Notícias do Mercado

-

20:30

U.S.: Total Vehicle Sales, mln, July 16.5 (forecast 16.8)

-

19:20

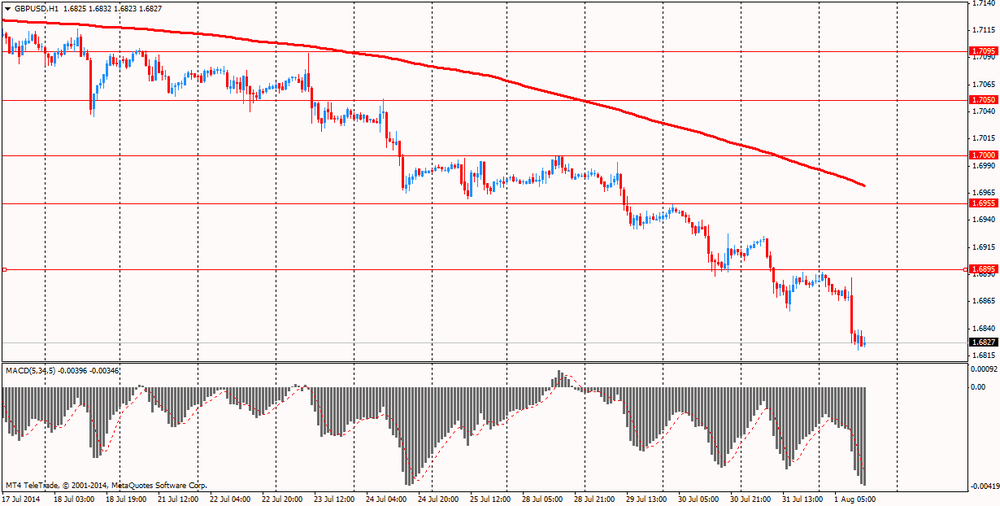

American focus: the pound has fallen significantly against the U.S. currency

The dollar declined significantly against the euro, which was associated with the release of a report on the U.S. labor market, which has not met expectations. As it became known, unemployment unexpectedly rose in July - up 6.2% from June's 6.1%, which was the lowest value of the index since June 2008, according to the Ministry of Labor of the country. Analysts predicted changes. The number of jobs in the U.S. economy increased in July by 209 thousand after increasing by a revised 298 thousand a month earlier. Experts interviewed expected the figure to 230 thousand, previous assessment of the June rise equaled 288 thousand Edit Data for May and June added 15 thousand to employment growth. Improvement in the U.S. labor market this year, is expected to contribute to the sustainable growth of consumer spending, which, in turn, will support the creation of new jobs and ensure further economic recovery.

Dollar was little support data potrebdoveriyu. As shown by the final results of studies presented Thomson-Reuters and the Michigan Institute in July, American consumers feel more pessimistic about the economy than was recorded in the last month. According to the data, in July the final index of consumer sentiment fell to 81.8 compared with the final reading for June at 82.5 and the initial estimate for July at around 81.3. It is worth noting that, according to the average estimates of experts, the index was down compared with the June value to the level of 81.5.

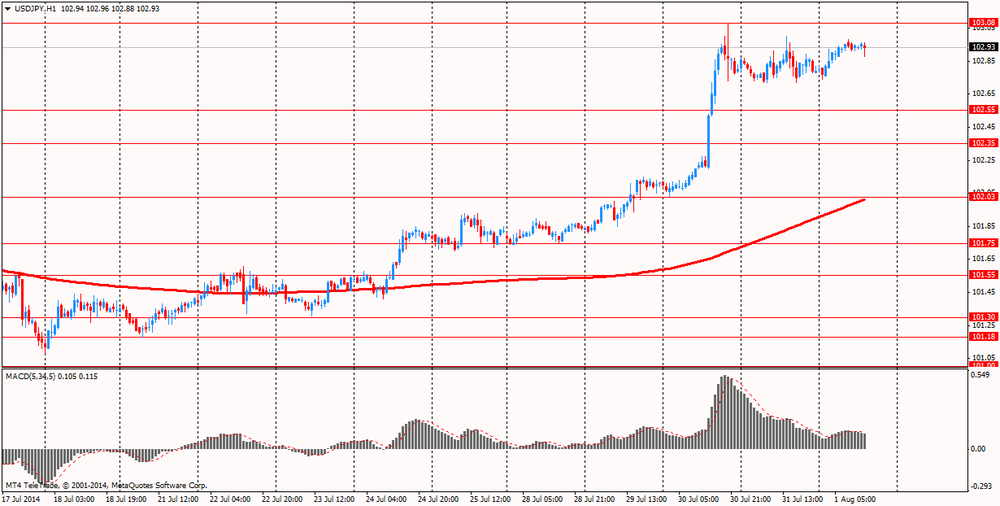

The yen has strengthened significantly against the U.S. dollar, after data on employment in the United States reported an increase in the number of jobs in the labor market at a moderate pace. However, they fell short of market expectations, while the unemployment rate rose. The July employment report in the U.S. has forced investors to transfer funds in U.S. Treasury bonds, especially with short maturities, triggering a drop in bond yields. Its reduction, in turn, exert downward pressure on the dollar against other currencies. U.S. bond yields decline makes the dollar less attractive to investors, as it reduces the gain on assets denominated in that currency. It is worth noting that improving data supported the prevailing market view that the U.S. economy is close to the Fed's mandate. In a statement this week, the Fed acknowledged the improvement of data, indicating that it may be approaching the first increase in interest rates since the financial crisis.

The British pound fell sharply against the U.S. dollar, as data on manufacturing activity disappointed investors. In the UK manufacturing activity grew at the slowest pace in a year in July, while a slowdown in new orders and output end of the first half of the "significant growth spurt," said Friday Markit Economics. Industrial activity index fell to 55.4 from a revised level of 57.2 in June. Economists had forecast a reading of 57.2 in July, from 57.5 previously voiced in June. The new orders index fell to 57.8 from 60.6 and the output index also fell. Although the report refers to some loss of momentum in manufacturing, the sensor is higher than the average in the 51.5 series, and showed expansion of 17 consecutive months. Other indicators show continued strength - a report from the Confederation of British Industry showed that factory orders are at their highest level since 1995. "Despite the cooling in July, growth in production and new orders remain well above their long-term trends, maintaining a constant job creation," said Rob Dobson, economist at Markit in London. "Growth rates remain historically very strong, to help promote another robust economic growth in the third quarter."

-

15:00

U.S.: Construction Spending, m/m, June -1.8% (forecast +0.4%)

-

15:00

U.S.: ISM Manufacturing, July 57.1 (forecast 56.1)

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, July 81.8 (forecast 81.5)

-

14:45

U.S.: Manufacturing PMI, July 55.8 (forecast 56.3)

-

14:30

Option expiries for today's 1400GMT cut

EUR/USD $1.3274(E140mn), $1.3350(E187mn), $1.3375(E198mn), $1.3400(E926mn), $1.3450(E140mn), $1.3460(E395mn), $1.3475(E149mn), $1.3500(E599mn), $1.3510(E235mn), $1.3525(E140mn)

USD/JPY Y101.00($936mn), Y101.80(Y200mn), Y102.25($450mn), Y102.50($215mn), Y102.70($400mn), Y102.75($200mn), Y104.00($521mn), Y104.95($747mn

GBP/USD $1.6955(stg211mn)

AUD/USD $0.9300(A$100mn), $0.9330(A$100mn), $0.9340(A$202mn)

USD/CAD C$1.0700($350mn), C$1.0745($285mn), C$1.0750($140mn), C$1.0775($130mn), C$1.0785($125mn), C$1.0795($102mn), C$1.0800($600mn), C$1.0870($106mn), C$1.0910($147mn), C$1.0920($158mn)

-

13:33

U.S.: Average hourly earnings , July 0.0% (forecast +0.2%)

-

13:32

U.S.: Average workweek, July 34.5

-

13:32

U.S.: Personal spending , June +0.4% (forecast +0.5%)

-

13:31

U.S.: PCE price index ex food, energy, m/m, June +0.1% (forecast +0.2%)

-

13:31

U.S.: PCE price index ex food, energy, Y/Y, June +1.5%

-

13:31

U.S.: Unemployment Rate, July 6.2% (forecast 6.1%)

-

13:30

U.S.: Nonfarm Payrolls, July 209 (forecast 230)

-

13:30

U.S.: Personal Income, m/m, June +0.4% (forecast +0.4%)

-

13:15

European session: the euro rose

07:48 France Manufacturing PMI (Finally) July 47.6 47.6 47.8

07:53 Germany Manufacturing PMI (Finally) July 52.9 52.9 52.4

07:58 Eurozone Manufacturing PMI (Finally) July 51.9 51.9 51.8

08:30 United Kingdom Purchasing Manager Index Manufacturing July 57.5 57.2 55.4

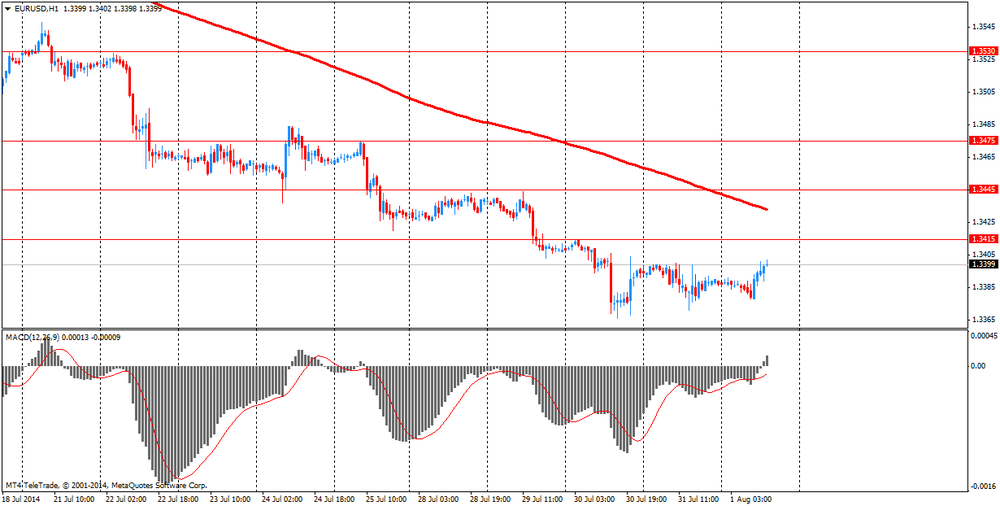

During the European session, the Forex market the euro rose against the dollar on the final data on business activity in the manufacturing sector.

Eurozone manufacturing activity growth remained stable at seven-month low of June, final data showed Markit Economics, published on Friday.

On a seasonally adjusted final index of purchasing managers in manufacturing was 51.8 in July, unchanged from June. Pre-reading for July was at 51.9.

The continuing growth of activity in Germany was partly offset by a deep recession of the French manufacturers.

At the same time, the German industrial sector has shown steady growth in July. Manufacturing PMI Markit / BME rose to 52.4 in July from 52 eight-month low in June. But the value for July was lower than the preliminary assessment 52.9.

On the other hand, the French manufacturing sector weakened in July, but a little less than originally anticipated.

French PMI index fell to 47.8 from a revised 48.2 in June. It was its lowest value in 2014 till now. Value for July was revised from 47.6.

The British pound fell against the U.S. dollar, as data on manufacturing activity disappointed investors.

In the UK manufacturing activity grew at the slowest pace in a year in July, while a slowdown in new orders and output end of the first half of the "significant growth spurt," said Friday Markit Economics. Industrial activity index fell to 55.4 from a revised level of 57.2 in June. Economists had forecast a reading of 57.2 in July, from 57.5 previously voiced in June. The new orders index fell to 57.8 from 60.6 and the output index also fell.

Although the report refers to some loss of momentum in manufacturing, the sensor is higher than the average in the 51.5 series, and showed expansion of 17 consecutive months. Other indicators show continued strength - a report from the Confederation of British Industry showed that factory orders are at their highest level since 1995.

"Despite the cooling in July, growth in production and new orders remain well above their long-term trends, maintaining a constant job creation," said Rob Dobson, economist at Markit in London. "Growth rates remain historically very strong, to help promote another robust economic growth in the third quarter."

EUR / USD: during the European session, the pair rose to $ 1.3402

GBP / USD: during the European session, the pair fell to $ 1.6820

USD / JPY: during the European session, the pair rose to Y102.98

U.S. at 12:30 GMT publish unemployment, changes in the number of people employed in non-agricultural sector, the change in the number of employees in the private sector of the economy, changes in the number of people employed in the manufacturing sector of the economy, the change in average hourly wages, the share of the economically active population, the total revision of employment for 2 months in July, the main index for personal consumption expenditures, changes in spending, deflator for personal consumption expenditures for June, in 13:55 GMT - indicator of consumer confidence from the University of Michigan in July in 14:00 GMT - ISM manufacturing index for July .

-

13:00

Orders

EUR/USD

Offers $1.3440-50, $1.3440, $1.3415-25, $1.3400

Bids $1.3360/50, $1.3320

GBP/USD

Offers $1.6926

Bids $1.6800, $1.6785/80, $1.6750

AUD/USD

Offers $0.9375/80, $0.9350, $0.9315/20, $0.9300

Bids $0.9250, $0.9200, $0.9150

EUR/JPY

Offers Y138.80, Y138.50, Y138.00

Bids Y137.50, Y137.20, Y137.05/00, Y136.80, Y136.50

USD/JPY

Offers Y104.00, Y103.50, Y103.15, Y103.00

Bids Y102.50, Y102.25/20, Y102.00, Y101.80

EUR/GBP

Offers stg0.8015-20, stg0.8000, stg0.7980/85

Bids stg0.7900

-

10:29

Option expiries for today's 1400GMT cut

EUR/USD $1.3274(E140mn), $1.3350(E187mn), $1.3375(E198mn), $1.3400(E926mn), $1.3450(E140mn), $1.3460(E395mn), $1.3475(E149mn), $1.3500(E599mn), $1.3510(E235mn), $1.3525(E140mn)

USD/JPY Y101.00($936mn), Y101.80(Y200mn), Y102.25($450mn), Y102.50($215mn), Y102.70($400mn), Y102.75($200mn), Y104.00($521mn), Y104.95($747mn

GBP/USD $1.6955(stg211mn)

AUD/USD $0.9300(A$100mn), $0.9330(A$100mn), $0.9340(A$202mn)

USD/CAD C$1.0700($350mn), C$1.0745($285mn), C$1.0750($140mn), C$1.0775($130mn), C$1.0785($125mn), C$1.0795($102mn), C$1.0800($600mn), C$1.0870($106mn), C$1.0910($147mn), C$1.0920($158mn)

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , July 55.4 (forecast 57.2)

-

09:00

Eurozone: Manufacturing PMI, July 51.8 (forecast 51.9)

-

08:56

Germany: Manufacturing PMI, July 52.4 (forecast 52.9)

-

08:50

France: Manufacturing PMI, July 47.8 (forecast 47.6)

-

07:31

Australia: Commodity Prices, Y/Y, July -12.1%

-

06:27

Options levels on friday, August 1, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3501 (2517)

$1.3467 (1651)

$1.3436 (695)

Price at time of writing this review: $ 1.3385

Support levels (open interest**, contracts):

$1.3356 (2627)

$1.3326 (2796)

$1.3288 (2862)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 31896 contracts, with the maximum number of contracts with strike price $1,3600 (4432);

- Overall open interest on the PUT options with the expiration date August, 8 is 33841 contracts, with the maximum number of contracts with strike price $1,3500 (6149);

- The ratio of PUT/CALL was 1.06 versus 1.11 from the previous trading day according to data from July, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (2650)

$1.7001 (1107)

$1.6904 (650)

Price at time of writing this review: $1.6872

Support levels (open interest**, contracts):

$1.6798 (1972)

$1.6699 (1088)

$1.6600 (437)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 18321 contracts, with the maximum number of contracts with strike price $1,7100 (2650);

- Overall open interest on the PUT options with the expiration date August, 8 is 25096 contracts, with the maximum number of contracts with strike price $1,7000 (2692);

- The ratio of PUT/CALL was 1.40 versus 1.43 from the previous trading day according to data from Jule, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:22

Asian session: The dollar headed for a third weekly gain versus the euro

01:00 China Manufacturing PMI July 51.0 51.4 51.7

01:30 Australia Producer price index, q / q Quarter II +0.9% +0.7% -0.1%

01:30 Australia Producer price index, y/y Quarter II +2.5% +2.3%

01:45 China HSBC Manufacturing PMI (Finally) July 52.0 52.0 51.7

03:30 Japan BOJ Governor Haruhiko Kuroda Speaks

The dollar headed for a third weekly gain versus the euro, the longest stretch in two months, as signs of a sustained U.S. recovery boost speculation the Federal Reserve is moving toward raising interest rates.

The Bloomberg Dollar Spot Index approached the strongest since March as economists said data today will show U.S. employers boosted jobs and the Fed's preferred gauge of inflation was near the most since 2012. U.S. employers added 230,000 workers in July and the jobless rate stayed at an almost six-year low of 6.1 percent, according to Bloomberg surveys before today's Labor Department data. The personal consumption expenditure deflator, an inflation measure preferred by the Fed, rose an annual 1.7 percent in June after climbing 1.8 percent in May, which was the biggest gain since 2012, a separate survey showed.

The dollar rose for an 11th day versus the yen, the longest stretch since 2001.

Australia's dollar headed for its biggest weekly loss since May after a Chinese Purchasing Managers' Index for manufacturing from HSBC Holdings Plc and Markit Economics showed a final reading of 51.7 in July, less than its preliminary figure of 52.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3385-90

GBP / USD: during the Asian session the pair fell to $ 1.6865

USD / JPY: during the Asian session, the pair rose to Y102.95

Focus on key US employment data at 1230GMT, with action in the dollar providing the main market drive, though UK mfg PMI at 0830GMT (median 57.2 vs 57.5 last) will provide the earlier domestic interest.

-

02:45

China: HSBC Manufacturing PMI, July 51.7 (forecast 52.0)

-

02:30

Australia: Producer price index, y/y, Quarter II +2.3%

-

02:30

Australia: Producer price index, q / q, Quarter II -0.1% (forecast +0.7%)

-

02:00

China: Manufacturing PMI , July 51.7 (forecast 51.4)

-

00:30

Australia: AIG Manufacturing Index, July 50.7

-