Noticias del mercado

-

22:11

Major US stock closed below the zero mark

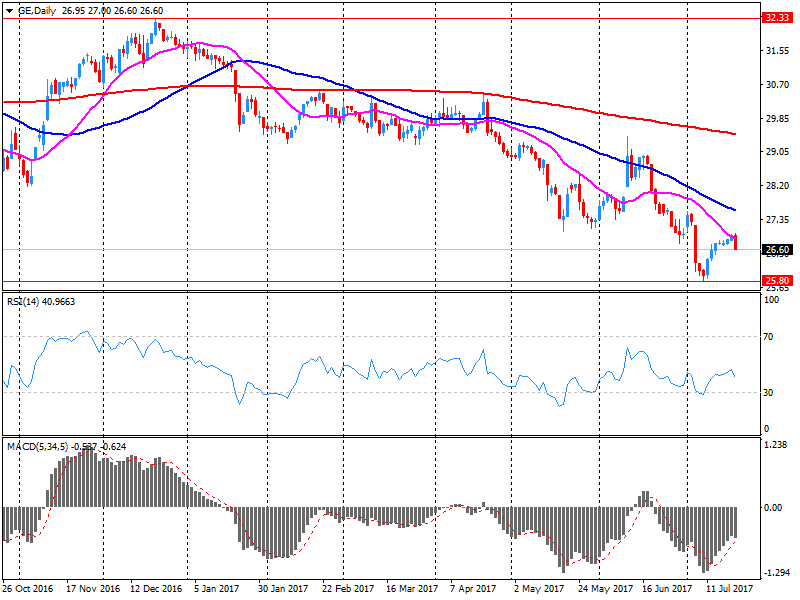

Major US stock indexes fell slightly, retreating from record levels, due to the weak reporting of the industrial heavyweight General Electric (GE) and a significant drop in oil prices.

As it became known, GE net profit fell by 34% per annum in the first half of 2017, to $ 1.9 billion. Revenues decreased by 7% to $ 57.2 billion. In the second quarter, GE net profit amounted to $ 1.4 billion , Which was 2.1 times less than last year. Revenue fell 12% to $ 29.6 billion.

Oil fell by about 2.7%, continuing yesterday's dynamics, which was due to another concern about the persistence of oil surplus in the world market after reports of growth in OPEC supplies in July. Supplies from OPEC members in July will exceed 33 million barrels per day, which is more than 600,000 barrels per day more than the average in the first half of 2017, according to Petro-Logistics SA, which tracks tanker movements.

Next week, Exxon Mobil (XOM), Chevron (CVX), Verizon (VZ), Boeing (BA), Procter & Gamble (PG), Intel (INTC), Caterpillar (CAT), Merck (MRK), Coca -Cola (KO), 3M (MMM) and many others. In addition, an important event next week will be a meeting of the Fed, which is scheduled for July 25-26.

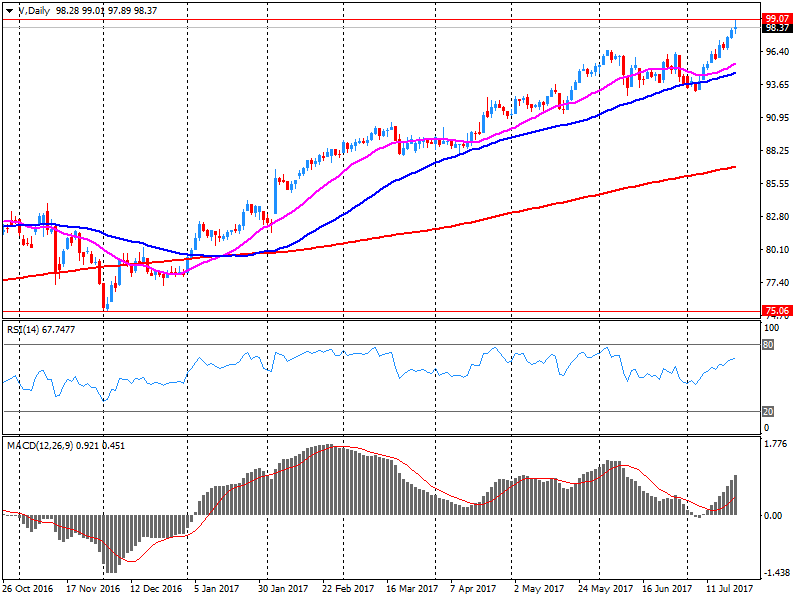

Most components of the DOW index finished trading in the red (19 out of 30). Leader of growth were shares of Visa Inc. (V, + 1.50%). Outsider were shares of General Electric (GE, -2.92%).

S & P sectors demonstrated mixed dynamics. The utilities sector grew most (+ 0.7%). The largest decrease was shown by the sector of basic materials (-0.8%).

At this moment:

Dow -0.15% 21.580.07 -31.71

Nasdaq -0.04% 6.387.75 -2.25

S & P -0.04% 2.472.54 -0.91

-

21:00

DJIA -0.20% 21,569.48 -42.30 Nasdaq -0.14% 6,380.81 -9.19 S&P -0.12% 2,470.41 -3.04

-

18:00

European stocks closed: FTSE 100 -34.96 7452.91 -0.47% DAX -207.19 12240.06 -1.66% CAC 40 -81.56 5117.66 -1.57%

-

15:32

U.S. Stocks open: Dow -0.21%, Nasdaq -0.15%, S&P -0.20%

-

15:27

Before the bell: S&P futures -0.12%, NASDAQ futures -0.28%

U.S. stock-index futures fell slightly as investors digested a slew of earnings from notable companies like Microsoft (MSFT), General Electric (GE), Honeywell (HON) and Visa (V), among others.

Global Stocks:

Nikkei 20,099.75 -44.84 -0.22%

Hang Seng 26,706.09 -34.12 -0.13%

Shanghai 3,238.16 -6.71 -0.21%

S&P/ASX 5,722.84 38.61 -0.67%

FTSE 7,477.81 -10.06 -0.13%

CAC 5,147.73 -51.49 -0.99%

DAX 12,255.53 -191.72 -1.54%

Crude $46.50 (-0.90%)

Gold $1,251.70 (+0.50%)

-

15:09

Target price changes before the market open

Visa (V) target raised to o $111 from $98 at RBC Capital

Visa (V) target raised to $114 from $107 at JPM

Visa (V) target raised to $107 from $105 at Cowen & Co.

Visa (V) target raised to $120 from $105 at Instinet

Microsoft (MSFT) target raised to $86 from $75 at BMO

-

15:08

Downgrades before the market open

Johnson & Johnson (JNJ) downgraded to Sell from Neutral at BTIG Research

Johnson & Johnson (JNJ) downgraded to Underweight from Neutral at Alembic Global Advisors

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

36.5

-0.22(-0.60%)

641

ALTRIA GROUP INC.

MO

73.5

-0.09(-0.12%)

1472

Amazon.com Inc., NASDAQ

AMZN

1,021.00

-7.70(-0.75%)

17869

Apple Inc.

AAPL

150.1

-0.24(-0.16%)

31407

AT&T Inc

T

36.57

0.05(0.14%)

849

Barrick Gold Corporation, NYSE

ABX

16.49

0.17(1.04%)

22270

Cisco Systems Inc

CSCO

31.8

-0.06(-0.19%)

5352

Citigroup Inc., NYSE

C

66.2

-0.16(-0.24%)

6151

Exxon Mobil Corp

XOM

80.85

-0.01(-0.01%)

685

Facebook, Inc.

FB

164.28

-0.25(-0.15%)

35212

Ford Motor Co.

F

11.63

-0.07(-0.60%)

136235

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.15

0.11(0.84%)

30717

General Electric Co

GE

25.91

-0.78(-2.92%)

2539638

General Motors Company, NYSE

GM

36.1

-0.31(-0.85%)

6138

Goldman Sachs

GS

221.75

-0.55(-0.25%)

8787

Google Inc.

GOOG

968

-0.15(-0.02%)

1439

Hewlett-Packard Co.

HPQ

18.95

0.01(0.05%)

3521

Home Depot Inc

HD

147.7

0.67(0.46%)

10313

HONEYWELL INTERNATIONAL INC.

HON

135.25

0.30(0.22%)

7520

International Business Machines Co...

IBM

147.6

-0.06(-0.04%)

289

Johnson & Johnson

JNJ

135.7

-0.87(-0.64%)

2002

JPMorgan Chase and Co

JPM

90.95

-0.25(-0.27%)

2931

McDonald's Corp

MCD

154.7

0.49(0.32%)

343

Microsoft Corp

MSFT

74

-0.22(-0.30%)

1484857

Nike

NKE

58.84

-0.26(-0.44%)

2278

Pfizer Inc

PFE

33.64

0.10(0.30%)

1078

Procter & Gamble Co

PG

88.38

-0.22(-0.25%)

2637

Starbucks Corporation, NASDAQ

SBUX

58

-0.03(-0.05%)

2381

Tesla Motors, Inc., NASDAQ

TSLA

329.2

-0.72(-0.22%)

20484

The Coca-Cola Co

KO

44.99

0.17(0.38%)

215

Twitter, Inc., NYSE

TWTR

20.36

-0.17(-0.83%)

56744

Visa

V

98.8

0.69(0.70%)

58103

Yandex N.V., NASDAQ

YNDX

31.3

-0.06(-0.19%)

1300

-

14:55

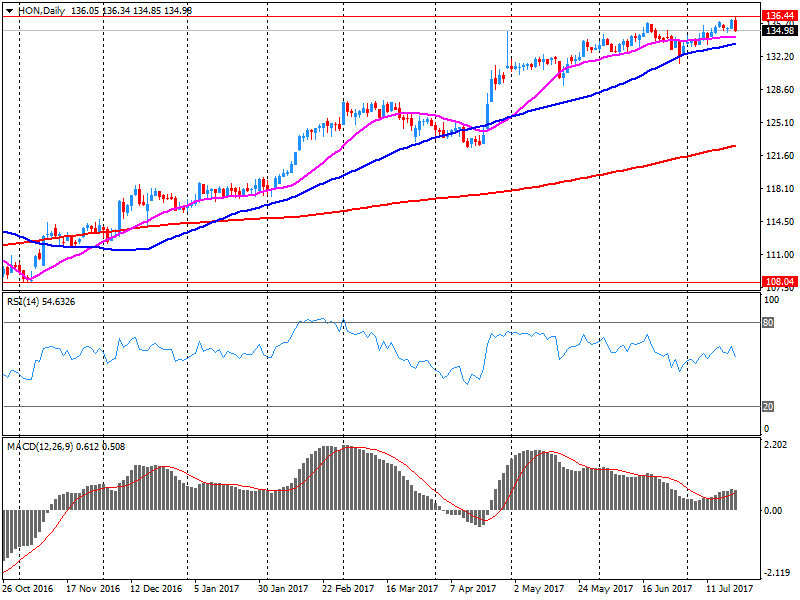

Company News: Honeywell (HON) quarterly results beat analysts’ expectations

Honeywell (HON) reported Q2 FY 2017 earnings of $1.80 per share (versus $1.64 in Q2 FY 2016), beating analysts' consensus estimate of $1.78.

The company's quarterly revenues amounted to $10.078 bln (+0.9% y/y), beating analysts' consensus estimate of $9.886 bln.

HON rose to $135.25 (+0.22%) in pre-market trading.

-

14:49

Company News: General Electric (GE) quarterly results beat analysts’ estimates

General Electric (GE) reported Q2 FY 2017 earnings of $0.28 per share (versus $0.51 in Q2 FY 2016), beating analysts' consensus estimate of $0.25.

The company's quarterly revenues amounted to $29.558 bln (-11.8% y/y), beating analysts' consensus estimate of $29.068 bln.

GE fell to $25.85 (-3.15%) in pre-market trading.

-

14:44

Company News: Visa (V) quarterly results beat analysts’ forecasts

Visa (V) reported Q2 FY 2017 earnings of $0.86 per share (versus $0.69 in Q2 FY 2016), beating analysts' consensus estimate of $0.81.

The company's quarterly revenues amounted to $4.545 bln (+25.8% y/y), beating analysts' consensus estimate of $4.355bln.

V rose to $98.80 (+0.70%) in pre-market trading.

-

14:36

Company News: Microsoft (MSFT) quarterly results beat analysts’ expectations

Microsoft (MSFT) reported Q2 FY 2017 earnings of $0.75 per share (versus $0.69 in Q2 FY 2016), beating analysts' consensus estimate of $0.71.

The company's quarterly revenues amounted to $24.700 bln (+9.1% y/y), beating analysts' consensus estimate of $24.294 bln.

MSFT fell to $73.86 (-0.48%) in pre-market trading.

-

09:52

Major stock exchanges in Europe trading mixed: FTSE 7495.59 +7.72 + 0.10%, DAX 12422.30 -24.95 -0.20%, CAC 5192.29 -6.93 -0.13%

-

07:26

Global Stocks

Equities across the Asia-Pacific region were lower on Friday, taking a breather from the recent surge where gains in Australian shares lagged behind other indexes as sharp moves its currency plagued stocks. Though the Aussie dollar retreated slightly against the greenback Friday after hitting a two-year high on Wednesday, it was still up 1.2% this week, driven in part by strong jobs data and a recent surge in the price of iron-ore, one of the country's main commodity exports.

European stocks reversed course and closed lower Thursday as investors weighed the possibility the European Central Bank is moving closer to reducing monetary stimulus for the eurozone economy that has helped pushed equities to record highs. German, French, Spanish and Italian shares flipped down at the same time the euro leapt to its highest in more than a year against the U.S. dollar. Those moves were made on the prospect that the ECB will soon say it's time to start winding down its massive program of bond purchases.

U.S. stocks finished mostly lower on Thursday as Home Depot weighed on the Dow, but the Nasdaq bucked the trend to match its best win streak since February 2015 and closed at a record.

-

00:28

Stocks. Daily history for Jul 20’2017:

(index / closing price / change items /% change)

Nikkei +123.73 20144.59 +0.62%

TOPIX +11.14 1633.01 +0.69%

Hang Seng +68.05 26740.21 +0.26%

CSI 300 +18.13 3747.88 +0.49%

Euro Stoxx 50 -0.79 3499.49 -0.02%

FTSE 100 +56.96 7487.87 +0.77%

DAX -4.80 12447.25 -0.04%

CAC 40 -16.85 5199.22 -0.32%

DJIA -28.97 21611.78 -0.13%

S&P 500 -0.38 2473.45 -0.02%

NASDAQ +4.96 6390.00 +0.08%

S&P/TSX +19.93 15264.64 +0.13%

-