Noticias del mercado

-

22:07

Major US stock indices closed above zero

Major US stock indexes finished trading with a slight increase. Investors analyzed the protocols of the Fed meeting and followed the dynamics of the oil market.

The minutes of the Fed meeting, which was held on 26-27 July, it was reported that the leaders of the Central Bank in July, tried to leave the door open for a rate hike. They also tried to come to a unified assessment of prospects for the economy, as well as to coordinate as possible raising short-term interest rates. In general, reports signaled that rates could be raised as early as September, but the Central Bank will not act as long as the majority of its leaders will not come to a consensus regarding the outlook for the economy, employment and inflation.

Meanwhile, today the President of St. Louis Fed Bullard said that short-term interest rates the Fed is very close to the proper level. He also noted that the US economy is growing at a moderate pace, inflation and employment rates are stable. Bullard believes that in such circumstances, the current target range for the Fed's short-term rates (0.25% -0.50%) should be increased about once so that he has reached a level that corresponds to the current state of the economy and that in which it is It expected to be in the future.

Quotes of oil rose moderately, supported by on US petroleum inventories report. US Department of Energy reported that in the week of August 6-12 crude oil inventories fell by 2.5 million barrels to 521.1 million barrels. Analysts predicted that inventories will rise by 500,000 barrels. Oil reserves in Cushing terminal fell 724,000 barrels to 64.5 million barrels. Gasoline inventories fell by 2.7 million barrels to 232.7 million barrels. Analysts had expected inventories fell by 1.7 million barrels.

Most DOW components of the index closed in positive territory (19 of 30). Most remaining shares rose Pfizer Inc. (PFE, + 1.03%). Outsider were shares of Cisco Systems, Inc. (CSCO, -1.49%).

Sector S & P Index showed mixed trends. The leader turned utilities sector (+ 1.2%). conglomerates (-1.1%) sectors fell most.

At the close:

Dow + 0.11% 18,572.57 +20.55

Nasdaq + 0.03% 5,228.66 +1.55

S & P + 0.18% 2,182.09 +3.94

-

21:00

Dow +0.02% 18,556.30 +4.28 Nasdaq -0.05% 5,224.28 -2.83 S&P +0.05% 2,179.24 +1.09

-

19:01

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes trading at their lowest in one week on Wednesday as investors held off from making big bets ahead of the release of the minutes of the Federal Reserve's July policy meeting. The Fed left interest rates unchanged at its meeting last month but said near-term risks to the economy had diminished, leaving the door open for a possible rate hike this year.

Most of all Dow stocks in negative area (25 of 30). Top gainer - Pfizer Inc. (PFE, +0.22%). Top loser - Cisco Systems, Inc. (CSCO, -1.74%).

Most of S&P sectors also in negative area. Top gainer - Utilities (+0.1%). Top loser - Conglomerates (-1.0%).

At the moment:

Dow 18495.00 -29.00 -0.16%

S&P 500 2172.75 -4.00 -0.18%

Nasdaq 100 4791.25 -7.25 -0.15%

Oil 46.43 -0.15 -0.32%

Gold 1349.20 -7.70 -0.57%

U.S. 10yr 1.58 +0.00

-

18:01

European stocks closed: FTSE 100 -34.77 6859.15 -0.50% DAX -138.98 10537.67 -1.30% CAC 40 -42.76 4417.68 -0.96%

-

17:48

Oil rose after the US Department of Energy report on stocks

Crude oil futures were trading down nearly 1 percent but after the release of the US petroleum inventory report sharply turned, and moved into positive territory.

In the week of August 6-12 crude oil inventories fell by 2.5 million barrels to 521.1 million barrels. Analysts predicted that inventories will rise by 500,000 barrels. Oil reserves in Cushing terminal fell 724,000 barrels to 64.5 million barrels. Gasoline inventories fell by 2.7 million barrels to 232.7 million barrels. Distillate stocks rose unexpectedly by 1.9 million barrels to 153.1 million barrels. Analysts had forecast a drop to 400,000 barrels. The utilization of refining capacity increased by 1.3% to 93.5% vs a decline of 0.4% expected. Meanwhile, oil production in the US rose to 8.597 million barrels per day versus 8.445 million barrels per day in the previous week. Yesterday the American Petroleum Institute reported that crude oil inventories for the week fell by 1 million barrels, while gasoline inventories rose by 2.2 million barrels.

A slight effect on the course of trading had an overview of BMI Research. "China will increase imports of crude oil in the next two quarters after its contraction in the current quarter in the conditions of surplus stocks of raw materials, as well as seasonal maintenance work at refineries. China's imports will rise in the fourth quarter 2016 and first quarter of 2017." Also, experts noted that the reduction in investments in production by state oil companies of China, the depletion of conventional oil reserves, as well as the focus on the development of the gas industry, limit the production of oil in China. According to the National Statistics Administration of China, oil production in the country in July fell by 8.1% - to 16.7 million tons, or 3.95 million b / d, which is the lowest since October 2011.

The cost of the October futures for US light crude oil WTI rose to 47.02 dollars per barrel.

October futures price for North Sea petroleum mix of Brent crude rose to 49.28 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:46

WSE: Session Results

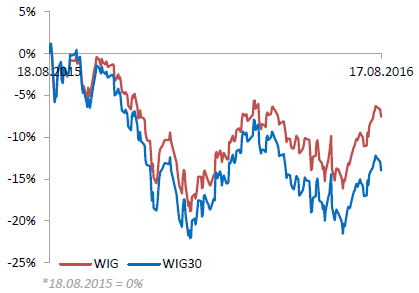

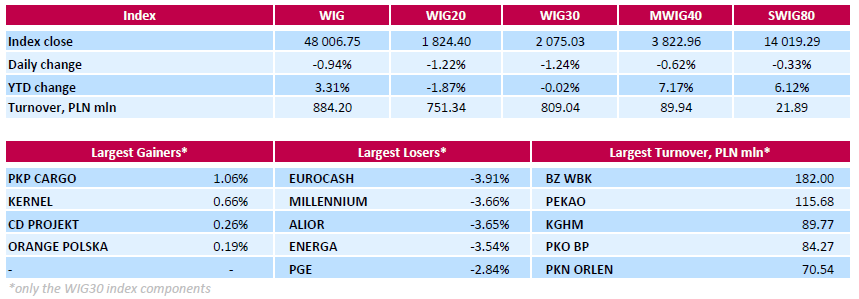

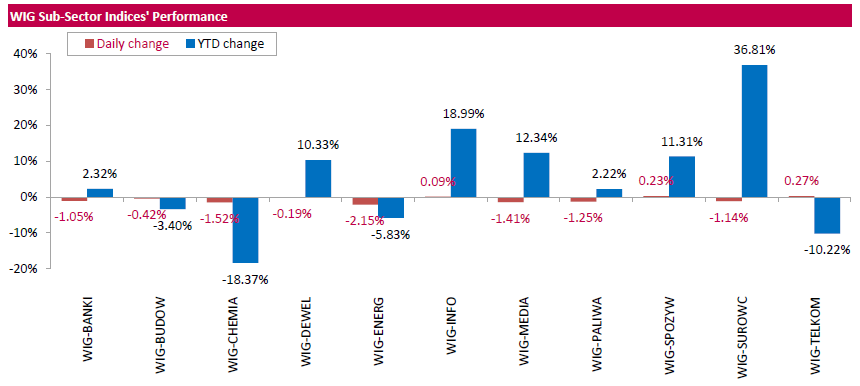

Polish equity market plunged on Wednesday. The broad market measure, the WIG Index, declined by 0.94%. Sector-wise, utilities names (-2.15%) were the worst-performing group, while telecommunication sector stocks (+0.27%) outpaced.

The large-cap stocks' measure, the WIG30 Index, fell by 1.24%. A majority of the index components recorded losses. FMCG-wholesaler EUROCASH (WSE: EUR) topped the decliners' list, dropping by 3.91% on analyst downgrade. It was followed by two banking sector stocks MILLENNIUM (WSE: MIL) and ALIOR (WSE: ALR) and two utilities names ENERGA (WSE: ENG) and PGE (WSE: PGE), slumping between 2.84% and 3.66%. At the same time, the handful advancers included railway freight transport operator PKP CARGO (WSE: PKP), agricultural producer KERNEL (WSE: KER), videogame developer CD PROJEKT (WSE: CDR) and telecommunication services provider ORANGE POLSKA (WSE: OPL), gaining between 0.19% and 1.06%.

-

17:31

Gold fell slightly

Quotes of gold fell slightly on the recent statements by the Fed. Additionally, investors await the publication of FOMC meeting minutes which could shed light on the Central Bank plans for the timing of interest rate increases.

Fed's Dudley said the Fed admits raising rates as early September. "We are approaching the moment when it is appropriate to re-raise the rate. Employment in the last 3 months is growing at an average rate of 190 thousand per month, and economic growth should accelerate in the 2nd half of the year. There are signals of accelerate wage growth. overall, the US economy is in good condition. "

Atlanta Fed President Lockhart said he's optimistic about the economic outlook, and therefore feel justified in raising rates. He added that the weak data on US GDP for the 2nd quarter should be viewed in the context of other factors. "Most of the fundamental factors right now havea positive effect on consumer spending. I remain confident in the prospects for the economy in the 2nd half of 2016 and 2017." - Said Lockhart.

According to the futures market, the probability of a Fed hike is 18% in September. Meanwhile, the probability of a rate hike in December is estimated at 45.5% versus 45.1% yesterday.

"The recent fluctuations in gold are associated with speculation about when the Fed will raise interest rates - said Simon Gambarini, an analyst at Capital Economics -. We have to wait for the publication of the Fed's meeting minutes in order to have a better idea of when the officials start to raise rates" .

The gold reserves in the largest ETF SPDR Gold Trust rose on Tuesday by 0.19 percent, reaching the level of 962.23 tons.

Since the beginning of the year gold has risen in price by about 27%, helped by concerns about global economic growth and expectations of monetary stimulus.

The cost of the October futures on COMEX fell to $ 1347.00 per ounce.

-

16:34

US crude oil inventories decline significantly

U.S. crude oil refinery inputs averaged about 16.9 million barrels per day during the week ending August 12, 2016, 268,000 barrels per day more than the previous week's average. Refineries operated at 93.5% of their operable capacity last week. Gasoline production increased last week, averaging 10.3 million barrels per day. Distillate fuel production increased last week, averaging over 4.9 million barrels per day.

U.S. crude oil imports averaged 8.2 million barrels per day last week, down by 211,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged over 8.4 million barrels per day, 11.3% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 610,000 barrels per day. Distillate fuel imports averaged 92,000 barrels per day last week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.5 million barrels from the previous week. At 521.1 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories decreased by 2.7 million barrels last week, but are well above the upper limit of the average range. Finished gasoline inventories increased while blending components inventories decreased last week. Distillate fuel inventories increased by 1.9 million barrels last week and are near the upper limit of the average range for this time of year. Propane/propylene inventories rose 1.8 million barrels last week and are at the upper limit of the average range. Total commercial petroleum inventories increased by 1.3 million barrels last week.

-

16:30

U.S.: Crude Oil Inventories, August -2.5

-

15:53

WSE: After start on Wall Street

The first bars of trade on Wall Street may be a disappointment for those investors who several minutes ago were guided by quotations of contracts. The latter showed in fact a neutral start, while in the first minutes of the trading bears gain an advantage. The opening on the S&P500 was neutral but already in the first minutes of the session bears manage to bring the index below the minimum of yesterday's session, which naturally opens the way to a deeper decline.

The continues problem remains the underlying markets, which - as the DAX - cannot break away from the bottom of the session and still create downward pressure. Also, other emerging markets will end today's quotations strengthening correction signals from the last session.

-

15:49

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1100 (EUR 324m) 1.1200 (351m) 1.1250 (515m) 1.1300 (210m)

USD/JPY 103.00 (USD 246m)

GBP/USD 1.2600 (GBP 849m) 1.2950 (532m) 1.2995 (340m)

AUD/USD 0.7400 (AUD 200m) 0.7625 (279m) 0.7690 (210m) 0.7715 (311m)

USD/CAD 1.3150 (USD 250m)

NZD/USD 0.7180 (NZD 451m) 0.7200-01 (417m)

AUD/NZD 1.0600 (AUD 809m)

-

15:32

U.S. Stocks open: Dow -0.08%, Nasdaq -0.01%, S&P -0.05%

-

15:29

FOMC minutes: The knee-jerk reaction could see the USD strengthen - BofA Merrill

"Despite the strong July employment report the USD struggled this week. Headline payroll growth was strong, but with the unemployment rate steady, wages stable, and the labor force participation rate ticking up, the report does little to force the Fed's hand and leaves them comfortably on hold for now. The resulting low vol, positive carry environment precipitated a further reduction in USD positioning as 2016 Fed expectations were little changed. For the USD to rally further, we need to see a more consistent trend of upside surprises that convinces the market Fed normalization will continue beyond just one hike. In other words, we need to see a more significant repricing of 2017 and 2018 expectations.

This week's FOMC Minutes could have some impact on market pricing. We expect the Minutes to offer a bit more optimistic assessment of the US economy and global financial conditions, similar to the July statement.

The knee-jerk reaction could see the USD strengthen as this will be viewed on the hawkish side given the USD selloff we have seen since the NFP report. But, a failure by the Fed to signal hikes are imminent and/or a more protracted normalization cycle means the FX market impact is likely to be short-lived".

Copyright © 2016 BofAML, eFXnews™

-

15:08

Before the bell: S&P futures 0.00%, NASDAQ futures +0.10%

U.S. stock-index futures were little changed as investors awaited minutes from the Federal Reserve's last meeting for clues on the path of monetary policy.

Global Stocks:

Nikkei 16,745.64 +149.13 +0.90%

Hang Seng 22,799.78 -111.06 -0.48%

Shanghai 3,110.23 +0.1886 +0.01%

FTSE 6,873.56 -20.36 -0.30%

CAC 4,433.31 -27.13 -0.61%

DAX 10,566.93 -109.72 -1.03%

Crude $46.33 (-0.54%)

Gold $1349.10 (-0.57%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.6

1.46(0.8196%)

294

ALCOA INC.

AA

10.34

0.05(0.4859%)

11825

ALTRIA GROUP INC.

MO

66.2

-0.06(-0.0906%)

140546

Amazon.com Inc., NASDAQ

AMZN

764.81

0.77(0.1008%)

47522

American Express Co

AXP

65.3

0.00(0.00%)

74646

AMERICAN INTERNATIONAL GROUP

AIG

59.59

0.28(0.4721%)

28303

Apple Inc.

AAPL

109.25

-0.13(-0.1189%)

103156

AT&T Inc

T

41.95

-0.01(-0.0238%)

6668

Barrick Gold Corporation, NYSE

ABX

21.16

-0.16(-0.7505%)

14618

Boeing Co

BA

135

0.00(0.00%)

39293

Caterpillar Inc

CAT

84.29

0.00(0.00%)

30313

Chevron Corp

CVX

101.55

0.00(0.00%)

515

Cisco Systems Inc

CSCO

31.26

0.14(0.4499%)

91159

Citigroup Inc., NYSE

C

46.59

-0.03(-0.0643%)

23600

Deere & Company, NYSE

DE

78.15

0.00(0.00%)

19069

E. I. du Pont de Nemours and Co

DD

68.3183

0.2883(0.4238%)

67509

Exxon Mobil Corp

XOM

87.92

-0.00(-0.00%)

1498

Facebook, Inc.

FB

123.45

0.15(0.1217%)

31703

FedEx Corporation, NYSE

FDX

166.73

0.00(0.00%)

5634

Ford Motor Co.

F

12.36

0.02(0.1621%)

912

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12

-0.08(-0.6623%)

86993

General Electric Co

GE

31.25

0.06(0.1924%)

300

General Motors Company, NYSE

GM

31.7

-0.01(-0.0315%)

441523

Goldman Sachs

GS

165.71

0.06(0.0362%)

600

Google Inc.

GOOG

777.14

0.00(0.00%)

21021

Hewlett-Packard Co.

HPQ

14.07

-0.34(-2.3595%)

1050

Home Depot Inc

HD

135.32

-0.91(-0.668%)

24512

HONEYWELL INTERNATIONAL INC.

HON

116.23

0.595(0.5146%)

62198

Intel Corp

INTC

35.19

-0.02(-0.0568%)

5832

International Business Machines Co...

IBM

160.98

0.28(0.1742%)

400

International Paper Company

IP

46.66

0.00(0.00%)

33449

Johnson & Johnson

JNJ

120.33

0.00(0.00%)

3345

JPMorgan Chase and Co

JPM

65.62

-0.09(-0.137%)

300

McDonald's Corp

MCD

118

0.06(0.0509%)

200

Merck & Co Inc

MRK

63.04

0.00(0.00%)

572

Microsoft Corp

MSFT

57.44

-0.00(-0.00%)

2409

Nike

NKE

56.89

0.01(0.0176%)

66854

Pfizer Inc

PFE

34.79

0.00(0.00%)

400

Procter & Gamble Co

PG

86.6851

0.1051(0.1214%)

171522

Starbucks Corporation, NASDAQ

SBUX

55.7

0.33(0.596%)

3808

Tesla Motors, Inc., NASDAQ

TSLA

223.95

0.34(0.152%)

8100

The Coca-Cola Co

KO

43.83

0.00(0.00%)

181348

Travelers Companies Inc

TRV

116.98

0.00(0.00%)

17165

Twitter, Inc., NYSE

TWTR

20.44

0.04(0.1961%)

58060

United Technologies Corp

UTX

109.16

0.66(0.6083%)

54717

UnitedHealth Group Inc

UNH

141.08

0.00(0.00%)

160235

Verizon Communications Inc

VZ

53

0.24(0.4549%)

1074

Visa

V

80.81

0.14(0.1735%)

196977

Wal-Mart Stores Inc

WMT

71.8

-1.09(-1.4954%)

33666

Walt Disney Co

DIS

97.09

0.21(0.2168%)

1108

Yahoo! Inc., NASDAQ

YHOO

42.37

-0.12(-0.2824%)

12938

Yandex N.V., NASDAQ

YNDX

23.4

0.05(0.2141%)

900

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Home Depot (HD) target raised $155 from $150 at RBC Capital Mkts

Home Depot (HD) target raised to $145 from $140 at Wedbush

Cisco Systems (CSCO) target raised to $35 from $30.75 at Jefferies

Hewlett Packard Enterprise (HPE) initiated with a Mkt Perform at Raymond James

-

14:35

BMI Research forecast: China will increase oil imports in July-December

China will increase imports of crude oil in the next two quarters after its contraction in the current quarter in the conditions of surplus stocks of raw materials, as well as seasonal maintenance work at refineries, BMI Research said.

China's imports of crude oil will rise in the fourth quarter 2016 and first quarter of 2017, according to the review.

Reduced investment in production by state oil companies, the depletion of conventional oil reserves, as well as the focus on the development of the gas industry, limit the production of oil in China.

According to the National Statistics Administration, oil production in the country in July fell by 8.1% - to 16.7 million tons, or 3.95 million b / d, which is the lowest since October 2011.

According to their estimates, in 2016 China's oil imports will be about 7.4 million barrels per day. By 2020, the volume of imports may rise to 8.6 million b / d.

-

14:21

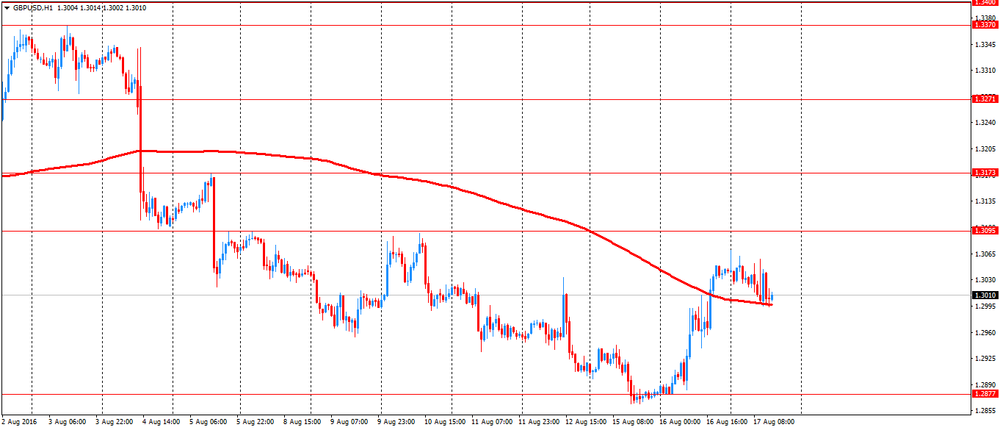

European session review: Pound drops moderately on confirmation of stable employment

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 Changing UK average earnings (excluding bonuses), m 3 / y in June 2.2% 2.3% 2.3%

8:30 UK Change of average earnings, 3 m / d in June 2.3% 2.4% 2.4%

8:30 UK ILO unemployment rate for June 4.9% 4.9% 4.9%

8:30 UK Number of applications for unemployment benefits, thousand. 0.9 Revised July 10 with 0.4 -8.6

9:00 Switzerland investor expectations index according to ZEW and Credit Suisse in August 5.9 -2.8

In the UK, the number of applications for unemployment benefits unexpectedly fell in July, while the unemployment rate remained stable at its lowest level in more than 10 years.

The number of people applying for unemployment benefits decreased by 8 600 people in July from June, confounding expectations for an increase of 10,000.

The unemployment rate according to ILO standards was 4.9 percent in the second quarter, in line with expectations, and at the same rate as it was during the three months to May. The last time it was lower was in the period from July to September 2005.

In the second quarter, average earnings, including bonuses, rose by 2.4 percent, as expected, and earnings excluding bonuses rose by 2.3 percent compared with a year earlier.

The employment rate in the second quarter amounted to 74.5 percent, the highest figure since comparable records began in 1971.

The number of unemployed fell by 52,000 compared with the previous quarter to 1.64 million.

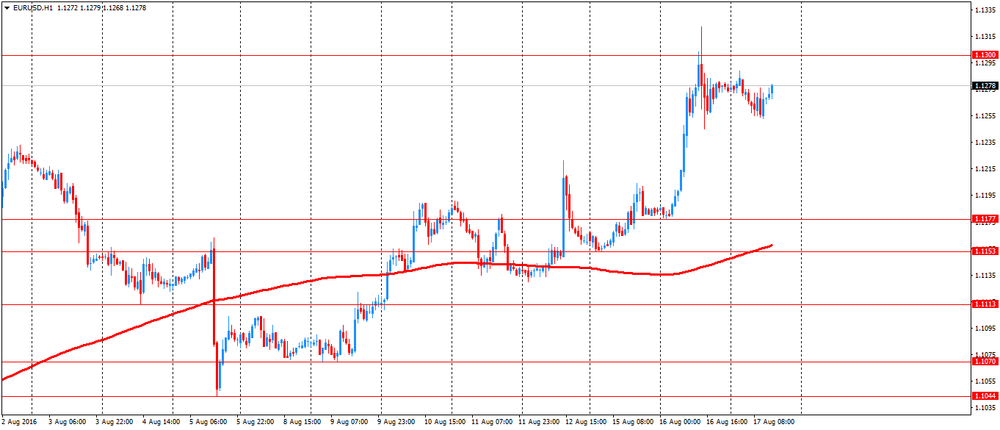

Euro moderately lower against the US dollar, correcting after sharp rise yesterday. Market participants analyzed the recent statements by the Fed, as well as the expected release of protocols of the July FOMC meeting, which could shed light on the Central Bank plans for the timing of rate hikes.

Recall, Dudley said yesterday that he supports a hike in September. "We are approaching the moment when it is appropriate to re-raise the rate, - said Dudley -. US employment in the last 3 months is growing at an average rate at the level of 190 thousand per month, and economic growth should accelerate in the 2nd half of the year.. and the signals of accelerating wage growth. Overall, the US economy is in good condition".

Meanwhile, the head of the Federal Reserve Bank of Atlanta, Lockhart said that he's optimistic about the economic outlook, and therefore feel justified o hike. He added that the weak data on US GDP for the 2nd quarter should be viewed in the context of other factors.

EUR / USD: during the European session, the pair fell to $ 1.1253

GBP / USD: during the European session, the pair fell to $ 1.2994

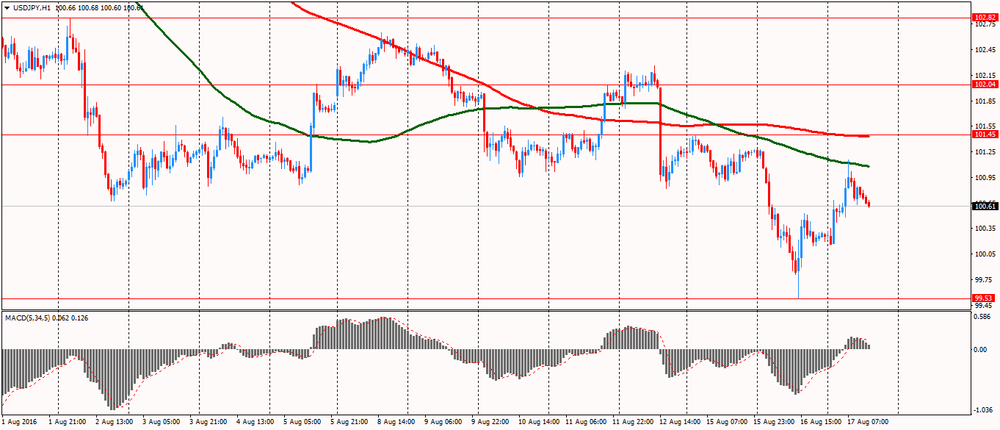

USD / JPY: during the European session, the pair vysrosla to Y101.16 and retreated

-

14:13

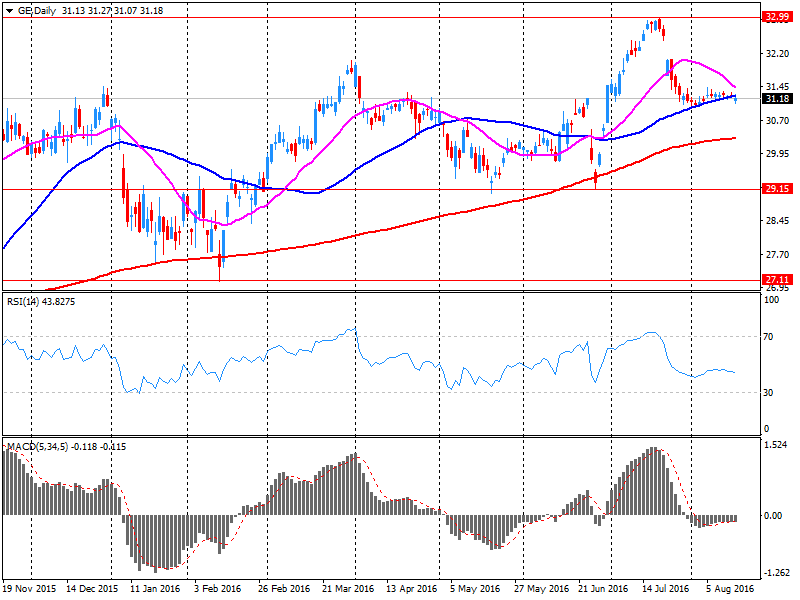

Company news: the financial division of General Electric (GE), GE Capital, is selling 12% stake in Townsquare Media

According to the WSJ, GE Capital has agreed to sell 3.2 million Townsquare Media shares Inc., which is 12% of the total issued shares of the company. The market value of Townsquare is about $ 230 mln., The value of the share is estimated at nearly $ 30 million. The companies are expected to report on the deal on Wednesday.

GE shares at the end of trading on Tuesday close at $ 31.19 (-0.16%).

-

13:52

Orders

EUR/USD

Offers : 1.1285 1.1300 1.1325-30 1.1350 1.1370-80 1.1400

Bids : 1.1250 1.1230 1.1200 1.1185 1.1150 1.1130 1.1115 1.1100

GBP/USD

Offers : 1.3050 1.3065 1.3080 1.3095-05 1.3130 1.3150

Bids : 1.3000 1.2980 1.2950 1.2930 1.2900 1.2880 1.1265 1.2850 1.2830 1.2800

EUR/GBP

Offers : 0.8660-65 0.8685 0.8700 0.8725-30 0.8750

Bids : 0.8625-30 0.8600 0.8585 0.8570 0.8550

EUR/JPY

Offers : 113.85 114.00 114.30 114.50 114.75 115.00 115.50

Bids : 113.20 113.00 112.75 112.50 112.30 112.00-10 111.85 111.50

USD/JPY

Offers : 101.00 101.25-30 101.50 101.80 102.00 102.25 102.50

Bids : 100.70 100.50 100.30 100.00 99.85 99.50 99.30 99.00

AUD/USD

Offers : 0.7700 0.7720 0.7750-55 0.7785 0.7800

Bids : 0.7660 0.7635-40 0.7620 0.7600 0.7585 0.7565

-

13:15

Major stock indices in Europe moderately lower

European stocks mostly lower after the stock prices of oil and technology companies declined.

Statistical data on the UK economy, published on Wednesday, pointed to the preservation of the country's labor market flexibility, despite Brexit, and offer support to the British stock markets.

The number of applications for unemployment benefits in the UK fell unexpectedly in July, by 8.6 thousand., after rising 900 applications in June, according to the country's National Statistical Management (ONS).

In the second quarter of 2016 the number of employees in the UK has increased by 172 thousand persons to a record 31.8 million people. Unemployment rate was 4.9% in April-June, as well as in March-May, the rwage growth accelerated to 2.3% from 2.2%.

At the same time, investors await the FOMC minutes in the search for clues on the timing of the next rate hike.

Investors remain cautious after the head of the Federal Reserve Bank of New York William Dudley said the Fed is approaching the point where it would be appropriate to raise interest rates.

In addition, the Federal Reserve Bank of Atlanta President Dennis Lockhart declared the possibility of two rate increases in 2016.

The composite index of the largest companies in the region Stoxx Europe 600 fell during trading 0,4% - to 341.97 points.

Shares of BP, Royal Dutch Shell and Total fell 0.1%, 0.2% and 0.6% on renewed decline of oil prices.

Shares of ASML Holding NV, Europe's largest manufacturer of equipment for the production of semiconductors, dropped by 6%.

Shares of the Dutch bank ABN Amro jumped 4.9%. The bank, which reduced net income in the second quarter by 35%, announced its intention to reduce costs in the area of support and control of operations by 25%, or 200 million euros next year.

Securities of mining companies show mixed results: BHP Billiton shares rose 1%, Antofagasta - fell by 0.7%.

The capitalization of the British insurer Admiral Group fell by 8%. The company increased its pre-tax profit in the first half by 4.3% and raised its dividend by 23%, but warned that market volatility after the British decision to withdraw from the European Union (Brexit) have a negative impact on its creditworthiness.

Wienerberger Shares fell 8.2%, as the company warned of the negative impact of the currency against the background of the weakness of the pound sterling.

Carlsberg Shares slipped 4.1% as the Danish brewer introduced semi-annual results, which were below analysts' expectations, but said that will keep the forecast for 2016 due to the progress in the implementation of the cost reduction strategies.

Meanwhile, shares of Balfour Beatty rose by 7.7%, as the construction company resumed dividend payments.

At the moment:

FTSE 6894.32 0.40 0.01%

DAX 10603.81 -72.84 -0.68%

CAC 4444.40 -16.04 -0.36%

-

13:02

WSE: Mid session comment

The first half of trading on the Warsaw market was a clear direction down. After a drop in the first hour of the session the market consolidated for the next 90 minutes, indicating better balance. Another piece of trading, however, brought a decline to new lows of the session and the loss of the main market index at the level of 1 percent. Thus our market, which in the first half of August was characterized by the relative strength, today is at the forefront of downward moving parquets. It is also worth to note that the observed declines are not the work of blue chips only but also apply to the broad market, as confirmed by the behavior of the mWIG40 and the sWIG80 indices.

At the halfway point of the session the WIG20 index was at the level of 1,826 points (-1,12%), with the turnover of PLN 285 mln.

-

11:33

Economic sentiment in Switzerland has once again experienced a decrease

In August 2016, the ZEW-CS-Indicator for the economic sentiment in Switzerland has once again experienced a decrease. With a drop by 8.7 points to a reading of minus 2.8 points, the indicator continues the downward trend already seen in the previous month. When it comes to the current economic situation, however, the surveyed experts recorded an upward trend, with the relevant indicator rising from 0.0 points in July 2016 to a current reading of 11.3 points.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), August -2.8

-

10:33

UK labor market steady. What Brexit effect?

Between January to March 2016 and April to June 2016, the number of people in work increased. The number of unemployed people and the number of people not working and not seeking or available to work (economically inactive) fell.

There were 31.75 million people in work, 172,000 more than for January to March 2016 and 606,000 more than for a year earlier.

There were 23.22 million people working full-time, 374,000 more than for a year earlier. There were 8.53 million people working part-time, 231,000 more than for a year earlier.

The unemployment rate was 4.9%, down from 5.6% for a year earlier. The last time it was lower was for July to September 2005. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed.

Average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.4% including bonuses and by 2.3% excluding bonuses compared with a year earlier.

-

10:30

United Kingdom: Average Earnings, 3m/y , June 2.4% (forecast 2.4%)

-

10:30

United Kingdom: Claimant count , July -8.6 (forecast 10)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, June 2.3% (forecast 2.3%)

-

10:30

United Kingdom: ILO Unemployment Rate, June 4.9% (forecast 4.9%)

-

10:23

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1100 (EUR 324m) 1.1200 (351m) 1.1250 (515m) 1.1300 (210m)

USD/JPY 103.00 (USD 246m)

GBP/USD 1.2600 (GBP 849m) 1.2950 (532m) 1.2995 (340m)

AUD/USD 0.7400 (AUD 200m) 0.7625 (279m) 0.7690 (210m) 0.7715 (311m)

USD/CAD 1.3150 (USD 250m)

NZD/USD 0.7180 (NZD 451m) 0.7200-01 (417m)

AUD/NZD 1.0600 (AUD 809m)

-

10:05

Oil trading lower. Brent down 1% so far

This morning, New York crude oil futures for WTI fell by -0.62% to $ 46.27 and Brent oil futures were down -0.93% to $ 48.77 per barrel. Thus, the black gold is traded lower on the background of doubts in possible negotiations between producing countries on the production limits to stabilize the market. Doubts that the world's largest oil producers may agree to freeze production in the near future intensified after Iran made it clear that it is not interested in such an agreement. In addition, the Iranian Ministry said that the Iranian authorities have not yet decided whether or not the country will participate in the September meeting of OPEC. At the same time, analysts note that the participation of Iran in the frozen oil is an essential condition of the agreement put forward by Saudi Arabia earlier.

-

09:49

Positive start for major stock exchanges: FTSE 100 6,910.30 + 16.38 + 0.24%, DAX 10,684.83 + 8.18 + 0.08%

-

09:17

WSE: After opening

WIG20 index opened at 1847.28 points (+0.02%)

WIG 48450.02 -0.03%

WIG30 2100.24 -0.04%

mWIG40 3843.92 -0.08%

*/ - change to previous close

The futures contracts of September series (WSE: FW20U1620) began the day with a discount of 0.05 percent which does not seem to take into account the risk of deepening and markdowns means that players are counting on a shallow correction.

As expected, trading on the spot market (the WIG20 index) also began with small changes, causing that the WIG20 index in the first minutes was recorded at neutral level.

However, after the first transactions market went down, and after the first quarter of trading the WIG20 was on the level of 1841 points (-0,29%).

-

09:10

Today’s events:

At 14:30 GMT the US will publish data on crude oil inventories from the Department of Energy

At 17:00 GMT US Fed James Bullard speech

At 18:00 GMT FOMC meeting minutes

-

08:32

Options levels on wednesday, August 17, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1414 (3605)

$1.1361 (5176)

$1.1328 (3352)

Price at time of writing this review: $1.1267

Support levels (open interest**, contracts):

$1.1179 (2050)

$1.1148 (2223)

$1.1112 (3413)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52974 contracts, with the maximum number of contracts with strike price $1,1250 (5176);

- Overall open interest on the PUT options with the expiration date September, 9 is 56464 contracts, with the maximum number of contracts with strike price $1,1000 (5743);

- The ratio of PUT/CALL was 1.07 versus 1.12 from the previous trading day according to data from August, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.3304 (2593)

$1.3206 (2257)

$1.3110 (1270)

Price at time of writing this review: $1.3047

Support levels (open interest**, contracts):

$1.2990 (2151)

$1.2893 (2099)

$1.2796 (2613)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32411 contracts, with the maximum number of contracts with strike price $1,3300 (2593);

- Overall open interest on the PUT options with the expiration date September, 9 is 26250 contracts, with the maximum number of contracts with strike price $1,2800 (2613);

- The ratio of PUT/CALL was 0.81 versus 0.81 from the previous trading day according to data from August, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:29

Mixed start expected on the major stock exchanges in Europe: DAX-0.3%, CAC40 + 0.2%, FTSE 0.0%

-

08:19

WSE: Before opening

Tuesday's session on Wall Street ended with declines in major indices in the context of clear correlation. Night did not bring major changes, and the valuation of contracts on the S&P500 and the DAX signal now opening in Europe without significant changes. However the corrective mood on Wall Street will be difficult to ignore.

Today's calendar of economic reports in the world is virtually empty. Global markets are waiting for the publication of the minutes of the last FOMC meeting.

It is reasonable to assume that the core markets have space for correction, which may result for the S&P500 meeting with the region of 2,200 points. In the case of emerging markets - an important point of reference for the WIG20 index and the Warsaw Stock Exchange - the last two sessions are something more than a warning before correction. In recent times, the emerging markets segment had almost euphoric phase of growth and the Tuesday counterattack of supply must be noticed also in Warsaw. There is no doubt that emerging markets are on the verge of correction.

-

07:54

EUR/USD Will Reach 1.20 Before It Reaches 1.00 - Danske

"Growth. US growth surprised on the downside in Q2 but recent labour market data has surprised on the upside. Private consumption should be supported in coming months despite the weak July retail sales. European data have been stronger than we expected given Brexit but the sharp slowdown in the UK is likely to impact the eurozone with a lag. As such, we expect to see some softness in European data in the coming months.

Monetary policy. The Fed was slightly more hawkish than expected at its July meeting. Fed chairman Janet Yellen is likely to give more clarity on her thinking regarding monetary policy at her Jackson Hole speech on 26 August. We believe that the Fed will wait until H1 17 to raise interest rates again. The market is pricing around 40% probability for a 25bp rate hike before end- 2016 which appears fair. Meanwhile, we expect that the ECB as a minimum will have to extend its QE purchases beyond March 2017 but it is unlikely that it will cut interest rates further.

Flows. The market is short EUR/USD according to IMM data but not in stretched territory. As such, this increases the sensitivity of the cross to any impetus from relative rates.

Valuation. Both our PPP and MEVA models suggest the mid- 1.20s are 'fundamentally' justified and thus that the cross remains undervalued.

Forecast: 1.12 (1M), 1.12 (3M), 1.14 (6M), 1.18 (12M).

Risks. Political risks in the eurozone and in the US will weigh on markets in coming months. However, this can be both EUR and USD negative.

Conclusion. We are adjusting up our EUR/USD forecasts to 1.12 in 1M (from 1.09) 1.12 (1.07), 1.14 (1.10) and 1.18 (1.14). These are the forecasts we had before Brexit. Brexit has not had the economic impact on the eurozone as we expected. While we believe that there will be some slowdown in the eurozone in coming months, we still do not expect that the ECB will cut rates. Political uncertainty could weigh on both the EUR and the USD.

We maintain our long-held view that the undervaluation of the EUR and the wide eurozone-US current account differential are longerterm EUR positives. Hence, EUR/USD will reach 1.20 before it reaches 1.00".

Copyright © 2016 Danske, eFXnews™

-

07:51

New Zeeland: producer prices rose due to higher fuel and electricity prices

Producer prices rose in the June 2016 quarter, due to higher fuel and electricity prices, Statistics New Zealand said today.

The input prices (costs paid) for the petroleum and coal product manufacturing industry rose 22 percent in the June 2016 quarter, due to higher international prices for crude oil. This follows falls of 22 percent in both the March and December quarters.

"Despite the June quarterly increase in costs paid by fuel manufacturers, fuel prices have fallen by about half since mid-2012," business prices manager Sarah Williams said.

-

07:49

Moody's affirms Australia's Aaa rating; maintains stable outlook

Moody's Investors Service has today affirmed Australia's Aaa government issuer ratings, the Aaa senior unsecured rating and the (P)Aaa senior unsecured shelf rating. The stable outlook is maintained.

The factors supporting the rating affirmation are:

1. Moody's expectation that Australia's demonstrated economic resilience will endure in an uncertain global environment;

2. A very strong institutional framework;

3. Stronger fiscal metrics than many similarly rated peers - despite the increase in government debt from previous low levels - which we expect to remain consistent with a Aaa rating over the medium term.

Moody's notes that Australia's reliance on external financing, elevated household debt and rising residential property prices pose risks. The stable outlook on the rating reflects Moody's expectations that policy vigilance and response to these risks will be effective, and Australia's sovereign credit profile will remain resilient to these risks.

Australia's long-term local and foreign-currency bond and deposit ceilings remain at Aaa. The short-term foreign-currency bond and deposit ceilings remain at Prime.

-

07:48

NZD supported by better unemployment but then retreats

The unemployment rate decreased to 5.1 percent in the June 2016 quarter (from a revised 5.2 percent in the March quarter), Statistics New Zealand said today. Compared with the March 2016 quarter, 1,000 fewer people were unemployed in New Zealand.

The official estimate of unemployment is based on people who are both actively seeking work and available to work, as measured in the HLFS.

Unemployment was also down from where it was a year ago (5.5 percent in the June 2015 quarter), particularly for women.

"Compared with June 2015, there were 8,000 fewer unemployed women, and their unemployment rate fell from 6.2 percent to 5.4 percent," labour and income statistics manager Mark Gordon said.

In unadjusted terms, unemployment was down from a year ago across many North Island regions, including Auckland, which had an unemployment rate of 4.7 percent in the June 2016 quarter. This is the lowest rate for the Auckland region since the September 2008 quarter (when it was 4.1 percent).

-

07:45

Australian wage prices up 0.5% q/q

In the June quarter 2016, the Private sector index rose 0.4% and the Public sector rose 0.5%. The All sectors quarterly rise was 0.5%.

The Private sector through the year rise to the June quarter 2016 of 1.9% was lower than the Public sector rise of 2.3%. Through the year, All sectors rose 2.1%.

Private sector index rose 0.5% and the Public sector rose 0.6%. The All sectors quarterly rise was 0.5%.

Through the year, All sectors rose 2.1%. The Private sector through the year rise to the June quarter 2016 of 2.0% was lower than the Public sector rise of 2.4%.

In the June quarter 2016, wages grew 0.4% for All sectors for the third consecutive quarter. Wages grew 0.3% in both the Private and Public sectors.

The All sectors through the year rise was 2.1%. The Private sector rose 1.9%, the lowest through the year rise since the beginning of the series in September 1998, and the Public sector rose 2.4%.

-

07:08

Global Stocks

European stocks closed in negative territory Tuesday, but gains within the commodities group kept the decline somewhat in check.

The Stoxx Europe 600 SXXP, -0.79% fell 0.8% to close at 343.32, with only the basic materials SXPR, +1.31% and oil and gas SXER, +0.19% sectors advancing. The index on Monday slipped less than 0.1%, a second straight decline.

European traders apparently failed to take heart from the continued climb in U.S. equities, which hit records Monday as oil prices rallied.

Stocks in the U.K. fell Tuesday, pulling back after eight consecutive advances, but gains for miners limited the loss for the benchmark index.

The FTSE 100 UKX, -0.68% dropped 0.7% to 6,893.92, with only the mining sector finishing higher.

U.S. stocks closed at session lows Tuesday, a day after notching record highs, as investors weighed hawkish comments by Federal Reserve officials against sharp gains for oil futures, a weakening dollar and fresh consumer-price data that showed U.S. inflation remains tepid.

The S&P 500 index SPX, -0.55% fell 12 points, or 0.6%, to close at 2,178.15, as nine out of 10 sectors traded lower, led by a 2% drop in telecom stocks and a 1.2% loss in utility shares. Telecom and utilities are two income-paying stock sectors traditionally viewed as bond alternatives-which take a hit when interest-rate expectations rise.

Energy was the only S&P 500 sector to close in positive territory, up 0.2%, boosted by strong gains in crude-oil futures CLU6, -0.62%

The Dow Jones Industrial Average DJIA, -0.45% closed down 84.03 points, or 0.5%, at 18,552.02, pressured by a 1.6% declines in both Johnson & Johnson Inc. JNJ, -1.62% and Verizon Communications Inc. VZ, -1.59%

Asian shares pulled back from a one-year high and the dollar strengthened on Wednesday, after an influential Federal Reserve official said interest rates could rise as soon as September.

New York Fed President William Dudley said that as the U.S. labour market tightens and as evidence of rising wages builds, "we're edging closer towards the point in time where it will be appropriate I think to raise interest rates further."

Comments from Dudley, a permanent voter on policy and a close ally of Fed Chair Janet Yellen, also included an unusual warning on low bond yields and were seen as more hawkish than a cautious message last month.

Atlanta Federal Reserve Bank President Dennis Lockhart, seen as centrist, concurred saying he did not rule out a September hike - something markets have almost completely priced out.

-

03:30

Australia: Wage Price Index, q/q, Quarter II 0.5% (forecast 0.5%)

-

03:30

Australia: Wage Price Index, y/y, Quarter II 2.1% (forecast 2%)

-

02:46

Australia: Leading Index, July 0.1%

-

01:02

Commodities. Daily history for Aug 16’2016:

(raw materials / closing price /% change)

Oil 46.49 -0.19%

Gold 1,351.50 -0.40%

-

01:01

Stocks. Daily history for Aug 16’2016:

(index / closing price / change items /% change)

Nikkei 225 16,596.51 -273.05 -1.62%

Shanghai Composite 3,110.48 -14.72 -0.47%

S&P/ASX 200 5,531.98 -7.98 -0.14%

FTSE 100 6,893.92 -47.27 -0.68%

CAC 40 4,460.44 -37.42 -0.83%

S&P 500 2,178.15 -12.00 -0.55%

Dow Jones 18,552.02 -84.03 -0.45%

S&P/TSX Composite 14,703.44 -73.58 -0.50%

-

01:01

Currencies. Daily history for Aug 16’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1274 +0,81%

GBP/USD $1,3042 +1,24%

USD/CHF Chf0,9619 -1,14%

USD/JPY Y100,26 -1,00%

EUR/JPY Y113,03 -0,19%

GBP/JPY Y130,75 +0,26%

AUD/USD $0,7697 +0,31%

NZD/USD $0,7280 +0,89%

USD/CAD C$1,2856 -0,54%

-

00:46

New Zealand: PPI Output (QoQ) , Quarter II 0.2%

-

00:46

New Zealand: PPI Input (QoQ), Quarter II 0.9%

-

00:45

New Zealand: Employment Change, q/q, Quarter II 2.4% (forecast 0.6%)

-

00:45

New Zealand: Unemployment Rate, Quarter II 5.1% (forecast 5.3%)

-

00:00

Schedule for today, Wednesday, Aug 17’2016

(time / country / index / period / previous value / forecast)

00:30 Australia Leading Index July -0.2%

01:30 Australia Wage Price Index, q/q Quarter II 0.4% 0.5%

01:30 Australia Wage Price Index, y/y Quarter II 2.1% 2%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June 2.2% 2.3%

08:30 United Kingdom Average Earnings, 3m/y June 2.3% 2.4%

08:30 United Kingdom ILO Unemployment Rate June 4.9% 4.9%

08:30 United Kingdom Claimant count July 0.4 10

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August 5.9

14:30 U.S. Crude Oil Inventories August 1.055

17:00 U.S. FOMC Member James Bullard Speaks

18:00 U.S. FOMC meeting minutes

23:50 Japan Trade Balance Total, bln July 693 283.7

-