Notícias do Mercado

-

17:30

Fed Chair Janet Yellen sees “pockets of increased risk-taking across the financial system”

The Federal Reserve Chair Janet Yellen was speaking at an inaugural central banking lecture at the IMF in Washington:

- There is no need to change monetary policy to address financial stability concerns;

- She sees "pockets of increased risk-taking across the financial system";

- "Efforts to promote financial stability through adjustments in interest rates would increase the volatility of inflation and employment";

- The monetary policy should focus on jobs and inflation;

- "Monetary policy faces significant limitations as a tool to promote financial stability";

- The crisis would not have been prevented or significantly mitigated by substantially tighter monetary policy in the mid-2000s.

The transcript of the whole speech by Janet Yellen can be found here.

- There is no need to change monetary policy to address financial stability concerns;

-

16:30

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies after the ADP report

The U.S. dollar traded higher against the most major currencies after the ADP report. The U.S. economy added 281,000 jobs in June, after an increase of 179,000 jobs in May. That was the highest increase since November 2012. It is a sign that the U.S. labour market is strengthening.

Analysts had expected the U.S. economy to add 206,000 jobs.

Factory orders in the U.S. declined 0.5% in May, missing expectations for a 0.1% fall, after a 0.7% gain in April.

The euro traded lower against the U.S. dollar due to the better-than-expected U.S. jobs report. Eurozone's gross domestic product increased 0.2% in the first quarter, in line with expectations, after a 0.2% gain the previous month. On a yearly basis, Eurozone's gross domestic product climbed 0.9% in the first quarter, in line with expectations, after a 0.9% rise the previous month.

The producer price index in the Eurozone declined 0.1% in May, missing expectations for a 0.1% gain, after a 0.1% decrease in April. On a yearly basis, Eurozone's producer price index fell 1.0% in May, in line with expectations, after a 1.2% decline in April.

The number of jobless claims in Spain decreased by 122,684 from May.

The British pound traded higher against the U.S. dollar due to the better-than-expected U.K. construction purchase managers' index. The U.K. construction purchasing managers' index surged to 62.6 in June from 60.0 in May. Analysts had expected the index to fall to 59.7.

Nationwide house price index for the U.K. increased 1.0% in June, exceeding expectations for a 0.7% rise, after a 0.7% gain in May.

On a yearly basis, Nationwide house price index for the U.K. climbed 11.8% in June, after 11.1% rise in May.

The New Zealand dollar declined against the U.S dollar after milk powder prices decreased at an auction, but later recovered a part of its losses. No economic reports were released in New Zealand.

The Australian dollar declined against the U.S. dollar due to the weaker-than-expected Australian trade balance and the better-than-expected U.S. jobs report. Australia's trade deficit increased to A$1.91 billion in May, from A$0.78 billion in April. April's figure was revised down from a deficit of A$0.12 billion. Analysts had expected the trade deficit to sink to A$0.21 billion.

The Japanese yen declined against the U.S. dollar due to the better-than-expected U.S. jobs report.

The monetary base in Japan climbed 42.6% in June, missing expectations for a 48.3% increase, after a 45.6% rise in May.

-

15:30

U.S.: Crude Oil Inventories, June -3.2

-

15:00

U.S.: Factory Orders , May -0.5% (forecast -0.1%)

-

14:45

Option expiries for today's 1400GMT cut

USD/JPY 101.25, 102.50

USD/CAD 1.0630, 1.0675, 1.0770

EUR/USD 1.3600, 1.3610, 1.3640, 1.3650, 1.3675, 1.3700

AUD/USD 0.9350, 0.9450

EUR/GBP 0.7950, 0.7985

EUR/CHF 1.2200

-

14:17

U.S. economy created 281,000 jobs in June

The ADP Research Institute released its employment report today. The U.S. economy added 281,000 jobs in June, after an increase of 179,000 jobs in May. That was the highest increase since November 2012. It is a sign that the U.S. labour market is strengthening.

Analysts had expected the U.S. economy to add 206,000 jobs.

Manufacturers, builders and other goods-producing industries added 51,000 jobs. Construction payrolls rose by 36,000 positions. The factory sector added 12,000 jobs.

Service-sector payrolls climbed by 230,000 jobs.

The U.S. Bureau of Labor Statistics will reveal its labour market data on Thursday. Analysts expect that the U.S. economy will add 211,000 jobs in June, after 217,000 jobs in May.

The unemployment rate in the U.S. should remain unchanged at 6.3% in June.

-

13:15

U.S.: ADP Employment Report, June 281 (forecast 206)

-

13:00

Foreign exchange market. European session: the British pound climbed against the U.S. dollar due to the better-than-expected U.K. construction purchase managers' index

Economic calendar (GMT0):

01:30 Australia Trade Balance May -0.12 -0.21 -1.91

06:00 United Kingdom Nationwide house price index June +0.7% +0.7% +1.0%

06:00 United Kingdom Nationwide house price index, y/y June +11.1% +11.8%

08:30 United Kingdom PMI Construction June 60.0 59.7 62.6

09:00 Eurozone GDP (QoQ) (Finally) Quarter I +0.2% +0.2% +0.2%

09:00 Eurozone GDP (YoY) (Finally) Quarter I +0.9% +0.9% +0.9%

09:00 Eurozone Producer Price Index, MoM May -0.1% +0.1% -0.1%

09:00 Eurozone Producer Price Index (YoY) May -1.2% -1.0% -1.0%

11:15 Australia RBA Assist Gov Debelle Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. jobs data and factory orders. The U.S. economy should add 206,000 jobs according to the ADP employment report.

Factory orders in the U.S. should decline 0.1% in May, after a 0.7% gain in April.

The euro declined against the U.S. dollar after the weaker-than-expected economic data from Eurozone. Eurozone's gross domestic product increased 0.2% in the first quarter, in line with expectations, after a 0.2% gain the previous month. On a yearly basis, Eurozone's gross domestic product climbed 0.9% in the first quarter, in line with expectations, after a 0.9% rise the previous month.

The producer price index in the Eurozone declined 0.1% in May, missing expectations for a 0.1% gain, after a 0.1% decrease in April. On a yearly basis, Eurozone's producer price index fell 1.0% in May, in line with expectations, after a 1.2% decline in April.

The British pound climbed against the U.S. dollar due to the better-than-expected U.K. construction purchase managers' index. The U.K. construction purchasing managers' index surged to 62.6 in June from 60.0 in May. Analysts had expected the index to fall to 59.7.

Nationwide house price index for the U.K. increased 1.0% in June, exceeding expectations for a 0.7% rise, after a 0.7% gain in May.

On a yearly basis, Nationwide house price index for the U.K. climbed 11.8% in June, after 11.1% rise in May.

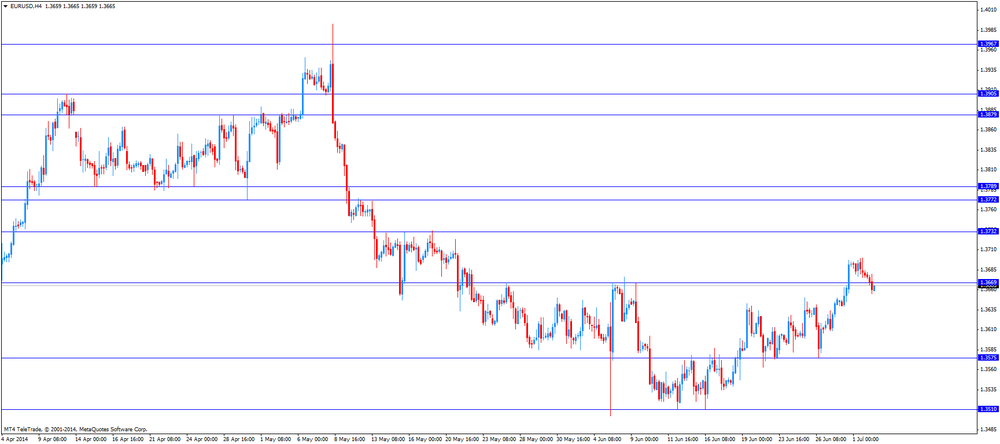

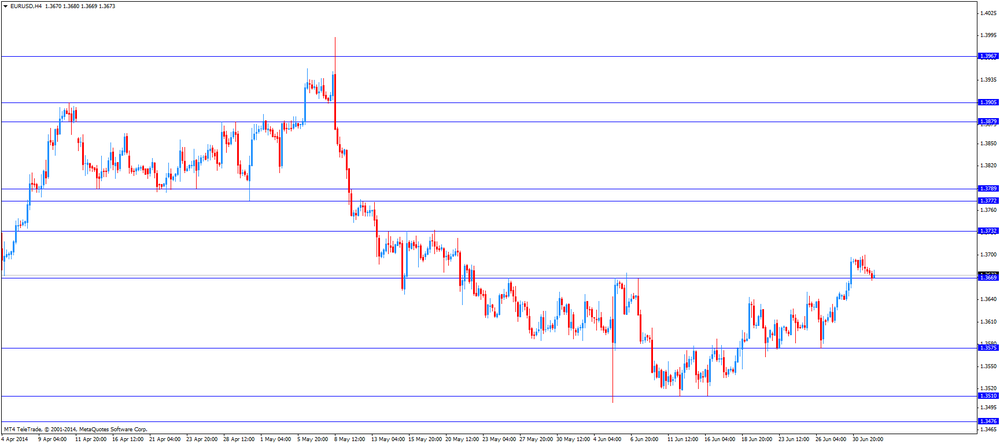

EUR/USD: the currency pair declined to $1.3655

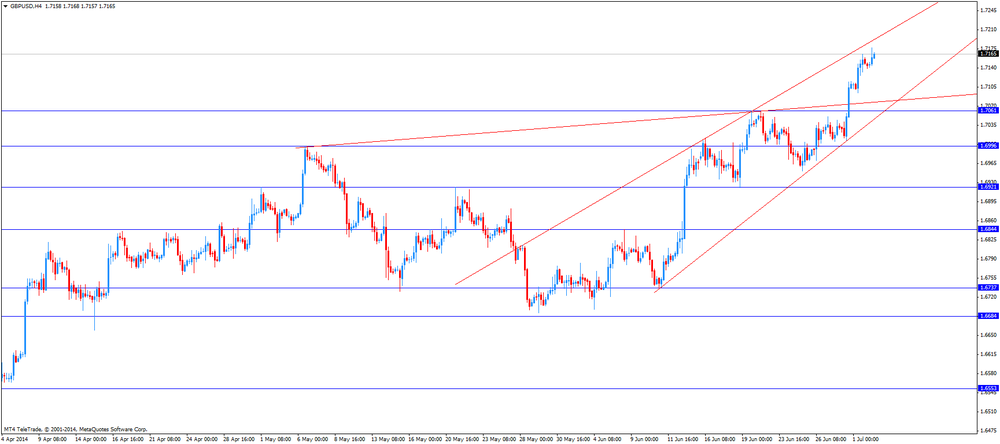

GBP/USD: the currency pair climbed to $1.7177

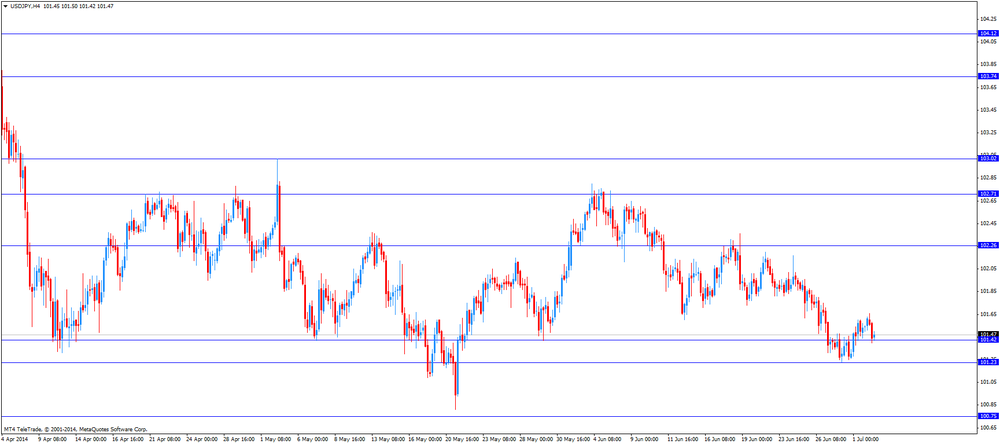

USD/JPY: the currency pair decreased to Y101.40

The most important news that are expected (GMT0):

12:15 U.S. ADP Employment Report June 179 206

14:00 U.S. Factory Orders May +0.7% -0.1%

15:00 U.S. Fed Chairman Janet Yellen Speaks

-

12:45

Orders

EUR/USD

Offers $1.3700-20

Bids $1.3656-50, $1.3576-74, $1.3565

GBP/USD

Offers $1.7250, $1.7230, $1.7200

Bids $1.7095/90

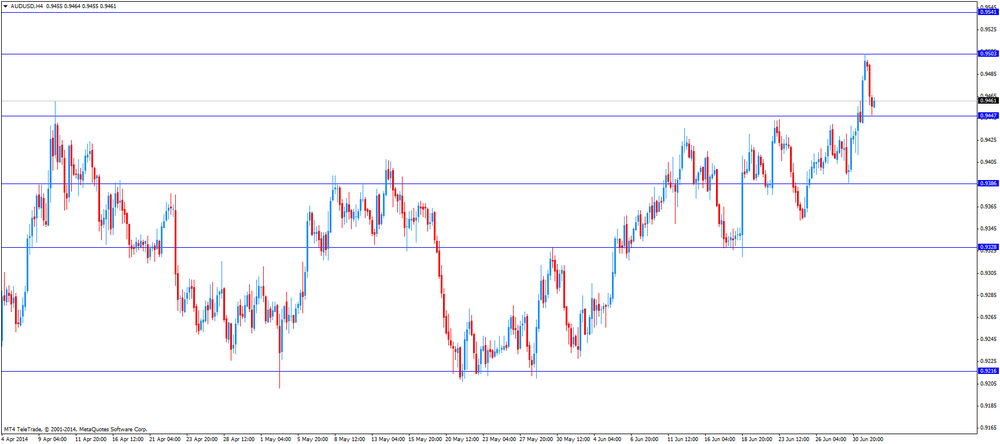

AUD/USD

Offers $0.9650, $0.9600, $0.9550, $0.9505

Bids $0.9450, $0.9420, $0.9400, $0.9380, $0.9350

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y138.85/90

Bids Y138.50, Y138.20, Y138.00, Y137.50

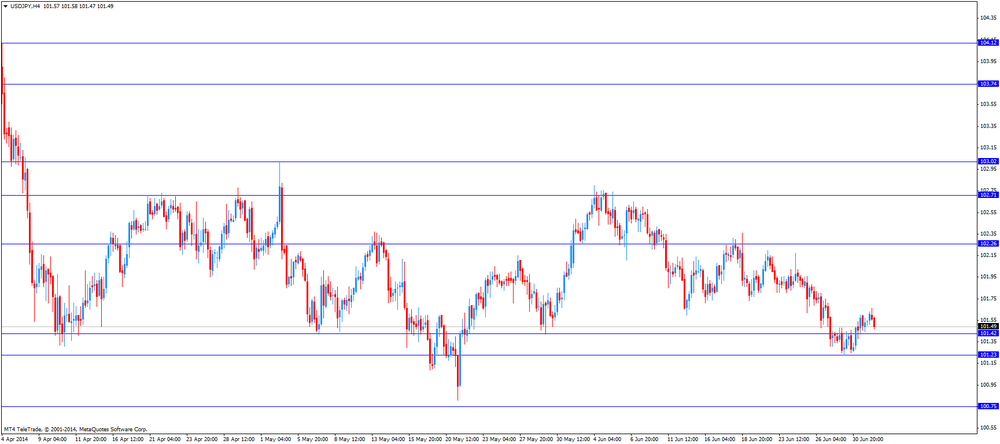

USD/JPY

Offers Y102.50, Y102.00, Y101.80, Y101.65/70

Bids Y101.40/30, Y101.20, Y101.10/00, Y100.50

EUR/GBP

Offers stg0.8000

Bids stg0.7950, stg0.7930-20, stg0.7900

-

10:29

Option expiries for today's 1400GMT cut

USD/JPY 101.25, 102.50

USD/CAD 1.0630, 1.0675, 1.0770

EUR/USD 1.3600, 1.3610, 1.3640, 1.3650, 1.3675, 1.3700

AUD/USD 0.9350, 0.9450

EUR/GBP 0.7950, 0.7985

EUR/CHF 1.2200

-

10:03

Eurozone: GDP (YoY), Quarter I +0.9% (forecast +0.9%)

-

10:02

Eurozone: GDP (QoQ), Quarter I +0.2% (forecast +0.2%)

-

10:00

Eurozone: Producer Price Index, MoM , May -0.1% (forecast +0.1%)

-

10:00

Eurozone: Producer Price Index (YoY), May -1.0% (forecast -1.0%)

-

09:58

Foreign exchange market. Asian session: the Australian dollar dropped against the U.S. dollar due to the weaker-than-expected Australian trade balance

Economic calendar (GMT0):

01:30 Australia Trade Balance May -0.12 -0.21 -1.91

06:00 United Kingdom Nationwide house price index June +0.7% +0.7% +1.0%

06:00 United Kingdom Nationwide house price index, y/y June +11.1% +11.8%

08:30 United Kingdom PMI Construction June 60.0 59.7 62.6

The U.S. dollar traded higher against the most major currencies. The U.S. currency remained under pressure after yesterday's release of weaker-than-expected economic data. U.S. final manufacturing purchasing managers' index declined to 57.3 in June from 57.5 in April. Analysts had expected the index to remain unchanged.

ISM manufacturing PMI in the U.S. decreased to 55.3 in June from 55.4 in May, missing expectations for a rise to 55.6.

The New Zealand dollar declined against the U.S dollar after milk powder prices decreased at an auction. No economic reports were released in New Zealand.

The Australian dollar dropped against the U.S. dollar due to the weaker-than-expected Australian trade balance. Australia's trade deficit increased to A$1.91 billion in May, from A$0.78 billion in April. April's figure was revised down from a deficit of A$0.12 billion. Analysts had expected the trade deficit to sink to A$0.21 billion.

The Japanese yen traded mixed against the U.S. dollar due to the declining demand for safe-haven currency.

The monetary base in Japan climbed 42.6% in June, missing expectations for a 48.3% increase, after a 45.6% rise in May.

EUR/USD: the currency pair declined to $1.3670

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to Y101.65

AUD/USD: the currency pair decreased to $0.9448

The most important news that are expected (GMT0):

09:00 Eurozone GDP (QoQ) (Finally) Quarter I +0.2% +0.2%

09:00 Eurozone GDP (YoY) (Finally) Quarter I +0.9% +0.9%

09:00 Eurozone Producer Price Index, MoM May -0.1% +0.1%

09:00 Eurozone Producer Price Index (YoY) May -1.2% -1.0%

11:15 Australia RBA Assist Gov Debelle Speaks

12:15 U.S. ADP Employment Report June 179 206

14:00 U.S. Factory Orders May +0.7% -0.1%

15:00 U.S. Fed Chairman Janet Yellen Speaks

-

09:30

United Kingdom: PMI Construction, June 62.6 (forecast 59.7)

-

07:00

United Kingdom: Nationwide house price index , June +1.0% (forecast +0.7%)

-

07:00

United Kingdom: Nationwide house price index, y/y, June +11.8%

-

06:30

Options levels on tuesday, July 2, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3758 (3038)

$1.3724 (5863)

$1.3691 (3640)

Price at time of writing this review: $ 1.3671

Support levels (open interest**, contracts):

$1.3659 (1591)

$1.3630 (1736)

$1.3592 (3998)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 32914 contracts, with the maximum number of contracts with strike price $1,3700 (5863);

- Overall open interest on the PUT options with the expiration date July, 3 is 42467 contracts, with the maximum number of contracts with strike price $1,3500 (5628);

- The ratio of PUT/CALL was 1.29 versus 1.28 from the previous trading day according to data from July, 1

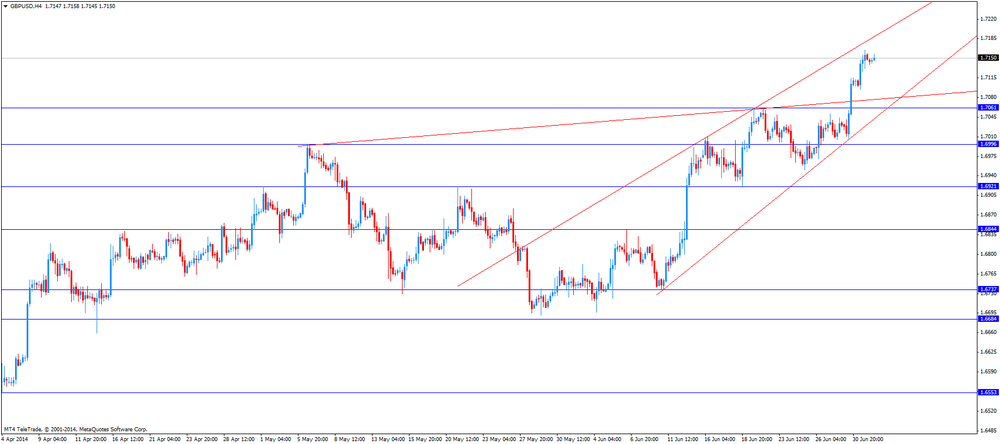

GBP/USD

Resistance levels (open interest**, contracts)

$1.7400 (1019)

$1.7300 (433)

$1.7201 (2201)

Price at time of writing this review: $1.7145

Support levels (open interest**, contracts):

$1.7098 (590)

$1.7000 (2066)

$1.6900 (2269)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 29602 contracts, with the maximum number of contracts with strike price $1,7100 (6267);

- Overall open interest on the PUT options with the expiration date July, 3 is 28561 contracts, with the maximum number of contracts with strike price $1,6700 (2413);

- The ratio of PUT/CALL was 0.96 versus 1.01 from the previous trading day according to data from Jule, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:20

Currencies. Daily history for Jule 1'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3678 -0,10%

GBP/USD $1,7148 +0,22%

USD/CHF Chf0,8873 +0,08%

USD/JPY Y101,54 +0,23%

EUR/JPY Y138,90 +0,13%

GBP/JPY Y174,12 +0,47%

AUD/USD $0,9492 +0,65%

NZD/USD $0,8769 +0,09%

USD/CAD C$1,0631 -0,34%

-

05:01

Schedule for today, Wednesday, July 2’2014:

(time / country / index / period / previous value / forecast)

01:30 Australia Trade Balance May -0.12 -0.21

06:00 United Kingdom Nationwide house price index June +0.7% +0.7%

06:00 United Kingdom Nationwide house price index, y/y June +11.1%

08:30 United Kingdom PMI Construction June 60.0 59.7

09:00 Eurozone GDP (QoQ) Quarter I +0.2% +0.2%

09:00 Eurozone GDP (YoY) Quarter I +0.9% +0.9%

09:00 Eurozone Producer Price Index, MoM May -0.1% +0.1%

09:00 Eurozone Producer Price Index (YoY) May -1.2% -1.0%

11:15 Australia RBA Assist Gov Debelle Speaks

12:15 U.S. ADP Employment Report June 179 206

14:00 U.S. Factory Orders May +0.7% -0.1%

14:30 U.S. Crude Oil Inventories June +1.7

15:00 U.S. Fed Chairman Janet Yellen Speaks

23:30 Australia AIG Services Index June 49.9

-