Notícias do Mercado

-

23:40

Commodities. Daily history for Oct 2'2014:

(raw materials / closing price /% change)

Light Crude 91.40 +0.43%

Gold 1,214.80 -0.02%

-

23:34

Stocks. Daily history for Oct 2'2014:

(index / closing price / change items /% change)

Nikkei 225 15,661.99 -420.26 -2.61%

S&P/ASX 200 5,297.7 -36.43 -0.68%

FTSE 100 6,446.39 -111.13 -1.69%

CAC 40 4,242.67 -122.60 -2.81%

Xetra DAX 9,195.68 -186.35 -1.99%

S&P 500 1,946.17 +0.01 0.00%

NASDAQ Composite 4,430.2 +8.11 +0.18%

Dow Jones 16,801.05 -3.66 -0.02%

-

23:19

Currencies. Daily history for Oct 2'2014:

(pare/closed(GMT +2)/change, %)

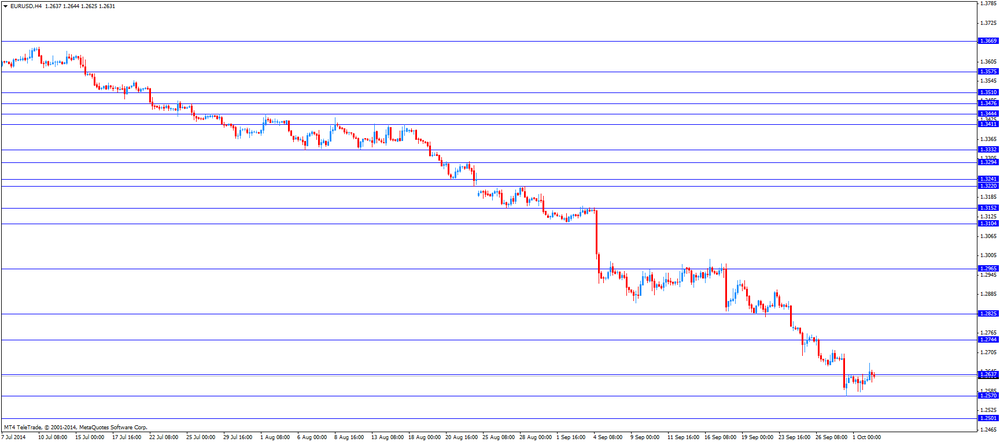

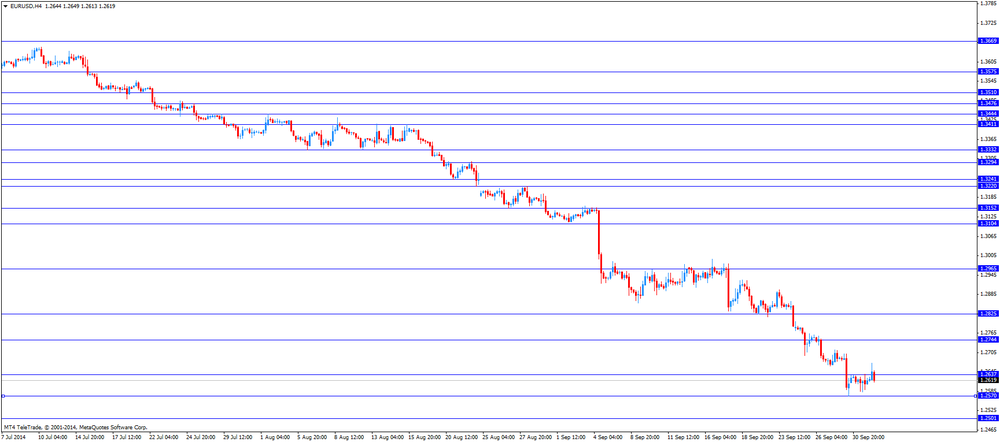

EUR/USD $1,2668 +0,40%

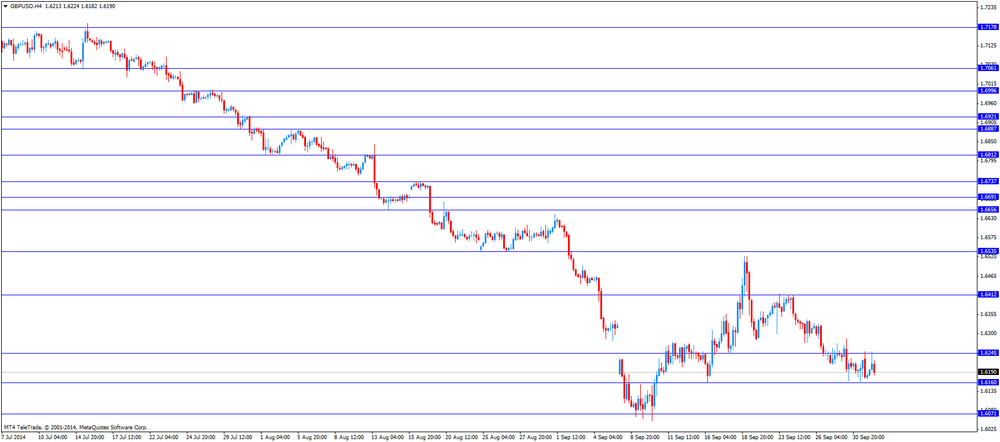

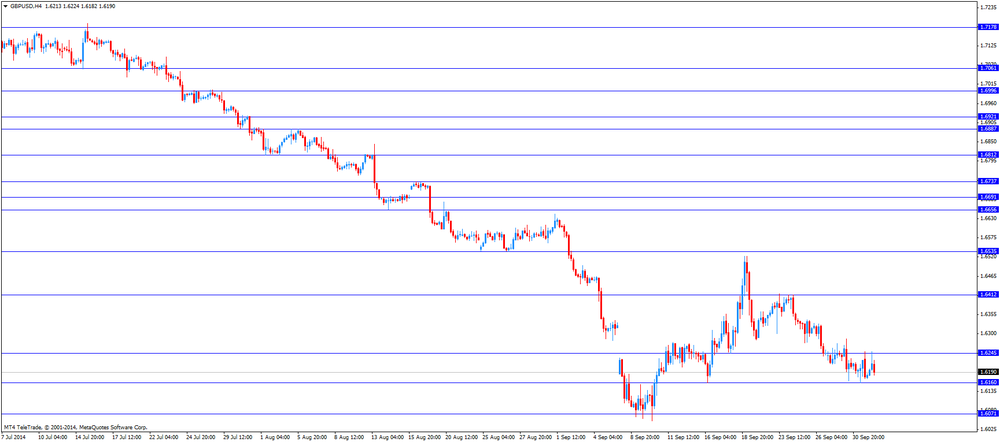

GBP/USD $1,6149 -0,20%

USD/CHF Chf0,9536 -0,28%

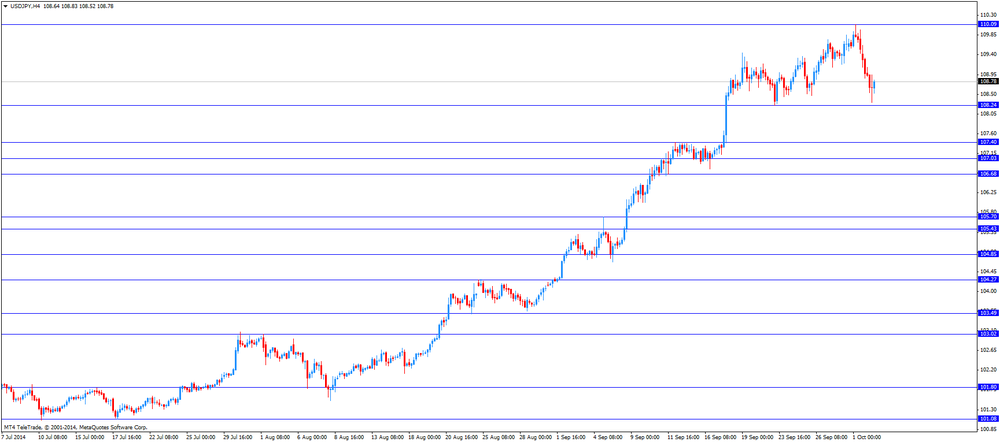

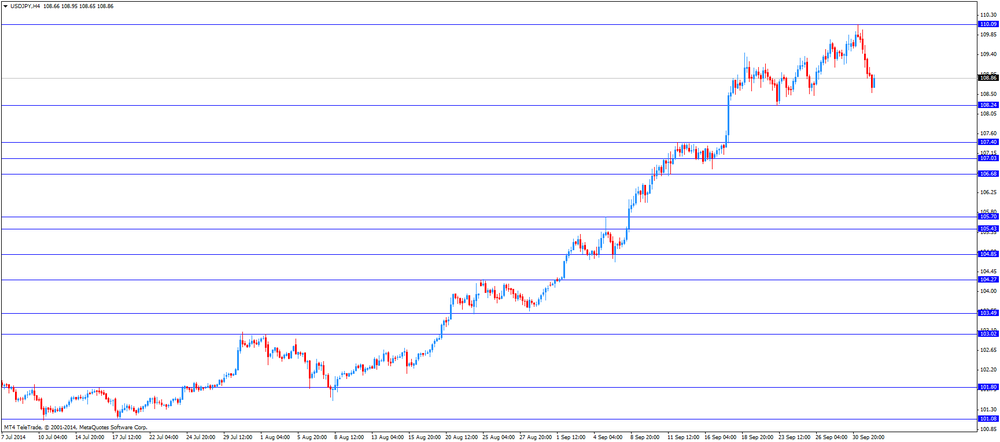

USD/JPY Y108,39 -0,54%

EUR/JPY Y137,33 -0,12%

GBP/JPY Y175,02 -0,75%

AUD/USD $0,8798 +0,75%

NZD/USD $0,7898 +1,48%

USD/CAD C$1,1156 -0,04%

-

23:03

Schedule for today, Friday, Oct 3’2014:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

01:00 China Non-Manufacturing PMI September 54.4

06:00 Germany Bank Holiday

07:50 France Services PMI (Finally) September 50.3 49.4

07:55 Germany Services PMI (Finally) September 54.9 55.4

08:00 Eurozone Services PMI (Finally) September 52.8 52.8

08:30 United Kingdom Purchasing Manager Index Services September 60.5 59.1

09:00 Eurozone Retail Sales (MoM) August -0.4% +0.1%

09:00 Eurozone Retail Sales (YoY) August +0.8% +0.6%

12:30 Canada Trade balance, billions August 2.6 1.5

12:30 U.S. International Trade, bln August -40.5 -41.0

12:30 U.S. Average hourly earnings August +0.2% +0.2%

12:30 U.S. Nonfarm Payrolls September 142 216

12:30 U.S. Unemployment Rate September 6.1% 6.1%

13:45 U.S. Services PMI (Finally) September 58.5 58.5

14:00 U.S. ISM Non-Manufacturing September 59.6 58.5

-

20:00

Dow 16,843.35 +38.64 +0.23%, Nasdaq 4,440.12 +18.03 +0.41%, S&P 500 1,950.82 +4.66 +0.24%

-

17:04

European stocks close: most stocks closed lower after the European Central Bank’s press conference

Stock indices closed lower after the European Central Bank's press conference. The European Central Bank kept its interest rate unchanged at 0.05%.

The ECB President Mario Draghi said at the press conference that the central bank will start purchasing covered bonds in the second half of October, while the asset-backed securities (ABSs) program will begin before the end of the year. Both programs will last for at least two years.

Draghi pointed out that the economic growth in the Eurozone is weakening.

Market participants have concerns over the volume of the ECB's asset-buying program.

Eurozone's producer price index fell 0.1% in August, beating forecasts for a 0.2% drop, after a 0.2% decline in July. July's figure was revised down from a 0.1% decrease.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,446.39 -111.13 -1.69%

DAX 9,195.68 -186.35 -1.99%

CAC 40 4,242.67 -122.60 -2.81%

-

17:00

European stocks closed in minus: FTSE 100 6,455.24 -102.28 -1.56%, CAC 40 4,254.6 -110.67 -2.54%, DAX 9,213.74 -168.29 -1.79%

-

16:40

Oil dropped below $90 for the first time in 17 months

West Texas Intermediate oil dropped below $90 for the first time in 17 months amid signs that global supplies are outstripping demand. Brent, Europe's benchmark, headed for a bear market.

WTI fell as much as 2.8 percent to $88.18 a barrel in New York, bringing the decline to 9.9 percent this year. The U.S. benchmark pared losses. Brent has fallen 20 percent from its peak in June. Prices retreated yesterday after Saudi Arabia, the world's largest oil exporter, cut its official selling price for crude to Asia to the lowest since 2008.

"It's been slaughter the last few days," Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York, said by phone. "Supply has been outpacing demand and that doesn't appear to be changing anytime soon. We finally broke through $90 after yesterday's move by the Saudis showed that they're fighting for market share."

U.S. output will rise next year to the highest since 1970, the Energy Information Administration forecast Sept. 9. The shale boom has turned the U.S. into the world's largest producer of oil liquids, reducing its appetite for imports as global demand growth slows. Losses in WTI below $90 would slow U.S. production, Goldman Sachs Group Inc. said yesterday. Russian data showed the country's output rose to a near post-Soviet era record. Kurdistan's oil production over the next 15 months may increase by more than Chinese demand growth.

WTI for November delivery slipped 48 cents, or 0.5 percent, to $90.26 a barrel at 10:31 a.m. on the New York Mercantile Exchange. It fell below $90 for the first time since April 24, 2013. The volume of all futures traded was more than double the 100-day average for this time of day. Futures declined 13 percent in the three months to Sept. 30, the worst quarterly performance in more than two years.

November gasoline futures fell 5.14 cents, or 2.1 percent, to $2.3983 a gallon on the Nymex. Futures touched $2.387, the lowest level since January 2011. Average pump prices in the U.S. fell to $3.328 a gallon yesterday, the lowest since February, according to the Heathrow, Florida-based American Automobile Association Inc., the nation's largest U.S. motoring group.

Brent for November settlement tumbled $1.33, or 1.4 percent, to $92.83 a barrel on the London-based ICE Futures Europe exchange. It touched $91.55, the lowest since June 28, 2012. Volumes were 48 percent higher than the 100-day average. The grade traded at $2.57 premium to WTI, down from $3.43 at yesterday's close.

-

16:38

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the mixed economic data from the U.S.

The U.S. dollar traded mixed to higher against the most major currencies after the number of initial jobless claims and factory orders in the U.S. The number of initial jobless claims in the week ending September 27 fell by 8,000 to 287,000 from 295,000 in the previous week. Analysts had expected the number of initial jobless claims to climb by 4,000 to 299,000 last week.

Factory orders in the U.S. dropped 10.1% in August, missing expectations for a 9.2%, after a 10.5% gain in July.

The euro traded mixed against the U.S. dollar after the European Central Bank's interest decision and press conference. The European Central Bank kept its interest rate unchanged at 0.05%.

The ECB President Mario Draghi said at the press conference that the central bank will start purchasing covered bonds in the second half of October, while the asset-backed securities (ABSs) program will begin before the end of the year. Both programs will last for at least two years.

Draghi pointed out that the economic growth in the Eurozone is weakening.

Eurozone's producer price index fell 0.1% in August, beating forecasts for a 0.2% drop, after a 0.2% decline in July. July's figure was revised down from a 0.1% decrease.

The British pound declined against the U.S. dollar despite the better-than-expected construction purchasing managers' index from U.K. The U.K. construction purchasing managers' index rose to 64.2 in September from 64.0 in August. Analysts had expected the index to decline to 63.7.

The New Zealand dollar traded slightly lower against the U.S. dollar. In the overnight trading session, the kiwi jumped against the greenback due to weaker U.S. dollar. No major economic reports were released in New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie climbed against the U.S. currency due to the solid economic data from Australia. The building permits in Australia rose 3.0% in August, exceeding expectations for a 1.1% increase, after a 2.1% gain in July. July's figure was revised down from a 2.5% rise.

Australia's trade deficit fell to A$0.79 billion in August from A$1.08 billion in July. July's figure was revised from a deficit of A$1.36 billion. Analysts had expected the trade deficit to decline to A$0.78 billion.

The Japanese yen traded higher against the U.S. dollar. Japan's monetary base increased 35.3% in September, missing expectations for a 38.9% rise, after a 40.5% gain in August.

-

16:20

Gold moderate growth

Gold prices rise restraint, receiving support from a weak production statistics in the United States and the first cases of infection with the Ebola virus, which caused a decline in the stock markets.

Stock markets in Japan and South Korea were down on Thursday, falling European and American markets.

"Given the likelihood of further weakening of the capital markets in conjunction with the still unstable situation in Hong Kong, we would not like to have a short position in gold, because we believe that precious metals will benefit from short covering before the weekend," - said analyst Edward Meir INTL FCStone.

Democracy activists, mostly young people, have been demonstrating for almost a week in Hong Kong, the Chinese government demanding greater freedom, in particular, the opportunity to choose the mayor of Hong Kong. Some banks and financial companies relocation of staff replacement offices on the outskirts of the city, in order to avoid disruptions.

The European Central Bank said today the program of asset purchases to stimulate the economy and inflation in the eurozone. The ECB plans to buy securities backed by assets, loans to help small and medium-sized enterprises, which form the basis of the European economy.

The world's largest reserves of the gold-exchange-traded fund SPDR Gold Trust on Wednesday fell by 1.20 tonnes to 768.66 tonnes - the lowest level since December 2008.

The cost of the December gold futures on the COMEX today rose to 1224.00 dollars per ounce.

-

15:20

European Central Bank kept its interest rate unchanged

The European Central (ECB) Bank released its interest rate decision today. The ECB its benchmark interest rate unchanged at 0.05%, its marginal lending rate at 0.30% and its deposit facility rate at -0.20%.

The ECB President Mario Draghi said at the press conference that the central bank will start purchasing covered bonds in the second half of October, while the asset-backed securities (ABSs) program will begin before the end of the year. Both programs will last for at least two years.

Draghi pointed out that the economic growth in the Eurozone is weakening.

-

15:00

U.S.: Factory Orders , August -10.1% (forecast -9.2%)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD: $1.2635(E352mn), $1.2650(E402mn), $1.2700(E1.68bn), $1.2720-25(E440mn)

USD/JPY: Y109.00($291mn), Y109.20($600mn), Y109.95-110.00($441mn)

GBP/USD: $1.6100(stg1.64bn), $1.6200(stg308mn), $1.6240(stg270mn), $1.6265-70(stg319mn), $1.6285(stg181mn)

EUR/GBP: stg0.7730-35(E300mn), Stg0.7820(E300mn), stg0.7840-50(E445mn)

USD/CAD: C$1.1070($322mn), C$1.1150($150mn)

-

14:34

U.S. Stocks open: Dow 16,779.34 -25.37 -0.15%, Nasdaq 4,423.16 +1.07 +0.02%, S&P 1,945.61 -0.55 -0.03%

-

14:28

Before the bell: S&P futures -0.03%, Nasdaq futures +0.04%

U.S. stock futures are mixed as details of the European Central Bank's stimulus program disappointed investors.

Global markets:

Nikkei 15,661.99 -420.26 -2.61%

FTSE 6,530.61 -26.91 -0.41%

CAC 4,329.95 -35.32 -0.81%

DAX 9,333.04 -48.99 -0.52%

Crude oil $89.47 (-1.40%)

Gold $1213.10 (-0.20%)

-

14:19

DOW components before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

94.20

+0.01%

1.8K

Chevron Corp

CVX

117.75

+0.08%

0.2K

Travelers Companies Inc

TRV

93.22

+0.13%

1.2K

Pfizer Inc

PFE

29.19

+0.14%

0.7K

Verizon Communications Inc

VZ

49.50

+0.14%

1.5K

Wal-Mart Stores Inc

WMT

76.25

+0.17%

2.1K

Intel Corp

INTC

34.05

+0.18%

4.6K

International Business Machines Co...

IBM

187.50

+0.18%

2.8K

Walt Disney Co

DIS

87.65

+0.18%

0.1K

Caterpillar Inc

CAT

97.80

+0.19%

0.2K

Johnson & Johnson

JNJ

104.50

+0.19%

0.5K

Microsoft Corp

MSFT

45.99

+0.20%

3.9K

American Express Co

AXP

86.00

+0.22%

2.8K

General Electric Co

GE

25.22

+0.24%

8.5K

Boeing Co

BA

124.99

+0.26%

3.2K

AT&T Inc

T

35.07

+0.31%

7.4K

Cisco Systems Inc

CSCO

25.14

+0.44%

3.5K

Procter & Gamble Co

PG

83.14

0.00%

0.6K

Nike

NKE

87.68

-0.02%

0.3K

The Coca-Cola Co

KO

42.72

-0.05%

0.7K

3M Co

MMM

139.07

-0.08%

0.3K

Goldman Sachs

GS

180.36

-0.19%

0.1K

JPMorgan Chase and Co

JPM

59.20

-0.29%

11.2K

Exxon Mobil Corp

XOM

92.50

-0.39%

16.1K

Visa

V

209.00

-0.48%

5.0K

E. I. du Pont de Nemours and Co

DD

70.07

-0.58%

0.3K

-

14:08

Upgrades and downgrades before the market open

Upgrades:

Twitter (TWTR) upgraded to Overweight from Neutral at JP Morgan, target raised to $64 from $54

Bank of America (BAC) upgraded to Buy from Neutral at UBS, target raised to $20 from $16

Downgrades:

JPMorgan Chase (JPM) downgraded to Neutral from Buy at UBS

Other:

-

13:30

U.S.: Initial Jobless Claims, September 287 (forecast 299)

-

13:02

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar ahead of the European Central Bank’s press conference

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

01:00 Australia HIA New Home Sales, m/m August -5.7%

01:30 Australia Building Permits, y/y August +9.4% +14.5%

01:30 Australia Building Permits, m/m August +2.5% +1.1% +3.0%

01:30 Australia Trade Balance August -1.36 -0.78 -0.79

05:15 Australia RBA Annual Report

08:30 United Kingdom PMI Construction September 64.0 63.7 64.2

09:00 Eurozone Producer Price Index, MoM August -0.1% -0.2% -0.1%

09:00 Eurozone Producer Price Index (YoY) August -1.1% -1.1% -1.4%

11:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.05%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the number of initial jobless claims and factory orders in the U.S. The number of initial jobless claims is expected to climb by 6,000 to 299,000.

Factory orders in the U.S. are expected to drop 9.2% in August, after a 10.5% gain in July.

The euro traded mixed against the U.S. dollar ahead of the European Central Bank's press conference. The European Central Bank kept its interest rate unchanged at 0.05%.

Investors are awaiting the release the size of the ECB's asset-buying program.

Eurozone's producer price index fell 0.1% in August, beating forecasts for a 0.2% drop, after a 0.2% decline in July. July's figure was revised down from a 0.1% decrease.

The British pound dropped against the U.S. dollar despite the better-than-expected construction purchasing managers' index from U.K. The U.K. construction purchasing managers' index rose to 64.2 in September from 64.0 in August. Analysts had expected the index to decline to 63.7.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.6127

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Eurozone ECB Press Conference

12:30 U.S. Initial Jobless Claims September 293 299

14:00 U.S. Factory Orders August +10.5% -9.2%

-

13:00

Orders

EUR/USD

Offers $1.2820/30, $1.2800, $1.2780/85, $1.2760, $1.2700

Bids $1.2560/50, $1.2500

GBP/USD

Offers $1.6425/30, $1.6400/10, $1.6325/30, $1.6285

Bids $1.6160, $1.6100, $1.6050

AUD/USD

Offers $0.8900, $0.8850

Bids $0.8700, $0.8660, $0.8650, $0.8600

EUR/JPY

Offers Y140.00, Y139.70, Y139.10, Y138.80, Y138.00

Bids Y137.25, Y137.00

USD/JPY

Offers Y111.00, Y110.10

Bids Y108.25, Y108.00, Y107.65

EUR/GBP

Offers stg0.7890, stg0.7850, stg0.7830

Bids stg0.7755/45, stg0.7700

-

12:45

Eurozone: ECB Interest Rate Decision, 0.05% (forecast 0.05%)

-

12:00

European stock markets mid session: stocks traded little changed ahead of the European Central Bank’s interest decision

Stock indices traded little changed ahead of the European Central Bank's interest decision. Analysts expect that European Central Bank (ECB) will keep its interest rate unchanged.

Investors are awaiting the release the size of the ECB's asset-buying program.

Eurozone's producer price index fell 0.1% in August, beating forecasts for a 0.2% drop, after a 0.2% decline in July. July's figure was revised down from a 0.1% decrease.

Current figures:

Name Price Change Change %

FTSE 6,542.18 -15.34 -0.23%

DAX 9,374.34 -7.69 -0.08%

CAC 40 4,352.53 -12.74 -0.29%

-

10:59

Asian Stocks close: Japanese stocks closed lower due to stronger yen

Japanese stocks closed lower due to stronger yen. The Japanese yen rose against the U.S. dollar as yesterday's weaker-than-expected ISM manufacturing purchasing managers' index weighed on the greenback. The ISM manufacturing purchasing managers' index in the U.S. decreased to 56.6 in September from 59.0 in August, missing expectations for a decline to 58.6.

Japan's monetary base increased 35.3% in September, missing expectations for a 38.9% rise, after a 40.5% gain in August.

Markets in Hong Kong are closed until Friday, while markets in Shanghai are closed until October 7 for a public holiday.

Indexes on the close:

Nikkei 225 15,661.99 -420.26 -2.61%

Hang Seng closed

Shanghai Composite closed

-

10:29

Option expiries for today's 1400GMT cut

EUR/USD: $1.2635(E352mn), $1.2650(E402mn), $1.2700(E1.68bn), $1.2720-25(E440mn)

USD/JPY: Y109.00($291mn), Y109.20($600mn), Y109.95-110.00($441mn)

GBP/USD: $1.6100(stg1.64bn), $1.6200(stg308mn), $1.6240(stg270mn), $1.6265-70(stg319mn), $1.6285(stg181mn)

EUR/GBP: stg0.7730-35(E300mn), Stg0.7820(E300mn), stg0.7840-50(E445mn)

USD/CAD: C$1.1070($322mn), C$1.1150($150mn)

-

10:18

Foreign exchange market. Asian session: the Australian dollar climbed against the U.S. dollar due to the solid economic data from Australia

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

01:00 Australia HIA New Home Sales, m/m August -5.7%

01:30 Australia Building Permits, y/y August +9.4% +14.5%

01:30 Australia Building Permits, m/m August +2.5% +1.1% +3.0%

01:30 Australia Trade Balance August -1.36 -0.78 -0.79

05:15 Australia RBA Annual Report

08:30 United Kingdom PMI Construction September 64.0 63.7 64.2

09:00 Eurozone Producer Price Index, MoM August -0.1% -0.2% -0.1%

09:00 Eurozone Producer Price Index (YoY) August -1.1% -1.1% -1.4%

The U.S. dollar traded lower against the most major currencies due to yesterday's weaker-than-expected ISM manufacturing purchasing managers' index. The ISM manufacturing purchasing managers' index in the U.S. decreased to 56.6 in September from 59.0 in August, missing expectations for a decline to 58.6.

The New Zealand dollar increased against the U.S. dollar due to weaker U.S. dollar. No major economic reports were released in New Zealand.

The Australian dollar climbed against the U.S. dollar due to the solid economic data from Australia. The building permits in Australia rose 3.0% in August, exceeding expectations for a 1.1% increase, after a 2.1% gain in July. July's figure was revised down from a 2.5% rise.

Australia's trade deficit fell to A$0.79 billion in August from A$1.08 billion in July. July's figure was revised from a deficit of A$1.36 billion. Analysts had expected the trade deficit to decline to A$0.78 billion.

The Japanese yen rose against the U.S. dollar due to the weaker U.S. dollar.

Japan's monetary base increased 35.3% in September, missing expectations for a 38.9% rise, after a 40.5% gain in August.

EUR/USD: the currency pair rose to $1.2673

GBP/USD: the currency pair increased to $1.6249

USD/JPY: the currency pair fell to Y108.54

The most important news that are expected (GMT0):

11:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

12:30 Eurozone ECB Press Conference

12:30 U.S. Initial Jobless Claims September 293 299

14:00 U.S. Factory Orders August +10.5% -9.2%

-

10:00

Eurozone: Producer Price Index, MoM , August -0.1% (forecast -0.2%)

-

10:00

Eurozone: Producer Price Index (YoY), August -1.4% (forecast -1.1%)

-

09:30

United Kingdom: PMI Construction, September 64.2 (forecast 63.7)

-

06:26

Options levels on thursday, October 2, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2807 (2878)

$1.2764 (1817)

$1.2695 (695)

Price at time of writing this review: $ 1.2655

Support levels (open interest**, contracts):

$1.2590 (2996)

$1.2530 (1675)

$1.2490 (1563)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 65303contracts, with the maximum number of contracts with strike price $1,3000 (4936);

- Overall open interest on the PUT options with the expiration date October, 3 is 63335 contracts, with the maximum number of contracts with strike price $1,2600 (6268);

- The ratio of PUT/CALL was 0.97 versus 0.97 from the previous trading day according to data from October, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.6500 (2726)

$1.6400 (1759)

$1.6301 (1692)

Price at time of writing this review: $1.6229

Support levels (open interest**, contracts):

$1.6194 (2579)

$1.6098 (3626)

$1.5999 (2009)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 33083 contracts, with the maximum number of contracts with strike price $1,6700 (3649);

- Overall open interest on the PUT options with the expiration date October, 3 is 42293 contracts, with the maximum number of contracts with strike price $1,6300 (4582);

- The ratio of PUT/CALL was 1.27 versus 1.27 from the previous trading day according to data from October, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:01

Nikkei 225 15,818.56 -263.69 -1.64%, S&P/ASX 200 5,306.4-27.73 -0.52%

-

02:31

Australia: Building Permits, y/y, August +14.5%

-

02:30

Australia: Building Permits, m/m, August +3.0% (forecast +1.1%)

-

02:30

Australia: Trade Balance , August -0.79 (forecast -0.78)

-

00:52

Japan: Monetary Base, y/y, September +35.3% (forecast +38.9%)

-