Notícias do Mercado

-

19:30

American focus : the euro fell against the U.S. dollar

The dollar has increased markedly against the euro , reaching with the highest value for the month. In the absence of key U.S. reports the focus of investors were speeches by Fed officials at a conference in Philadelphia , including Lacker and Plosser .

" The U.S. Federal Reserve is facing serious challenges when it comes to folding the current program of" cheap money " eventually . Perhaps she will have to raise short-term rates faster than many expect , " warned the president of the Federal Reserve Bank of Philadelphia Charles Plosser .

Although Plosser said that the central bank is on the verge of a rate hike from the current very low levels , he pointed out that the Fed sees a wide range of sources of uncertainty as to what the outcome of this process . Plosser has long been skeptical about the Fed's ongoing program of bond purchases , and it worried how long short-term interest rates are at very low levels .

Regarding Lacker speech , he noted that the Fed's decision to start rolling incentive was true . Moreover , he added that the Fed should monitor inflation now . Note that Lacker expects inflation to the target level of the Fed , is 2 %

He also said that further minimize the incentive should be on the agenda at the next Fed meeting . According to him , the growth of the U.S. economy in 2014 will be at the level of 2%.

Of particular interest will be Bernanke , who will leave his post on January 31 , giving him Janet Yellen . Before the publication of the last meeting next week the markets will wait hints at the future of folding . Recall that at the December meeting of the Central Bank minimized program to $ 10 billion to $ 75 billion , as reasons for calling the economic growth forecast. It is expected that further Fed QE again reduce by 10 billion U.S. dollars , completing it by December 2014 .

Pound was down against the U.S. dollar , which was associated with the release of UK data , which showed that activity in the UK construction sector has increased the eighth consecutive month in December , the pace close to a six-year highs due to the emergence of new companies and the growth of confidence in late 2013 .

The continuing increase in construction work in all three sectors : residential , commercial and civil engineering , followed by growth in the manufacturing sector , suggesting that the British economy ended the year on the rise.

PMI was 62.1 in December from 62.6 in November. A reading above 50 indicates growth in activity , while below shows the reduction of activity in the sector . Balance is calculated by subtracting the number of respondents who reported falling activity, the number of those who celebrate the increase . Commercial construction is growing at the fastest pace since August 2007 .

The Swiss franc fell against the U.S. dollar reacted so weak Swiss data . It is learned that manufacturing activity in Switzerland in December remained in positive territory , but at a lower level . This indicates a slowing business in this country. These data were presented with Credit Suisse.

Purchasing Managers Index (PMI) in Switzerland in December fell to 53.9 points from 56.5 points in November . This figure is the lowest since June, when the index stood at 51.9 . Nevertheless , despite the recession , PMI remains above the threshold of 50 points the ninth consecutive month , indicating growth. The index remained above the threshold of 50 points within 11 months of 2013, indicating a recovery in Switzerland , partly due to the lower limit of 1.20 francs per euro set by the Swiss National Bank , which eased the pressure on exporters , limiting force franc. Switzerland also supported the partial recovery in the euro area , which is the largest export partner of this country.

-

16:00

U.S.: Crude Oil Inventories, December -7.0

-

13:40

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3700

USD/JPY Y104.00, Y105.00

GBP/USD $1.6400

AUD/USD $0.8940, $0.8950

AUD/NZD NZ$1.0860

USD/CAD C$1.0600, C$1.0625, C$1.0640, C$1.0680

-

13:20

European session: the euro fell

07:00 United Kingdom Nationwide house price index December +0.7% Revised From +0.6% +0.8% +1.4%

07:00 United Kingdom Nationwide house price index, y/y December +6.5% +7.1% +8.4%

08:00 Switzerland KOF Leading Indicator December 1.85 1.92 1.95

08:30 Switzerland Manufacturing PMI December 56.5 56.4 53.9

09:00 Eurozone M3 money supply, adjusted y/y November +1.4% +1.5% +1.5%

09:30 United Kingdom PMI Construction December 62.6 62.3 62.1

09:30 United Kingdom BOE Credit Conditions Survey Quarter IV

09:30 United Kingdom Net Lending to Individuals, bln November 1.7 2.0 0.91

09:30 United Kingdom Mortgage Approvals November 67.7 69.7 70.8

Тhe euro is trading slightly lower against the U.S. dollar , amid reducing lending to the private sector in the euro area . Overall eurozone money supply grew slightly faster pace in November , data showed the European Central Bank . Annual M3 growth at 1.5 per cent in November compared with 1.4 percent in October. Annual growth rate of M1 amounted to 6.5 per cent in November.

Loans to the private sector decreased by 2.3 percent year on year in November , after falling 2.2 percent in October. Meanwhile, loans to households increased by 0.1 per cent per annum after 0.2 percent growth in the previous month . Annual growth rate of lending for house purchase , the most important component of household loans amounted to 0.9 percent in November , unchanged compared with the previous month . Loans to non-monetary financial intermediaries except insurance corporations and pension funds , fell 9.1 percent from a year earlier in November. This followed a decline of 8 percent in the previous month .

In the absence of key U.S. reports the focus of investors will be performances by the Fed at a conference in Philadelphia , including Plosser , Stein and Ben Bernanke. Jeffrey Lacker will speak separately in Baltimore.

Of particular interest is Bernanke , who will leave his post on January 31 , giving him Janet Yellen . Before the publication of the last meeting next week the markets will wait hints at the future of folding . Recall that at the December meeting of the Central Bank minimized program to $ 10 billion to $ 75 billion , as reasons for calling the economic growth forecast. It is expected that further Fed QE again reduce by 10 billion U.S. dollars , completing it by December 2014 .

Previously pound rose against the U.S. dollar after the release of data on business activity in the construction sector. Activity in the UK construction sector has increased the eighth consecutive month in December , the pace close to a six-year highs due to the emergence of new companies and the growth of confidence in late 2013 .

The continuing increase in construction work in all three sectors : residential , commercial and civil engineering , followed by growth in the manufacturing sector , suggesting that the British economy ended the year on the rise.

PMI was 62.1 in December from 62.6 in November. A reading above 50 indicates growth in activity , while below shows the reduction of activity in the sector . Balance is calculated by subtracting the number of respondents who reported falling activity, the number of those who celebrate the increase .

Commercial construction is growing at the fastest pace since August 2007 . " The latest survey stresses that developers come in 2014 with the wind in their sails , - said Chris Williamson , chief economist at Markit. - More than half of all respondents anticipate an increase in the level of production in 2014 , instead of 1/3 at the same time a year ago. "

Increased activity also increased job creation the seventh consecutive month , emphasizing strengthening confidence in the sector.

EUR / USD: during the European session, the pair fell to $ 1.3627

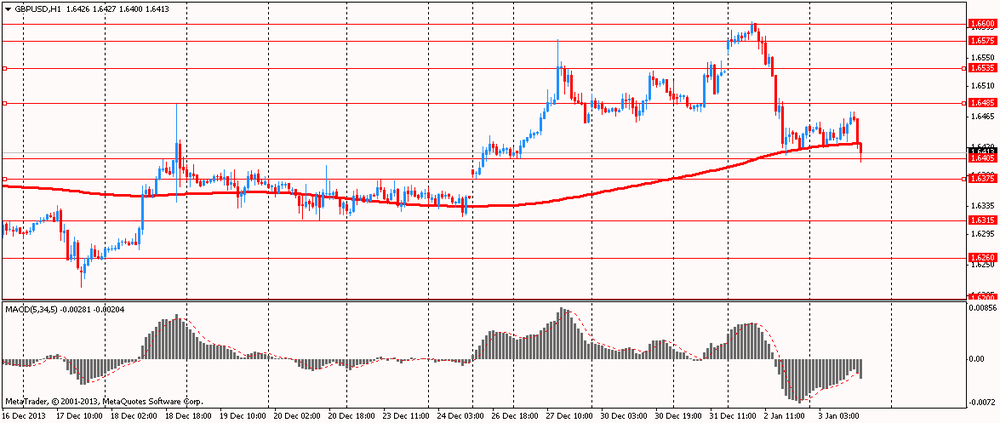

GBP / USD: during the European session, the pair rose to $ 1.6472 , and then fell to $ 1.6400

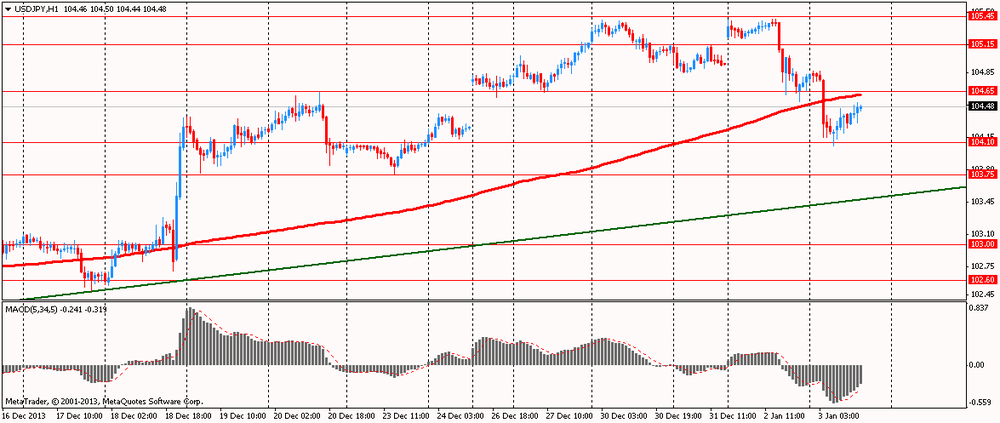

USD / JPY: during the European session, the pair rose to Y104.53

-

13:00

Orders

EUR/USD

Offers $1.3810-20, $1.3770/80, $1.3750, $1.3720/25, $1.3700/05, $1.3680

Bids $1.3610/00

AUD/USD

Offers $0.9020, $0.9000

Bids $0.8955/50, $0.8925/20, $0.8900, $0.8825/20, $0.8800

GBP/USD

Offers $1.6615/20, $1.6560, $1.6530/35, $1.6500/10, $1.6480/85

Bids $1.6410/00, $1.6380/70, $1.6355/50, $1.6320/15, $1.6300

EUR/GBP

Offers stg0.8370/80, stg0.8350, stg0.8330/35, stg0.8300

Bids stg0.8260/50, stg0.8250, stg0.8220, stg0.8205/00

USD/JPY

Offers Y106.00, Y105.80, Y105.45/50, Y105.00, Y104.60

Bids Y104.10/00, Y103.80/75, Y103.50, Y103.20-00, Y102.60/50

EUR/JPY

Offers Y146.50, Y146.00, Y145.70/80, Y144.80/85, Y144.30/35, Y143.90/4.00, Y143.50

Bids Y142.10/00, Y141.70, Y141.00/0.90, Y140.20/00

-

10:24

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3700, $1.3735, $1.3750, $1.3800

USD/JPY Y105.00, Y105.25, Y106.00

GBP/USD $1.6510

USD/CHF Chf0.8900, Chf0.8950

AUD/USD $0.8840, $0.8940, $0.8950

AUD/NZD NZ$1.0860

USD/CAD C$1.0860

-

09:31

United Kingdom: Net Lending to Individuals, bln, November 0.91 (forecast 2.0)

-

09:30

United Kingdom: PMI Construction, December 62.1 (forecast 62.3)

-

09:30

United Kingdom: Mortgage Approvals, November 70.8 (forecast 69.7)

-

09:00

Eurozone: M3 money supply, adjusted y/y, November +1.5% (forecast +1.5%)

-

08:30

Switzerland: Manufacturing PMI, December 53.9 (forecast 56.4)

-

08:00

Switzerland: KOF Leading Indicator, December 1.95 (forecast 1.92)

-

07:15

Asian session: The yen and Australian dollar were set for the biggest weekly gains

01:00 China Non-Manufacturing PMI December 56.0 54.6

The yen and Australian dollar, the two worst-performing major currencies in 2013, were set for the biggest weekly gains in more than two months on signs their recent declines may have been too rapid.

Japan’s currency headed for gains versus most major peers this week amid speculation the nation’s investors will repatriate earnings.

The euro was set for a weekly drop on bets policy makers will add to measures supporting growth. ECB President Mario Draghi surprised investors in November by cutting the euro region’s main interest rate to a record 0.25 percent. He and his board will probably hold borrowing costs when they next gather on Jan. 9, according to the median estimate of economists surveyed by Bloomberg.

The extra yield 10-year U.S. Treasuries offered over similar government debt for Germany, the euro region’s biggest economy, was near a seven-year high before Federal Reserve Chairman Ben S. Bernanke speaks today and European Central Bank officials meet next week. Bernanke is scheduled to make remarks today at an economics conference in Philadelphia, as is Philadelphia Fed President Charles Plosser.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3645-70

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6420-60

USD / JPY: on Asian session the pair fell to Y104.05

UK data begins with the release of Nationwide house prices at 0700GMT, with UK construction PMI due at 0930GMT along with UK lending data. -

07:00

United Kingdom: Nationwide house price index , December +1.4% (forecast +0.8%)

-

07:00

United Kingdom: Nationwide house price index, y/y, December +8.4% (forecast +7.1%)

-

06:26

Currencies. Daily history for Jan 2'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3671 -0,72%

GBP/USD $1,6451 -0,49%

USD/CHF Chf0,8989 +0,86%

USD/JPY Y104,80 -0,13%

EUR/JPY Y143,24 -0,87%

GBP/JPY Y172,41 -0,61%

AUD/USD $0,8909 -0,27%

NZD/USD $0,8183 -0,42%

USD/CAD C$1,0669 +0,31%

-

06:00

Schedule for today, Friday, Jan 3’2013:

01:00 China Non-Manufacturing PMI December 56.0

07:00 United Kingdom Nationwide house price index December +0.6% +0.8%

07:00 United Kingdom Nationwide house price index, y/y December +6.5% +7.1%

08:00 Switzerland KOF Leading Indicator December 1.85 1.92

08:30 Switzerland Manufacturing PMI December 56.5 56.4

09:00 Eurozone M3 money supply, adjusted y/y November +1.4% +1.5%

09:30 United Kingdom PMI Construction December 62.6 62.3

09:30 United Kingdom BOE Credit Conditions Survey Quarter IV

09:30 United Kingdom Net Lending to Individuals, bln November 1.7 2.0

09:30 United Kingdom Mortgage Approvals November 67.7 69.7

16:00 U.S. Crude Oil Inventories December -4.7

19:30 U.S. Fed Chairman Bernanke Speaks

-