Notícias do Mercado

-

23:58

Japan's Kato: Country not using foreign exchange policy to weaken Yen

Japan's Finance Minister, Katsunobu Kato, said early Tuesday that the country is not devaluing the Japanese Yen.

Key quotes

Japan is not pursuing a policy of devaluaing the Yen.

I have confirmed with US Treasury Secretary Bessent our basic stance on forex.

I won't comment on foreign leaders have to say.Market reaction

At the press time, the USD/JPY pair is down 0.12% on the day to trade at 149.25.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

-

23:56

GBP/USD rallies on a moment of Greenback weakness, but tensions remains high

- GBP/USD rose nearly a full percent on Monday.

- US President Donald Trump continues to explore tariff threats, but lacks action.

- ANother NFP Friday looms ahead as markets hope for more tariff walkbacks.

GBP/USD rose on Monday, buoyed by a broadly-underbid US Dollar and a latent recovery in Pound Sterling flows. The pair is knocking back into the 1.2700 handle, with price action continuing to get mired in the 200-day Exponential Moving Average (EMA).

US President Donald Trump reiterated his threats to impose a 25% tariff package on Canada and Mexico on Monday, which are set to automatically go into effect at midnight EST Tuesday morning. Markets have gotten used to President Trump kicking the can on his own policy threats since taking office in January, but this time may turn out to be different and general market sentiment is wobbling.

Data remains limited this week on the UK side of the economic data docket, leaving markets to toil under the burden of tariff threats, as well as a looming Friday Nonfarm Payrolls (NFP) print due at the end of the week.

Trader confidence in the US economy has grown shaky quite quickly, and investors will be watching this week’s NFP jobs print with a keen eye. However, a smattering of Federal Reserve (Fed) policymakers will be making public appearances throughout the week, and US ISM Services Purchasing Managers Index (PMI) Services figures are due on Wednesday. According to a sampling of key business operators, business activity expectations for March shrank slightly, with the ISM Manufacturing PMI falling to 50.3. The economic indicator is still holding above the key 50.0 level that typically separates contraction versus expansion expectations, but the one-month fall from February’s 50.9 accelerated through median market forecasts of a slight trim to 50.5.

GBP/USD price forecast

GBP/USD is trading back into the 200-day EMA once again, testing chart paper near the 1.2700 handle. Cable has skidded sideways recently, with price action getting squeezed between the 200-day EMA and the 50-day EMA near 1.2540.

Bullish momentum has been a steady force since GBP/USD bottomed out at 1.2100 in January, but topside momentum looks about over. Cable traders remain unwilling to sell off enough to kick off a fresh leg lower, but a fresh push into bull country looks unlikely with technical oscillators stuck in overbought territory.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

-

23:52

Japan Monetary Base (YoY) climbed from previous -2.5% to -1.8% in February

-

23:50

Japan Capital Spending came in at -0.2%, below expectations (4.9%) in 4Q

-

23:30

Japan Jobs / Applicants Ratio registered at 1.26 above expectations (1.25) in January

-

23:30

Japan Unemployment Rate registered at 2.5% above expectations (2.4%) in January

-

23:26

OPEC+ sets to raise oil output in April following extended cuts

The Organization of the Petroleum Exporting Countries Plus (OPEC+) said it will proceed with a plan to increase oil production from April. This increase follows a series of output cuts made by OPEC+ to stabilize the market, per Financial Times

Market reaction

At the time of writing, the WTI price is trading around $68.10, down 0.05% on the day.

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

-

23:09

USD/JPY Price Forecast: Struggles on weak US data, tariff woes

- Momentum remains bearish, with key support at 149.00 and 148.57.

- JPY strengthens as safe-haven demand rises amid US trade tensions.

- A rebound above 150.00 could open the door for 151.14 and 152.38.

The USD/JPY begins Tuesday’s Asian session unchanged after registering losses of 0.74% on Monday. Soft US data and tariffs on Mexico, Canada, and China beginning on March 4 keep the Greenback on the backfoot against most G7 currencies. The pair trades at 149.59, up 0.06%.

USD/JPY Price Forecast: Technical outlook

After posting solid gains in the last week, the USD/JPY began the current one negatively as Japanese Yen (JPY) buyers entered the market at a better price. This followed an eight-day rally that witnessed an appreciation of 3.87% for the JPY, which drove the pair from 154.55 to 148.57.

Momentum remains tilted to the downside, as depicted by the Relative Strength Index (RSI). With that said, the USD/JPY's first support would be 149.00. Once surpassed, the next stop would be the February 25 low of 148.57, followed by the September 30 swing low of 141.64.

On the other hand, if USD/JPY recovers and climbs past 150.00, look for a retest of the Senkou Span A at 151.14 before challenging the Kijun-sen at 152.38.

USD/JPY Price Chart – Daily

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

-

23:04

USD/CAD extends the rally to near 1.4500 as Trump confirms tariffs

- USD/CAD gains momentum to near 1.4490 in Monday’s late American session.

- Trump said that tariffs on Canada and Mexico will go into effect on Tuesday, denting hopes of another reprieve.

- US ISM Manufacturing PMI declined to 50.3 in February vs. 50.9 prior, weaker than expected.

The USD/CAD pair extends its upside to around 1.4490 during the late American session on Monday. The Canadian Dollar (CAD) weakens to near a one-month low against the Greenback as US President Donald Trump was due to place 25% tariffs on Canadian goods, with the exception of a 10% levy on energy goods, by Tuesday.

Trump confirmed on Monday that tariffs on Canada and Mexico would go into effect on Tuesday. Trump had previously reaffirmed the new March date after having initially set it for April. Fresh tariff threats from Trump exert some selling pressure on the Loonie.

Additionally, a fall in crude oil prices on reports OPEC+ will proceed with a planned oil output increase in April and worries that a trade war could hurt the global economy also weigh on the commodity-linked Canadian Dollar. It’s worth noting that Canada is the largest oil exporter to the United States (US), and lower crude oil prices tend to have a negative impact on the CAD value.

On the other hand, the weaker US Dollar (USD) after weaker US economic data might cap the upside for the pair. Data released by the Institute for Supply Management (ISM) on Monday showed that the US Manufacturing Purchasing Managers' Index (PMI) eased to 50.3 in February from 50.9 in January. This figure came in weaker than the expectation of 50.5.Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

-

23:00

South Korea Service Sector Output fell from previous 1.7% to -0.8% in January

-

23:00

South Korea Industrial Output Growth registered at -2.3% above expectations (-3.1%) in January

-

23:00

South Korea Industrial Output (YoY) came in at -4.1%, below expectations (-2%) in January

-

22:40

Crude Oil backslides after OPEC announces production increase, WTI eases to $68

- Crude Oil markets declined on Monday, sending WTI 2.5% lower.

- OPEC has announced a tentative agreement to begin increasing production.

- Challenges still lie ahead, as many OPEC members rely on high barrel prices.

West Texas Intermediate (WTI) Crude Oil prices took a tumble on Monday, falling 2.5% at the outset of the new trading week after the Organization of the Petroleum Exporting Countries (OPEC) announced a tentative agreement to begin ramping up Crude Oil production globally. OPEC has had trouble convincing its own cartel members of following through with production quotas; historically, OPEC member states are either desperate to sell more Crude Oil at any price so they can fund their government spending, or prefer to wait out low-production periods in order to bolster barrel prices, and thus raise Crude Oil prices.

According to OPEC’s announcement, the global oil cartel is due to begin a “gradual and flexible” increase of voluntary production caps in April, but with the caveat attached that this move is entirely dependent on a positive global growth outlook and “healthy market fundamentals”, which is typically code for “rising Crude Oil demand.”

US President Donald Trump has been pursuing lower Crude Oil prices as a part of his campaign platform, and OPEC appears set to throw the US President a bone. However, OPEC gave itself an out, noting that OPEC reserves the right to “pause or reverse the decision based on market conditions”.

WTI price forecast

Monday’s sharp decline in WTI prices has pushed US Crude Oil barrel bids into fresh 12-week lows near $68.25. WTI has declined for the past six straight weeks, and Monday’s early declines put US Crude Oil prices on pace for a seventh week of weakness.

WTI bids are reeling following a technical rejection from the 50-day Exponential Moving Average (EMA) near $71.50, and January’s bullish push back above the 200-day EMA at the 73.00 handle has fizzled into a fresh bearish trend.

WTI daily chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

-

22:20

Canadian Dollar falls again as tariff threats loom

- The Canadian Dollar lost nearly half of a percent on Monday at its lowest.

- The Loonie has shed weight against the Greenback for seven straight sessions.

- Canadian PMI figures widely missed the mark, signaling risk of recession.

The Canadian Dollar (CAD) turned tail and ran from the Greenback on Monday, backsliding around one-fifth of one percent after plumbing the depths of a seventh straight bearish session. The Loonie is broadly backsliding as fresh threats of a 25% tariff package on all Canadian goods came from the social media of US President Donald Trump.

President Trump issued threats of steep tariff packages on some of the US’ closest trading allies at the start of his presidency, but after kicking the can repeatedly since January Donald Trump looks set to finally make good on his threat to “punish” foreign countries he has decreed as “taking advantage” of the US by steeply taxing his own constituents. Donald Trump’s tariffs exist in a particular quantum state, where they are both meant to change other countries’ trade behaviour, but are also meant to shore up US government finances, which are facing steep deficits if President Trump’s planned tax and government revenue cuts go through, which are poised to add trillions of dollars to the US government deficit in the coming years.

Daily digest market movers: Fresh tariff threats pummel Canadian Dollar

- The Canadian Dollar is poised for a return to multi-year lows as Loonie weakness pushes USD/CAD back into the 1.4500 region.

- President Trump reiterated his intent to begin 25% tariffs on US imports from Canada on Tuesday.

- The Organization of the Petroleum Exporting Countries (OPEC) also tentatively announced a production limit increase in the coming months, further suppressing the Loonie.

- Canadian officials already have retaliatory tariffs and punitive economic actions prepared for US consumers if tariffs go ahead this week.

- According to Donald Trump, further “reciprocal tariffs” are also slated to begin in April.

- Adding insult to injury, Canadian Purchasing Managers Index (PMI) Manufacturing figures for March declined sharply to 47.8, entirely missing the forecast uptick from 51.6 to 51.9. The survey results index has fallen to its lowest level in a little over a year as recession fears loom over businesses in the face of potential steep trade tariffs.

Canadian Dollar price forecast

Fresh weakness in the Canadian Dollar has bullied USD/CAD higher, clipping into a seventh straight gaining session as the Greenback climbs against the Loonie. After a brief recovery from multi-year highs in January, the Canadian Dollar has resumed waffling against the US Dollar, dragging USD/CAD back into the 1.4500 handle.

The pair is trending back above the 50-day Exponential Moving Average (EMA) near 1.4300, but technical oscillators are beginning to pivot in overbought territory in a clear signal of potential exhaustion. While it’s unlikely that a fresh bout of bullish momentum behind the Loonie will fundamentally change the ongoing trend, a brief pullback period could be on the cards.

USD/CAD daily chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

-

22:14

Silver Price Forecast: XAG/USD surges past $31.50 on soft USD

- XAG/USD reclaims $31.50, as tariff uncertainty lifts demand.

- Silver rebounds after dipping below 50-day SMA, now targeting $32.00.

- Trump confirms March 4 tariffs on Mexico, Canada, and China, fueling safe-haven demand.

- A daily close above $31.50 could pave the way for a retest of $33.20.

Silver price recovers, climbs above the $31.50 mark on Monday as the Greenback depreciates sharply across the board. Tariffs on Mexico, Canada and China would begin on March 4, according to US President Donald Trump in a press conference held at the Oval Office. This and the drop in US Treasury bond yields keep XAG/USD trading at $31.67, gaining over 1.76%.

XAG/USD Price Forecast: Technical outlook

Silver price rebound after dipping below the 50-day Simple Moving Average (SMA) of $30.93, before reclaiming $31.00. On its way to the current spot price, XAG/USD climbed past the 100-day SMA at $31.21, exacerbating Silver’s advance past the $31.50 area.

If XAG/USD closes on a daily basis above the latter, it would be poised to challenge key resistance levels like the $32.00 mark, and the February 20 peak at $33.20.

Conversely, if XAG/USD drops below $31.50, the immediate support would be the 50-day SMA, followed by the 200-day SMA at $30.43.

XAG/USD Price Chart – Daily

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

-

21:47

NZD/USD Price Analysis: Kiwi steadies after a prolonged sell-off but downside risks persist

- NZD/USD edged higher, pausing its five-day losing streak, but gains remain limited.

- After losing the 20-day SMA and reaching its lowest level since mid-February, the pair stabilized as selling pressure eased.

- Resistance is seen at 0.5680, while support lies near 0.5580; indicators suggest a fragile recovery.

NZD/USD posted a mild gain on Monday after a prolonged losing streak, as the pair found some stability following its recent sell-off. Despite the brief upside move, the broader trend remains bearish, with the pair trading well below the 20-day Simple Moving Average (SMA). The downtrend has been reinforced by technical signals, suggesting that any bullish attempt might face strong resistance.

Momentum indicators highlight the fragility of the recovery. The Relative Strength Index (RSI) is turning higher but remains in negative territory, indicating that selling pressure is not yet fully exhausted. Meanwhile, the Moving Average Convergence Divergence (MACD) has crossed below its signal line, a bearish development that hints at continued downside risks.

From a technical perspective, the pair now faces immediate resistance at 0.5680, aligning with the 20-day SMA. A sustained move above this level could provide some breathing room for the bulls. On the downside, support emerges near 0.5580, a level that, if breached, could accelerate declines toward the 0.5540 region.

NZD/USD daily chart

-

21:34

AUD/JPY Price Analysis: Volatile session sees gains erased as key support holds

- AUD/JPY saw a choppy session, briefly rising to 94.00 before retreating back toward 93.00.

- The pair remains near its lowest levels since mid-September, with indicators suggesting potential consolidation.

- Key support holds around 93.00, while resistance at 94.00 remains a hurdle for bulls.

The AUD/JPY pair experienced a volatile trading session, initially climbing towards 94.00 before reversing and retreating back near 93.00. This price action highlights continued uncertainty in the market, with sellers stepping in at higher levels to cap bullish attempts. Despite the intraday fluctuations, the pair remains near multi-month lows, suggesting that bearish sentiment still lingers.

From a technical standpoint, the Relative Strength Index (RSI) remains in a near-oversold zone, reflecting weak upside momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram prints flat red bars, signaling a pause in selling pressure but no decisive shift toward bullish control.

Looking ahead, the pair is currently testing support around 93.00, a key level that has held so far. A break below this area could intensify losses, exposing 92.50 as the next downside target. On the upside, resistance at 94.00 continues to limit bullish advances. A decisive push above this level could encourage buyers and open the door toward 94.50.

AUD/JPY daily chart

-

20:44

Gold price rallies on haven demand amid trade and geopolitical tensions

- XAU/USD climbs to $2,888 as markets brace for tariffs, weaker US growth

- Gold snaps a two-day losing streak as risk-off sentiment drives safe-haven flows.

- Trump’s tariff threats, clash with Zelenskyy fuel market uncertainty.

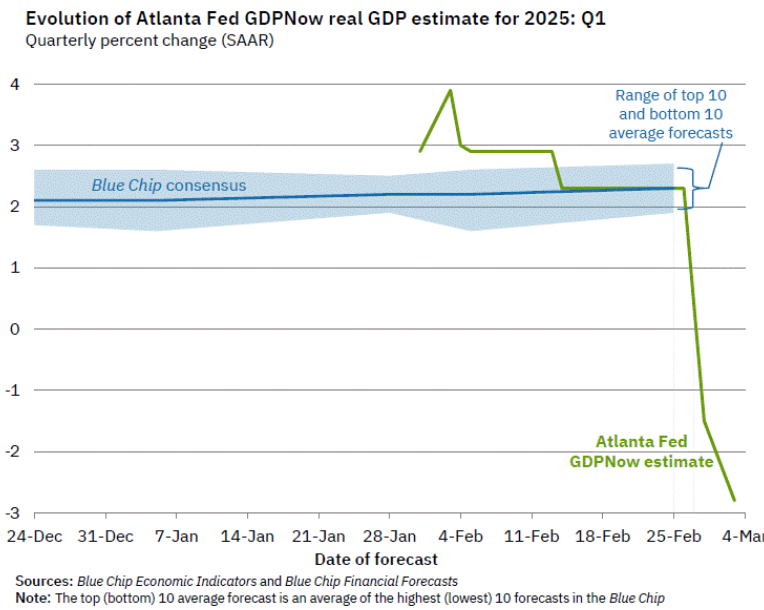

- Atlanta Fed GDP Now forecast plunges to -2.8%, boosts Gold’s appeal.

Gold price is rallying over 1% on Monday, snapping two days of losses as the Greenback gets battered due to safe-haven demand and falling United States (US) Treasury bond yields. Geopolitical tensions and tariff threats by US President Donald Trump increased demand for the safety appeal of Bullion. XAU/USD trades at $2,888 at the time of writing.

Risk appetite deteriorated following the clash between US President Donald Trump and Ukrainian President Volodymir Zelenskyy last Friday. In the meantime, tariffs imposed on Mexico, Canada and China are expected to kick in on Tuesday.

Data-wise, business activity in the manufacturing sector in February was mixed, with S&P Global improving, while the ISM dipped but continued to expand.

In the meantime, the last round of US economic data pushed the Atlanta GDP Now Q1 2025 forecast model further deep into negative territory from -1.6% on February 28 to -2.8% as of writing.

Source: GDPNow

Therefore, traders seeking safety bought Bullion pushing prices on the way towards $2,900. The US 10-year Treasury note falls two basis points (bps) down to 4.176% levels last seen in December 2024.

Alongside the data, St. Louis Fed President Alberto Musalem said the economic outlook is for continued solid economic growth, but recent data pose some downside risks.

Daily digest market movers: Gold price surges amid pessimistic US economic outlook

- US real yields, as measured by the yield in the US 10-year Treasury Inflation-Protected Securities (TIPS), tumble almost three bps to 1.808%.

- The US ISM Manufacturing PMI for February held steady at 50.3, slightly down from 50.9 and below the 50.5 forecast, indicating a mild slowdown in business activity.

- S&P Global Manufacturing PMI showed improvement, rising to 52.7 from 51.2, surpassing expectations of 51.6, signaling continued expansion in the sector.

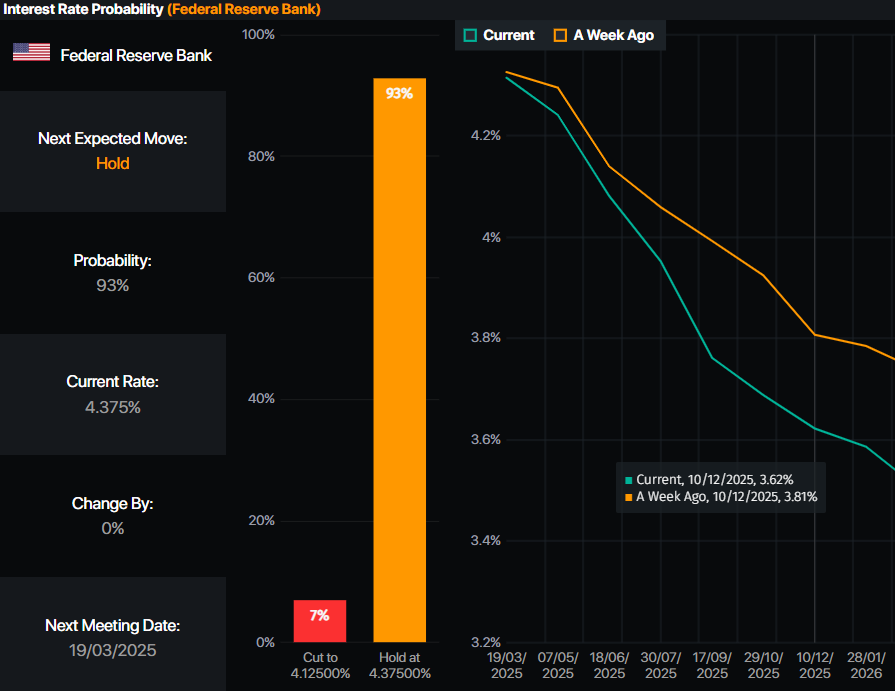

- Money markets had priced in that the Federal Reserve (Fed) would ease policy by 71 basis points (bps), up from 58 bps last week, revealed data from Prime Market Terminal.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price advances towards $2,900

Gold price uptrend resumed after two days of losses that drove XAU/USD below the $2,900 figure. Nevertheless, buyers stepped in near the $2,830 mark, lifting spot prices above $2,850, which exacerbated the rally toward $2,893. If buyers achieve a daily close above $2,900, bullion could be poised to challenge the year-to-date (YTD) peak at $2,954.

Otherwise, on further weakness, XAU/USD could aim toward the February 14 low of $2,877, followed by the February 12 swing low of $2,864. However, the broader uptrend remains intact unless XAU/USD drops below $2,800.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

-

20:27

AUD/USD jumps to near 0.6230 as US Dollar tumbles, upside remains capped

- The Aussie rebounded by roughly 0.67%, lifting the pair toward 0.6245 but still under last week’s negative outlook.

- Federal Reserve (Fed) dovish bets firm up after softer United States Personal Spending data.

- President Donald Trump reiterates he will double China tariffs to 20%.

- Tariff stalemate extends to Mexico and Canada, with no room left for negotiation according to Trump.

AUD/USD gains sharply to near 0.6230 as the US Dollar (USD) faces strong selling pressure. Fed dovish bets have escalated following a decline in United States (US) Personal Spending for January. However, the Australian Dollar (AUD) could again face selling pressure if President Donald Trump proceeds with additional tariffs on key trading partners, including China, Mexico, and Canada.

Daily digest market movers: Traders eye Trump’s new tariff pledges and RBA policy signals

- President Trump announced an intention to lift tariffs on Chinese imports to 20%, up from the currently planned 10%. He also said there is “no room left for a deal” on duties affecting Mexico and Canada, intensifying trade uncertainty across currency markets.

- Regarding the Fed policy, the probability of a Fed rate cut at June’s meeting has risen to 74%, according to the CME FedWatch tool, triggered by a downbeat US Personal Spending report. Markets interpret the data as a sign that the Fed may soften its policy stance sooner.

- On the local front, the Reserve Bank of Australia (RBA) cut its Official Cash Rate by 25 basis points to 4.10% in February and signaled a measured approach going forward. Investors await the RBA minutes due on Tuesday for hints of further easing measures as inflation remains a priority.

- While the US Dollar has weakened amid Fed cut speculation, President Trump’s decision to double China tariffs stirs caution. The Aussie, sensitive to Chinese demand, could rapidly drop if Beijing retaliates or if other trading partners see increased barriers.

- On Monday, Trump clarified he has “not talked about suspending military aid to Ukraine,” yet tensions emerged after Ukrainian officials rejected a prior “rare earth deal.”

- Meanwhile, the People’s Bank of China’s (PBOC) supportive stance might buffer some risk for China, but any slowdown there still undermines Australia’s commodity-driven economy.

AUD/USD technical outlook: Pair halts losing streak but remains vulnerable below key barriers

The AUD/USD pair rose by about 0.67% to the mid-0.6200 region, temporarily reversing its downward momentum from last week. While the Aussie stopped the bleeding on account of a softer US Dollar, the outlook stays bearish after multiple sessions of losses. The Relative Strength Index (RSI) currently sits in a lower band, although it is rising sharply and suggests some buyer interest returning. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram shows red bars, indicating lackluster upside strength. Key resistance stands near the 0.6300–0.6330 handle, with further hurdles around recent swing highs. A renewed tariff threat or weaker Chinese demand could easily cap gains and trigger a retest of last week’s lows.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

-

19:53

Forex Today: The RBA takes centre stage

The US Dollar made a U-turn and left behind three days of gains in quite a negative kick-off of the new trading week, all amid a generalised sharp recovery in the risk-associated universe.

Here is what you need to know on Tuesday, March 4:

The US Dollar Index (DXY) came under renewed selling pressure, setting aside three daily advances in a row and returning to the 106.50 region amid a mixed tone in US yields. The RCM/TIPP Economic Optimism Index is due, seconded by the API’s weekly report on US crude oil inventories. In addition, the Fed’s Williams is due to speak.

EUR/USD jumped to two-day highs above the 1.0500 mark on the back of renewed optimism around a potential end of the Russia-Ukraine war. Next on tap on the euro docket will be the release of the Unemployment Rate in the region, while the final HCOB Services PMIs in Germany and the euro area, as well as Producer Prices in the whole bloc are all expected on March 5.

GBP/USD climbed to fresh 2025 peaks past the 1.2700 hurdle on the back of the intense sell-off in the Greenback. The final S&P Global Services PMI will take centre stage on March 5, seconded by speeches by the BoE’s Bailey and Pill.

Renewed downside pressure motivated USD/JPY to leave behind three consecutive days of gains despite an initial move to muti-day highs around 151.30. Japan’s Unemployment Rate will be published, followed by Capital Spending figures and the Consumer Confidence gauge.

AUD/USD set aside six consecutive daily pullbacks and regained the 0.6200 barrier and above on Monday. The publication of the RBA Minutes will be at the centre of the debate, along with Retail Sales, and quarterly Current Account results. Additionally, the RBA’s Hauser is due to speak.

WTI dropped markedly and broke below the $68.00 mark per barrel to hit new YTD lows after the OPEC+ confirmed it will proceed with supply hikes in April.

Prices of Gold charted a decent advance and revisited the vicinity of the $2,900 region per troy ounce, leaving behind two daily drops in a row. Silver prices rebounded markedly to two-day peaks around $31.70 per ounce.

-

19:31

US President Donald Trump: US agriculture products should be sold in US

United States (US) President Donald Trump hit social media wires on Monday, touching on a wide swath of subjects, but carving time out of his social posting to briefly signal his plans to fundamentally shift how the US agriculture sector works at a foundational level.

The US is a net exporter of food products, exporting high-value agriculture and food products for profit and importing low-cost food goods at a discount. According to President Trump, this arrangement is no longer desirable. Donald Trump is likely in a rush to pivot to a new topic for the day after facing blowback from key conservatives and crypto industry professionals after ham-handedly backing a "cryptocurrency reserve" stockpile.

President Trump is expected to make a final decision on Mexico, Canada, and China tariffs, which are due to begin on Tuesday, sometime this afternoon.

Key highlights

US agricultural products will be sold inside the US.

Tariffs on external agricultural products April 2nd.

Trump on Zelenskiy's comment that the war will go on for a very long time: This is the worst statement that could have been made by Zelenskyy.

TSMC will invest at least $100B in new capital.

The TSMC investment will be in Arizona.

TSMC's total investment in the US will be at least $165 billion, building 5 additional chip factories in the US.

Many companies want to announce investments.

The world's most powerful chips will be made in the US.

CNN, citing US Commerce Secretary Lutnick: Trump wants automaker manufacturing jobs back in the US.

-

18:18

US Dollar tumbles as Ukraine peace talks gain traction

- DXY erases Friday’s gains, slipping as European leaders back Ukraine peace deal guarantees.

- US Manufacturing PMI beats estimates, while ISM Manufacturing PMI misses expectations.

- Bond yields edge lower, reinforcing expectations of Fed rate cuts later in 2025.

- Technical indicators suggest further downside as key moving averages converge near 107.00.

The US Dollar Index (DXY), which tracks the performance of the Greenback against a basket of six major currencies, is diving sharply on Monday as optimism surrounding a potential Ukraine peace deal weighs on safe-haven demand. European leaders have signaled their willingness to back security guarantees for Ukraine, boosting risk sentiment across global markets.

Meanwhile, United States (US) economic data provided mixed signals. The ISM Manufacturing PMI missed forecasts, while the S&P Global Manufacturing PMI came in stronger than expected. As a result, DXY slides back from last week's highs, undoing Friday’s advance.

Daily digest market movers: US Dollar plunges as geopolitical optimism lifts sentiment, US data comes mixed

- DXY tumbles as investors reduce safe-haven exposure amid Ukraine peace deal optimism. This came after several European leaders cooled down the jitters after Friday’s heated conversations between the American and Ukrainian presidents.

- On the data front, S&P Global’s final Manufacturing PMI for February exceeded estimates at 52.7, strengthening from the preliminary reading.

- ISM Manufacturing PMI came in at 50.3, slightly below the 50.5 forecast and down from January’s 50.9.

- The ISM Prices Paid subindex spiked to 62.4, surpassing estimates and accelerating from January’s 54.9.

- New Orders component dropped to 48.6, reflecting a significant decline from 55.1 in January.

- As a reaction, Wall Street trades mixed, with major US indices posting marginal gains and losses. US Treasury yields drift lower, extending the downtrend from last week’s highs.

- The CME FedWatch Tool indicates an increasing probability of a Fed rate cut in June, though some odds still favor steady rates.

DXY technical outlook: Bearish crossover looms as downside momentum builds

The US Dollar Index (DXY) turns lower, slipping below the 20-day and 100-day Simple Moving Averages (SMA), which are nearing a bearish crossover around the 107.00 level. Momentum indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are reinforcing the negative outlook. Key support levels emerge at 106.00 and 105.50, while 107.00 remains the first resistance level should the index attempt a rebound. However, with fundamental and technical factors aligning to the downside, further weakness is likely in the short term.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

-

18:13

Fed's Musalem: Unanchoring inflation expectations would concern me

Federal Reserve (Fed) Bank of St Louis Alberto Musalem hit newswires on Monday, admitting that signs of economic deterioration are beginning to show through the cracks, but that overall growth and labor figures still look good, at least for the time being.

Key highlights

Signs inflation expectations unanchoring would concern me.

Recent data suggest downside risk to economic growth.

Long-term inflation expectations are broadly anchored.

More monetary policy work required for price stability.

Economic growth outlook looks good and job market is healthy.

Outlook is for continued solid economic growth, but recent consumer and housing data pose some downside risk.

Patient approach to policy will help achieve Fed's goals and sustain economic growth.

Restrictive monetary policy still needed to ensure inflation returns to 2% target.

It's hard to separate weather and confidence from January spending.

I see the labor market as at, or around, full employment.

There are good reasons to think that productivity growth is persistent.

-

18:06

Dow Jones Industrial Average softens on uneasy Monday

- The Dow Jones shed some weight on Monday, easing lower around 270 points.

- Equity markets await the latest news on Trump tariff plans; details are expected on Tuesday.

- Manufacturing expectations dipped again, but price worries continue to rise.

The Dow Jones Industrial Average (DJIA) spun in a worried circle on Monday, opening the gates on a new trading week and holding near the 43,800 level before ongoing investor worries took hold and dragged the DJIA lower by around 270 points for the day. The major equity index continues to churn out a middling pattern near key moving averages as investors await the latest iteration of United States (US) President Donald Trump’s tariff threats. Paradoxically, Trump’s tariffs are claimed to be both a masterful negotiating tactic by the Republican platform runner who doesn’t actually intend to impose import taxes on his own citizens, but also a critically necessary form of revenue generation for the US government that will be getting imposed no matter what. Whichever form the tariffs take tend to depend on who in the Trump administration is talking.

According to President Trump and his staffers, further details on an impending 25% tariff package on Canada and Mexico, as well as yet another 10% levy on Chinese imports, are expected at some point on Tuesday.

PMI figures miss the mark ahead of another NFP Friday

Another Nonfarm Payrolls (NFP) week is on the books, with Friday’s key jobs data looming ahead. Things are off to a soft start after US ISM Purchasing Managers Index (PMI) survey results came in softer than expected. According to a sampling of key business operators, business activity expectations for March shrank slightly, with the ISM Manufacturing PMI falling to 50.3. The economic indicator is still holding above the key 50.0 level that typically separates contraction versus expansion expectations, but the one-month fall from February’s 50.9 accelerated through median market forecasts of a slight trim to 50.5.

US ISM Manufacturing Prices Paid accelerated however, bringing renewed inflation fears back into the picture. The indicator rose to nearly a two-year high as tariff fears continue to squeeze higher price pressures into the market. ISM Prices Paid expectations rose to 62.4 in March, rising from the previous print of 50.9 and blowing through the forecast of 56.2.

Dow Jones news

Most of the Dow Jones is trading into the green on Monday, despite some overall tepid tones from equity markets to kick off the new trading week. Reports are surfacing that Nvidia (NVDA) products have been making their way to China despite US restrictions on Chinese access to US-produced microchips. Singapore is officially probing some of Nvidia’s key customers, including Dell (DELL) and Super Micro Computer (SMCI), who may have been putting Nvidia’s latest chipset, Blackwell, into servers and then shipping them to China in order to subvert export restrictions. Nvidia is down around 5.6%, tumbling below $118 per share.

Dow Jones price forecast

The Dow Jones continues to churn into the 50-day Exponential Moving Average (EMA) at 43,850, and price action is set for further downside explorations after the latest swing low found the 43,200 level. The DJIA is still holding well into bull country on the north side of the 200-day EMA at 42,100, however the ongoing bullish trend is beginning to grow long in the tooth. It has been 14 consecutive trading weeks since the Dow Jones set a new all-time high, and signs of exhaustion are beginning to set in as bidders get used to trading below the 44,000 handle.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

-

18:00

Mexican Peso rebounds as markets await tariff decision

- USD/MXN dips 0.41% to 20.41 ahead of key trade developments.

- Trump’s 25% tariffs on Mexico set to take effect Tuesday, pending final decision.

- Mexico’s business confidence deteriorates, manufacturing contracts for the eighth straight month.

- US economic data mixed with weak ISM PMI fueling growth concerns.

The Mexican Peso recovers some ground against the Greenback on Monday, a day before tariffs of 25% would be applied on Mexican goods imported to the United States (US) as President Donald Trump promised. However, the Peso rises as decent US economic data did little to offset projections that the economy might not grow in Q1 2025, according to the Atlanta Fed’s GDPNow model. The USD/MXN trades at 20.41, down 0.41%.

Over the weekend, the US Commerce Secretary said that tariffs on Mexico and Canada commence on Tuesday but that Trump would determine whether to stick to the planned 25% level. If tariffs proceed as projected, it could prompt traders to seek the security of the US Dollar (USD) and push the USD/MXN higher. Otherwise, the Peso could sustain a relief rally, and the pair could continue to edge lower.

Mexico’s economic data showed that business manufacturing activity contracted for the eight straight month, revealed S&P Global. At the same time, Business Confidence in February continued to witness a deterioration, revealed by the National Statistics Agency (INEGI), underscoring the gloomy economic outlook.

Banco de Mexico (Banxico) private economists’ poll was revealed, and analysts expect growth to remain below 1%, while inflation expectations remain unchanged.

Across the border, Manufacturing PMI data revealed by S&P Global and the Institute for Supply Management (ISM) was mixed. The former expanded compared to January’s figures, while the ISM dipped but remained in expansionary territory.

Daily digest market movers: Mexican Peso rises despite soft economic data

- Mexico’s Manufacturing PMI in February, according to S&P Global, contracted 47.6, down from 49.1. That was due to “demand conditions remaining on a downward path and cashflow pressures intensifying,” said Pollyanna de Lima, Economics Associate Director at S&P Global Market Intelligence.

- Business Confidence in Mexico fell 1.4 points, down from 51.5 to 50.1. Compared to last year, the index plunged 4.9 points, though the index has expanded for the last 25 straight months above the 50 threshold.

- Banxico’s poll showed that Gross Domestic Product (GDP) is expected at 0.81%, down from 1% for 2025. Headline inflation is predicted to end at 3.71%, down from 3.83%, and core Consumer Price Index (CPI) is estimated to end at 3.75%, up from 3.75%.

- Economists estimate the USD/MXN exchange rate to end 2025 at 20.85, down from 20.90, but for 2026 they eye a depreciation of the Peso far beyond the 21.30 figure expected in the January poll.

- The US ISM Manufacturing PMI showed that business activity in February remained steady at 50.3, down from 50.9 and below economists’ estimates of 50.5.

- S&P Global revealed that manufacturing activity in February increased by 52.7, up from 51.2 and exceeding forecasts of 51.6.

USD/MXN technical outlook: Mexican Peso climbs as USD/MXN drops below 20.50

The USD/MXN uptrend remains in place, though the exotic pair has consolidated within the 20.20–20.70 range for the latest 18 days, hinting that buyers are not committed to pushing spot prices higher. Short term, momentum is tilted to the downside as depicted by the Relative Strength Index (RSI) turning bearish.

For a bearish continuation, the USD/MXN must clear the 100-day Simple Moving Average (SMA) at 20.30. Once surpassed, the next stop would be the 20.00 figure ahead of the 200-day SMA at 19.50. On the other hand, if buyers push the exchange rate past 20.50, they must clear the latest peak seen at 20.71 on February 6, before testing the February 3 high at 21.28.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

-

15:58

Europe: Brave new world – Standard Chartered

Europe’s ability to defend itself and Ukraine is probably greater than is perceived. But in the short term and in the case of an all-out war with Russia, a US backstop is irreplaceable. Europe likely to continue financial support for Ukraine, whilst ramping up its own defence spending. EUR 500bn extra funding could be needed over five years to boost defence spending to 3.0% of GDP. Growth impact will depend on how the money is raised, where it is spent, and reliance on imports, Standard Chartered's economists note.

Europe to continue supporting Ukraine, whatever it takes

"Initial impressions that the US might impose a ceasefire on essentially all Russian terms, with no consultations with either Europe or Ukraine, have been more nuanced of late, with Washington seemingly more open to European arguments that a peace deal at any costs would endanger the whole international security architecture. However, it posed the question of what would and could Europeans do without any US backing. Europe could do much more to (re)arm itself and Ukraine and act as a credible deterrent to any future Russian aggression. But short-term, in a scenario of an all-out war with Russia, Western Europe would still need the irreplaceable backing of the US."

"Irrespective of how the war unfolds, Europe will likely have to continue providing financial support for Ukraine, whilst also ramping up its own defence spending. We estimate the additional spending costs of increasing defence spending to 3.0% of GDP over the next five years in the order of EUR 500bn. EU states are considering various mechanisms to achieve this, from a relaxing of EU fiscal rules to repurposing recovery funds, as well as possible EU common borrowing."

"We explore how each would work in practice, and their likelihood given political interests. While a major increase in defence spending could have positive implications for growth, any benefit will be limited by how the money is raised (tax increases or spending cuts elsewhere would mitigate the impact), where the money is spent (R&D carries the biggest spillovers), the degree to which countries work together, and to what extent imports are relied upon."

-

15:51

US reciprocal tariffs: What could they look like? – Standard Chartered

US will deliver full reciprocal trade analysis on 1 April; it is likely to focus on 20 key economies initially. Tariff differentials are small, and our estimates of non-tariff barriers do not give the US much leverage. Tariffs could be raised significantly by including VAT rates (heavily disputed as a trade barrier). In addition to China and the EU, Argentina, India, Brazil and UK look vulnerable; but concessions are likely to be negotiated, Standard Chartered's Economists Madhur Jha and Ethan Lester note.

Targeting a high number

"The deadline for US investigations to be completed under the Reciprocal Trade Act is 1 April. There is still uncertainty on the scope and implementation of any resulting tariffs. More recent communications, however, suggest that the Trump administration is focusing on the EU and 20 large major and EM economies in its initial investigations on reciprocal tariffs. Tariff rate differentials with the US tend to be highest for EM, but equalising these differentials is unlikely to meet the US objectives of raising revenues or narrowing trade deficits. To make significant progress on either of these objectives, we think the US will look to target key trading partners like China and the EU."

"This is likely to mean a greater focus on imputing a value to non-tariff barriers (NTBs) and on treating VAT as a trade barrier. Imputing a tariff equivalent (ad-valorem equivalent, or AVE) to NTBs is notoriously difficult. However, we attempt a rough estimate using a joint study by the UN Trade and Development (UNCTAD) and the World Bank as a basis. For simplicity, we assume that the US imposes one average tariff rate on all goods from each country."

"Tariff increases based on NTBs are still small, so the US could focus (controversially) on VAT as a trade barrier. In its review of NTBs in the past few years, the US administration has particularly focused on VAT distortions in China, the EU, Türkiye, Argentina and Russia. Taking tariff differentials, NTBs and VAT together, Argentina, India, Türkiye, Russia, Brazil, the EU and the UK are all vulnerable – we see them facing possible reciprocal tariffs of 20%+. However, some of these economies have already made overtures to the US to gain concessions."

-

15:45

EUR/USD Price Analysis: Bulls regain control, breaking key resistance levels

- EUR/USD surged at the start of the week, posting strong gains and reclaiming higher ground.

- The pair soared past the convergence of the 20-day and 100-day SMA, signaling renewed bullish momentum.

- Resistance is now seen at 1.0520, while support lies at 1.0450, with indicators suggesting further upside potential.

EUR/USD kicked off the week with a solid rally rising past 1.0450, climbing above key technical levels and suggesting that buyers are regaining momentum. The pair decisively broke through the confluence of the 20-day and 100-day Simple Moving Averages (SMA), reinforcing a shift in sentiment. This move comes after last week's struggle around these levels, where sellers had temporarily kept the pair in check.

Technical indicators reflect this resurgence. The Relative Strength Index (RSI) is rising sharply in positive territory, confirming an increase in buying pressure. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram shows decreasing red bars, hinting that while bullish momentum is strengthening, some consolidation could still take place before another push higher.

Looking ahead, immediate resistance is now located at 1.0520, a level that, if breached, could accelerate gains toward 1.0560. On the downside, support is found at 1.0450, which coincides with the recently broken moving averages. A drop below this level would weaken the bullish outlook and bring 1.0400 into focus.

EUR/USD daily chart

-

15:25

GBPUSD rallies on soft US ISM data, falling US yields

- Atlanta Fed GDP Now forecast weakens, fueling recession concerns.

- ISM Manufacturing PMI drops to 50.3 as Trump tariffs dent outlook.

- UK 10-year GILTS yield rises, while US 10-year T-note yield declines.

The Pound Sterling snaps two days of losses and rises over 0.89% amid a weaker US Dollar (DXY) which appreciated on Friday following a weaker than expected Atlanta GDP Now forecast for Q1 2025. At the time of writing, the GBP/USD traded at 1.2694 after hitting a daily low of 1.2577.

Pound rebounds toward 1.2700 as US slowdown fears weigh on USD

Last week’s data suggested the US economy is undergoing an economic slowdown. As of writing, the ISM Manufacturing PMI showed that business activity in February remained steady at 50.3, down from 50.9 and below economists’ estimates of 50.5. According to the ISM poll, the decline in other subcomponents of the PMI were fueled by Trump’s tariffs threats on imported goods.

Meanwhile, S&P Global revealed that manufacturing activity in February expanded by 52.7, up from 51.2 and exceeding forecasts of 51.6.

Across the pond, the economic docket in the United Kingdom remains light, though Bank of England (BoE) Governor Andrew Bailey could set the tone on Wednesday, on his appearance before the Treasury Select Committee.

Another reason from GBP/USD upside, is that the 10-year GILTS yield is pushing higher, while the yield of the US 10-year T-note continued to decline. This sponsored a leg-up in the pair, with buyers setting their sights on the 1.2700 handle.

Up next, the US economic docket will feature a speech by St. Louis Fed President Alberto Musalem.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is neutral to slightly upward biased, but to cement the uptrend buyers must clear the latest cycle peak at 1.2715. If surpassed they will be able to challenge the 200-day Simple Moving Average (SMA) at 1.2785, followed by the 1.2800 mark. On the other hand, further weakness is seen, if the pair slides beneath the 100-day SMA at 1.2631, opening the door to test 1.2600.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

USD EUR GBP JPY CAD AUD NZD CHF USD -1.11% -0.94% -0.21% -0.29% -0.60% -0.51% -0.59% EUR 1.11% 0.06% 0.69% 0.64% 0.41% 0.42% 0.34% GBP 0.94% -0.06% 0.74% 0.59% 0.36% 0.36% 0.28% JPY 0.21% -0.69% -0.74% 0.12% -0.36% -0.27% -0.41% CAD 0.29% -0.64% -0.59% -0.12% -0.17% -0.23% -0.30% AUD 0.60% -0.41% -0.36% 0.36% 0.17% 0.00% -0.08% NZD 0.51% -0.42% -0.36% 0.27% 0.23% -0.00% -0.08% CHF 0.59% -0.34% -0.28% 0.41% 0.30% 0.08% 0.08% The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

-

15:01

United States ISM Manufacturing Prices Paid above forecasts (56.2) in February: Actual (62.4)

-

15:00

United States ISM Manufacturing PMI came in at 50.3 below forecasts (50.5) in February

-

15:00

United States ISM Manufacturing New Orders Index down to 48.6 in February from previous 55.1

-

15:00

United States Construction Spending (MoM) below forecasts (0%) in January: Actual (-0.2%)

-

15:00

United States ISM Manufacturing Employment Index dipped from previous 50.3 to 47.6 in February

-

14:47

United States S&P Global Manufacturing PMI above forecasts (51.6) in February: Actual (52.7)

-

14:47

United States S&P Global Manufacturing PMI above expectations (51.6) in February: Actual (52)

-

14:34

USD/CAD slumps to near 1.4400 as investors await Trump’s tariffs plan for Canada

- USD/CAD falls sharply to near 1.4400 as investors look for US President Trump’s tariff plane for Canada, Mexico and China.

- Escalating dovish Fed bets have weighed on the US Dollar.

- Investors await the US ISM Manufacturing PMI, which will be published at 15:00 GMT.

The USD/CAD pair slides to near the key level of 1.4400 in North American trading hours on Monday. The Loonie pair weakens as the US Dollar (USD) underperforms across the board, with investors awaiting United States (US) President Donald Trump’s tariff plan for Canada, Mexico and China.

President Donald Trump is poised to impose tariffs on his North American peers and China on Tuesday as stated in his tweet on Truth.Social on Thursday. Trump said that he will slap 25% tariffs on Canada and Mexico, and additional 10% on China as drugs are still pouring into the economy.

However, US Commerce Secretary Howard Lutnick indicated over the weekend that tariffs by President Donald Trump on Canada and Mexico could be lower than 25%. Such a scenario will be favorable for the Canadian Dollar (CAD).

Erstwhile, escalating Federal Reserve (Fed) dovish bets have also weighed on the US Dollar. According to the CME FedWatch tool, the probability for the Fed to cut interest rates in the June meeting has increased to 74% from 63% a week ago. Fed dovish bets swelled due to a decline in the US Personal Spending data for January.

This week, investors will focus a slew of US economic and the Canadian labor market data.