Noticias del mercado

-

22:07

Major US stock indexes completed the session in different directions

The main US stock indexes finished trading without a single dynamic amid weak revenues of large banks and failures in the legislative agenda of President Donald Trump after the Republicans' efforts to review the health care system failed.

Meanwhile, the US Bureau of Labor Statistics said that in June, import prices fell by 0.2% after a decrease of 0.1% in May. Lower fuel prices led to a decline in June, which more than offset the increase in prices for non-fuel products. The US export price index fell 0.2% in June after a 0.5% decrease in May.

In addition, the confidence of builders in the market of newly built single-family houses fell by two points in July to a level of 64 from the revised June index of the index of the National Association of House Builders (HMI). This is the lowest since November 2016. All three components of the HMI recorded losses in July, but are still on solid territory. The component measuring current sales conditions fell by 2 points to 70, and the sales forecast index in the next six months decreased by 2 points to 73. The component measuring consumer traffic decreased by 1 point to 48.

Oil prices rose by almost 1%, as increased demand absorbed some of the surplus supplies of OPEC and the United States. Support for oil was also provided by the general weakness of the dollar.

Most components of the DOW index recorded a decline (19 out of 30). Outsider were the shares of The Goldman Sachs Group, Inc. (GS, -2.62%). The leader of growth was the shares of Johnson & Johnson (JNJ, + 1.98%).

Most sectors of the S & P index showed an increase. The utilities sector grew most (+ 0.3%). The greatest decrease was shown by the sector of conglomerates (-0.6%).

At closing:

DJIA -0.25% 21.576.03 -53.69

Nasdaq + 0.47% 6.334.31 +29.88

S & P + 0.06% 2.460.65 +1.51

-

20:57

DJIA -0.29% 21,566.72 -63.00 Nasdaq +0.37% 6,337.90 +23.47 S&P -0.02% 2,458.54 -0.60

-

18:00

European stocks closed: FTSE 100 -13.91 7390.22 -0.19% DAX -156.77 12430.39 -1.25% CAC 40 -56.90 5173.27 -1.09%

-

15:32

U.S. Stocks open: Dow -0.28%, Nasdaq -0.19%, S&P -0.20%

-

15:23

Before the bell: S&P futures -0.22%, NASDAQ futures -0.30%

U.S. stock-index futures fell amid mixed earnings reports and concerns over the U.S. President Donald Trump's ability to implement his campaign pledges.

Global Stocks:

Nikkei 19,999.91 -118.95 -0.59%

Hang Seng 26,524.94 +54.36 +0.21%

Shanghai 3,186.93 +10.47 +0.33%

S&P/ASX 5,687.39 -68.08 -1.18%

FTSE 7,416.66 +38.27 +0.52%

CAC 5,185.29 -44.88 -0.86%

DAX 12,417.00 -170.16 -1.35%

Crude $46.72 (+1.52%)

Gold $1,238.40 (+0.38%)

-

14:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

210.99

-0.69(-0.33%)

320

ALTRIA GROUP INC.

MO

73.2

-0.17(-0.23%)

373

Amazon.com Inc., NASDAQ

AMZN

1,005.10

-4.94(-0.49%)

28093

Apple Inc.

AAPL

149.05

-0.51(-0.34%)

74367

AT&T Inc

T

36.4

0.01(0.03%)

4115

Barrick Gold Corporation, NYSE

ABX

16.28

0.20(1.24%)

13277

Caterpillar Inc

CAT

108.25

0.19(0.18%)

865

Chevron Corp

CVX

104.8

0.59(0.57%)

4041

Cisco Systems Inc

CSCO

31.53

0.03(0.10%)

1525

Citigroup Inc., NYSE

C

66.48

-0.35(-0.52%)

15762

Deere & Company, NYSE

DE

125.91

0.03(0.02%)

2583

Exxon Mobil Corp

XOM

81.1

0.24(0.30%)

1080

Facebook, Inc.

FB

159.87

0.14(0.09%)

58177

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.05

0.05(0.38%)

18960

General Electric Co

GE

26.81

-0.01(-0.04%)

7450

Goldman Sachs

GS

226.55

-2.71(-1.18%)

115471

Google Inc.

GOOG

954.99

1.57(0.16%)

1731

Home Depot Inc

HD

154.03

0.14(0.09%)

295

Intel Corp

INTC

34.37

-0.10(-0.29%)

521

International Business Machines Co...

IBM

153.1

0.09(0.06%)

2352

Johnson & Johnson

JNJ

132.92

0.77(0.58%)

64420

JPMorgan Chase and Co

JPM

90.87

-0.52(-0.57%)

13932

Microsoft Corp

MSFT

73.4

0.05(0.07%)

46429

Procter & Gamble Co

PG

87.57

0.02(0.02%)

569

Starbucks Corporation, NASDAQ

SBUX

58.35

0.02(0.03%)

1730

Tesla Motors, Inc., NASDAQ

TSLA

318.82

-0.75(-0.23%)

25803

The Coca-Cola Co

KO

44.81

0.08(0.18%)

4222

Twitter, Inc., NYSE

TWTR

19.85

-0.09(-0.45%)

33231

UnitedHealth Group Inc

UNH

186.75

0.40(0.21%)

10299

Verizon Communications Inc

VZ

43.75

0.09(0.21%)

919

Visa

V

97

0.17(0.18%)

13641

Wal-Mart Stores Inc

WMT

76.35

-0.02(-0.03%)

747

Walt Disney Co

DIS

104.7

-0.09(-0.09%)

902

Yandex N.V., NASDAQ

YNDX

31.47

0.13(0.41%)

3011

-

14:44

Target price changes before the market open

Visa (V) target raised to $112 from $104 at Jefferies

-

14:13

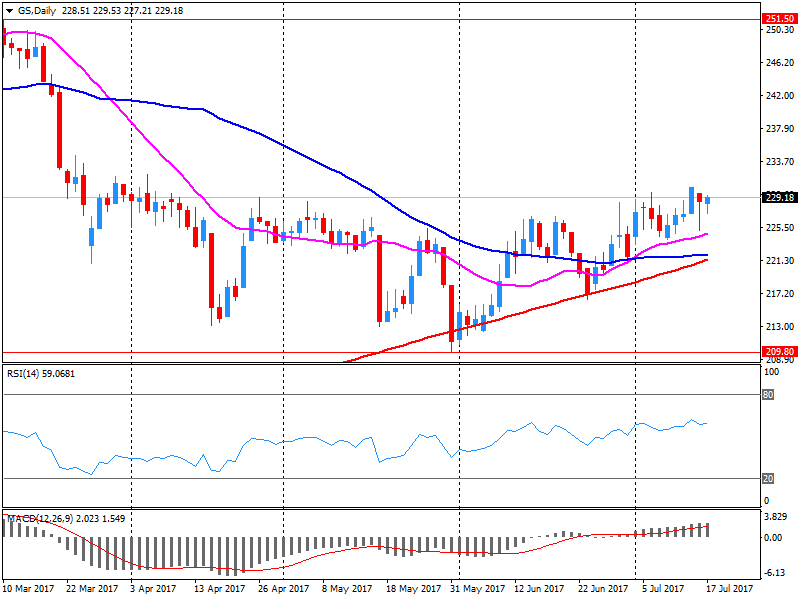

Company News: Goldman Sachs (GS) Q2 results beat analysts’ forecasts

Goldman Sachs (GS) reported Q2 FY 2017 earnings of $3.95 per share (versus $3.72 in Q2 FY 2016), beating analysts' consensus estimate of $3.39.

The company's quarterly revenues amounted to $7.887 bln (-0.6% y/y), beating analysts' consensus estimate of $7.475 bln.

GS fell to $227.01 (-0.98%) in pre-market trading.

-

14:11

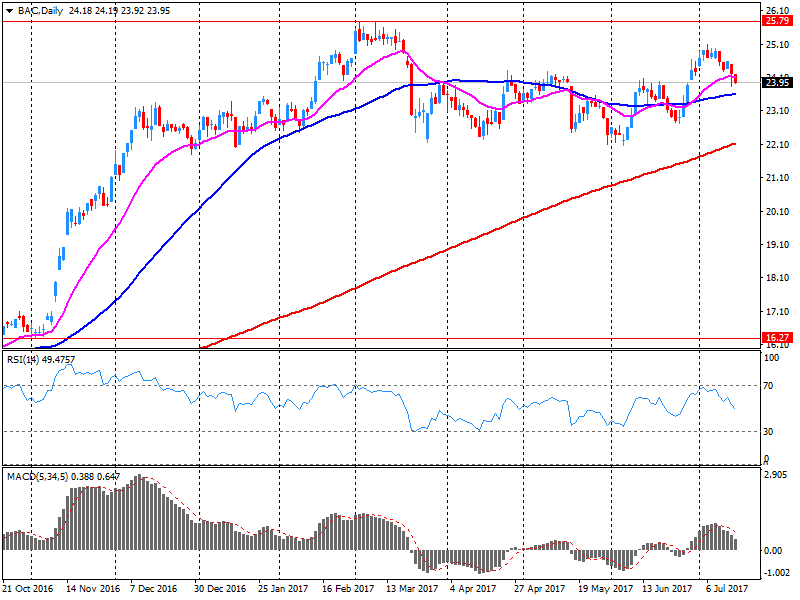

Company News: Bank of America (BAC) Q2 results beat analysts’ expectations

Bank of America (BAC) reported Q2 FY 2017 earnings of $0.46 per share (versus $0.36 in Q2 FY 2016), beating analysts' consensus estimate of $0.44.

The company's quarterly revenues amounted to $22.800 bln (+7.1% y/y), beating analysts' consensus estimate of $21.838 bln.

BAC fell to $23.80 (-0.92%) in pre-market trading.

-

14:07

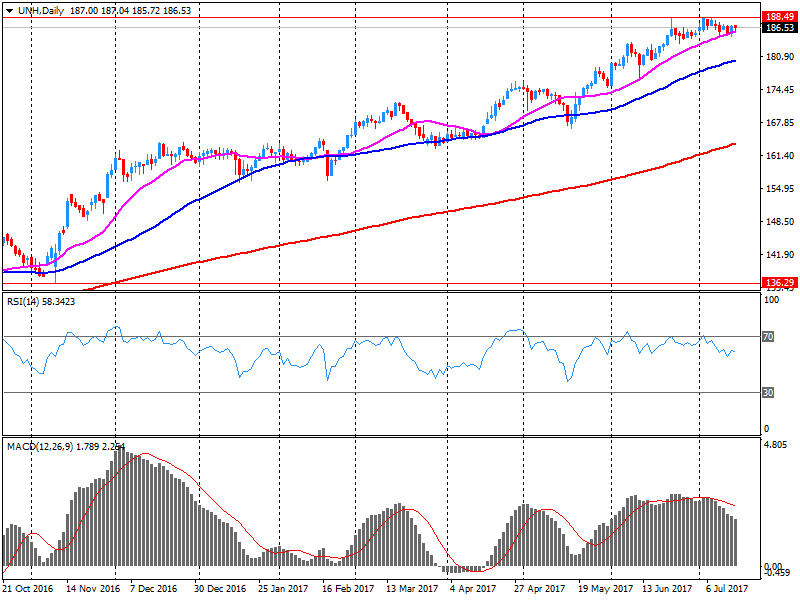

Company News: UnitedHealth (UNH) Q2 EPS beat analysts’ forecast

UnitedHealth (UNH) reported Q2 FY 2017 earnings of $2.46 per share (versus $1.96 in Q2 FY 2016), beating analysts' consensus estimate of $2.38.

The company's quarterly revenues amounted to $50.053 bln (+7.7% y/y), generally in-line with analysts' consensus estimate of $49.973 bln.

The company also improved guidance for FY 2017, projecting EPS of $9.75-9.90 compared to prior $9.65-9.85 and analysts' consensus estimate of $9.80.

UNH rose to $186.50 (+0.08%) in pre-market trading.

-

14:05

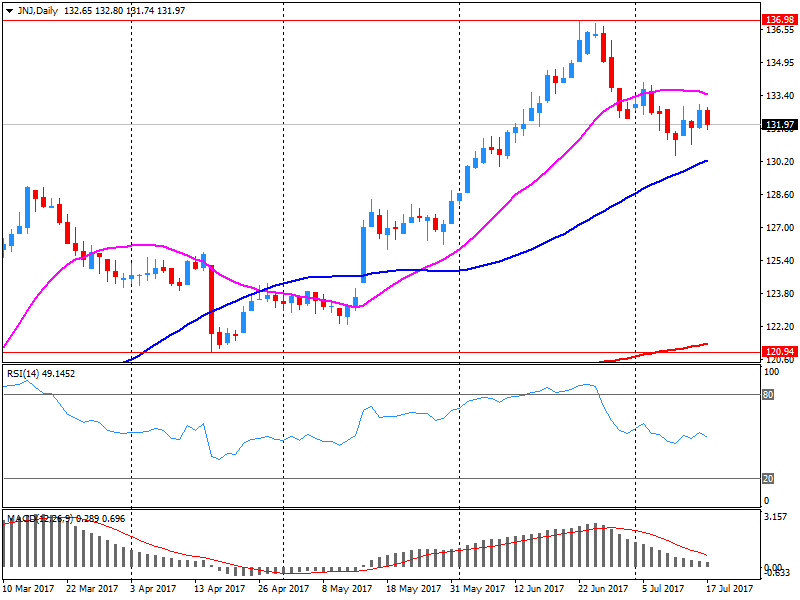

Company News: Johnson & Johnson (JNJ) Q2 EPS beat analysts’ estimate

Johnson & Johnson (JNJ) reported Q2 FY 2017 earnings of $1.83 per share (versus $1.74 in Q2 FY 2016), beating analysts' consensus estimate of $1.79.

The company's quarterly revenues amounted to $18.839 bln (+1.9% y/y), generally in-line with analysts' consensus estimate of $18.942 bln.

The company also issued upside guidance for FY 2017, raising EPS forecast to $7.12-7.22 from $7.00-7.15, (versus analysts' consensus estimate of $7.11) and revenues expectations to $75.8-76.1 bln from $75.4-76.1 bln (versus analysts' consensus estimate of $75.65 bln).

JNJ rose to $133.51 (+1.03%) in pre-market trading.

-

09:51

Major stock markets in Europe trading in the red zone: FTSE 7382.28 -21.85 -0.30%, DAX 12540.43 -46.73 -0.37%, CAC 5213.30 -16.87

-

08:32

Negative start of trading expected on the main European stock markets: DAX -0.2%, CAC 40 -0.1%, FTSE 100 flat

-

07:37

Global Stocks

Stocks in Europe broadly logged a steady finish Monday, with mining shares bumped higher after China's quarterly growth figures topped expectations.

U.S. stocks finished little changed Monday, after a session of struggling to push higher only to fall short of records, as investors looked toward key quarterly results that will be released this week to set the tone.

Asian shares were broadly weaker Tuesday, with Chinese stocks stabilizing after Monday's slump and Japanese stocks falling in reaction to the dollar's weakness. Tokyo investors returned from their Monday holiday and sold shares in reaction to the slide in the dollar on Friday after disappointing U.S. economic data added to skepticism about more Federal Reserve rate increases this year.

-

00:17

Stocks. Daily history for Jul 17’2017:

(index / closing price / change items /% change)

Nikkei +19.05 20118.86 +0.09%

TOPIX +6.37 1625.48 +0.39%

Hang Seng +81.35 26470.58 +0.31%

CSI 300 -39.53 3663.56 -1.07%

Euro Stoxx 50 -9.59 3516.35 -0.27%

FTSE 100 +25.74 7404.13 +0.35%

DAX -44.56 12587.16 -0.35%

CAC 40 -5.14 5230.17 -0.10%

DJIA -8.02 21629.72 -0.04%

S&P 500 -0.13 2459.14 -0.01%

NASDAQ +1.97 6314.43 +0.03%

S&P/TSX -9.45 15165.36 -0.06%

-