Notícias do Mercado

-

17:15

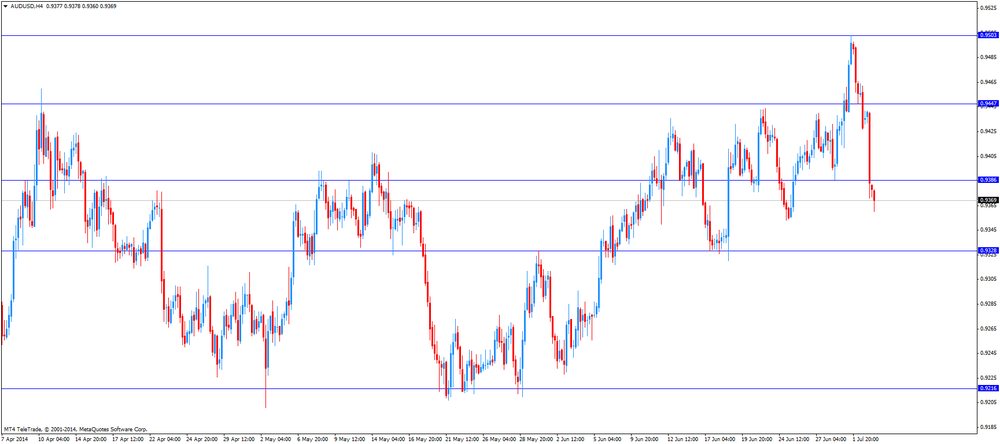

RBA Governor Glenn Stevens: a significant fall in the Australian dollar is possible

The Reserve Bank of Australia Governor Glenn Stevens said at the Australian Conference of Economists on Thursday:

- The Australian dollar remains high by historical standards;

- Investors are underestimating the probability of a significant fall in the Australian dollar at some point;

- A profitable "carry trade" is pushing the value of the Australian dollar up.

- The Australian dollar remains high by historical standards;

-

16:47

Foreign exchange market. American session: the U.S. dollar rose against the most major currencies after the strong U.S. labour market data

The U.S. dollar rose against the most major currencies after the strong U.S. labour market data. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May. May's figure was revised up from a rise of 217,000 positions.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008. Analysts had expected the unemployment rate to remain unchanged at 6.3%.

These figures are signs of the strength of the U.S. labour market. Despite of the U.S. economy's contraction in first quarter, the Federal Reserve may hike its interest rate sooner as expected.

The ISM non-manufacturing purchasing managers' index for the U.S. declined to 56.0 in June from 56.3 in May, missing expectations for a decrease to 56.2.

The U.S. trade deficit shrank to $44.4 billion in May from a $47.0 billion in April, beating forecasts of a decline to $45.1 billion. April's figure was revised down from $47.2 billion.

The number of initial jobless claims in the U.S. rose by 2,000 to a seasonally adjusted 315,000 in the week ended June 28.

The euro dropped against the U.S. dollar after the European Central Bank's interest rate decision and U.S. labour market data. The ECB kept its interest rate unchanged at 0.15%. The European Central Bank President Mario Draghi said the ECB will keep interest rate at the present levels for an extended period of time. He added "the Governing Council is unanimous in its commitment to also using unconventional instruments" if required, to address risks of a longer period of low inflation.

Mr. Draghi also said the ECB will change the frequency of its monetary policy meetings to a six-week cycle from January 2015 and the ECB will start publishing meeting minutes from January 2015.

Retail sales in the Eurozone were flat in May, missing expectations for a 0.2% gain, after a 0.2% decline in April. April's figure was revised down from a 0.4% rise.

On a yearly basis, retail sales in the Eurozone increased 0.7% in May, missing expectations for a 1.2% rise, after a 1.8% gain in April. April's figure was revised down from a 2.4% increase.

Eurozone's services purchasing managers' index decreased to 52.8 in June from 53.2 in May, in line with expectations.

German final services purchasing managers' index declined to 54.6 in June from 56.0 in May, missing expectations for a drop to 54.8.

French final services purchasing managers' index fell to 48.2 in June from 49.1 in May, in line with expectations.

Spanish services purchasing managers' index decreased to 54.8 in June from 55.7 in May, missing expectations for a rise to 55.8.

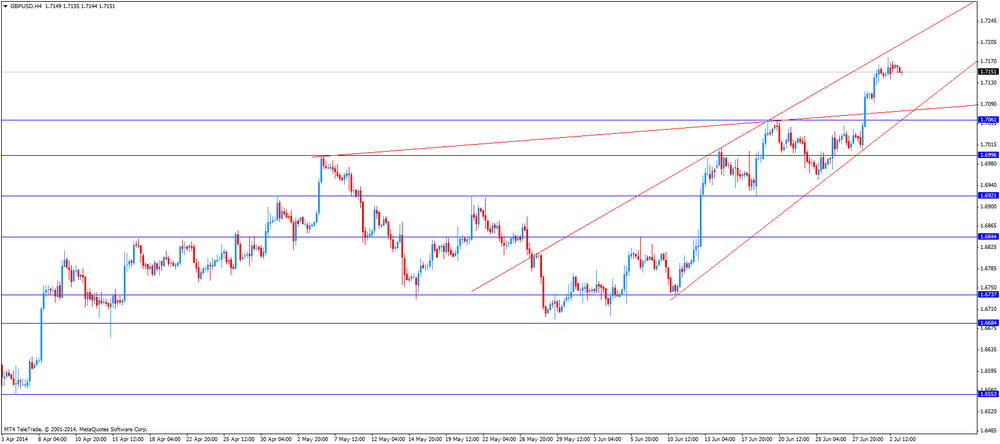

The British pound traded slightly lower against the U.S. dollar after the weaker-than-expected U.K. services purchase managers' index. The U.K. services purchasing managers' index dropped to 57.7 in June from 58.6 in May. Analysts had expected the index to decline to 58.1.

The British currency remained supported by speculations that the Bank of England will hike its interest rate sooner that expected.

The Canadian dollar traded against the U.S. dollar after the Canadian trade balance and U.S. labour market data. The Canadian trade balance deficit narrowed to C$0.152 billion in May from a deficit of C$0.961 billion in April, beating expectations for a C$0.30 billion deficit. April's figure was revised down from a deficit of C$0.64 billion.

The New Zealand dollar traded lower against the U.S dollar due to the strong U.S. labour market data. No economic reports were released in New Zealand.

The Australian dollar declined against the U.S. dollar after mixed Australian economic data, and comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens and due to the strong U.S. labour market data. The RBA Governor said that the Australian dollar remains high by historical standards and investors are underestimating the probability of a significant fall in the Australian dollar at some point.

Retail sales in Australia decreased 0.5% in May, missing expectations for a 0.3% gain, after a 0.1% decline in April. April's figure was revised down from a 0.2% rise.

Building permits in Australia increased 9.9% in May, exceeding expectations for a 3.5% gain, after a 5.8% slip in April. April's figure was revised down from a 5.6% decrease.

AIG services index for Australia declined to 47.6 in June from 49.9 in May.

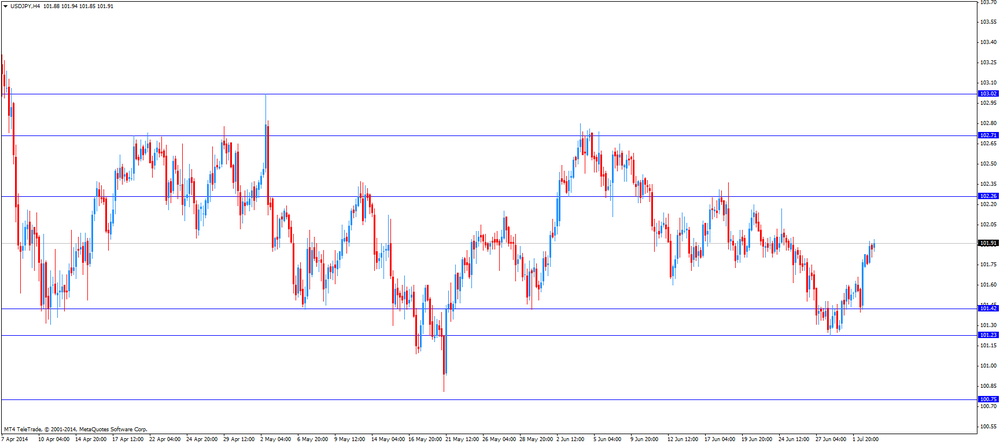

The Japanese yen traded lower against the U.S. dollar due to the strong U.S. labour market data. No economic reports were released in Japan.

-

15:45

European Central Bank President Mario Draghi: the ECB will keep interest rate at the present levels for an extended period of time

The European Central Bank President Mario Draghi said at the press conference today:

- The ECB will keep interest rate at the present levels for an extended period of time;

- "The Governing Council is unanimous in its commitment to also using unconventional instruments" if required, to address risks of a longer period of low inflation;

- Geopolitical risks, developments in emerging market economies and global financial markets may have the potential to affect economy in the Eurozone negatively;

- The exchange rate of the euro is not a policy target;

- If banks don't lend after receiving loans from the European Central Bank, they will have to pay the money back;

- The frequency of ECB's monetary policy meetings will change to a six-week cycle from January 2015;

- The ECB will start publishing meeting minutes from January 2015;

- There are further downside risk relates to insufficient structural reforms in euro area countries;

- The economic outlook for the Eurozone remain on the downside;

- The economy in the Eurozone recovered moderately in the second quarter;

- The ECB is interested in asset-backed securities.

- The ECB will keep interest rate at the present levels for an extended period of time;

-

15:00

U.S.: ISM Non-Manufacturing, June 56.0 (forecast 56.2)

-

14:45

U.S.: Services PMI, June 61.0

-

14:30

U.S. companies added 288,000 jobs in June, unemployment rate declined to 6.1%

The U.S. Bureau of Labor Statistics released its labour market data today. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May. May's figure was revised up from a rise of 217,000 positions.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008. Analysts had expected the unemployment rate to remain unchanged at 6.3%.

These figures are signs of the strength of the U.S. labour market. Despite of the U.S. economy's contraction in first quarter, the Federal Reserve may hike its interest rate sooner as expected. Analysts expect the first interest rate hike mid-2015.

The U.S. economy contracted 2.9% in the first quarter. The contraction was caused by the extremely cold winter in the U.S. But recently released figures show that the U.S. labour market and U.S. housing market gain momentum.

-

13:32

U.S.: Average hourly earnings , June +0.2% (forecast +0.2%)

-

13:32

U.S.: Average workweek, June 34.5

-

13:31

U.S.: International Trade, bln, May -44.4 (forecast -45.1)

-

13:31

Canada: Trade balance, billions, May -0.152 (forecast -0.3)

-

13:30

U.S.: Initial Jobless Claims, June 315 (forecast 310)

-

13:30

U.S.: Nonfarm Payrolls, June 288 (forecast 211)

-

13:30

U.S.: Unemployment Rate, June 6.1% (forecast 6.3%)

-

13:00

Orders

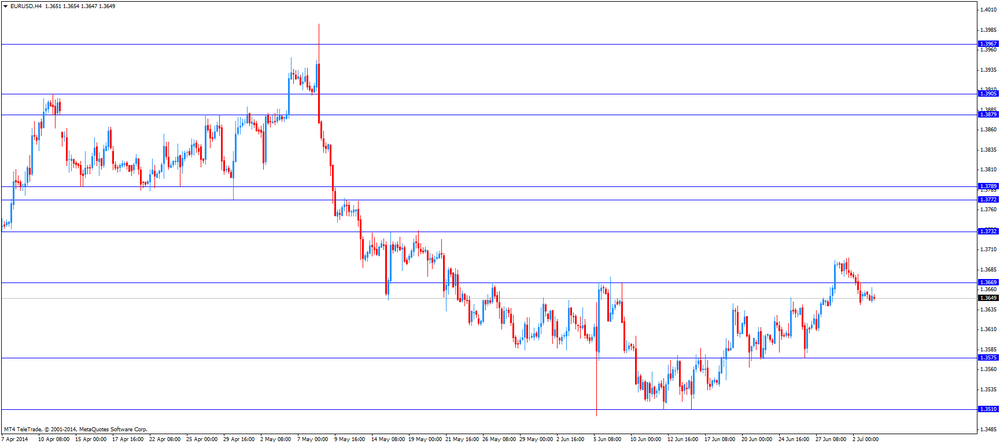

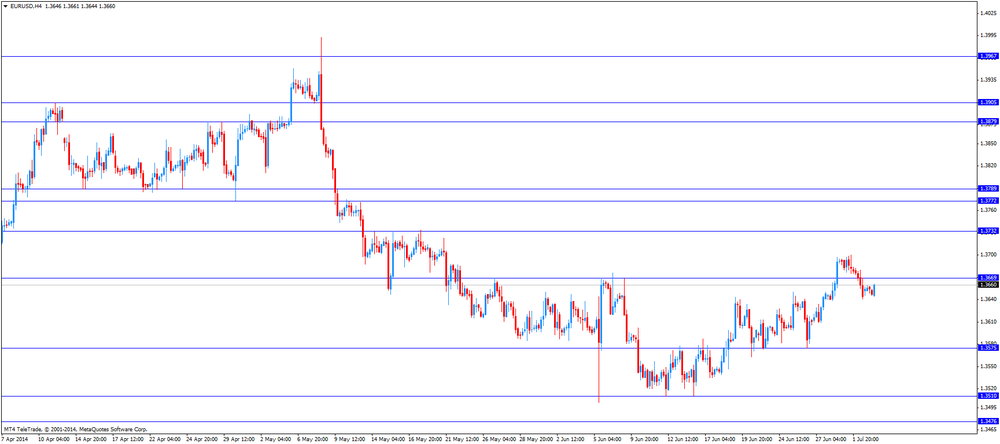

EUR/USD

Offers $1.3700-20, $1.3680/85

Bids $1.3625/20, $1.3576-74, $1.3565, $1.3550/40

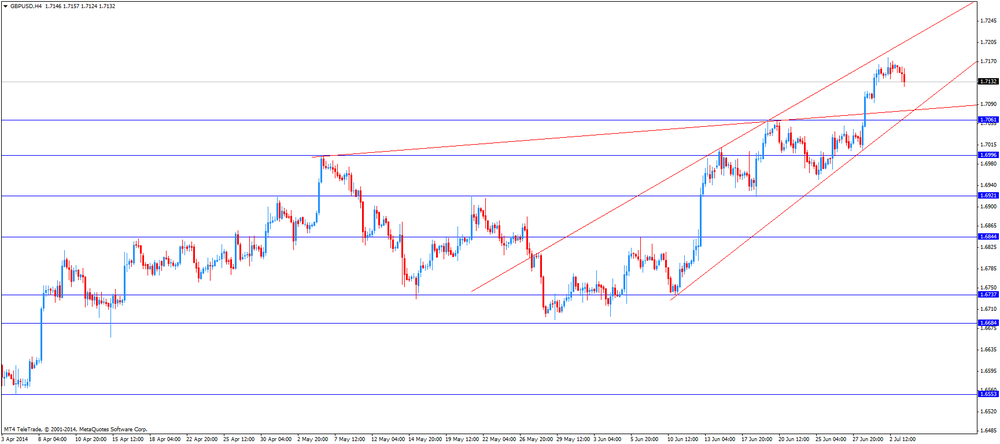

GBP/USD

Offers $1.7300, $1.7250, $1.7230, $1.7200

Bids $1.7095/90, $1.7035/30

AUD/USD

Offers $0.9505, $0.9480, $0.9465/70, $0.9420, $0.9400

Bids $0.9350, $0.9320, $0.9300

EUR/JPY

Offers Y140.50, Y140.00, Y139.50

Bids Y138.50, Y138.20, Y138.00

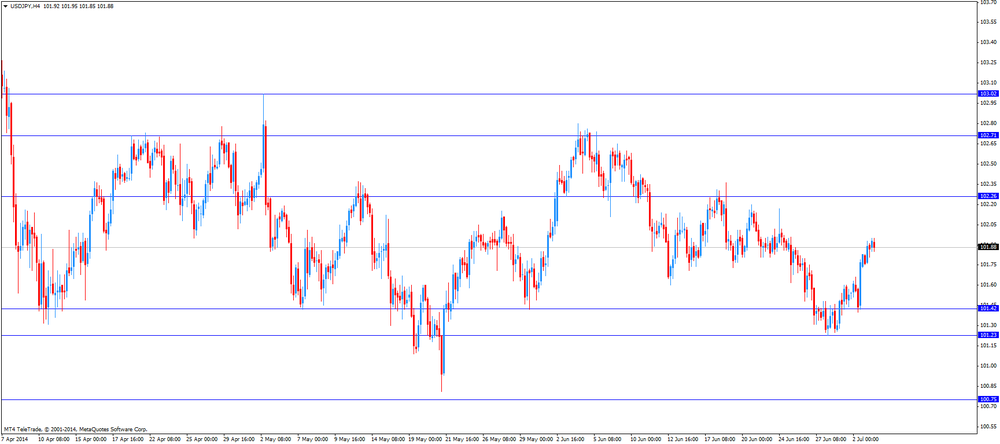

USD/JPY

Offers Y102.50, Y102.00

Bids Y101.50, Y101.40/30, Y101.20, Y101.10/00, Y100.80

EUR/GBP

Offers stg0.8000

Bids stg0.7950, stg0.7935/30, stg0.7925/20, stg0.7905-890

-

13:00

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the European Central Bank’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia RBA's Governor Glenn Stevens Speech

01:00 China Non-Manufacturing PMI June 55.5 55.0

01:30 Australia Building Permits, m/m May -5.6% +3.5% +9.9%

01:30 Australia Building Permits, y/y May +1.1% +14.3%

01:30 Australia Retail sales (MoM) May +0.2% +0.3% -0.5%

01:30 Australia Retail Sales Y/Y May +5.7% +4.6%

01:45 China HSBC Services PMI June 50.7 53.1

07:48 France Services PMI (Finally) June 49.1 48.2 48.2

07:53 Germany Services PMI (Finally) June 56.0 54.8 54.6

07:58 Eurozone Services PMI (Finally) June 53.2 52.8 52.8

08:30 United Kingdom Purchasing Manager Index Services June 58.6 58.1 57.7

09:00 Eurozone Retail Sales (MoM) May +0.4% +0.3% 0.0%

09:00 Eurozone Retail Sales (YoY) May +2.4% +0.7%

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15% 0.15%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. labour market data. Analysts expect that the U.S. economy will add 211,000 jobs in June, after 217,000 jobs in May.

The unemployment rate in the U.S. should remain unchanged at 6.3% in June.

The euro traded mixed against the U.S. dollar after the European Central Bank's interest rate decision. The ECB kept its interest rate unchanged at 0.15%.

Retail sales in the Eurozone were flat in May, missing expectations for a 0.2% gain, after a 0.2% decline in April. April's figure was revised down from a 0.4% rise.

On a yearly basis, retail sales in the Eurozone increased 0.7% in May, missing expectations for a 1.2% rise, after a 1.8% gain in April. April's figure was revised down from a 2.4% increase.

Eurozone's services purchasing managers' index decreased to 52.8 in June from 53.2 in May, in line with expectations.

German final services purchasing managers' index declined to 54.6 in June from 56.0 in May, missing expectations for a drop to 54.8.

French final services purchasing managers' index fell to 48.2 in June from 49.1 in May, in line with expectations.

Spanish services purchasing managers' index decreased to 54.8 in June from 55.7 in May, missing expectations for a rise to 55.8.

The British pound declined against the U.S. dollar after the weaker-than-expected U.K. services purchase managers' index. The U.K. services purchasing managers' index dropped to 57.7 in June from 58.6 in May. Analysts had expected the index to decline to 58.1.

The Canadian dollar increased against the U.S. dollar ahead of the Canadian trade balance. The Canadian trade balance deficit should narrow to C$0.3 billion in May from a deficit of C$0.64 billion in April.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.7124

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions May -0.64 -0.3

12:30 U.S. International Trade, bln May -47.2 -45.1

12:30 U.S. Initial Jobless Claims June 312 310

12:30 U.S. Average hourly earnings June +0.2% +0.2%

12:30 U.S. Nonfarm Payrolls June 217 211

12:30 U.S. Unemployment Rate June 6.3% 6.3%

14:00 U.S. ISM Non-Manufacturing June 56.3 56.2

-

12:45

Eurozone: ECB Interest Rate Decision, 0.15% (forecast 0.15%)

-

10:30

Option expiries for today's 1400GMT cut

EUR/USD 1.3500, 1.3550, 1.3570/75, 1.3600/05, 1.3630/40, 1.3650, 1.3665, 1.3685, 1.3700, 1.3750, 1.3770, 1.3795/800

AUD/USD 0.9200, 0.9225/30, 0.9250/55, 0.9280, 0.9300, 0.9350, 0.9385, 0.9400, 0.9420, 0.9430, 0.9500

USD/JPY 101.00, 101.25, 101.45/50, 101.75, 101.90, 102.00/10, 102.35/40, 102.50, 102.55/60, 102.75, 103.00, 103.25, 103.50/60

GBP/USD 1.7040, 1.7050, 1.7200

USD/CAD 1.0600, 1.0620, 1.0650/55, 1.0660, 1.0680, 1.0690/700, 1.0720/25

EUR/GBP 0.8040

-

10:17

Foreign exchange market. Asian session: the Australian dollar declined against the U.S. dollar after mixed Australian economic data and comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia RBA's Governor Glenn Stevens Speech

01:00 China Non-Manufacturing PMI June 55.5 55.0

01:30 Australia Building Permits, m/m May -5.6% +3.5% +9.9%

01:30 Australia Building Permits, y/y May +1.1% +14.3%

01:30 Australia Retail sales (MoM) May +0.2% +0.3% -0.5%

01:30 Australia Retail Sales Y/Y May +5.7% +4.6%

01:45 China HSBC Services PMI June 50.7 53.1

07:48 France Services PMI (Finally) June 49.1 48.2 48.2

07:53 Germany Services PMI (Finally) June 56.0 54.8 54.6

07:58 Eurozone Services PMI (Finally) June 53.2 52.8 52.8

08:30 United Kingdom Purchasing Manager Index Services June 58.6 58.1 57.7

09:00 Eurozone Retail Sales (MoM) May +0.4% +0.3% 0.0%

09:00 Eurozone Retail Sales (YoY) May +2.4% +0.7%

The U.S. dollar traded higher against the most major currencies. The U.S. currency was supported by yesterday's the better-than-expected U.S. jobs report. The U.S. economy added 281,000 jobs in June, after an increase of 179,000 jobs in May.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar declined against the U.S. dollar after mixed Australian economic data and comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens. The RBA Governor said that the Australian dollar remains high by historical standards and investors are underestimating the probability of a significant fall in the Australian dollar at some point.

Retail sales in Australia decreased 0.5% in May, missing expectations for a 0.3% gain, after a 0.1% decline in April. April's figure was revised down from a 0.2% rise.

Building permits in Australia increased 9.9% in May, exceeding expectations for a 3.5% gain, after a 5.8% slip in April. April's figure was revised down from a 5.6% decrease.

AIG services index for Australia declined to 47.6 in June from 49.9 in May.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair declined to $1.3645

GBP/USD: the currency pair fell to $1.7150

USD/JPY: the currency pair climbed to Y101.95

AUD/USD: the currency pair decreased to $0.9371

The most important news that are expected (GMT0):

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15%

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions May -0.64 -0.3

12:30 U.S. International Trade, bln May -47.2 -45.1

12:30 U.S. Initial Jobless Claims June 312 310

12:30 U.S. Average hourly earnings June +0.2% +0.2%

12:30 U.S. Nonfarm Payrolls June 217 211

12:30 U.S. Unemployment Rate June 6.3% 6.3%

14:00 U.S. ISM Non-Manufacturing June 56.3 56.2

-

10:00

Eurozone: Retail Sales (MoM), May 0.0% (forecast +0.3%)

-

10:00

Eurozone: Retail Sales (YoY), May +0.7%

-

09:32

United Kingdom: Purchasing Manager Index Services, June 57.7 (forecast 58.1)

-

09:00

Eurozone: Services PMI, June 52.8 (forecast 52.8)

-

08:57

Germany: Services PMI, June 54.6 (forecast 54.8)

-

08:56

France: Services PMI, June 48.2 (forecast 48.2)

-

06:23

Options levels on thursday, July 3, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3752 (2927)

$1.3709 (5984)

$1.3681 (2285)

Price at time of writing this review: $ 1.3651

Support levels (open interest**, contracts):

$1.3627 (1835)

$1.3591 (3933)

$1.3541 (4583)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 32909 contracts, with the maximum number of contracts with strike price $1,3700 (5984);

- Overall open interest on the PUT options with the expiration date July, 3 is 42478 contracts, with the maximum number of contracts with strike price $1,3500 (5608);

- The ratio of PUT/CALL was 1.29 versus 1.29 from the previous trading day according to data from July, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.7400 (1019)

$1.7300 (423)

$1.7201 (3451)

Price at time of writing this review: $1.7156

Support levels (open interest**, contracts):

$1.7099 (730)

$1.7000 (2186)

$1.6900 (2269)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 32171 contracts, with the maximum number of contracts with strike price $1,7150 (8273);

- Overall open interest on the PUT options with the expiration date July, 3 is 30161 contracts, with the maximum number of contracts with strike price $1,6700 (2413);

- The ratio of PUT/CALL was 0.94 versus 0.96 from the previous trading day according to data from Jule, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:20

Currencies. Daily history for Jule 2'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3656 -0,16%

GBP/USD $1,7163 +0,09%

USD/CHF Chf0,8887 +0,16%

USD/JPY Y101,76 +0,22%

EUR/JPY Y138,97 +0,05%

GBP/JPY Y174,65 +0,30%

AUD/USD $0,9441 -0,54%

NZD/USD $0,8771 +0,02%

USD/CAD C$1,0666 +0,33%

-

05:00

Schedule for today, Thursday, July 3’2014:

(time / country / index / period / previous value / forecast)

01:00 Australia RBA's Governor Glenn Stevens Speech

01:00 China Non-Manufacturing PMI June 55.5 55.0

01:30 Australia Building Permits, m/m May -5.6% +3.5% +9.9%

01:30 Australia Building Permits, y/y May +1.1% +14.3%

01:30 Аustralia Retail sales (MoM) May +0.2% +0.3% -0.5%

01:30 Australia Retail Sales Y/Y May +5.7%

01:45 China HSBC Services PMI June 50.7 53.1

07:48 France Services PMI (Finally) June 49.1 48.2

07:53 Germany Services PMI (Finally) June 56.0 54.8

07:58 Eurozone Services PMI (Finally) June 53.2 52.8

08:30 United Kingdom Purchasing Manager Index Services June 58.6 58.1

09:00 Eurozone Retail Sales (MoM) May +0.4% +0.3%

09:00 Eurozone Retail Sales (YoY) May +2.4%

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15%

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions May -0.64 -0.3

12:30 U.S. Average workweek June 34.5

12:30 U.S. International Trade, bln May -47.2 -45.1

12:30 U.S. Initial Jobless Claims June 312 310

12:30 U.S. Average hourly earnings June +0.2% +0.2%

12:30 U.S. Nonfarm Payrolls June 217 211

12:30 U.S. Unemployment Rate June 6.3% 6.3%

13:45 U.S. Services PMI (Finally) June 61.2

14:00 U.S. ISM Non-Manufacturing June 56.3 56.2

-