Notícias do Mercado

-

23:45

New Zealand: Employment Change, q/q, Quarter II +0.4% (forecast +0.7%)

-

23:45

New Zealand: Unemployment Rate, Quarter II 5.6% (forecast 5.8%)

-

23:21

Currencies. Daily history for Aug 5'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3372 -0,37%

GBP/USD $1,6882 +0,14%

USD/CHF Chf0,9092 +0,30%

USD/JPY Y102,61 +0,07%

EUR/JPY Y137,21 -0,31%

GBP/JPY Y173,22 +0,20%

AUD/USD $0,9303 -0,30%

NZD/USD $0,8461 -0,74%

USD/CAD C$1,0959 +0,50%

-

23:00

Schedule for today, Wednesday, Aug 6’2014:

(time / country / index / period / previous value / forecast)

05:00 Japan Leading Economic Index June 104.8% 105.5%

05:00 Japan Coincident Index June 111.3%

06:00 Germany Factory Orders s.a. (MoM) June -1.7% +0.5%

06:00 Germany Factory Orders n.s.a. (YoY) June +5.5%

07:00 United Kingdom Halifax house price index July -0.6%

07:00 United Kingdom Halifax house price index 3m Y/Y July +8.8%

07:15 Switzerland Consumer Price Index (MoM) July -0.1% -0.5%

07:15 Switzerland Consumer Price Index (YoY) July 0.0% 0.0%

08:30 United Kingdom Industrial Production (MoM) June -0.7% +0.6%

08:30 United Kingdom Industrial Production (YoY) June +2.3% +1.5%

08:30 United Kingdom Manufacturing Production (MoM) June -1.3% +0.7%

08:30 United Kingdom Manufacturing Production (YoY) June +3.7% +2.1%

12:30 Canada Trade balance, billions June -0.2 -0.1

12:30 U.S. International Trade, bln June -44.4 -44.2

14:00 United Kingdom NIESR GDP Estimate July +0.9%

14:30 U.S. Crude Oil Inventories July -3.7

23:30 Australia AiG Performance of Construction Index July 51,8

-

17:03

Foreign exchange market. American session: the U.S. dollar increased against the most major currencies after the better-than-expected ISM service sector activity in the U.S. and factory orders in the U.S.

The U.S. dollar increased against the most major currencies after the better-than-expected ISM service sector activity in the U.S. and factory orders in the U.S. The ISM non-manufacturing PMI increased to 58.7 in July, from 56.0 in June, exceeding expectations for a rise to 56.6. That was the highest level since January 2008.

Factory orders in the U.S. jumped 1.1% in June, beating expectations for a 0.6% rise, after a 0.6% fall in May. May's figure was revised down from a 0.5% decline.

The euro dropped against the U.S. dollar after mixed economic data from the Eurozone. Retail sales in the Eurozone climbed 0.4% in June, in line with expectations, after a 0.3% rise in May. May's figure was revised up from 0.0%.

On a yearly basis, retail sales in the Eurozone jumped 2.4% in June, beating expectations for a 1.2% gain, after a 0.6% increase in May. May's figure was revised down from a 0.7% rise.

Eurozone's services purchasing managers' index rose to 54.2 in July from 52.8 in June, missing expectations for an increase to 54.4.

Germany's services purchasing managers' index increased to 56.7 in July from 54.5 in June, exceeding expectations for a rise to 56.6.

France's services purchasing managers' index climbed to 50.4 in July from 48.2 in June, in line with expectations.

The British pound increased against the U.S. dollar after the better-than-expected services purchasing managers' index in the UK, but later lost its gains. Services purchasing managers' index in the UK increased to 59.1 in July from 57.7 in June, beating expectations for a rise to 58.1.

The New Zealand dollar declined against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded higher against the U.S. dollar after the Reserve Bank of Australia's interest rate decision, but dropped after the better-than-expected ISM service sector activity in the U.S. and factory orders in the U.S. The RBA kept its interest rate unchanged at 2.50%. This decision was expected by analysts.

The RBA said its accommodative monetary policy should provide support to demand and help growth to strengthen over time. Australia's central bank added that inflation is expected to be within the 2-3 per cent over the next two years.

The Reserve Bank of Australia governor Glenn Stevens said that there had been some improvement in the labour market.

Australia's trade deficit decreased to A$1.68 billion in June from A$2.04 billion in May. May's figure was revised down from a deficit of A$1.91 billion. Analysts had expected the trade deficit to decline to A$2.00 billion.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports in Japan.

-

16:04

Reserve Bank of Australia kept its interest rate unchanged at 2.50%

The Reserve Bank of Australia (RBA) released its interest rate decision today. The RBA kept its interest rate unchanged at 2.50%. This decision was expected by analysts. Australia's central bank released almost the same statement accompanying the RBA's decision as its statement in July.

The RBA governor Glenn Stevens said that the RBA will keep its interest rate unchanged in the face of forecasts of below trend economic growth.

Australia's central bank expects that inflation will be within the 2-3 per cent over the next two years.

The board of the RBA added that "monetary policy is appropriately configured to foster sustainable growth in demand and inflation outcomes consistent with the target. On present indications, the most prudent course is likely to be a period of stability in interest rates."

-

15:44

US services sector reached the highest level since January 2008

The Institute for Supply Management released its services index today. The index increased to 58.7 in July, from 56.0 in June, exceeding expectations for a rise to 56.6. That was the highest level since January 2008.

A figure above 50 indicates expansion.

-

15:27

Eurozone’s retail sales rose 0.4% in June

Eurostat released retail sales for the Eurozone today. Retail sales in the Eurozone climbed 0.4% in June, in line with expectations, after a 0.3% rise in May. May's figure was revised up from 0.0%.

On a yearly basis, retail sales in the Eurozone jumped 2.4% in June, beating expectations for a 1.2% gain, after a 0.6% increase in May. That was the fastest growth since March 2007.

May's figure was revised down from a 0.7% rise.

The annual increase was driven by a rise in sales of non-food products and sales of food, drinks and tobacco.

The highest growth was registered in Germany (+1.3%), Austria (+1.1%) and Poland (+1.0%). The largest decline was registered in Finland (-1.8%), Portugal (-1.4%), and Spain (-0.8%).

On a yearly basis, retail sales in Germany rose at fastest pace since February 2011.

-

15:00

U.S.: ISM Non-Manufacturing, July 58.7 (forecast 56.6)

-

15:00

U.S.: Factory Orders , June +1.1% (forecast +0.6%)

-

14:45

U.S.: Services PMI, July 60.8 (forecast 61.0)

-

14:30

Option expiries for today's 1400GMT cut

USD/JPY 101.05, 101.15, 101.40, 101.60, 101.75, 101.80, 101.85, 102.00 (1.6bn), 102.50 (2.01bn), 102.75, 102.95, 103.00, 103.15, 103.50

EUR/USD 1.3340, 1.3350, 1.3450 (1.3bn), 1.3525, 1.3550

AUD/USD 0.9200, 0.9205, 0.9250, 0.9275, 0.9320, 0.9340, 0.9420

USD/CAD 1.0770, 1.0775, 1.0800, 1.0845, 1.0870, 1.0875

GBP/USD 1.6850

EUR/GBP 0.7905, 0.7930, 0.8000

-

13:00

Orders

EUR/USD

Offers $1.3530, $1.3500-10, $1.3485, $1.3445-50

Bids $1.3400, $1.3360/50

GBP/USD

Offers $1.6700, $1.6926, $1.6900

Bids $1.6800, $1.6785/80, $1.6750, $1.6700-693

AUD/USD

Offers $0.9400, $0.9375/80, $0.9350

Bids $0.9300, $0.9250, $0.9200

EUR/JPY

Offers Y139.00, Y138.80, Y138.50, Y138.00

Bids Y137.20, Y137.05/00, Y136.80, Y136.50

USD/JPY

Offers Y104.00, Y103.50, Y103.15, Y102.80

Ордера на покупку Y102.30, Y102.25/20, Y102.00, Y101.80

EUR/GBP

Offers stg0.8100, stg0.8000, stg0.7985

Bids stg0.7920, stg0.7900

-

13:00

Foreign exchange market. European session: the euro declined against the U.S. dollar after mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Trade Balance June -2.04 -2.00 -1.68

01:45 China HSBC Services PMI July 53.1 50

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

07:48 France Services PMI (Finally) July 48.2 50.4 50.4

07:53 Germany Services PMI (Finally) July 54.5 56.6 56.7

07:58 Eurozone Services PMI (Finally) July 52.8 54.4 54.2

08:30 United Kingdom Purchasing Manager Index Services July 57.7 58.1 59.1

09:00 Eurozone Retail Sales (MoM) June +0.3% Revised From 0.0% +0.4% +0.4%

09:00 Eurozone Retail Sales (YoY) June +0.6% Revised From +0.7% +1.2% +2.4%

The U.S. dollar traded higher against the most major currencies ahead of the ISM service sector activity in the U.S. and factory orders in the U.S. The ISM non-manufacturing PMI is expected to rise to 56.6 in July from 56.0 in June.

Factory orders in the U.S. are expected to climb 0.6% in June, after a 0.5% fall in May.

The euro declined against the U.S. dollar after mixed economic data from the Eurozone. Retail sales in the Eurozone climbed 0.4% in June, in line with expectations, after a 0.3% rise in May. May's figure was revised up from 0.0%.

On a yearly basis, retail sales in the Eurozone jumped 2.4% in June, beating expectations for a 1.2% gain, after a 0.6% increase in May. May's figure was revised down from a 0.7% rise.

Eurozone's services purchasing managers' index rose to 54.2 in July from 52.8 in June, missing expectations for an increase to 54.4.

Germany's services purchasing managers' index increased to 56.7 in July from 54.5 in June, exceeding expectations for a rise to 56.6.

France's services purchasing managers' index climbed to 50.4 in July from 48.2 in June, in line with expectations.

The British pound increased against the U.S. dollar after the better-than-expected services purchasing managers' index in the UK, but later lost its gains. Services purchasing managers' index in the UK increased to 59.1 in July from 57.7 in June, beating expectations for a rise to 58.1.

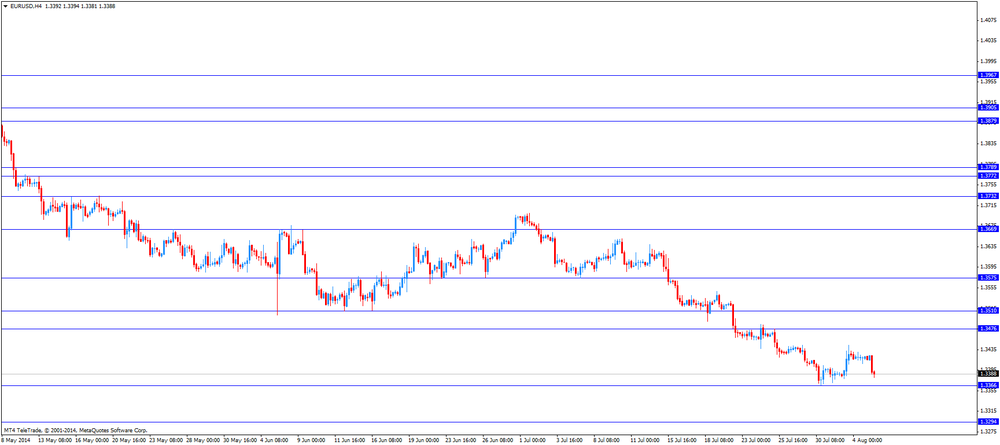

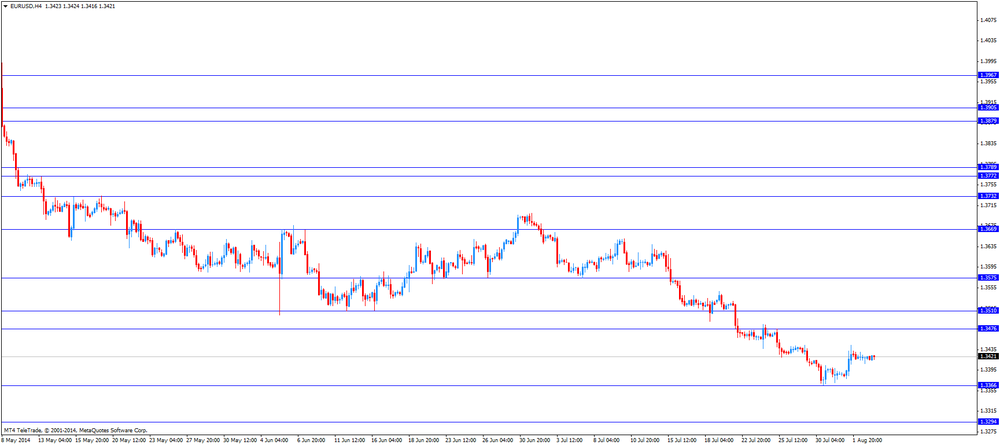

EUR/USD: the currency pair declined to $1.3381

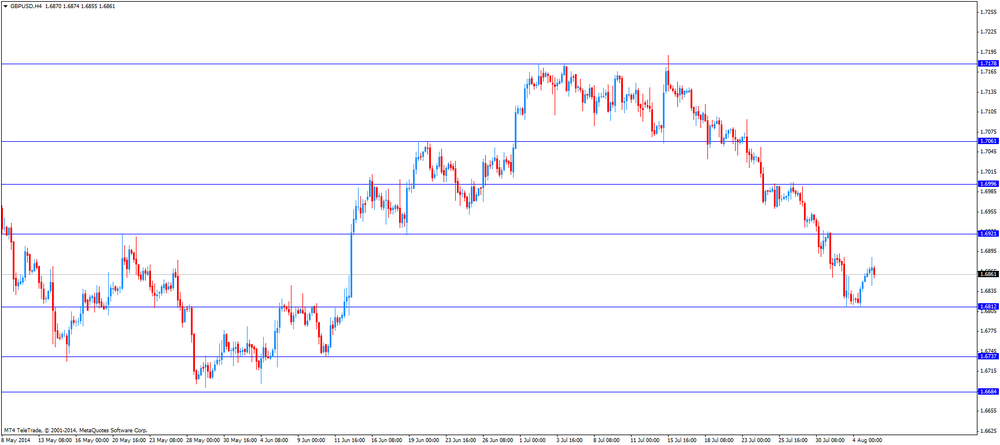

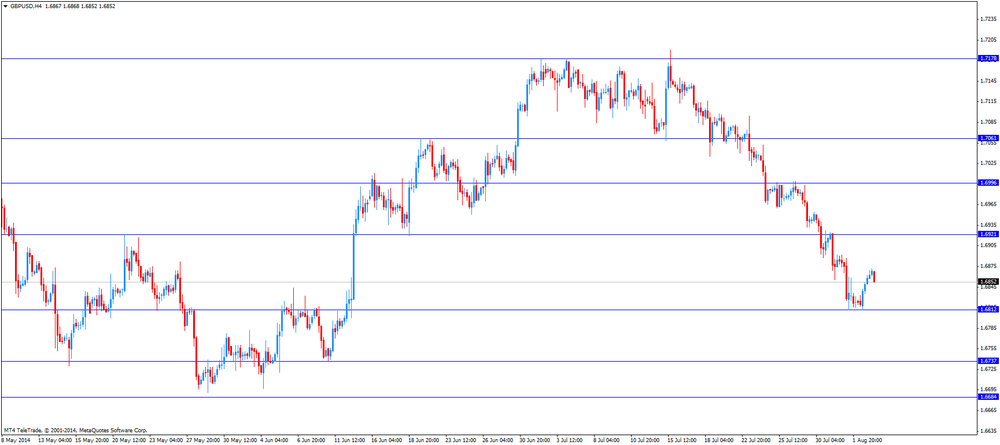

GBP/USD: the currency pair fell to $1.6855

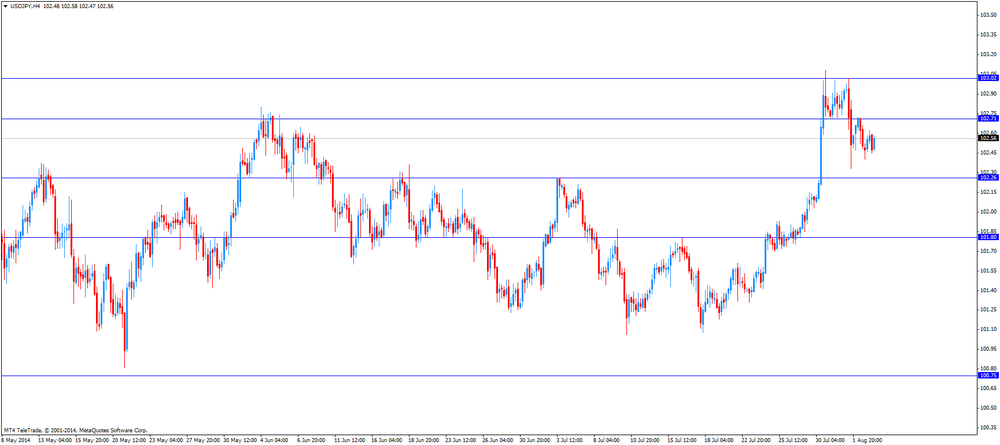

USD/JPY: the currency pair increased to Y102.72

The most important news that are expected (GMT0):

14:00 U.S. ISM Non-Manufacturing July 56.0 56.6

14:00 U.S. Factory Orders June -0.5% +0.6%

22:45 New Zealand Unemployment Rate Quarter II 6.0% 5.8%

22:45 New Zealand Employment Change, q/q Quarter II +0.9% +0.7%

-

10:28

Option expiries for today's 1400GMT cut

USD/JPY 101.05, 101.15, 101.40, 101.60, 101.75, 101.80, 101.85, 102.00 (1.6bn), 102.50 (2.01bn), 102.75, 102.95, 103.00, 103.15, 103.50

EUR/USD 1.3340, 1.3350, 1.3450 (1.3bn), 1.3525, 1.3550

AUD/USD 0.9200, 0.9205, 0.9250, 0.9275, 0.9320, 0.9340, 0.9420

USD/CAD 1.0770, 1.0775, 1.0800, 1.0845, 1.0870, 1.0875

GBP/USD 1.6850

EUR/GBP 0.7905, 0.7930, 0.8000

-

10:00

Eurozone: Retail Sales (MoM), June +0.4% (forecast +0.4%)

-

10:00

Eurozone: Retail Sales (YoY), June +2.4% (forecast +1.2%)

-

09:47

Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar after the Reserve Bank of Australia’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Trade Balance June -2.04 -2.00 -1.68

01:45 China HSBC Services PMI July 53.1 50

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

07:48 France Services PMI (Finally) July 48.2 50.4 50.4

07:53 Germany Services PMI (Finally) July 54.5 56.6 56.7

07:58 Eurozone Services PMI (Finally) July 52.8 54.4 54.2

08:30 United Kingdom Purchasing Manager Index Services July 57.7 58.1 59.1

The U.S. dollar traded mixed against the most major currencies. Friday's release of U.S. labour market data still weighed on the U.S. currency. The U.S. economy added 209,000 jobs in July, missing expectations for a growth of 230,000 jobs. The unemployment rate in the U.S. increased to 6.2% in July from 6.1% in June.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded higher against the U.S. dollar after the Reserve Bank of Australia's interest rate decision. The RBA kept its interest rate unchanged at 2.50%. This decision was expected by analysts.

The RBA said its accommodative monetary policy should provide support to demand and help growth to strengthen over time. Australia's central bank added that inflation is expected to be within the 2-3 per cent over the next two years.

The Reserve Bank of Australia governor Glenn Stevens said that there had been some improvement in the labour market.

Australia's trade deficit decreased to A$1.68 billion in June from A$2.04 billion in May. May's figure was revised down from a deficit of A$1.91 billion. Analysts had expected the trade deficit to decline to A$2.00 billion.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.6870

USD/JPY: the currency pair declined to Y102.47

AUD/USD: the currency pair was up to $0.9339

The most important news that are expected (GMT0):

09:00 Eurozone Retail Sales (MoM) June 0.0% +0.4%

09:00 Eurozone Retail Sales (YoY) June +0.7% +1.2%

14:00 U.S. ISM Non-Manufacturing July 56.0 56.6

14:00 U.S. Factory Orders June -0.5% +0.6%

22:45 New Zealand Unemployment Rate Quarter II 6.0% 5.8%

22:45 New Zealand Employment Change, q/q Quarter II +0.9% +0.7%

-

09:30

United Kingdom: Purchasing Manager Index Services, July 59.1 (forecast 58.1)

-

09:00

Eurozone: Services PMI, July 54.2 (forecast 54.4)

-

08:55

Germany: Services PMI, July 56.7 (forecast 56.6)

-

08:50

France: Services PMI, July 50.4 (forecast 50.4)

-

06:24

Options levels on tuesday, August 5, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.3552 (2737)

$1.3501 (3167)

$1.3466 (2310)

Price at time of writing this review: $ 1.3421

Support levels (open interest**, contracts):

$1.3382 (2948)

$1.3344 (2601)

$1.3298 (2791)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 33895 contracts, with the maximum number of contracts with strike price $1,3600 (4120);

- Overall open interest on the PUT options with the expiration date August, 8 is 33277 contracts, with the maximum number of contracts with strike price $1,3500 (5893);

- The ratio of PUT/CALL was 0.98 versus 0.99 from the previous trading day according to data from August, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (2740)

$1.7000 (1222)

$1.6901 (1022)

Price at time of writing this review: $1.6866

Support levels (open interest**, contracts):

$1.6799 (3808)

$1.6700 (1068)

$1.6600 (431)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 19847 contracts, with the maximum number of contracts with strike price $1,7100 (2740);

- Overall open interest on the PUT options with the expiration date August, 8 is 26345 contracts, with the maximum number of contracts with strike price $1,6800 (3808);

- The ratio of PUT/CALL was 1.33 versus 1.36 from the previous trading day according to data from August, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:45

China: HSBC Services PMI, July 50

-

02:30

Australia: Trade Balance , June -1.68 (forecast -2.00)

-

00:30

Australia: AIG Services Index, July 49.3

-