Notícias do Mercado

-

16:41

Foreign exchange market. American session: the Australian dollar rose against the U.S. dollar after the weaker-than-expected U.S. economic data

The U.S. dollar traded mixed against the most major currencies after the weaker-than-expected U.S. economic data. U.S. final manufacturing purchasing managers' index declined to 57.3 in June from 57.5 in April. Analysts had expected the index to remain unchanged.

ISM manufacturing PMI in the U.S. decreased to 55.3 in June from 55.4 in May, missing expectations for a rise to 55.6.

Construction spending in the U.S. climbed 0.1% in May, missing expectations for a 0.5% gain, after 0.8% rise in April. April's figure was revised up from a 0.2% increase.

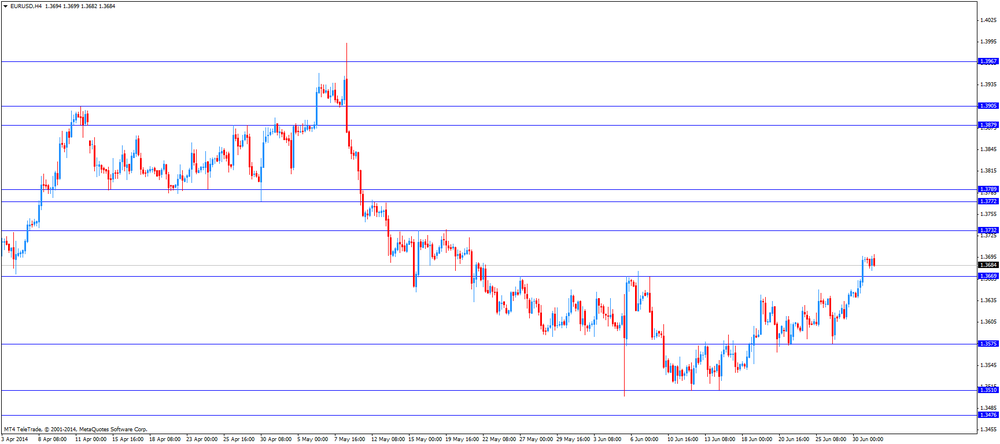

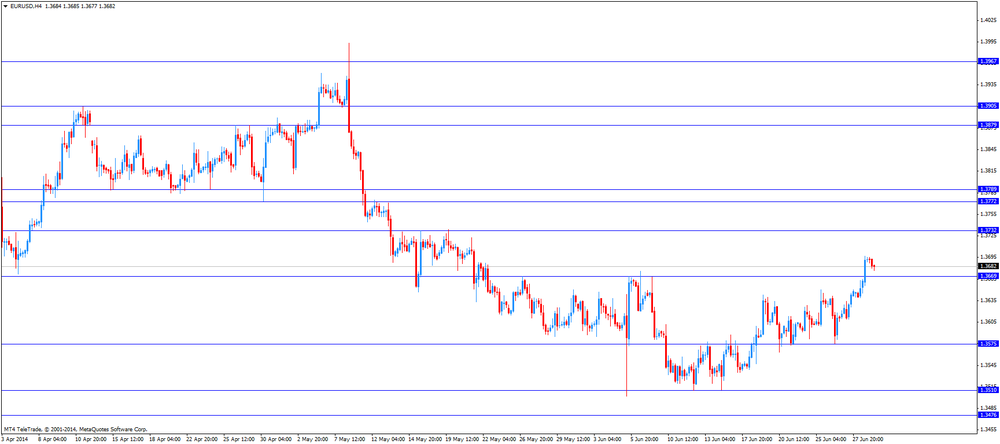

The euro traded slightly lower against the U.S. dollar after the weaker-than-expected U.S. economic data. Eurozone's unemployment rate remained unchanged at 11.6% in May. Analysts had expected an increase to 11.7%.

German unemployment rate remained unchanged at 6.7% in June, in line with expectations.

The German economy lost 9,000 jobs in June. Analysts had expected the economy to add 9,000 jobs.

German final manufacturing purchase managers' index declined to 52.0 in June from 52.3 in May, missing expectations for a rise to 52.4.

French final manufacturing purchase managers' index decreased to 48.2 in June from 49.6 in May, beating expectations for a drop to 47.8.

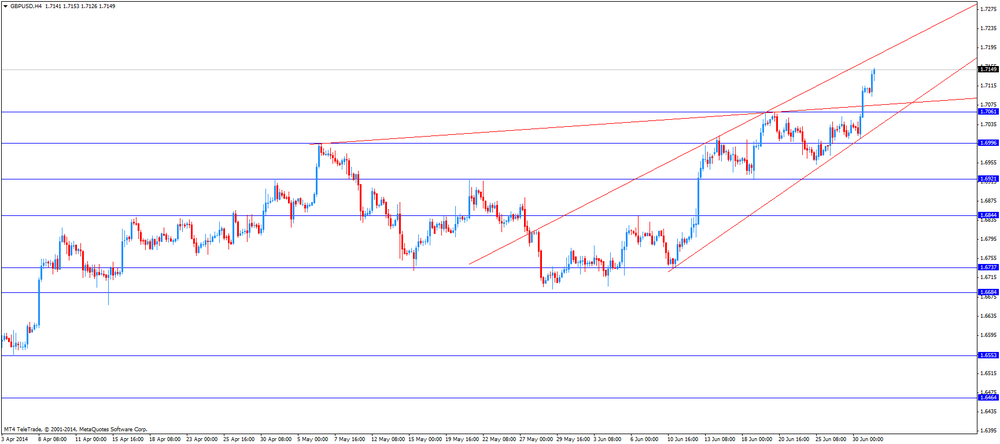

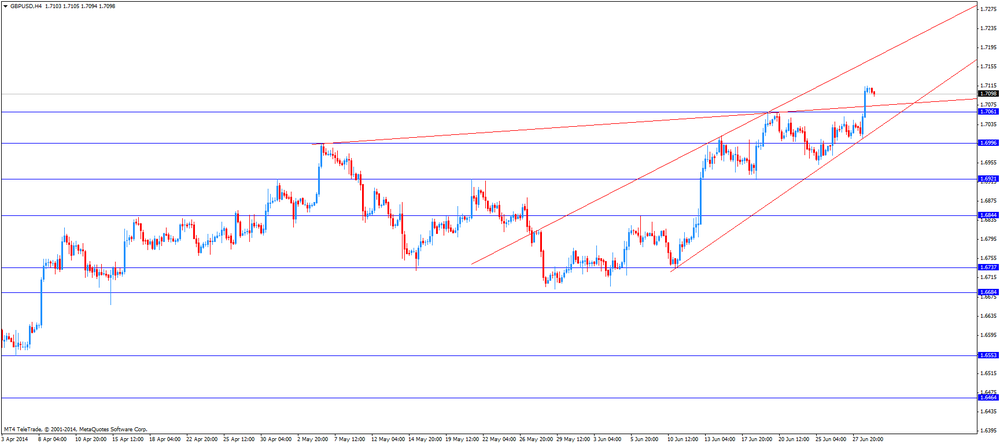

The British pound traded higher against the U.S. dollar after the weaker-than-expected U.S. economic data. The U.K. manufacturing purchase managers' index rose to 57.5 in June from 57.0 in May, beating forecasts of a decline to 56.7.

The Swiss franc traded mixed against the U.S. dollar after the weaker-than-expected U.S. economic data. The manufacturing purchase managers' index in Switzerland gained to 54.0 in June from 52.5 in May, beating expectations for a rise to 52.6.

The New Zealand dollar traded higher against the U.S dollar after the weaker-than-expected U.S. economic data and due to the strong manufacturing data from China. The Chinese manufacturing purchase managers' index increased to 51.0 in June from 50.8 in May, in line with expectations.

China's final HSBC manufacturing purchase managers' index declined to 50.7 in June from 50.8 in May. Analysts had forecasted the index to remain unchanged at 50.8.

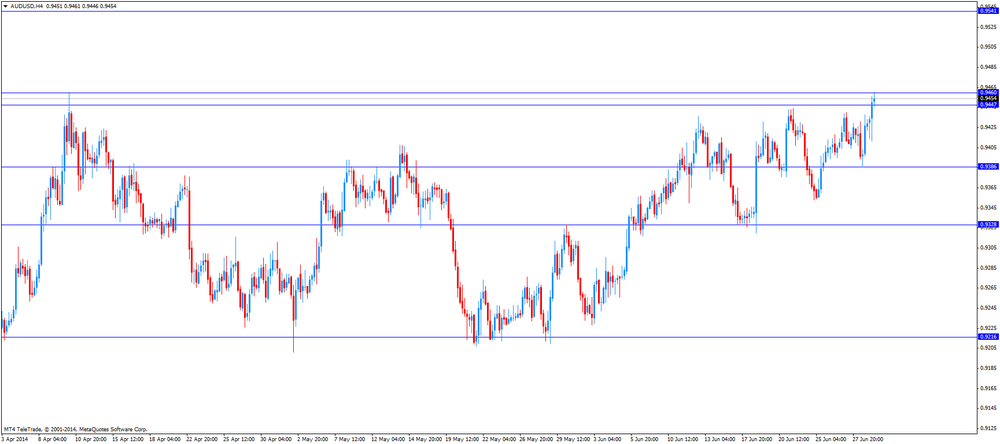

The Australian dollar rose against the U.S. dollar after the weaker-than-expected U.S. economic data. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at a record low 2.5%. The RBA Governor Glenn Stevens said that the Australian dollar "offering less assistance than it might" in lifting economic growth.

RBA commodity prices decreased 9.6% in June, after a 12.8 drop in May.

AIG manufacturing index for Australia declined to 48.9 in June from 49.2 in May.

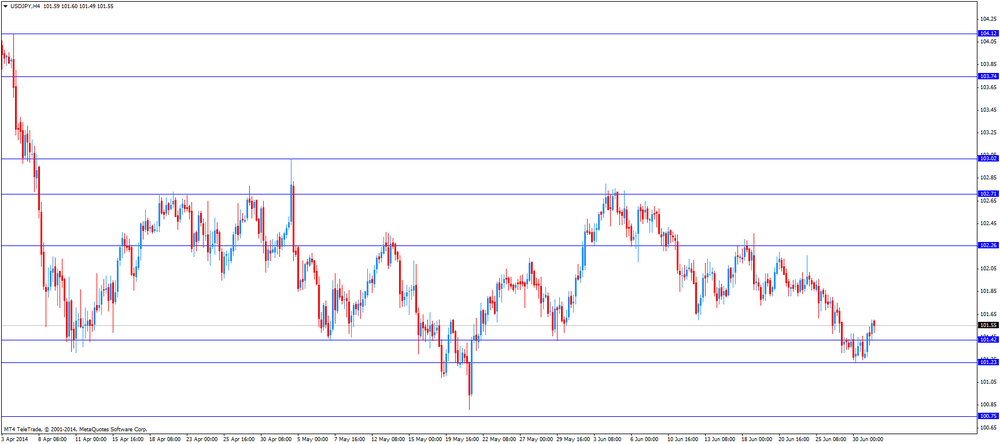

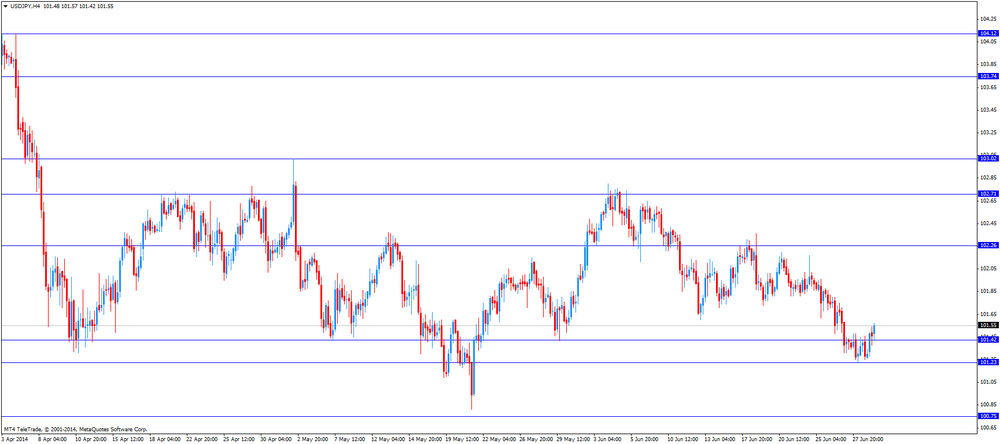

The Japanese yen traded mixed against the U.S. dollar after the weaker-than-expected U.S. economic data. Japan's Tankan manufacturing index was plus 12 in the second quarter, missing expectations for plus 16, after plus 17 the previous quarter. This was the first decline in six quarters.

Japan's Tankan non-manufacturing index was plus 19 in the second quarter, in line with expectations, after plus 24 the previous quarter.

Japan's average cash earnings climbed 0.8% in May, in line with expectations, after a 0.7% gain in April.

Japanese manufacturing purchase managers' index climbed to 51.5 in June from 51.1 in May.

-

15:50

Reserve Bank of Australia kept its interest rate unchanged at a record low 2.5%

The Reserve Bank of Australia (RBA) released its interest decision on Tuesday:

- The RBA kept its interest rate unchanged at a record low 2.5%. This decision was expected by market participants;

- The economic growth should be below trend over the year.

The RBA Governor Glenn Stevens said:

- The Australian dollar "offering less assistance than it might" in lifting economic growth;

- Commodity prices remain high, but some commodity prices that are important to Australia have declined;

- "There has been some improvement in indicators for the labour market in recent months, but it will probably be some time yet before unemployment declines consistently. Growth in wages has declined noticeably".

- The RBA kept its interest rate unchanged at a record low 2.5%. This decision was expected by market participants;

-

15:00

U.S.: Construction Spending, m/m, May +0.1% (forecast +0.5%)

-

15:00

U.S.: ISM Manufacturing, June 55.3 (forecast 55.6)

-

14:45

U.S.: Manufacturing PMI, June 57.3 (forecast 57.5)

-

14:30

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3610, $1.3620, $1.3625, $1.3640

USD/JPY Y101.50, Y102.50

EUR/JPY Y138.00, Y139.65

AUD/USD $0.9350, $0.9400, $0.9425, $0.9500

EUR/GBP stg0.7900, stg0.7990, stg0.8010, stg0.8020, stg0.8065, stg0.8075, stg0.8135

EUR/CHF Chf1.2200

-

13:29

Foreign exchange market. European session: the British pound increased against the U.S. dollar after the better-than-expected U.K. manufacturing purchase managers' index

Economic calendar (GMT0):

01:00 China Manufacturing PMI June 50.8 51.0 51.0

01:30 Japan Labor Cash Earnings, YoY May +0.7% +0.8% +0.8%

01:35 Japan Manufacturing PMI June 51.1 51.5

01:45 China HSBC Manufacturing PMI (Finally) June 50.8 50.8 50.7

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

06:30 Australia RBA Commodity prices, y/y June -12.8% -9.6%

07:30 Switzerland Manufacturing PMI June 52.5 52.6 54.0

07:48 France Manufacturing PMI (Finally) June 49.6 47.8 48.2

07:53 Germany Manufacturing PMI (Finally) June 52.3 52.4 52.0

07:55 Germany Unemployment Change June 24 -9 9

07:55 Germany Unemployment Rate s.a. June 6.7% 6.7% 6.7%

07:58 Eurozone Manufacturing PMI (Finally) June 52.2 51.9 51.8

08:30 United Kingdom Purchasing Manager Index Manufacturing June 57.0 56.7 57.5

09:00 Eurozone Unemployment Rate May 11.6% 11.7% 11.6%

12:00 Canada Bank holiday

12:00 U.S. Treasury Sec Lew Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. U.S. final manufacturing purchasing managers' index should remain unchanged at 57.5 in June.

ISM manufacturing PMI in the U.S. should climb to 55.6 in June from 55.4 in May.

The euro traded mixed against the U.S. dollar after mixed economic data from Eurozone. Eurozone's unemployment rate remained unchanged at 11.6% in May. Analysts had expected an increase to 11.7%.

German unemployment rate remained unchanged at 6.7% in June, in line with expectations.

The German economy lost 9,000 jobs in June. Analysts had expected the economy to add 9,000 jobs.

German final manufacturing purchase managers' index declined to 52.0 in June from 52.3 in May, missing expectations for a rise to 52.4.

French final manufacturing purchase managers' index decreased to 48.2 in June from 49.6 in May, beating expectations for a drop to 47.8.

The British pound increased against the U.S. dollar after the better-than-expected U.K. manufacturing purchase managers' index. The U.K. manufacturing purchase managers' index rose to 57.5 in June from 57.0 in May, beating forecasts of a decline to 56.7.

The Swiss franc traded mixed against the U.S. dollar after the better-than-expected manufacturing purchase managers' index from Switzerland. The manufacturing purchase managers' index in Switzerland gained to 54.0 in June from 52.5 in May, beating expectations for a rise to 52.6.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair was up to $1.7153

USD/JPY: the currency pair increased to Y101.60

The most important news that are expected (GMT0):

13:45 U.S. Manufacturing PMI (Finally) June 57.5 57.5

14:00 U.S. Construction Spending, m/m May +0.2% +0.5%

14:00 U.S. ISM Manufacturing June 55.4 55.6

23:50 Japan Monetary Base, y/y June +45.6% +48.3%

-

13:01

Orders

EUR/USD

Offers $1.3750, $1.3695/700

Bids $1.3576-74

GBP/USD

Offers $1.7200, $1.7170/75, $1.7150

Bids $1.7100/090, $1.7070/60, $1.7035/30, $1.7000

AUD/USD

Offers $0.9550, $0.9500

Bids $0.9400, $0.9380, $0.9350, $0.9320

EUR/JPY

Offers Y140.00, Y139.50, Y139.20

Bids Y138.50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y102.50, Y102.00, Y101.80

Bids Y101.20, Y101.10/00, Y100.80, Y100.50

EUR/GBP

Offers

Bids stg0.7985-80, stg0.7950, stg0.7930-20, stg0.7900

-

10:29

Option expiries for today's 1400GMT cut

EUR/USD $1.3500, $1.3610, $1.3620, $1.3625, $1.3640USD/JPY Y101.50, Y102.50

EUR/JPY Y138.00, Y139.65

AUD/USD $0.9350, $0.9400, $0.9425, $0.9500

EUR/GBP stg0.7900, stg0.7990, stg0.8010, stg0.8020, stg0.8065, stg0.8075, stg0.8135

EUR/CHF Chf1.2200

-

10:17

Foreign exchange market. Asian session: the Australian dollar increased against the U.S. dollar after the Reserve Bank of Australia’s interest rate decision and the strong manufacturing data from China

Economic calendar (GMT0):

01:00 China Manufacturing PMI June 50.8 51.0 51.0

01:30 Japan Labor Cash Earnings, YoY May +0.7% +0.8% +0.8%

01:35 Japan Manufacturing PMI June 51.1 51.5

01:45 China HSBC Manufacturing PMI (Finally) June 50.8 50.8 50.7

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

06:30 Australia RBA Commodity prices, y/y June -12.8% -9.6%

07:30 Switzerland Manufacturing PMI June 52.5 52.6 54.0

07:48 France Manufacturing PMI (Finally) June 49.6 47.8 48.2

07:53 Germany Manufacturing PMI (Finally) June 52.3 52.4 52.0

07:55 Germany Unemployment Change June 24 -9 9

07:55 Germany Unemployment Rate s.a. June 6.7% 6.7% 6.7%

07:58 Eurozone Manufacturing PMI (Finally) June 52.2 51.9 51.8

08:30 United Kingdom Purchasing Manager Index Manufacturing June 57.0 56.7 57.5

09:00 Eurozone Unemployment Rate May 11.6% 11.7% 11.6%

The U.S. dollar traded mixed against the most major currencies. The U.S. currency remained under pressure after yesterday's release of weaker-than-expected Chicago purchasing managers' index. Chicago purchasing managers' index dropped to 62.6 in June from 65.5 in May, missing expectations for a decline to 63.2.

The New Zealand dollar traded slightly higher against the U.S dollar due to the strong manufacturing data from China. The Chinese manufacturing purchase managers' index increased to 51.0 in June from 50.8 in May, in line with expectations.

China's final HSBC manufacturing purchase managers' index declined to 50.7 in June from 50.8 in May. Analysts had forecasted the index to remain unchanged at 50.8.

The Australian dollar increased against the U.S. dollar after the Reserve Bank of Australia's interest rate decision and the strong manufacturing data from China. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at a record low 2.5%. The RBA Governor Glenn Stevens said that the Australian dollar "offering less assistance than it might" in lifting economic growth.

RBA commodity prices decreased 9.6% in June, after a 12.8 drop in May.

AIG manufacturing index for Australia declined to 48.9 in June from 49.2 in May.

The Japanese yen traded mixed against the U.S. dollar after the weaker-than-expected data from Japan and the strong manufacturing data from China. Japan's Tankan manufacturing index was plus 12 in the second quarter, missing expectations for plus 16, after plus 17 the previous quarter. This was the first decline in six quarters.

Japan's Tankan non-manufacturing index was plus 19 in the second quarter, in line with expectations, after plus 24 the previous quarter.

Japan's average cash earnings climbed 0.8% in May, in line with expectations, after a 0.7% gain in April.

Japanese manufacturing purchase managers' index climbed to 51.5 in June from 51.1 in May.

EUR/USD: the currency pair declined to $1.3685

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

AUD/USD: the currency pair increased to $0.9456

The most important news that are expected (GMT0):

12:00 Canada Bank holiday

12:00 U.S. Treasury Sec Lew Speaks

13:45 U.S. Manufacturing PMI (Finally) June 57.5 57.5

14:00 U.S. Construction Spending, m/m May +0.2% +0.5%

14:00 U.S. ISM Manufacturing June 55.4 55.6

23:50 Japan Monetary Base, y/y June +45.6% +48.3%

-

10:00

Eurozone: Unemployment Rate , May 11.6% (forecast 11.7%)

-

09:31

United Kingdom: Purchasing Manager Index Manufacturing , June 57.5 (forecast 56.7)

-

09:00

Eurozone: Manufacturing PMI, June 51.8 (forecast 51.9)

-

08:55

Germany: Unemployment Rate s.a. , June 6.7% (forecast 6.7%)

-

08:55

Germany: Unemployment Change, June 9 (forecast -9)

-

08:55

Germany: Manufacturing PMI, June 52.0 (forecast 52.4)

-

08:51

France: Manufacturing PMI, June 48.2 (forecast 47.8)

-

07:31

Australia: RBA Commodity prices, y/y, June -9.6%

-

06:30

Options levels on tuesday, July 1, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3765 (2912)

$1.3735 (6263)

$1.3706 (3657)

Price at time of writing this review: $ 1.3683

Support levels (open interest**, contracts):

$1.3663 (1599)

$1.3632 (1613)

$1.3592 (4120)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 33220 contracts, with the maximum number of contracts with strike price $1,3700 (6263);

- Overall open interest on the PUT options with the expiration date July, 3 is 42445 contracts, with the maximum number of contracts with strike price $1,3500 (5604);

- The ratio of PUT/CALL was 1.28 versus 1.24 from the previous trading day according to data from June, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.7400 (1019)

$1.7300 (428)

$1.7201 (2123)

Price at time of writing this review: $1.7103

Support levels (open interest**, contracts):

$1.6999 (1859)

$1.6900 (2295)

$1.6800 (1721)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 27236 contracts, with the maximum number of contracts with strike price $1,7100 (4437);

- Overall open interest on the PUT options with the expiration date July, 3 is 27509 contracts, with the maximum number of contracts with strike price $1,6700 (2413);

- The ratio of PUT/CALL was 1.01 versus 1.09 from the previous trading day according to data from June, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:19

Currencies. Daily history for June 30'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3694 +0,33%

GBP/USD $1,7111 +0,43%

USD/CHF Chf0,8866 -0,46%

USD/JPY Y101,31 -0,10%

EUR/JPY Y138,72 -0,05%

GBP/JPY Y173,31 +0,32%

AUD/USD $0,9430 +0,04%

NZD/USD $0,8761 -0,18%

USD/CAD C$1,0667 +0,03%

-

05:10

Schedule for today, Tuesday, July 1’2014:

(time / country / index / period / previous value / forecast)

01:00 China Manufacturing PMI June 50.8 51.0 51.0

01:30 Japan Labor Cash Earnings, YoY May +0.7% +0.8% +0.8%

01:35 Japan Manufacturing PMI June 51.1 51.5

01:45 China HSBC Manufacturing PMI (Finally) June 50.8 50.8 50.7

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

04:30 Australia RBA Rate Statement

06:30 Australia RBA Commodity prices, y/y June -12.8%

07:30 Switzerland Manufacturing PMI June 52.5 52.6

07:48 France Manufacturing PMI (Finally) June 49.6 47.8

07:53 Germany Manufacturing PMI (Finally) June 52.3 52.4

07:55 Germany Unemployment Change June 24 -9

07:55 Germany Unemployment Rate s.a. June 6.7% 6.7%

07:58 Eurozone Manufacturing PMI (Finally) June 52.2 51.9

08:30 United Kingdom Purchasing Manager Index Manufacturing June 57.0 56.7

09:00 Eurozone Unemployment Rate May 11.7% 11.7%

12:00 Canada Bank holiday

12:00 U.S. Treasury Sec Lew Speaks

13:45 U.S. Manufacturing PMI (Finally) June 57.5 57.5

14:00 U.S. Construction Spending, m/m May +0.2% +0.5%

14:00 U.S. ISM Manufacturing June 55.4 55.6

20:30 U.S. API Crude Oil Inventories June +4.0

23:50 Japan Monetary Base, y/y June +45.6% +48.3%

-