Noticias del mercado

-

23:58

Schedule for today,Thursday, Jul 20’2017 (GMT0)

01:30 Australia Changing the number of employed June 42.0 15

01:30 Australia Unemployment rate June 5.5% 5.6%

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m May 2.1%

05:00 Japan BOJ Outlook Report

06:00 Germany Producer Price Index (YoY) June 2.8% 2.3%

06:00 Germany Producer Price Index (MoM) June -0.2% -0.1%

06:00 Switzerland Trade Balance June 3.4 2.89

06:30 Japan BOJ Press Conference

08:00 Eurozone Current account, unadjusted, bln May 21.5

08:30 United Kingdom Retail Sales (YoY) June 0.9% 2.6%

08:30 United Kingdom Retail Sales (MoM) June -1.2% 0.4%

11:45 Eurozone Deposit Facilty Rate -0.4% -0.4%

11:45 Eurozone ECB Interest Rate Decision 0% 0%

12:30 Eurozone ECB Press Conference

12:30 U.S. Continuing Jobless Claims 1945 1950

12:30 U.S. Philadelphia Fed Manufacturing Survey July 27.6 24

12:30 U.S. Initial Jobless Claims 247 245

14:00 Eurozone Consumer Confidence (Preliminary) July -1.3 -1.1

14:00 U.S. Leading Indicators June 0.3% 0.4%

22:45 New Zealand Visitor Arrivals June 8.0%

-

22:06

The main US stock indices grew moderately following the results of today's trading

The main US stock indexes finished the auction with an increase, updating the record highs, which contributed to corporate reporting and statistics on the US housing market. At the same time, a significant decline in IBM shares prevented the Dow index from showing more serious growth.

According to the Ministry of Trade, housing construction finished the second quarter on a stronger note, as the bookings of new houses were restored in June at the fastest pace in four months. The laying of new homes increased by 8.3% to 1.22 million units (recalculated for annual rates). The laying of new houses for May was revised to 1.12 million from 1.09 million. Construction permits grew by 7.4% to 1.25 million per annum. The construction of single-family houses grew by 6.3% to 849,000 on an annualized basis. Bookmarks for apartment buildings jumped by 13.3% in June, to 366,000 in annual terms.

Oil prices rose by more than 1.5%, receiving support from statistics on oil products in the US, which indicated a more significant than expected decline in oil reserves. The US Energy Ministry reported that in the week of July 8-14, oil reserves fell by 4.727 million barrels to 490.62 million barrels. Analysts had expected a reduction of only 3.21 million barrels. Oil reserves in the Cushing terminal fell by 23 thousand barrels to 57.54 million barrels.

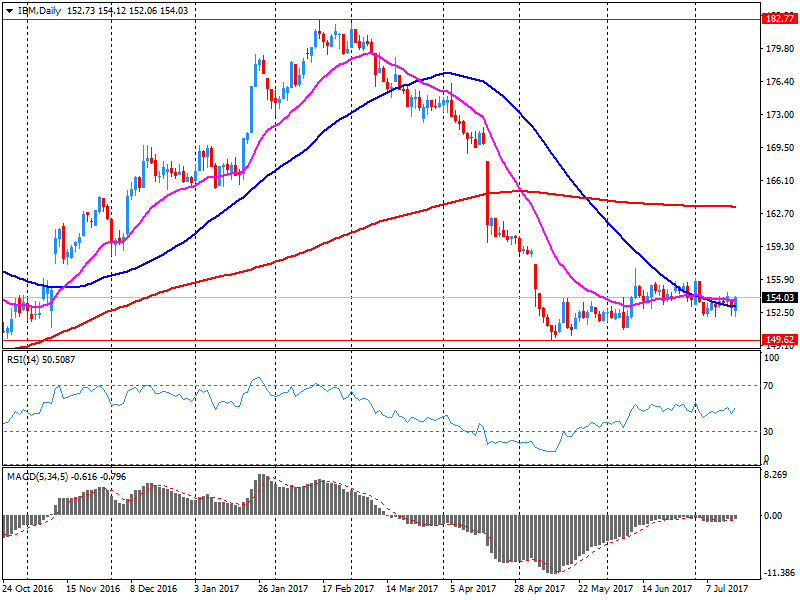

Most components of the DOW index recorded a rise (24 out of 30). The leader of growth was the shares of E. I. du Pont de Nemours and Company (DD, + 1.55%). Outsider were the shares of International Business Machines Corporation (IBM, -4.39%).

All sectors of the S & P index showed growth. The maximum increase was shown by the conglomerate sector (+ 1.2%).

At closing:

DJIA + 0.29% 21.636.50 +61.77

Nasdaq + 0.64% 6.385.04 +40.73

S & P + 0.53% 2.473.67 +13.06

-

20:59

DJIA +0.20% 21,618.68 +43.95 Nasdaq +0.66% 6,385.90 +41.59 S&P +0.45% 2,471.61 +11.00

-

18:00

European stocks closed: FTSE 100 +40.69 7430.91 +0.55% DAX +21.66 12452.05 +0.17% CAC 40 +42.80 5216.07 +0.83%

-

16:33

U.S. commercial crude oil inventories decreased by 4.7 million barrels from the previous week

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.7 million barrels from the previous week. At 490.6 million barrels, U.S. crude oil inventories are in the upper half of the average range for this time of year.

Total motor gasoline inventories decreased by 4.4 million barrels last week, but are in the upper half of the average range. Both finished gasoline inventories and blending components inventories decreased last week.

Distillate fuel inventories decreased by 2.1 million barrels last week but are near the upper limit of the average range for this time of year. Propane/propylene inventories increased by 3.5 million barrels last week but are in the lower half of the average range. Total commercial petroleum inventories decreased by 10.2 million barrels last week.

-

16:30

U.S.: Crude Oil Inventories, July -4.727

-

16:03

U.S. commerce secretary Wilbur Ross says U.S. trade deficit not a product of free market forces

-

Says time to rebalance trade and investment relationship with China in fair, balanced manner

-

Must rebalance trade by selling more 'made in America' goods to China

-

-

16:02

U.S. treasury yields hold at higher levels after stronger-than-forecast increase in U.S. housing starts in June

-

15:49

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1300 (EUR 500m) 1.1400 (880m) 1.1450 (410m) 1.1475 (500m) 1.1500 (710m) 1.1600 (525m)

USDJPY: 110.30 (USD 500m) 112.25 (460m) 112.50 (440m)

GBPUSD: 1.2800 (GBP 375m)

EURGBP: 0.8764 (1.1bln)

EURJPY: 129.50 (EUR 690m) 130.00 (515m)

-

15:31

U.S. Stocks open: Dow +0.06%, Nasdaq +0.29%, S&P +0.16%

-

15:13

Before the bell: S&P futures +0.11%, NASDAQ futures +0.28%

U.S. stock-index futures rose slightly as investors focused on Q2 earnings reports of the U.S. companies.

Global Stocks:

Nikkei 20,020.86 +20.95 +0.10%

Hang Seng 26,672.16 +147.22 +0.56%

Shanghai 3,232.87 +45.30 +1.42%

S&P/ASX 5,732.13 +44.73 +0.79%

FTSE 7,409.90 +19.68 +0.27%

CAC 5,190.43 +17.16 +0.33%

DAX 12,441.59 +11.20 +0.09%

Crude $46.45 (+0.11%)

Gold $1,240.80 (-0.09%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

210.99

-0.69(-0.33%)

320

ALTRIA GROUP INC.

MO

73.2

-0.17(-0.23%)

373

Amazon.com Inc., NASDAQ

AMZN

1,005.10

-4.94(-0.49%)

28093

Apple Inc.

AAPL

149.05

-0.51(-0.34%)

74367

AT&T Inc

T

36.4

0.01(0.03%)

4115

Barrick Gold Corporation, NYSE

ABX

16.28

0.20(1.24%)

13277

Caterpillar Inc

CAT

108.25

0.19(0.18%)

865

Chevron Corp

CVX

104.8

0.59(0.57%)

4041

Cisco Systems Inc

CSCO

31.53

0.03(0.10%)

1525

Citigroup Inc., NYSE

C

66.48

-0.35(-0.52%)

15762

Deere & Company, NYSE

DE

125.91

0.03(0.02%)

2583

Exxon Mobil Corp

XOM

81.1

0.24(0.30%)

1080

Facebook, Inc.

FB

159.87

0.14(0.09%)

58177

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.05

0.05(0.38%)

18960

General Electric Co

GE

26.81

-0.01(-0.04%)

7450

Goldman Sachs

GS

226.55

-2.71(-1.18%)

115471

Google Inc.

GOOG

954.99

1.57(0.16%)

1731

Home Depot Inc

HD

154.03

0.14(0.09%)

295

Intel Corp

INTC

34.37

-0.10(-0.29%)

521

International Business Machines Co...

IBM

153.1

0.09(0.06%)

2352

Johnson & Johnson

JNJ

132.92

0.77(0.58%)

64420

JPMorgan Chase and Co

JPM

90.87

-0.52(-0.57%)

13932

Microsoft Corp

MSFT

73.4

0.05(0.07%)

46429

Procter & Gamble Co

PG

87.57

0.02(0.02%)

569

Starbucks Corporation, NASDAQ

SBUX

58.35

0.02(0.03%)

1730

Tesla Motors, Inc., NASDAQ

TSLA

318.82

-0.75(-0.23%)

25803

The Coca-Cola Co

KO

44.81

0.08(0.18%)

4222

Twitter, Inc., NYSE

TWTR

19.85

-0.09(-0.45%)

33231

UnitedHealth Group Inc

UNH

186.75

0.40(0.21%)

10299

Verizon Communications Inc

VZ

43.75

0.09(0.21%)

919

Visa

V

97

0.17(0.18%)

13641

Wal-Mart Stores Inc

WMT

76.35

-0.02(-0.03%)

747

Walt Disney Co

DIS

104.7

-0.09(-0.09%)

902

Yandex N.V., NASDAQ

YNDX

31.47

0.13(0.41%)

3011

-

14:42

Analyst coverage initiations before the market open

NIKE (NKE) initiated with a Hold at Needham

-

14:40

Target price changes before the market open

UnitedHealth (UNH) target raised to $235 from $200 at Mizuho

Facebook (FB) target raised to $185 from $165 at Needham

-

14:40

Downgrades before the market open

Goldman Sachs (GS) downgraded to Mkt Perform from Outperform at Keefe Bruyette

-

14:39

Upgrades before the market open

Boeing (BA) upgraded to Neutral from Underperform at BofA/Merrill

-

14:37

Canadian manufacturing sales increased for the third consecutive month, up 1.1% to $54.6 billion in May

Manufacturing sales increased for the third consecutive month, up 1.1% to $54.6 billion in May. The gain was mainly attributable to higher sales in the transportation equipment and chemical manufacturing industries.

Sales were up in 16 of 21 industries, representing 71% of the manufacturing sector. Sales of durable goods rose 2.2%, while sales of non-durable goods declined 0.3%.

In constant dollars, sales were up 1.1%, indicating that higher volumes of manufactured goods were sold in May.

Sales in the transportation equipment industry rose 4.2% to $11.5 billion in May, the third gain in four months. The growth was the result of increases in the motor vehicle (+8.6%) and the motor vehicle parts (+5.7%) industries, mainly reflecting higher volumes. After removing the effect of price changes, sales in volume terms rose 8.1% and 5.0% respectively in these industries in May.

-

14:35

US building permits and housing starts rose more than expected in June

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,254,000. This is 7.4 percent above the revised May rate of 1,168,000 and is 5.1 percent above the June 2016 rate of 1,193,000. Single-family authorizations in June were at a rate of 811,000; this is 4.1 percent above the revised May figure of 779,000. Authorizations of units in buildings with five units or more were at a rate of 409,000 in June.

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,215,000. This is 8.3 percent above the revised May estimate of 1,122,000 and is 2.1 percent above the June 2016 rate of 1,190,000. Single-family housing starts in June were at a rate of 849,000; this is 6.3 percent above the revised May figure of 799,000. The June rate for units in buildings with five units or more was 359,000.

-

14:30

U.S.: Housing Starts, June 1215 (forecast 1155)

-

14:30

Canada: Manufacturing Shipments (MoM), May 1.1% (forecast 0.7%)

-

14:30

U.S.: Building Permits, June 1254 (forecast 1200)

-

13:46

Company News: Morgan Stanley (MS) quarterly results beat analysts’ expectations

Morgan Stanley (MS) reported Q2 FY 2017 earnings of $0.87 per share (versus $0.75 in Q2 FY 2016), beating analysts' consensus estimate of $0.77.

The company's quarterly revenues amounted to $9.503 bln (+6.7% y/y), beating analysts' consensus estimate of $9.052 bln.

MS rose to $46.10 (+2.13%) in pre-market trading.

-

13:44

Company News: IBM (IBM) Q2 EPS beat analysts’ estimate

IBM (IBM) reported Q2 FY 2017 earnings of $2.97 per share (versus $2.95 in Q2 FY 2016), beating analysts' consensus estimate of $2.74.

The company's quarterly revenues amounted to $19.289 bln (-4.7% y/y), generally in-line with analysts' consensus estimate of $19.452 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of 'at least' $13.80 versus analysts' consensus estimate of $13.68.

IBM fell to $149.50 (-2.92%) in pre-market trading.

-

13:21

Hungarian prime minister Orban says Visegrad countries thnk EU-Israel relations should be improved

-

12:05

UK debt management office gets 3.10 times cover at sale of 2.75 bln GBP 0.75 pct gilts due 2023

-

Gets 1 tick price tail at 2023 gilt sale

-

Gets 0.2 basis point yield tail at 2023 gilt sale

-

-

11:19

Britain will probably need to set up fewer than 10 new regulators after Brexit - Government source

-

Britain's new business council will be attended by business leaders representing a range of sectors, particularly those likely to be most affected by Brexit - May's spokesman

-

-

11:03

Eurozone: Construction Output, y/y, May 2.6%

-

10:23

Czech crown firms 0.2 pct on day to 26.045 per euro, strongest since Central Bank's interventions ended in April

-

09:51

ECB's Villeroy says we still need accommodative monetary policy, but are adapting its intensity depending on economic situation and inflation

-

09:35

Major stock markets in Europe trading mixed: FTSE 7387.42 -2.80 -0.04%, DAX 12449.49 +19.10 + 0.15%, CAC 5182.42 +9.15 + 0.18%

-

08:56

Negative start of trading expected on the main European stock markets: DAX -0.2%, CAC 40 -0.1%, FTSE 100 flat

-

08:45

Options levels on wednesday, July 19, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1636 (5255)

$1.1614 (1545)

$1.1601 (748)

Price at time of writing this review: $1.1538

Support levels (open interest**, contracts):

$1.1495 (452)

$1.1462 (873)

$1.1425 (1896)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 4 is 67597 contracts (according to data from July, 18) with the maximum number of contracts with strike price $1,1500 (5255);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3177 (3030)

$1.3152 (2233)

$1.3106 (1699)

Price at time of writing this review: $1.3033

Support levels (open interest**, contracts):

$1.2973 (361)

$1.2942 (378)

$1.2908 (1040)

Comments:

- Overall open interest on the CALL options with the expiration date August, 4 is 27362 contracts, with the maximum number of contracts with strike price $1,3100 (3030);

- Overall open interest on the PUT options with the expiration date August, 4 is 25151 contracts, with the maximum number of contracts with strike price $1,2800 (2957);

- The ratio of PUT/CALL was 0.92 versus 0.93 from the previous trading day according to data from July, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:29

10-year U.S. treasury yield at 2.271 percent vs U.S. close of 2.263 percent on Tuesday

-

08:24

Trump, Putin Held A Second, Undisclosed Meeting At G20 Summit In Germany - White House Official @LiveSquawk

-

08:23

Fake News story of secret dinner with Putin is "sick." All G20 leaders, and spouses, were invited by the Chancellor of Germany. Press knew! @realDonaldTrump

-

07:30

Global Stocks

Equity markets lacked direction in Asia on Wednesday, as was the case overnight in the U.S., though Australian stocks outperformed on strong gains among the country's biggest banks. Markets are expected to remain in narrow ranges ahead of policy statements from the European and Japanese central banks, due Thursday. Some investors are avoiding aggressive trading as a result.

Stocks across Europe dropped on Tuesday, with the exporter-heavy DAX 30 index DAX, -1.25% ending 1.3% lower at 12,430.39-its worst session since June 29. More broadly, European benchmarks finished the session under pressure as the euro stepped up to a 14-month high against the U.S. dollar and as disappointing corporate earnings reports rolled in. A stronger euro can hurt European exporters as it makes products more expensive for overseas customers.

The S&P 500 and the Nasdaq closed at records on Tuesday as gains in tech stocks offset weakness in telecom services and energy shares. A surge in Netflix Inc. NFLX, +13.54% shares on the back of strong earnings gave the broader tech sector a boost and helped to underpin the large-cap index push into the positive territory.

-

02:31

Australia: Leading Index, June -0.1%

-

00:31

Commodities. Daily history for Jul 18’2017:

(raw materials / closing price /% change)

Oil 46.25 -0.32%

Gold 1,241.90 0.00%

-

00:30

Stocks. Daily history for Jul 18’2017:

(index / closing price / change items /% change)

Nikkei -118.95 19999.91 -0.59%

TOPIX -5.00 1620.48 -0.31%

Hang Seng +54.36 26524.94 +0.21%

CSI 300 +3.62 3667.18 +0.10%

Euro Stoxx 50 -37.67 3478.68 -1.07%

FTSE 100 -13.91 7390.22 -0.19%

DAX -156.77 12430.39 -1.25%

CAC 40 -56.90 5173.27 -1.09%

DJIA -54.99 21574.73 -0.25%

S&P 500 +1.47 2460.61 +0.06%

NASDAQ +29.87 6344.31 +0.47%

S&P/TSX -15.79 15149.57 -0.10%

-

00:28

Currencies. Daily history for Jul 18’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1553 +0,65%

GBP/USD $1,3034 -0,15%

USD/CHF Chf0,95437 -0,83%

USD/JPY Y112,04 -0,52%

EUR/JPY Y129,45 +0,14%

GBP/JPY Y146,113 -0,63%

AUD/USD $0,7912 +1,49%

NZD/USD $0,7344 +0,33%

USD/CAD C$1,26255 -0,56%

-

00:01

Schedule for today,Wednesday, Jul 19’2017 (GMT0)

00:30 Australia Leading Index June 0.0%

09:00 Eurozone Construction Output, y/y May 3.2%

12:30 Canada Manufacturing Shipments (MoM) May 1.1% 0.7%

12:30 U.S. Housing Starts June 1092 1155

12:30 U.S. Building Permits June 1168 1200

14:30 U.S. Crude Oil Inventories July -7.564

23:50 Japan Trade Balance Total, bln June -203.4 484.7

-