Notícias do Mercado

-

20:00

U.S.: Consumer Credit , October 13.2 (forecast 16.5)

-

16:42

Foreign exchange market. American session: the U.S. dollar increased against the most major currencies after the solid U.S. labour market data

The U.S. dollar increased against the most major currencies after the solid U.S. labour market data. The U.S. economy added 321,000 jobs in November, exceeding expectations for a rise of 225,000 jobs, after a gain of 243,000 jobs in October. October's figure was revised up from a rise of 214,000 jobs.

The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

Average hourly earnings climbed 0.4% in November, beating forecasts of a 0.2% gain, after a 0.1% increase in October.

The U.S. trade deficit narrowed to $43.4 billion in October from a deficit of $43.6 billion in September. September's figure was revised down from a deficit of $43.0 billion. Analysts had expected the trade deficit to narrow to $41.2 billion.

Factory orders in the U.S. dropped 0.7% in October, missing expectations for a 0.2% decrease, after a 0.5% decline in September. September's figure was revised up from a 0.6% fall.

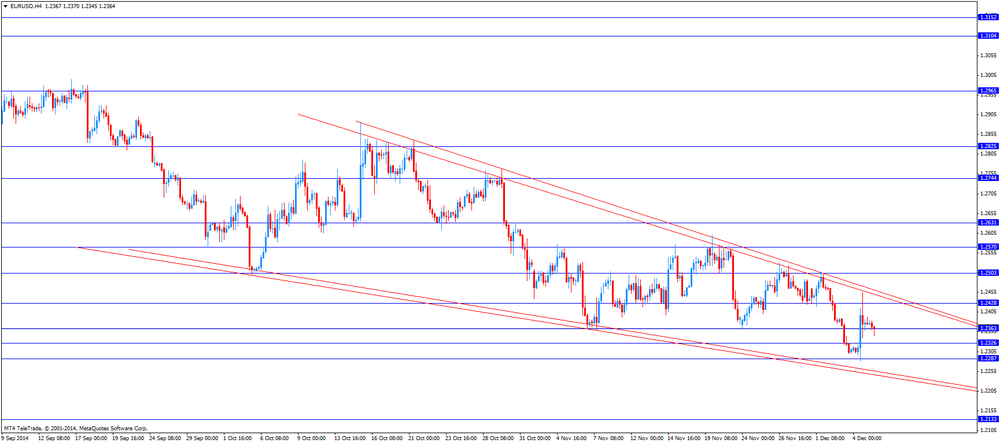

The euro declined against the U.S. dollar. Eurozone's revised gross domestic product (GDP) rose 0.2% in third quarter, in line with expectations and matching an initial estimate.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 0.8% in third quarter, in line with expectations and matching an initial estimate.

German factory orders climbed 2.5% in October, exceeding expectations for a 0.6% rise, after a 1.1% increase. September's figure was revised up from a 0.8% gain.

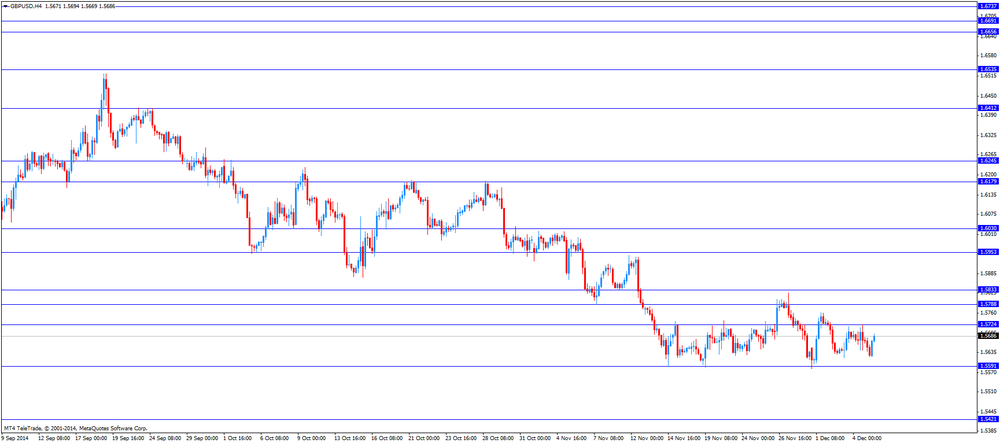

The British pound fell against the U.S. dollar. Consumer inflation expectations for the coming year in the UK declined to 2.5% from 2.8% in August.

The Canadian dollar traded lower against the U.S. dollar after of the weak Canadian labour market data. Canada's unemployment rate rose to 6.6% in November from 6.5% in October, in line with expectations.

The number of employed people decreased by 10,700 in November, missing expectations for a gain of 5,300, after a 43,100 rise in October.

Canada's trade surplus declined to C$99 million in October from a surplus of C$307 million in September. September's figure was revised down from a surplus of C$710 million. Analysts had expected the trade surplus of C$0.4 billion.

The Swiss franc traded lower against the U.S. dollar. The Swiss National Bank's foreign exchange reserves increased to 462.395 billion Swiss francs in November from 460.556 billion francs in October.

The New Zealand dollar decreased against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar dropped against the U.S. dollar. In the overnight trading session, the Aussie fell against the greenback after the AIG performance of construction index from Australia. The AIG performance of construction index declined to 45.5 in November from 53.4 in October.

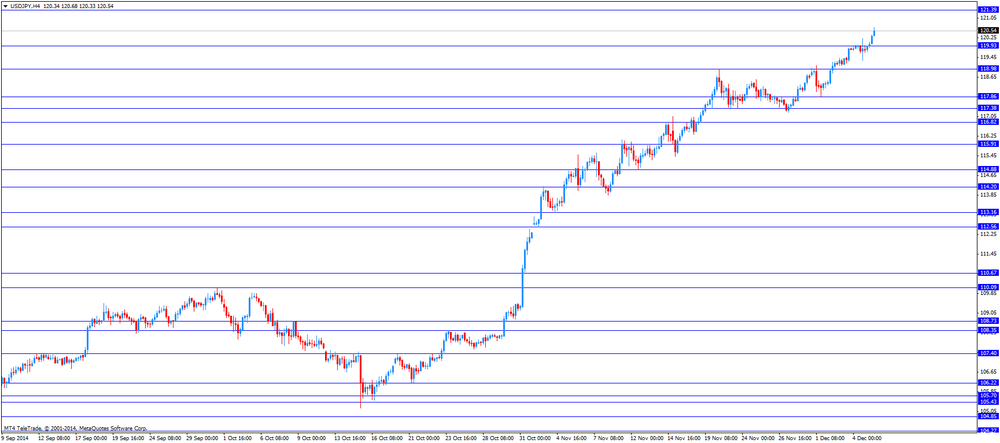

The Japanese yen fell against the U.S. dollar. Japan's leading economic index declined to 104 in October from 105.6 in September.

Japan's coincident index climbed to 110.2 in October from 109.8 in September.

-

15:41

U.S. factory orders dropped 0.7% in October

The U.S. Commerce Department released factory orders data on Friday. Factory orders in the U.S. dropped 0.7% in October, missing expectations for a 0.2% decrease, after a 0.5% decline in September. September's figure was revised up from a 0.6% fall.

That was the third straight decline.

Factory orders excluding transportation fell 1.4% in October.

-

15:25

U.S. trade deficit narrowed to $43.4 billion in October

The U.S. Commerce Department released the trade data on Friday. The U.S. trade deficit narrowed to $43.4 billion in October from a deficit of $43.6 billion in September. September's figure was revised down from a deficit of $43.0 billion. Analysts had expected the trade deficit to narrow to $41.2 billion.

Exports increased 1.2% in October.

Exports to the European Union climbed 8.5% in October. Exports to China jumped 36%, while exports to Japan increased 4.0%.

Imports rose 0.9% in October. Petroleum imports reached the lowest level since November of 2009.

-

15:00

U.S.: Factory Orders , October -0.7% (forecast -0.2%)

-

14:50

Canada's trade surplus declined to C$99 million in October

Statistics Canada released the trade data on Tuesday. Canada's trade surplus declined to C$99 million in October from a surplus of C$307 million in September. September's figure was revised down from a surplus of C$710 million. Analysts had expected the trade surplus of C$0.4 billion.

Exports increased 0.1% in October. Exports were driven by industrial machinery, equipment and parts. Industrial machinery and equipment shipments climbed 8.0%.

Imports rose 0.5% in October. Imports were driven by higher shipments of consumer goods. The aircraft and other transportation equipment category increased 12.4%, while energy declined 10.1%.

-

14:23

Canada’s unemployment rate rose to 6.6% in November

Statistics Canada released the labour market data on Friday. Canada's unemployment rate rose to 6.6% in November from 6.5% in October, in line with expectations.

The number of employed people decreased by 10,700 in November, missing expectations for a gain of 5,300, after a 43,100 rise in October.

The labour participation rate remained unchanged at 66% in November.

Canada's economy lost 45,600 private-sector jobs in November and added 22,600 positions in the public sector. The number of self-employed workers increased by 12,300 jobs.

Retail and wholesale trade lost 41,600 jobs in November, while professional, scientific and technical services lost 32,900.

The youth unemployment rate rose by 0.4% to 13% in November.

-

14:08

U.S. economy added 321,000 jobs in November

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 321,000 jobs in November, exceeding expectations for a rise of 225,000 jobs, after a gain of 243,000 jobs in October. October's figure was revised up from a rise of 214,000 jobs.

The U.S. economy has added at least 200,000 jobs for 10 months in a row. This is the longest growth period since 1995.

The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

Average hourly earnings climbed 0.4% in November, beating forecasts of a 0.2% gain, after a 0.1% increase in October.

The labour-force participation rate remained unchanged at 62.8% in November.

These figures are signs that the labour market in the U.S. is strengthening.

-

13:54

Swiss National Bank's foreign exchange reserves increased to 462.395 billion Swiss francs in November

The Swiss National Bank's foreign exchange reserves increased to 462.395 billion Swiss francs in November from 460.556 billion francs in October, according to data on Friday. That could be an indication that the Swiss National Bank (SNB) had intervened in currency markets to keep the franc down.

The SNB declined to comment on whether it had intervened or not.

The SNB capped the franc at 1.20 per euro in September 2011. It had intervened heavily in 2012 to defend the cap.

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2300(E1.2bn), $1.2350(E1.3bn), $1.2400(E1.75bn), $1.2415(E557mn), $1.2450(E1.3bn)

USD/JPY: Y118.50($1.50bn), Y120.00($550mn), Y121.00($702mn)

AUD/USD: $0.8400(A$486mn)

USD/CAD: Cad1.1250($400mn), Cad1.1280($760mn), Cad1.1350, Cad1.1425/30($440mn)

EUR/GBP: stg0.7850, stg0.7900, stg0.8000

-

13:33

Canada: Trade balance, billions, October 0.1 (forecast 0.4)

-

13:32

U.S.: Average hourly earnings , November +0.4% (forecast +0.2%)

-

13:31

U.S.: International Trade, bln, October -43.4 (forecast -41.2)

-

13:31

Canada: Employment , November -10.7 (forecast 5.3)

-

13:31

Canada: Unemployment rate, November 6.6% (forecast 6.6%)

-

13:30

U.S.: Nonfarm Payrolls, November 321 (forecast 225)

-

13:30

U.S.: Unemployment Rate, November 5.8% (forecast 5.8%)

-

13:21

Consumer inflation expectations for the coming year in the UK declined to 2.5% in November

The Bank of England and research group GfK NOP released its quarterly Inflation Attitudes Survey on Friday. Consumer inflation expectations for the coming year in the UK declined to 2.5% in November from 2.8% in August. That was the lowest inflation expectation since February 2010.

37% of Britons expected in November that interest rate will be increased in the next year, down from 49% in August. That was the lowest figure since November 2013.

-

13:01

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies ahead of the U.S. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Leading Economic Index October 105.6 104.0

05:00 Japan Coincident Index October 109.8 110.2

07:00 Germany Factory Orders s.a. (MoM) October +1.1% Revised From +0.8% +0.6% +2.5%

07:00 Germany Factory Orders n.s.a. (YoY) October -0.7% Revised From -1.0% +2.4%

08:00 Switzerland Foreign Currency Reserves November 460.4 462.4

09:30 United Kingdom Consumer Inflation Expectations November +2.8% +2.5%

10:00 Eurozone GDP (QoQ) (Revised) Quarter III +0.2% +0.2% +0.2%

10:00 Eurozone GDP (YoY) (Revised) Quarter III +0.8% +0.8% +0.8%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. labour market data. The U.S. unemployment rate is expected to remain unchanged at 5.8% in November. The U.S. economy is expected to add 225,000 jobs in November.

The euro traded lower against the U.S. dollar. Eurozone's revised gross domestic product (GDP) rose 0.2% in third quarter, in line with expectations and matching an initial estimate.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 0.8% in third quarter, in line with expectations and matching an initial estimate.

German factory orders climbed 2.5% in October, exceeding expectations for a 0.6% rise, after a 1.1% increase. September's figure was revised up from a 0.8% gain.

The British pound rose against the U.S. dollar after consumer inflation expectations from the U.K. Consumer inflation expectations for the coming year in the UK declined to 2.5% from 2.8% in August.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian labour market data. The unemployment rate in Canada is expected to rise to 6.6% in November from 6.5% in October.

Canada's economy is expected to add 5,300 jobs in November.

The Swiss franc traded slightly lower against the U.S. dollar. The Swiss National Bank's foreign exchange reserves increased to 462.395 billion Swiss francs in November from 460.556 billion francs in October.

EUR/USD: the currency pair fell to $1.2345

GBP/USD: the currency pair rose to $1.5694

USD/JPY: the currency pair increased to Y120.68

The most important news that are expected (GMT0):

13:30 Canada Trade balance, billions October 0.7 0.4

13:30 Canada Employment November 43.1 5.3

13:30 Canada Unemployment rate November 6.5% 6.6%

13:30 U.S. International Trade, bln October -43.0 -41.2

13:30 U.S. Average hourly earnings November +0.1% +0.2%

13:30 U.S. Nonfarm Payrolls November 214 225

13:30 U.S. Unemployment Rate November 5.8% 5.8%

13:45 U.S. FOMC Member Mester Speaks

15:00 U.S. Factory Orders October -0.6% -0.2%

19:45 U.S. FED Vice Chairman Stanley Fischer Speaks

-

13:00

Orders

EUR/USD

Offers $1.2450, $1.2410/20, $1.2400

Bids $1.2350, $1.2320, $1.2300, $1.2250

GBP/USD

Offers $1.5780/00, $1.5750, $1.5720

Bids $1.5645/40, $1.5610/00, $1.5550, $1.5520

AUD/USD

Offers $0.8540/50, $0.8500, $0.8450, $0.8400

Bids $0.8350, $0.8300, $0.8250

EUR/JPY

Offers Y150.50, Y150.00, Y149.80, Y149.50, Y148.90/00

Bids Y148.50, Y148.00, Y147.55/50

USD/JPY

Offers Y121.50, Y121.00, Y120.80, Y120.50

Bids Y119.50, Y119.00, Y118.50

EUR/GBP

Offers stg0.8020, stg0.8000, stg0.7980, stg0.7950

Bids stg0.7850, stg0.7820

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2300(E1.2bn), $1.2350(E1.3bn), $1.2400(E1.75bn), $1.2415(E557mn), $1.2450(E1.3bn)

USD/JPY: Y118.50($1.50bn), Y120.00($550mn), Y121.00($702mn)

AUD/USD: $0.8400(A$486mn)

USD/CAD: Cad1.1250($400mn), Cad1.1280($760mn), Cad1.1350, Cad1.1425/30($440mn)

EUR/GBP: stg0.7850, stg0.7900, stg0.8000

-

10:00

Eurozone: GDP (QoQ), Quarter III +0.2% (forecast +0.2%)

-

10:00

Eurozone: GDP (YoY), Quarter III +0.8% (forecast +0.8%)

-

09:30

United Kingdom: Consumer Inflation Expectations, November +2.5%

-

09:30

Press Review: Bundesbank halves 2015 growth outlook for Germany

FORBES

A Currency War With Japan Won't Help China Reform Its Economy

China was well into an intended transformation toward a consumer-driven economy when Japan, fittingly enough, threw a wrench into the works. The latest iteration of the "Abenomics" stimulus measures, on top of news of recurring recession, drove down the value of the Japanese yen against the Chinese yuan (or renminbi) by 15% this year.

Of course, the rest of Asia was affected as well, and the business press noted other countries scrambling to keep their currencies from getting out of whack with the yen. But China has held firm so far, basically remaining stable against the U.S. dollar since June. (The Hong Kong dollar, tied to the U.S. greenback, similarly didn't move.) A collapsing world oil price has been a loud accompaniment, helping to sustain the Japanese policy by holding energy import costs in check.

REUTERS

Bundesbank halves 2015 growth outlook for Germany

Dec 5 (Reuters) - Germany's Bundesbank halved its 2015 growth forecast for Europe's largest economy on Friday and also trimmed its estimate for this year, though its president said there were signs that current weakness would soon be overcome.

In bi-annual projections, the bank said it expected the economy to expand by 1.0 percent next year, compared with its June estimate of 2.0 percent.

Source: http://www.reuters.com/article/2014/12/05/germany-economy-bundesbank-idUSB4N0SO00R20141205

BLOOMBERG

Bank of Russia Sold $1.9 Billion on Dec. 3 to Stem Ruble Decline

Russia's central bank sold $1.9 billion of foreign currency on Dec. 3 when the ruble ended its worst six-day drop since 1998.

The Bank of Russia intervened in the currency market for the second time since moving to a free float last month, according to a statement on its website today. Policy makers sold $700 million on Dec. 1, the data show. The ruble climbed 1.6 percent to 53.45 versus the dollar as of 10:12 a.m. in Moscow, paring its weekly decline to 5.7 percent.

-

08:01

Switzerland: Foreign Currency Reserves, November 462.4

-

07:30

Foreign exchange market. Asian session: the greenback traded stronger against its major counterparts

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan Leading Economic Index October 105.6 104.0

05:00 Japan Coincident Index October 109.8 110.2

07:00 Germany Factory Orders s.a. (MoM) October +0.8% +0.6% +2.5%

07:00 Germany Factory Orders n.s.a. (YoY) October -1.0% +2.4%

The greenback steadied against the single currency after yesterday's highly volatile trading. In yesterday's speech ECB president Mario Draghi said that the bank will not immediately extend its stimulus program and will reassess the success of what has been done already and the impact of the declining oil prices early next year. Investors were disappointed as they speculated that the ECB will announce further stimulus measures. The ECB revised down forecasts for growth and inflation. Markets are now awaiting U.S. Nofarm Payrolls and the Unemployment Rate being published at 13:30 GMT and Eurozone's GDP earlier in the session at 10:00 GMT.

The Australian dollar traded weaker against the greenback after disappointing data on the AiG Performance of Construction Index. The index declined to 45.4 in November dropping from expansion territory with a previous reading of 53.4. Goldman Sachs Australia Chief Economist Tim Toohey predicted the aussie will slide to 83 U.S. cents in three months and 79 U.S. cents in the next year.

The New Zealand dollar further weakened against the U.S. dollar falling near a three-week low. Plummeting milk-prices weigh on the currency.

The Japanese yen fell for a fourth consecutive day against the U.S. dollar trading above the important USD120 level for the first time since July 2007, currently quoted at USD120.08. Solid U.S. data, Japan in recession and expectations that Prime Minister Abe will win in the upcoming elections put further pressure on the currency. The yen already lost more than 15% since June 30.

EUR/USD: the euro steadied against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded lower against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Switzerland Foreign Currency Reserves November 460.4

09:30 United Kingdom Consumer Inflation Expectations November +2.8%

10:00 Eurozone GDP (QoQ) (Revised) Quarter III +0.2% +0.2%

10:00 Eurozone GDP (YoY) (Revised) Quarter III +0.8% +0.8%

13:30 Canada Trade balance, billions October 0.7 0.4

13:30 Canada Employment November 43.1 5.3

13:30 Canada Unemployment rate November 6.5% 6.6%

13:30 U.S. International Trade, bln October -43.0 -41.2

13:30 U.S. Average hourly earnings November +0.1% +0.2%

13:30 U.S. Nonfarm Payrolls November 214 225

13:30 U.S. Unemployment Rate November 5.8% 5.8%

13:45 U.S. FOMC Member Mester Speaks

15:00 U.S. Factory Orders October -0.6% -0.2%

19:45 U.S. FED Vice Chairman Stanley Fischer Speaks

20:00 U.S. Consumer Credit October 15.9 16.5

-

07:00

Germany: Factory Orders s.a. (MoM), October +2.5% (forecast +0.6%)

-

06:33

Options levels on friday, December 5, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2503 (7697)

$1.2458 (2177)

$1.2422 (3936)

Price at time of writing this review: $ 1.2377

Support levels (open interest**, contracts):

$1.2346 (6923)

$1.2321 (6157)

$1.2286 (5261)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 122301 contracts, with the maximum number of contracts with strike price $1,2500 (7697);

- Overall open interest on the PUT options with the expiration date December, 5 is 112282 contracts, with the maximum number of contracts with strike price $1,2250 (7235);

- The ratio of PUT/CALL was 0.92 versus 0.94 from the previous trading day according to data from December, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.5900 (1363)

$1.5800 (1082)

$1.5702 (2161)

Price at time of writing this review: $1.5634

Support levels (open interest**, contracts):

$1.5599 (2683)

$1.5500 (827)

$1.5400 (979)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 44176 contracts, with the maximum number of contracts with strike price $1,5850 (2239);

- Overall open interest on the PUT options with the expiration date December, 5 is 41424 contracts, with the maximum number of contracts with strike price $1,5600 (2683);

- The ratio of PUT/CALL was 0.94 versus 0.96 from the previous trading day according to data from December, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:02

Japan: Leading Economic Index , October 104.0

-