Noticias del mercado

-

17:51

Oil reached a six-week high

Oil futures rose in today's trading, reaching a six-week high, as the world's largest oil producers have signaled their readiness to discuss the possibility of freezing production levels.

Brent crude oil prices have risen by more than 20 percent since the beginning of the month in response to the news that members of OPEC and other key exporters are likely to resume talks on freezing production levels at the meeting in September.

Many OPEC members have been hit hard by the collapse in oil prices over the past two years. While some Gulf oil exporters have very low production costs, other producers, such as Iran and Venezuela, need oil prices above $ 100 to balance their budgets. However, analysts believe that the freezing of production at current levels would not be able to support prices. Meanwhile, Saudi Arabia has made it clear that, in August, can increase oil deliveries to a new record level, although it has expressed willingness to discuss production levels with other manufacturers.

In view of this situation, Citi analysts have warned that there are risks to the price rally, based primarily on the potential for future negotiations on freezing oil production levels, given that similar meetings earlier this year ended without result.

The cost of October futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 48.60 dollars per barrel.

October futures price for North Sea petroleum mix of Brent crude rose to 50.87 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

16:54

Fed, Dudley: wage gains are gradually starting to pick up

-

NYC job gains are widespread outside of finance, on tech hiring

-

Labour market conditions continue to improve

-

Job gains have remained very sturdy

-

If we're downshifting in jobs it's tiny

-

Wage gains are gradually starting to pick up

-

There's probably still a little slack in the labour market

-

Q3 GDP will be quite stronger that H1

-

H2 should be 2% or more

-

Q2 GDP was misleading due to a drag from inventories

*via forexlive -

-

16:05

US CB leading index up 0.4% in July

The Conference Board Leading Economic Index® (LEI) for the U.S. increased 0.4 percent in July to 124.3 (2010 = 100), following a 0.3 percent increase in June, and a 0.2 percent decline in May.

"The U.S. LEI picked up again in July, suggesting moderate economic growth should continue through the end of 2016," said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board.

"There may even be some moderate upside growth potential if recent improvements in manufacturing and construction are sustained, and average consumer expectations don't deteriorate further."

-

16:00

U.S.: Leading Indicators , July 0.4% (forecast 0.3%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1350 (EUR 605m)

USD/JPY 101.00 (USD 1.46bln) 103.00 (USD 877m) 104.00 (1.08bln)

AUD/USD 0.7650 (AUD 640m)

USD/CAD 1.2990-1.3000 (USD 756m)

AUD/NZD 1.0700 (AUD 310m) 1.0710-12 (AUD (485m)

-

14:41

International transactions in securities generated a net inflow of funds into the Canadian economy

Foreign investors increased their holdings of Canadian securities by $9.0 billion in June, with acquisitions led by significant portfolio investment in equities. At the same time, Canadian investors acquired $4.1 billion of foreign securities, mainly non-US foreign equities.

As a result, international transactions in securities generated a net inflow of funds into the Canadian economy of $4.9 billion in June, for a total of $24.0 billion in the second quarter. This followed a $51.7 billion inflow of funds recorded in the first quarter.

-

14:40

US jobless claims declined slightly

In the week ending August 13, the advance figure for seasonally adjusted initial claims was 262,000, a decrease of 4,000 from the previous week's unrevised level of 266,000. The 4-week moving average was 265,250, an increase of 2,500 from the previous week's unrevised average of 262,750.

There were no special factors impacting this week's initial claims. This marks 76 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

14:38

US: Philadelphia Fed manufacturing suggest that growth was positive but tenuous this month. The dollar little changed

Firms responding to the Manufacturing Business Outlook Survey suggest that growth was positive but tenuous this month. The diffusion index for current general activity moved from a negative reading to a marginally positive reading, while the indicators for new orders and employment suggested continued general weakness in business conditions. Of the current broad indicators, the diffusion index for shipments recorded the strongest reading. The respondents were confident about future growth, as their forecasts of future activity showed notable improvement.

The index for current manufacturing activity in the region rose 5 points to only 2.0 in August, as the share of firms reporting an increase in activity (35 percent) barely exceeded the share reporting a decrease (33 percent). This is only the third positive reading of the index in the current year.

The current new orders index dropped significantly from a reading of 11.8 in July to -7.2 in August.

The survey's indicators of employment weakened considerably. The employment index fell 18 points to -20.0, which is its largest negative reading for the current year.

The survey's indicators of employment weakened considerably. The employment index fell 18 points to -20.0, which is its largest negative reading for the current year.

-

14:30

U.S.: Initial Jobless Claims, 262 (forecast 265)

-

14:30

Canada: Foreign Securities Purchases, June 9.02

-

14:30

U.S.: Continuing Jobless Claims, 2175 (forecast 2140)

-

14:23

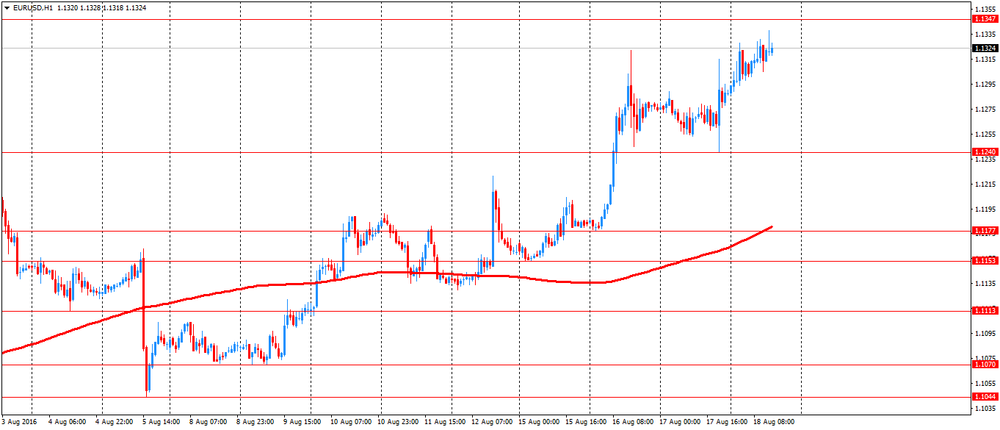

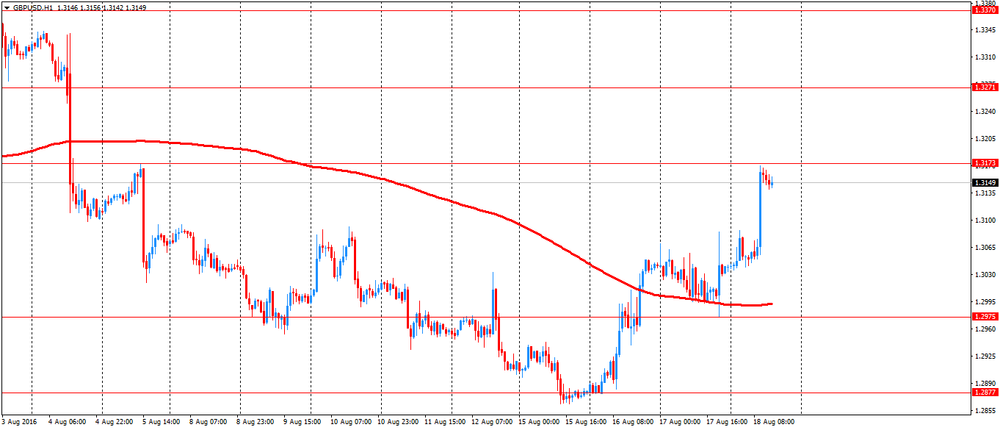

European session review: the pound rose sharply on strong retail sales data

The following data was published:

(Time / country / index / period / previous value / forecast)

8:00 Eurozone balance of payments, without taking into account seasonal adjustments, 16.5 billion in June from 15.4 37.6 Revised

08:30 UK Retail Sales m / m in July -0.9% 0.2% 1.4%

8:30 UK Retail sales, y / y in July 4.3% 4.2% 5.9%

9:00 Eurozone construction volume change, y / y in June -0.8% 0.6%

9:00 Eurozone Consumer Price Index m / m in July 0.2% -0.5% -0.6%

9:00 Eurozone Consumer Price Index y / y (final data) July 0.1% 0.2% 0.2%

9:00 Eurozone consumer price index base value, y / y (final data) July 0.9% 0.9% 0.9%

The pound rose sharply against the US dollar afterdata on retail sales exceeded forecasts. In the UK, retail sales rebounded in July, as sales in stores of food and non-food products rose, showed the Office for National Statistics.

Retail sales, including automotive fuel, increased by 1.4 percent for the month, after a 0.9 percent drop in June. Sales were expected to grow by only 0.2 percent.

In the same way, except automotive fuel, retail sales rose 1.5 percent after falling 0.9 percent the previous month. The increase was much faster than expected (+0.3%)..

In annual terms, the growth in the overall volume of retail sales improved to 5.9 percent in July from 4.3 percent. Sales excluding auto fuel advanced 5.4 percent, faster than the growth of 3.9 percent in June.

Economists had forecast that total sales will grow by 4.2 percent, while sales excluding automotive fuel will rise by 3.9 percent.

The euro rose moderately against the US dollar, continuing the rise started yesterday. Pressure on the dollar put protocols of the July meeting of the FOMC, which showed that between the leaders of the Fed there is no agreement on the policy tightening. Markets were waiting for the signal of a tight policy, but protocols have been balanced.

FOMC members sought to reconcile views on the economic outlook and the timing of interest rate increases, and sought to leave open all possibilities. Some Fed officials suggested not to tighten policy until there is more confidence in the achievement of the inflation target of 2%, and others said that the US labor market is almost fully recovered.

Today investors focus on euro zone inflation data for July.

Inflation rose to 0.2 percent from 0.1 percent in June. Prices rose for the second month in a row in July.

Inflation remains below the target level of the European Central Bank's.

Core inflation, which excludes energy, food, alcohol and tobacco, remained stable at 0.9 percent in July.

Both the consumer and the main indicators of inflation matched the preliminary estimate published on 29 July.

On a monthly basis, consumer prices fell 0.6 percent in July.

EUR / USD: during the European session, the pair rose to $ 1.1338

GBP / USD: during the European session, the pair rose to $ 1.3170

USD / JPY: during the European session, the pair rose to Y100.49

-

13:49

Orders

EUR/USD

Offers : 1.1325-30 1.1350 1.1370-80 1.1400 1.1425-30 1.1450

Bids : 1.1300 1.1280 1.1250 1.1230 1.1200 1.1185 1.1150

GBP/USD

Offers : 1.3080 1.3095-05 1.3130 1.3150 1.3175-80 1.3200

Bids : 1.3030 1.3000 1.2980 1.2950 1.2930 1.2900 1.2880 1.1265 1.2850

EUR/GBP

Offers : 0.8685 0.8700 0.8725-30 0.8750

Bids : 0.8650 0.8625-30 0.8600 0.8585 0.8570 0.8550

EUR/JPY

Offers : 113.30 113.50 113.85 114.00 114.30 114.50 114.75 115.00

Bids : 112.75-80 112.50 112.30 112.00-10 111.85 111.50

USD/JPY

Offers : 100.25-30 100.60 101.00 101.25-30 101.50

Bids : 99.65 99.50 99.30 99.00 98.80 98.50

AUD/USD

Offers : 0.7725-30 0.7750-55 0.7785 0.7800 0.7830 0.7850

Bids : 0.7700 0.7680-85 0.7660 0.7635 0.7620 0.7600 0.7585 0.7565 0.7550

-

13:40

ECB meeting minutes

-

There was a need to convey cautious optimism on the Eurozone recovery

-

ECB made a strong call to limit the political uncertainty on Brexit

-

Saw no clear upward trend in inflation

-

Peter Praet said weak prices were an ongoing source of concern

-

Felt time was needed to assess information over following months

-

Consequences of Brexit vote less marked than expected

-

-

12:36

Major stock indices in Europe moderately higher

European stocks rose as the July Fed meeting minutes dismissed the likelihood of a rate hike in September, while investors moved focus on forthcoming publication of the minutes of the last meeting of the European Central Bank.

The composite index of the largest companies in the region Stoxx Europe 600 rising for the first time in five sessions, +0,6% - to 342.48 points.

Shares of Anglo American rose during trading 2,3%, Antofagasta +2,2%, BHP Billiton +2,1%, Fresnillo +1.9%.

Vestas Wind shares jumped 9%, as the operating income of the Danish manufacturer of wind turbines in the second quarter exceeded forecasts, and the company has improved the forecast for 2016.

Shares of NN Group increased by 6.5%, as the Dutch insurance company reported a smaller decline in profits than many analysts expected.

Thyssenkrupp AG shares rose 1.6% after Deutsche Bank analysts confirmed their rating to "buy."

Shares of Nestle SA fell 0.6% after the Swiss food giant said sales growth in the first quarter by 3.5%, worse than analysts' expectations.

Kingfisher shares have fallen by 1.5%, despite the retailer's message on the growth of sales in the second quarter by 3% and the statement that "there is no clear evidence of the impact on demand from Brexit".

At the moment:

FTSE 6868.29 9.14 0.13%

DAX 10593.06 55.39 0.53%

CAC 4425.96 8.28 0.19%

-

11:59

Japan Verbal Intervention Won't Reverse The Stronger JPY Trend - BTMU

"The yen has been undermined overnight as well by Japanese policymakers stepping up verbal intervention in response to USD/JPY falling below the 100.00-level. The Vice Minister for International Affairs Masatsugu Asakawa has stated that Japan is closely watching for "speculative" moves with a strong sense on concern. He noted that price action could be exaggerated in thin summer markets. If there are extreme FX moves he warned that Japan will have to act while keeping in close contact with other G7 nations.

Verbal intervention may help temporarily to dampen yen strength but it will not reverse the stronger yen trend. We still believe that direct intervention remains unlikely in the near-term given strong opposition from the US.

The upcoming US Presidential election could make Japan even more sensitive about intervening given the focus on protectionism. It is also difficult to argue that fundamentals justify intervention. While the yen is stronger now we believe that it is only closer to fair value, and yen volatility has eased recently".

Copyright © 2016 BTMU, eFXnews™

-

11:07

Euro area annual inflation up 0.2%

Euro area annual inflation was 0.2% in July 2016, up from 0.1% in June. In July 2015 the rate was 0.2%. European Union annual inflation was also 0.2% in July 2016, up from 0.1% in June. A year earlier the rate was 0.2%. These figures come from Eurostat, the statistical office of the European Union.

In July 2016, negative annual rates were observed in twelve Member States. The lowest annual rates were registered in Bulgaria and Croatia (both -1.1%) and Slovakia (-0.9%). The highest annual rates were recorded in Belgium (2.0%), Sweden (1.1%) and Malta (0.9%). Compared with June 2016, annual inflation fell in nine Member States, remained stable in seven and rose in twelve.

The largest upward impacts to euro area annual inflation came from restaurants & cafés (+0.11 percentage points), vegetables (+0.09 pp) and fruit (+0.08 pp), while fuels for transport (-0.46 pp), heating oil (-0.15 pp) and gas (-0.12 pp) had the biggest downward impacts

-

11:00

Eurozone: Harmonized CPI, Y/Y, July 0.2% (forecast 0.2%)

-

11:00

Eurozone: Harmonized CPI, July -0.6% (forecast -0.5%)

-

11:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, July 0.9% (forecast 0.9%)

-

11:00

Eurozone: Construction Output, y/y, June 0.6%

-

10:38

Huge retail sales from UK the month after Brexit

The reporting period for this release covers a 4 week period from 3 July to 30 July 2016 and therefore includes data for the month following the EU referendum. The data are based on sales made in Great Britain and will include sales made to both Great Britain residents and non-residents.

In July 2016, the quantity bought (volume) of retail sales is estimated to have increased by 5.9% compared with July 2015; all sectors showed growth with the main contribution coming from non-food stores.

Compared with June 2016, the quantity bought increased by 1.4%; all sectors showed growth with the main contribution again coming from non-food stores.

Average store prices (including petrol stations) fell by 2.0% in July 2016 compared with July 2015. Compared with June 2016, there was a fall of 0.8%.

The amount spent (value) in the retail industry increased by 3.6% compared with July 2015 and 1.6% compared with June 2016.

The amount spent online increased by 16.7% compared with July 2015 and increased by 1.2% compared with June 2016.

-

10:35

The pound on the rise after retail sales confirming too the low impact of Brexit so far

-

10:30

United Kingdom: Retail Sales (MoM), July 1.4% (forecast 0.2%)

-

10:30

United Kingdom: Retail Sales (YoY) , July 5.9% (forecast 4.2%)

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1350 (EUR 605m)

USD/JPY 101.00 (USD 1.46bln) 103.00 (USD 877m) 104.00 (1.08bln)

AUD/USD 0.7650 (AUD 640m)

USD/CAD 1.2990-1.3000 (USD 756m)

AUD/NZD 1.0700 (AUD 310m) 1.0710-12 (AUD (485m)

-

10:06

The current account of the euro area recorded a surplus of €28.2 billion in June

The current account of the euro area recorded a surplus of €28.2 billion in June 2016. This reflected surpluses for goods (€32.9 billion) and services (€5.3 billion), which were partly offset by a deficit in secondary income (€10.1 billion). The primary income account was close to balance.

The 12-month cumulated current account for the period ending in June 2016 recorded a surplus of €347.8 billion (3.3% of euro area GDP), compared with one of €302.1 billion (2.9% of euro area GDP) for the 12 months to June 2015 (see Table 1 and Chart 1). This development was mostly due to an increase in the surplus for goods (from €306.6 billion to €368.4 billion) and to a decrease in the deficit for secondary income (from €134.8 billion to €123.4 billion). These were partly offset by decreases in the surpluses for both primary income (from €64.0 billion to €40.4 billion) and services (from €66.4 billion to €62.5 billion).

-

10:01

Eurozone: Current account, unadjusted, bln , June 37.6

-

09:10

Today’s events:

At 11:30 GMT the ECB will report on monetary policy meeting.

At 14:05 GMT FOMC member William Dudley will make a speech.

At 20:00 GMT FOMC members John Williams will deliver a speech.

-

08:45

FOMC Minutes: Odds Of A Fed Hike In September Relatively Low; December 'A Long-Way Off' - RBS

"The minutes from the July FOMC meeting were less hawkish than the market feared. As widely noted, the Committee was divided on the need for another interest rate hike. It is important to remember, however, that the decision to act will ultimately rest with Fed Chair Yellen. There will be no rate hike until Yellen believes a rate hike is warranted. Given that Yellen is among the most dovish on the Committee, we must assume that Yellen is among the faction who expressed a preference to delay action.

Thus, after reading the minutes, we remain comfortable with our view that the Fed Chair is in no hurry to hike and that the odds of a move in September are relatively low.

...In our view, the "several" and "some" participants noted above almost surely includes Yellen, who is among the most dovish of the Committee members. If we are right, then Yellen is sticking to her risk management policy approach and feels little urgency to raise rates. While the data of late have been reassuring, the hurdle for hiking -- i.e. a sustained move up in inflation and/or evidence that suggests the economy has enough momentum to withstand a downward shock to demand -- is pretty high and does not appear likely to be met by the September meeting. Maybe by December, but December is a long way off (and, in any case, we are skeptical)".

Copyright © 2016 RBS, eFXnews™

-

08:39

Japan's trade balance above expectations in July

The positive balance of Japan's foreign trade in July was Y513,5 billion, higher than the Y283,7 billion forecast. However, the trade balance in July was lower than the previous value of 693.1 billion.

Exports from Japan during the period from January to July fell by 14.0%, after declining by 7.4% from January to June. Economists had forecast a decline of 13.0%.

Imports to Japan in July, year on year, down by 24.7%, after declining by 18.8% in June.

Adjusted Trade Balance, published by the Customs Department of Japan totaled Y317,6 billion, well above the forecast of Y142,2bln. In June, the trade balance was Y335,0 billion.

-

08:29

Options levels on thursday, August 18, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1416 (3620)

$1.1388 (4768)

$1.1348 (3352)

Price at time of writing this review: $1.1316

Support levels (open interest**, contracts):

$1.1256 (1001)

$1.1216 (2292)

$1.1155 (2381)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 53469 contracts, with the maximum number of contracts with strike price $1,1250 (5049);

- Overall open interest on the PUT options with the expiration date September, 9 is 56913 contracts, with the maximum number of contracts with strike price $1,1000 (5799);

- The ratio of PUT/CALL was 1.06 versus 1.07 from the previous trading day according to data from August, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.3304 (2954)

$1.3206 (2108)

$1.3110 (1257)

Price at time of writing this review: $1.3063

Support levels (open interest**, contracts):

$1.2990 (2181)

$1.2893 (2067)

$1.2796 (2605)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32604 contracts, with the maximum number of contracts with strike price $1,3300 (2954);

- Overall open interest on the PUT options with the expiration date September, 9 is 26346 contracts, with the maximum number of contracts with strike price $1,2800 (2605);

- The ratio of PUT/CALL was 0.81 versus 0.81 from the previous trading day according to data from August, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:26

Advisor to the Prime Minister of Japan, Etsuro Honda: The only correct conclusion - the need for further easing of monetary policy

- In September, the probability of a decisive easing policy exceeds 50%

- If the Bank of Japan does not take measures in the next month, the Japanese have lost hope

- I do not think that the Prime Minister believes that the easing of monetary policy by the Bank of Japan has reached its limits

- Strengthening of the yen is clearly excessive, indicating a failure of the current policy.

- It is necessary to act more decisively against the yen, and it does not matter what the US officials say.

- Japan will never be able to defeat deflation if the Bank of Japan decides that policy easing is ineffective

- No need for a further reduction of negative interest rates on deposits

-

08:19

The US dollar fell after FOMC minutes disappoint again

Federal Reserve officials remain divided on whether to raise interest rates, the minutes of the most recent Federal Reserve meeting showed Wednesday.

Two officials pushed for a rate hike but others remained concerned about the near-term economic risks.

Although officials were relieved that the Brexit fears were unfounded, many officials said it was appropriate to wait for additional information before deciding another rate hike was warranted.

The information reviewed for the July 26-27 meeting indicated that labor market conditions generally improved in June and that growth in real gross domestic product (GDP) was moderate in the second quarter.

-

08:13

The unemployment rate in Australia was a seasonally adjusted 5.7 percent in July

The unemployment rate in Australia was a seasonally adjusted 5.7 percent in July, the Australian Bureau of Statistics said on Thursday.

That beat forecasts for 5.8 percent, which would have been unchanged from the June reading.

The Australian economy added 26,200 jobs in July, blowing past expectations for a gain of 10,000 jobs following the increase of 7,900 jobs in the previous month.

The participation rate came in at 64.9 percent - unchanged and in line with expectations - RTT.

-

03:30

Australia: Unemployment rate, July 5.7% (forecast 5.8%)

-

03:30

Australia: Changing the number of employed, July 26.2 (forecast 11)

-

01:51

Japan: Trade Balance Total, bln, July 513.5 (forecast 283.7)

-

00:29

Currencies. Daily history for Aug 17’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1287 +0,12%

GBP/USD $1,3040 -0,02%

USD/CHF Chf0,9621 +0,02%

USD/JPY Y100,20 -0,06%

EUR/JPY Y113,14 +0,10%

GBP/JPY Y130,67 -0,06%

AUD/USD $0,7657 -0,52%

NZD/USD $0,7253 -0,37%

USD/CAD C$1,2848 -0,06%

-

00:00

Schedule for today, Thursday, Aug 18’2016

(time / country / index / period / previous value / forecast)

01:30 Australia Unemployment rate July 5.8% 5.8%

01:30 Australia Changing the number of employed July 7.9 11

08:00 Eurozone Current account, unadjusted, bln June 15.4

08:30 United Kingdom Retail Sales (MoM) July -0.9% 0.1%

08:30 United Kingdom Retail Sales (YoY) July 4.3% 4.2%

09:00 Eurozone Construction Output, y/y June -0.8%

09:00 Eurozone Harmonized CPI July 0.2% -0.5%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) July 0.1% 0.2%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) July 0.9% 0.9%

12:30 Canada Foreign Securities Purchases June 14.73

12:30 U.S. Philadelphia Fed Manufacturing Survey August -2.9 2

12:30 U.S. Continuing Jobless Claims 2155 2140

12:30 U.S. Initial Jobless Claims 266 265

14:00 U.S. Leading Indicators July 0.3% 0.3%

20:00 U.S. FOMC Member Williams Speaks

22:45 New Zealand Visitor Arrivals July 10.9%

-