Noticias del mercado

-

22:15

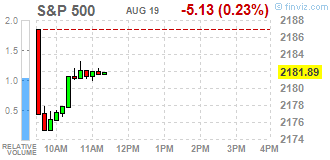

Major US stock indexes finished trading below zero

Major US stock indexes fell slightly as investors once again focused attention on the fact that the Fed will raise interest rates.

Investors were also cautious behavior prior to the annual meeting of central bankers from around the world next week in Jackson Hole, Wyoming, where Fed Chairman Janet Yellen is likely to confirm the expectations of rate increases slowly.

Recall Protocol July meeting to determine the Fed's monetary policy, released Wednesday, showed that those responsible for the policies of the central bank officials still disagree on the need to raise rates this year, reducing expectations of an increase in September. Nevertheless, the president of the San Francisco Federal Reserve Bank, John Williams yesterday expressed support for higher interest rates in the US in the coming months, noting that if you wait too long, it can be expensive economy.

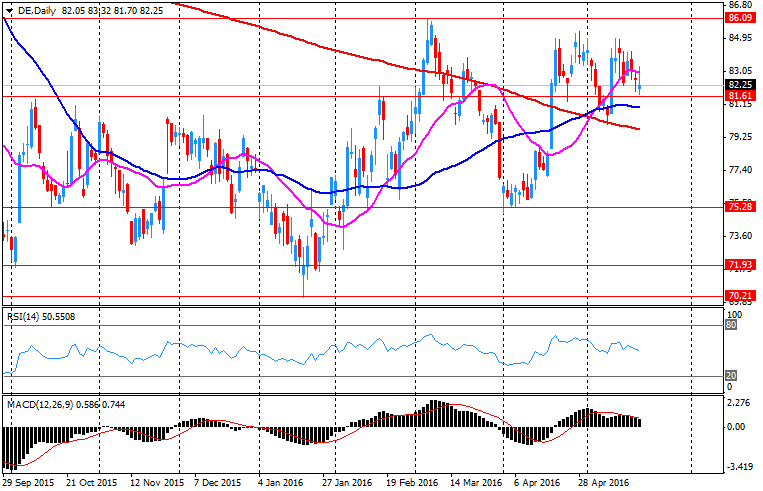

Among the corporate nature should note the publication of financial reports of the company Deere (DE) reports that data showed that the company's profit for the third quarter of fiscal year 2016 was $ 1.55 per share, which was at $ 0.61 above the average forecast of analysts.

Most DOW components of the index closed in negative territory (20 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 2.97%). Outsider is shares Wal-Mart Stores Inc. (WMT, -2.14%).

All business sectors S & P index showed a decline. Conglomerates sectors fell most (-1.8%).

-

21:00

Dow -0.20% 18,560.75 -36.95 Nasdaq -0.05% 5,237.79 -2.36 S&P -0.15% 2,183.84 -3.18

-

18:00

European stocks closed: FTSE 100 -10.01 6858.95 -0.15% DAX -58.67 10544.36 -0.55% CAC 40 -36.54 4400.52 -0.82%

-

17:37

WSE: Session Results

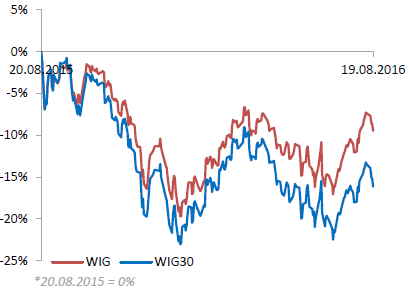

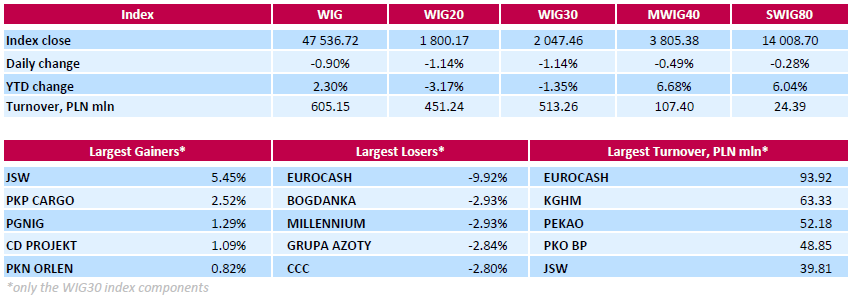

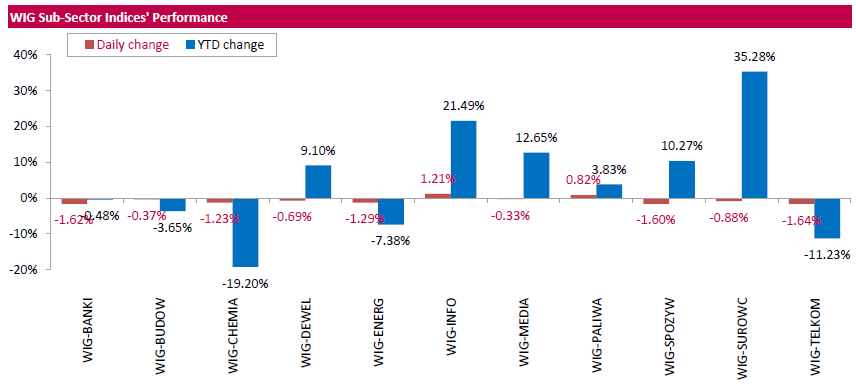

Polish equity market closed lower on Friday. The broad measure, the WIG index, recorded a 0.9% drop. Except for information technology (+1.21%) and oil and gas (+0.82%), every sector in the WIG Index declined, with telecommunication services (-1.64%) lagging behind.

The large-cap stocks fell by 1.14%, as measured by the WIG30 Index. In the index basket, FMCG-wholesaler EUROCASH (WSE: EUR) demonstrated the sharpest decline, tumbling by 9.92% on lower-than-expected Q2 earnings. The company posted Q2 FY16 net profit of PLN 52.5 mln versus analysts' consensus estimate of PLN 61 mln. The other notable losers were thermal coal miner BOGDANKA (WSE: LWB), bank MILLENNIUM (WSE: MIL), chemical producer GRUPA AZOTY (WSE: ATT) and footwear retailer CCC (WSE: CCC), which plunged by 2.8%-2.93%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) led the gainer, rebounding by 5.45% after yesterday's drop. It was followed by railway freight transport operator PKP CARGO (WSE: PKP), oil and gas producer PGNIG (WSE: PGN) and videogame developer CD PROJEKT (WSE: CDR), adding 1.09%-2.52%.

-

17:23

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexws little changed on Friday, with investors again focusing on when the Federal Reserve will hike interest rates next and with the corporate earnings season winding down. Investors were also cagey ahead of next week's annual meeting of central bankers from around the world in Jackson Hole, Wyoming, in which Fed Chair Janet Yellen is likely to cement expectations for a slow pace of rate increases.

Most of Dow stocks in negative area (20 of 30). Top gainer - NIKE, Inc. (NKE, +2.87%). Top loser - Verizon Communications Inc. (VZ, -1.01%).

All of S&P sectors in negative area. Top loser - Conglomerates (-2.1%).

At the moment:

Dow 18552.00 -13.00 -0.07%

S&P 500 2180.00 -3.50 -0.16%

Nasdaq 100 4814.00 +5.50 +0.11%

Oil 48.68 -0.21 -0.43%

Gold 1349.40 -7.80 -0.57%

U.S. 10yr 1.59 +0.05

-

15:45

WSE: After start on Wall Street

We did not spend a long time on these, slightly higher levels, which we mentioned in the previous comment. After 14 o'clock (Warsaw time) contracts for the S&P500 went back to session lows area and in response to such behavior both of the DAX as well as our WIG20 went down to the vicinity of its minimum levels.

In anticipation of the start of Wall Street once again we went down in the area of the previous lows of the session, which confirms that even in the afternoon cards on our parquet are distributed by the supply side. It seems that the bears are standing in the blocks and just waiting for a good opportunity to start the attack on the level of 1,800 points.

Such a situation occurred after the start of trading in the US. Among blue chips grow only two companies - PGNiG 1.8 percent and PKN Orlen 0.2 percent.

The WIG20 index 15 minutes after the start of overseas trading stood at the level of 1,798 points (-1,22%).

-

15:32

U.S. Stocks open: Dow -0.35%, Nasdaq -0.29%, S&P -0.32%

-

15:20

Before the bell: S&P futures -0.23%, NASDAQ futures -0.21%

U.S. stock-index futures slipped amid shifting speculation over the next Federal Reserve rate increase and volatile oil prices.

Global Stocks:

Nikkei 16,545.82 +59.81 +0.36%

Hang Seng 22,937.22 -85.94 -0.37%

Shanghai 3,108.72 +4.61 +0.15%

FTSE 6,861.55 -7.41 -0.11%

CAC 4,398.91 -38.15 -0.86%

DAX 10,561.47 -41.56 -0.39%

Crude $48.06 (-0.33%)

Gold $1343.40 (-1.02%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.18

0.00(0.00%)

33535

ALCOA INC.

AA

10.38

-0.07(-0.6699%)

4811

ALTRIA GROUP INC.

MO

66.31

0.00(0.00%)

425686

Amazon.com Inc., NASDAQ

AMZN

761.06

-3.40(-0.4448%)

9413

American Express Co

AXP

65.63

0.00(0.00%)

79165

AMERICAN INTERNATIONAL GROUP

AIG

58.98

0.00(0.00%)

114653

Apple Inc.

AAPL

109

-0.08(-0.0733%)

62808

AT&T Inc

T

41.26

-0.14(-0.3382%)

1200

Barrick Gold Corporation, NYSE

ABX

20.58

-0.46(-2.1863%)

138450

Boeing Co

BA

135.14

0.14(0.1037%)

625

Caterpillar Inc

CAT

83.6

0.22(0.2639%)

3716

Chevron Corp

CVX

103.49

-0.06(-0.0579%)

465

Cisco Systems Inc

CSCO

30.4

-0.08(-0.2625%)

4861

Citigroup Inc., NYSE

C

46.3

-0.20(-0.4301%)

1575

Deere & Company, NYSE

DE

80.29

3.35(4.354%)

200100

E. I. du Pont de Nemours and Co

DD

69.6

0.15(0.216%)

133

Exxon Mobil Corp

XOM

88.85

-0.06(-0.0675%)

303

Facebook, Inc.

FB

123.83

-0.08(-0.0646%)

29371

FedEx Corporation, NYSE

FDX

167.19

0.00(0.00%)

11712

Ford Motor Co.

F

12.3

-0.03(-0.2433%)

24141

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.02

-0.21(-1.7171%)

52467

General Electric Co

GE

31.35

-0.08(-0.2545%)

4832

General Motors Company, NYSE

GM

31.5

-0.05(-0.1585%)

10996

Google Inc.

GOOG

775.13

-2.37(-0.3048%)

2417

Hewlett-Packard Co.

HPQ

14.51

0.00(0.00%)

869997

Home Depot Inc

HD

134.73

-0.07(-0.0519%)

961

HONEYWELL INTERNATIONAL INC.

HON

115.86

0.00(0.00%)

201201

Intel Corp

INTC

34.89

-0.08(-0.2288%)

3263

International Business Machines Co...

IBM

161.36

0.00(0.00%)

409577

International Paper Company

IP

47.61

0.00(0.00%)

80088

Johnson & Johnson

JNJ

119.9

-0.02(-0.0167%)

1345

JPMorgan Chase and Co

JPM

65.95

0.00(0.00%)

568737

McDonald's Corp

MCD

117.13

0.00(0.00%)

302257

Merck & Co Inc

MRK

63.63

0.00(0.00%)

613475

Microsoft Corp

MSFT

57.45

-0.15(-0.2604%)

10870

Nike

NKE

57.4

0.19(0.3321%)

4619

Pfizer Inc

PFE

35.15

-0.04(-0.1137%)

1427

Procter & Gamble Co

PG

87.11

-0.33(-0.3774%)

670

Starbucks Corporation, NASDAQ

SBUX

55.45

-0.08(-0.1441%)

3416

Tesla Motors, Inc., NASDAQ

TSLA

222.9

-0.61(-0.2729%)

6956

The Coca-Cola Co

KO

44.09

-0.01(-0.0227%)

359

Travelers Companies Inc

TRV

117.82

0.00(0.00%)

37911

Twitter, Inc., NYSE

TWTR

18.89

-0.11(-0.579%)

55018

United Technologies Corp

UTX

109.33

0.00(0.00%)

138349

UnitedHealth Group Inc

UNH

142.17

0.00(0.00%)

82120

Verizon Communications Inc

VZ

52.84

-0.03(-0.0567%)

770

Visa

V

80

-0.27(-0.3364%)

501

Wal-Mart Stores Inc

WMT

74.4

0.10(0.1346%)

124

Walt Disney Co

DIS

96.5

-0.15(-0.1552%)

2710

Yahoo! Inc., NASDAQ

YHOO

42.9

0.00(0.00%)

20250

Yandex N.V., NASDAQ

YNDX

22.77

0.00(0.00%)

200

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Wal-Mart (WMT) target raised to $76 from $73 at RBC Capital Mkts; Underperform

Wal-Mart (WMT) target raised to $78 from $71 at Telsey Advisory Group

-

14:18

Company News: Deere (DE) Q3 EPS beat analysts’ estimate

Deere reported Q3FY16 earnings of $1.55 per share (versus $1.53 in Q3FY15), beating analysts' consensus estimate of $0.94.

The company's quarterly revenues amounted to $5.861 bln (-14.3% y/y), missing analysts' consensus estimate of $6.027 bln.

Deere also increased its FY16 net income forecast to $1.35 bln from $1.2 bln, but lowered FY16 sales projection to down 10% from down 9%.

DE rose to $79.90 (+3.85%) in pre-market trading.

-

13:00

WSE: Mid session comment

The morning phase of the session on the WIG20 diagram is a clear correlation with the graph of the German DAX. In the first hours of trading our market declined "head to head" with the German index. As a result, the WIG20 lost about 1 percent and stabilized in the area of the psychological barrier of 1,800 points. Successive bars of trade brought a rebound in Euroland and the DAX recovered 2/3 of today's losses. On Warsaw market such effect is far much smaller, which does not mean that it may not be bigger.

Noon rarely results in lasting pulses, so at least, for a serious move we will wait until the time at which its presence in the markets will mark investors from the USA.

In the middle of today's session the WIG20 reached the level of 1,808 points (-0,68%).

-

12:44

Major stock indices in Europe trading lower

European stocks dropped in the course of trading today and for the week, while the Stoxx 600 may show the biggest weekly decline since July, despite a steady rebound in oil prices.

The composite index of Europe's largest enterprises Stoxx 600 fell by 0.6% - to 340.96 points. Since the beginning of the week lost almost 7%.

The capitalization of mining companies BHP Billiton and Glencore Plc declined 1.1% and 1%, respectively, following the decline in metal prices.

BMW shares fell 1.8% after the German automaker was forced to recall 956 sedans models of the M5, M6 coupes, convertibles and sedans M6 M6 Gran Coupe 2015 because of problems with the quality of the welding.

Vonovia shares climbed 0.9% after the company raised annual profit forecast for the second time.

The price of securities of the transport and oil companies A.P. Moeller-Maersk A / S has increased by 0.9%. Denmark's largest company said it is still considering different options for further strategic development. Earlier media reported that the company can be divided into two parts, one of which will depart transport assets, the other - in the sphere of oil production assets.

Norwegian telecommunications company Telenor has added 1% of market value after its head Segway Brekke stated that the company intends to sell its stake in VimpelCom Ltd.

Shares of betting company William Hill jumped 5.3% on news that its operating profit in the current year will be closer to the upper limit of its forecast.

Shares of Vopak, the world's largest independent tank terminal operator for the storage of petroleum products decreased by 3.5% after the company reported results for the first half.

Nibe Shares added 3.5% as earningssurpassed the forecasts.

At the moment:

FTSE 6853.47 -15.49 -0.23%

DAX 10540.18 -62.85 -0.59%

CAC 4404.75 -32.31 -0.73%

-

09:59

Mixed start for major stock exchanges: FTSE flat, DAX + 0.1%, CAC40 flat, FTMIB -0.3%, IBEX flat

-

09:12

WSE: After opening

WIG20 index opened at 1824.95 points (+0.22%)

WIG 48055.68 0.18%

WIG30 2075.03 0.20%

mWIG40 3832.93 0.23%

*/ - change to previous close

The WIG20 futures took off with a predominance of up to 9 points compared to yesterday's close. Such a significant optimism in the trade before 9:00 am may not be favorable for the bulls, but results, among others, from improved sentiment after yesterday's growth in the US, which moves as long as the specter of a global correction in the markets. Morale on major European stock exchanges are also optimistic, as evidenced by the increase in contracts for the major indexes.

Start of the cash market, as in the case of contracts was quite nice. Bulls manage to not only defend yesterday pulled up the final fixing, but even earn more points. Prevails, of course, the green color, but the distinctions growth include only Tauron (WSE: TPE), which tried to make up for yesterday's losses. On the red side of the market at the forefront we may see Eurocash (WSE: EUR), which lost 2.6 percent. after the release of weaker-than-expected results for the second quarter.

-

08:23

Mixed start expected on the major stock exchanges in Europe: DAX + 0.1%, CAC40 -0.2%, FTSE -0.1%

-

08:21

WSE: Before opening

Thursday's session on Wall Street ended with modest increases in the major indexes. In the case of the broad S&P500 growth was 0.22 percent. The biggest impact on the outcome of the session was the behavior of oil prices, which helped for the raw material sector. The low level of turnover showed that the US trade had holiday character. The situation is similar in the Asian markets where local indices record cosmetic changes. It does not promise any serious emotions in early trading in Europe. Emotions also hard to find in the macro calendar, which lacks of important reports today.

From the point of view of the Warsaw Stock Exchange is worth to note yesterday's growth (+ 0.9%) of emerging markets cart. This is a continuation of the previous session and the positive reaction of investors to the minutes of the FOMC meeting. Yesterday's defense of 1,819-1,800 points area on the WIG20 index indicates that the buyer always count on shallow withdrawal.

-

07:12

Global Stocks

European's main stock benchmark closed with gains for the first time in five sessions on Thursday, with resource companies helping to lead the charge higher on bets the U.S. Federal Reserve won't raise rates this year.

The Stoxx Europe 600 index SXXP, +0.72% gained 0.7% to end at 342.91, recovering almost entirely from a 0.8% drop on Wednesday.

Wednesday's weakness came as investors feared the minutes from the Federal Reserve's July would signal a rate increase could happen as soon as September. However, the meeting minutes, released after the European market closed on Wednesday, showed the central-bank officials remain split over whether a rate increase is needed soon.

U.K. stocks rose on Thursday after surprisingly strong retail sales for July dispelled fears Britain is sliding into a recession because of the Brexit vote.

The FTSE 100 index UKX, +0.14% gained 0.1% to close at 6,868.96, partly recovering from a 0.5% loss on Wednesday.

Retail sales were the main focus on the data front on Thursday, capping off a week of the first economic data to show the real effect on the U.K. economy from the referendum on European Union membership.

The Office for National Statistics said sales rose 1.4%, well above a 0.2% estimated rise in a FactSet poll of analysts.

U.S. stocks on Thursday logged a modest return in a trading session marked by relatively muted moves for the main benchmarks as investors pored over a batch of upbeat economic data and digested signs that the Federal Reserve remains divided about the timing of the next interest-rate hike.

A rise in oil prices, which pushed West Texas Intermediate crude trading on the New York Mercantile Exchange - the U.S. benchmark - into bull-market territory, helped nudge energy stocks up. A bull market is defined as a 20% rise from a recent low.

Asian stocks retreated on Friday and the dollar edged up from a near eight-week low after some Federal Reserve officials reiterated the case for raising interest rates in coming months.

Japan's Nikkei .N225 erased earlier gains to trade 0.1 percent lower, set for a weekly loss of 2.6 percent.

China's CSI 300 index .CSI300 and the Shanghai Composite .SSEC slid 0.2 percent, but were still up 1.9 percent and 1.6 percent for the week, respectively.

-

01:04

Stocks. Daily history for Aug 18’2016:

(index / closing price / change items /% change)

Nikkei 225 16,486.01 -259.63 -1.55%

Shanghai Composite 3,104.32 -5.23 -0.17%

S&P/ASX 200 5,507.82 0.00 0.00%

FTSE 100 6,868.96 +9.81 +0.14%

CAC 40 4,437.06 +19.38 +0.44%

Xetra DAX 10,603.03 +65.36 +0.62%

S&P 500 2,187.02 +4.80 +0.22%

Dow Jones Industrial Average 18,597.70 +23.76 +0.13%

S&P/TSX Composite 14,695.68 -1.92 -0.01%

-