Noticias del mercado

-

22:08

Major US stock indices closed above zero

Major Wall Street stock indexes finished trading almost unchanged, despite the significant rise in oil prices and strong Wal-Mart quarterly results.

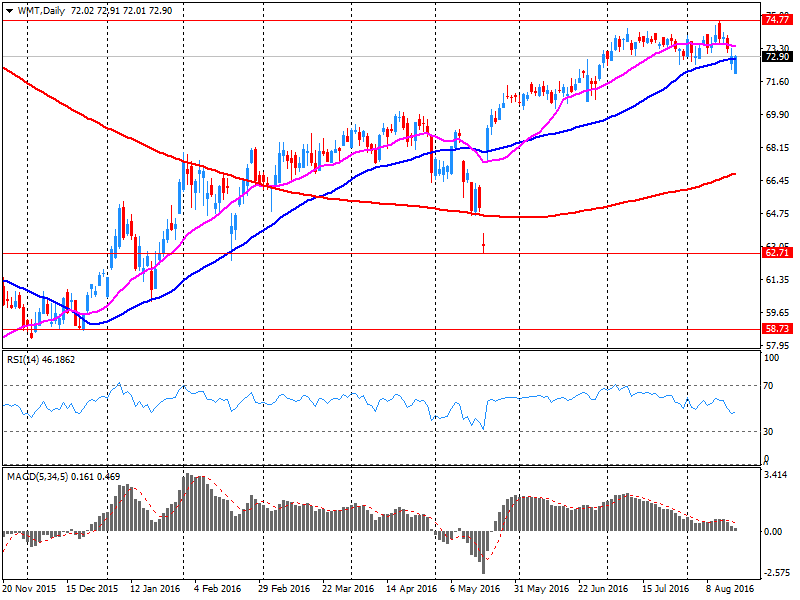

Thus, the report of the company Wal-Mart (WMT) pleased investors because the company's quarterly profit surpassed analysts' forecasts - $ 1.07 per against the average forecast of $ 1.02. Quarterly revenue of Wal-Mart, as well as analysts predicted, actually remained at the level of the second quarter of the previous year and amounted to $ 119.405 billion. The Wal-Mart also reported figure forecast increase in earnings per share for 2017 to $ 4.15-4.35 previous c $ 4.00-4.30.

Oil prices rose significantly, reaching a six-week high, as the largest oil producers in the world have signaled their readiness to discuss the possibility of freezing production levels. Brent crude oil prices have risen by more than 20% since the beginning of the month in response to the news that members of the Organization of Petroleum Exporting Countries and other key exporters are likely to resume talks on freezing production levels at a meeting in September.

In addition, as reported by the Ministry of Labour, the number of Americans who applied for unemployment benefits fell more than expected last week. Primary applications for state unemployment benefits fell by 4,000 and reached a seasonally adjusted 262,000 for the week ended August 13th. Economists forecast that initial applications fall to 265,000 last week. Primary applications now remain below 300,000, a threshold associated with a strong labor market for 76 consecutive weeks. This is the longest period since 1973, when the labor market was much smaller.

At the same time, the index of leading economic indicators from the Conference Board (LEI) for the US increased by 0.4% in July to 124.3 (2010 = 100), after rising by 0.3% in June, as well as the decline in 0, 2% in May. "The index of leading indicators continued to improve in July, suggesting that moderate economic growth should continue until the end of 2016", - said Ataman Oziildirim expert Conference Board. - Maybe even celebrated some acceleration of growth if the recent improvement in manufacturing and construction will continue, and consumer expectations are not to deteriorate. "

DOW index components finished trading in different directions (14 against 16 in the red in the black). Most remaining shares increased Wal-Mart Stores Inc. (WMT, + 1.82%). Outsider were shares of Caterpillar Inc. (CAT, -1.35%).

Sector S & P index closed mostly in positive territory. The leader turned out to be the basic materials sector (+ 1.2%). conglomerates (-2.9%) sectors fell most.

At the close:

Dow + 0.12% 18,597.12 +23.18

Nasdaq + 0.22% 5,240.15 +11.49

S & P + 0.22% 2,186.99 +4.77

-

21:00

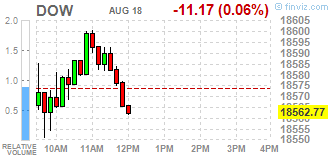

Dow -0.03% 18,567.64 -6.30 Nasdaq +0.17% 5,237.73 +9.07 S&P +0.09% 2,184.12 +1.90

-

18:40

WSE: Session Results

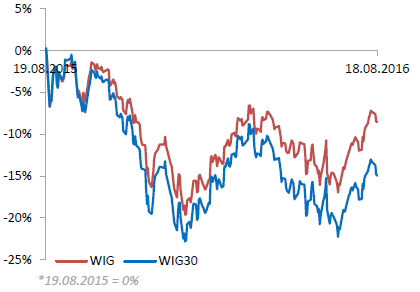

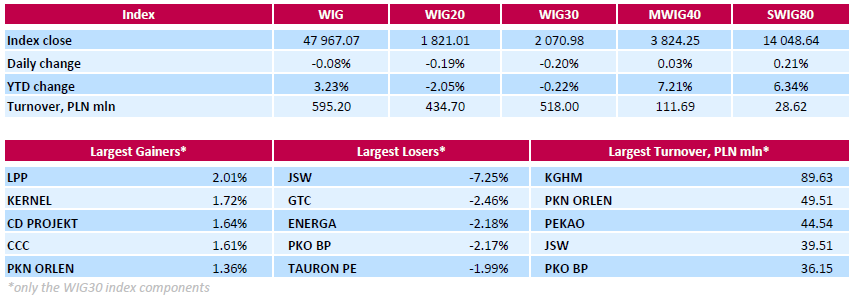

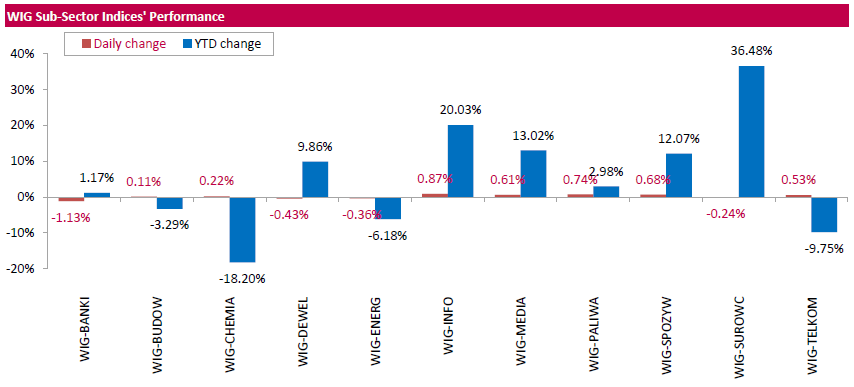

Polish equity market closed flat on Thursday. The broad market measure, the WIG Index, edged down 0.08%. From a sector perspective, information technology (+0.87%) fared the best, while banking sector (-1.13%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 0.20%. In the index basket, coking coal producer JSW (WSE: JSW) was hit the hardest, down 7.25%, as the company announced its net loss narrowed to PLN 89.3 mln (-79.2% y/y) in Q2, while analysts' consensus estimate suggested reduction to PLN 43.7 mln. It was followed by property developer GTC (WSE: GTC), genco ENERGA (WSE: ENG) and bank PKO BP (WSE: PKO), plunging by 2.46%, 2.18% and 2.17%. On the other side of the ledger, clothing retailer LPP (WSE: LPP) and agricultural producer KERNEL (WSE: KER) recorded the biggest daily gains, surging by 2.01% and 1.72% respectively.

-

18:08

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday despite the impact of a rise in oil prices and strong results at Wal-Mart was offset by weakness in consumer discretionary and financial stocks.

Dow component Wal-Mart (WMT) rose after the retailer posted a better-than-expected quarterly profit. The stock provided the biggest boost to the Dow and the S&P 500.

Oil stocks rose as Brent crude touched $50 a barrel for the first time in six weeks after major producers prepared to discuss a possible freeze in output. U.S. crude was trading near $47.

Dow stocks mixed (15 vs 15). Top gainer - Wal-Mart Stores Inc. (WMT, +1.58%). Top loser - Caterpillar Inc. (CAT, -1.34%).

Most of S&P sectors in positive area. Top gainer - Basic Materials (+1.0%). Top loser - Conglomerates (-2.6%).

At the moment:

Dow 18545.00 +4.00 +0.02%

S&P 500 2181.75 +2.00 +0.09%

Nasdaq 100 4807.50 +3.50 +0.07%

Oil 48.69 +1.17 +2.46%

Gold 1355.70 +6.90 +0.51%

U.S. 10yr 1.55 -0.01

-

18:00

European stocks closed: FTSE 100 +9.81 6868.96 +0.14% DAX +65.36 10603.03 +0.62% CAC 40 +19.38 4437.06 +0.44%

-

15:41

WSE: After start on Wall Street

The series of national data, which we met in the afternoon were quite clearly disappointing, especially at the level of industrial production. Still fatal information about the construction and assembly production, which means that the investments do not move. Better looks sales gaining 2%, however it is less than expected. The data weakened the zloty and the stock market.

We also met the US labor market data, which traditionally are very good and few variable. In turn, the Philadelphia Fed index was in line with expectations. These data will not have much meaning today as investors in the US will have to decide themselves whether yesterday's increases were justified or it's time to take profits.

Although contracts for the S&P500 reported a decline at the beginning of the session on Wall Street, the Americans took off on the green side. The growth of individual indexes are small indeed, but we may easily see a reaction to that by above mentioned contracts, which quickly went up to the equilibrium level. No additional external pressure is obviously good news for the bulls. The only problem is that our market does not respond to all of these facts.

-

15:33

U.S. Stocks open: Dow +0.05%, Nasdaq +0.06%, S&P +0.07%

-

15:26

Before the bell: S&P futures -0.08%, NASDAQ futures -0.11%

U.S. stock-index futures were little changed as investors weighed near-record equity levels, and indications an uncertain economic outlook gives policy makers little reason to raise interest rates until at least next year.

Global Stocks:

Nikkei 16,486.01 -259.63 -1.55%

Hang Seng 23,023.16 +223.38 +0.98%

Shanghai 3,104.32 -5.23 -0.17%

FTSE 6,865.43 +6.28 +0.09%

CAC 4,419.28 +1.60 +0.04%

DAX 10,567.11 +29.44 +0.28%

Crude $47.08 (+0.62%)

Gold $1356.60 (+0.58%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.87

0.00(0.00%)

17943

ALCOA INC.

AA

10.4

0.04(0.3861%)

23310

ALTRIA GROUP INC.

MO

66.46

0.00(0.00%)

113632

Amazon.com Inc., NASDAQ

AMZN

764.24

-0.39(-0.051%)

1847

American Express Co

AXP

65.68

0.00(0.00%)

30567

AMERICAN INTERNATIONAL GROUP

AIG

59

-0.03(-0.0508%)

500

Apple Inc.

AAPL

109.05

-0.17(-0.1556%)

31083

AT&T Inc

T

41.9

0.04(0.0956%)

1242

Barrick Gold Corporation, NYSE

ABX

21.09

0.22(1.0541%)

59585

Boeing Co

BA

134.72

0.00(0.00%)

24083

Caterpillar Inc

CAT

84.38

-0.03(-0.0355%)

1099

Chevron Corp

CVX

102.4

0.18(0.1761%)

3600

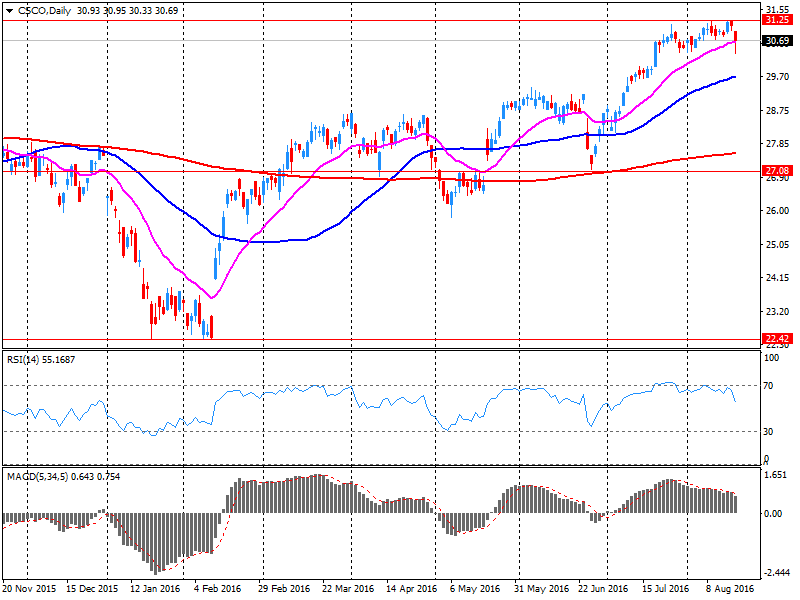

Cisco Systems Inc

CSCO

30.3

-0.42(-1.3672%)

131343

Citigroup Inc., NYSE

C

46.5

-0.13(-0.2788%)

24994

Deere & Company, NYSE

DE

77.43

0.00(0.00%)

1700

E. I. du Pont de Nemours and Co

DD

68.62

0.00(0.00%)

12497

Exxon Mobil Corp

XOM

88.11

0.00(0.00%)

985

Facebook, Inc.

FB

124.35

-0.02(-0.0161%)

44290

FedEx Corporation, NYSE

FDX

166.45

0.00(0.00%)

16386

Ford Motor Co.

F

12.38

-0.01(-0.0807%)

9591

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.2

0.20(1.6667%)

92251

General Electric Co

GE

31.29

0.00(0.00%)

2100

General Motors Company, NYSE

GM

31.85

0.00(0.00%)

43670

Goldman Sachs

GS

165.8

0.13(0.0785%)

125

Google Inc.

GOOG

777

-2.91(-0.3731%)

409

Hewlett-Packard Co.

HPQ

14.5

0.00(0.00%)

815202

Home Depot Inc

HD

136.22

0.07(0.0514%)

149017

HONEYWELL INTERNATIONAL INC.

HON

115.78

0.00(0.00%)

20456

Intel Corp

INTC

34.98

-0.04(-0.1142%)

705

International Business Machines Co...

IBM

160

-0.44(-0.2742%)

423

International Paper Company

IP

47.31

0.00(0.00%)

23524

Johnson & Johnson

JNJ

121.15

-0.16(-0.1319%)

10353

JPMorgan Chase and Co

JPM

65.84

-0.05(-0.0759%)

200

McDonald's Corp

MCD

117.4

0.30(0.2562%)

375

Merck & Co Inc

MRK

63.21

-0.08(-0.1264%)

108314

Microsoft Corp

MSFT

57.56

0.00(0.00%)

465

Nike

NKE

57.1

0.24(0.4221%)

553

Pfizer Inc

PFE

35.14

0.00(0.00%)

1800

Procter & Gamble Co

PG

86.96

0.00(0.00%)

62447

Starbucks Corporation, NASDAQ

SBUX

55.8

0.00(0.00%)

500

Tesla Motors, Inc., NASDAQ

TSLA

223.55

0.31(0.1389%)

3191

The Coca-Cola Co

KO

44.05

-0.01(-0.0227%)

4000

Travelers Companies Inc

TRV

117.42

0.00(0.00%)

8832

Twitter, Inc., NYSE

TWTR

19.6

-0.57(-2.826%)

415998

United Technologies Corp

UTX

108.94

0.00(0.00%)

18155

UnitedHealth Group Inc

UNH

141.71

0.00(0.00%)

18037

Verizon Communications Inc

VZ

53.24

0.07(0.1317%)

1413

Visa

V

80.31

-0.53(-0.6556%)

5750

Wal-Mart Stores Inc

WMT

74.8

1.87(2.5641%)

1544929

Walt Disney Co

DIS

96.76

-0.11(-0.1136%)

1385

Yahoo! Inc., NASDAQ

YHOO

42.68

-0.02(-0.0468%)

1196

Yandex N.V., NASDAQ

YNDX

22.71

-0.16(-0.6996%)

2100

-

14:41

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Twitter (TWTR) downgraded to Sell from Hold at Evercore ISI; target lowered to $17 from $18

Cisco Systems (CSCO) reiterated with an Outperform rating at RBC Capital; target $35

-

13:25

Company News: Wal-Mart (WMT) Q2 EPS beat analysts’ estimate

Wal-Mart reported Q2 FY 2017 earnings of $1.07 per share (versus $1.08 in Q2 FY 2016), beating analysts' consensus estimate of $1.02.

The company's quarterly revenues amounted to $119.405 bln (+0.1% y/y), in-line with analysts' consensus estimate of $119.327 bln.

Wal-Mart increased its FY2017 EPS projection to $4.15-4.35 from $4.00-4.30.

WMT rose to $75.40 (+3.39%) in pre-market trading.

-

13:14

WSE: Mid session comment

At the start of today's trading appeared cooling of the favorable atmosphere in the environment, which resulted in reduction in the rate of observed increases. On the Warsaw market the WIG20 went below support and yesterday's session lows. In the following hours of trading, while the Euroland was maintain stable and did not confirm our pessimism signaled already in the first hour, on the main floor bulls managed to make up approx. half of the losses accruing from maximum to minimum of the session. Noteworthy is the metamorphosis of KGHM, which after substantial initial decline caused by weaker-than-expected results of the second quarter, grow 0.4 percent now. On the green side of the market is also PGE. The third of the largest companies on the green side is PKN Orlen. Lasted more than an hour stabilization at the session's maxima favorites bulls in the second half of the session. At the halfway point of today's trading the WIG20 index reported the level of 1,818 points (-0.30%).

-

12:28

Company News: Cisco Systems (CSCO) Q4 results beat analysts’ expectations

Cisco Systems reported Q4FY16 earnings of $0.63 per share (versus $0.59 in Q4FY15), beating analysts' consensus estimate of $0.60.

The company's quarterly revenues amounted to $12.638 bln (-1.6% y/y), slightly beating analysts' consensus estimate of $12.571 bln.

Cisco also issued guidance for Q1FY17, projecting EPS of $0.58-0.60 (versus analysts' consensus of $0.60) and revenue of approx. $12.15-12.39 bln, -1%-1% y/y (versus analysts' consensus of $12.49 bln).

CSCO fell to $30.22. (-1.63%) in pre-market trading.

-

09:23

Major stock exchanges trading mixed after opening: FTSE 100 6,885.15-8.77-0.13%, DAX 10,616.82 + 79.15 + 0.75%

-

09:13

WSE: After opening

WIG20 index opened at 1824.61 points (+0.01%)

WIG 48003.25 -0.01%

WIG30 2073.34 -0.08%

mWIG40 3830.21 0.19%

*/ - change to previous close

The futures market opened with increase of 0.22% to 1,830 points. The cash market began with modest increase of 0.01% to 1,824 points and with turnover focused on the shares of KGHM, where the company's results have not been received favorably. Similarly, in the case of JSW and Tauron. Better attitude of surrounding the DAX (+0.7%) supports sentiment, but local factors work against.

-

08:27

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.7%, CAC40 + 0.2%, FTSE 0.3%

-

08:26

WSE: Before opening

Yesterday's session on Wall Street ended with small increases, and today in the morning looks good most Asian stock markets. The only exception are the declines in Tokyo, due to the strong yen. It is necessary to mention about published last night minutes of the last FOMC meeting. Some of the members of the Fed's Open Market Committee expect that soon they will need to hike rates, but in the Committee there is a general consensus that before taking such a decision some additional data will be needed. The protocol has been received as a conservative, as indicated by the decline in the dollar, the rise in stock prices, and declines in bond yields.

On the Warsaw market the results of companies will be important today. Results of KGHM (WSE: KGH) at the net level was disappointed. Slightly better was Tauron (WSE: TPE), although the company said earlier estimate of its results. Worse-than-expected results was announced by JSW.

There are the information about the next banks that KNF wants to consider as systemically important institutions and impose additional buffer. This time it comes to the Millennium (WSE: MIL), mBank (WSE: MBK) and Raiffeisen Bank Poland (not listed on the WSE). Local factors do not seem to be supported, although improvement in global sentiment should result in stopping developing of three days correction.

-

07:23

Global Stocks

European stocks lost ground Wednesday, with semiconductor company ASML Holding NV and brewer Carlsberg AS among the largest decliners.

The decline in the pan-European stock benchmark came as investors waited for clues about whether U.S. policy makers are ready to start raising interest rates.

The Stoxx Europe 600 SXXP, -0.83% fell 0.8% to close at 340.47, marking a fourth straight loss in a row.

U.K. stocks finished lower Wednesday amid sharp losses for miners on the back of weaker metals prices, offsetting better-than-expected labor-market data.

The FTSE 100 UKX, -0.50% dropped 0.5% to close at 6,859.15, its second-straight day of losses. The index on Tuesday fell 0.7%, breaking an eight-day winning streak, the longest run of gains since October 2015.

U.S. stocks closed slightly higher Wednesday after sharply paring earlier losses as minutes from the Federal Reserve's July meeting showed policy makers remained divided on prospects for a near-term rate increase.

Stocks bounced off session lows after St. Louis Fed President James Bullard said that with U.S. growth trending below 2%, interest rates can stay low.

Later, following a small pullback following the release of the Fed minutes, stocks had fluctuated between slight gains and losses after the minutes revealed that Fed officials were largely unchanged in their debate over interest rate hikes.

The Dow Jones Industrial Average DJIA, +0.12% rose 21.92 points, or 0.1%, to close at 18,573.94, after being down as many as 83 points earlier in session.

The S&P 500 index SPX, +0.19% rose 4.07 points, or 0.2%, to close at 2,182.22, overcoming an earlier 10-point deficit.

Meanwhile, the Nasdaq Composite Index COMP, +0.03% finished up 1.55 points at 5,228.66, after being down about 30 points earlier.

Asian stocks rose and the greenback languished near two-month lows on Thursday after minutes of the U.S. Federal Reserve's latest meeting showed policymakers were in no rush to raise interest rates.

The July meeting minutes released on Wednesday showed that Fed policymakers were generally upbeat about the U.S. economic outlook and labor market. But they also said they wanted to "leave their policy options open" as any slowdown in hiring would argue against near-term monetary tightening.

Market participants interpreted the minutes as moderately positive for risk-taking appetite, with the Fed remaining divided on the timing of the next rate hike. Futures contracts dipped slightly, signaling receding bets of a U.S. rate increase.

-

00:30

Stocks. Daily history for Aug 17’2016:

(index / closing price / change items /% change)

Nikkei 225 16,745.64 +149.13 +0.90%

Shanghai Composite 3,110.23 +0.1886 +0.01%

S&P/ASX 200 5,535.05 +3.06 +0.06%

FTSE 100 6,859.15 -34.77 -0.50%

CAC 40 4,417.68 -42.76 -0.96%

S&P 500 2,182.22 +4.07 +0.19%

Dow Jones Industrial Average 18,573.94 +21.92 +0.12%

S&P/TSX Composite 14,697.60 -5.84 -0.04%

-