Notícias do Mercado

-

20:00

Dow +57.77 16,499.12 +0.35% Nasdaq -2.35 4,140.72 -0.06% S&P +3.51 1,835.49 +0.19%

-

19:30

American focus : the euro fell against the U.S. dollar

The dollar has increased markedly against the euro , reaching with the highest value for the month. In the absence of key U.S. reports the focus of investors were speeches by Fed officials at a conference in Philadelphia , including Lacker and Plosser .

" The U.S. Federal Reserve is facing serious challenges when it comes to folding the current program of" cheap money " eventually . Perhaps she will have to raise short-term rates faster than many expect , " warned the president of the Federal Reserve Bank of Philadelphia Charles Plosser .

Although Plosser said that the central bank is on the verge of a rate hike from the current very low levels , he pointed out that the Fed sees a wide range of sources of uncertainty as to what the outcome of this process . Plosser has long been skeptical about the Fed's ongoing program of bond purchases , and it worried how long short-term interest rates are at very low levels .

Regarding Lacker speech , he noted that the Fed's decision to start rolling incentive was true . Moreover , he added that the Fed should monitor inflation now . Note that Lacker expects inflation to the target level of the Fed , is 2 %

He also said that further minimize the incentive should be on the agenda at the next Fed meeting . According to him , the growth of the U.S. economy in 2014 will be at the level of 2%.

Of particular interest will be Bernanke , who will leave his post on January 31 , giving him Janet Yellen . Before the publication of the last meeting next week the markets will wait hints at the future of folding . Recall that at the December meeting of the Central Bank minimized program to $ 10 billion to $ 75 billion , as reasons for calling the economic growth forecast. It is expected that further Fed QE again reduce by 10 billion U.S. dollars , completing it by December 2014 .

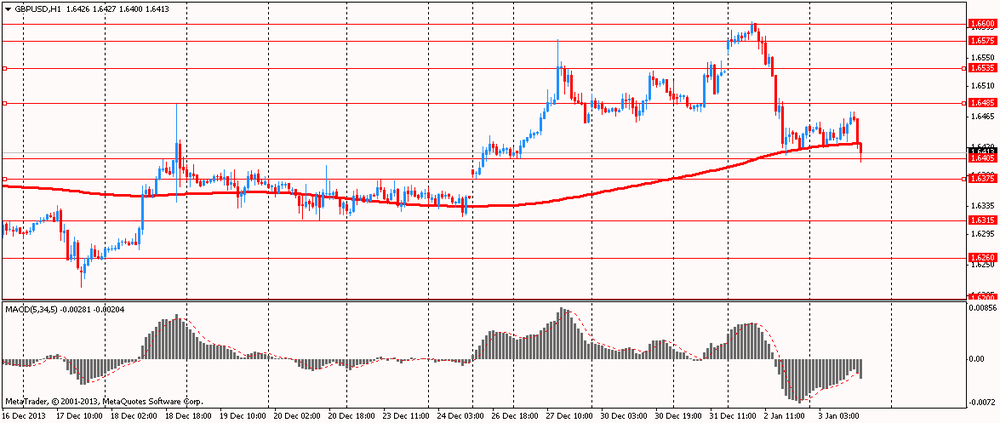

Pound was down against the U.S. dollar , which was associated with the release of UK data , which showed that activity in the UK construction sector has increased the eighth consecutive month in December , the pace close to a six-year highs due to the emergence of new companies and the growth of confidence in late 2013 .

The continuing increase in construction work in all three sectors : residential , commercial and civil engineering , followed by growth in the manufacturing sector , suggesting that the British economy ended the year on the rise.

PMI was 62.1 in December from 62.6 in November. A reading above 50 indicates growth in activity , while below shows the reduction of activity in the sector . Balance is calculated by subtracting the number of respondents who reported falling activity, the number of those who celebrate the increase . Commercial construction is growing at the fastest pace since August 2007 .

The Swiss franc fell against the U.S. dollar reacted so weak Swiss data . It is learned that manufacturing activity in Switzerland in December remained in positive territory , but at a lower level . This indicates a slowing business in this country. These data were presented with Credit Suisse.

Purchasing Managers Index (PMI) in Switzerland in December fell to 53.9 points from 56.5 points in November . This figure is the lowest since June, when the index stood at 51.9 . Nevertheless , despite the recession , PMI remains above the threshold of 50 points the ninth consecutive month , indicating growth. The index remained above the threshold of 50 points within 11 months of 2013, indicating a recovery in Switzerland , partly due to the lower limit of 1.20 francs per euro set by the Swiss National Bank , which eased the pressure on exporters , limiting force franc. Switzerland also supported the partial recovery in the euro area , which is the largest export partner of this country.

-

18:20

European stock close

European stocks advanced, paring a weekly drop for the benchmark Stoxx Europe 600 Index, as Next Plc led retailers higher and investors awaited a speech by Federal Reserve Chairman Ben S. Bernanke.

The Stoxx 600 added 0.5 percent to 327.53 at 4:30 p.m. in London and was little changed for the week. The gauge rallied 17 percent last year as central banks around the world left interest rates low and the Fed’s decision to slow the pace of its stimulus booster investor confidence in the U.S. recovery.

Bernanke will address the annual meeting of the American Economic Association at 2:30 p.m. in Philadelphia, four weeks before the end of his tenure as the head of the U.S. central bank. Fed Bank of Philadelphia President Charles Plosser will also speak at the event. Investors will watch the speeches for clues on the direction of the monetary policy as the Fed begins tapering its bond purchases.

In Spain, registered unemployment fell by 107,570 people in December, the country’s labor ministry said in Madrid. That was largest drop since June. In China, a report showed services growth fell in December to the slowest in four months.

National benchmarks rose in all the 18 western European markets.

FTSE 100 6,730.67 +12.76 +0.19% CAC 40 4,247.65 +20.37 +0.48% DAX 9,435.15 +35.11 +0.37%

Next climbed 10 percent to 6,085 pence, its highest price since at least 1988, according to data compiled by Bloomberg. The U.K.’s second-largest clothing retailer said pretax profit for the year ending this month will be 684 million pounds ($1.1 billion) to 700 million pounds. That compares with its forecast in October for earnings of 650 million pounds to 680 million pounds. Next said it will pay a special dividend of 50 pence a share on Feb. 3.

Marks & Spencer Group Plc rose 4 percent to 444.3 pence, it biggest increase since Nov. 5. Debenhams Plc, which slumped 12 percent on Dec. 31 after predicting a decline in first-half profit, added 3.8 percent to 78 pence today. A gauge of European retailers posted the biggest rally among the 19 industry groups in the Stoxx 600, climbing 1.4 percent.

Schroders gained 1.3 percent to 2,640 pence after Barclays upgraded the asset-management company to overweight, a rating similar to buy, from underweight, which corresponds to a sell recommendation. U.K. asset managers are set to benefit from a bullish outlook for equities in 2014, according to Barclays.

Telecom Italia SpA increased 7.2 percent to 76 euro cents after a report its largest owner is advancing a plan to sell the company’s Brazilian business to competitors. Telefonica SA is close to setting up a financial vehicle to split Tim Participacoes SA and sell it to rivals Vivo Participacoes SA, Oi SA and Carlos Slim’s Claro, Il Sole 24 Ore said.

Remy Cointreau (RCO), the producer of Remy Martin cognac, slipped 2.5 percent to 58.93 euros after the resignation of Pflanz, who will remain at the company as development director. Pflanz will have responsibility for assignments that he has already started, Remy Cointreau said.

-

17:00

European stock close: FTSE 100 6,730.67 +12.76 +0.19% CAC 40 4,247.65 +20.37 +0.48% DAX 9,435.15 +35.11 +0.37%

-

16:40

Oil: an overview of the market situation

Oil prices fell today , while dropping to one-month low (mark WTI), after a report showed that inventories of gasoline and distillates rose , and production increased .

Futures fell 1.1 percent after the Energy Department data on changes in stocks in the week December 23-29 showed that:

- Oil reserves fell by 7.007 million barrels to 360.567 million barrels ;

- Gasoline inventories rose by 0.844 million barrels . to 220.716 million barrels . ;

- Distillate stocks increased by 5.042 million barrels . to 119.147 million barrels .

- Refining capacity utilization rate of 92.4 % against 92.7 % a week earlier .

Distillate stocks are forecast should grow by 750 thousand , while gasoline inventories had to climb the 1,000 barrels , according to the average of eight analysts in the survey responses . Gasoline stocks are projected to increase 1.38 million As for oil , they are estimated to have been reduced by 2.83 million In addition, it was reported that U.S. production increased by 10,000 barrels per day to 8.12 million barrels , while reaching the highest level since 1988.

Price dynamics also affect the growth expectations of the Libyan demand. Libya hopes to resume production at one of its largest oilfields - El Shararah west of the country , within three days after the protesters agreed to suspend their two-month strike .

Experts note that the increase in oil exports from OPEC , which has fallen to less than 250,000 barrels per day from 1.4 million barrels per day in July , will stimulate supply and put pressure on prices.

February futures price of U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 94.49 a barrel on the New York Mercantile Exchange.

February futures price for North Sea Brent crude oil mixture fell $0.75 to $107.07 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices rose moderately today , reaching in this two-week high as traders began to return to the market after prices fell to a six-month low . We add that the weakness in the stock market has also stimulated demand for the metal as a safe haven . Who sent the precious metal to its largest weekly increase since October , after fixing its biggest annual decline in 32 years.

Analysts warn, however , that the upward momentum in the first days of the new year may last only a few weeks, after which prices continue to decline, and will close in 2014 another drop . Recall that during quantitative easing by the U.S. central bank have been favorable for gold , keeping interest rates and stoking inflation fears . But with the improvement of the U.S. labor market and other positive signs in the economy , the Fed decided to fold stimulation, which negatively affected the attractiveness of gold.

Meanwhile , we add that the rise in prices helps active demand for the precious metal in China

" Trading volume is slowly recovering as traders return from the holidays, and talks about the major Chinese purchases of gold coming from Hong Kong, improved mood , helping rally in Asian session " , - said Joyce Liu of Phillip Futures. She believes that gold prices will meet resistance at 1244 dollars per ounce , which can be tested for strength later on Friday . However, in the medium term, analysts remain negative expectations regarding gold prices.

The course of trade also affected the data for China , which showed that the index measuring the non-productive business activity amounted to a seasonally adjusted 54.6 in December.

The main indicator remains above the neutral mark of 50 that separates expansion from contraction, although the value has declined sharply in December from 56.0 in November.

Cost February gold futures on the COMEX today rose to $ 1235.70 per ounce.

-

16:00

U.S.: Crude Oil Inventories, December -7.0

-

14:34

U.S. Stocks open: Dow 16,467.75 +26.40 +0.16%, Nasdaq 4,146.34 +3.27 +0.08%, S&P 1,834.27 +2.29 +0.13%

-

14:24

Before the bell: S&P futures +0.17%, Nasdaq futures +0.06%

U.S. stock futures rose, as investors waited on a speech from Federal Reserve Chairman Ben Bernanke for clues on the econonmy’s strength.

Global markets:

Nikkei 16,291.31 +112.37 +0.69%

Hang Seng 22,817.28 -522.77 -2.24%

Shanghai Composite 2,083.14 -26.25 -1.24%

FTSE 6,737.01 +19.10 +0.28%

CAC 4,249.73 +22.45 +0.53%

DAX 9,431.7 +31.66 +0.34%

Crude oil $95.38 (-0.06%).

Gold $1229.30 (+0.33%).

-

13:40

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3700

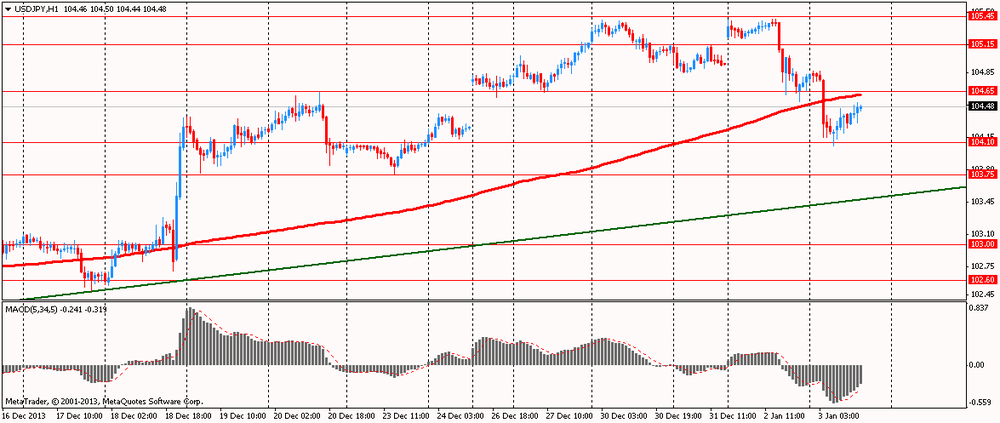

USD/JPY Y104.00, Y105.00

GBP/USD $1.6400

AUD/USD $0.8940, $0.8950

AUD/NZD NZ$1.0860

USD/CAD C$1.0600, C$1.0625, C$1.0640, C$1.0680

-

13:20

European session: the euro fell

07:00 United Kingdom Nationwide house price index December +0.7% Revised From +0.6% +0.8% +1.4%

07:00 United Kingdom Nationwide house price index, y/y December +6.5% +7.1% +8.4%

08:00 Switzerland KOF Leading Indicator December 1.85 1.92 1.95

08:30 Switzerland Manufacturing PMI December 56.5 56.4 53.9

09:00 Eurozone M3 money supply, adjusted y/y November +1.4% +1.5% +1.5%

09:30 United Kingdom PMI Construction December 62.6 62.3 62.1

09:30 United Kingdom BOE Credit Conditions Survey Quarter IV

09:30 United Kingdom Net Lending to Individuals, bln November 1.7 2.0 0.91

09:30 United Kingdom Mortgage Approvals November 67.7 69.7 70.8

Тhe euro is trading slightly lower against the U.S. dollar , amid reducing lending to the private sector in the euro area . Overall eurozone money supply grew slightly faster pace in November , data showed the European Central Bank . Annual M3 growth at 1.5 per cent in November compared with 1.4 percent in October. Annual growth rate of M1 amounted to 6.5 per cent in November.

Loans to the private sector decreased by 2.3 percent year on year in November , after falling 2.2 percent in October. Meanwhile, loans to households increased by 0.1 per cent per annum after 0.2 percent growth in the previous month . Annual growth rate of lending for house purchase , the most important component of household loans amounted to 0.9 percent in November , unchanged compared with the previous month . Loans to non-monetary financial intermediaries except insurance corporations and pension funds , fell 9.1 percent from a year earlier in November. This followed a decline of 8 percent in the previous month .

In the absence of key U.S. reports the focus of investors will be performances by the Fed at a conference in Philadelphia , including Plosser , Stein and Ben Bernanke. Jeffrey Lacker will speak separately in Baltimore.

Of particular interest is Bernanke , who will leave his post on January 31 , giving him Janet Yellen . Before the publication of the last meeting next week the markets will wait hints at the future of folding . Recall that at the December meeting of the Central Bank minimized program to $ 10 billion to $ 75 billion , as reasons for calling the economic growth forecast. It is expected that further Fed QE again reduce by 10 billion U.S. dollars , completing it by December 2014 .

Previously pound rose against the U.S. dollar after the release of data on business activity in the construction sector. Activity in the UK construction sector has increased the eighth consecutive month in December , the pace close to a six-year highs due to the emergence of new companies and the growth of confidence in late 2013 .

The continuing increase in construction work in all three sectors : residential , commercial and civil engineering , followed by growth in the manufacturing sector , suggesting that the British economy ended the year on the rise.

PMI was 62.1 in December from 62.6 in November. A reading above 50 indicates growth in activity , while below shows the reduction of activity in the sector . Balance is calculated by subtracting the number of respondents who reported falling activity, the number of those who celebrate the increase .

Commercial construction is growing at the fastest pace since August 2007 . " The latest survey stresses that developers come in 2014 with the wind in their sails , - said Chris Williamson , chief economist at Markit. - More than half of all respondents anticipate an increase in the level of production in 2014 , instead of 1/3 at the same time a year ago. "

Increased activity also increased job creation the seventh consecutive month , emphasizing strengthening confidence in the sector.

EUR / USD: during the European session, the pair fell to $ 1.3627

GBP / USD: during the European session, the pair rose to $ 1.6472 , and then fell to $ 1.6400

USD / JPY: during the European session, the pair rose to Y104.53

-

13:00

Orders

EUR/USD

Offers $1.3810-20, $1.3770/80, $1.3750, $1.3720/25, $1.3700/05, $1.3680

Bids $1.3610/00

AUD/USD

Offers $0.9020, $0.9000

Bids $0.8955/50, $0.8925/20, $0.8900, $0.8825/20, $0.8800

GBP/USD

Offers $1.6615/20, $1.6560, $1.6530/35, $1.6500/10, $1.6480/85

Bids $1.6410/00, $1.6380/70, $1.6355/50, $1.6320/15, $1.6300

EUR/GBP

Offers stg0.8370/80, stg0.8350, stg0.8330/35, stg0.8300

Bids stg0.8260/50, stg0.8250, stg0.8220, stg0.8205/00

USD/JPY

Offers Y106.00, Y105.80, Y105.45/50, Y105.00, Y104.60

Bids Y104.10/00, Y103.80/75, Y103.50, Y103.20-00, Y102.60/50

EUR/JPY

Offers Y146.50, Y146.00, Y145.70/80, Y144.80/85, Y144.30/35, Y143.90/4.00, Y143.50

Bids Y142.10/00, Y141.70, Y141.00/0.90, Y140.20/00

-

11:30

European stocks advanced

European stocks advanced, paring a weekly loss, as Next Plc led retailers higher. U.S. equity-index futures were little changed, while Asian shares declined.

Services growth in China fell in December to the slowest in four months, data showed today. A purchasing managers’ index for the non-manufacturing industries fell to 54.6 from 56 in November, a report the Beijing-based National Bureau of Statistics and the China Federation of Logistics and Purchasing showed. A figure above 50 indicates expansion.

Next climbed 9.7 percent to 6,065 pence, its highest price since at least 1988, according to data compiled by Bloomberg. The U.K.’s second-largest clothing retailer raised its full-year forecast and announced a special dividend after holiday sales exceeded the company’s expectations.

Schroders Plc gained 1.5 percent to 2,643 pence, rising for a ninth day. Barclays Plc upgraded the asset-management company to overweight, a rating similar to buy, from underweight, which corresponds to a sell recommendation.

Remy Cointreau, the producer of Remy Martin cognac, slipped 2.2 percent to 59.11 euros after the resignation of Pflanz, who will remain in the company as development director. Pflanz will have responsibility for assignments that he has already started, Remy Cointreau said.

FTSE 100 6,728.36 +10.45 +0.16%

CAC 40 4,247.8 +20.52 +0.49%

DAX 9,423.15 +23.11 +0.25%

-

10:24

Option expiries for today's 1400GMT cut

EUR/USD $1.3600, $1.3700, $1.3735, $1.3750, $1.3800

USD/JPY Y105.00, Y105.25, Y106.00

GBP/USD $1.6510

USD/CHF Chf0.8900, Chf0.8950

AUD/USD $0.8840, $0.8940, $0.8950

AUD/NZD NZ$1.0860

USD/CAD C$1.0860

-

09:59

Asia Pacific stocks close

Asian stocks fell, with a regional benchmark index heading for its biggest decline in three weeks, after U.S. equities retreated from record highs and a gauge of China’s non-manufacturing industries declined.

Nikkei 225 Closed

Hang Seng 22,792.99 -547.06 -2.34%

S&P/ASX 200 5,350.1 -17.81 -0.33%

Shanghai Composit Closed

Industrial & Commercial Bank of China Ltd., the nation’s biggest lender, dropped 2.5 percent in Hong Kong.

Woodside Petroleum Ltd., Australia’s second-largest oil and gas producer, fell 1.1 percent in Sydney after crude futures traded near a month low.

Celltrion Inc. jumped 6.4 percent after the South Korean arthritis drug maker said its No. 1 shareholder was in talks with potential buyers.

-

09:31

United Kingdom: Net Lending to Individuals, bln, November 0.91 (forecast 2.0)

-

09:30

United Kingdom: PMI Construction, December 62.1 (forecast 62.3)

-

09:30

United Kingdom: Mortgage Approvals, November 70.8 (forecast 69.7)

-

09:00

Eurozone: M3 money supply, adjusted y/y, November +1.5% (forecast +1.5%)

-

08:47

FTSE 100 6,699.55 -18.36 -0.27%, CAC 40 4,229.77 +2.49 +0.06%, Xetra DAX 9,368.75 -31.29 -0.33%

-

08:30

Switzerland: Manufacturing PMI, December 53.9 (forecast 56.4)

-

08:00

Switzerland: KOF Leading Indicator, December 1.95 (forecast 1.92)

-

07:15

Asian session: The yen and Australian dollar were set for the biggest weekly gains

01:00 China Non-Manufacturing PMI December 56.0 54.6

The yen and Australian dollar, the two worst-performing major currencies in 2013, were set for the biggest weekly gains in more than two months on signs their recent declines may have been too rapid.

Japan’s currency headed for gains versus most major peers this week amid speculation the nation’s investors will repatriate earnings.

The euro was set for a weekly drop on bets policy makers will add to measures supporting growth. ECB President Mario Draghi surprised investors in November by cutting the euro region’s main interest rate to a record 0.25 percent. He and his board will probably hold borrowing costs when they next gather on Jan. 9, according to the median estimate of economists surveyed by Bloomberg.

The extra yield 10-year U.S. Treasuries offered over similar government debt for Germany, the euro region’s biggest economy, was near a seven-year high before Federal Reserve Chairman Ben S. Bernanke speaks today and European Central Bank officials meet next week. Bernanke is scheduled to make remarks today at an economics conference in Philadelphia, as is Philadelphia Fed President Charles Plosser.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3645-70

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6420-60

USD / JPY: on Asian session the pair fell to Y104.05

UK data begins with the release of Nationwide house prices at 0700GMT, with UK construction PMI due at 0930GMT along with UK lending data. -

07:00

United Kingdom: Nationwide house price index , December +1.4% (forecast +0.8%)

-

07:00

United Kingdom: Nationwide house price index, y/y, December +8.4% (forecast +7.1%)

-

06:26

Commodities. Daily history for Jan 2’2013:

Gold $1224.00 +21.70 +1.8%

Oil $95.64 -2.78 -2.82%

-

06:26

Stocks. Daily history for Jan 2’2013:

Nikkei 225 Closed

Hang Seng 23,340.05 +33.66 +0.14%

S&P/ASX 200 5,367.91 +15.70 +0.29%

Shanghai Composit Closed

FTSE 100 6,717.91 -31.18 -0.46%

CAC 40 4,227.28 -68.67 -1.60%

DAX 9,400.04 -152.12 -1.59%

Dow -130.43 16,446.23 -0.79%

Nasdaq -33.55 4,143.04 -0.80%

S&P -16.12 1,832.24 -0.87%

-

06:26

Currencies. Daily history for Jan 2'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3671 -0,72%

GBP/USD $1,6451 -0,49%

USD/CHF Chf0,8989 +0,86%

USD/JPY Y104,80 -0,13%

EUR/JPY Y143,24 -0,87%

GBP/JPY Y172,41 -0,61%

AUD/USD $0,8909 -0,27%

NZD/USD $0,8183 -0,42%

USD/CAD C$1,0669 +0,31%

-

06:00

Schedule for today, Friday, Jan 3’2013:

01:00 China Non-Manufacturing PMI December 56.0

07:00 United Kingdom Nationwide house price index December +0.6% +0.8%

07:00 United Kingdom Nationwide house price index, y/y December +6.5% +7.1%

08:00 Switzerland KOF Leading Indicator December 1.85 1.92

08:30 Switzerland Manufacturing PMI December 56.5 56.4

09:00 Eurozone M3 money supply, adjusted y/y November +1.4% +1.5%

09:30 United Kingdom PMI Construction December 62.6 62.3

09:30 United Kingdom BOE Credit Conditions Survey Quarter IV

09:30 United Kingdom Net Lending to Individuals, bln November 1.7 2.0

09:30 United Kingdom Mortgage Approvals November 67.7 69.7

16:00 U.S. Crude Oil Inventories December -4.7

19:30 U.S. Fed Chairman Bernanke Speaks

-