Noticias del mercado

-

22:06

The main US stock indices grew moderately following the results of today's trading

The main US stock indexes finished the auction with an increase, updating the record highs, which contributed to corporate reporting and statistics on the US housing market. At the same time, a significant decline in IBM shares prevented the Dow index from showing more serious growth.

According to the Ministry of Trade, housing construction finished the second quarter on a stronger note, as the bookings of new houses were restored in June at the fastest pace in four months. The laying of new homes increased by 8.3% to 1.22 million units (recalculated for annual rates). The laying of new houses for May was revised to 1.12 million from 1.09 million. Construction permits grew by 7.4% to 1.25 million per annum. The construction of single-family houses grew by 6.3% to 849,000 on an annualized basis. Bookmarks for apartment buildings jumped by 13.3% in June, to 366,000 in annual terms.

Oil prices rose by more than 1.5%, receiving support from statistics on oil products in the US, which indicated a more significant than expected decline in oil reserves. The US Energy Ministry reported that in the week of July 8-14, oil reserves fell by 4.727 million barrels to 490.62 million barrels. Analysts had expected a reduction of only 3.21 million barrels. Oil reserves in the Cushing terminal fell by 23 thousand barrels to 57.54 million barrels.

Most components of the DOW index recorded a rise (24 out of 30). The leader of growth was the shares of E. I. du Pont de Nemours and Company (DD, + 1.55%). Outsider were the shares of International Business Machines Corporation (IBM, -4.39%).

All sectors of the S & P index showed growth. The maximum increase was shown by the conglomerate sector (+ 1.2%).

At closing:

DJIA + 0.29% 21.636.50 +61.77

Nasdaq + 0.64% 6.385.04 +40.73

S & P + 0.53% 2.473.67 +13.06

-

20:59

DJIA +0.20% 21,618.68 +43.95 Nasdaq +0.66% 6,385.90 +41.59 S&P +0.45% 2,471.61 +11.00

-

18:00

European stocks closed: FTSE 100 +40.69 7430.91 +0.55% DAX +21.66 12452.05 +0.17% CAC 40 +42.80 5216.07 +0.83%

-

15:31

U.S. Stocks open: Dow +0.06%, Nasdaq +0.29%, S&P +0.16%

-

15:13

Before the bell: S&P futures +0.11%, NASDAQ futures +0.28%

U.S. stock-index futures rose slightly as investors focused on Q2 earnings reports of the U.S. companies.

Global Stocks:

Nikkei 20,020.86 +20.95 +0.10%

Hang Seng 26,672.16 +147.22 +0.56%

Shanghai 3,232.87 +45.30 +1.42%

S&P/ASX 5,732.13 +44.73 +0.79%

FTSE 7,409.90 +19.68 +0.27%

CAC 5,190.43 +17.16 +0.33%

DAX 12,441.59 +11.20 +0.09%

Crude $46.45 (+0.11%)

Gold $1,240.80 (-0.09%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

210.99

-0.69(-0.33%)

320

ALTRIA GROUP INC.

MO

73.2

-0.17(-0.23%)

373

Amazon.com Inc., NASDAQ

AMZN

1,005.10

-4.94(-0.49%)

28093

Apple Inc.

AAPL

149.05

-0.51(-0.34%)

74367

AT&T Inc

T

36.4

0.01(0.03%)

4115

Barrick Gold Corporation, NYSE

ABX

16.28

0.20(1.24%)

13277

Caterpillar Inc

CAT

108.25

0.19(0.18%)

865

Chevron Corp

CVX

104.8

0.59(0.57%)

4041

Cisco Systems Inc

CSCO

31.53

0.03(0.10%)

1525

Citigroup Inc., NYSE

C

66.48

-0.35(-0.52%)

15762

Deere & Company, NYSE

DE

125.91

0.03(0.02%)

2583

Exxon Mobil Corp

XOM

81.1

0.24(0.30%)

1080

Facebook, Inc.

FB

159.87

0.14(0.09%)

58177

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.05

0.05(0.38%)

18960

General Electric Co

GE

26.81

-0.01(-0.04%)

7450

Goldman Sachs

GS

226.55

-2.71(-1.18%)

115471

Google Inc.

GOOG

954.99

1.57(0.16%)

1731

Home Depot Inc

HD

154.03

0.14(0.09%)

295

Intel Corp

INTC

34.37

-0.10(-0.29%)

521

International Business Machines Co...

IBM

153.1

0.09(0.06%)

2352

Johnson & Johnson

JNJ

132.92

0.77(0.58%)

64420

JPMorgan Chase and Co

JPM

90.87

-0.52(-0.57%)

13932

Microsoft Corp

MSFT

73.4

0.05(0.07%)

46429

Procter & Gamble Co

PG

87.57

0.02(0.02%)

569

Starbucks Corporation, NASDAQ

SBUX

58.35

0.02(0.03%)

1730

Tesla Motors, Inc., NASDAQ

TSLA

318.82

-0.75(-0.23%)

25803

The Coca-Cola Co

KO

44.81

0.08(0.18%)

4222

Twitter, Inc., NYSE

TWTR

19.85

-0.09(-0.45%)

33231

UnitedHealth Group Inc

UNH

186.75

0.40(0.21%)

10299

Verizon Communications Inc

VZ

43.75

0.09(0.21%)

919

Visa

V

97

0.17(0.18%)

13641

Wal-Mart Stores Inc

WMT

76.35

-0.02(-0.03%)

747

Walt Disney Co

DIS

104.7

-0.09(-0.09%)

902

Yandex N.V., NASDAQ

YNDX

31.47

0.13(0.41%)

3011

-

14:42

Analyst coverage initiations before the market open

NIKE (NKE) initiated with a Hold at Needham

-

14:40

Target price changes before the market open

UnitedHealth (UNH) target raised to $235 from $200 at Mizuho

Facebook (FB) target raised to $185 from $165 at Needham

-

14:40

Downgrades before the market open

Goldman Sachs (GS) downgraded to Mkt Perform from Outperform at Keefe Bruyette

-

14:39

Upgrades before the market open

Boeing (BA) upgraded to Neutral from Underperform at BofA/Merrill

-

13:46

Company News: Morgan Stanley (MS) quarterly results beat analysts’ expectations

Morgan Stanley (MS) reported Q2 FY 2017 earnings of $0.87 per share (versus $0.75 in Q2 FY 2016), beating analysts' consensus estimate of $0.77.

The company's quarterly revenues amounted to $9.503 bln (+6.7% y/y), beating analysts' consensus estimate of $9.052 bln.

MS rose to $46.10 (+2.13%) in pre-market trading.

-

13:44

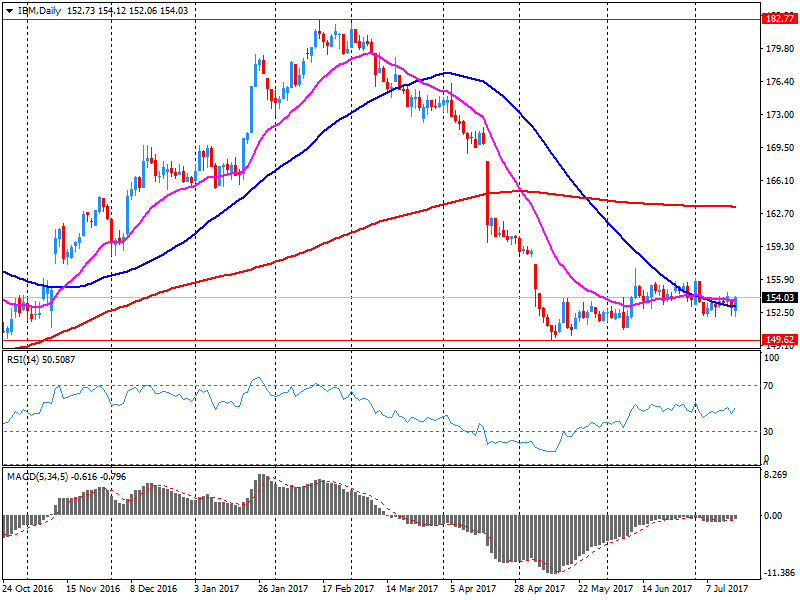

Company News: IBM (IBM) Q2 EPS beat analysts’ estimate

IBM (IBM) reported Q2 FY 2017 earnings of $2.97 per share (versus $2.95 in Q2 FY 2016), beating analysts' consensus estimate of $2.74.

The company's quarterly revenues amounted to $19.289 bln (-4.7% y/y), generally in-line with analysts' consensus estimate of $19.452 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of 'at least' $13.80 versus analysts' consensus estimate of $13.68.

IBM fell to $149.50 (-2.92%) in pre-market trading.

-

09:35

Major stock markets in Europe trading mixed: FTSE 7387.42 -2.80 -0.04%, DAX 12449.49 +19.10 + 0.15%, CAC 5182.42 +9.15 + 0.18%

-

08:56

Negative start of trading expected on the main European stock markets: DAX -0.2%, CAC 40 -0.1%, FTSE 100 flat

-

07:30

Global Stocks

Equity markets lacked direction in Asia on Wednesday, as was the case overnight in the U.S., though Australian stocks outperformed on strong gains among the country's biggest banks. Markets are expected to remain in narrow ranges ahead of policy statements from the European and Japanese central banks, due Thursday. Some investors are avoiding aggressive trading as a result.

Stocks across Europe dropped on Tuesday, with the exporter-heavy DAX 30 index DAX, -1.25% ending 1.3% lower at 12,430.39-its worst session since June 29. More broadly, European benchmarks finished the session under pressure as the euro stepped up to a 14-month high against the U.S. dollar and as disappointing corporate earnings reports rolled in. A stronger euro can hurt European exporters as it makes products more expensive for overseas customers.

The S&P 500 and the Nasdaq closed at records on Tuesday as gains in tech stocks offset weakness in telecom services and energy shares. A surge in Netflix Inc. NFLX, +13.54% shares on the back of strong earnings gave the broader tech sector a boost and helped to underpin the large-cap index push into the positive territory.

-

00:30

Stocks. Daily history for Jul 18’2017:

(index / closing price / change items /% change)

Nikkei -118.95 19999.91 -0.59%

TOPIX -5.00 1620.48 -0.31%

Hang Seng +54.36 26524.94 +0.21%

CSI 300 +3.62 3667.18 +0.10%

Euro Stoxx 50 -37.67 3478.68 -1.07%

FTSE 100 -13.91 7390.22 -0.19%

DAX -156.77 12430.39 -1.25%

CAC 40 -56.90 5173.27 -1.09%

DJIA -54.99 21574.73 -0.25%

S&P 500 +1.47 2460.61 +0.06%

NASDAQ +29.87 6344.31 +0.47%

S&P/TSX -15.79 15149.57 -0.10%

-