Noticias del mercado

-

22:07

Major US stock indexes finished trading near the zero mark

Major US stock indexes finished the session almost unchanged, which was due to the fall of the industrial goods sector and the disappointing returns of some large companies.

As the report presented by the Federal Reserve Bank of Philadelphia showed, the index of business activity in the production sector fell in June, reaching a level of 19.5 points compared to 27.6 points in June. Economists had expected a decline to 24 points. The index is the results of a survey of manufacturers in Philadelphia for their attitude to the current economic situation. The indicator is published a little earlier than the index of purchasing managers ISM and can give an idea of what the indicator of business activity at the national level will be. The values of the index above zero indicate an expansion in the industry, below zero the reduction.

In addition, the number of Americans applying for unemployment benefits declined in mid-July and fluctuated at almost 44-year low, reflecting the healthiest labor market in the last ten years. Initial applications for unemployment benefits in the period from July 9 to July 15 fell by 15,000 to 233,000, taking into account seasonal fluctuations, the report of the Ministry of Labor said on Thursday. This corresponds to the second level since the recession of 2007-09.

Most components of the DOW index recorded a rise (17 out of 30). Leader of the growth were shares of NIKE, Inc. (NKE, + 2.27%). Outsider was the shares of The Home Depot, Inc. (HD, -4.01%).

Most sectors of S & P completed the auction in positive territory. The healthcare sector grew most (+ 0.8%). The largest decrease was registered in the sector of industrial goods (-0.5%).

At closing:

DJIA -0.11% 21.616.44 -24.31

Nasdaq + 0.08% 6,390.00 +4.96

S & P -0.00% 2,473.76 -0.07

-

21:00

DJIA -0.02% 21,636.17 -4.58 Nasdaq +0.02% 6,386.39 +1.35 S&P +0.07% 2,475.64 +1.81

-

18:00

European stocks closed: FTSE 100 +56.96 7487.87 +0.77% DAX -4.80 12447.25 -0.04% CAC 40 -16.85 5199.22 -0.32%

-

15:32

U.S. Stocks open: Dow +0.08%, Nasdaq +0.16%, S&P +0.12%

-

15:24

Before the bell: S&P futures +0.04%, NASDAQ futures +0.16%

U.S. stock-index futures rose slightly as investors focused on latest data from the U.S. labour market, Q2 earnings reports and the European Central Bank and the Bank of Japan's decisions to leave their policies unchanged.

Global Stocks:

Nikkei 20,144.59 +123.73 +0.62%

Hang Seng 26,740.21 +68.05 +0.26%

Shanghai 26,740.21 +68.05 +0.26%

S&P/ASX 5,761.45 +29.33 +0.51%

FTSE 7,482.56 +51.65 +0.70%

CAC 5,220.64 +4.57 +0.09%

DAX 12,509.52 +57.47 +0.46%

Crude $47.63 (+0.66%)

Gold $1,237.80 (-0.34%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

35.65

-0.85(-2.33%)

17410

ALTRIA GROUP INC.

MO

73.15

-0.40(-0.54%)

2720

American Express Co

AXP

84.3

-1.63(-1.90%)

14991

Apple Inc.

AAPL

151.29

0.27(0.18%)

55953

AT&T Inc

T

36.25

0.12(0.33%)

18564

Barrick Gold Corporation, NYSE

ABX

16.12

-0.01(-0.06%)

16107

Boeing Co

BA

211.25

0.37(0.18%)

430

Cisco Systems Inc

CSCO

32

0.10(0.31%)

1269

Citigroup Inc., NYSE

C

66.55

-0.15(-0.22%)

867

E. I. du Pont de Nemours and Co

DD

85.58

0.23(0.27%)

1455

Exxon Mobil Corp

XOM

81

0.15(0.19%)

4670

Ford Motor Co.

F

11.75

0.07(0.60%)

62153

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.15

0.04(0.31%)

3318

General Electric Co

GE

27

0.06(0.22%)

46449

Google Inc.

GOOG

973

2.11(0.22%)

1484

Hewlett-Packard Co.

HPQ

18.95

0.25(1.34%)

15411

Home Depot Inc

HD

153

-0.30(-0.20%)

4056

International Business Machines Co...

IBM

147.6

0.07(0.05%)

2290

Johnson & Johnson

JNJ

135.5

0.29(0.21%)

425

McDonald's Corp

MCD

154.3

0.41(0.27%)

603

Microsoft Corp

MSFT

74.15

0.29(0.39%)

101380

Nike

NKE

59.15

1.38(2.39%)

31701

Pfizer Inc

PFE

33.33

-0.29(-0.86%)

3955

Starbucks Corporation, NASDAQ

SBUX

57.98

-0.13(-0.22%)

7898

Tesla Motors, Inc., NASDAQ

TSLA

326.75

1.49(0.46%)

40150

The Coca-Cola Co

KO

44.85

0.02(0.04%)

850

Travelers Companies Inc

TRV

124.5

-1.96(-1.55%)

401

Twitter, Inc., NYSE

TWTR

20.18

0.06(0.30%)

4893

Visa

V

98.8

0.55(0.56%)

18976

Wal-Mart Stores Inc

WMT

75.64

-0.23(-0.30%)

815

Walt Disney Co

DIS

106.85

0.03(0.03%)

394

Yandex N.V., NASDAQ

YNDX

31.01

-0.09(-0.29%)

1050

-

14:42

Analyst coverage initiations before the market open

Tesla (TSLA) initiated with a Neutral at Citigroup; target $357

-

14:41

Analyst coverage resumption before the market open

Johnson & Johnson (JNJ) resumed with a Outperform at Credit Suisse; target $148

-

14:41

Downgrades before the market open

Pfizer (PFE) downgraded to Neutral from Outperform at Credit Suisse

-

14:40

Upgrades before the market open

NIKE (NKE) upgraded Overweight from Equal-Weight at Morgan Stanley; target $68

HP (HPQ) upgraded to Outperform at RBC Capital Mkts; target raised to $22 from $21

-

14:16

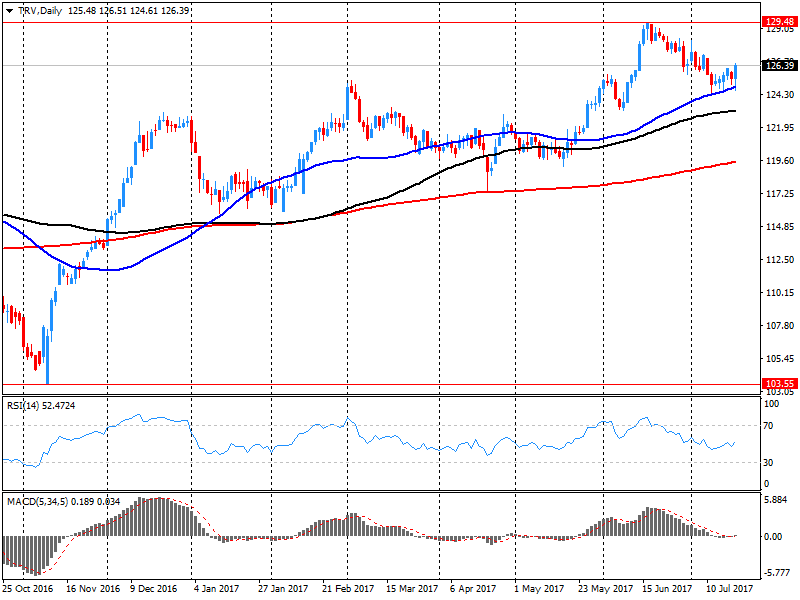

Company News: Travelers (TRV) Q2 EPS miss analysts’ estimate

Travelers (TRV) reported Q2 FY 2017 earnings of $1.92 per share (versus $2.20 in Q2 FY 2016), missing analysts' consensus estimate of $2.14.

The company's quarterly revenues amounted to $6.351 bln (+4.7% y/y), generally in-line with analysts' consensus estimate of $6.314 bln.

TRV fell to $124.50 (-1.55%).in pre-market trading.

-

14:09

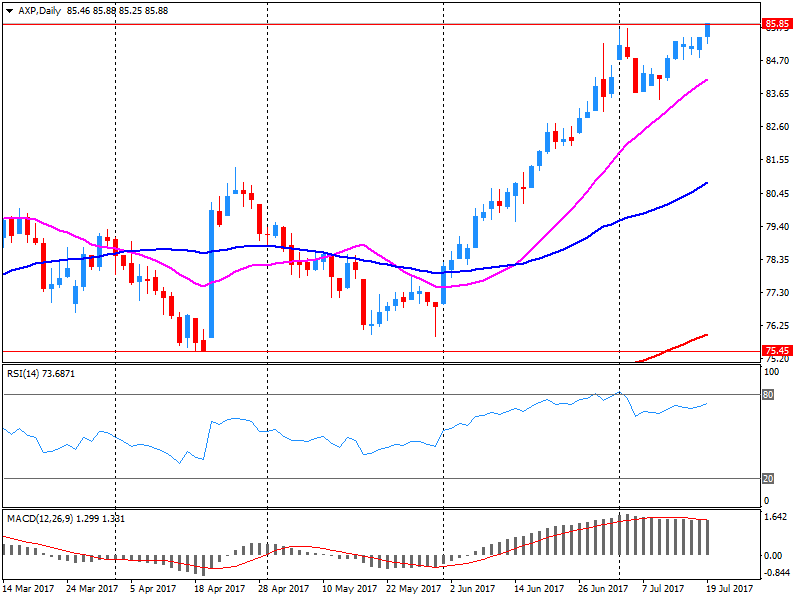

Company News: American Express (AXP) Q2 results beat analysts’ expectations

American Express (AXP) reported Q2 FY 2017 earnings of $1.47 per share (versus $2.10 in Q2 FY 2016), beating analysts' consensus estimate of $1.44.

The company's quarterly revenues amounted to $8.307 bln (+0.9% y/y), beating analysts' consensus estimate of $8.205 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $5.60-5.80 analysts' consensus estimate of $5.70.

AXP fell to $84.90 (-1.2%) in pre-market trading.

-

13:42

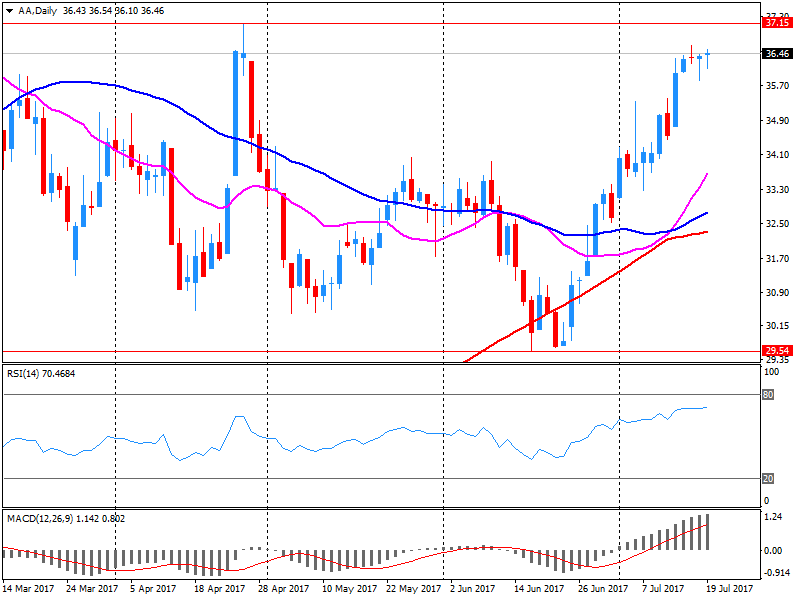

Company News: Alcoa (AA) Q2 EPS beat analysts’ estimate

Alcoa (AA) reported Q2 FY 2017 earnings of $0.62 per share (versus $0.15 in Q2 FY 2016), beating analysts' consensus estimate of $0.58.

The company's quarterly revenues amounted to $2.859 bln (+23.1% y/y), slightly missing analysts' consensus estimate of $2.879 bln.

AA fell to $35.70 (-2.19%) in pre-market trading.

-

09:37

Major European stock exchanges trading in the green zone: FTSE 7450.50 +19.59 + 0.26%, DAX 12520.42 +68.37 + 0.55%, CAC 5243.46 +27.39 + 0.53%

-

08:57

Positive start of trading expected on the main European stock markets: DAX + 0.6%, CAC 40 + 0.4%, FTSE 100 + 0.3%

-

07:32

Global Stocks

Equity markets in Asia extended overnight gains in the U.S. early Thursday, lifted by expectations of upbeat earnings reports and higher oil prices, though investor caution over central-bank action has capped the upside. Investors were awaiting central-bank decisions by the Bank of Japan - which maintained its monetary policy Thursday and pushed back its inflation goal - and the European Central Bank, due later in the day. While the banks were widely expected to stand pat, the focus now is on any fresh guidance from the ECB toward tighter monetary policy.

European stocks finished with solid gains Wednesday, carried by well-received corporate earnings reports including from Swedish appliance maker Electrolux AB, while a more than $4 billion deal drew Reckitt Benckiser Group PLC shares higher .

U.S. stock-index gauges on Wednesday carved out fresh all-time highs, with the Dow joining the S&P 500 and Nasdaq at records. Better-than-expected results from Morgan Stanley helped to reaffirm optimism about the current economy and earnings season-factors crucial to supporting current levels considered lofty.

-

01:31

Stocks. Daily history for Jul 19’2017:

(index / closing price / change items /% change)

Nikkei +20.95 20020.86 +0.10%

TOPIX +1.39 1621.87 +0.09%

Hang Seng +147.22 26672.16 +0.56%

CSI 300 +62.57 3729.75 +1.71%

Euro Stoxx 50 +21.60 3500.28 +0.62%

FTSE 100 +40.69 7430.91 +0.55%

DAX +21.66 12452.05 +0.17%

CAC 40 +42.80 5216.07 +0.83%

DJIA +66.02 21640.75 +0.31%

S&P 500 +13.22 2473.83 +0.54%

NASDAQ +40.74 6385.04 +0.64%

S&P/TSX +95.14 15244.71 +0.63%

-