Notícias do Mercado

-

19:01

U.S.: FOMC QE Decision, 25

-

19:00

U.S.: Fed Interest Rate Decision , 0.25% (forecast 0.25%)

-

18:41

American focus: the dollar rose sharply against major currencies

The dollar against the euro has increased markedly, which was associated with the release of better than expected U.S. GDP data. The U.S. economy rose sharply this spring after the reduction in the first quarter, which led to positive growth in the last six months and raised hopes for sustained growth in the second half of 2014. Gross domestic product, the broadest measure of goods and services produced in the economy, increased from a seasonally adjusted annual rate of 4.0% in the second quarter, the Commerce Department said Wednesday. Economists had forecast an increase of 3.1% for the quarter. The rise in stocks and acceleration in consumer spending led to widespread growth and leveled a lot of resistance from increased imports. Growth has replaced the first quarter, when the economy contracted by 2.1%. While this was the worst quarter in the current recovery, this figure reflects an upward revision from the previously estimated 2.9% reduction. The economy grew by about 1% during the first half of 2014. Annual changes published on Wednesday, showed that the economy also expanded by 4% in the second half of 2013, it is the best indicator for the six months to 10 years.

The dollar has appreciated significantly against the pound and the yen amid the U.S. economic recovery, as well as expectations for the outcome of the meeting of the monetary policy by the Federal Reserve later in the session. Official data showed that U.S. gross domestic product grew in the second quarter at an annual rate of 4%. The report also showed that the U.S. economy shrank by 2.9% in the first quarter, as harsh winter weather conditions suppressed economic activity. Report came after data that indicates that the level of employment in the private sector rose by 218 thousand this month, lower than expected increase of 234 thousand in June, the economy added 281 thousand jobs.

Now the focus of the Fed's decision on monetary policy, which will be announced tonight. The Committee is expected to announce more QE minimize the program to $ 10 billion to $ 25 billion. Earlier this month, the Federal Reserve Janet Yellen noted that U.S. interest rates may rise sooner if the recovery in the labor market will continue.

-

15:30

U.S.: Crude Oil Inventories, July -3.7

-

14:46

Option expiries for today's 1400GMT cut

EUR/USD $1.3400, $1.3415, $1.3470, $1.3500

USD/JPY Y101.70-75, Y102.50

GBP/USD $1.6800

EUR/GBP stg0.7800, stg0.7900, stg0.7950, stg0.8000

AUD/USD $0.9400, $0.9425, $0.9450, $0.9475

USD/CAD C$1.0800

-

13:31

U.S.: PCE price index ex food, energy, q/q, Quarter II +2.0%

-

13:31

U.S.: PCE price index, q/q, Quarter II +2.3%

-

13:30

Canada: Raw Material Price Index, June +1.1% (forecast +0.6%)

-

13:30

Canada: Industrial Product Prices, m/m, June -0.1% (forecast +0.3%)

-

13:30

U.S.: GDP, q/q, Quarter II +4.0% (forecast +3.1%)

-

13:15

U.S.: ADP Employment Report, July 218 (forecast 234)

-

13:12

European session: the euro fell

06:00 Switzerland UBS Consumption Indicator June 1.77 2.06

07:00 Switzerland KOF Leading Indicator July 100.5 Revised From 100.4 101.1 98.1

09:00 Eurozone Business climate indicator July 0.22 0.17

09:00 Eurozone Industrial confidence July -4.3 -4.5 -3.8

09:00 Eurozone Economic sentiment index July 102.1 Revised From 102.0 102.2

12:00 Germany CPI, m/m (Preliminary) July +0.3% +0.2% +0.3%

12:00 Germany CPI, y/y (Preliminary) July +1.0% +0.9% +0.8%

During the European session, the Forex market the euro fell slightly against the dollar on the data by the mood in the economy.

In the eurozone, the level of economic confidence rose unexpectedly in July, which was due to the improvement of industrial sentiment data showed on Wednesday the European Commission survey.

Economic sentiment index rose to 102.2 in July from a revised 102.1 in June. Economists predicted that the figure will fall to 101.9 from June initial appraised value 102.

Industrial Confidence rose to -3.8 from -4.3 a month ago. Increased confidence in the industry was the result of more optimistic managers on expected production and the current level of total portfolio, and their assessment of stocks of finished products in general remained unchanged.

Meanwhile, confidence in the services sector fell to 3.6 from 4.4 months ago. Reduced confidence in the services sector was due to significantly lower expectations and managers demand more muted assessment of past business situation, which outweighed a more positive stance on past demand.

According to preliminary estimates consumer sentiment fell to -8.4 from -7.5 in June. The consumer confidence index fell due to the markedly more pessimistic estimates of future unemployment and future general economic situation, which were only partially offset by a moderate improvement in consumers' assessment of their readiness for future savings.

Sentiment in the construction sector improved to -28.2 from -31.7 in the previous month. Increased confidence in the building was part of the revision of the expressed expectations of employment and, to a lesser extent, improved assessment of the level of portfolio managers orders.

More data showed that business confidence dropped slightly to 0.17 in July from 0.21 in June.

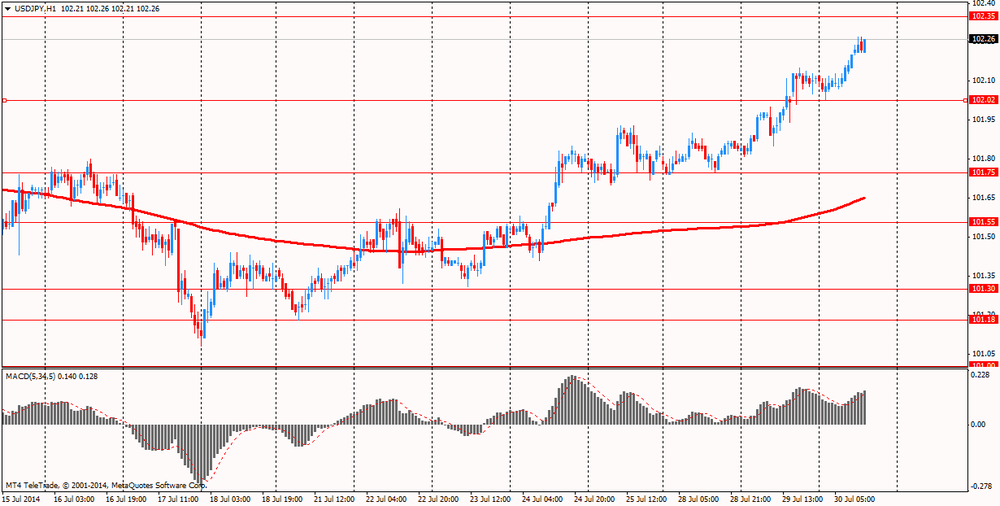

The U.S. dollar rose against the yen in anticipation of strong employment data in the U.S. that may prompt the Fed to further reduce the incentive programs. Remember, today completed a 2-day meeting of the Committee on the open market operations of the Federal Reserve System and the decision will be announced on the possible timing of rate increases the rate of the Central Bank and the further reduction of bond purchases.

In addition, will be held today publication of data on U.S. growth in the preceding quarter. According to the median forecast of economists, GDP world's largest economy will grow by 3.1%, after falling 2.9% previously. If this forecast is confirmed, then this figure will rise to the highest since September 2013.

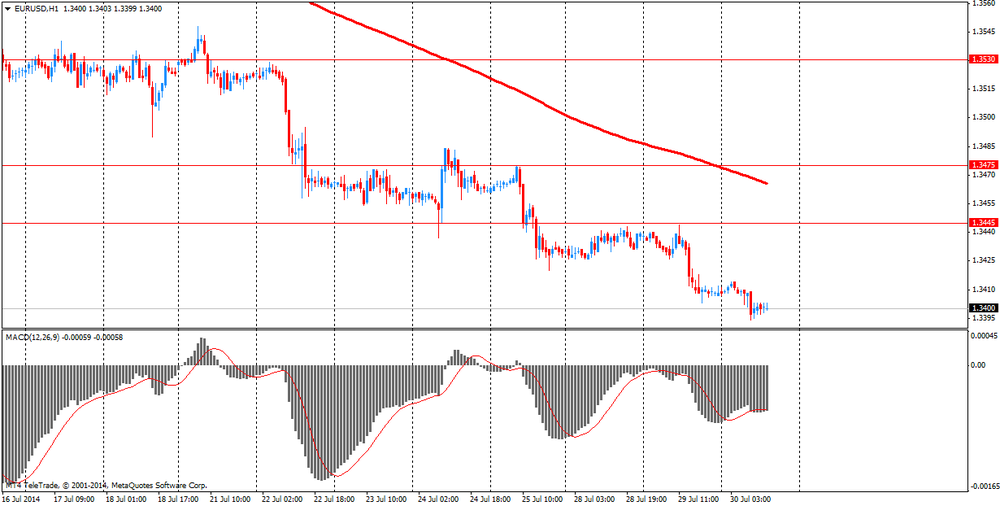

EUR / USD: during the European session, the pair fell to $ 1.3394

GBP / USD: during the European session, the pair fell to $ 1.6921

USD / JPY: during the European session, the pair rose to Y102.27

At 12:15 GMT the United States will change ADP Employment for July. At 12:30 GMT, Canada will present the raw material price index for June. U.S. at 12:30 GMT to publish preliminary data on changes in GDP, the GDP price index, the index of personal consumption expenditures, the main index of personal consumption expenditures for the 2nd quarter to 14:30 GMT - data on crude oil inventories from the Energy Department. At 18:00 GMT we will know the FOMC decision on the basic interest rate and the accompanying statement will be made FOMC. At 23:05 GMT UK release indicator of consumer confidence from the GfK July.

-

13:00

Germany: CPI, m/m, July +0.3% (forecast +0.2%)

-

13:00

Germany: CPI, y/y , July +0.8% (forecast +0.9%)

-

12:45

Orders

EUR/USD

Offers $1.3485, $1.3460/65, $1.3440-50, $1.3430/35

Bids $1.3390, $1.3380-70, $1.3355/50

GBP/USD

Offers

Bids $1.6925-20, $1.6900, $1.6885/80

AUD/USD

Offers $0.9480, $0.9450, $0.9420/25, $0.9400

Bids $0.9350, $0.9320, $0.9300

EUR/JPY

Offers Y137.75/80, Y137.50, Y137.20/25

Bids Y136.80, Y136.50, Y136.00

USD/JPY

Offers Y102.80, Y102.50

Bids Y102.00, Y101.85/80, Y101.50

EUR/GBP

Offers stg0.7980/85, stg0.7950

Bids

-

10:29

Option expiries for today's 1400GMT cut

EUR/USD $1.3400, $1.3415, $1.3470, $1.3500

USD/JPY Y101.70-75, Y102.50

GBP/USD $1.6800

EUR/GBP stg0.7800, stg0.7900, stg0.7950, stg0.8000

AUD/USD $0.9400, $0.9425, $0.9450, $0.9475

USD/CAD C$1.0800

-

10:00

Eurozone: Business climate indicator , July 0.17

-

10:00

Eurozone: Industrial confidence, July -3.8 (forecast -4.5)

-

10:00

Eurozone: Economic sentiment index , July 102.2

-

08:00

Switzerland: KOF Leading Indicator, July 98.1 (forecast 101.1)

-

07:01

Switzerland: UBS Consumption Indicator, June 2.06

-

06:27

Options levels on wednesday, July 30, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3515 (2360)

$1.3481 (1309)

$1.3455 (264)

Price at time of writing this review: $ 1.3408

Support levels (open interest**, contracts):

$1.3380 (3638)

$1.3356 (2973)

$1.3324 (2365)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 29713 contracts, with the maximum number of contracts with strike price $1,3600 (3991);

- Overall open interest on the PUT options with the expiration date August, 8 is 34638 contracts, with the maximum number of contracts with strike price $1,3500 (6975);

- The ratio of PUT/CALL was 1.17 versus 1.20 from the previous trading day according to data from July, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.7200 (1636)

$1.7101 (2005)

$1.7003 (1005)

Price at time of writing this review: $1.6943

Support levels (open interest**, contracts):

$1.6896 (2162)

$1.6799 (2113)

$1.6700 (1058)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 17067 contracts, with the maximum number of contracts with strike price $1,7250 (2423);

- Overall open interest on the PUT options with the expiration date August, 8 is 25014 contracts, with the maximum number of contracts with strike price $1,7000 (2692);

- The ratio of PUT/CALL was 1.47 versus 1.51 from the previous trading day according to data from Jule, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:19

Asian session: The dollar was near the highest in almost eight weeks

The dollar was near the highest in almost eight weeks against major peers amid prospects jobs numbers will add to indicators of stronger economic growth, prompting the Federal Reserve to further taper stimulus at a meeting that concludes today.

The Bloomberg Dollar Spot Index gained the most in six weeks yesterday, rising above its 200-day moving average, before data today forecast to show the U.S. economy rebounded last quarter. The Commerce Department will say today that U.S. gross domestic product climbed an annualized 3 percent last quarter, rebounding from a 2.9 percent contraction in the prior three months. That would indicate the fastest pace of growth for the world's biggest economy since the quarter ended September 2013.

The euro was near an eight-month low after German benchmark yields dropped to a record as the European Union and U.S. increased sanctions against Russia. Germany is forecast to report today that inflation slowed this month. German consumer price inflation moderated to 0.8 percent in July compared with a year earlier, from 1 percent in June, economists predicted before a report today.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3410-15

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6945-55

USD / JPY: on Asian session the pair traded in the range of Y102.05-15

A light UK calendar today with most attention on US ADP (ahead of Friday's NFP), US Q2 GDP and tonight's FOMC announcement. Ahead of this the market will turn focus on Germany CPI state/national releases.

-

01:27

Currencies. Daily history for Jule 29'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3408 -0,23%

GBP/USD $1,6943 -0,22%

USD/CHF Chf0,9067 +0,32%

USD/JPY Y102,11 +0,26%

EUR/JPY Y136,92 +0,04%

GBP/JPY Y172,99 +0,03%

AUD/USD $0,9381 -0,23%

NZD/USD $0,8505 -0,49%

USD/CAD C$1,0849 +0,48%

-

01:00

Schedule for today, Wednesday, Jule 30’2014:

(time / country / index / period / previous value / forecast)

06:00 Switzerland UBS Consumption Indicator June 1.77

07:00 Switzerland KOF Leading Indicator July +0.3% +0.2%

09:00 Eurozone Business climate indicator July 0.22

09:00 Eurozone Industrial confidence July -4.3 -4.5

09:00 Eurozone Economic sentiment index July 102.0

12:00 Germany CPI, m/m July +0.3% +0.2%

12:00 Germany CPI, y/y July +1.0% +0.9%

12:15 U.S. ADP Employment Report July 281 234

12:30 Canada Industrial Product Prices, m/m June -0.5% +0.3%

12:30 Canada Raw Material Price Index June -0.4% +0.6%

12:30 U.S. PCE price index, q/q Quarter II +1.0%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +1.2%

12:30 U.S. GDP, q/q Quarter II -2.9% +3.1%

14:30 U.S. Crude Oil Inventories July -4.0

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC QE Decision 35

18:00 U.S. FOMC Statement

23:05 United Kingdom Gfk Consumer Confidence July 1 2

-

00:52

Japan: Industrial Production (YoY), June +3.2%

-

00:51

Japan: Industrial Production (MoM) , June -3.3% (forecast -1.0%)

-