Noticias del mercado

-

22:07

Major US stock indices closed above zero

Major US stock indexes finished trading with a slight increase. Investors analyzed the protocols of the Fed meeting and followed the dynamics of the oil market.

The minutes of the Fed meeting, which was held on 26-27 July, it was reported that the leaders of the Central Bank in July, tried to leave the door open for a rate hike. They also tried to come to a unified assessment of prospects for the economy, as well as to coordinate as possible raising short-term interest rates. In general, reports signaled that rates could be raised as early as September, but the Central Bank will not act as long as the majority of its leaders will not come to a consensus regarding the outlook for the economy, employment and inflation.

Meanwhile, today the President of St. Louis Fed Bullard said that short-term interest rates the Fed is very close to the proper level. He also noted that the US economy is growing at a moderate pace, inflation and employment rates are stable. Bullard believes that in such circumstances, the current target range for the Fed's short-term rates (0.25% -0.50%) should be increased about once so that he has reached a level that corresponds to the current state of the economy and that in which it is It expected to be in the future.

Quotes of oil rose moderately, supported by on US petroleum inventories report. US Department of Energy reported that in the week of August 6-12 crude oil inventories fell by 2.5 million barrels to 521.1 million barrels. Analysts predicted that inventories will rise by 500,000 barrels. Oil reserves in Cushing terminal fell 724,000 barrels to 64.5 million barrels. Gasoline inventories fell by 2.7 million barrels to 232.7 million barrels. Analysts had expected inventories fell by 1.7 million barrels.

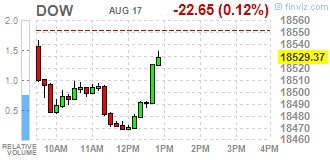

Most DOW components of the index closed in positive territory (19 of 30). Most remaining shares rose Pfizer Inc. (PFE, + 1.03%). Outsider were shares of Cisco Systems, Inc. (CSCO, -1.49%).

Sector S & P Index showed mixed trends. The leader turned utilities sector (+ 1.2%). conglomerates (-1.1%) sectors fell most.

At the close:

Dow + 0.11% 18,572.57 +20.55

Nasdaq + 0.03% 5,228.66 +1.55

S & P + 0.18% 2,182.09 +3.94

-

21:00

Dow +0.02% 18,556.30 +4.28 Nasdaq -0.05% 5,224.28 -2.83 S&P +0.05% 2,179.24 +1.09

-

19:01

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes trading at their lowest in one week on Wednesday as investors held off from making big bets ahead of the release of the minutes of the Federal Reserve's July policy meeting. The Fed left interest rates unchanged at its meeting last month but said near-term risks to the economy had diminished, leaving the door open for a possible rate hike this year.

Most of all Dow stocks in negative area (25 of 30). Top gainer - Pfizer Inc. (PFE, +0.22%). Top loser - Cisco Systems, Inc. (CSCO, -1.74%).

Most of S&P sectors also in negative area. Top gainer - Utilities (+0.1%). Top loser - Conglomerates (-1.0%).

At the moment:

Dow 18495.00 -29.00 -0.16%

S&P 500 2172.75 -4.00 -0.18%

Nasdaq 100 4791.25 -7.25 -0.15%

Oil 46.43 -0.15 -0.32%

Gold 1349.20 -7.70 -0.57%

U.S. 10yr 1.58 +0.00

-

18:01

European stocks closed: FTSE 100 -34.77 6859.15 -0.50% DAX -138.98 10537.67 -1.30% CAC 40 -42.76 4417.68 -0.96%

-

17:46

WSE: Session Results

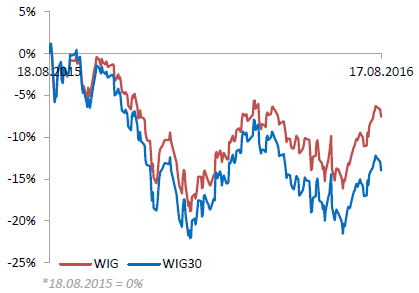

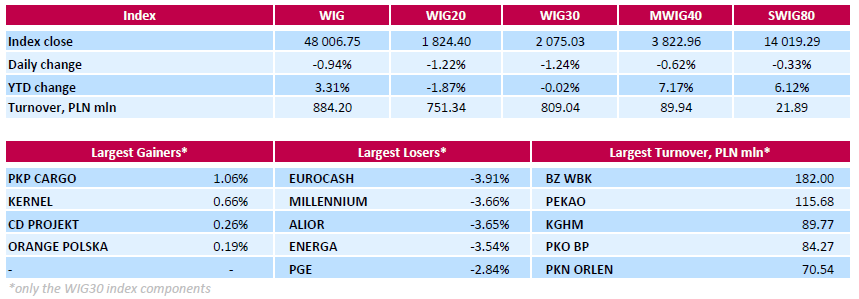

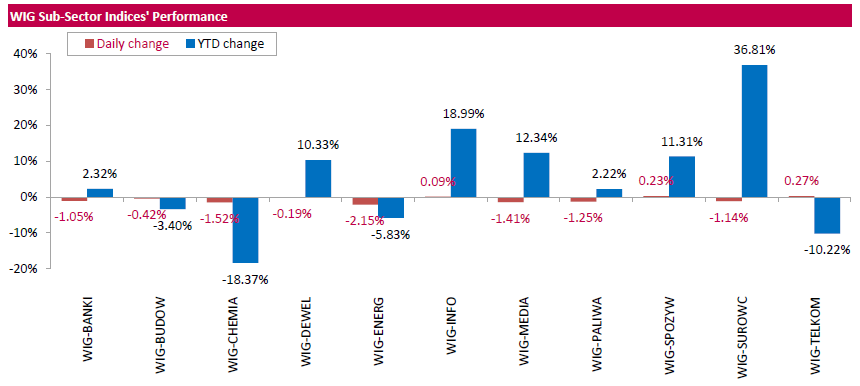

Polish equity market plunged on Wednesday. The broad market measure, the WIG Index, declined by 0.94%. Sector-wise, utilities names (-2.15%) were the worst-performing group, while telecommunication sector stocks (+0.27%) outpaced.

The large-cap stocks' measure, the WIG30 Index, fell by 1.24%. A majority of the index components recorded losses. FMCG-wholesaler EUROCASH (WSE: EUR) topped the decliners' list, dropping by 3.91% on analyst downgrade. It was followed by two banking sector stocks MILLENNIUM (WSE: MIL) and ALIOR (WSE: ALR) and two utilities names ENERGA (WSE: ENG) and PGE (WSE: PGE), slumping between 2.84% and 3.66%. At the same time, the handful advancers included railway freight transport operator PKP CARGO (WSE: PKP), agricultural producer KERNEL (WSE: KER), videogame developer CD PROJEKT (WSE: CDR) and telecommunication services provider ORANGE POLSKA (WSE: OPL), gaining between 0.19% and 1.06%.

-

15:53

WSE: After start on Wall Street

The first bars of trade on Wall Street may be a disappointment for those investors who several minutes ago were guided by quotations of contracts. The latter showed in fact a neutral start, while in the first minutes of the trading bears gain an advantage. The opening on the S&P500 was neutral but already in the first minutes of the session bears manage to bring the index below the minimum of yesterday's session, which naturally opens the way to a deeper decline.

The continues problem remains the underlying markets, which - as the DAX - cannot break away from the bottom of the session and still create downward pressure. Also, other emerging markets will end today's quotations strengthening correction signals from the last session.

-

15:32

U.S. Stocks open: Dow -0.08%, Nasdaq -0.01%, S&P -0.05%

-

15:08

Before the bell: S&P futures 0.00%, NASDAQ futures +0.10%

U.S. stock-index futures were little changed as investors awaited minutes from the Federal Reserve's last meeting for clues on the path of monetary policy.

Global Stocks:

Nikkei 16,745.64 +149.13 +0.90%

Hang Seng 22,799.78 -111.06 -0.48%

Shanghai 3,110.23 +0.1886 +0.01%

FTSE 6,873.56 -20.36 -0.30%

CAC 4,433.31 -27.13 -0.61%

DAX 10,566.93 -109.72 -1.03%

Crude $46.33 (-0.54%)

Gold $1349.10 (-0.57%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.6

1.46(0.8196%)

294

ALCOA INC.

AA

10.34

0.05(0.4859%)

11825

ALTRIA GROUP INC.

MO

66.2

-0.06(-0.0906%)

140546

Amazon.com Inc., NASDAQ

AMZN

764.81

0.77(0.1008%)

47522

American Express Co

AXP

65.3

0.00(0.00%)

74646

AMERICAN INTERNATIONAL GROUP

AIG

59.59

0.28(0.4721%)

28303

Apple Inc.

AAPL

109.25

-0.13(-0.1189%)

103156

AT&T Inc

T

41.95

-0.01(-0.0238%)

6668

Barrick Gold Corporation, NYSE

ABX

21.16

-0.16(-0.7505%)

14618

Boeing Co

BA

135

0.00(0.00%)

39293

Caterpillar Inc

CAT

84.29

0.00(0.00%)

30313

Chevron Corp

CVX

101.55

0.00(0.00%)

515

Cisco Systems Inc

CSCO

31.26

0.14(0.4499%)

91159

Citigroup Inc., NYSE

C

46.59

-0.03(-0.0643%)

23600

Deere & Company, NYSE

DE

78.15

0.00(0.00%)

19069

E. I. du Pont de Nemours and Co

DD

68.3183

0.2883(0.4238%)

67509

Exxon Mobil Corp

XOM

87.92

-0.00(-0.00%)

1498

Facebook, Inc.

FB

123.45

0.15(0.1217%)

31703

FedEx Corporation, NYSE

FDX

166.73

0.00(0.00%)

5634

Ford Motor Co.

F

12.36

0.02(0.1621%)

912

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12

-0.08(-0.6623%)

86993

General Electric Co

GE

31.25

0.06(0.1924%)

300

General Motors Company, NYSE

GM

31.7

-0.01(-0.0315%)

441523

Goldman Sachs

GS

165.71

0.06(0.0362%)

600

Google Inc.

GOOG

777.14

0.00(0.00%)

21021

Hewlett-Packard Co.

HPQ

14.07

-0.34(-2.3595%)

1050

Home Depot Inc

HD

135.32

-0.91(-0.668%)

24512

HONEYWELL INTERNATIONAL INC.

HON

116.23

0.595(0.5146%)

62198

Intel Corp

INTC

35.19

-0.02(-0.0568%)

5832

International Business Machines Co...

IBM

160.98

0.28(0.1742%)

400

International Paper Company

IP

46.66

0.00(0.00%)

33449

Johnson & Johnson

JNJ

120.33

0.00(0.00%)

3345

JPMorgan Chase and Co

JPM

65.62

-0.09(-0.137%)

300

McDonald's Corp

MCD

118

0.06(0.0509%)

200

Merck & Co Inc

MRK

63.04

0.00(0.00%)

572

Microsoft Corp

MSFT

57.44

-0.00(-0.00%)

2409

Nike

NKE

56.89

0.01(0.0176%)

66854

Pfizer Inc

PFE

34.79

0.00(0.00%)

400

Procter & Gamble Co

PG

86.6851

0.1051(0.1214%)

171522

Starbucks Corporation, NASDAQ

SBUX

55.7

0.33(0.596%)

3808

Tesla Motors, Inc., NASDAQ

TSLA

223.95

0.34(0.152%)

8100

The Coca-Cola Co

KO

43.83

0.00(0.00%)

181348

Travelers Companies Inc

TRV

116.98

0.00(0.00%)

17165

Twitter, Inc., NYSE

TWTR

20.44

0.04(0.1961%)

58060

United Technologies Corp

UTX

109.16

0.66(0.6083%)

54717

UnitedHealth Group Inc

UNH

141.08

0.00(0.00%)

160235

Verizon Communications Inc

VZ

53

0.24(0.4549%)

1074

Visa

V

80.81

0.14(0.1735%)

196977

Wal-Mart Stores Inc

WMT

71.8

-1.09(-1.4954%)

33666

Walt Disney Co

DIS

97.09

0.21(0.2168%)

1108

Yahoo! Inc., NASDAQ

YHOO

42.37

-0.12(-0.2824%)

12938

Yandex N.V., NASDAQ

YNDX

23.4

0.05(0.2141%)

900

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Home Depot (HD) target raised $155 from $150 at RBC Capital Mkts

Home Depot (HD) target raised to $145 from $140 at Wedbush

Cisco Systems (CSCO) target raised to $35 from $30.75 at Jefferies

Hewlett Packard Enterprise (HPE) initiated with a Mkt Perform at Raymond James

-

14:13

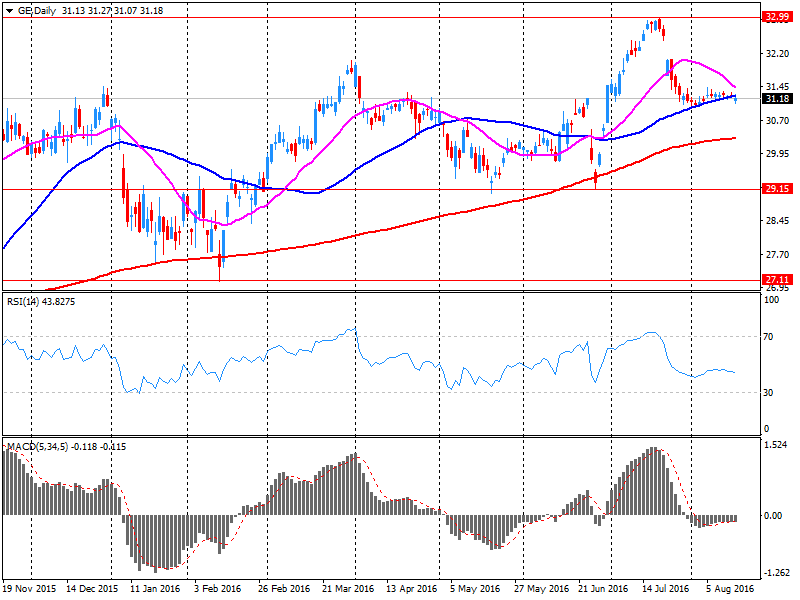

Company news: the financial division of General Electric (GE), GE Capital, is selling 12% stake in Townsquare Media

According to the WSJ, GE Capital has agreed to sell 3.2 million Townsquare Media shares Inc., which is 12% of the total issued shares of the company. The market value of Townsquare is about $ 230 mln., The value of the share is estimated at nearly $ 30 million. The companies are expected to report on the deal on Wednesday.

GE shares at the end of trading on Tuesday close at $ 31.19 (-0.16%).

-

13:15

Major stock indices in Europe moderately lower

European stocks mostly lower after the stock prices of oil and technology companies declined.

Statistical data on the UK economy, published on Wednesday, pointed to the preservation of the country's labor market flexibility, despite Brexit, and offer support to the British stock markets.

The number of applications for unemployment benefits in the UK fell unexpectedly in July, by 8.6 thousand., after rising 900 applications in June, according to the country's National Statistical Management (ONS).

In the second quarter of 2016 the number of employees in the UK has increased by 172 thousand persons to a record 31.8 million people. Unemployment rate was 4.9% in April-June, as well as in March-May, the rwage growth accelerated to 2.3% from 2.2%.

At the same time, investors await the FOMC minutes in the search for clues on the timing of the next rate hike.

Investors remain cautious after the head of the Federal Reserve Bank of New York William Dudley said the Fed is approaching the point where it would be appropriate to raise interest rates.

In addition, the Federal Reserve Bank of Atlanta President Dennis Lockhart declared the possibility of two rate increases in 2016.

The composite index of the largest companies in the region Stoxx Europe 600 fell during trading 0,4% - to 341.97 points.

Shares of BP, Royal Dutch Shell and Total fell 0.1%, 0.2% and 0.6% on renewed decline of oil prices.

Shares of ASML Holding NV, Europe's largest manufacturer of equipment for the production of semiconductors, dropped by 6%.

Shares of the Dutch bank ABN Amro jumped 4.9%. The bank, which reduced net income in the second quarter by 35%, announced its intention to reduce costs in the area of support and control of operations by 25%, or 200 million euros next year.

Securities of mining companies show mixed results: BHP Billiton shares rose 1%, Antofagasta - fell by 0.7%.

The capitalization of the British insurer Admiral Group fell by 8%. The company increased its pre-tax profit in the first half by 4.3% and raised its dividend by 23%, but warned that market volatility after the British decision to withdraw from the European Union (Brexit) have a negative impact on its creditworthiness.

Wienerberger Shares fell 8.2%, as the company warned of the negative impact of the currency against the background of the weakness of the pound sterling.

Carlsberg Shares slipped 4.1% as the Danish brewer introduced semi-annual results, which were below analysts' expectations, but said that will keep the forecast for 2016 due to the progress in the implementation of the cost reduction strategies.

Meanwhile, shares of Balfour Beatty rose by 7.7%, as the construction company resumed dividend payments.

At the moment:

FTSE 6894.32 0.40 0.01%

DAX 10603.81 -72.84 -0.68%

CAC 4444.40 -16.04 -0.36%

-

13:02

WSE: Mid session comment

The first half of trading on the Warsaw market was a clear direction down. After a drop in the first hour of the session the market consolidated for the next 90 minutes, indicating better balance. Another piece of trading, however, brought a decline to new lows of the session and the loss of the main market index at the level of 1 percent. Thus our market, which in the first half of August was characterized by the relative strength, today is at the forefront of downward moving parquets. It is also worth to note that the observed declines are not the work of blue chips only but also apply to the broad market, as confirmed by the behavior of the mWIG40 and the sWIG80 indices.

At the halfway point of the session the WIG20 index was at the level of 1,826 points (-1,12%), with the turnover of PLN 285 mln.

-

09:49

Positive start for major stock exchanges: FTSE 100 6,910.30 + 16.38 + 0.24%, DAX 10,684.83 + 8.18 + 0.08%

-

09:17

WSE: After opening

WIG20 index opened at 1847.28 points (+0.02%)

WIG 48450.02 -0.03%

WIG30 2100.24 -0.04%

mWIG40 3843.92 -0.08%

*/ - change to previous close

The futures contracts of September series (WSE: FW20U1620) began the day with a discount of 0.05 percent which does not seem to take into account the risk of deepening and markdowns means that players are counting on a shallow correction.

As expected, trading on the spot market (the WIG20 index) also began with small changes, causing that the WIG20 index in the first minutes was recorded at neutral level.

However, after the first transactions market went down, and after the first quarter of trading the WIG20 was on the level of 1841 points (-0,29%).

-

08:29

Mixed start expected on the major stock exchanges in Europe: DAX-0.3%, CAC40 + 0.2%, FTSE 0.0%

-

08:19

WSE: Before opening

Tuesday's session on Wall Street ended with declines in major indices in the context of clear correlation. Night did not bring major changes, and the valuation of contracts on the S&P500 and the DAX signal now opening in Europe without significant changes. However the corrective mood on Wall Street will be difficult to ignore.

Today's calendar of economic reports in the world is virtually empty. Global markets are waiting for the publication of the minutes of the last FOMC meeting.

It is reasonable to assume that the core markets have space for correction, which may result for the S&P500 meeting with the region of 2,200 points. In the case of emerging markets - an important point of reference for the WIG20 index and the Warsaw Stock Exchange - the last two sessions are something more than a warning before correction. In recent times, the emerging markets segment had almost euphoric phase of growth and the Tuesday counterattack of supply must be noticed also in Warsaw. There is no doubt that emerging markets are on the verge of correction.

-

07:08

Global Stocks

European stocks closed in negative territory Tuesday, but gains within the commodities group kept the decline somewhat in check.

The Stoxx Europe 600 SXXP, -0.79% fell 0.8% to close at 343.32, with only the basic materials SXPR, +1.31% and oil and gas SXER, +0.19% sectors advancing. The index on Monday slipped less than 0.1%, a second straight decline.

European traders apparently failed to take heart from the continued climb in U.S. equities, which hit records Monday as oil prices rallied.

Stocks in the U.K. fell Tuesday, pulling back after eight consecutive advances, but gains for miners limited the loss for the benchmark index.

The FTSE 100 UKX, -0.68% dropped 0.7% to 6,893.92, with only the mining sector finishing higher.

U.S. stocks closed at session lows Tuesday, a day after notching record highs, as investors weighed hawkish comments by Federal Reserve officials against sharp gains for oil futures, a weakening dollar and fresh consumer-price data that showed U.S. inflation remains tepid.

The S&P 500 index SPX, -0.55% fell 12 points, or 0.6%, to close at 2,178.15, as nine out of 10 sectors traded lower, led by a 2% drop in telecom stocks and a 1.2% loss in utility shares. Telecom and utilities are two income-paying stock sectors traditionally viewed as bond alternatives-which take a hit when interest-rate expectations rise.

Energy was the only S&P 500 sector to close in positive territory, up 0.2%, boosted by strong gains in crude-oil futures CLU6, -0.62%

The Dow Jones Industrial Average DJIA, -0.45% closed down 84.03 points, or 0.5%, at 18,552.02, pressured by a 1.6% declines in both Johnson & Johnson Inc. JNJ, -1.62% and Verizon Communications Inc. VZ, -1.59%

Asian shares pulled back from a one-year high and the dollar strengthened on Wednesday, after an influential Federal Reserve official said interest rates could rise as soon as September.

New York Fed President William Dudley said that as the U.S. labour market tightens and as evidence of rising wages builds, "we're edging closer towards the point in time where it will be appropriate I think to raise interest rates further."

Comments from Dudley, a permanent voter on policy and a close ally of Fed Chair Janet Yellen, also included an unusual warning on low bond yields and were seen as more hawkish than a cautious message last month.

Atlanta Federal Reserve Bank President Dennis Lockhart, seen as centrist, concurred saying he did not rule out a September hike - something markets have almost completely priced out.

-

01:01

Stocks. Daily history for Aug 16’2016:

(index / closing price / change items /% change)

Nikkei 225 16,596.51 -273.05 -1.62%

Shanghai Composite 3,110.48 -14.72 -0.47%

S&P/ASX 200 5,531.98 -7.98 -0.14%

FTSE 100 6,893.92 -47.27 -0.68%

CAC 40 4,460.44 -37.42 -0.83%

S&P 500 2,178.15 -12.00 -0.55%

Dow Jones 18,552.02 -84.03 -0.45%

S&P/TSX Composite 14,703.44 -73.58 -0.50%

-