Notícias do Mercado

-

23:23

Currencies. Daily history for Jule 31'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3387 -0,05%

GBP/USD $1,6884 -0,16%

USD/CHF Chf0,9086 +0,01%

USD/JPY Y102,79 -0,01%

EUR/JPY Y137,62 -0,06%

GBP/JPY Y173,55 -0,17%

AUD/USD $0,9293 -0,34%

NZD/USD $0,8497 +0,15%

USD/CAD C$1,0903 +0,01%

-

23:01

Schedule for today, Friday, Aug 1’2014:

(time / country / index / period / previous value / forecast)

01:00 China Manufacturing PMI July 51.0 51.4

01:30 Australia Producer price index, q / q Quarter II +0.9% +0.7%

01:30 Australia Producer price index, y/y Quarter II +2.5%

01:45 China HSBC Manufacturing PMI July 52.0 52.0

03:30 Japan BOJ Governor Haruhiko Kuroda Speaks

06:00 Switzerland Bank holiday

06:30 Australia Commodity Prices, Y/Y July -9.6%

07:48 France Manufacturing PMI July 47.6 47.6

07:53 Germany Manufacturing PMI July 52.9 52.9

07:58 Eurozone Manufacturing PMI July 51.9 51.9

08:30 United Kingdom Purchasing Manager Index Manufacturing July 57.5 57.2

12:30 U.S. Average workweek July 34.5

12:30 U.S. Average hourly earnings July +0.2% +0.2%

12:30 U.S. Personal Income, m/m June +0.4% +0.4%

12:30 U.S. Personal spending June +0.2% +0.5%

12:30 U.S. PCE price index ex food, energy, m/m June +0.2% +0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y June +1.5%

12:30 U.S. Unemployment Rate July 6.1% 6.1%

12:30 U.S. Nonfarm Payrolls July 288 230

13:45 U.S. Manufacturing PMI July 56.3 56.3

13:55 U.S. Reuters/Michigan Consumer Sentiment Index July 81.3 81.5

14:00 U.S. Construction Spending, m/m June +0.1% +0.4%

14:00 U.S. ISM Manufacturing July 55.3 56.1

17:00 U.S. Total Vehicle Sales, mln July 17.0 16.8

-

19:20

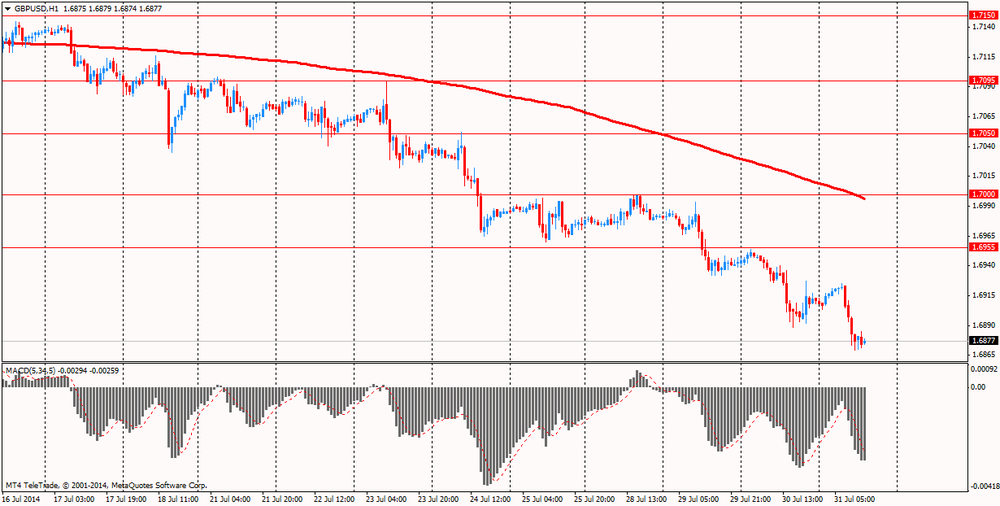

American focus: the pound has fallen significantly against the U.S. currency

The euro exchange rate fell slightly against the dollar amid inflation data in the eurozone and the U.S. labor market. Eurozone inflation slowed in July to its lowest level in four and a half years, mainly due to falling energy prices, showed on Thursday, preliminary data from Eurostat. Inflation slowed to 0.4 percent in July from 0.5 percent in June. Inflation is expected to remain unchanged at 0.5 percent. This is the lowest figure since the beginning of price growth since November 2009. Core inflation, excluding energy, food, alcohol and tobacco remained unchanged at 0.8 percent in July. Energy prices fell by 1 percent, and prices for food, alcohol and tobacco fell by 0.3 percent. At the same time, the prices of non-energy industrial goods remained in the flat, and the cost of services increased by 1.3 percent.

Meanwhile, a report by the United States has shown that the number of initial claims for unemployment benefits rose by 23,000 and amounted to a seasonally adjusted 302,000 in the week ended July 26. Data were slightly better than expected. Economists on average had forecast 306,000 initial claims. Treatment in the previous week were revised up to 279,000, the lowest level since May 2000. The four-week moving average of claims, which smooths out weekly volatility, fell by 3,500 to 297,250 - the lowest level since April 2006. The report also showed: number of workers continuing to receive unemployment benefits increased by 31,000 and reached a seasonally adjusted 2.54 million in the week ended July 19.

British pound retreated from a session low against the dollar, but continues to trade with a noticeable decrease since yesterday upbeat data on U.S. economic growth continue to support demand for the U.S. currency. We also add that yesterday the Fed in its decision on the rate stated that the labor market is still considerable slack, despite the recent acceleration of job growth, and pointed out that while the rates remain at current levels. The central bank also said that inflation is rising and approaching the long-term target level.

Also had little effect on Britain today's data, which showed that house price growth slowed in July, lagging behind the expectations of economists. Mortgage lender Nationwide said that house prices rose by 10.6 percent compared with the previous year in July, an increase of the seventeenth consecutive month, and followed growth of 11.8 percent in June. This was less than the growth of 11.3 percent expected by economists. On a monthly basis, prices rose at the slowest pace since April 2013, by 0.1 percent in July - much slower than the increase of 1 percent in June and 0.5 percent growth expected by economists. The average price of a house rose to 188,949 pounds from 188,903 pounds in June.

The Canadian dollar has appreciated strongly against its U.S. counterpart, received support from the Canadian GDP data. The Canadian economy grew at the fastest pace in four months in May, driven by growth in the manufacturing, wholesale and retail trade, energy and construction. Gross domestic product (the total amount of goods and services produced in the country) grew by 0.4% to 1.62 trillion Canadian dollars ($ 1,490 billion), accelerating compared with an increase in each of the previous two months by 0.1%. This Statistics Canada said Thursday. Rise exceeded market expectations (0.3%). In annualized growth rose to 2.3% from 2.1%. In the services sector grew by 0.4 release%, corresponding strengthening of the previous month. In the production of goods issue recovered from the recession in the previous month, an increase of 0.5% - this is the largest increase since February.

-

14:45

U.S.: Chicago Purchasing Managers' Index , July 52.6 (forecast 63.2)

-

14:30

Option expiries for today's 1400GMT cut

EUR/USD $1.3382, $1.3400, $1.3405, $1.3450

USD/JPY Y101.00, Y101.40-45, Y101.50, Y101.75, Y101.80, Y101.85, Y101.95, Y102.00, Y102.20, Y102.25, Y102.40, Y102.50, Y102.60, Y102.75, Y103.00

GBP/USD $1.6850

EUR/GBP stg0.7850, stg0.7900, stg0.7920, stg0.7980

AUD/USD $0.9320, $0.9360, $0.9365, $0.9375

USD/CAD C$107.65, C$1.0800

-

13:30

U.S.: Initial Jobless Claims, July 302 (forecast 306)

-

13:30

U.S.: Employment Cost Index, Quarter II +0.7% (forecast +0.5%)

-

13:30

Canada: GDP (m/m) , May +0.4% (forecast +0.3%)

-

13:15

European session: the euro fell

06:00 United Kingdom Nationwide house price index July +1.0% +0.6% +0.1%

06:00 United Kingdom Nationwide house price index, y/y July +6.0% Revised From +11.8% +10.6%

06:00 Germany Retail sales, real adjusted June -0.2% Revised From -0.6% +1.1% +1.3%

06:00 Germany Retail sales, real unadjusted, y/y June +2.4% Revised From +1.9% +0.4%

06:45 France Consumer spending June +1.0% +0.3% +0.9%

06:45 France Consumer spending, y/y June -0.6% +1.8%

07:55 Germany Unemployment Change July +7 Revised From +9 -5 -12

07:55 Germany Unemployment Rate s.a. July 6.7% 6.7%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) July +0.5% +0.5% +0.4%

09:00 Eurozone Unemployment Rate June 11.6% 11.6% 11.5%

During the European session on Forex euro fell against the dollar on background data on inflation and unemployment in the eurozone. Eurozone inflation slowed in July to its lowest level in four and a half years, mainly due to falling energy prices, showed on Thursday, preliminary data from Eurostat.

Inflation slowed to 0.4 percent in July from 0.5 percent in June. Inflation is expected to remain unchanged at 0.5 percent. This is the lowest figure since the beginning of price growth since November 2009.

Core inflation, excluding energy, food, alcohol and tobacco remained unchanged at 0.8 percent in July.

Energy prices fell by 1 percent, and prices for food, alcohol and tobacco fell by 0.3 percent. At the same time, the prices of non-energy industrial goods remained in the flat, and the cost of services increased by 1.3 percent.

Eurozone unemployment rate unexpectedly fell in June, showed data released Thursday by Eurostat.

The unemployment rate fell slightly to 11.5 percent from 11.6 percent in May. Rate forecast was to remain unchanged at 11.6 percent.

In addition, the youth unemployment rate fell to 23.1 percent in June from 23.2 percent a month earlier.

The total number of unemployed persons decreased by 152,000 from May to 18.41 million in June.

The British pound fell against the dollar after data on house prices. In the UK house price growth slowed in July, lagging behind the expectations of economists, data showed on Thursday surveys mortgage lender Nationwide.

House prices rose by 10.6 percent compared with the previous year in July, an increase of the seventeenth consecutive month, and followed growth of 11.8 percent in June. This was less than the growth of 11.3 percent expected by economists.

On a monthly basis, prices rose at the slowest pace since April 2013, by 0.1 percent in July. It was slower than the increase of 1 percent in June and 0.5 percent growth expected by economists.

The average price of a house rose to 188,949 pounds from 188,903 pounds in June.

Robert Gardner, chief economist at Nationwide, said: "The slowdown should not be considered surprising, given the evidence of moderate activity in recent months."

"Approved Mortgage Applications fell by almost 20 percent in the period from January to May, and there has also been some easing in promising indicators - such as new customer demands."

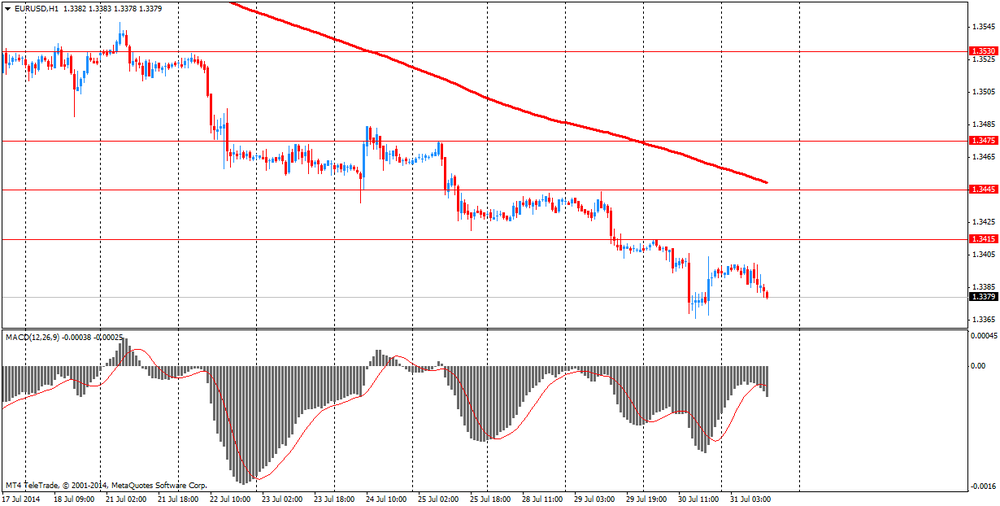

EUR / USD: during the European session, the pair fell to $ 1.3379

GBP / USD: during the European session, the pair fell to $ 1.6869

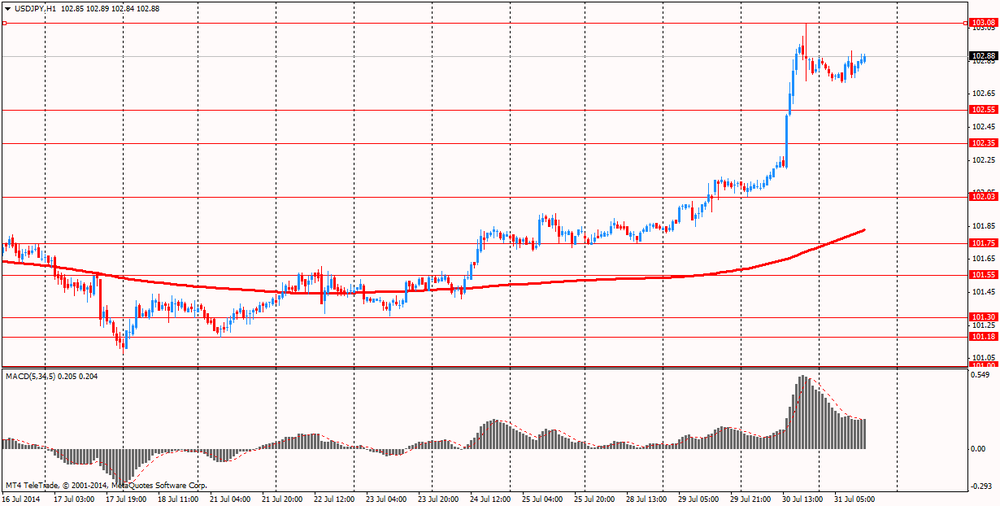

USD / JPY: during the European session, the pair rose to Y102.91

At 12:30 GMT, Canada will release the change in GDP in May. In the U.S. at 12:30 GMT will number of initial claims for unemployment insurance, the number of repeated applications for unemployment benefits, labor cost index for the 2nd quarter in 13:45 GMT - Chicago PMI index for July.

-

13:00

Orders

EUR/USD

Offers $1.3485, $1.3460, $1.3440-50, $1.3440, $1.3415-25

Bids $1.3360/50, $1.3320

GBP/USD

Offers $1.7065, $1.7020-25

Bids $1.6870/65, $1.6850/40, $1.6800

AUD/USD

Offers $0.9400, $0.9350, $0.9310/15

Bids $0.9280, $0.9250, $0.9200

EUR/JPY

Offers Y138.50, Y138.00

Bids Y137.50, Y137.20, Y137.05/00, Y136.80, Y136.50

USD/JPY

Offers Y104.00, Y103.50, Y103.15, Y103.00

Bids Y102.50, Y102.25/20, Y102.00, Y101.85/80

EUR/GBP

Offers stg0.8000, stg0.7980/85, stg0.7940-50

Bids

-

10:30

Option expiries for today's 1400GMT cut

EUR/USD $1.3382, $1.3400, $1.3405, $1.3450

USD/JPY Y101.00, Y101.40-45, Y101.50, Y101.75, Y101.80, Y101.85, Y101.95, Y102.00, Y102.20, Y102.25, Y102.40, Y102.50, Y102.60, Y102.75, Y103.00

GBP/USD $1.6850

EUR/GBP stg0.7850, stg0.7900, stg0.7920, stg0.7980

AUD/USD $0.9320, $0.9360, $0.9365, $0.9375

USD/CAD C$107.65, C$1.0800

-

10:00

Eurozone: Unemployment Rate , June 11.5% (forecast 11.6%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, July +0.4% (forecast +0.5%)

-

08:57

Germany: Unemployment Change, July -12 (forecast -5)

-

08:55

Germany: Unemployment Rate s.a. , July 6.7%

-

07:45

France: Consumer spending , June +0.9% (forecast +0.3%)

-

07:01

United Kingdom: Nationwide house price index , July +0.1% (forecast +0.6%)

-

07:01

United Kingdom: Nationwide house price index, y/y, July +10.6%

-

07:00

Germany: Retail sales, real adjusted , June +1.3% (forecast +1.1%)

-

07:00

Germany: Retail sales, real unadjusted, y/y, June +0.4%

-

06:23

Options levels on thursday, July 31, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3511 (2347)

$1.3473 (1518)

$1.3444 (516)

Price at time of writing this review: $ 1.3397

Support levels (open interest**, contracts):

$1.3370 (3500)

$1.3349 (2624)

$1.3320 (2539)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 30827 contracts, with the maximum number of contracts with strike price $1,3600 (4125);

- Overall open interest on the PUT options with the expiration date August, 8 is 34294 contracts, with the maximum number of contracts with strike price $1,3500 (6567);

- The ratio of PUT/CALL was 1.11 versus 1.17 from the previous trading day according to data from July, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.7200 (1648)

$1.7101 (2005)

$1.7002 (1063)

Price at time of writing this review: $1.6922

Support levels (open interest**, contracts):

$1.6895 (2107)

$1.6798 (1993)

$1.6699 (1035)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 17502 contracts, with the maximum number of contracts with strike price $1,7250 (2423);

- Overall open interest on the PUT options with the expiration date August, 8 is 24988 contracts, with the maximum number of contracts with strike price $1,7000 (2692);

- The ratio of PUT/CALL was 1.43 versus 1.47 from the previous trading day according to data from Jule, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:21

Asian session: The U.S. currency has risen

01:30 Australia Building Permits, m/m June +10.3% Revised From +9.9% +0.2% -5.0%

01:30 Australia Building Permits, y/y June +15.2% Revised From +14.3% +16.0%

01:30 Australia Import Price Index, q/q Quarter II +3.2% -1.4% -3.0%

01:30 Australia Export Price Index, q/q Quarter II +3.6% -7.9%

01:30 Australia Private Sector Credit, m/m June +0.4% +0.4% +0.7%

01:30 Australia Private Sector Credit, y/y June +4.7% +5.1%

01:30 Japan Labor Cash Earnings, YoY June +0.6% Revised From +0.8% +0.7% +0.4%

05:00 Japan Housing Starts, y/y June -15.0% -11.2% -9.5%

The U.S. currency has risen versus all except one of its 16 major counterparts in July as reports have shown gross domestic product rebounded, consumer confidence improved and durable goods orders increased. The world's biggest economy expanded at a 4 percent annualized pace last quarter, rebounding from a contraction of 2.1 percent in the previous three months and beating the median forecast for 3 percent in another Bloomberg survey.

The U.S. Labor Department will say tomorrow employers added 231,000 jobs in July, versus 288,000 the prior month, according to a Bloomberg survey.

Treasury 10-year yields climbed to a two-week high yesterday, while economists predict data tomorrow will show U.S. employers added more than 200,000 jobs for a sixth month. Treasury 10-year yields increased to 2.56 percent yesterday, the highest since July 16. The unemployment rate held at 6.1 percent, the lowest in almost six years, economists predicted.

Australia's dollar approached an eight-week low after building approvals unexpectedly declined. The Bureau of Statistics said building approvals fell 5 percent in June, compared with economist forecasts for an unchanged reading.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3390-00

GBP / USD: during the Asian session, the pair rose to $ 1.6925

USD / JPY: on Asian session the pair fell to Y102.75

Focus this morning will initially be turned to the release of Nationwide house price data at 0600GMT (median 0.5%mm, 11.3%yy), though more focus will be on outside influences with US weekly jobless claims and the Chicago Report the main focus as main drive seen coming via dollar moves.

-

06:02

Japan: Housing Starts, y/y, June -9.5% (forecast -11.2%)

-

02:33

Australia: Private Sector Credit, y/y, June +5.1%

-

02:32

Australia: Export Price Index, q/q, Quarter II -7.9%

-

02:32

Australia: Import Price Index, q/q, Quarter II -3.0% (forecast -1.4%)

-

02:32

Japan: Labor Cash Earnings, YoY, June +0.4% (forecast +0.7%)

-

02:31

Australia: Building Permits, y/y, June +16.0%

-

02:31

Australia: Private Sector Credit, m/m, June +0.7% (forecast +0.4%)

-

02:30

Australia: Building Permits, m/m, June -0.5% (forecast +0.2%)

-

01:23

Currencies. Daily history for Jule 30'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $ 1,3394 -0,10%

GBP/USD $1,6911 -0,19%

USD/CHF Chf0,9085 +0,20%

USD/JPY Y102,80 +0,67%

EUR/JPY Y137,70 +0,57%

GBP/JPY Y173,84 +0,49%

AUD/USD $0,9325 -0,60%

NZD/USD $0,8484 -0,25%

USD/CAD C$1,0902 +0,49%

-

01:00

Schedule for today, Thursday, Jule 31’2014:

(time / country / index / period / previous value / forecast)

01:30 Australia Building Permits, m/m June +9.9% +0.2%

01:30 Australia Building Permits, y/y June +14.3%

01:30 Australia Import Price Index, q/q Quarter II +3.2% -1.4%

01:30 Australia Export Price Index, q/q Quarter II +3.6%

01:30 Australia Private Sector Credit, m/m June +0.4% +0.4%

01:30 Australia Private Sector Credit, y/y June +4.7%

01:30 Japan Labor Cash Earnings, YoY June +0.6% Revised From +0.8% +0.7%

05:00 Japan Housing Starts, y/y June -15.0% -11.2%

06:00 United Kingdom Nationwide house price index July +1.0% +0.6%

06:00 United Kingdom Nationwide house price index, y/y July +11.8%

06:00 Germany Retail sales, real adjusted June -0.6% +1.1%

06:00 Germany Retail sales, real unadjusted, y/y June +1.9%

06:45 France Consumer spending June +1.0% +0.3%

06:45 France Consumer spending, y/y June -0.6%

07:55 Germany Unemployment Change July +9 -5

07:55 Germany Unemployment Rate s.a. July 6.7%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) July +0.5% +0.5%

09:00 Eurozone Unemployment Rate June 11.6% 11.6%

12:30 Canada GDP (m/m) May +0.1% +0.3%

12:30 U.S. Initial Jobless Claims July 284 306

12:30 U.S. Employment Cost Index Quarter II +0.3% +0.5%

13:45 U.S. Chicago Purchasing Managers' Index July 62.6 63.2

23:30 Australia AIG Manufacturing Index July 48.9

-