Notícias do Mercado

-

23:19

Currencies. Daily history for Oct 2'2014:

(pare/closed(GMT +2)/change, %)

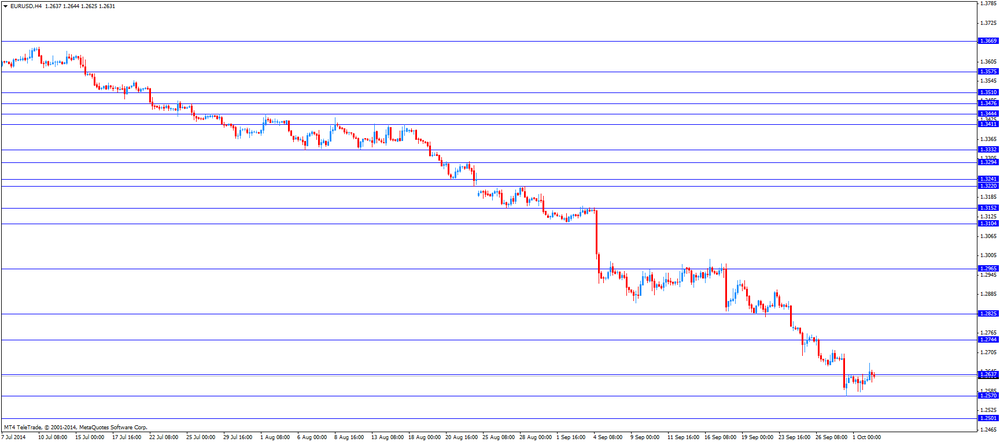

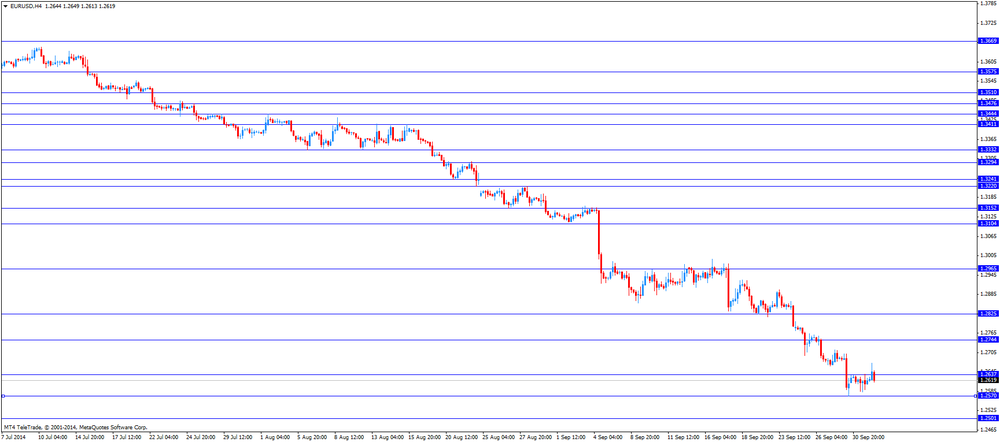

EUR/USD $1,2668 +0,40%

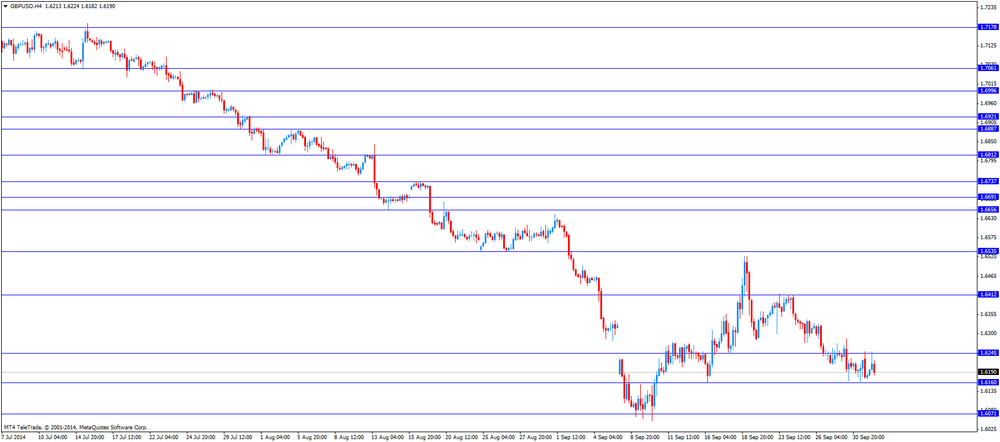

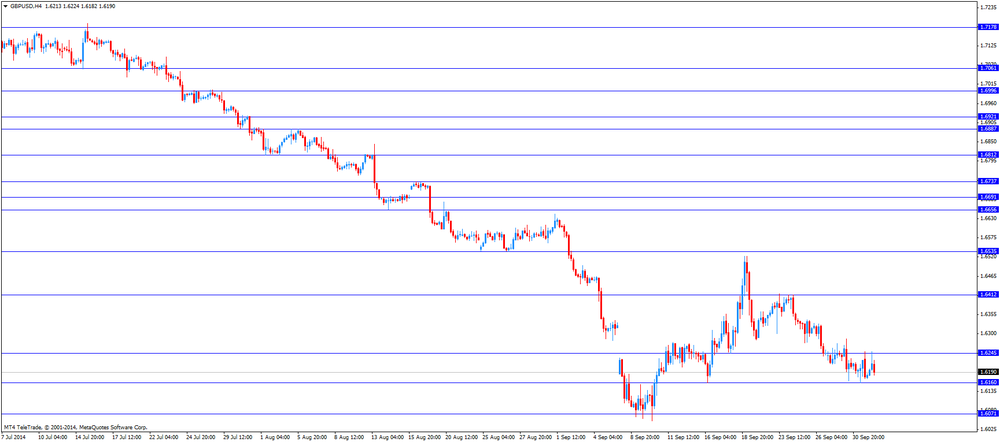

GBP/USD $1,6149 -0,20%

USD/CHF Chf0,9536 -0,28%

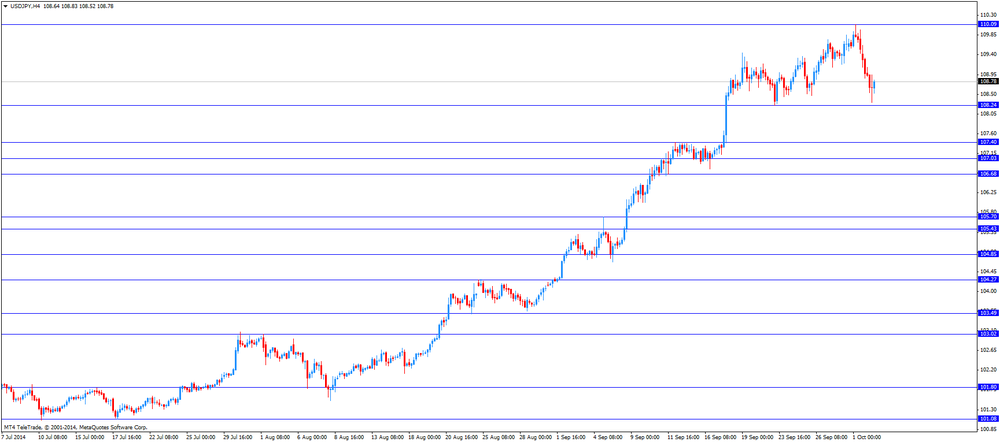

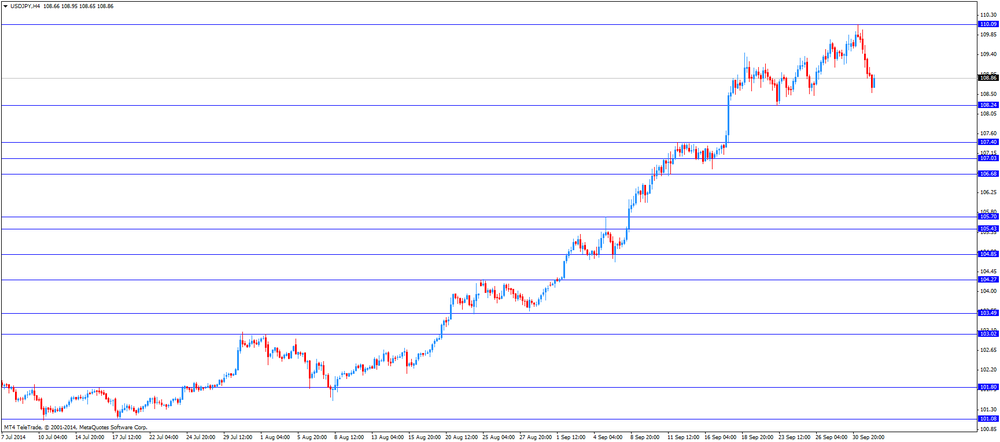

USD/JPY Y108,39 -0,54%

EUR/JPY Y137,33 -0,12%

GBP/JPY Y175,02 -0,75%

AUD/USD $0,8798 +0,75%

NZD/USD $0,7898 +1,48%

USD/CAD C$1,1156 -0,04%

-

23:03

Schedule for today, Friday, Oct 3’2014:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

01:00 China Non-Manufacturing PMI September 54.4

06:00 Germany Bank Holiday

07:50 France Services PMI (Finally) September 50.3 49.4

07:55 Germany Services PMI (Finally) September 54.9 55.4

08:00 Eurozone Services PMI (Finally) September 52.8 52.8

08:30 United Kingdom Purchasing Manager Index Services September 60.5 59.1

09:00 Eurozone Retail Sales (MoM) August -0.4% +0.1%

09:00 Eurozone Retail Sales (YoY) August +0.8% +0.6%

12:30 Canada Trade balance, billions August 2.6 1.5

12:30 U.S. International Trade, bln August -40.5 -41.0

12:30 U.S. Average hourly earnings August +0.2% +0.2%

12:30 U.S. Nonfarm Payrolls September 142 216

12:30 U.S. Unemployment Rate September 6.1% 6.1%

13:45 U.S. Services PMI (Finally) September 58.5 58.5

14:00 U.S. ISM Non-Manufacturing September 59.6 58.5

-

16:38

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the mixed economic data from the U.S.

The U.S. dollar traded mixed to higher against the most major currencies after the number of initial jobless claims and factory orders in the U.S. The number of initial jobless claims in the week ending September 27 fell by 8,000 to 287,000 from 295,000 in the previous week. Analysts had expected the number of initial jobless claims to climb by 4,000 to 299,000 last week.

Factory orders in the U.S. dropped 10.1% in August, missing expectations for a 9.2%, after a 10.5% gain in July.

The euro traded mixed against the U.S. dollar after the European Central Bank's interest decision and press conference. The European Central Bank kept its interest rate unchanged at 0.05%.

The ECB President Mario Draghi said at the press conference that the central bank will start purchasing covered bonds in the second half of October, while the asset-backed securities (ABSs) program will begin before the end of the year. Both programs will last for at least two years.

Draghi pointed out that the economic growth in the Eurozone is weakening.

Eurozone's producer price index fell 0.1% in August, beating forecasts for a 0.2% drop, after a 0.2% decline in July. July's figure was revised down from a 0.1% decrease.

The British pound declined against the U.S. dollar despite the better-than-expected construction purchasing managers' index from U.K. The U.K. construction purchasing managers' index rose to 64.2 in September from 64.0 in August. Analysts had expected the index to decline to 63.7.

The New Zealand dollar traded slightly lower against the U.S. dollar. In the overnight trading session, the kiwi jumped against the greenback due to weaker U.S. dollar. No major economic reports were released in New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie climbed against the U.S. currency due to the solid economic data from Australia. The building permits in Australia rose 3.0% in August, exceeding expectations for a 1.1% increase, after a 2.1% gain in July. July's figure was revised down from a 2.5% rise.

Australia's trade deficit fell to A$0.79 billion in August from A$1.08 billion in July. July's figure was revised from a deficit of A$1.36 billion. Analysts had expected the trade deficit to decline to A$0.78 billion.

The Japanese yen traded higher against the U.S. dollar. Japan's monetary base increased 35.3% in September, missing expectations for a 38.9% rise, after a 40.5% gain in August.

-

15:20

European Central Bank kept its interest rate unchanged

The European Central (ECB) Bank released its interest rate decision today. The ECB its benchmark interest rate unchanged at 0.05%, its marginal lending rate at 0.30% and its deposit facility rate at -0.20%.

The ECB President Mario Draghi said at the press conference that the central bank will start purchasing covered bonds in the second half of October, while the asset-backed securities (ABSs) program will begin before the end of the year. Both programs will last for at least two years.

Draghi pointed out that the economic growth in the Eurozone is weakening.

-

15:00

U.S.: Factory Orders , August -10.1% (forecast -9.2%)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2635(E352mn), $1.2650(E402mn), $1.2700(E1.68bn), $1.2720-25(E440mn)

USD/JPY: Y109.00($291mn), Y109.20($600mn), Y109.95-110.00($441mn)

GBP/USD: $1.6100(stg1.64bn), $1.6200(stg308mn), $1.6240(stg270mn), $1.6265-70(stg319mn), $1.6285(stg181mn)

EUR/GBP: stg0.7730-35(E300mn), Stg0.7820(E300mn), stg0.7840-50(E445mn)

USD/CAD: C$1.1070($322mn), C$1.1150($150mn)

-

13:30

U.S.: Initial Jobless Claims, September 287 (forecast 299)

-

13:02

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar ahead of the European Central Bank’s press conference

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

01:00 Australia HIA New Home Sales, m/m August -5.7%

01:30 Australia Building Permits, y/y August +9.4% +14.5%

01:30 Australia Building Permits, m/m August +2.5% +1.1% +3.0%

01:30 Australia Trade Balance August -1.36 -0.78 -0.79

05:15 Australia RBA Annual Report

08:30 United Kingdom PMI Construction September 64.0 63.7 64.2

09:00 Eurozone Producer Price Index, MoM August -0.1% -0.2% -0.1%

09:00 Eurozone Producer Price Index (YoY) August -1.1% -1.1% -1.4%

11:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.05%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the number of initial jobless claims and factory orders in the U.S. The number of initial jobless claims is expected to climb by 6,000 to 299,000.

Factory orders in the U.S. are expected to drop 9.2% in August, after a 10.5% gain in July.

The euro traded mixed against the U.S. dollar ahead of the European Central Bank's press conference. The European Central Bank kept its interest rate unchanged at 0.05%.

Investors are awaiting the release the size of the ECB's asset-buying program.

Eurozone's producer price index fell 0.1% in August, beating forecasts for a 0.2% drop, after a 0.2% decline in July. July's figure was revised down from a 0.1% decrease.

The British pound dropped against the U.S. dollar despite the better-than-expected construction purchasing managers' index from U.K. The U.K. construction purchasing managers' index rose to 64.2 in September from 64.0 in August. Analysts had expected the index to decline to 63.7.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.6127

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Eurozone ECB Press Conference

12:30 U.S. Initial Jobless Claims September 293 299

14:00 U.S. Factory Orders August +10.5% -9.2%

-

13:00

Orders

EUR/USD

Offers $1.2820/30, $1.2800, $1.2780/85, $1.2760, $1.2700

Bids $1.2560/50, $1.2500

GBP/USD

Offers $1.6425/30, $1.6400/10, $1.6325/30, $1.6285

Bids $1.6160, $1.6100, $1.6050

AUD/USD

Offers $0.8900, $0.8850

Bids $0.8700, $0.8660, $0.8650, $0.8600

EUR/JPY

Offers Y140.00, Y139.70, Y139.10, Y138.80, Y138.00

Bids Y137.25, Y137.00

USD/JPY

Offers Y111.00, Y110.10

Bids Y108.25, Y108.00, Y107.65

EUR/GBP

Offers stg0.7890, stg0.7850, stg0.7830

Bids stg0.7755/45, stg0.7700

-

12:45

Eurozone: ECB Interest Rate Decision, 0.05% (forecast 0.05%)

-

10:29

Option expiries for today's 1400GMT cut

EUR/USD: $1.2635(E352mn), $1.2650(E402mn), $1.2700(E1.68bn), $1.2720-25(E440mn)

USD/JPY: Y109.00($291mn), Y109.20($600mn), Y109.95-110.00($441mn)

GBP/USD: $1.6100(stg1.64bn), $1.6200(stg308mn), $1.6240(stg270mn), $1.6265-70(stg319mn), $1.6285(stg181mn)

EUR/GBP: stg0.7730-35(E300mn), Stg0.7820(E300mn), stg0.7840-50(E445mn)

USD/CAD: C$1.1070($322mn), C$1.1150($150mn)

-

10:18

Foreign exchange market. Asian session: the Australian dollar climbed against the U.S. dollar due to the solid economic data from Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

01:00 Australia HIA New Home Sales, m/m August -5.7%

01:30 Australia Building Permits, y/y August +9.4% +14.5%

01:30 Australia Building Permits, m/m August +2.5% +1.1% +3.0%

01:30 Australia Trade Balance August -1.36 -0.78 -0.79

05:15 Australia RBA Annual Report

08:30 United Kingdom PMI Construction September 64.0 63.7 64.2

09:00 Eurozone Producer Price Index, MoM August -0.1% -0.2% -0.1%

09:00 Eurozone Producer Price Index (YoY) August -1.1% -1.1% -1.4%

The U.S. dollar traded lower against the most major currencies due to yesterday's weaker-than-expected ISM manufacturing purchasing managers' index. The ISM manufacturing purchasing managers' index in the U.S. decreased to 56.6 in September from 59.0 in August, missing expectations for a decline to 58.6.

The New Zealand dollar increased against the U.S. dollar due to weaker U.S. dollar. No major economic reports were released in New Zealand.

The Australian dollar climbed against the U.S. dollar due to the solid economic data from Australia. The building permits in Australia rose 3.0% in August, exceeding expectations for a 1.1% increase, after a 2.1% gain in July. July's figure was revised down from a 2.5% rise.

Australia's trade deficit fell to A$0.79 billion in August from A$1.08 billion in July. July's figure was revised from a deficit of A$1.36 billion. Analysts had expected the trade deficit to decline to A$0.78 billion.

The Japanese yen rose against the U.S. dollar due to the weaker U.S. dollar.

Japan's monetary base increased 35.3% in September, missing expectations for a 38.9% rise, after a 40.5% gain in August.

EUR/USD: the currency pair rose to $1.2673

GBP/USD: the currency pair increased to $1.6249

USD/JPY: the currency pair fell to Y108.54

The most important news that are expected (GMT0):

11:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

12:30 Eurozone ECB Press Conference

12:30 U.S. Initial Jobless Claims September 293 299

14:00 U.S. Factory Orders August +10.5% -9.2%

-

10:00

Eurozone: Producer Price Index, MoM , August -0.1% (forecast -0.2%)

-

10:00

Eurozone: Producer Price Index (YoY), August -1.4% (forecast -1.1%)

-

09:30

United Kingdom: PMI Construction, September 64.2 (forecast 63.7)

-

06:26

Options levels on thursday, October 2, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2807 (2878)

$1.2764 (1817)

$1.2695 (695)

Price at time of writing this review: $ 1.2655

Support levels (open interest**, contracts):

$1.2590 (2996)

$1.2530 (1675)

$1.2490 (1563)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 65303contracts, with the maximum number of contracts with strike price $1,3000 (4936);

- Overall open interest on the PUT options with the expiration date October, 3 is 63335 contracts, with the maximum number of contracts with strike price $1,2600 (6268);

- The ratio of PUT/CALL was 0.97 versus 0.97 from the previous trading day according to data from October, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.6500 (2726)

$1.6400 (1759)

$1.6301 (1692)

Price at time of writing this review: $1.6229

Support levels (open interest**, contracts):

$1.6194 (2579)

$1.6098 (3626)

$1.5999 (2009)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 33083 contracts, with the maximum number of contracts with strike price $1,6700 (3649);

- Overall open interest on the PUT options with the expiration date October, 3 is 42293 contracts, with the maximum number of contracts with strike price $1,6300 (4582);

- The ratio of PUT/CALL was 1.27 versus 1.27 from the previous trading day according to data from October, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:31

Australia: Building Permits, y/y, August +14.5%

-

02:30

Australia: Building Permits, m/m, August +3.0% (forecast +1.1%)

-

02:30

Australia: Trade Balance , August -0.79 (forecast -0.78)

-

00:52

Japan: Monetary Base, y/y, September +35.3% (forecast +38.9%)

-