Noticias del mercado

-

22:08

Major US stock indices closed above zero

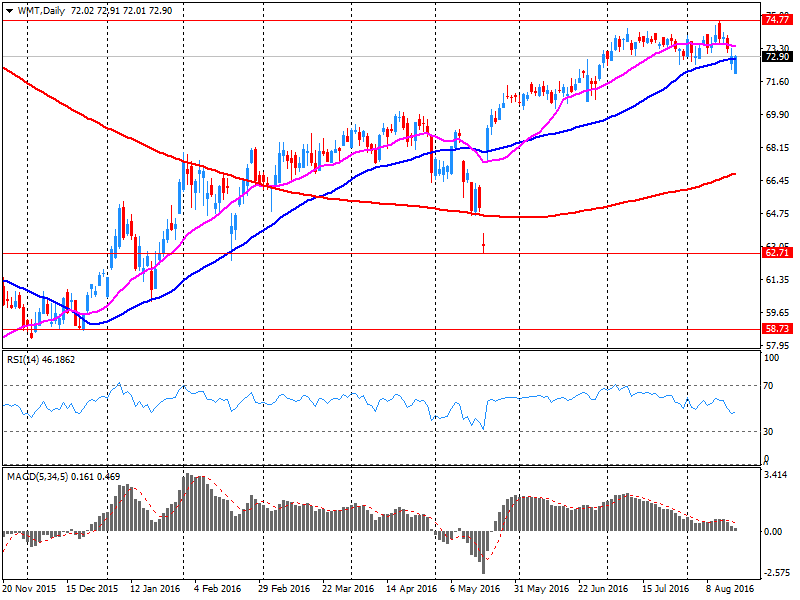

Major Wall Street stock indexes finished trading almost unchanged, despite the significant rise in oil prices and strong Wal-Mart quarterly results.

Thus, the report of the company Wal-Mart (WMT) pleased investors because the company's quarterly profit surpassed analysts' forecasts - $ 1.07 per against the average forecast of $ 1.02. Quarterly revenue of Wal-Mart, as well as analysts predicted, actually remained at the level of the second quarter of the previous year and amounted to $ 119.405 billion. The Wal-Mart also reported figure forecast increase in earnings per share for 2017 to $ 4.15-4.35 previous c $ 4.00-4.30.

Oil prices rose significantly, reaching a six-week high, as the largest oil producers in the world have signaled their readiness to discuss the possibility of freezing production levels. Brent crude oil prices have risen by more than 20% since the beginning of the month in response to the news that members of the Organization of Petroleum Exporting Countries and other key exporters are likely to resume talks on freezing production levels at a meeting in September.

In addition, as reported by the Ministry of Labour, the number of Americans who applied for unemployment benefits fell more than expected last week. Primary applications for state unemployment benefits fell by 4,000 and reached a seasonally adjusted 262,000 for the week ended August 13th. Economists forecast that initial applications fall to 265,000 last week. Primary applications now remain below 300,000, a threshold associated with a strong labor market for 76 consecutive weeks. This is the longest period since 1973, when the labor market was much smaller.

At the same time, the index of leading economic indicators from the Conference Board (LEI) for the US increased by 0.4% in July to 124.3 (2010 = 100), after rising by 0.3% in June, as well as the decline in 0, 2% in May. "The index of leading indicators continued to improve in July, suggesting that moderate economic growth should continue until the end of 2016", - said Ataman Oziildirim expert Conference Board. - Maybe even celebrated some acceleration of growth if the recent improvement in manufacturing and construction will continue, and consumer expectations are not to deteriorate. "

DOW index components finished trading in different directions (14 against 16 in the red in the black). Most remaining shares increased Wal-Mart Stores Inc. (WMT, + 1.82%). Outsider were shares of Caterpillar Inc. (CAT, -1.35%).

Sector S & P index closed mostly in positive territory. The leader turned out to be the basic materials sector (+ 1.2%). conglomerates (-2.9%) sectors fell most.

At the close:

Dow + 0.12% 18,597.12 +23.18

Nasdaq + 0.22% 5,240.15 +11.49

S & P + 0.22% 2,186.99 +4.77

-

21:00

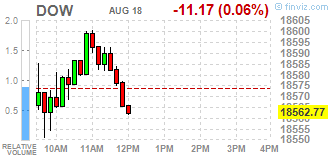

Dow -0.03% 18,567.64 -6.30 Nasdaq +0.17% 5,237.73 +9.07 S&P +0.09% 2,184.12 +1.90

-

18:40

WSE: Session Results

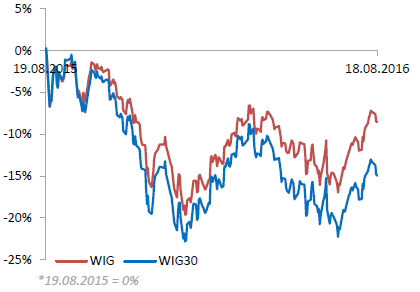

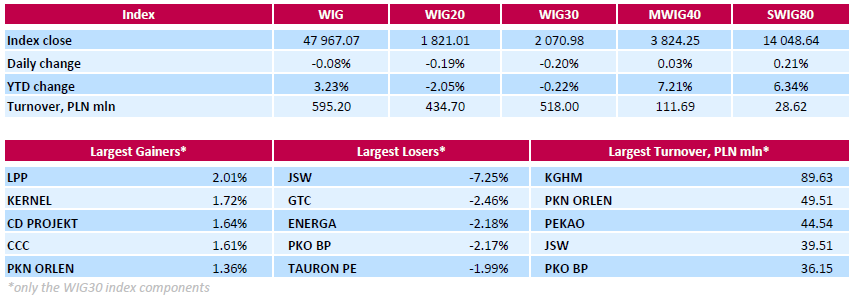

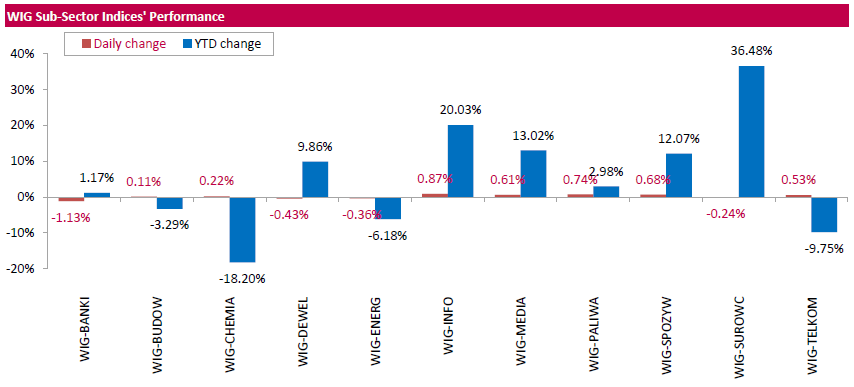

Polish equity market closed flat on Thursday. The broad market measure, the WIG Index, edged down 0.08%. From a sector perspective, information technology (+0.87%) fared the best, while banking sector (-1.13%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 0.20%. In the index basket, coking coal producer JSW (WSE: JSW) was hit the hardest, down 7.25%, as the company announced its net loss narrowed to PLN 89.3 mln (-79.2% y/y) in Q2, while analysts' consensus estimate suggested reduction to PLN 43.7 mln. It was followed by property developer GTC (WSE: GTC), genco ENERGA (WSE: ENG) and bank PKO BP (WSE: PKO), plunging by 2.46%, 2.18% and 2.17%. On the other side of the ledger, clothing retailer LPP (WSE: LPP) and agricultural producer KERNEL (WSE: KER) recorded the biggest daily gains, surging by 2.01% and 1.72% respectively.

-

18:08

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday despite the impact of a rise in oil prices and strong results at Wal-Mart was offset by weakness in consumer discretionary and financial stocks.

Dow component Wal-Mart (WMT) rose after the retailer posted a better-than-expected quarterly profit. The stock provided the biggest boost to the Dow and the S&P 500.

Oil stocks rose as Brent crude touched $50 a barrel for the first time in six weeks after major producers prepared to discuss a possible freeze in output. U.S. crude was trading near $47.

Dow stocks mixed (15 vs 15). Top gainer - Wal-Mart Stores Inc. (WMT, +1.58%). Top loser - Caterpillar Inc. (CAT, -1.34%).

Most of S&P sectors in positive area. Top gainer - Basic Materials (+1.0%). Top loser - Conglomerates (-2.6%).

At the moment:

Dow 18545.00 +4.00 +0.02%

S&P 500 2181.75 +2.00 +0.09%

Nasdaq 100 4807.50 +3.50 +0.07%

Oil 48.69 +1.17 +2.46%

Gold 1355.70 +6.90 +0.51%

U.S. 10yr 1.55 -0.01

-

18:00

European stocks closed: FTSE 100 +9.81 6868.96 +0.14% DAX +65.36 10603.03 +0.62% CAC 40 +19.38 4437.06 +0.44%

-

17:51

Oil reached a six-week high

Oil futures rose in today's trading, reaching a six-week high, as the world's largest oil producers have signaled their readiness to discuss the possibility of freezing production levels.

Brent crude oil prices have risen by more than 20 percent since the beginning of the month in response to the news that members of OPEC and other key exporters are likely to resume talks on freezing production levels at the meeting in September.

Many OPEC members have been hit hard by the collapse in oil prices over the past two years. While some Gulf oil exporters have very low production costs, other producers, such as Iran and Venezuela, need oil prices above $ 100 to balance their budgets. However, analysts believe that the freezing of production at current levels would not be able to support prices. Meanwhile, Saudi Arabia has made it clear that, in August, can increase oil deliveries to a new record level, although it has expressed willingness to discuss production levels with other manufacturers.

In view of this situation, Citi analysts have warned that there are risks to the price rally, based primarily on the potential for future negotiations on freezing oil production levels, given that similar meetings earlier this year ended without result.

The cost of October futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 48.60 dollars per barrel.

October futures price for North Sea petroleum mix of Brent crude rose to 50.87 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:27

Gold price rose slightly today

Gold prices rose slightly, supported by the weakening US dollar and the minutes of the last meeting of FOMC.

The US currency fell 0.4 percent against a basket of major currencies. Recall, the weakening dollar makes commodities cheaper for holders of other currencies.

FOMC minutes revealed that some members of the Fed's Board of Governors anticipate that in the near future will need to increase interest rates in the US, but many believe that additional data is necesary in order to make such a decision. Some said that the slowdown in hiring will prevent the rapid increase of rates in the future. Some politicians have expressed concern that low interest rates may harm financial stability.

According to the futures market, the probability of a Fed hike is 18% in September and 42.9% in December versus 41.7% yesterday.

"No one will be willing to aggressively sell gold, even if the interest rate rise, as presidential elections, scheduled for November, will create uncertainty," - said Yuichi Ikemitsu expert at Standard Bank in Tokyo.

The gold reserves in the largest gold ETF SPDR Gold Trust fell on Wednesday by 0.46 percent, reaching the level of 957.78 tons.

The cost of October gold futures on COMEX rose to $ 1,350.40 an ounce.

-

16:54

Fed, Dudley: wage gains are gradually starting to pick up

-

NYC job gains are widespread outside of finance, on tech hiring

-

Labour market conditions continue to improve

-

Job gains have remained very sturdy

-

If we're downshifting in jobs it's tiny

-

Wage gains are gradually starting to pick up

-

There's probably still a little slack in the labour market

-

Q3 GDP will be quite stronger that H1

-

H2 should be 2% or more

-

Q2 GDP was misleading due to a drag from inventories

*via forexlive -

-

16:05

US CB leading index up 0.4% in July

The Conference Board Leading Economic Index® (LEI) for the U.S. increased 0.4 percent in July to 124.3 (2010 = 100), following a 0.3 percent increase in June, and a 0.2 percent decline in May.

"The U.S. LEI picked up again in July, suggesting moderate economic growth should continue through the end of 2016," said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board.

"There may even be some moderate upside growth potential if recent improvements in manufacturing and construction are sustained, and average consumer expectations don't deteriorate further."

-

16:00

U.S.: Leading Indicators , July 0.4% (forecast 0.3%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1350 (EUR 605m)

USD/JPY 101.00 (USD 1.46bln) 103.00 (USD 877m) 104.00 (1.08bln)

AUD/USD 0.7650 (AUD 640m)

USD/CAD 1.2990-1.3000 (USD 756m)

AUD/NZD 1.0700 (AUD 310m) 1.0710-12 (AUD (485m)

-

15:41

WSE: After start on Wall Street

The series of national data, which we met in the afternoon were quite clearly disappointing, especially at the level of industrial production. Still fatal information about the construction and assembly production, which means that the investments do not move. Better looks sales gaining 2%, however it is less than expected. The data weakened the zloty and the stock market.

We also met the US labor market data, which traditionally are very good and few variable. In turn, the Philadelphia Fed index was in line with expectations. These data will not have much meaning today as investors in the US will have to decide themselves whether yesterday's increases were justified or it's time to take profits.

Although contracts for the S&P500 reported a decline at the beginning of the session on Wall Street, the Americans took off on the green side. The growth of individual indexes are small indeed, but we may easily see a reaction to that by above mentioned contracts, which quickly went up to the equilibrium level. No additional external pressure is obviously good news for the bulls. The only problem is that our market does not respond to all of these facts.

-

15:33

U.S. Stocks open: Dow +0.05%, Nasdaq +0.06%, S&P +0.07%

-

15:26

Before the bell: S&P futures -0.08%, NASDAQ futures -0.11%

U.S. stock-index futures were little changed as investors weighed near-record equity levels, and indications an uncertain economic outlook gives policy makers little reason to raise interest rates until at least next year.

Global Stocks:

Nikkei 16,486.01 -259.63 -1.55%

Hang Seng 23,023.16 +223.38 +0.98%

Shanghai 3,104.32 -5.23 -0.17%

FTSE 6,865.43 +6.28 +0.09%

CAC 4,419.28 +1.60 +0.04%

DAX 10,567.11 +29.44 +0.28%

Crude $47.08 (+0.62%)

Gold $1356.60 (+0.58%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.87

0.00(0.00%)

17943

ALCOA INC.

AA

10.4

0.04(0.3861%)

23310

ALTRIA GROUP INC.

MO

66.46

0.00(0.00%)

113632

Amazon.com Inc., NASDAQ

AMZN

764.24

-0.39(-0.051%)

1847

American Express Co

AXP

65.68

0.00(0.00%)

30567

AMERICAN INTERNATIONAL GROUP

AIG

59

-0.03(-0.0508%)

500

Apple Inc.

AAPL

109.05

-0.17(-0.1556%)

31083

AT&T Inc

T

41.9

0.04(0.0956%)

1242

Barrick Gold Corporation, NYSE

ABX

21.09

0.22(1.0541%)

59585

Boeing Co

BA

134.72

0.00(0.00%)

24083

Caterpillar Inc

CAT

84.38

-0.03(-0.0355%)

1099

Chevron Corp

CVX

102.4

0.18(0.1761%)

3600

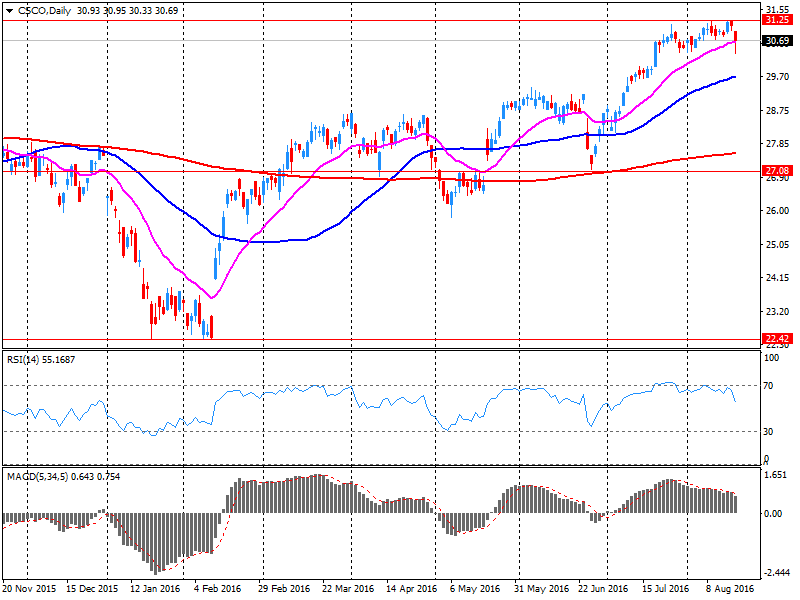

Cisco Systems Inc

CSCO

30.3

-0.42(-1.3672%)

131343

Citigroup Inc., NYSE

C

46.5

-0.13(-0.2788%)

24994

Deere & Company, NYSE

DE

77.43

0.00(0.00%)

1700

E. I. du Pont de Nemours and Co

DD

68.62

0.00(0.00%)

12497

Exxon Mobil Corp

XOM

88.11

0.00(0.00%)

985

Facebook, Inc.

FB

124.35

-0.02(-0.0161%)

44290

FedEx Corporation, NYSE

FDX

166.45

0.00(0.00%)

16386

Ford Motor Co.

F

12.38

-0.01(-0.0807%)

9591

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.2

0.20(1.6667%)

92251

General Electric Co

GE

31.29

0.00(0.00%)

2100

General Motors Company, NYSE

GM

31.85

0.00(0.00%)

43670

Goldman Sachs

GS

165.8

0.13(0.0785%)

125

Google Inc.

GOOG

777

-2.91(-0.3731%)

409

Hewlett-Packard Co.

HPQ

14.5

0.00(0.00%)

815202

Home Depot Inc

HD

136.22

0.07(0.0514%)

149017

HONEYWELL INTERNATIONAL INC.

HON

115.78

0.00(0.00%)

20456

Intel Corp

INTC

34.98

-0.04(-0.1142%)

705

International Business Machines Co...

IBM

160

-0.44(-0.2742%)

423

International Paper Company

IP

47.31

0.00(0.00%)

23524

Johnson & Johnson

JNJ

121.15

-0.16(-0.1319%)

10353

JPMorgan Chase and Co

JPM

65.84

-0.05(-0.0759%)

200

McDonald's Corp

MCD

117.4

0.30(0.2562%)

375

Merck & Co Inc

MRK

63.21

-0.08(-0.1264%)

108314

Microsoft Corp

MSFT

57.56

0.00(0.00%)

465

Nike

NKE

57.1

0.24(0.4221%)

553

Pfizer Inc

PFE

35.14

0.00(0.00%)

1800

Procter & Gamble Co

PG

86.96

0.00(0.00%)

62447

Starbucks Corporation, NASDAQ

SBUX

55.8

0.00(0.00%)

500

Tesla Motors, Inc., NASDAQ

TSLA

223.55

0.31(0.1389%)

3191

The Coca-Cola Co

KO

44.05

-0.01(-0.0227%)

4000

Travelers Companies Inc

TRV

117.42

0.00(0.00%)

8832

Twitter, Inc., NYSE

TWTR

19.6

-0.57(-2.826%)

415998

United Technologies Corp

UTX

108.94

0.00(0.00%)

18155

UnitedHealth Group Inc

UNH

141.71

0.00(0.00%)

18037

Verizon Communications Inc

VZ

53.24

0.07(0.1317%)

1413

Visa

V

80.31

-0.53(-0.6556%)

5750

Wal-Mart Stores Inc

WMT

74.8

1.87(2.5641%)

1544929

Walt Disney Co

DIS

96.76

-0.11(-0.1136%)

1385

Yahoo! Inc., NASDAQ

YHOO

42.68

-0.02(-0.0468%)

1196

Yandex N.V., NASDAQ

YNDX

22.71

-0.16(-0.6996%)

2100

-

14:41

International transactions in securities generated a net inflow of funds into the Canadian economy

Foreign investors increased their holdings of Canadian securities by $9.0 billion in June, with acquisitions led by significant portfolio investment in equities. At the same time, Canadian investors acquired $4.1 billion of foreign securities, mainly non-US foreign equities.

As a result, international transactions in securities generated a net inflow of funds into the Canadian economy of $4.9 billion in June, for a total of $24.0 billion in the second quarter. This followed a $51.7 billion inflow of funds recorded in the first quarter.

-

14:41

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Twitter (TWTR) downgraded to Sell from Hold at Evercore ISI; target lowered to $17 from $18

Cisco Systems (CSCO) reiterated with an Outperform rating at RBC Capital; target $35

-

14:40

US jobless claims declined slightly

In the week ending August 13, the advance figure for seasonally adjusted initial claims was 262,000, a decrease of 4,000 from the previous week's unrevised level of 266,000. The 4-week moving average was 265,250, an increase of 2,500 from the previous week's unrevised average of 262,750.

There were no special factors impacting this week's initial claims. This marks 76 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

14:38

US: Philadelphia Fed manufacturing suggest that growth was positive but tenuous this month. The dollar little changed

Firms responding to the Manufacturing Business Outlook Survey suggest that growth was positive but tenuous this month. The diffusion index for current general activity moved from a negative reading to a marginally positive reading, while the indicators for new orders and employment suggested continued general weakness in business conditions. Of the current broad indicators, the diffusion index for shipments recorded the strongest reading. The respondents were confident about future growth, as their forecasts of future activity showed notable improvement.

The index for current manufacturing activity in the region rose 5 points to only 2.0 in August, as the share of firms reporting an increase in activity (35 percent) barely exceeded the share reporting a decrease (33 percent). This is only the third positive reading of the index in the current year.

The current new orders index dropped significantly from a reading of 11.8 in July to -7.2 in August.

The survey's indicators of employment weakened considerably. The employment index fell 18 points to -20.0, which is its largest negative reading for the current year.

The survey's indicators of employment weakened considerably. The employment index fell 18 points to -20.0, which is its largest negative reading for the current year.

-

14:30

U.S.: Initial Jobless Claims, 262 (forecast 265)

-

14:30

Canada: Foreign Securities Purchases, June 9.02

-

14:30

U.S.: Continuing Jobless Claims, 2175 (forecast 2140)

-

14:23

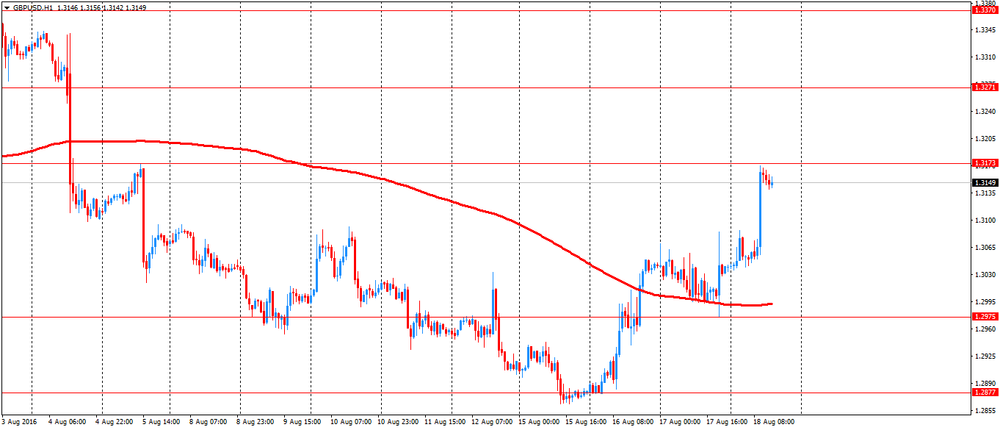

European session review: the pound rose sharply on strong retail sales data

The following data was published:

(Time / country / index / period / previous value / forecast)

8:00 Eurozone balance of payments, without taking into account seasonal adjustments, 16.5 billion in June from 15.4 37.6 Revised

08:30 UK Retail Sales m / m in July -0.9% 0.2% 1.4%

8:30 UK Retail sales, y / y in July 4.3% 4.2% 5.9%

9:00 Eurozone construction volume change, y / y in June -0.8% 0.6%

9:00 Eurozone Consumer Price Index m / m in July 0.2% -0.5% -0.6%

9:00 Eurozone Consumer Price Index y / y (final data) July 0.1% 0.2% 0.2%

9:00 Eurozone consumer price index base value, y / y (final data) July 0.9% 0.9% 0.9%

The pound rose sharply against the US dollar afterdata on retail sales exceeded forecasts. In the UK, retail sales rebounded in July, as sales in stores of food and non-food products rose, showed the Office for National Statistics.

Retail sales, including automotive fuel, increased by 1.4 percent for the month, after a 0.9 percent drop in June. Sales were expected to grow by only 0.2 percent.

In the same way, except automotive fuel, retail sales rose 1.5 percent after falling 0.9 percent the previous month. The increase was much faster than expected (+0.3%)..

In annual terms, the growth in the overall volume of retail sales improved to 5.9 percent in July from 4.3 percent. Sales excluding auto fuel advanced 5.4 percent, faster than the growth of 3.9 percent in June.

Economists had forecast that total sales will grow by 4.2 percent, while sales excluding automotive fuel will rise by 3.9 percent.

The euro rose moderately against the US dollar, continuing the rise started yesterday. Pressure on the dollar put protocols of the July meeting of the FOMC, which showed that between the leaders of the Fed there is no agreement on the policy tightening. Markets were waiting for the signal of a tight policy, but protocols have been balanced.

FOMC members sought to reconcile views on the economic outlook and the timing of interest rate increases, and sought to leave open all possibilities. Some Fed officials suggested not to tighten policy until there is more confidence in the achievement of the inflation target of 2%, and others said that the US labor market is almost fully recovered.

Today investors focus on euro zone inflation data for July.

Inflation rose to 0.2 percent from 0.1 percent in June. Prices rose for the second month in a row in July.

Inflation remains below the target level of the European Central Bank's.

Core inflation, which excludes energy, food, alcohol and tobacco, remained stable at 0.9 percent in July.

Both the consumer and the main indicators of inflation matched the preliminary estimate published on 29 July.

On a monthly basis, consumer prices fell 0.6 percent in July.

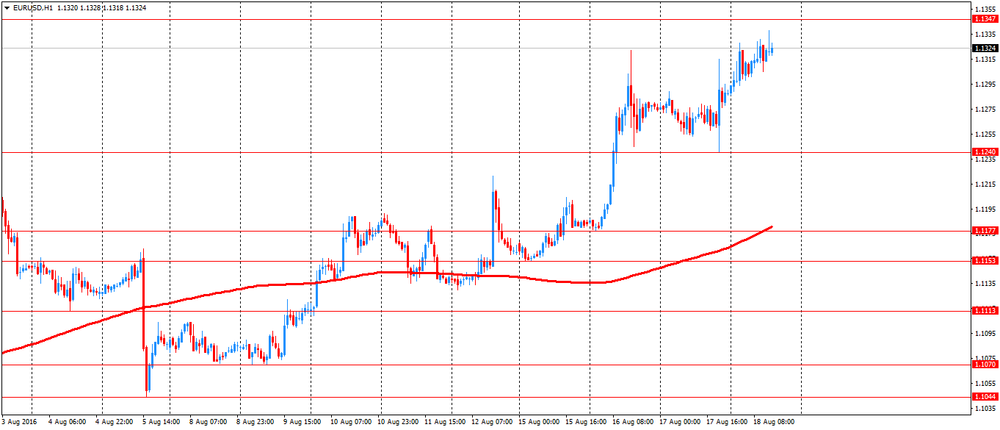

EUR / USD: during the European session, the pair rose to $ 1.1338

GBP / USD: during the European session, the pair rose to $ 1.3170

USD / JPY: during the European session, the pair rose to Y100.49

-

13:49

Orders

EUR/USD

Offers : 1.1325-30 1.1350 1.1370-80 1.1400 1.1425-30 1.1450

Bids : 1.1300 1.1280 1.1250 1.1230 1.1200 1.1185 1.1150

GBP/USD

Offers : 1.3080 1.3095-05 1.3130 1.3150 1.3175-80 1.3200

Bids : 1.3030 1.3000 1.2980 1.2950 1.2930 1.2900 1.2880 1.1265 1.2850

EUR/GBP

Offers : 0.8685 0.8700 0.8725-30 0.8750

Bids : 0.8650 0.8625-30 0.8600 0.8585 0.8570 0.8550

EUR/JPY

Offers : 113.30 113.50 113.85 114.00 114.30 114.50 114.75 115.00

Bids : 112.75-80 112.50 112.30 112.00-10 111.85 111.50

USD/JPY

Offers : 100.25-30 100.60 101.00 101.25-30 101.50

Bids : 99.65 99.50 99.30 99.00 98.80 98.50

AUD/USD

Offers : 0.7725-30 0.7750-55 0.7785 0.7800 0.7830 0.7850

Bids : 0.7700 0.7680-85 0.7660 0.7635 0.7620 0.7600 0.7585 0.7565 0.7550

-

13:40

ECB meeting minutes

-

There was a need to convey cautious optimism on the Eurozone recovery

-

ECB made a strong call to limit the political uncertainty on Brexit

-

Saw no clear upward trend in inflation

-

Peter Praet said weak prices were an ongoing source of concern

-

Felt time was needed to assess information over following months

-

Consequences of Brexit vote less marked than expected

-

-

13:25

Company News: Wal-Mart (WMT) Q2 EPS beat analysts’ estimate

Wal-Mart reported Q2 FY 2017 earnings of $1.07 per share (versus $1.08 in Q2 FY 2016), beating analysts' consensus estimate of $1.02.

The company's quarterly revenues amounted to $119.405 bln (+0.1% y/y), in-line with analysts' consensus estimate of $119.327 bln.

Wal-Mart increased its FY2017 EPS projection to $4.15-4.35 from $4.00-4.30.

WMT rose to $75.40 (+3.39%) in pre-market trading.

-

13:14

WSE: Mid session comment

At the start of today's trading appeared cooling of the favorable atmosphere in the environment, which resulted in reduction in the rate of observed increases. On the Warsaw market the WIG20 went below support and yesterday's session lows. In the following hours of trading, while the Euroland was maintain stable and did not confirm our pessimism signaled already in the first hour, on the main floor bulls managed to make up approx. half of the losses accruing from maximum to minimum of the session. Noteworthy is the metamorphosis of KGHM, which after substantial initial decline caused by weaker-than-expected results of the second quarter, grow 0.4 percent now. On the green side of the market is also PGE. The third of the largest companies on the green side is PKN Orlen. Lasted more than an hour stabilization at the session's maxima favorites bulls in the second half of the session. At the halfway point of today's trading the WIG20 index reported the level of 1,818 points (-0.30%).

-

12:36

Major stock indices in Europe moderately higher

European stocks rose as the July Fed meeting minutes dismissed the likelihood of a rate hike in September, while investors moved focus on forthcoming publication of the minutes of the last meeting of the European Central Bank.

The composite index of the largest companies in the region Stoxx Europe 600 rising for the first time in five sessions, +0,6% - to 342.48 points.

Shares of Anglo American rose during trading 2,3%, Antofagasta +2,2%, BHP Billiton +2,1%, Fresnillo +1.9%.

Vestas Wind shares jumped 9%, as the operating income of the Danish manufacturer of wind turbines in the second quarter exceeded forecasts, and the company has improved the forecast for 2016.

Shares of NN Group increased by 6.5%, as the Dutch insurance company reported a smaller decline in profits than many analysts expected.

Thyssenkrupp AG shares rose 1.6% after Deutsche Bank analysts confirmed their rating to "buy."

Shares of Nestle SA fell 0.6% after the Swiss food giant said sales growth in the first quarter by 3.5%, worse than analysts' expectations.

Kingfisher shares have fallen by 1.5%, despite the retailer's message on the growth of sales in the second quarter by 3% and the statement that "there is no clear evidence of the impact on demand from Brexit".

At the moment:

FTSE 6868.29 9.14 0.13%

DAX 10593.06 55.39 0.53%

CAC 4425.96 8.28 0.19%

-

12:28

Company News: Cisco Systems (CSCO) Q4 results beat analysts’ expectations

Cisco Systems reported Q4FY16 earnings of $0.63 per share (versus $0.59 in Q4FY15), beating analysts' consensus estimate of $0.60.

The company's quarterly revenues amounted to $12.638 bln (-1.6% y/y), slightly beating analysts' consensus estimate of $12.571 bln.

Cisco also issued guidance for Q1FY17, projecting EPS of $0.58-0.60 (versus analysts' consensus of $0.60) and revenue of approx. $12.15-12.39 bln, -1%-1% y/y (versus analysts' consensus of $12.49 bln).

CSCO fell to $30.22. (-1.63%) in pre-market trading.

-

11:59

Japan Verbal Intervention Won't Reverse The Stronger JPY Trend - BTMU

"The yen has been undermined overnight as well by Japanese policymakers stepping up verbal intervention in response to USD/JPY falling below the 100.00-level. The Vice Minister for International Affairs Masatsugu Asakawa has stated that Japan is closely watching for "speculative" moves with a strong sense on concern. He noted that price action could be exaggerated in thin summer markets. If there are extreme FX moves he warned that Japan will have to act while keeping in close contact with other G7 nations.

Verbal intervention may help temporarily to dampen yen strength but it will not reverse the stronger yen trend. We still believe that direct intervention remains unlikely in the near-term given strong opposition from the US.

The upcoming US Presidential election could make Japan even more sensitive about intervening given the focus on protectionism. It is also difficult to argue that fundamentals justify intervention. While the yen is stronger now we believe that it is only closer to fair value, and yen volatility has eased recently".

Copyright © 2016 BTMU, eFXnews™

-

11:07

Euro area annual inflation up 0.2%

Euro area annual inflation was 0.2% in July 2016, up from 0.1% in June. In July 2015 the rate was 0.2%. European Union annual inflation was also 0.2% in July 2016, up from 0.1% in June. A year earlier the rate was 0.2%. These figures come from Eurostat, the statistical office of the European Union.

In July 2016, negative annual rates were observed in twelve Member States. The lowest annual rates were registered in Bulgaria and Croatia (both -1.1%) and Slovakia (-0.9%). The highest annual rates were recorded in Belgium (2.0%), Sweden (1.1%) and Malta (0.9%). Compared with June 2016, annual inflation fell in nine Member States, remained stable in seven and rose in twelve.

The largest upward impacts to euro area annual inflation came from restaurants & cafés (+0.11 percentage points), vegetables (+0.09 pp) and fruit (+0.08 pp), while fuels for transport (-0.46 pp), heating oil (-0.15 pp) and gas (-0.12 pp) had the biggest downward impacts

-

11:00

Eurozone: Harmonized CPI, Y/Y, July 0.2% (forecast 0.2%)

-

11:00

Eurozone: Harmonized CPI, July -0.6% (forecast -0.5%)

-

11:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, July 0.9% (forecast 0.9%)

-

11:00

Eurozone: Construction Output, y/y, June 0.6%

-

10:38

Huge retail sales from UK the month after Brexit

The reporting period for this release covers a 4 week period from 3 July to 30 July 2016 and therefore includes data for the month following the EU referendum. The data are based on sales made in Great Britain and will include sales made to both Great Britain residents and non-residents.

In July 2016, the quantity bought (volume) of retail sales is estimated to have increased by 5.9% compared with July 2015; all sectors showed growth with the main contribution coming from non-food stores.

Compared with June 2016, the quantity bought increased by 1.4%; all sectors showed growth with the main contribution again coming from non-food stores.

Average store prices (including petrol stations) fell by 2.0% in July 2016 compared with July 2015. Compared with June 2016, there was a fall of 0.8%.

The amount spent (value) in the retail industry increased by 3.6% compared with July 2015 and 1.6% compared with June 2016.

The amount spent online increased by 16.7% compared with July 2015 and increased by 1.2% compared with June 2016.

-

10:35

The pound on the rise after retail sales confirming too the low impact of Brexit so far

-

10:30

United Kingdom: Retail Sales (YoY) , July 5.9% (forecast 4.2%)

-

10:30

United Kingdom: Retail Sales (MoM), July 1.4% (forecast 0.2%)

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1350 (EUR 605m)

USD/JPY 101.00 (USD 1.46bln) 103.00 (USD 877m) 104.00 (1.08bln)

AUD/USD 0.7650 (AUD 640m)

USD/CAD 1.2990-1.3000 (USD 756m)

AUD/NZD 1.0700 (AUD 310m) 1.0710-12 (AUD (485m)

-

10:09

Oil is gaining in early trading

This morning, the New York WTI futures rose 0.66% to $ 47.10 and crude oil futures for Brent rose by + 0.26% to $ 49.98 per barrel. Thus, the black gold has increased slightly, correcting after the recent collapse amid fears of increase Saudi oil production to record levels. There were reports that Saudi Arabia can update the record of oil production in August, which was recorded in July at the level of 10.67 million barrels per day. This prompted traders to take profits on a background of a 20% increase this month.

-

10:06

The current account of the euro area recorded a surplus of €28.2 billion in June

The current account of the euro area recorded a surplus of €28.2 billion in June 2016. This reflected surpluses for goods (€32.9 billion) and services (€5.3 billion), which were partly offset by a deficit in secondary income (€10.1 billion). The primary income account was close to balance.

The 12-month cumulated current account for the period ending in June 2016 recorded a surplus of €347.8 billion (3.3% of euro area GDP), compared with one of €302.1 billion (2.9% of euro area GDP) for the 12 months to June 2015 (see Table 1 and Chart 1). This development was mostly due to an increase in the surplus for goods (from €306.6 billion to €368.4 billion) and to a decrease in the deficit for secondary income (from €134.8 billion to €123.4 billion). These were partly offset by decreases in the surpluses for both primary income (from €64.0 billion to €40.4 billion) and services (from €66.4 billion to €62.5 billion).

-

10:01

Eurozone: Current account, unadjusted, bln , June 37.6

-

09:23

Major stock exchanges trading mixed after opening: FTSE 100 6,885.15-8.77-0.13%, DAX 10,616.82 + 79.15 + 0.75%

-

09:13

WSE: After opening

WIG20 index opened at 1824.61 points (+0.01%)

WIG 48003.25 -0.01%

WIG30 2073.34 -0.08%

mWIG40 3830.21 0.19%

*/ - change to previous close

The futures market opened with increase of 0.22% to 1,830 points. The cash market began with modest increase of 0.01% to 1,824 points and with turnover focused on the shares of KGHM, where the company's results have not been received favorably. Similarly, in the case of JSW and Tauron. Better attitude of surrounding the DAX (+0.7%) supports sentiment, but local factors work against.

-

09:10

Today’s events:

At 11:30 GMT the ECB will report on monetary policy meeting.

At 14:05 GMT FOMC member William Dudley will make a speech.

At 20:00 GMT FOMC members John Williams will deliver a speech.

-

08:45

FOMC Minutes: Odds Of A Fed Hike In September Relatively Low; December 'A Long-Way Off' - RBS

"The minutes from the July FOMC meeting were less hawkish than the market feared. As widely noted, the Committee was divided on the need for another interest rate hike. It is important to remember, however, that the decision to act will ultimately rest with Fed Chair Yellen. There will be no rate hike until Yellen believes a rate hike is warranted. Given that Yellen is among the most dovish on the Committee, we must assume that Yellen is among the faction who expressed a preference to delay action.

Thus, after reading the minutes, we remain comfortable with our view that the Fed Chair is in no hurry to hike and that the odds of a move in September are relatively low.

...In our view, the "several" and "some" participants noted above almost surely includes Yellen, who is among the most dovish of the Committee members. If we are right, then Yellen is sticking to her risk management policy approach and feels little urgency to raise rates. While the data of late have been reassuring, the hurdle for hiking -- i.e. a sustained move up in inflation and/or evidence that suggests the economy has enough momentum to withstand a downward shock to demand -- is pretty high and does not appear likely to be met by the September meeting. Maybe by December, but December is a long way off (and, in any case, we are skeptical)".

Copyright © 2016 RBS, eFXnews™

-

08:39

Japan's trade balance above expectations in July

The positive balance of Japan's foreign trade in July was Y513,5 billion, higher than the Y283,7 billion forecast. However, the trade balance in July was lower than the previous value of 693.1 billion.

Exports from Japan during the period from January to July fell by 14.0%, after declining by 7.4% from January to June. Economists had forecast a decline of 13.0%.

Imports to Japan in July, year on year, down by 24.7%, after declining by 18.8% in June.

Adjusted Trade Balance, published by the Customs Department of Japan totaled Y317,6 billion, well above the forecast of Y142,2bln. In June, the trade balance was Y335,0 billion.

-

08:29

Options levels on thursday, August 18, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1416 (3620)

$1.1388 (4768)

$1.1348 (3352)

Price at time of writing this review: $1.1316

Support levels (open interest**, contracts):

$1.1256 (1001)

$1.1216 (2292)

$1.1155 (2381)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 53469 contracts, with the maximum number of contracts with strike price $1,1250 (5049);

- Overall open interest on the PUT options with the expiration date September, 9 is 56913 contracts, with the maximum number of contracts with strike price $1,1000 (5799);

- The ratio of PUT/CALL was 1.06 versus 1.07 from the previous trading day according to data from August, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.3304 (2954)

$1.3206 (2108)

$1.3110 (1257)

Price at time of writing this review: $1.3063

Support levels (open interest**, contracts):

$1.2990 (2181)

$1.2893 (2067)

$1.2796 (2605)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32604 contracts, with the maximum number of contracts with strike price $1,3300 (2954);

- Overall open interest on the PUT options with the expiration date September, 9 is 26346 contracts, with the maximum number of contracts with strike price $1,2800 (2605);

- The ratio of PUT/CALL was 0.81 versus 0.81 from the previous trading day according to data from August, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:27

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.7%, CAC40 + 0.2%, FTSE 0.3%

-

08:26

Advisor to the Prime Minister of Japan, Etsuro Honda: The only correct conclusion - the need for further easing of monetary policy

- In September, the probability of a decisive easing policy exceeds 50%

- If the Bank of Japan does not take measures in the next month, the Japanese have lost hope

- I do not think that the Prime Minister believes that the easing of monetary policy by the Bank of Japan has reached its limits

- Strengthening of the yen is clearly excessive, indicating a failure of the current policy.

- It is necessary to act more decisively against the yen, and it does not matter what the US officials say.

- Japan will never be able to defeat deflation if the Bank of Japan decides that policy easing is ineffective

- No need for a further reduction of negative interest rates on deposits

-

08:26

WSE: Before opening

Yesterday's session on Wall Street ended with small increases, and today in the morning looks good most Asian stock markets. The only exception are the declines in Tokyo, due to the strong yen. It is necessary to mention about published last night minutes of the last FOMC meeting. Some of the members of the Fed's Open Market Committee expect that soon they will need to hike rates, but in the Committee there is a general consensus that before taking such a decision some additional data will be needed. The protocol has been received as a conservative, as indicated by the decline in the dollar, the rise in stock prices, and declines in bond yields.

On the Warsaw market the results of companies will be important today. Results of KGHM (WSE: KGH) at the net level was disappointed. Slightly better was Tauron (WSE: TPE), although the company said earlier estimate of its results. Worse-than-expected results was announced by JSW.

There are the information about the next banks that KNF wants to consider as systemically important institutions and impose additional buffer. This time it comes to the Millennium (WSE: MIL), mBank (WSE: MBK) and Raiffeisen Bank Poland (not listed on the WSE). Local factors do not seem to be supported, although improvement in global sentiment should result in stopping developing of three days correction.

-

08:19

The US dollar fell after FOMC minutes disappoint again

Federal Reserve officials remain divided on whether to raise interest rates, the minutes of the most recent Federal Reserve meeting showed Wednesday.

Two officials pushed for a rate hike but others remained concerned about the near-term economic risks.

Although officials were relieved that the Brexit fears were unfounded, many officials said it was appropriate to wait for additional information before deciding another rate hike was warranted.

The information reviewed for the July 26-27 meeting indicated that labor market conditions generally improved in June and that growth in real gross domestic product (GDP) was moderate in the second quarter.

-

08:13

The unemployment rate in Australia was a seasonally adjusted 5.7 percent in July

The unemployment rate in Australia was a seasonally adjusted 5.7 percent in July, the Australian Bureau of Statistics said on Thursday.

That beat forecasts for 5.8 percent, which would have been unchanged from the June reading.

The Australian economy added 26,200 jobs in July, blowing past expectations for a gain of 10,000 jobs following the increase of 7,900 jobs in the previous month.

The participation rate came in at 64.9 percent - unchanged and in line with expectations - RTT.

-

07:23

Global Stocks

European stocks lost ground Wednesday, with semiconductor company ASML Holding NV and brewer Carlsberg AS among the largest decliners.

The decline in the pan-European stock benchmark came as investors waited for clues about whether U.S. policy makers are ready to start raising interest rates.

The Stoxx Europe 600 SXXP, -0.83% fell 0.8% to close at 340.47, marking a fourth straight loss in a row.

U.K. stocks finished lower Wednesday amid sharp losses for miners on the back of weaker metals prices, offsetting better-than-expected labor-market data.

The FTSE 100 UKX, -0.50% dropped 0.5% to close at 6,859.15, its second-straight day of losses. The index on Tuesday fell 0.7%, breaking an eight-day winning streak, the longest run of gains since October 2015.

U.S. stocks closed slightly higher Wednesday after sharply paring earlier losses as minutes from the Federal Reserve's July meeting showed policy makers remained divided on prospects for a near-term rate increase.

Stocks bounced off session lows after St. Louis Fed President James Bullard said that with U.S. growth trending below 2%, interest rates can stay low.

Later, following a small pullback following the release of the Fed minutes, stocks had fluctuated between slight gains and losses after the minutes revealed that Fed officials were largely unchanged in their debate over interest rate hikes.

The Dow Jones Industrial Average DJIA, +0.12% rose 21.92 points, or 0.1%, to close at 18,573.94, after being down as many as 83 points earlier in session.

The S&P 500 index SPX, +0.19% rose 4.07 points, or 0.2%, to close at 2,182.22, overcoming an earlier 10-point deficit.

Meanwhile, the Nasdaq Composite Index COMP, +0.03% finished up 1.55 points at 5,228.66, after being down about 30 points earlier.

Asian stocks rose and the greenback languished near two-month lows on Thursday after minutes of the U.S. Federal Reserve's latest meeting showed policymakers were in no rush to raise interest rates.

The July meeting minutes released on Wednesday showed that Fed policymakers were generally upbeat about the U.S. economic outlook and labor market. But they also said they wanted to "leave their policy options open" as any slowdown in hiring would argue against near-term monetary tightening.

Market participants interpreted the minutes as moderately positive for risk-taking appetite, with the Fed remaining divided on the timing of the next rate hike. Futures contracts dipped slightly, signaling receding bets of a U.S. rate increase.

-

03:30

Australia: Unemployment rate, July 5.7% (forecast 5.8%)

-

03:30

Australia: Changing the number of employed, July 26.2 (forecast 11)

-

01:51

Japan: Trade Balance Total, bln, July 513.5 (forecast 283.7)

-

00:31

Commodities. Daily history for Aug 17’2016:

(raw materials / closing price /% change)

Oil 46.91 +0.26%

Gold 1,353.90 +0.38%

-

00:30

Stocks. Daily history for Aug 17’2016:

(index / closing price / change items /% change)

Nikkei 225 16,745.64 +149.13 +0.90%

Shanghai Composite 3,110.23 +0.1886 +0.01%

S&P/ASX 200 5,535.05 +3.06 +0.06%

FTSE 100 6,859.15 -34.77 -0.50%

CAC 40 4,417.68 -42.76 -0.96%

S&P 500 2,182.22 +4.07 +0.19%

Dow Jones Industrial Average 18,573.94 +21.92 +0.12%

S&P/TSX Composite 14,697.60 -5.84 -0.04%

-

00:29

Currencies. Daily history for Aug 17’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1287 +0,12%

GBP/USD $1,3040 -0,02%

USD/CHF Chf0,9621 +0,02%

USD/JPY Y100,20 -0,06%

EUR/JPY Y113,14 +0,10%

GBP/JPY Y130,67 -0,06%

AUD/USD $0,7657 -0,52%

NZD/USD $0,7253 -0,37%

USD/CAD C$1,2848 -0,06%

-

00:00

Schedule for today, Thursday, Aug 18’2016

(time / country / index / period / previous value / forecast)

01:30 Australia Unemployment rate July 5.8% 5.8%

01:30 Australia Changing the number of employed July 7.9 11

08:00 Eurozone Current account, unadjusted, bln June 15.4

08:30 United Kingdom Retail Sales (MoM) July -0.9% 0.1%

08:30 United Kingdom Retail Sales (YoY) July 4.3% 4.2%

09:00 Eurozone Construction Output, y/y June -0.8%

09:00 Eurozone Harmonized CPI July 0.2% -0.5%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) July 0.1% 0.2%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) July 0.9% 0.9%

12:30 Canada Foreign Securities Purchases June 14.73

12:30 U.S. Philadelphia Fed Manufacturing Survey August -2.9 2

12:30 U.S. Continuing Jobless Claims 2155 2140

12:30 U.S. Initial Jobless Claims 266 265

14:00 U.S. Leading Indicators July 0.3% 0.3%

20:00 U.S. FOMC Member Williams Speaks

22:45 New Zealand Visitor Arrivals July 10.9%

-