Noticias del mercado

-

16:30

U.S.: Crude Oil Inventories, August -2.5

-

15:49

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1100 (EUR 324m) 1.1200 (351m) 1.1250 (515m) 1.1300 (210m)

USD/JPY 103.00 (USD 246m)

GBP/USD 1.2600 (GBP 849m) 1.2950 (532m) 1.2995 (340m)

AUD/USD 0.7400 (AUD 200m) 0.7625 (279m) 0.7690 (210m) 0.7715 (311m)

USD/CAD 1.3150 (USD 250m)

NZD/USD 0.7180 (NZD 451m) 0.7200-01 (417m)

AUD/NZD 1.0600 (AUD 809m)

-

15:29

FOMC minutes: The knee-jerk reaction could see the USD strengthen - BofA Merrill

"Despite the strong July employment report the USD struggled this week. Headline payroll growth was strong, but with the unemployment rate steady, wages stable, and the labor force participation rate ticking up, the report does little to force the Fed's hand and leaves them comfortably on hold for now. The resulting low vol, positive carry environment precipitated a further reduction in USD positioning as 2016 Fed expectations were little changed. For the USD to rally further, we need to see a more consistent trend of upside surprises that convinces the market Fed normalization will continue beyond just one hike. In other words, we need to see a more significant repricing of 2017 and 2018 expectations.

This week's FOMC Minutes could have some impact on market pricing. We expect the Minutes to offer a bit more optimistic assessment of the US economy and global financial conditions, similar to the July statement.

The knee-jerk reaction could see the USD strengthen as this will be viewed on the hawkish side given the USD selloff we have seen since the NFP report. But, a failure by the Fed to signal hikes are imminent and/or a more protracted normalization cycle means the FX market impact is likely to be short-lived".

Copyright © 2016 BofAML, eFXnews™

-

14:21

European session review: Pound drops moderately on confirmation of stable employment

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 Changing UK average earnings (excluding bonuses), m 3 / y in June 2.2% 2.3% 2.3%

8:30 UK Change of average earnings, 3 m / d in June 2.3% 2.4% 2.4%

8:30 UK ILO unemployment rate for June 4.9% 4.9% 4.9%

8:30 UK Number of applications for unemployment benefits, thousand. 0.9 Revised July 10 with 0.4 -8.6

9:00 Switzerland investor expectations index according to ZEW and Credit Suisse in August 5.9 -2.8

In the UK, the number of applications for unemployment benefits unexpectedly fell in July, while the unemployment rate remained stable at its lowest level in more than 10 years.

The number of people applying for unemployment benefits decreased by 8 600 people in July from June, confounding expectations for an increase of 10,000.

The unemployment rate according to ILO standards was 4.9 percent in the second quarter, in line with expectations, and at the same rate as it was during the three months to May. The last time it was lower was in the period from July to September 2005.

In the second quarter, average earnings, including bonuses, rose by 2.4 percent, as expected, and earnings excluding bonuses rose by 2.3 percent compared with a year earlier.

The employment rate in the second quarter amounted to 74.5 percent, the highest figure since comparable records began in 1971.

The number of unemployed fell by 52,000 compared with the previous quarter to 1.64 million.

Euro moderately lower against the US dollar, correcting after sharp rise yesterday. Market participants analyzed the recent statements by the Fed, as well as the expected release of protocols of the July FOMC meeting, which could shed light on the Central Bank plans for the timing of rate hikes.

Recall, Dudley said yesterday that he supports a hike in September. "We are approaching the moment when it is appropriate to re-raise the rate, - said Dudley -. US employment in the last 3 months is growing at an average rate at the level of 190 thousand per month, and economic growth should accelerate in the 2nd half of the year.. and the signals of accelerating wage growth. Overall, the US economy is in good condition".

Meanwhile, the head of the Federal Reserve Bank of Atlanta, Lockhart said that he's optimistic about the economic outlook, and therefore feel justified o hike. He added that the weak data on US GDP for the 2nd quarter should be viewed in the context of other factors.

EUR / USD: during the European session, the pair fell to $ 1.1253

GBP / USD: during the European session, the pair fell to $ 1.2994

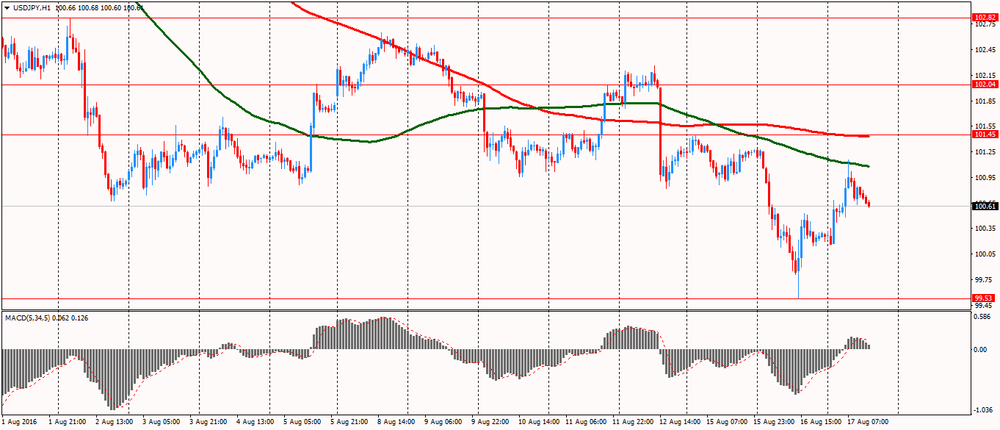

USD / JPY: during the European session, the pair vysrosla to Y101.16 and retreated

-

13:52

Orders

EUR/USD

Offers : 1.1285 1.1300 1.1325-30 1.1350 1.1370-80 1.1400

Bids : 1.1250 1.1230 1.1200 1.1185 1.1150 1.1130 1.1115 1.1100

GBP/USD

Offers : 1.3050 1.3065 1.3080 1.3095-05 1.3130 1.3150

Bids : 1.3000 1.2980 1.2950 1.2930 1.2900 1.2880 1.1265 1.2850 1.2830 1.2800

EUR/GBP

Offers : 0.8660-65 0.8685 0.8700 0.8725-30 0.8750

Bids : 0.8625-30 0.8600 0.8585 0.8570 0.8550

EUR/JPY

Offers : 113.85 114.00 114.30 114.50 114.75 115.00 115.50

Bids : 113.20 113.00 112.75 112.50 112.30 112.00-10 111.85 111.50

USD/JPY

Offers : 101.00 101.25-30 101.50 101.80 102.00 102.25 102.50

Bids : 100.70 100.50 100.30 100.00 99.85 99.50 99.30 99.00

AUD/USD

Offers : 0.7700 0.7720 0.7750-55 0.7785 0.7800

Bids : 0.7660 0.7635-40 0.7620 0.7600 0.7585 0.7565

-

11:33

Economic sentiment in Switzerland has once again experienced a decrease

In August 2016, the ZEW-CS-Indicator for the economic sentiment in Switzerland has once again experienced a decrease. With a drop by 8.7 points to a reading of minus 2.8 points, the indicator continues the downward trend already seen in the previous month. When it comes to the current economic situation, however, the surveyed experts recorded an upward trend, with the relevant indicator rising from 0.0 points in July 2016 to a current reading of 11.3 points.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), August -2.8

-

10:33

UK labor market steady. What Brexit effect?

Between January to March 2016 and April to June 2016, the number of people in work increased. The number of unemployed people and the number of people not working and not seeking or available to work (economically inactive) fell.

There were 31.75 million people in work, 172,000 more than for January to March 2016 and 606,000 more than for a year earlier.

There were 23.22 million people working full-time, 374,000 more than for a year earlier. There were 8.53 million people working part-time, 231,000 more than for a year earlier.

The unemployment rate was 4.9%, down from 5.6% for a year earlier. The last time it was lower was for July to September 2005. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed.

Average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.4% including bonuses and by 2.3% excluding bonuses compared with a year earlier.

-

10:30

United Kingdom: Average Earnings, 3m/y , June 2.4% (forecast 2.4%)

-

10:30

United Kingdom: Claimant count , July -8.6 (forecast 10)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, June 2.3% (forecast 2.3%)

-

10:30

United Kingdom: ILO Unemployment Rate, June 4.9% (forecast 4.9%)

-

10:23

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1100 (EUR 324m) 1.1200 (351m) 1.1250 (515m) 1.1300 (210m)

USD/JPY 103.00 (USD 246m)

GBP/USD 1.2600 (GBP 849m) 1.2950 (532m) 1.2995 (340m)

AUD/USD 0.7400 (AUD 200m) 0.7625 (279m) 0.7690 (210m) 0.7715 (311m)

USD/CAD 1.3150 (USD 250m)

NZD/USD 0.7180 (NZD 451m) 0.7200-01 (417m)

AUD/NZD 1.0600 (AUD 809m)

-

09:10

Today’s events:

At 14:30 GMT the US will publish data on crude oil inventories from the Department of Energy

At 17:00 GMT US Fed James Bullard speech

At 18:00 GMT FOMC meeting minutes

-

08:32

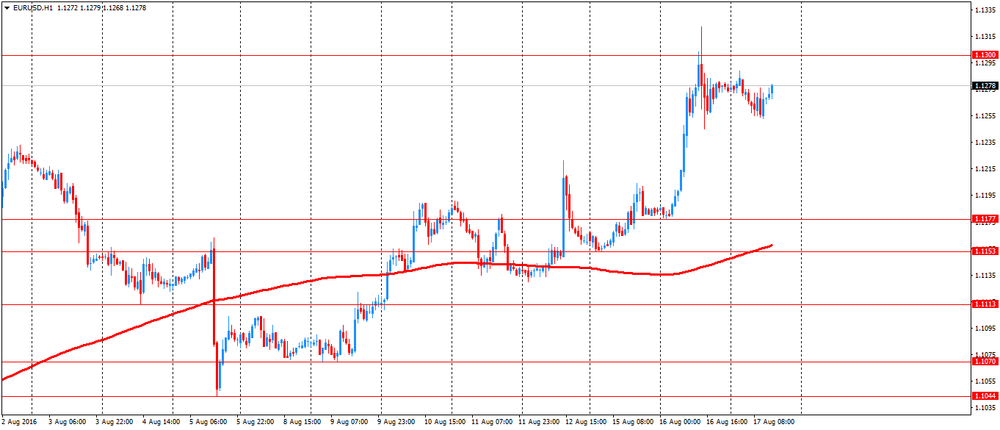

Options levels on wednesday, August 17, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1414 (3605)

$1.1361 (5176)

$1.1328 (3352)

Price at time of writing this review: $1.1267

Support levels (open interest**, contracts):

$1.1179 (2050)

$1.1148 (2223)

$1.1112 (3413)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52974 contracts, with the maximum number of contracts with strike price $1,1250 (5176);

- Overall open interest on the PUT options with the expiration date September, 9 is 56464 contracts, with the maximum number of contracts with strike price $1,1000 (5743);

- The ratio of PUT/CALL was 1.07 versus 1.12 from the previous trading day according to data from August, 16

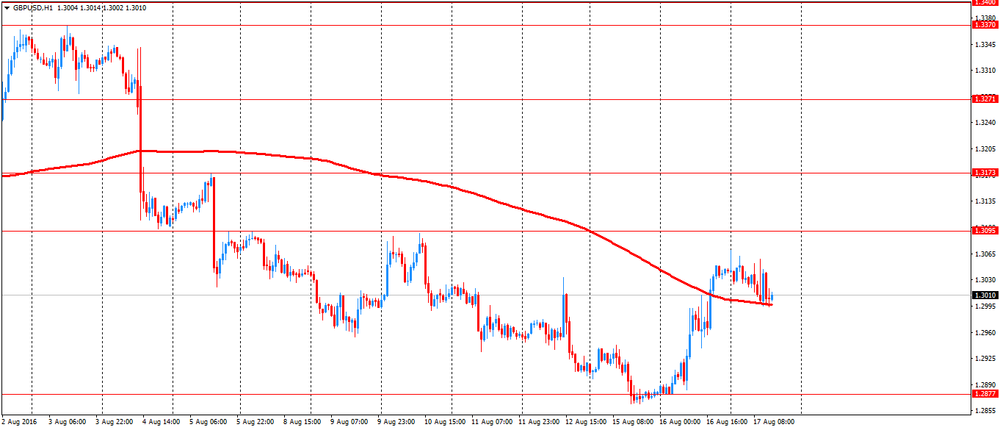

GBP/USD

Resistance levels (open interest**, contracts)

$1.3304 (2593)

$1.3206 (2257)

$1.3110 (1270)

Price at time of writing this review: $1.3047

Support levels (open interest**, contracts):

$1.2990 (2151)

$1.2893 (2099)

$1.2796 (2613)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32411 contracts, with the maximum number of contracts with strike price $1,3300 (2593);

- Overall open interest on the PUT options with the expiration date September, 9 is 26250 contracts, with the maximum number of contracts with strike price $1,2800 (2613);

- The ratio of PUT/CALL was 0.81 versus 0.81 from the previous trading day according to data from August, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:54

EUR/USD Will Reach 1.20 Before It Reaches 1.00 - Danske

"Growth. US growth surprised on the downside in Q2 but recent labour market data has surprised on the upside. Private consumption should be supported in coming months despite the weak July retail sales. European data have been stronger than we expected given Brexit but the sharp slowdown in the UK is likely to impact the eurozone with a lag. As such, we expect to see some softness in European data in the coming months.

Monetary policy. The Fed was slightly more hawkish than expected at its July meeting. Fed chairman Janet Yellen is likely to give more clarity on her thinking regarding monetary policy at her Jackson Hole speech on 26 August. We believe that the Fed will wait until H1 17 to raise interest rates again. The market is pricing around 40% probability for a 25bp rate hike before end- 2016 which appears fair. Meanwhile, we expect that the ECB as a minimum will have to extend its QE purchases beyond March 2017 but it is unlikely that it will cut interest rates further.

Flows. The market is short EUR/USD according to IMM data but not in stretched territory. As such, this increases the sensitivity of the cross to any impetus from relative rates.

Valuation. Both our PPP and MEVA models suggest the mid- 1.20s are 'fundamentally' justified and thus that the cross remains undervalued.

Forecast: 1.12 (1M), 1.12 (3M), 1.14 (6M), 1.18 (12M).

Risks. Political risks in the eurozone and in the US will weigh on markets in coming months. However, this can be both EUR and USD negative.

Conclusion. We are adjusting up our EUR/USD forecasts to 1.12 in 1M (from 1.09) 1.12 (1.07), 1.14 (1.10) and 1.18 (1.14). These are the forecasts we had before Brexit. Brexit has not had the economic impact on the eurozone as we expected. While we believe that there will be some slowdown in the eurozone in coming months, we still do not expect that the ECB will cut rates. Political uncertainty could weigh on both the EUR and the USD.

We maintain our long-held view that the undervaluation of the EUR and the wide eurozone-US current account differential are longerterm EUR positives. Hence, EUR/USD will reach 1.20 before it reaches 1.00".

Copyright © 2016 Danske, eFXnews™

-

07:51

New Zeeland: producer prices rose due to higher fuel and electricity prices

Producer prices rose in the June 2016 quarter, due to higher fuel and electricity prices, Statistics New Zealand said today.

The input prices (costs paid) for the petroleum and coal product manufacturing industry rose 22 percent in the June 2016 quarter, due to higher international prices for crude oil. This follows falls of 22 percent in both the March and December quarters.

"Despite the June quarterly increase in costs paid by fuel manufacturers, fuel prices have fallen by about half since mid-2012," business prices manager Sarah Williams said.

-

07:49

Moody's affirms Australia's Aaa rating; maintains stable outlook

Moody's Investors Service has today affirmed Australia's Aaa government issuer ratings, the Aaa senior unsecured rating and the (P)Aaa senior unsecured shelf rating. The stable outlook is maintained.

The factors supporting the rating affirmation are:

1. Moody's expectation that Australia's demonstrated economic resilience will endure in an uncertain global environment;

2. A very strong institutional framework;

3. Stronger fiscal metrics than many similarly rated peers - despite the increase in government debt from previous low levels - which we expect to remain consistent with a Aaa rating over the medium term.

Moody's notes that Australia's reliance on external financing, elevated household debt and rising residential property prices pose risks. The stable outlook on the rating reflects Moody's expectations that policy vigilance and response to these risks will be effective, and Australia's sovereign credit profile will remain resilient to these risks.

Australia's long-term local and foreign-currency bond and deposit ceilings remain at Aaa. The short-term foreign-currency bond and deposit ceilings remain at Prime.

-

07:48

NZD supported by better unemployment but then retreats

The unemployment rate decreased to 5.1 percent in the June 2016 quarter (from a revised 5.2 percent in the March quarter), Statistics New Zealand said today. Compared with the March 2016 quarter, 1,000 fewer people were unemployed in New Zealand.

The official estimate of unemployment is based on people who are both actively seeking work and available to work, as measured in the HLFS.

Unemployment was also down from where it was a year ago (5.5 percent in the June 2015 quarter), particularly for women.

"Compared with June 2015, there were 8,000 fewer unemployed women, and their unemployment rate fell from 6.2 percent to 5.4 percent," labour and income statistics manager Mark Gordon said.

In unadjusted terms, unemployment was down from a year ago across many North Island regions, including Auckland, which had an unemployment rate of 4.7 percent in the June 2016 quarter. This is the lowest rate for the Auckland region since the September 2008 quarter (when it was 4.1 percent).

-

07:45

Australian wage prices up 0.5% q/q

In the June quarter 2016, the Private sector index rose 0.4% and the Public sector rose 0.5%. The All sectors quarterly rise was 0.5%.

The Private sector through the year rise to the June quarter 2016 of 1.9% was lower than the Public sector rise of 2.3%. Through the year, All sectors rose 2.1%.

Private sector index rose 0.5% and the Public sector rose 0.6%. The All sectors quarterly rise was 0.5%.

Through the year, All sectors rose 2.1%. The Private sector through the year rise to the June quarter 2016 of 2.0% was lower than the Public sector rise of 2.4%.

In the June quarter 2016, wages grew 0.4% for All sectors for the third consecutive quarter. Wages grew 0.3% in both the Private and Public sectors.

The All sectors through the year rise was 2.1%. The Private sector rose 1.9%, the lowest through the year rise since the beginning of the series in September 1998, and the Public sector rose 2.4%.

-

03:30

Australia: Wage Price Index, q/q, Quarter II 0.5% (forecast 0.5%)

-

03:30

Australia: Wage Price Index, y/y, Quarter II 2.1% (forecast 2%)

-

02:46

Australia: Leading Index, July 0.1%

-

01:01

Currencies. Daily history for Aug 16’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1274 +0,81%

GBP/USD $1,3042 +1,24%

USD/CHF Chf0,9619 -1,14%

USD/JPY Y100,26 -1,00%

EUR/JPY Y113,03 -0,19%

GBP/JPY Y130,75 +0,26%

AUD/USD $0,7697 +0,31%

NZD/USD $0,7280 +0,89%

USD/CAD C$1,2856 -0,54%

-

00:46

New Zealand: PPI Output (QoQ) , Quarter II 0.2%

-

00:46

New Zealand: PPI Input (QoQ), Quarter II 0.9%

-

00:45

New Zealand: Employment Change, q/q, Quarter II 2.4% (forecast 0.6%)

-

00:45

New Zealand: Unemployment Rate, Quarter II 5.1% (forecast 5.3%)

-

00:00

Schedule for today, Wednesday, Aug 17’2016

(time / country / index / period / previous value / forecast)

00:30 Australia Leading Index July -0.2%

01:30 Australia Wage Price Index, q/q Quarter II 0.4% 0.5%

01:30 Australia Wage Price Index, y/y Quarter II 2.1% 2%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June 2.2% 2.3%

08:30 United Kingdom Average Earnings, 3m/y June 2.3% 2.4%

08:30 United Kingdom ILO Unemployment Rate June 4.9% 4.9%

08:30 United Kingdom Claimant count July 0.4 10

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August 5.9

14:30 U.S. Crude Oil Inventories August 1.055

17:00 U.S. FOMC Member James Bullard Speaks

18:00 U.S. FOMC meeting minutes

23:50 Japan Trade Balance Total, bln July 693 283.7

-