figures on Tuesday. Real GDP of 34 OECD member countries rose 0.3% in the first quarter, after a 0.5% gain in the fourth quarter.

Real GDP of the United States was down to 0.1% from 0.5%, real GDP of Germany declined to 0.3% from 0.7%, while Britain's economy slowed to 0.3% from 0.6%.

GDP of France climbed to 0.6% from 0.0%, Italy's economy increased 0.3%, while Japan's GDP was up to 0.6% from 0.3%.

Eurozone's economy expanded at 0.4% in the first quarter, after a 0.3% rise in the fourth quarter. On a yearly basis,

GDP of 34 OECD member countries was up to 1.9% in the first quarter from 1.8% in the previous quarter.

-

10:28

European Central Bank Governing Council Member Ignazio Visco: the central bank should continue its quantitative easing until inflation in the Eurozone does not reach the central bank’s 2% target

European Central Bank (ECB) Governing Council Member Ignazio Visco said that the central bank should continue its quantitative easing until inflation in the Eurozone does not reach the central bank's 2% target.

He ruled out that the central bank's asset buying programme encourage risk taking on financial markets.

"There are no signs to date that low interest rates are provoking generalised imbalances," Visco noted.

-

10:15

Industrial profits in China rise 2.6% in April

China's National Bureau of Statistics released its industrial profits data on Wednesday. Industrial profits in China increased at an annual pace of 2.6% in April, after a 0.4% decline in March. It was the first annual rise since September 2014.

During the first four months of 2015, industrial profits were down 1.3% as compared to the same period last year.

Profit of the mining industry dropped at an annual pace of 60.7% in the January to April period, while profits in the manufacturing sector rose 6.2%.

-

04:06

Nikkei 225 20,423.39 -14.09 -0.07 %, Hang Seng 28,095.42 -154.44 -0.55 %, Shanghai Composite 4,919.46 +8.56 +0.17 %

-

00:30

Stocks. Daily history for Apr May 26’2015:

(index / closing price / change items /% change)

Nikkei 225 20,437.48 +23.71 +0.12 %

Hang Seng 28,249.86 +257.03 +0.92 %

S&P/ASX 200 5,773.4 +51.91 +0.91 %

Shanghai Composite 4,910.9 +97.10 +2.02 %

FTSE 100 6,948.99 -82.73 -1.18 %

CAC 40 5,083.54 -33.63 -0.66 %

Xetra DAX 11,625.13 -189.88 -1.61 %

S&P 500 2,104.2 -21.86 -1.03 %

NASDAQ Composite 5,032.75 -56.61 -1.11 %

Dow Jones 18,041.54 -190.48 -1.04 %

-